Mga Batayang Estadistika

| Nilai Portofolio | $ 554,785,195 |

| Posisi Saat Ini | 47 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

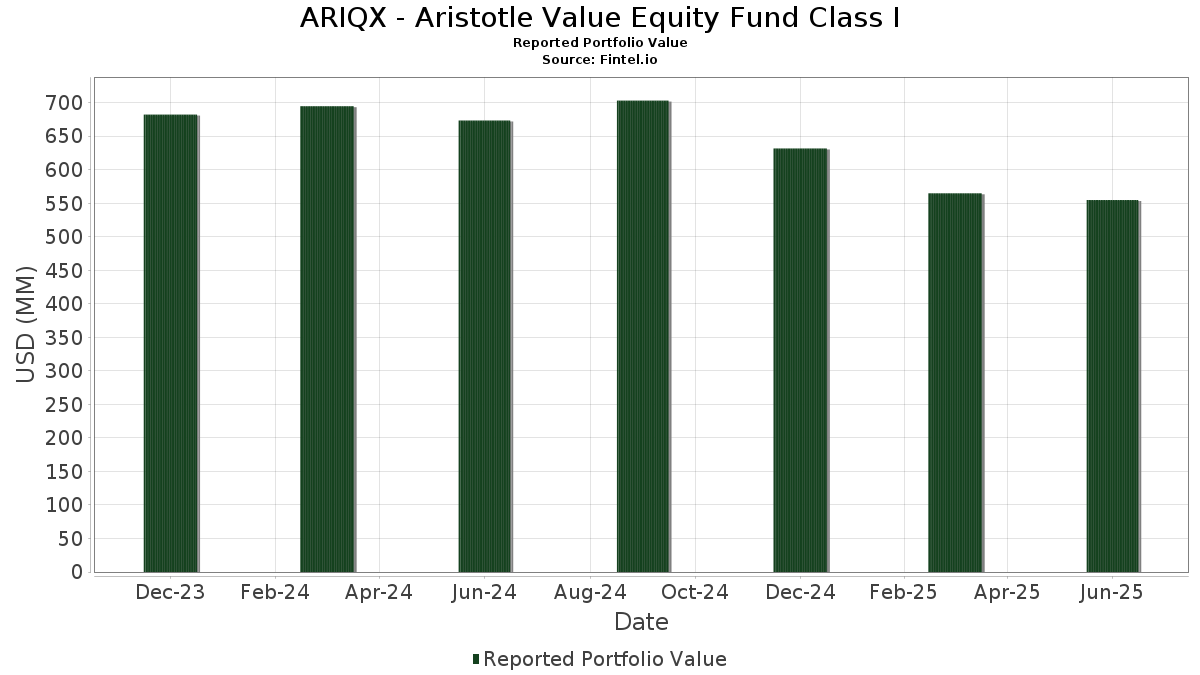

ARIQX - Aristotle Value Equity Fund Class I telah mengungkapkan total kepemilikan 47 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 554,785,195 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama ARIQX - Aristotle Value Equity Fund Class I adalah Parker-Hannifin Corporation (US:PH) , Microsoft Corporation (US:MSFT) , Capital One Financial Corporation (US:COF) , Corteva, Inc. (US:CTVA) , and Ameriprise Financial, Inc. (US:AMP) . Posisi baru ARIQX - Aristotle Value Equity Fund Class I meliputi: Uber Technologies, Inc. (US:UBER) , Synopsys, Inc. (US:SNPS) , Wells Fargo & Company (US:WFC) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.15 | 13.80 | 2.4939 | 2.4939 | |

| 0.02 | 12.41 | 2.2433 | 2.2433 | |

| 7.02 | 7.02 | 1.2679 | 1.2679 | |

| 0.05 | 23.58 | 4.2612 | 0.8695 | |

| 0.04 | 3.52 | 0.6368 | 0.6368 | |

| 0.17 | 12.01 | 2.1697 | 0.6036 | |

| 0.10 | 20.36 | 3.6799 | 0.4719 | |

| 0.04 | 26.82 | 4.8475 | 0.4475 | |

| 0.27 | 20.32 | 3.6733 | 0.3782 | |

| 0.03 | 15.32 | 2.7681 | 0.2170 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.00 | 1.52 | 0.2752 | -2.5286 | |

| 0.03 | 17.13 | 3.0964 | -0.5370 | |

| 0.04 | 12.29 | 2.2203 | -0.3895 | |

| 0.42 | 10.54 | 1.9050 | -0.3504 | |

| 0.13 | 11.07 | 2.0008 | -0.2498 | |

| 0.07 | 10.72 | 1.9379 | -0.2444 | |

| 0.11 | 11.58 | 2.0924 | -0.2284 | |

| 0.04 | 5.81 | 1.0496 | -0.2266 | |

| 0.08 | 11.67 | 2.1094 | -0.2257 | |

| 0.28 | 11.97 | 2.1631 | -0.2087 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-28 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| PH / Parker-Hannifin Corporation | 0.04 | -5.65 | 26.82 | 8.42 | 4.8475 | 0.4475 | |||

| MSFT / Microsoft Corporation | 0.05 | -6.69 | 23.58 | 23.64 | 4.2612 | 0.8695 | |||

| COF / Capital One Financial Corporation | 0.10 | -4.87 | 20.36 | 12.88 | 3.6799 | 0.4719 | |||

| CTVA / Corteva, Inc. | 0.27 | -7.37 | 20.32 | 9.71 | 3.6733 | 0.3782 | |||

| AMP / Ameriprise Financial, Inc. | 0.03 | -23.93 | 17.13 | -16.14 | 3.0964 | -0.5370 | |||

| SONY / Sony Group Corporation - Depositary Receipt (Common Stock) | 0.62 | -6.97 | 16.11 | -4.63 | 2.9116 | -0.0927 | |||

| MLM / Martin Marietta Materials, Inc. | 0.03 | -7.00 | 15.32 | 6.78 | 2.7681 | 0.2170 | |||

| ATO / Atmos Energy Corporation | 0.10 | -6.49 | 14.66 | -6.77 | 2.6488 | -0.1472 | |||

| ECL / Ecolab Inc. | 0.05 | -7.07 | 14.17 | -1.23 | 2.5614 | 0.0094 | |||

| QCOM / QUALCOMM Incorporated | 0.09 | -3.65 | 13.87 | -0.11 | 2.5070 | 0.0373 | |||

| UBER / Uber Technologies, Inc. | 0.15 | 13.80 | 2.4939 | 2.4939 | |||||

| LEN / Lennar Corporation | 0.12 | -3.08 | 13.59 | -6.60 | 2.4569 | -0.1316 | |||

| AIG / American International Group, Inc. | 0.15 | -6.13 | 13.23 | -7.59 | 2.3915 | -0.1552 | |||

| GOOG / Alphabet Inc. | 0.07 | -6.47 | 13.13 | 6.20 | 2.3724 | 0.1740 | |||

| SNPS / Synopsys, Inc. | 0.02 | 12.41 | 2.2433 | 2.2433 | |||||

| TDY / Teledyne Technologies Incorporated | 0.02 | -0.82 | 12.40 | 2.08 | 2.2407 | 0.0808 | |||

| AMGN / Amgen Inc. | 0.04 | -6.58 | 12.29 | -16.28 | 2.2203 | -0.3895 | |||

| KO / The Coca-Cola Company | 0.17 | -6.47 | 12.27 | -7.61 | 2.2172 | -0.1444 | |||

| USB / U.S. Bancorp | 0.27 | -7.13 | 12.27 | -0.46 | 2.2171 | 0.0252 | |||

| ADBE / Adobe Inc. | 0.03 | -4.29 | 12.07 | -3.46 | 2.1816 | -0.0422 | |||

| MCHP / Microchip Technology Incorporated | 0.17 | -6.21 | 12.01 | 36.34 | 2.1697 | 0.6036 | |||

| VZ / Verizon Communications Inc. | 0.28 | -5.92 | 11.97 | -10.25 | 2.1631 | -0.2087 | |||

| AWK / American Water Works Company, Inc. | 0.08 | -5.73 | 11.67 | -11.11 | 2.1094 | -0.2257 | |||

| RPM / RPM International Inc. | 0.11 | -6.56 | 11.58 | -11.27 | 2.0924 | -0.2284 | |||

| BX / Blackstone Inc. | 0.08 | -5.04 | 11.55 | 1.61 | 2.0870 | 0.0659 | |||

| MUFG / Mitsubishi UFJ Financial Group, Inc. - Depositary Receipt (Common Stock) | 0.84 | -5.54 | 11.52 | -4.92 | 2.0827 | -0.0729 | |||

| PNC / The PNC Financial Services Group, Inc. | 0.06 | -5.14 | 11.35 | 0.60 | 2.0518 | 0.0449 | |||

| GD / General Dynamics Corporation | 0.04 | -7.64 | 11.29 | -1.17 | 2.0400 | 0.0087 | |||

| APD / Air Products and Chemicals, Inc. | 0.04 | -3.62 | 11.25 | -7.82 | 2.0340 | -0.1375 | |||

| ALC / Alcon Inc. | 0.13 | -5.93 | 11.07 | -12.52 | 2.0008 | -0.2498 | |||

| XEL / Xcel Energy Inc. | 0.16 | -6.96 | 11.02 | -10.50 | 1.9914 | -0.1980 | |||

| PG / The Procter & Gamble Company | 0.07 | -6.53 | 10.72 | -12.62 | 1.9379 | -0.2444 | |||

| TTE / TotalEnergies SE - Depositary Receipt (Common Stock) | 0.17 | -3.88 | 10.64 | -8.79 | 1.9228 | -0.1516 | |||

| CTRA / Coterra Energy Inc. | 0.42 | -5.36 | 10.54 | -16.88 | 1.9050 | -0.3504 | |||

| LOW / Lowe's Companies, Inc. | 0.05 | -5.77 | 10.52 | -10.36 | 1.9007 | -0.1858 | |||

| DHR / Danaher Corporation | 0.05 | -5.46 | 10.25 | -8.90 | 1.8529 | -0.1487 | |||

| CFR / Cullen/Frost Bankers, Inc. | 0.07 | -3.38 | 9.19 | -0.80 | 1.6610 | 0.0133 | |||

| MRK / Merck & Co., Inc. | 0.11 | -1.19 | 8.57 | -12.85 | 1.5480 | -0.2001 | |||

| MDT / Medtronic plc | 0.10 | -1.94 | 8.35 | -4.89 | 1.5093 | -0.0522 | |||

| OSK / Oshkosh Corporation | 0.07 | -8.90 | 7.90 | 9.95 | 1.4282 | 0.1499 | |||

| ELS / Equity LifeStyle Properties, Inc. | 0.13 | -5.56 | 7.75 | -12.68 | 1.4010 | -0.1779 | |||

| US BANK MMDA - USBGFS 9 / STIV (N/A) | 7.02 | 7.02 | 1.2679 | 1.2679 | |||||

| CBSH / Commerce Bancshares, Inc. | 0.10 | -4.45 | 6.40 | -4.55 | 1.1573 | -0.0358 | |||

| STZ / Constellation Brands, Inc. | 0.04 | -8.70 | 5.81 | -19.07 | 1.0496 | -0.2266 | |||

| WFC / Wells Fargo & Company | 0.04 | 3.52 | 0.6368 | 0.6368 | |||||

| ANSS / ANSYS, Inc. | 0.00 | -91.29 | 1.52 | -90.35 | 0.2752 | -2.5286 | |||

| LENB / Lennar Corp. - Class B | 0.00 | 0.00 | 0.01 | 0.00 | 0.0015 | -0.0000 |