Mga Batayang Estadistika

| Nilai Portofolio | $ 15,521,089 |

| Posisi Saat Ini | 101 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

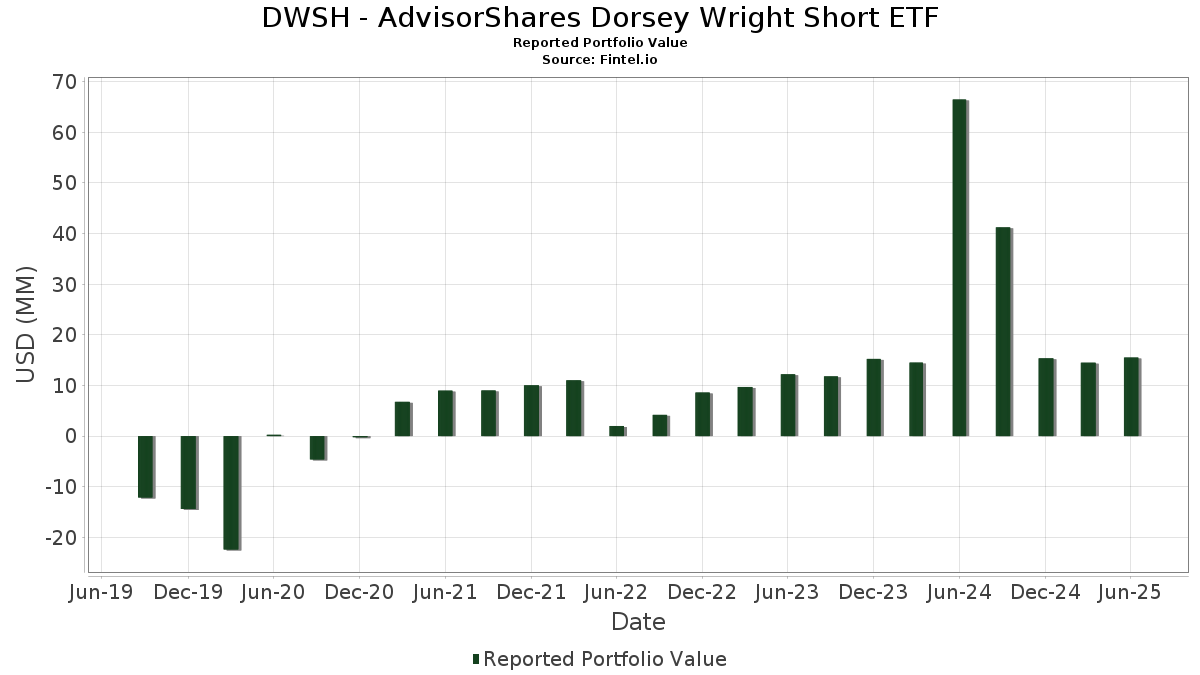

DWSH - AdvisorShares Dorsey Wright Short ETF telah mengungkapkan total kepemilikan 101 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 15,521,089 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama DWSH - AdvisorShares Dorsey Wright Short ETF adalah Terex Corporation (US:TEX) , Dollar Tree, Inc. (US:DLTR) , Microchip Technology Incorporated (US:MCHP) , Visteon Corporation (US:VC) , and O-I Glass, Inc. (US:OI) . Posisi baru DWSH - AdvisorShares Dorsey Wright Short ETF meliputi: IQVIA Holdings Inc. (US:IQV) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 27.58 | 27.58 | 220.4148 | 220.4148 | |

| 0.00 | 0.00 | 1.4687 | ||

| 0.00 | 0.00 | 1.3186 | ||

| 0.00 | 0.00 | 1.3095 | ||

| 0.00 | 0.00 | 1.3095 | ||

| 0.00 | 0.00 | 1.2920 | ||

| 0.00 | 0.00 | 1.2417 | ||

| 0.00 | 0.00 | 1.1707 | ||

| 0.00 | 0.00 | 1.0847 | ||

| 0.00 | 0.00 | 1.0725 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| -0.01 | -0.15 | -1.2354 | -1.2354 | |

| -0.00 | -0.15 | -1.1999 | -1.1999 | |

| -0.00 | -0.14 | -1.1208 | -1.1208 | |

| -0.00 | -0.13 | -1.0563 | -1.0563 | |

| -0.00 | -0.13 | -1.0095 | -1.0095 | |

| -0.00 | -0.13 | -1.0070 | -1.0070 | |

| -0.00 | -0.13 | -1.0042 | -1.0042 | |

| -0.00 | -0.12 | -0.9955 | -0.9955 | |

| -0.00 | -0.12 | -0.9835 | -0.9835 | |

| -0.00 | -0.12 | -0.9823 | -0.9823 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-25 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| Invesco Government & Agency Portfolio / STIV (000000000) | 27.58 | 27.58 | 220.4148 | 220.4148 | |||||

| TEX / Terex Corporation | 0.00 | -100.00 | 0.00 | -100.00 | 0.9986 | ||||

| DG / Dollar General Corporation | 0.00 | -100.00 | 0.00 | -100.00 | 1.2920 | ||||

| AAP / Advance Auto Parts, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.8790 | ||||

| F / Ford Motor Company | 0.00 | -100.00 | 0.00 | -100.00 | 1.0383 | ||||

| DLTR / Dollar Tree, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 1.0847 | ||||

| BMRN / BioMarin Pharmaceutical Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 1.2417 | ||||

| NYCB / Flagstar Financial, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 1.3095 | ||||

| MCHP / Microchip Technology Incorporated | 0.00 | -100.00 | 0.00 | -100.00 | 0.7452 | ||||

| NYCB / Flagstar Financial, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 1.3095 | ||||

| BEN / Franklin Resources, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.8966 | ||||

| HLF / Herbalife Ltd. | 0.00 | -100.00 | 0.00 | -100.00 | 1.4687 | ||||

| ELV / Elevance Health, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 1.3186 | ||||

| GT / The Goodyear Tire & Rubber Company | 0.00 | -100.00 | 0.00 | -100.00 | 1.1707 | ||||

| VC / Visteon Corporation | 0.00 | -100.00 | 0.00 | -100.00 | 1.0725 | ||||

| OI / O-I Glass, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 1.0272 | ||||

| ADM / Archer-Daniels-Midland Company | 0.00 | -100.00 | 0.00 | -100.00 | 0.9746 | ||||

| IONS / Ionis Pharmaceuticals, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.9110 | ||||

| HUN / Huntsman Corporation | Short | -0.01 | 20.47 | -0.08 | -21.15 | -0.6615 | 0.1316 | ||

| HP / Helmerich & Payne, Inc. | Short | -0.01 | -20.03 | -0.08 | -66.12 | -0.6627 | 0.3434 | ||

| WLK / Westlake Corporation | Short | -0.00 | -12.76 | -0.08 | -33.60 | -0.6638 | 0.2917 | ||

| FMC / FMC Corporation | Short | -0.00 | -11.44 | -0.08 | -11.58 | -0.6716 | 0.0589 | ||

| TFX / Teleflex Incorporated | Short | -0.00 | -12.75 | -0.08 | -25.00 | -0.6734 | 0.1855 | ||

| ASH / Ashland Inc. | Short | -0.00 | -14.48 | -0.09 | -27.50 | -0.6999 | 0.2200 | ||

| COTY / Coty Inc. | Short | -0.02 | -7.33 | -0.09 | -20.72 | -0.7045 | 0.1480 | ||

| ASGN / ASGN Incorporated | Short | -0.00 | -39.16 | -0.09 | -59.91 | -0.7142 | 0.2090 | ||

| CC / The Chemours Company | Short | -0.01 | -6.05 | -0.09 | -20.35 | -0.7242 | 0.1441 | ||

| REGN / Regeneron Pharmaceuticals, Inc. | Short | -0.00 | -13.07 | -0.09 | -28.57 | -0.7258 | 0.2356 | ||

| HAIN / The Hain Celestial Group, Inc. | Short | -0.06 | 105.43 | -0.09 | -25.00 | -0.7266 | 0.1939 | ||

| ARE / Alexandria Real Estate Equities, Inc. | Short | -0.00 | -14.72 | -0.09 | -33.33 | -0.7400 | 0.3135 | ||

| ENOV / Enovis Corporation | Short | -0.00 | -5.74 | -0.09 | -22.69 | -0.7405 | 0.1719 | ||

| BFB / Brown-Forman Corp. - Class B | Short | -0.00 | -10.39 | -0.09 | -29.23 | -0.7417 | 0.2534 | ||

| HAL / Halliburton Company | Short | -0.00 | -7.24 | -0.09 | -26.19 | -0.7509 | 0.2097 | ||

| MAN / ManpowerGroup Inc. | Short | -0.00 | -6.36 | -0.10 | -34.48 | -0.7606 | 0.3486 | ||

| ALB / Albemarle Corporation | Short | -0.00 | -4.35 | -0.10 | -17.24 | -0.7717 | 0.1120 | ||

| LYB / LyondellBasell Industries N.V. | Short | -0.00 | -13.92 | -0.10 | -29.50 | -0.7860 | 0.2731 | ||

| CABO / Cable One, Inc. | Short | -0.00 | 36.55 | -0.10 | -30.77 | -0.7988 | 0.2924 | ||

| OLN / Olin Corporation | Short | -0.00 | -6.91 | -0.10 | -22.48 | -0.8006 | 0.1885 | ||

| BIIB / Biogen Inc. | Short | -0.00 | -16.48 | -0.10 | -23.66 | -0.8039 | 0.1957 | ||

| IPGP / IPG Photonics Corporation | Short | -0.00 | -6.95 | -0.10 | 2.02 | -0.8081 | -0.0467 | ||

| SRPT / Sarepta Therapeutics, Inc. | Short | -0.01 | -0.10 | -0.8171 | -0.8171 | ||||

| OXY / Occidental Petroleum Corporation | Short | -0.00 | -12.25 | -0.10 | -25.55 | -0.8178 | 0.2260 | ||

| NOV / NOV Inc. | Short | -0.01 | -5.72 | -0.10 | -23.31 | -0.8189 | 0.1949 | ||

| AES / The AES Corporation | Short | -0.01 | -10.33 | -0.10 | -23.70 | -0.8245 | 0.2103 | ||

| XRX / Xerox Holdings Corporation | Short | -0.02 | -9.06 | -0.11 | -0.94 | -0.8412 | -0.0331 | ||

| PTEN / Patterson-UTI Energy, Inc. | Short | -0.02 | -9.84 | -0.11 | -35.19 | -0.8425 | 0.3922 | ||

| EIX / Edison International | Short | -0.00 | -12.34 | -0.11 | -23.19 | -0.8494 | 0.2053 | ||

| RHI / Robert Half Inc. | Short | -0.00 | -0.11 | -0.8562 | -0.8562 | ||||

| VFC / V.F. Corporation | Short | -0.01 | -0.11 | -0.8695 | -0.8695 | ||||

| DVN / Devon Energy Corporation | Short | -0.00 | -6.53 | -0.11 | -20.44 | -0.8732 | 0.1738 | ||

| 0I14 / Cognex Corporation | Short | -0.00 | -9.22 | -0.11 | -3.54 | -0.8732 | -0.0109 | ||

| TGT / Target Corporation | Short | -0.00 | 5.79 | -0.11 | -27.33 | -0.8790 | 0.1192 | ||

| LEA / Lear Corporation | Short | -0.00 | -14.87 | -0.11 | -8.26 | -0.8911 | 0.0356 | ||

| LEN / Lennar Corporation | Short | -0.00 | -13.68 | -0.11 | -17.16 | -0.8927 | 0.1302 | ||

| ALGN / Align Technology, Inc. | Short | -0.00 | -11.79 | -0.11 | 4.72 | -0.8941 | -0.0834 | ||

| GNTX / Gentex Corporation | Short | -0.01 | -10.21 | -0.11 | -15.15 | -0.8962 | 0.1119 | ||

| STZ / Constellation Brands, Inc. | Short | -0.00 | -13.75 | -0.11 | -23.29 | -0.8970 | 0.2213 | ||

| WST / West Pharmaceutical Services, Inc. | Short | -0.00 | -0.11 | -0.9004 | -0.9004 | ||||

| XRAY / DENTSPLY SIRONA Inc. | Short | -0.01 | -8.63 | -0.11 | -3.45 | -0.9005 | -0.0167 | ||

| CE / Celanese Corporation | Short | -0.00 | -12.82 | -0.11 | -15.15 | -0.9020 | 0.1099 | ||

| TECH / Bio-Techne Corporation | Short | -0.00 | -0.11 | -0.9127 | -0.9127 | ||||

| APA / APA Corporation | Short | -0.01 | -4.87 | -0.11 | -17.39 | -0.9145 | 0.1386 | ||

| ZD / Ziff Davis, Inc. | Short | -0.00 | -0.11 | -0.9180 | -0.9180 | ||||

| SWKS / Skyworks Solutions, Inc. | Short | -0.00 | -9.40 | -0.11 | 3.64 | -0.9182 | -0.0804 | ||

| SIRI / Sirius XM Holdings Inc. | Short | -0.01 | -8.57 | -0.12 | -6.50 | -0.9202 | 0.0214 | ||

| WEN / The Wendy's Company | Short | -0.01 | -0.12 | -0.9263 | -0.9263 | ||||

| HOG / Harley-Davidson, Inc. | Short | -0.00 | -7.30 | -0.12 | -13.43 | -0.9339 | 0.0936 | ||

| UPS / United Parcel Service, Inc. | Short | -0.00 | 24.57 | -0.12 | 14.71 | -0.9405 | -0.1563 | ||

| SNAP / Snap Inc. | Short | -0.01 | -0.12 | -0.9458 | -0.9458 | ||||

| CRI / Carter's, Inc. | Short | -0.00 | 42.96 | -0.12 | 5.31 | -0.9534 | -0.0905 | ||

| LW / Lamb Weston Holdings, Inc. | Short | -0.00 | -9.08 | -0.12 | -11.19 | -0.9538 | 0.0742 | ||

| DINO / HF Sinclair Corporation | Short | -0.00 | -8.75 | -0.12 | 13.33 | -0.9582 | -0.1570 | ||

| LEG / Leggett & Platt, Incorporated | Short | -0.01 | -8.39 | -0.12 | 3.45 | -0.9650 | -0.0746 | ||

| FND / Floor & Decor Holdings, Inc. | Short | -0.00 | -76.89 | -0.12 | -72.18 | -0.9712 | -0.0438 | ||

| TDC / Teradata Corporation | Short | -0.01 | -6.19 | -0.12 | -6.92 | -0.9729 | 0.0232 | ||

| BC / Brunswick Corporation | Short | -0.00 | -7.55 | -0.12 | -5.47 | -0.9733 | 0.0049 | ||

| RIG / Transocean Ltd. | Short | -0.05 | -2.99 | -0.12 | -20.78 | -0.9807 | 0.1987 | ||

| IQV / IQVIA Holdings Inc. | Short | -0.00 | -0.12 | -0.9823 | -0.9823 | ||||

| BIO / Bio-Rad Laboratories, Inc. | Short | -0.00 | -0.12 | -0.9835 | -0.9835 | ||||

| MUR / Murphy Oil Corporation | Short | -0.01 | 35.70 | -0.12 | 7.89 | -0.9842 | -0.1116 | ||

| ODFL / Old Dominion Freight Line, Inc. | Short | -0.00 | -8.87 | -0.12 | -10.22 | -0.9857 | 0.0654 | ||

| FBIN / Fortune Brands Innovations, Inc. | Short | -0.00 | -0.12 | -0.9955 | -0.9955 | ||||

| IART / Integra LifeSciences Holdings Corporation | Short | -0.01 | 39.76 | -0.13 | -21.87 | -1.0029 | 0.2229 | ||

| GPN / Global Payments Inc. | Short | -0.00 | -0.13 | -1.0042 | -1.0042 | ||||

| SWK / Stanley Black & Decker, Inc. | Short | -0.00 | -0.13 | -1.0070 | -1.0070 | ||||

| WEX / WEX Inc. | Short | -0.00 | -0.13 | -1.0095 | -1.0095 | ||||

| SVC / Service Properties Trust | Short | -0.05 | -11.47 | -0.13 | -18.59 | -1.0161 | 0.1786 | ||

| ON / ON Semiconductor Corporation | Short | -0.00 | -11.31 | -0.13 | 14.41 | -1.0177 | -0.1685 | ||

| KSS / Kohl's Corporation | Short | -0.02 | -8.34 | -0.13 | -5.22 | -1.0209 | 0.0032 | ||

| NUE / Nucor Corporation | Short | -0.00 | -7.46 | -0.13 | -0.78 | -1.0269 | -0.0442 | ||

| HUM / Humana Inc. | Short | -0.00 | -14.61 | -0.13 | -20.99 | -1.0276 | 0.2139 | ||

| ENTG / Entegris, Inc. | Short | -0.00 | 13.48 | -0.13 | -7.19 | -1.0312 | 0.0098 | ||

| 3UF / Cimpress plc | Short | -0.00 | -7.69 | -0.13 | -4.44 | -1.0366 | -0.0065 | ||

| JELD / JELD-WEN Holding, Inc. | Short | -0.03 | 37.10 | -0.13 | -10.42 | -1.0384 | 0.0612 | ||

| PVH / PVH Corp. | Short | -0.00 | -8.23 | -0.13 | -3.01 | -1.0388 | -0.0221 | ||

| PII / Polaris Inc. | Short | -0.00 | 46.06 | -0.13 | 46.07 | -1.0404 | -0.3566 | ||

| WFRD / Weatherford International plc | Short | -0.00 | 50.63 | -0.13 | 40.86 | -1.0525 | -0.3436 | ||

| BRKR / Bruker Corporation | Short | -0.00 | 38.53 | -0.13 | 36.46 | -1.0535 | -0.3191 | ||

| TER / Teradyne, Inc. | Short | -0.00 | -0.13 | -1.0563 | -1.0563 | ||||

| NKE / NIKE, Inc. | Short | -0.00 | -8.81 | -0.13 | 2.33 | -1.0576 | -0.0697 | ||

| BTU / Peabody Energy Corporation | Short | -0.01 | -5.54 | -0.14 | -6.16 | -1.0967 | 0.0207 | ||

| AGIO / Agios Pharmaceuticals, Inc. | Short | -0.00 | -4.14 | -0.14 | 8.66 | -1.1070 | -0.1373 | ||

| ILMN / Illumina, Inc. | Short | -0.00 | -0.14 | -1.1208 | -1.1208 | ||||

| S94 / Sensata Technologies Holding plc | Short | -0.00 | -14.68 | -0.14 | 5.93 | -1.1470 | -0.1141 | ||

| INTC / Intel Corporation | Short | -0.01 | -11.21 | -0.15 | -12.65 | -1.1630 | 0.1028 | ||

| MRVL / Marvell Technology, Inc. | Short | -0.00 | -0.15 | -1.1999 | -1.1999 | ||||

| ADNT / Adient plc | Short | -0.01 | -10.50 | -0.15 | 35.14 | -1.2066 | -0.3574 | ||

| VYX / NCR Voyix Corporation | Short | -0.01 | -0.15 | -1.2354 | -1.2354 | ||||

| CRL / Charles River Laboratories International, Inc. | Short | -0.00 | 48.50 | -0.16 | 49.52 | -1.2622 | -0.4585 | ||

| FSLR / First Solar, Inc. | Short | -0.00 | -9.47 | -0.16 | 18.80 | -1.2646 | -0.2477 | ||

| W / Wayfair Inc. | Short | -0.00 | -6.06 | -0.16 | 50.48 | -1.2660 | -0.4614 | ||

| MKSI / MKS Inc. | Short | -0.00 | 7.00 | -0.16 | 3.23 | -1.2863 | -0.2506 | ||

| AMD / Advanced Micro Devices, Inc. | Short | -0.00 | -10.22 | -0.16 | 24.62 | -1.2949 | -0.2995 | ||

| HPP / Hudson Pacific Properties, Inc. | Short | -0.06 | 35.21 | -0.17 | 25.95 | -1.3209 | -0.3183 | ||

| QRVO / Qorvo, Inc. | Short | -0.00 | -7.76 | -0.17 | 8.23 | -1.3706 | -0.1627 | ||

| EL / The Estée Lauder Companies Inc. | Short | -0.00 | -9.04 | -0.17 | 11.54 | -1.3966 | -0.2011 | ||

| NUS / Nu Skin Enterprises, Inc. | Short | -0.02 | -3.93 | -0.18 | 5.42 | -1.4044 | -0.1382 | ||

| VSAT / Viasat, Inc. | Short | -0.02 | -7.45 | -0.28 | 30.09 | -2.2476 | -0.5955 |