Mga Batayang Estadistika

| Nilai Portofolio | $ 4,306,059,895 |

| Posisi Saat Ini | 36 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

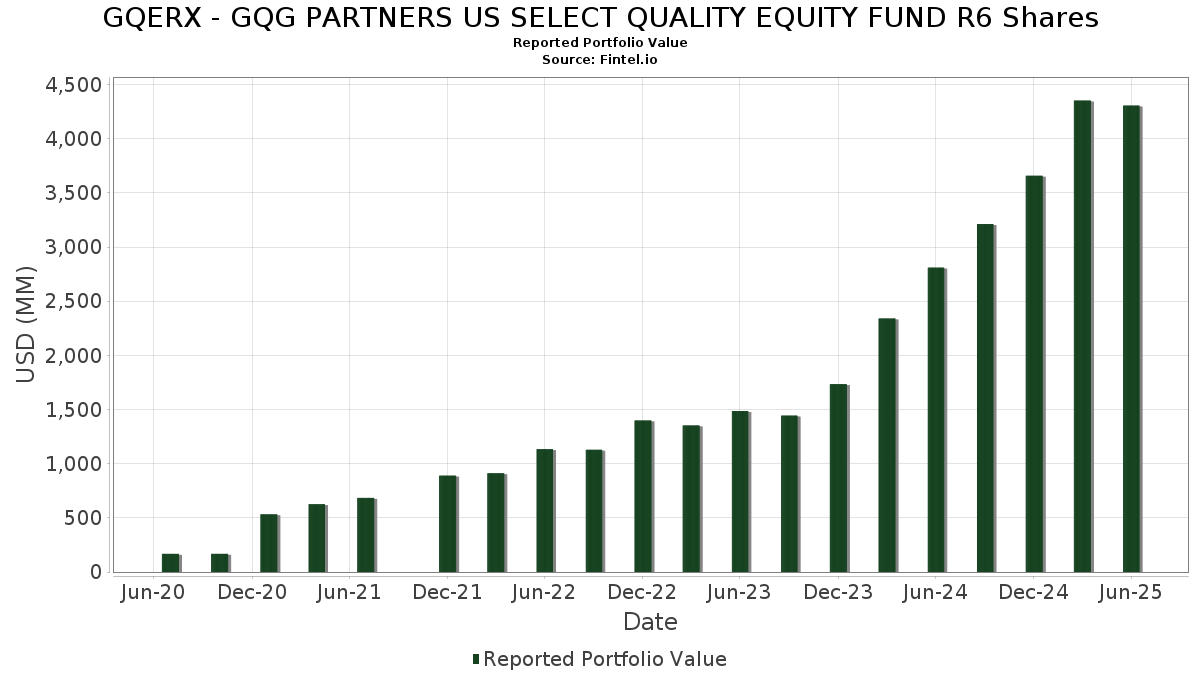

GQERX - GQG PARTNERS US SELECT QUALITY EQUITY FUND R6 Shares telah mengungkapkan total kepemilikan 36 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 4,306,059,895 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama GQERX - GQG PARTNERS US SELECT QUALITY EQUITY FUND R6 Shares adalah Philip Morris International Inc. (US:PM) , AT&T Inc. (US:T) , Verizon Communications Inc. (US:VZ) , American International Group, Inc. (US:AIG) , and The Progressive Corporation (US:PGR) . Posisi baru GQERX - GQG PARTNERS US SELECT QUALITY EQUITY FUND R6 Shares meliputi: The Kroger Co. (US:KR) , Xcel Energy Inc. (US:XEL) , DTE Energy Company (US:DTE) , American Water Works Company, Inc. (US:AWK) , and PPL Corporation (US:PPL) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 2.65 | 115.26 | 2.6667 | 2.6667 | |

| 1.31 | 94.20 | 2.1795 | 2.1795 | |

| 1.19 | 81.08 | 1.8757 | 1.8757 | |

| 2.27 | 83.30 | 1.9272 | 1.8230 | |

| 0.44 | 130.20 | 3.0123 | 1.6001 | |

| 0.49 | 64.67 | 1.4962 | 1.4962 | |

| 0.46 | 63.53 | 1.4699 | 1.4699 | |

| 0.14 | 183.10 | 4.2361 | 1.4424 | |

| 1.74 | 59.01 | 1.3652 | 1.3652 | |

| 1.83 | 333.85 | 7.7238 | 1.2914 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.07 | 11.62 | 0.2689 | -4.4792 | |

| 0.00 | 0.00 | -1.9740 | ||

| 0.00 | 0.00 | -1.9688 | ||

| 0.00 | 0.00 | -1.2477 | ||

| 0.11 | 88.17 | 2.0398 | -0.8999 | |

| 0.71 | 189.89 | 4.3933 | -0.4536 | |

| 0.26 | 91.25 | 2.1110 | -0.3635 | |

| 0.38 | 186.82 | 4.3222 | -0.2743 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-28 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| PM / Philip Morris International Inc. | 1.83 | 3.45 | 333.85 | 18.70 | 7.7238 | 1.2914 | |||

| T / AT&T Inc. | 10.34 | 4.73 | 299.11 | 7.18 | 6.9202 | 0.5372 | |||

| VZ / Verizon Communications Inc. | 5.33 | 34.66 | 230.43 | 28.46 | 5.3311 | 1.2285 | |||

| AIG / American International Group, Inc. | 2.29 | 21.98 | 196.34 | 20.08 | 4.5426 | 0.8030 | |||

| PGR / The Progressive Corporation | 0.71 | -4.97 | 189.89 | -10.39 | 4.3933 | -0.4536 | |||

| AEP / American Electric Power Company, Inc. | 1.81 | 29.04 | 188.07 | 22.54 | 4.3511 | 0.8408 | |||

| MSFT / Microsoft Corporation | 0.38 | -29.85 | 186.82 | -7.04 | 4.3222 | -0.2743 | |||

| NFLX / Netflix, Inc. | 0.14 | 4.38 | 183.10 | 49.90 | 4.2361 | 1.4424 | |||

| MO / Altria Group, Inc. | 3.06 | 2.31 | 179.13 | -0.06 | 4.1443 | 0.0450 | |||

| CI / The Cigna Group | 0.53 | 8.73 | 173.93 | 9.25 | 4.0240 | 0.3828 | |||

| META / Meta Platforms, Inc. | 0.22 | -0.49 | 162.37 | 27.44 | 3.7564 | 0.8425 | |||

| XOM / Exxon Mobil Corporation | 1.41 | 10.54 | 152.06 | 0.20 | 3.5180 | 0.0470 | |||

| IBM / International Business Machines Corporation | 0.44 | 77.87 | 130.20 | 110.86 | 3.0123 | 1.6001 | |||

| KO / The Coca-Cola Company | 1.77 | 19.23 | 125.42 | 17.78 | 2.9017 | 0.4662 | |||

| DUK / Duke Energy Corporation | 1.04 | 18.96 | 123.29 | 15.09 | 2.8524 | 0.4022 | |||

| EXC / Exelon Corporation | 2.65 | 115.26 | 2.6667 | 2.6667 | |||||

| NEE / NextEra Energy, Inc. | 1.55 | 15.96 | 107.66 | 13.56 | 2.4907 | 0.3224 | |||

| ALL / The Allstate Corporation | 0.53 | 4.69 | 106.65 | 1.78 | 2.4674 | 0.0709 | |||

| CME / CME Group Inc. | 0.38 | 15.85 | 105.69 | 20.37 | 2.4452 | 0.4369 | |||

| CINF / Cincinnati Financial Corporation | 0.67 | 15.74 | 99.90 | 16.68 | 2.3112 | 0.3531 | |||

| KR / The Kroger Co. | 1.31 | 94.20 | 2.1795 | 2.1795 | |||||

| V / Visa Inc. | 0.26 | -16.76 | 91.25 | -15.66 | 2.1110 | -0.3635 | |||

| LLY / Eli Lilly and Company | 0.11 | -27.32 | 88.17 | -31.40 | 2.0398 | -0.8999 | |||

| CNP / CenterPoint Energy, Inc. | 2.27 | 1,703.70 | 83.30 | 1,729.12 | 1.9272 | 1.8230 | |||

| XEL / Xcel Energy Inc. | 1.19 | 81.08 | 1.8757 | 1.8757 | |||||

| ELV / Elevance Health, Inc. | 0.18 | 455.59 | 70.30 | 386.41 | 1.6264 | 0.6567 | |||

| DTE / DTE Energy Company | 0.49 | 64.67 | 1.4962 | 1.4962 | |||||

| AWK / American Water Works Company, Inc. | 0.46 | 63.53 | 1.4699 | 1.4699 | |||||

| AMZN / Amazon.com, Inc. | 0.28 | 2.36 | 62.52 | 18.03 | 1.4464 | 0.2350 | |||

| PPL / PPL Corporation | 1.74 | 59.01 | 1.3652 | 1.3652 | |||||

| ATO / Atmos Energy Corporation | 0.26 | 40.62 | 0.9398 | 0.9398 | |||||

| SLDE / Slide Insurance Holdings, Inc. | 1.65 | 35.67 | 0.8253 | 0.8253 | |||||

| MCK / McKesson Corporation | 0.05 | 33.40 | 0.7727 | 0.7727 | |||||

| UNH / UnitedHealth Group Incorporated | 0.08 | 26.46 | 0.6122 | 0.6122 | |||||

| NVDA / NVIDIA Corporation | 0.07 | -94.33 | 11.62 | -93.33 | 0.2689 | -4.4792 | |||

| BROWN BROTHERS HARRIMAN SWEEP INTEREST / STIV (N/A) | 11.10 | 0.2569 | 0.2569 | ||||||

| OKE / ONEOK, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.2477 | ||||

| BDX / Becton, Dickinson and Company | 0.00 | -100.00 | 0.00 | -100.00 | -1.9688 | ||||

| FI / Fiserv, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.9740 |