Mga Batayang Estadistika

| Nilai Portofolio | $ 298,691,462 |

| Posisi Saat Ini | 130 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

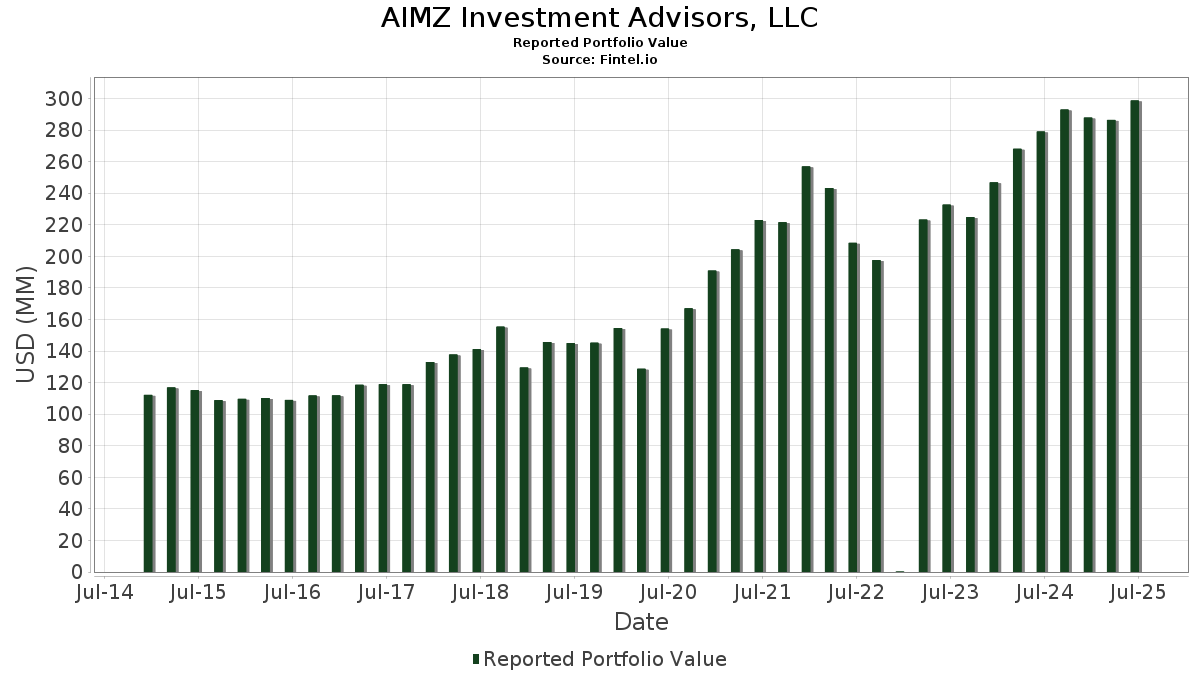

AIMZ Investment Advisors, LLC telah mengungkapkan total kepemilikan 130 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 298,691,462 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama AIMZ Investment Advisors, LLC adalah Meta Platforms, Inc. (US:META) , Apple Inc. (US:AAPL) , Microsoft Corporation (US:MSFT) , QUALCOMM Incorporated (US:QCOM) , and Vertex Pharmaceuticals Incorporated (US:VRTX) . Posisi baru AIMZ Investment Advisors, LLC meliputi: Ubiquiti Inc. (US:UI) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.03 | 14.38 | 4.8151 | 0.9722 | |

| 0.03 | 19.34 | 6.4749 | 0.9696 | |

| 0.01 | 5.69 | 1.9035 | 0.3850 | |

| 0.01 | 3.01 | 1.0066 | 0.2963 | |

| 0.06 | 6.14 | 2.0551 | 0.2686 | |

| 0.00 | 2.78 | 0.9307 | 0.2548 | |

| 0.04 | 3.14 | 1.0501 | 0.2499 | |

| 0.05 | 8.53 | 2.8567 | 0.2330 | |

| 0.02 | 3.03 | 1.0151 | 0.2089 | |

| 0.02 | 5.37 | 1.7963 | 0.1859 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.09 | 17.60 | 5.8921 | -0.7946 | |

| 0.02 | 9.23 | 3.0892 | -0.4571 | |

| 0.01 | 5.17 | 1.7320 | -0.4500 | |

| 0.03 | 2.78 | 0.9301 | -0.3330 | |

| 0.05 | 2.45 | 0.8190 | -0.3082 | |

| 0.01 | 5.18 | 1.7333 | -0.2735 | |

| 0.01 | 3.66 | 1.2265 | -0.2114 | |

| 0.07 | 7.21 | 2.4135 | -0.1871 | |

| 0.01 | 2.52 | 0.8428 | -0.1773 | |

| 0.02 | 2.92 | 0.9760 | -0.1726 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-12 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| META / Meta Platforms, Inc. | 0.03 | -4.23 | 19.34 | 22.65 | 6.4749 | 0.9696 | |||

| AAPL / Apple Inc. | 0.09 | -0.51 | 17.60 | -8.11 | 5.8921 | -0.7946 | |||

| MSFT / Microsoft Corporation | 0.03 | -1.39 | 14.38 | 30.67 | 4.8151 | 0.9722 | |||

| QCOM / QUALCOMM Incorporated | 0.06 | -0.93 | 9.25 | 2.72 | 3.0983 | -0.0473 | |||

| VRTX / Vertex Pharmaceuticals Incorporated | 0.02 | -1.07 | 9.23 | -9.16 | 3.0892 | -0.4571 | |||

| GOOG / Alphabet Inc. | 0.05 | 0.00 | 8.53 | 13.55 | 2.8567 | 0.2330 | |||

| GOOGL / Alphabet Inc. | 0.04 | -1.51 | 7.47 | 12.25 | 2.5004 | 0.1773 | |||

| GILD / Gilead Sciences, Inc. | 0.07 | -2.19 | 7.21 | -3.22 | 2.4135 | -0.1871 | |||

| NTAP / NetApp, Inc. | 0.06 | -1.10 | 6.14 | 19.95 | 2.0551 | 0.2686 | |||

| CTAS / Cintas Corporation | 0.03 | -1.88 | 5.82 | 6.40 | 1.9473 | 0.0387 | |||

| ADBE / Adobe Inc. | 0.01 | 29.59 | 5.69 | 30.72 | 1.9035 | 0.3850 | |||

| INFY / Infosys Limited - Depositary Receipt (Common Stock) | 0.31 | -0.65 | 5.66 | 0.87 | 1.8947 | -0.0641 | |||

| IBM / International Business Machines Corporation | 0.02 | -1.88 | 5.37 | 16.33 | 1.7963 | 0.1859 | |||

| CHKP / Check Point Software Technologies Ltd. | 0.02 | -0.49 | 5.18 | -3.41 | 1.7351 | -0.1380 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.01 | -1.25 | 5.18 | -9.93 | 1.7333 | -0.2735 | |||

| REGN / Regeneron Pharmaceuticals, Inc. | 0.01 | 0.00 | 5.17 | -17.22 | 1.7320 | -0.4500 | |||

| CSCO / Cisco Systems, Inc. | 0.07 | -1.12 | 4.87 | 11.17 | 1.6292 | 0.1009 | |||

| TROW / T. Rowe Price Group, Inc. | 0.05 | -1.16 | 4.74 | 3.81 | 1.5878 | -0.0071 | |||

| INCY / Incyte Corporation | 0.07 | -0.98 | 4.65 | 11.36 | 1.5560 | 0.0990 | |||

| WMT / Walmart Inc. | 0.05 | -3.60 | 4.63 | 7.37 | 1.5503 | 0.0445 | |||

| EXPD / Expeditors International of Washington, Inc. | 0.04 | -0.89 | 4.40 | -5.84 | 1.4737 | -0.1584 | |||

| CHRW / C.H. Robinson Worldwide, Inc. | 0.04 | -0.58 | 4.06 | -6.84 | 1.3587 | -0.1623 | |||

| PYPL / PayPal Holdings, Inc. | 0.05 | -1.51 | 4.01 | 12.16 | 1.3431 | 0.0945 | |||

| AZN / AstraZeneca PLC - Depositary Receipt (Common Stock) | 0.06 | -0.46 | 4.01 | -5.36 | 1.3413 | -0.1367 | |||

| EPAM / EPAM Systems, Inc. | 0.02 | -0.53 | 3.95 | 4.17 | 1.3219 | -0.0015 | |||

| TEVA / Teva Pharmaceutical Industries Limited - Depositary Receipt (Common Stock) | 0.22 | -0.62 | 3.76 | 8.38 | 1.2600 | 0.0475 | |||

| AMGN / Amgen Inc. | 0.01 | -0.75 | 3.66 | -11.05 | 1.2265 | -0.2114 | |||

| SYK / Stryker Corporation | 0.01 | -0.09 | 3.61 | 6.20 | 1.2095 | 0.0217 | |||

| GMAB / Genmab A/S - Depositary Receipt (Common Stock) | 0.17 | -1.13 | 3.43 | 4.32 | 1.1474 | 0.0004 | |||

| URBN / Urban Outfitters, Inc. | 0.04 | -1.14 | 3.14 | 36.88 | 1.0501 | 0.2499 | |||

| CI / The Cigna Group | 0.01 | -1.09 | 3.10 | -0.61 | 1.0387 | -0.0511 | |||

| NVDA / NVIDIA Corporation | 0.02 | -9.92 | 3.03 | 31.31 | 1.0151 | 0.2089 | |||

| ORCL / Oracle Corporation | 0.01 | -5.50 | 3.01 | 47.79 | 1.0066 | 0.2963 | |||

| ABBV / AbbVie Inc. | 0.02 | 0.03 | 2.92 | -11.37 | 0.9760 | -0.1726 | |||

| NFLX / Netflix, Inc. | 0.00 | 0.00 | 2.78 | 43.67 | 0.9307 | 0.2548 | |||

| GLOB / Globant S.A. | 0.03 | -0.49 | 2.78 | -23.20 | 0.9301 | -0.3330 | |||

| LOW / Lowe's Companies, Inc. | 0.01 | 0.02 | 2.60 | -4.86 | 0.8709 | -0.0837 | |||

| UNH / UnitedHealth Group Incorporated | 0.01 | 44.66 | 2.52 | -13.83 | 0.8428 | -0.1773 | |||

| BMY / Bristol-Myers Squibb Company | 0.05 | -0.16 | 2.45 | -24.23 | 0.8190 | -0.3082 | |||

| DLB / Dolby Laboratories, Inc. | 0.03 | 0.01 | 2.38 | -7.53 | 0.7973 | -0.1018 | |||

| GSK / GSK plc - Depositary Receipt (Common Stock) | 0.06 | -0.63 | 2.38 | -1.49 | 0.7954 | -0.0467 | |||

| ADI / Analog Devices, Inc. | 0.01 | -4.82 | 2.35 | 12.36 | 0.7852 | 0.0563 | |||

| EEFT / Euronet Worldwide, Inc. | 0.02 | 0.00 | 2.32 | -5.12 | 0.7756 | -0.0769 | |||

| VOE / Vanguard Index Funds - Vanguard Mid-Cap Value ETF | 0.01 | -7.37 | 2.30 | -5.09 | 0.7684 | -0.0760 | |||

| ABT / Abbott Laboratories | 0.02 | -0.59 | 2.26 | 1.94 | 0.7552 | -0.0175 | |||

| JNJ / Johnson & Johnson | 0.01 | -0.22 | 2.22 | -8.12 | 0.7431 | -0.1001 | |||

| ITW / Illinois Tool Works Inc. | 0.01 | -0.53 | 2.21 | -0.85 | 0.7387 | -0.0382 | |||

| MRK / Merck & Co., Inc. | 0.03 | -2.10 | 2.08 | -13.67 | 0.6979 | -0.1451 | |||

| TDY / Teledyne Technologies Incorporated | 0.00 | -0.10 | 2.06 | 2.84 | 0.6907 | -0.0098 | |||

| EMR / Emerson Electric Co. | 0.01 | -0.45 | 1.93 | 21.07 | 0.6467 | 0.0896 | |||

| VYM / Vanguard Whitehall Funds - Vanguard High Dividend Yield ETF | 0.01 | -6.32 | 1.91 | -3.19 | 0.6400 | -0.0492 | |||

| BEN / Franklin Resources, Inc. | 0.08 | -0.14 | 1.91 | 23.74 | 0.6388 | 0.1004 | |||

| KO / The Coca-Cola Company | 0.02 | -0.25 | 1.74 | -1.47 | 0.5821 | -0.0340 | |||

| PEP / PepsiCo, Inc. | 0.01 | -0.25 | 1.72 | -12.14 | 0.5746 | -0.1076 | |||

| SBUX / Starbucks Corporation | 0.02 | -2.59 | 1.72 | -9.02 | 0.5742 | -0.0839 | |||

| VTV / Vanguard Index Funds - Vanguard Value ETF | 0.01 | -7.99 | 1.70 | -5.88 | 0.5687 | -0.0613 | |||

| DOX / Amdocs Limited | 0.02 | -0.26 | 1.66 | -0.54 | 0.5541 | -0.0269 | |||

| PRLB / Proto Labs, Inc. | 0.04 | -3.02 | 1.64 | 10.83 | 0.5483 | 0.0323 | |||

| HD / The Home Depot, Inc. | 0.00 | -2.20 | 1.63 | -2.16 | 0.5462 | -0.0360 | |||

| NVS / Novartis AG - Depositary Receipt (Common Stock) | 0.01 | -0.18 | 1.61 | 8.33 | 0.5400 | 0.0203 | |||

| VIG / Vanguard Specialized Funds - Vanguard Dividend Appreciation ETF | 0.01 | -9.28 | 1.58 | -4.29 | 0.5305 | -0.0475 | |||

| SPGI / S&P Global Inc. | 0.00 | -1.96 | 1.58 | 1.74 | 0.5289 | -0.0132 | |||

| MDT / Medtronic plc | 0.02 | -0.17 | 1.54 | -3.14 | 0.5171 | -0.0397 | |||

| XOM / Exxon Mobil Corporation | 0.01 | -0.23 | 1.40 | -9.55 | 0.4692 | -0.0719 | |||

| VHT / Vanguard World Fund - Vanguard Health Care ETF | 0.01 | -9.72 | 1.29 | -15.31 | 0.4317 | -0.0999 | |||

| AMZN / Amazon.com, Inc. | 0.01 | 4.75 | 1.28 | 20.81 | 0.4278 | 0.0584 | |||

| PRF / Invesco Exchange-Traded Fund Trust - Invesco RAFI US 1000 ETF | 0.03 | 0.00 | 1.06 | 4.55 | 0.3538 | 0.0011 | |||

| WFC / Wells Fargo & Company | 0.01 | 0.00 | 0.92 | 11.66 | 0.3077 | 0.0202 | |||

| TSLA / Tesla, Inc. | 0.00 | -0.35 | 0.91 | 22.25 | 0.3054 | 0.0447 | |||

| KLAC / KLA Corporation | 0.00 | 0.00 | 0.90 | 31.87 | 0.3020 | 0.0630 | |||

| WIT / Wipro Limited - Depositary Receipt (Common Stock) | 0.29 | 0.00 | 0.89 | -1.34 | 0.2969 | -0.0168 | |||

| JPM / JPMorgan Chase & Co. | 0.00 | 0.00 | 0.84 | 18.19 | 0.2808 | 0.0330 | |||

| BAC / Bank of America Corporation | 0.02 | 0.00 | 0.83 | 13.32 | 0.2795 | 0.0225 | |||

| PLTR / Palantir Technologies Inc. | 0.01 | 0.00 | 0.83 | 61.67 | 0.2784 | 0.0986 | |||

| USMV / iShares Trust - iShares MSCI USA Min Vol Factor ETF | 0.01 | 0.00 | 0.75 | 0.27 | 0.2522 | -0.0102 | |||

| COST / Costco Wholesale Corporation | 0.00 | -3.31 | 0.72 | 1.12 | 0.2419 | -0.0074 | |||

| MMM / 3M Company | 0.00 | -1.05 | 0.71 | 2.59 | 0.2392 | -0.0040 | |||

| INTC / Intel Corporation | 0.03 | -1.68 | 0.70 | -3.06 | 0.2339 | -0.0176 | |||

| UPS / United Parcel Service, Inc. | 0.01 | 0.00 | 0.68 | -8.22 | 0.2281 | -0.0311 | |||

| DLTR / Dollar Tree, Inc. | 0.01 | -0.36 | 0.68 | 31.46 | 0.2270 | 0.0469 | |||

| HLN / Haleon plc - Depositary Receipt (Common Stock) | 0.06 | -2.56 | 0.67 | -1.76 | 0.2241 | -0.0139 | |||

| EBAY / eBay Inc. | 0.01 | 0.02 | 0.67 | 9.92 | 0.2228 | 0.0115 | |||

| MRVL / Marvell Technology, Inc. | 0.01 | 0.00 | 0.61 | 25.87 | 0.2053 | 0.0350 | |||

| VEU / Vanguard International Equity Index Funds - Vanguard FTSE All-World ex-US ETF | 0.01 | -4.23 | 0.60 | 6.23 | 0.1999 | 0.0035 | |||

| SPY / SPDR S&P 500 ETF | 0.00 | -3.75 | 0.57 | 6.33 | 0.1913 | 0.0036 | |||

| HIPO / Hippo Holdings Inc. | 0.02 | 0.00 | 0.56 | 9.30 | 0.1890 | 0.0086 | |||

| QQQ / Invesco QQQ Trust, Series 1 | 0.00 | 0.10 | 0.56 | 17.55 | 0.1865 | 0.0212 | |||

| ISRG / Intuitive Surgical, Inc. | 0.00 | 0.00 | 0.54 | 9.59 | 0.1801 | 0.0089 | |||

| ADP / Automatic Data Processing, Inc. | 0.00 | 0.00 | 0.52 | 0.97 | 0.1740 | -0.0058 | |||

| WBA / Walgreens Boots Alliance, Inc. | 0.04 | -1.19 | 0.48 | 1.69 | 0.1611 | -0.0043 | |||

| MCD / McDonald's Corporation | 0.00 | -8.44 | 0.48 | -14.41 | 0.1591 | -0.0347 | |||

| VUG / Vanguard Index Funds - Vanguard Growth ETF | 0.00 | -5.70 | 0.47 | 11.35 | 0.1579 | 0.0102 | |||

| LLY / Eli Lilly and Company | 0.00 | 0.00 | 0.46 | -5.60 | 0.1525 | -0.0160 | |||

| V / Visa Inc. | 0.00 | 0.00 | 0.43 | 1.18 | 0.1432 | -0.0042 | |||

| PRFZ / Invesco Exchange-Traded Fund Trust - Invesco RAFI US 1500 Small-Mid ETF | 0.01 | 0.00 | 0.43 | 7.56 | 0.1430 | 0.0042 | |||

| CPRI / Capri Holdings Limited | 0.02 | 0.00 | 0.42 | -10.45 | 0.1409 | -0.0229 | |||

| WAL / Western Alliance Bancorporation | 0.01 | 0.00 | 0.41 | 1.73 | 0.1376 | -0.0038 | |||

| MA / Mastercard Incorporated | 0.00 | 0.00 | 0.40 | 2.56 | 0.1343 | -0.0023 | |||

| PPL / PPL Corporation | 0.01 | -0.58 | 0.39 | -6.55 | 0.1290 | -0.0152 | |||

| PFE / Pfizer Inc. | 0.02 | -0.41 | 0.38 | -4.75 | 0.1277 | -0.0121 | |||

| AMAT / Applied Materials, Inc. | 0.00 | 0.00 | 0.38 | 26.17 | 0.1260 | 0.0218 | |||

| SRE / Sempra | 0.00 | 0.00 | 0.37 | 6.29 | 0.1246 | 0.0022 | |||

| SHEL / Shell plc - Depositary Receipt (Common Stock) | 0.01 | 0.00 | 0.37 | -3.89 | 0.1243 | -0.0106 | |||

| AVGO / Broadcom Inc. | 0.00 | 0.00 | 0.36 | 65.12 | 0.1190 | 0.0436 | |||

| T / AT&T Inc. | 0.01 | -4.14 | 0.33 | -1.77 | 0.1116 | -0.0070 | |||

| SCHV / Schwab Strategic Trust - Schwab U.S. Large-Cap Value ETF | 0.01 | 0.00 | 0.32 | 3.96 | 0.1056 | -0.0002 | |||

| AFL / Aflac Incorporated | 0.00 | 0.00 | 0.30 | -5.40 | 0.1001 | -0.0100 | |||

| HON / Honeywell International Inc. | 0.00 | 0.00 | 0.29 | 10.19 | 0.0978 | 0.0051 | |||

| GE / General Electric Company | 0.00 | 0.00 | 0.28 | 28.64 | 0.0950 | 0.0180 | |||

| PG / The Procter & Gamble Company | 0.00 | -3.11 | 0.28 | -9.45 | 0.0932 | -0.0141 | |||

| NOC / Northrop Grumman Corporation | 0.00 | 0.00 | 0.26 | -2.58 | 0.0887 | -0.0060 | |||

| CVX / Chevron Corporation | 0.00 | 0.00 | 0.26 | -14.43 | 0.0855 | -0.0187 | |||

| COP / ConocoPhillips | 0.00 | 0.00 | 0.25 | -14.58 | 0.0845 | -0.0186 | |||

| DELL / Dell Technologies Inc. | 0.00 | 0.24 | 0.0820 | 0.0820 | |||||

| XCOR / FundX Investment Trust - FundX ETF | 0.00 | 0.00 | 0.24 | 11.74 | 0.0798 | 0.0054 | |||

| PNC / The PNC Financial Services Group, Inc. | 0.00 | 0.00 | 0.23 | 6.39 | 0.0780 | 0.0013 | |||

| SPR / Spirit AeroSystems Holdings, Inc. | 0.01 | 0.00 | 0.23 | 10.48 | 0.0779 | 0.0045 | |||

| DIS / The Walt Disney Company | 0.00 | 0.23 | 0.0756 | 0.0756 | |||||

| VZ / Verizon Communications Inc. | 0.01 | 0.00 | 0.23 | -4.66 | 0.0755 | -0.0070 | |||

| UI / Ubiquiti Inc. | 0.00 | 0.22 | 0.0724 | 0.0724 | |||||

| ALL / The Allstate Corporation | 0.00 | 0.00 | 0.21 | -2.76 | 0.0708 | -0.0051 | |||

| HDV / iShares Trust - iShares Core High Dividend ETF | 0.00 | 0.56 | 0.21 | -2.80 | 0.0698 | -0.0050 | |||

| TRV / The Travelers Companies, Inc. | 0.00 | 0.00 | 0.21 | 1.46 | 0.0697 | -0.0021 | |||

| MYGN / Myriad Genetics, Inc. | 0.04 | 0.00 | 0.21 | -40.06 | 0.0697 | -0.0517 | |||

| WRB / W. R. Berkley Corporation | 0.00 | -17.04 | 0.21 | -14.58 | 0.0689 | -0.0150 | |||

| GPN / Global Payments Inc. | 0.00 | 0.20 | 0.0685 | 0.0685 | |||||

| TXN / Texas Instruments Incorporated | 0.00 | 0.20 | 0.0678 | 0.0678 | |||||

| MET / MetLife, Inc. | 0.00 | 0.20 | 0.0670 | 0.0670 | |||||

| KSS / Kohl's Corporation | 0.01 | -0.26 | 0.13 | 3.28 | 0.0425 | -0.0004 | |||

| NOK / Nokia Oyj - Depositary Receipt (Common Stock) | 0.02 | 0.00 | 0.10 | -2.00 | 0.0331 | -0.0020 | |||

| SGOV / iShares Trust - iShares 0-3 Month Treasury Bond ETF | 0.00 | -100.00 | 0.00 | 0.0000 |