Mga Batayang Estadistika

| Profil Orang Dalam | Appaloosa LP |

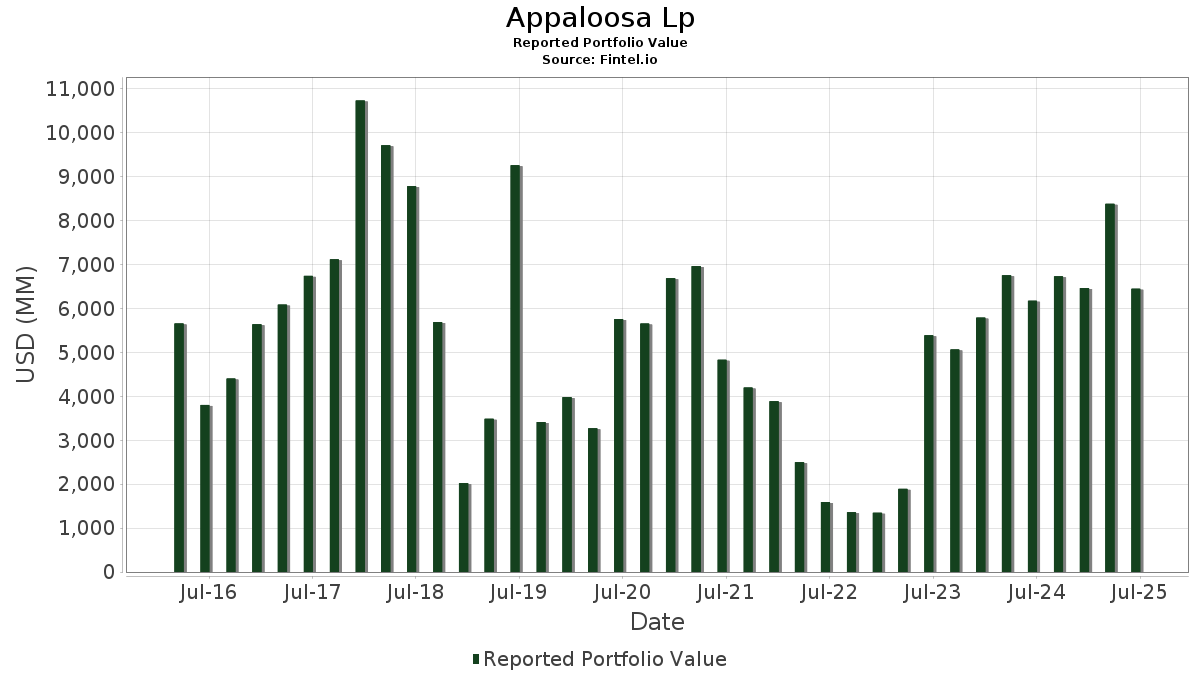

| Nilai Portofolio | $ 6,448,959,614 |

| Posisi Saat Ini | 38 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

Appaloosa Lp telah mengungkapkan total kepemilikan 38 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 6,448,959,614 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Appaloosa Lp adalah Alibaba Group Holding Limited - Depositary Receipt (Common Stock) (US:BABA) , UnitedHealth Group Incorporated (US:UNH) , Amazon.com, Inc. (US:AMZN) , Vistra Corp. (US:VST) , and NRG Energy, Inc. (US:NRG) . Posisi baru Appaloosa Lp meliputi: RTX Corporation (US:RTX) , IQVIA Holdings Inc. (US:IQV) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 2.45 | 764.33 | 11.8519 | 10.7585 | |

| 1.75 | 276.48 | 4.2872 | 3.8994 | |

| 2.70 | 592.35 | 9.1852 | 3.4884 | |

| 1.02 | 232.15 | 3.5998 | 3.0652 | |

| 8.00 | 179.20 | 2.7787 | 2.7787 | |

| 1.98 | 317.95 | 4.9302 | 2.5958 | |

| 1.80 | 348.86 | 5.4095 | 2.1873 | |

| 0.50 | 248.71 | 3.8565 | 1.5727 | |

| 0.58 | 85.42 | 1.3246 | 1.3246 | |

| 2.75 | 256.57 | 3.9785 | 1.1972 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 2.00 | 209.32 | 3.2458 | -2.9239 | |

| 7.07 | 801.50 | 12.4283 | -2.1311 | |

| 1.00 | 36.76 | 0.5700 | -1.8242 | |

| 0.15 | 32.79 | 0.5085 | -0.6590 | |

| 7.00 | 228.48 | 3.5429 | -0.4059 | |

| 1.50 | 26.61 | 0.4126 | -0.0427 | |

| 0.62 | 53.60 | 0.8311 | -0.0197 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-14 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| BABA / Alibaba Group Holding Limited - Depositary Receipt (Common Stock) | 7.07 | -23.43 | 801.50 | -34.33 | 12.4283 | -2.1311 | |||

| UNH / UnitedHealth Group Incorporated | 2.45 | 1,300.00 | 764.33 | 733.91 | 11.8519 | 10.7585 | |||

| AMZN / Amazon.com, Inc. | 2.70 | 7.57 | 592.35 | 24.04 | 9.1852 | 3.4884 | |||

| VST / Vistra Corp. | 1.80 | -21.74 | 348.86 | 29.15 | 5.4095 | 2.1873 | |||

| NRG / NRG Energy, Inc. | 1.98 | -3.41 | 317.95 | 62.47 | 4.9302 | 2.5958 | |||

| META / Meta Platforms, Inc. | 0.40 | -27.27 | 295.24 | -6.87 | 4.5780 | 0.7965 | |||

| NVDA / NVIDIA Corporation | 1.75 | 483.33 | 276.48 | 750.35 | 4.2872 | 3.8994 | |||

| GOOG / Alphabet Inc. | 1.50 | -25.37 | 266.08 | -15.27 | 4.1260 | 0.3800 | |||

| UBER / Uber Technologies, Inc. | 2.75 | -14.06 | 256.57 | 10.05 | 3.9785 | 1.1972 | |||

| MSFT / Microsoft Corporation | 0.50 | -1.96 | 248.71 | 29.91 | 3.8565 | 1.5727 | |||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 1.02 | 279.63 | 232.15 | 417.97 | 3.5998 | 3.0652 | |||

| JD / JD.com, Inc. - Depositary Receipt (Common Stock) | 7.00 | -13.04 | 228.48 | -30.98 | 3.5429 | -0.4059 | |||

| PDD / PDD Holdings Inc. - Depositary Receipt (Common Stock) | 2.00 | -54.23 | 209.32 | -59.53 | 3.2458 | -2.9239 | |||

| INTC / Intel Corporation | 8.00 | 179.20 | 2.7787 | 2.7787 | |||||

| KWEB / KraneShares Trust - KraneShares CSI China Internet ETF | 4.00 | 0.00 | 137.32 | -1.66 | 2.1293 | 0.4635 | |||

| LYFT / Lyft, Inc. | 8.00 | -11.11 | 126.08 | 18.02 | 1.9550 | 0.6806 | |||

| DB / Deutsche Bank Aktiengesellschaft | 4.00 | 6.67 | 117.12 | 31.06 | 1.8161 | 0.7501 | |||

| MU / Micron Technology, Inc. | 0.82 | 106.25 | 101.68 | 192.56 | 1.5767 | 1.1621 | |||

| GLW / Corning Incorporated | 1.75 | 0.37 | 92.03 | 15.30 | 1.4271 | 0.4749 | |||

| ET / Energy Transfer LP - Limited Partnership | 4.96 | 0.00 | 89.87 | -2.47 | 1.3936 | 0.2943 | |||

| LHX / L3Harris Technologies, Inc. | 0.35 | 16.67 | 87.79 | 39.81 | 1.3614 | 0.6123 | |||

| RTX / RTX Corporation | 0.58 | 85.42 | 1.3246 | 1.3246 | |||||

| CZR / Caesars Entertainment, Inc. | 2.10 | -4.55 | 59.62 | 8.40 | 0.9245 | 0.2684 | |||

| ASML / ASML Holding N.V. - Depositary Receipt (Common Stock) | 0.07 | 0.00 | 56.10 | 20.94 | 0.8699 | 0.3165 | |||

| QCOM / QUALCOMM Incorporated | 0.35 | 0.00 | 55.74 | 3.68 | 0.8643 | 0.2230 | |||

| BIDU / Baidu, Inc. - Depositary Receipt (Common Stock) | 0.62 | -19.35 | 53.60 | -24.85 | 0.8311 | -0.0197 | |||

| IQV / IQVIA Holdings Inc. | 0.30 | 47.28 | 0.7331 | 0.7331 | |||||

| UAL / United Airlines Holdings, Inc. | 0.55 | 43.80 | 0.6791 | 0.6791 | |||||

| XYZ / Block, Inc. | 0.64 | 755.73 | 43.60 | 970.13 | 0.6760 | 0.6274 | |||

| LRCX / Lam Research Corporation | 0.40 | -20.00 | 38.94 | 7.11 | 0.6038 | 0.1701 | |||

| FXI / iShares Trust - iShares China Large-Cap ETF | 1.00 | -82.14 | 36.76 | -81.68 | 0.5700 | -1.8242 | |||

| ORCL / Oracle Corporation | 0.15 | -78.57 | 32.79 | -66.49 | 0.5085 | -0.6590 | |||

| MPLX / MPLX LP - Limited Partnership | 0.58 | 0.00 | 29.80 | -3.76 | 0.4621 | 0.0927 | |||

| DAL / Delta Air Lines, Inc. | 0.55 | 27.05 | 0.4194 | 0.4194 | |||||

| WHR / Whirlpool Corporation | 0.27 | 26.99 | 0.4185 | 0.4185 | |||||

| BEKE / KE Holdings Inc. - Depositary Receipt (Common Stock) | 1.50 | -21.05 | 26.61 | -30.29 | 0.4126 | -0.0427 | |||

| GT / The Goodyear Tire & Rubber Company | 0.86 | 8.94 | 0.1386 | 0.1386 | |||||

| MHK / Mohawk Industries, Inc. | 0.07 | 6.81 | 0.1057 | 0.1057 | |||||

| AVGO / Broadcom Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| SPYX / SPDR Series Trust - SPDR S&P 500 Fossil Fuel Reserves Free ETF | Put | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| 165167172 / Chesapeake Energy Corp | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| AAPL / Apple Inc. | Put | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| LVS / Las Vegas Sands Corp. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| US1651671802 / Chesapeake Energy Corp. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| SMH / VanEck ETF Trust - VanEck Semiconductor ETF | Put | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| WYNN / Wynn Resorts, Limited | 0.00 | -100.00 | 0.00 | 0.0000 |