Mga Batayang Estadistika

| Nilai Portofolio | $ 559,416,277 |

| Posisi Saat Ini | 119 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

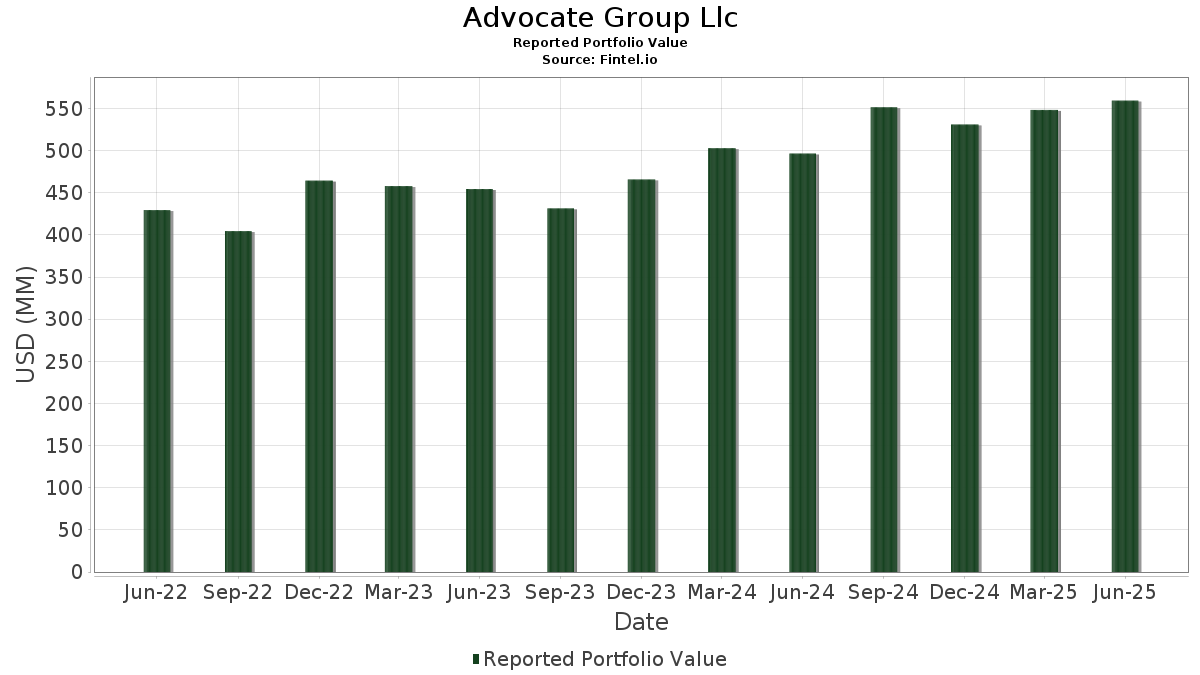

Advocate Group Llc telah mengungkapkan total kepemilikan 119 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 559,416,277 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Advocate Group Llc adalah General Mills, Inc. (US:GIS) , Vanguard Tax-Managed Funds - Vanguard FTSE Developed Markets ETF (US:VEA) , Vanguard Index Funds - Vanguard Large-Cap ETF (US:VV) , AbbVie Inc. (US:ABBV) , and Verizon Communications Inc. (US:VZ) . Posisi baru Advocate Group Llc meliputi: Salesforce, Inc. (US:CRM) , Wells Fargo & Company (GB:NWTD) , Alphabet Inc. (US:GOOGL) , Light & Wonder, Inc. (US:LNW) , and Harrow, Inc. (US:HROW) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.01 | 3.28 | 0.5866 | 0.5866 | |

| 0.03 | 12.59 | 2.2510 | 0.5039 | |

| 0.03 | 2.60 | 0.4645 | 0.4645 | |

| 0.01 | 2.42 | 0.4331 | 0.4331 | |

| 0.40 | 22.61 | 4.0419 | 0.4242 | |

| 0.02 | 6.47 | 1.1565 | 0.4112 | |

| 0.08 | 10.56 | 1.8885 | 0.3595 | |

| 0.06 | 17.32 | 3.0960 | 0.3413 | |

| 0.02 | 1.73 | 0.3097 | 0.3097 | |

| 0.12 | 8.71 | 1.5565 | 0.2713 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.50 | 25.99 | 4.6468 | -0.9372 | |

| 0.15 | 7.14 | 1.2763 | -0.3605 | |

| 0.08 | 15.09 | 2.6977 | -0.3263 | |

| 0.07 | 9.39 | 1.6777 | -0.2767 | |

| 0.34 | 14.67 | 2.6228 | -0.2107 | |

| 0.05 | 6.81 | 1.2181 | -0.1784 | |

| 0.04 | 8.68 | 1.5514 | -0.1699 | |

| 0.14 | 4.29 | 0.7677 | -0.1497 | |

| 0.35 | 8.37 | 1.4965 | -0.1379 | |

| 0.01 | 0.91 | 0.1619 | -0.1378 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-07-25 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| GIS / General Mills, Inc. | 0.50 | -2.02 | 25.99 | -15.10 | 4.6468 | -0.9372 | |||

| VEA / Vanguard Tax-Managed Funds - Vanguard FTSE Developed Markets ETF | 0.40 | 1.63 | 22.61 | 13.99 | 4.0419 | 0.4242 | |||

| VV / Vanguard Index Funds - Vanguard Large-Cap ETF | 0.06 | 3.30 | 17.32 | 14.66 | 3.0960 | 0.3413 | |||

| ABBV / AbbVie Inc. | 0.08 | 2.73 | 15.09 | -8.99 | 2.6977 | -0.3263 | |||

| VZ / Verizon Communications Inc. | 0.34 | -1.00 | 14.67 | -5.56 | 2.6228 | -0.2107 | |||

| IBM / International Business Machines Corporation | 0.05 | -8.17 | 14.06 | 8.86 | 2.5126 | 0.1578 | |||

| CSCO / Cisco Systems, Inc. | 0.19 | -2.18 | 13.52 | 9.97 | 2.4168 | 0.1748 | |||

| MSFT / Microsoft Corporation | 0.03 | -0.80 | 12.59 | 31.45 | 2.2510 | 0.5039 | |||

| JPM / JPMorgan Chase & Co. | 0.04 | -3.14 | 11.75 | 14.47 | 2.0999 | 0.2284 | |||

| ENB / Enbridge Inc. | 0.25 | -1.01 | 11.15 | 1.24 | 1.9923 | -0.0153 | |||

| SCHW / The Charles Schwab Corporation | 0.12 | -1.31 | 10.80 | 15.02 | 1.9303 | 0.2182 | |||

| EMR / Emerson Electric Co. | 0.08 | 3.62 | 10.56 | 26.02 | 1.8885 | 0.3595 | |||

| MS / Morgan Stanley | 0.07 | -2.48 | 10.56 | 17.75 | 1.8883 | 0.2520 | |||

| JNJ / Johnson & Johnson | 0.07 | 4.80 | 10.46 | -3.48 | 1.8705 | -0.1065 | |||

| EVRG / Evergy, Inc. | 0.15 | 4.61 | 10.06 | 4.57 | 1.7982 | 0.0439 | |||

| MDT / Medtronic plc | 0.11 | 2.29 | 9.81 | -0.77 | 1.7539 | -0.0493 | |||

| CVX / Chevron Corporation | 0.07 | 2.32 | 9.39 | -12.42 | 1.6777 | -0.2767 | |||

| MCD / McDonald's Corporation | 0.03 | 0.96 | 9.21 | -5.57 | 1.6465 | -0.1323 | |||

| KR / The Kroger Co. | 0.12 | 16.60 | 8.71 | 23.56 | 1.5565 | 0.2713 | |||

| AAPL / Apple Inc. | 0.04 | -0.45 | 8.68 | -8.05 | 1.5514 | -0.1699 | |||

| UPS / United Parcel Service, Inc. | 0.08 | 5.23 | 8.57 | -3.42 | 1.5324 | -0.0865 | |||

| DUK / Duke Energy Corporation | 0.07 | -1.17 | 8.48 | -4.39 | 1.5163 | -0.1016 | |||

| PFE / Pfizer Inc. | 0.35 | -2.35 | 8.37 | -6.59 | 1.4965 | -0.1379 | |||

| GJR / Strats Trust For Procter & Gambel Security - Preferred Security | 0.05 | 0.24 | 8.25 | -6.28 | 1.4741 | -0.1307 | |||

| SO / The Southern Company | 0.09 | -1.81 | 8.21 | -1.94 | 1.4671 | -0.0593 | |||

| UNP / Union Pacific Corporation | 0.03 | 1.42 | 7.85 | -1.23 | 1.4036 | -0.0462 | |||

| HD / The Home Depot, Inc. | 0.02 | 1.92 | 7.77 | 1.97 | 1.3888 | -0.0008 | |||

| D / Dominion Energy, Inc. | 0.14 | -1.82 | 7.65 | -1.04 | 1.3666 | -0.0422 | |||

| NTR / Nutrien Ltd. | 0.13 | -2.50 | 7.54 | 14.32 | 1.3470 | 0.1449 | |||

| CMI / Cummins Inc. | 0.02 | 1.37 | 7.42 | 5.92 | 1.3267 | 0.0488 | |||

| MRK / Merck & Co., Inc. | 0.09 | 9.88 | 7.42 | -3.10 | 1.3262 | -0.0700 | |||

| TXN / Texas Instruments Incorporated | 0.04 | -0.95 | 7.30 | 14.44 | 1.3049 | 0.1416 | |||

| VTIP / Vanguard Malvern Funds - Vanguard Short-Term Inflation-Protected Securities ETF | 0.14 | 2.42 | 7.25 | 3.19 | 1.2967 | 0.0145 | |||

| UL / Unilever PLC - Depositary Receipt (Common Stock) | 0.12 | -4.37 | 7.20 | -1.76 | 1.2875 | -0.0497 | |||

| BMY / Bristol-Myers Squibb Company | 0.15 | 4.82 | 7.14 | -20.45 | 1.2763 | -0.3605 | |||

| CB / Chubb Limited | 0.02 | 0.47 | 6.97 | -3.61 | 1.2458 | -0.0729 | |||

| TGT / Target Corporation | 0.07 | 8.60 | 6.91 | 2.66 | 1.2344 | 0.0076 | |||

| KMB / Kimberly-Clark Corporation | 0.05 | -1.83 | 6.81 | -11.01 | 1.2181 | -0.1784 | |||

| CAT / Caterpillar Inc. | 0.02 | 1.91 | 6.80 | 19.97 | 1.2157 | 0.1818 | |||

| SCHR / Schwab Strategic Trust - Schwab Intermediate-Term U.S. Treasury ETF | 0.26 | 1.66 | 6.55 | 2.34 | 1.1718 | 0.0038 | |||

| AVGO / Broadcom Inc. | 0.02 | -3.84 | 6.47 | 58.32 | 1.1565 | 0.4112 | |||

| GPK / Graphic Packaging Holding Company | 0.29 | 16.20 | 6.11 | -5.68 | 1.0930 | -0.0893 | |||

| VWO / Vanguard International Equity Index Funds - Vanguard FTSE Emerging Markets ETF | 0.12 | 1.98 | 6.00 | 11.45 | 1.0722 | 0.0906 | |||

| VTI / Vanguard Index Funds - Vanguard Total Stock Market ETF | 0.02 | 0.02 | 5.82 | 10.60 | 1.0412 | 0.0808 | |||

| ADBE / Adobe Inc. | 0.01 | 6.10 | 5.63 | 7.04 | 1.0063 | 0.0471 | |||

| VEU / Vanguard International Equity Index Funds - Vanguard FTSE All-World ex-US ETF | 0.08 | 1.60 | 5.49 | 12.57 | 0.9814 | 0.0921 | |||

| PSA / Public Storage | 0.02 | 0.84 | 5.43 | -1.15 | 0.9713 | -0.0311 | |||

| MINT / PIMCO ETF Trust - PIMCO Enhanced Short Maturity Active Exchange-Traded Fund | 0.05 | 0.49 | 5.23 | 0.40 | 0.9343 | -0.0150 | |||

| MA / Mastercard Incorporated | 0.01 | -0.77 | 4.90 | 1.74 | 0.8761 | -0.0025 | |||

| SHEL / Shell plc - Depositary Receipt (Common Stock) | 0.07 | -0.83 | 4.86 | -4.71 | 0.8682 | -0.0614 | |||

| WPC / W. P. Carey Inc. | 0.08 | 0.19 | 4.85 | -0.96 | 0.8662 | -0.0261 | |||

| AVB / AvalonBay Communities, Inc. | 0.02 | 0.42 | 4.43 | -4.77 | 0.7915 | -0.0565 | |||

| BP / BP p.l.c. - Depositary Receipt (Common Stock) | 0.14 | -3.61 | 4.29 | -14.63 | 0.7677 | -0.1497 | |||

| PLD / Prologis, Inc. | 0.04 | 4.08 | 4.08 | -2.11 | 0.7301 | -0.0309 | |||

| NEE / NextEra Energy, Inc. | 0.06 | 1.88 | 3.93 | -0.23 | 0.7028 | -0.0159 | |||

| LYB / LyondellBasell Industries N.V. | 0.07 | 8.13 | 3.85 | -11.12 | 0.6873 | -0.1018 | |||

| SCCO / Southern Copper Corporation | 0.04 | 0.96 | 3.82 | 9.28 | 0.6824 | 0.0454 | |||

| FCX / Freeport-McMoRan Inc. | 0.08 | 18.46 | 3.57 | 35.66 | 0.6386 | 0.1583 | |||

| ARE / Alexandria Real Estate Equities, Inc. | 0.05 | 30.62 | 3.55 | 2.54 | 0.6342 | 0.0032 | |||

| VO / Vanguard Index Funds - Vanguard Mid-Cap ETF | 0.01 | 3.16 | 3.32 | 11.62 | 0.5942 | 0.0511 | |||

| CRM / Salesforce, Inc. | 0.01 | 3.28 | 0.5866 | 0.5866 | |||||

| NKE / NIKE, Inc. | 0.05 | 9.84 | 3.24 | 22.93 | 0.5798 | 0.0986 | |||

| RIO / Rio Tinto Group - Depositary Receipt (Common Stock) | 0.05 | 3.40 | 3.18 | 0.41 | 0.5685 | -0.0092 | |||

| NWTD / Wells Fargo & Company | 0.03 | 2.60 | 0.4645 | 0.4645 | |||||

| WMT / Walmart Inc. | 0.03 | -11.66 | 2.50 | -1.61 | 0.4474 | -0.0165 | |||

| CCI / Crown Castle Inc. | 0.02 | -6.32 | 2.43 | -7.68 | 0.4343 | -0.0456 | |||

| DE / Deere & Company | 0.00 | -2.69 | 2.42 | 5.39 | 0.4333 | 0.0140 | |||

| GOOGL / Alphabet Inc. | 0.01 | 2.42 | 0.4331 | 0.4331 | |||||

| IXUS / iShares Trust - iShares Core MSCI Total International Stock ETF | 0.03 | 0.00 | 2.32 | 10.74 | 0.4146 | 0.0326 | |||

| AMAT / Applied Materials, Inc. | 0.01 | -0.47 | 1.85 | 25.61 | 0.3305 | 0.0619 | |||

| ABT / Abbott Laboratories | 0.01 | 0.00 | 1.80 | 2.51 | 0.3215 | 0.0016 | |||

| LNW / Light & Wonder, Inc. | 0.02 | 1.73 | 0.3097 | 0.3097 | |||||

| AMGN / Amgen Inc. | 0.01 | -6.02 | 1.62 | -15.80 | 0.2888 | -0.0611 | |||

| VUG / Vanguard Index Funds - Vanguard Growth ETF | 0.00 | 0.00 | 1.60 | 18.18 | 0.2860 | 0.0392 | |||

| FAST / Fastenal Company | 0.04 | 94.32 | 1.51 | 5.23 | 0.2698 | 0.0083 | |||

| VTV / Vanguard Index Funds - Vanguard Value ETF | 0.01 | 0.00 | 1.40 | 2.33 | 0.2511 | 0.0007 | |||

| TSLA / Tesla, Inc. | 0.00 | 0.00 | 1.30 | 22.60 | 0.2329 | 0.0390 | |||

| PAYX / Paychex, Inc. | 0.01 | -0.83 | 1.27 | -6.53 | 0.2279 | -0.0208 | |||

| VB / Vanguard Index Funds - Vanguard Small-Cap ETF | 0.01 | 4.26 | 1.26 | 11.43 | 0.2249 | 0.0190 | |||

| KO / The Coca-Cola Company | 0.01 | 0.00 | 0.92 | -1.28 | 0.1653 | -0.0054 | |||

| XOM / Exxon Mobil Corporation | 0.01 | -39.18 | 0.91 | -44.92 | 0.1619 | -0.1378 | |||

| AZN / AstraZeneca PLC - Depositary Receipt (Common Stock) | 0.01 | -0.96 | 0.88 | -5.90 | 0.1569 | -0.0131 | |||

| DRI / Darden Restaurants, Inc. | 0.00 | 0.00 | 0.80 | 4.97 | 0.1435 | 0.0040 | |||

| NSC / Norfolk Southern Corporation | 0.00 | -4.24 | 0.77 | 3.50 | 0.1375 | 0.0020 | |||

| CL / Colgate-Palmolive Company | 0.01 | -5.47 | 0.77 | -8.26 | 0.1370 | -0.0154 | |||

| STLD / Steel Dynamics, Inc. | 0.01 | -0.74 | 0.72 | 1.70 | 0.1285 | -0.0006 | |||

| DLR / Digital Realty Trust, Inc. | 0.00 | 0.00 | 0.67 | 21.64 | 0.1198 | 0.0193 | |||

| WSO / Watsco, Inc. | 0.00 | 0.00 | 0.61 | -13.09 | 0.1093 | -0.0190 | |||

| VNQ / Vanguard Specialized Funds - Vanguard Real Estate ETF | 0.01 | 0.00 | 0.55 | -1.60 | 0.0992 | -0.0037 | |||

| SPY / SPDR S&P 500 ETF | 0.00 | 0.00 | 0.54 | 10.59 | 0.0971 | 0.0074 | |||

| MAS / Masco Corporation | 0.01 | -21.58 | 0.49 | -27.42 | 0.0871 | -0.0353 | |||

| META / Meta Platforms, Inc. | 0.00 | 0.00 | 0.48 | 28.04 | 0.0866 | 0.0176 | |||

| CNP / CenterPoint Energy, Inc. | 0.01 | 0.00 | 0.44 | 1.37 | 0.0795 | -0.0005 | |||

| ENTG / Entegris, Inc. | 0.00 | 0.00 | 0.39 | -7.89 | 0.0689 | -0.0073 | |||

| IWM / iShares Trust - iShares Russell 2000 ETF | 0.00 | 0.00 | 0.37 | 8.19 | 0.0662 | 0.0038 | |||

| ADM / Archer-Daniels-Midland Company | 0.01 | -0.40 | 0.36 | 9.64 | 0.0651 | 0.0044 | |||

| PKG / Packaging Corporation of America | 0.00 | -29.84 | 0.36 | -33.27 | 0.0646 | -0.0341 | |||

| BSX / Boston Scientific Corporation | 0.00 | 0.00 | 0.35 | 6.36 | 0.0629 | 0.0026 | |||

| IWB / iShares Trust - iShares Russell 1000 ETF | 0.00 | 0.00 | 0.34 | 10.78 | 0.0607 | 0.0048 | |||

| COP / ConocoPhillips | 0.00 | 0.00 | 0.34 | -14.43 | 0.0605 | -0.0117 | |||

| SYY / Sysco Corporation | 0.00 | 0.00 | 0.30 | 0.68 | 0.0532 | -0.0006 | |||

| PEP / PepsiCo, Inc. | 0.00 | 46.76 | 0.29 | 29.46 | 0.0519 | 0.0109 | |||

| MDLZ / Mondelez International, Inc. | 0.00 | -46.36 | 0.29 | -46.74 | 0.0512 | -0.0468 | |||

| VNQI / Vanguard International Equity Index Funds - Vanguard Global ex-U.S. Real Estate ETF | 0.01 | 0.00 | 0.28 | 14.23 | 0.0503 | 0.0053 | |||

| IVV / iShares Trust - iShares Core S&P 500 ETF | 0.00 | 8.43 | 0.28 | 19.74 | 0.0499 | 0.0074 | |||

| COST / Costco Wholesale Corporation | 0.00 | 0.00 | 0.28 | 4.96 | 0.0492 | 0.0012 | |||

| HROW / Harrow, Inc. | 0.01 | 0.27 | 0.0482 | 0.0482 | |||||

| MMM / 3M Company | 0.00 | -6.46 | 0.27 | -3.27 | 0.0477 | -0.0025 | |||

| LMT / Lockheed Martin Corporation | 0.00 | 0.00 | 0.26 | 3.64 | 0.0458 | 0.0007 | |||

| CEG / Constellation Energy Corporation | 0.00 | 0.25 | 0.0451 | 0.0451 | |||||

| ETN / Eaton Corporation plc | 0.00 | 0.24 | 0.0430 | 0.0430 | |||||

| FNDX / Schwab Strategic Trust - Schwab Fundamental U.S. Large Company ETF | 0.01 | 0.00 | 0.23 | 3.60 | 0.0413 | 0.0008 | |||

| T / AT&T Inc. | 0.01 | -7.19 | 0.23 | -5.06 | 0.0403 | -0.0030 | |||

| SCHG / Schwab Strategic Trust - Schwab U.S. Large-Cap Growth ETF | 0.01 | 0.22 | 0.0402 | 0.0402 | |||||

| SCHV / Schwab Strategic Trust - Schwab U.S. Large-Cap Value ETF | 0.01 | 0.00 | 0.22 | 4.19 | 0.0401 | 0.0008 | |||

| OKE / ONEOK, Inc. | 0.00 | 0.22 | 0.0391 | 0.0391 | |||||

| GWW / W.W. Grainger, Inc. | 0.00 | 0.21 | 0.0376 | 0.0376 | |||||

| BB / BlackBerry Limited | 0.02 | 0.00 | 0.11 | 20.69 | 0.0189 | 0.0030 | |||

| UAMY / United States Antimony Corporation | 0.03 | 0.00 | 0.07 | -1.43 | 0.0125 | -0.0004 | |||

| BBY / Best Buy Co., Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| GILD / Gilead Sciences, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| DEO / Diageo plc - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| UNH / UnitedHealth Group Incorporated | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| XEL / Xcel Energy Inc. | 0.00 | -100.00 | 0.00 | 0.0000 |