Mga Batayang Estadistika

| Nilai Portofolio | $ 451,936,647 |

| Posisi Saat Ini | 28 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

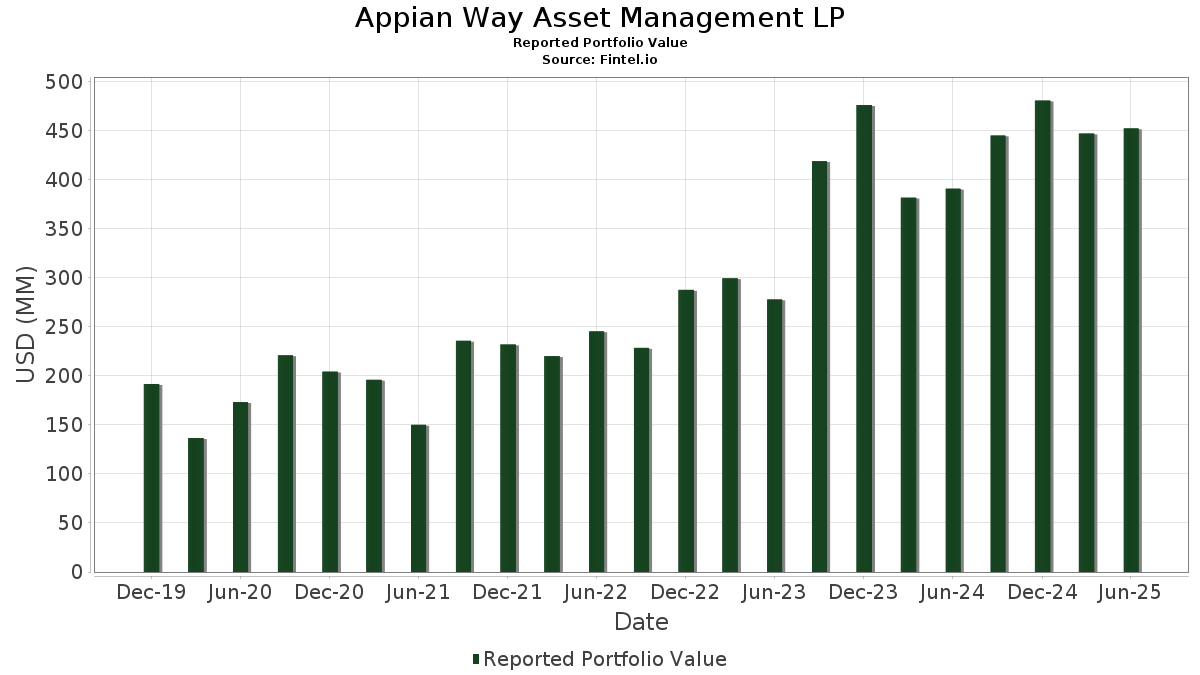

Appian Way Asset Management LP telah mengungkapkan total kepemilikan 28 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 451,936,647 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Appian Way Asset Management LP adalah PureCycle Technologies, Inc. (US:PCT) , Golar LNG Limited (US:GLNG) , FTAI Aviation Ltd. (US:FTAI) , The Chemours Company (US:CC) , and Amcor plc (US:AMCR) . Posisi baru Appian Way Asset Management LP meliputi: Darling Ingredients Inc. (US:DAR) , CF Industries Holdings, Inc. (US:CF) , The Mosaic Company (US:MOS) , GXO Logistics, Inc. (US:GXO) , and IAMGOLD Corporation (US:IAG) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.73 | 27.70 | 6.1283 | 6.1283 | |

| 3.78 | 34.74 | 7.6877 | 5.6600 | |

| 1.50 | 33.96 | 7.5153 | 3.9822 | |

| 0.16 | 17.58 | 3.8899 | 3.8899 | |

| 3.81 | 43.66 | 9.6613 | 2.1756 | |

| 0.09 | 8.28 | 1.8321 | 1.8321 | |

| 0.23 | 8.21 | 1.8162 | 1.8162 | |

| 0.13 | 6.25 | 1.3823 | 1.3823 | |

| 0.50 | 8.49 | 1.8781 | 1.0039 | |

| 0.50 | 3.67 | 0.8130 | 0.8130 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 5.36 | 24.12 | 5.3361 | -6.2193 | |

| 0.03 | 6.95 | 1.5377 | -4.9316 | |

| 0.70 | 21.82 | 4.8272 | -4.7985 | |

| 0.26 | 6.19 | 1.3702 | -2.5853 | |

| 1.21 | 49.93 | 11.0482 | -1.9187 | |

| 0.40 | 5.48 | 1.2126 | -0.6465 | |

| 0.42 | 47.75 | 10.5650 | -0.6399 | |

| 0.09 | 4.04 | 0.8937 | -0.3221 | |

| 0.35 | 4.01 | 0.8867 | -0.1734 | |

| 0.00 | 0.00 | -0.0114 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-14 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| PCT / PureCycle Technologies, Inc. | 3.86 | -47.55 | 52.83 | 3.84 | 11.6890 | 0.3002 | |||

| GLNG / Golar LNG Limited | 1.21 | -20.49 | 49.93 | -13.79 | 11.0482 | -1.9187 | |||

| FTAI / FTAI Aviation Ltd. | 0.42 | -7.93 | 47.75 | -4.60 | 10.5650 | -0.6399 | |||

| CC / The Chemours Company | 3.81 | 54.31 | 43.66 | 30.58 | 9.6613 | 2.1756 | |||

| AMCR / Amcor plc | 3.78 | 304.89 | 34.74 | 283.60 | 7.6877 | 5.6600 | |||

| ESI / Element Solutions Inc | 1.50 | 114.84 | 33.96 | 115.22 | 7.5153 | 3.9822 | |||

| DAR / Darling Ingredients Inc. | Call | 0.73 | 27.70 | 6.1283 | 6.1283 | ||||

| SGML / Sigma Lithium Corporation | 5.36 | 7.98 | 24.12 | -53.28 | 5.3361 | -6.2193 | |||

| SEE / Sealed Air Corporation | 0.70 | -52.74 | 21.82 | -49.26 | 4.8272 | -4.7985 | |||

| KEX / Kirby Corporation | 0.16 | 17.58 | 3.8899 | 3.8899 | |||||

| TH / Target Hospitality Corp. | 1.89 | 4.93 | 13.48 | 13.55 | 2.9825 | 0.3248 | |||

| CORZ / Core Scientific, Inc. | 0.50 | -7.81 | 8.49 | 117.34 | 1.8781 | 1.0039 | |||

| CF / CF Industries Holdings, Inc. | Call | 0.09 | 8.28 | 1.8321 | 1.8321 | ||||

| MOS / The Mosaic Company | Call | 0.23 | 8.21 | 1.8162 | 1.8162 | ||||

| DY / Dycom Industries, Inc. | 0.03 | -85.01 | 6.95 | -75.95 | 1.5377 | -4.9316 | |||

| KNX / Knight-Swift Transportation Holdings Inc. | 0.15 | 102.11 | 6.50 | 105.53 | 1.4382 | 0.7303 | |||

| GXO / GXO Logistics, Inc. | 0.13 | 6.25 | 1.3823 | 1.3823 | |||||

| GEO / The GEO Group, Inc. | 0.26 | -57.25 | 6.19 | -64.95 | 1.3702 | -2.5853 | |||

| PCT / PureCycle Technologies, Inc. | Call | 0.40 | -66.67 | 5.48 | -34.01 | 1.2126 | -0.6465 | ||

| MTZ / MasTec, Inc. | 0.03 | 15.01 | 5.48 | 67.93 | 1.2123 | 0.4820 | |||

| FCX / Freeport-McMoRan Inc. | 0.09 | -35.05 | 4.04 | -25.64 | 0.8937 | -0.3221 | |||

| CC / The Chemours Company | Call | 0.35 | 0.00 | 4.01 | -15.37 | 0.8867 | -0.1734 | ||

| IAG / IAMGOLD Corporation | 0.50 | 3.67 | 0.8130 | 0.8130 | |||||

| CSL / Carlisle Companies Incorporated | 0.01 | 3.19 | 0.7063 | 0.7063 | |||||

| DAR / Darling Ingredients Inc. | 0.07 | 2.50 | 0.5524 | 0.5524 | |||||

| KTOS / Kratos Defense & Security Solutions, Inc. | 0.05 | 2.29 | 0.5062 | 0.5062 | |||||

| JBT / JBT Marel Corporation | 0.02 | 2.00 | 0.4417 | 0.4417 | |||||

| DRIO / DarioHealth Corp. | 1.28 | 0.00 | 0.86 | 9.44 | 0.1899 | 0.0143 | |||

| GEV / GE Vernova Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| PKG / Packaging Corporation of America | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| NXE / NexGen Energy Ltd. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0114 | ||||

| AVNT / Avient Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| PSN / Parsons Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| WWD / Woodward, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| BA / The Boeing Company | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| IWM / iShares Trust - iShares Russell 2000 ETF | Call | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| WLK / Westlake Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| WFG / West Fraser Timber Co. Ltd. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| ATI / ATI Inc. | 0.00 | -100.00 | 0.00 | 0.0000 |