Mga Batayang Estadistika

| Nilai Portofolio | $ 316,810,272 |

| Posisi Saat Ini | 72 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

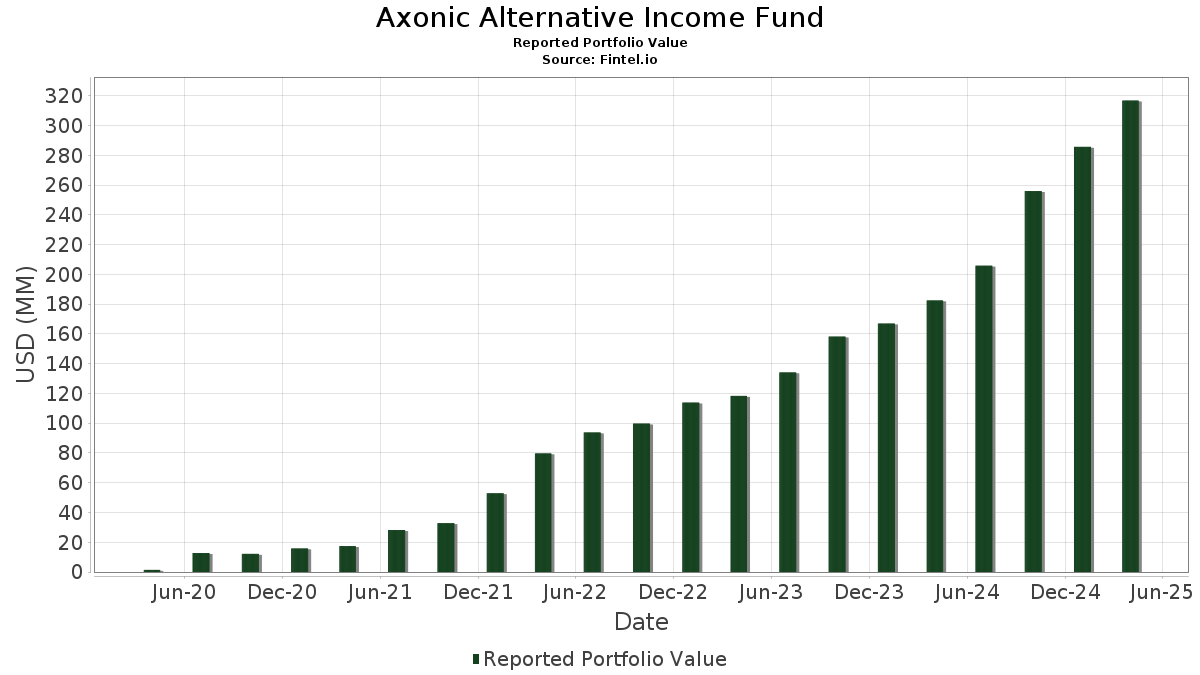

Axonic Alternative Income Fund telah mengungkapkan total kepemilikan 72 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 316,810,272 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Axonic Alternative Income Fund adalah First American Funds Inc - First American Government Obligations Fund Class X (US:FGXXX) , Freddie Mac Multifamily Structured Credit Risk (US:US35564BAA70) , FREMF 2018-KF44 Mortgage Trust (US:US30296JAE82) , FRESB 2022-SB100 Mortgage Trust (US:US30327XAL47) , and Lendingpoint Asset Securitization Trust (US:US52607HAD26) . Posisi baru Axonic Alternative Income Fund meliputi: Freddie Mac Multifamily Structured Credit Risk (US:US35564BAA70) , FREMF 2018-KF44 Mortgage Trust (US:US30296JAE82) , FRESB 2022-SB100 Mortgage Trust (US:US30327XAL47) , Lendingpoint Asset Securitization Trust (US:US52607HAD26) , and FRESB 2023-SB106 Mortgage Trust (US:US35802AAA16) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 39.38 | 12.2953 | 12.2953 | ||

| 16.35 | 5.1030 | 5.1030 | ||

| 13.90 | 4.3398 | 4.3398 | ||

| 13.07 | 4.0804 | 4.0804 | ||

| 12.12 | 3.7844 | 3.7844 | ||

| 7.50 | 2.3414 | 2.3414 | ||

| 7.00 | 2.1860 | 2.1860 | ||

| 5.86 | 1.8287 | 1.8287 | ||

| 5.49 | 1.7142 | 1.7142 | ||

| 4.24 | 1.3246 | 1.3246 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 21.20 | 21.20 | 6.6197 | -6.9467 | |

| -12.24 | -12.24 | -3.8200 | -3.8200 | |

| -10.84 | -10.84 | -3.3847 | -3.3847 | |

| 15.21 | 4.7469 | -0.6555 | ||

| 14.68 | 4.5841 | -0.5703 | ||

| 11.37 | 3.5511 | -0.5375 | ||

| 10.92 | 3.4099 | -0.4102 | ||

| 7.91 | 2.4696 | -0.3167 | ||

| 8.28 | 2.5855 | -0.3150 | ||

| 8.27 | 2.5821 | -0.2631 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-06-23 untuk periode pelaporan 2025-04-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| GSF 2023-1 Investor, LLC / LON (N/A) | 39.38 | 12.2953 | 12.2953 | ||||||

| FGXXX / First American Funds Inc - First American Government Obligations Fund Class X | 21.20 | -45.15 | 21.20 | -45.15 | 6.6197 | -6.9467 | |||

| Rivertree Landing Apartments LLC / LON (N/A) | 16.35 | 5.1030 | 5.1030 | ||||||

| US35564BAA70 / Freddie Mac Multifamily Structured Credit Risk | 15.21 | -1.23 | 4.7469 | -0.6555 | |||||

| MCR 2024-TWA Mortgage Trust / ABS-MBS (US582923AG37) | 14.68 | -0.03 | 4.5841 | -0.5703 | |||||

| 4-10 West 108th Owners LLC / ABS-MBS (N/A) | 13.90 | 4.3398 | 4.3398 | ||||||

| JPMCC Multifamily Housing Mortgage Loan Trust 2025-Q032 / ABS-MBS (US48129YAE05) | 13.07 | 4.0804 | 4.0804 | ||||||

| FRESB 2025-SB119 Mortgage Trust / ABS-MBS (US35802JAA25) | 12.12 | 3.7844 | 3.7844 | ||||||

| FRESB 2024-SB114 Mortgage Trust / ABS-MBS (US30337MAE21) | 11.37 | -2.38 | 3.5511 | -0.5375 | |||||

| FRESB 2024-SB117 Mortgage Trust / ABS-MBS (US35802CAE93) | 10.92 | 0.33 | 3.4099 | -0.4102 | |||||

| US30296JAE82 / FREMF 2018-KF44 Mortgage Trust | 8.28 | 0.19 | 2.5855 | -0.3150 | |||||

| THPT 2023-THL Mortgage Trust / ABS-MBS (US87252LAN55) | 8.27 | 2.01 | 2.5821 | -0.2631 | |||||

| US30327XAL47 / FRESB 2022-SB100 Mortgage Trust | 7.91 | -0.38 | 2.4696 | -0.3167 | |||||

| CRE_MEZZ_UPHOUSE_MF_202504 / LON (N/A) | 7.50 | 2.3414 | 2.3414 | ||||||

| US52607HAD26 / Lendingpoint Asset Securitization Trust | 7.35 | 28.83 | 2.2949 | 0.2925 | |||||

| US35802AAA16 / FRESB 2023-SB106 Mortgage Trust | 7.04 | 0.64 | 2.1971 | -0.2569 | |||||

| Portofino Mezz Partners, LLC / LON (N/A) | 7.00 | 2.1860 | 2.1860 | ||||||

| US44422PBY79 / HUDSONS BAY SIMON JV TRUST 2015-HBS SER 2015-HB10 CL C10 V/R REGD 144A P/P 5.44700000 | 6.48 | 2.58 | 2.0228 | -0.1938 | |||||

| US30333MAF32 / FRESB 2023-SB109 Mortgage Trust | 6.11 | 0.58 | 1.9072 | -0.2246 | |||||

| US80307AAC36 / SAPPHIRE AVIATION FINANCE II, Ltd. | 5.89 | 242.44 | 1.8390 | 1.2352 | |||||

| Surfrider Montauk / ABS-MBS (N/A) | 5.86 | 1.8287 | 1.8287 | ||||||

| US30327FAA75 / FRESB 2022-SB98 Mortgage Trust | 5.64 | 0.02 | 1.7595 | -0.2180 | |||||

| TCG Hunstville JV LLC / LON (N/A) | 5.49 | 1.7142 | 1.7142 | ||||||

| Center Street Lending Resi-Investor ABS Mortgage Trust 2024-RTL1 / ABS-MBS (US15169CAC29) | 5.29 | 0.95 | 1.6504 | -0.1873 | |||||

| US35802DAE76 / FRESB 2022-SB95 Mortgage Trust | 4.72 | -1.71 | 1.4744 | -0.2117 | |||||

| US44422PBN15 / HUDSONS BAY SIMON JV TRUST 2015-HBS SER 2015-HB10 CL A10 REGD 144A P/P 4.15450000 | 4.62 | 1.27 | 1.4412 | -0.1584 | |||||

| Grant Street Quad / LON (36271EAQ8) | 4.24 | 1.3246 | 1.3246 | ||||||

| US30329HAE36 / FREMF 2021-KF100 Mortgage Trust | 4.13 | 0.00 | 1.2903 | -0.1602 | |||||

| ABR.PRF / Arbor Realty Trust, Inc. - Preferred Stock | 4.01 | 1.2516 | 1.2516 | ||||||

| US30325WAE49 / FRESB 2021-SB93 Mortgage Trust | 3.76 | -1.93 | 1.1753 | -0.1716 | |||||

| Start, Ltd. / ABS-O (US85572RAC34) | 3.58 | 1.1168 | 1.1168 | ||||||

| US78458MAN48 / SMR 2022-IND Mortgage Trust | 3.57 | -1.82 | 1.1131 | -0.1614 | |||||

| US05553BAJ44 / BCP TRUST BCP 2021 330N C 144A | 3.37 | 1.42 | 1.0507 | -0.1139 | |||||

| US36175XAA81 / GKN Subordinated CTL Pass-Through Trust/Auburn MI | 3.35 | 2.35 | 1.0454 | -0.1026 | |||||

| Grant Street Quad / LON (36271EAP0) | 3.06 | 0.9542 | 0.9542 | ||||||

| Dominion Mortgage Trust 2025-RTL1 / ABS-MBS (US25746DAC11) | 3.02 | 0.9433 | 0.9433 | ||||||

| US30322KAA16 / FRESB 2021-SB90 Mortgage Trust | 2.72 | -0.18 | 0.8490 | -0.1071 | |||||

| MCR 2024-TWA Mortgage Trust / ABS-MBS (US582923AF53) | 2.64 | 1.03 | 0.8245 | -0.0929 | |||||

| US30320MAA99 / FRESB Multifamily Structured Pass Through Certificates | 2.55 | -0.82 | 0.7954 | -0.1058 | |||||

| US628870AN73 / NCMF Trust 2022-MFP | 2.35 | 0.26 | 0.7327 | -0.0887 | |||||

| LHOME Mortgage Trust 2024-RTL1 / ABS-MBS (US50205DAC39) | 2.28 | -0.78 | 0.7116 | -0.0947 | |||||

| US30317QAA58 / FRESB 2020-SB81Mortgage Trust | 2.27 | -1.56 | 0.7093 | -0.1005 | |||||

| US30326JAS15 / FREMF 2022-K748 Mortgage Trust | 2.16 | 2.18 | 0.6731 | -0.0673 | |||||

| US30306BAD55 / FRESB 2017-SB42 Mortgage Trust | 1.94 | -2.61 | 0.6053 | -0.0935 | |||||

| Project Silver / ABS-O (US827304AB22) | 1.91 | 0.5958 | 0.5958 | ||||||

| US302952AF35 / FRESB 2017-SB32 Mortgage Trust | 1.83 | -1.40 | 0.5700 | -0.0799 | |||||

| US78433XAD21 / Stonepeak 2021-1 ABS | 1.70 | -14.05 | 0.5294 | -0.1626 | |||||

| US72353PAC05 / Pioneer Aircraft Finance Ltd | 1.56 | 0.4870 | 0.4870 | ||||||

| US126395AN25 / CSMC, Series 2020-FACT, Class E | 1.53 | -3.59 | 0.4780 | -0.0794 | |||||

| US30300KAJ88 / FRESB 2017-SB28 Mortgage Trust | 1.39 | -0.50 | 0.4337 | -0.0562 | |||||

| US31189WAA53 / Fat Brands GFG Royalty LLC 6.00% Due 07/25/2051 | 1.23 | -2.07 | 0.3852 | -0.0568 | |||||

| Grant Street Quad / LON (36271EAN5) | 1.21 | 0.3784 | 0.3784 | ||||||

| US30291SAL79 / FRESB 2020-SB74 Mortgage Trust | 1.21 | 0.25 | 0.3776 | -0.0458 | |||||

| FAT Brands GFG Royalty I LLC / ABS-O (US31189WAD92) | 0.77 | 0.26 | 0.2416 | -0.0292 | |||||

| US88607AAB52 / Thunderbolt III Aircraft Lease, Ltd. | 0.74 | -0.80 | 0.2317 | -0.0308 | |||||

| US14856JAC80 / Castlelake Aircraft Structured Trust 2017-1R | 0.61 | 7.23 | 0.1899 | -0.0091 | |||||

| DGCXX / Dreyfus Government Cash Management Funds - Dreyfus Government Cash Management Fund Institutional Shares | 0.60 | -40.44 | 0.60 | -40.44 | 0.1868 | -0.1657 | |||

| ACR.PRD / ACRES Commercial Realty Corp. - Preferred Stock | 0.03 | -34.56 | 0.57 | -39.25 | 0.1776 | -0.1506 | |||

| Bear Stearns Asset Backed Securities I Trust 2006-AC3 / ABS-MBS (US07387NAE76) | 0.44 | -3.50 | 0.1378 | -0.0229 | |||||

| US30315EAF34 / FRESB 2020-SB76 Mortgage Trust | 0.41 | 1.99 | 0.1280 | -0.0133 | |||||

| US30305LAQ59 / FRESB 2017-SB38 Mortgage Trust | 0.28 | -1.06 | 0.0873 | -0.0119 | |||||

| US30318NAG88 / FRESB 2021-SB83 Mortgage Trust | 0.25 | -4.20 | 0.0786 | -0.0136 | |||||

| US30326JAN28 / FREMF 2022-K748 Mortgage Trust | 0.14 | -6.00 | 0.0441 | -0.0089 | |||||

| RWT / Redwood Trust, Inc. | 0.02 | 0.00 | 0.14 | -4.93 | 0.0422 | -0.0078 | |||

| US52521RBH30 / LEHMAN MORTGAGE TRUST LMT 2007 5 4A2 | 0.08 | -11.58 | 0.0263 | -0.0073 | |||||

| US30326JAQ58 / FREMF 2022-K748 Mortgage Trust | 0.04 | -7.14 | 0.0123 | -0.0024 | |||||

| US12543PAF09 / Countrywide Home Loans Mortgage Pass-Through Trust | 0.02 | -9.52 | 0.0060 | -0.0016 | |||||

| US57643MMM37 / MASTR Asset Securitization Trust 2006-1 | 0.02 | -14.29 | 0.0057 | -0.0016 | |||||

| REVERSE REPO / RA (RP8870AN7) | Short | -1.52 | 1.26 | -1.52 | 1.26 | -0.4761 | 0.0524 | ||

| REVERSE REPO / RA (RP422PBN1) | Short | -3.91 | 1.50 | -3.91 | 1.50 | -1.2213 | 0.1312 | ||

| REVERSE REPO. / RA (N/A) | Short | -10.84 | -10.84 | -3.3847 | -3.3847 | ||||

| REVERSE REPO. / RA (N/A) | Short | -12.24 | -12.24 | -3.8200 | -3.8200 |