Mga Batayang Estadistika

| Nilai Portofolio | $ 78,899,309 |

| Posisi Saat Ini | 936 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

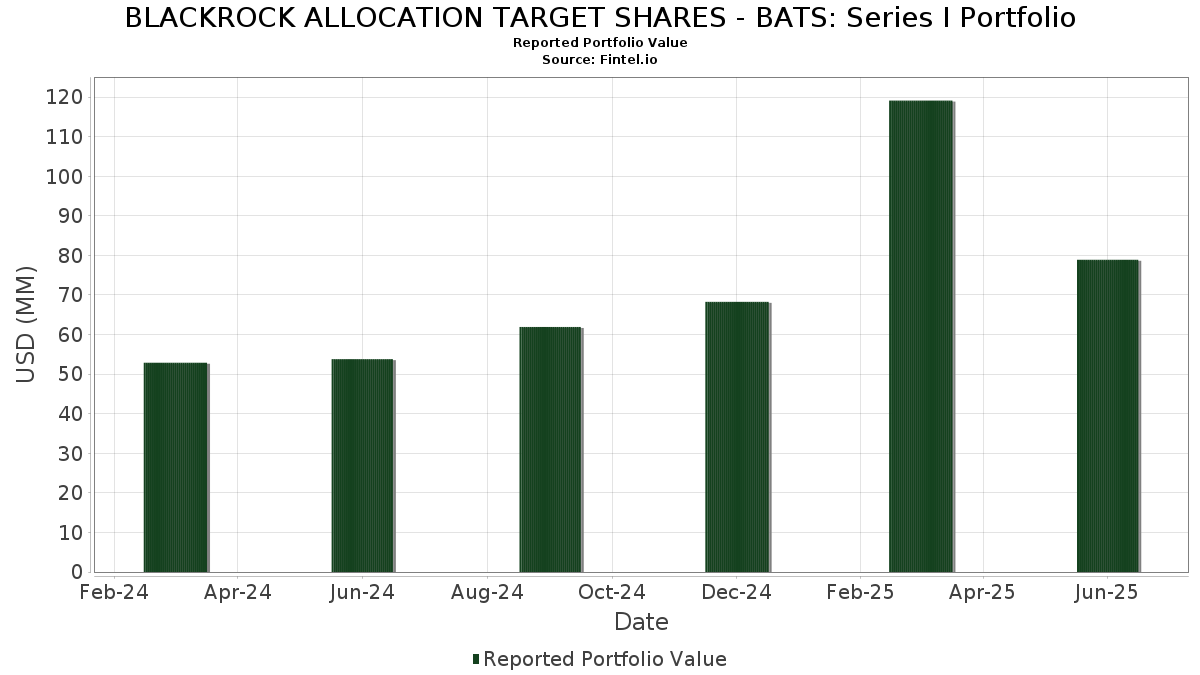

BLACKROCK ALLOCATION TARGET SHARES - BATS: Series I Portfolio telah mengungkapkan total kepemilikan 936 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 78,899,309 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama BLACKROCK ALLOCATION TARGET SHARES - BATS: Series I Portfolio adalah Uniform Mortgage-Backed Security, TBA (US:US01F0606750) , Edwards Lifesciences Corporation (US:EW) , Brazil Notas do Tesouro Nacional Serie F (BR:BRSTNCNTF1P8) , Picard Midco, Inc. (US:US88632QAE35) , and Edwards Lifesciences Corporation (US:EW) . Posisi baru BLACKROCK ALLOCATION TARGET SHARES - BATS: Series I Portfolio meliputi: Uniform Mortgage-Backed Security, TBA (US:US01F0606750) , Edwards Lifesciences Corporation (US:EW) , Brazil Notas do Tesouro Nacional Serie F (BR:BRSTNCNTF1P8) , Picard Midco, Inc. (US:US88632QAE35) , and Edwards Lifesciences Corporation (US:EW) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 6.39 | 8.7449 | 8.7449 | ||

| 3.34 | 3.34 | 4.5683 | 4.5683 | |

| 1.89 | 2.5789 | 2.1834 | ||

| 0.96 | 1.3094 | 1.0844 | ||

| 0.52 | 0.7072 | 0.7072 | ||

| 0.75 | 1.0266 | 0.5696 | ||

| 0.41 | 0.5634 | 0.5634 | ||

| 0.32 | 0.4414 | 0.4414 | ||

| 0.25 | 0.3421 | 0.3421 | ||

| 0.24 | 0.3334 | 0.3334 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.35 | 0.4784 | -2.1005 | ||

| 0.12 | 0.1640 | -0.4200 | ||

| -0.25 | -0.3475 | -0.3475 | ||

| -0.13 | -0.1786 | -0.1786 | ||

| 0.20 | 0.2763 | -0.1269 | ||

| 0.11 | 0.1462 | -0.1226 | ||

| 0.38 | 0.5219 | -0.1026 | ||

| 0.25 | 0.3381 | -0.0917 | ||

| 0.02 | 0.0282 | -0.0915 | ||

| 0.04 | 0.0582 | -0.0881 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-28 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US01F0606750 / Uniform Mortgage-Backed Security, TBA | 6.39 | 8.7449 | 8.7449 | ||||||

| Dreyfus Treasury Prime Cash Management Institutional Shares / STIV (N/A) | 3.34 | 3.34 | 4.5683 | 4.5683 | |||||

| EW / Edwards Lifesciences Corporation | 1.89 | 856.85 | 2.5789 | 2.1834 | |||||

| IE00BMD03L28 / Ireland Government Bond | 0.96 | 473.05 | 1.3094 | 1.0844 | |||||

| ADANIENSOL / Adani Energy Solutions Limited | 0.75 | 120.59 | 1.0266 | 0.5696 | |||||

| BRSTNCNTF1P8 / Brazil Notas do Tesouro Nacional Serie F | 0.56 | 3.35 | 0.7620 | 0.0384 | |||||

| Buoni Poliennali del Tesoro / DBT (IT0005631590) | 0.52 | 0.7072 | 0.7072 | ||||||

| AMI / Aurelia Metals Limited | 0.41 | 0.5634 | 0.5634 | ||||||

| US88632QAE35 / Picard Midco, Inc. | 0.38 | -17.89 | 0.5219 | -0.1026 | |||||

| BX Commercial Mortgage Trust, Series 2024-AIRC, Class A / ABS-MBS (US12433CAA36) | 0.36 | -2.70 | 0.4932 | -0.0041 | |||||

| EW / Edwards Lifesciences Corporation | 0.35 | -81.49 | 0.4784 | -2.1005 | |||||

| SAGB / Republic of South Africa Government Bond | 0.35 | 80.63 | 0.4726 | 0.2154 | |||||

| ADANIENSOL / Adani Energy Solutions Limited | 0.32 | 0.4414 | 0.4414 | ||||||

| XS2223762381 / Intesa Sanpaolo SpA | 0.30 | 11.11 | 0.4114 | 0.0472 | |||||

| XS2591803841 / Barclays PLC | 0.30 | 8.06 | 0.4039 | 0.0362 | |||||

| N1WG34 / NatWest Group plc - Depositary Receipt (Common Stock) | 0.27 | 8.37 | 0.3727 | 0.0348 | |||||

| Pinewood Finco plc / DBT (XS2783792307) | 0.27 | 6.69 | 0.3709 | 0.0286 | |||||

| TRESTLES CLO III Ltd., Series 2020-3A, Class ER / ABS-CBDO (US89532RAE09) | 0.25 | 2.02 | 0.3464 | 0.0123 | |||||

| ADLER Financing SARL, Series 1L / DBT (DE000A4D5RA0) | 0.25 | 136.79 | 0.3446 | 0.2010 | |||||

| Trestles CLO II Ltd., Series 2018-2A, Class A1R / ABS-CBDO (US89531MAJ18) | 0.25 | 0.40 | 0.3437 | 0.0069 | |||||

| Post CLO VI Ltd., Series 2024-2A, Class A1 / ABS-CBDO (US73742RAA86) | 0.25 | 0.40 | 0.3436 | 0.0072 | |||||

| GoldenTree Loan Management US CLO 10 Ltd., Series 2021-10A, Class DR / ABS-CBDO (US38138TAY73) | 0.25 | 0.40 | 0.3436 | 0.0064 | |||||

| Cedar Funding XIV CLO Ltd., Series 2021-14A, Class AR / ABS-CBDO (US15034AAL98) | 0.25 | 0.40 | 0.3435 | 0.0070 | |||||

| CarVal CLO VIII-C Ltd., Series 2022-2A, Class A1R / ABS-CBDO (US14686NAL55) | 0.25 | 0.40 | 0.3434 | 0.0072 | |||||

| Whitebox CLO II Ltd., Series 2020-2A, Class A1R2 / ABS-CBDO (US96466CAW82) | 0.25 | 0.00 | 0.3433 | 0.0071 | |||||

| CarVal CLO X-C Ltd., Series 2024-2A, Class A / ABS-CBDO (US146918AA59) | 0.25 | 0.00 | 0.3433 | 0.0070 | |||||

| Regatta XXVIII Funding Ltd., Series 2024-2A, Class A1 / ABS-CBDO (US75901PAA49) | 0.25 | 0.00 | 0.3433 | 0.0066 | |||||

| OHA Credit Funding 5 Ltd., Series 2020-5A, Class AR / ABS-CBDO (US67113GAS66) | 0.25 | 0.00 | 0.3432 | 0.0068 | |||||

| Benefit Street Partners CLO XXXV Ltd., Series 2024-35A, Class D / ABS-CBDO (US08182YAG35) | 0.25 | -0.40 | 0.3431 | 0.0052 | |||||

| US04623TAG04 / ASSURANT CLO II LTD | 0.25 | 0.40 | 0.3431 | 0.0073 | |||||

| OCP CLO Ltd., Series 2019-17A, Class AR2 / ABS-CBDO (US67113LAW63) | 0.25 | 0.00 | 0.3431 | 0.0068 | |||||

| US67109BDC54 / OHALF_15-1A | 0.25 | 0.00 | 0.3429 | 0.0061 | |||||

| US12511AAA25 / CBAM 2020-13 Ltd | 0.25 | 0.00 | 0.3429 | 0.0062 | |||||

| OHA Credit Funding 5 Ltd., Series 2020-5A, Class B1R / ABS-CBDO (US67113GAW78) | 0.25 | 0.00 | 0.3428 | 0.0068 | |||||

| US76761RAY53 / Riserva Clo Ltd | 0.25 | 0.40 | 0.3426 | 0.0070 | |||||

| TCW CLO Ltd., Series 2019-2A, Class A1R2 / ABS-CBDO (US87242BBG41) | 0.25 | 0.40 | 0.3426 | 0.0068 | |||||

| OCP CLO Ltd., Series 2016-11A, Class A1R2 / ABS-CBDO (US67110DBA46) | 0.25 | 0.40 | 0.3426 | 0.0070 | |||||

| Zegona Finance plc / DBT (XS2859406139) | 0.25 | 9.65 | 0.3424 | 0.0358 | |||||

| Green Lakes Park CLO LLC, Series 2025-1A, Class ARR / ABS-CBDO (US39310AAC45) | 0.25 | 0.3421 | 0.3421 | ||||||

| Palmer Square Loan Funding Ltd., Series 2024-2A, Class D / ABS-CBDO (US69703HAA59) | 0.25 | 0.81 | 0.3420 | 0.0074 | |||||

| Birch Grove CLO 3 Ltd., Series 2021-3A, Class BR / ABS-CBDO (US09076VAU52) | 0.25 | 0.81 | 0.3418 | 0.0098 | |||||

| Benefit Street Partners CLO XXIX Ltd., Series 2022-29A, Class AR / ABS-CBDO (US08186EAL20) | 0.25 | 0.00 | 0.3417 | 0.0057 | |||||

| XS2595028536 / Morgan Stanley | 0.25 | -22.57 | 0.3381 | -0.0917 | |||||

| ES0840609020 / CaixaBank SA | 0.24 | 10.41 | 0.3340 | 0.0362 | |||||

| XS2550081454 / COOPERATIEVE RABOBANK UA /EUR/ REGD V/R REG S EMTN SER GMTN 4.62500000 | 0.24 | 0.3334 | 0.3334 | ||||||

| XS2624938739 / HONEYWELL INTL | 0.24 | 10.05 | 0.3305 | 0.0354 | |||||

| AU3FN0029609 / AAI Ltd | 0.24 | 121.30 | 0.3280 | 0.1828 | |||||

| Glencore Capital Finance DAC / DBT (XS3081952791) | 0.24 | 0.3235 | 0.3235 | ||||||

| WFC / Wells Fargo & Company - Depositary Receipt (Common Stock) | 0.24 | 0.3222 | 0.3222 | ||||||

| XS1602547264 / Bank of America Corp | 0.23 | 120.75 | 0.3210 | 0.1772 | |||||

| US64134JAA16 / Neuberger Berman Loan Advisers Clo 40 Ltd | 0.23 | -3.70 | 0.3204 | -0.0064 | |||||

| XS1190974011 / BP Capital Markets PLC | 0.23 | 9.43 | 0.3183 | 0.0327 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.23 | -4.15 | 0.3170 | -0.0072 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.23 | -5.04 | 0.3104 | -0.0095 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.23 | -5.83 | 0.3093 | -0.0134 | |||||

| FR0013534336 / Electricite de France SA | 0.22 | 12.06 | 0.3054 | 0.0379 | |||||

| XS2623257503 / Motion Finco Sarl | 0.22 | 3.29 | 0.3022 | 0.0149 | |||||

| CBAV3 / Companhia Brasileira de Alumínio | 0.22 | 0.2994 | 0.2994 | ||||||

| Iliad Holding SASU / DBT (US449691AF14) | 0.21 | 1.91 | 0.2927 | 0.0107 | |||||

| ING / ING Groep N.V. - Depositary Receipt (Common Stock) | 0.21 | 0.95 | 0.2907 | 0.0085 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.21 | 0.2897 | 0.2897 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.21 | -3.23 | 0.2877 | -0.0052 | |||||

| FR001400KLT5 / Worldline SA/France | 0.21 | 92.52 | 0.2832 | 0.1385 | |||||

| Commercial Mortgage Trust, Series 2024-CBM, Class A2 / ABS-MBS (US12674GAC87) | 0.20 | -0.49 | 0.2783 | 0.0039 | |||||

| BBV / Banco Bilbao Vizcaya Argentaria, S.A. - Depositary Receipt (Common Stock) | 0.20 | 3.59 | 0.2774 | 0.0142 | |||||

| US35908MAA80 / FRONTIER COMMUNICATIONS HOLDINGS LLC 5.875% 11/01/2029 | 0.20 | -33.00 | 0.2763 | -0.1269 | |||||

| UBSG34 / UBS Group AG - Depositary Receipt (Common Stock) | 0.20 | 1.01 | 0.2748 | 0.0075 | |||||

| Stena International SA / DBT (US85858EAD58) | 0.20 | 0.50 | 0.2745 | 0.0058 | |||||

| TNETBB / Telenet Finance Luxembourg Notes Sarl | 0.20 | 1.55 | 0.2707 | 0.0100 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.20 | -5.74 | 0.2696 | -0.0123 | |||||

| US87256GAA04 / 2023-MIC Trust/THE | 0.20 | 0.51 | 0.2685 | 0.0054 | |||||

| XS2238020445 / Julius Baer Group Ltd | 0.20 | 0.52 | 0.2671 | 0.0062 | |||||

| ADANIENSOL / Adani Energy Solutions Limited | 0.19 | 11.05 | 0.2615 | 0.0295 | |||||

| US90320BAA70 / UPC Broadband Finco BV | 0.19 | 4.42 | 0.2588 | 0.0143 | |||||

| US92858RAB69 / Vmed O2 UK Financing I PLC | 0.19 | 6.94 | 0.2531 | 0.0196 | |||||

| CONE Trust, Series 2024-DFW1, Class A / ABS-MBS (US20682AAA88) | 0.18 | 0.55 | 0.2521 | 0.0053 | |||||

| Morgan Stanley Residential Mortgage Loan Trust, Series 2025-NQM1, Class M1 / ABS-MBS (US617932AF56) | 0.18 | -0.55 | 0.2473 | 0.0034 | |||||

| US91845AAA34 / VZ Secured Financing BV | 0.18 | 2.31 | 0.2434 | 0.0098 | |||||

| US68622TAB70 / Organon Finance 1 LLC | 0.17 | -0.57 | 0.2375 | 0.0031 | |||||

| US40056XCT19 / GS FLOAT 09/25/23 3.75 | 0.17 | -0.58 | 0.2365 | 0.0028 | |||||

| Cross Mortgage Trust, Series 2024-H5, Class A1 / ABS-MBS (US22757HAA95) | 0.17 | -6.63 | 0.2322 | -0.0114 | |||||

| GB00BMV7TC88 / United Kingdom Gilt | 0.17 | 0.2313 | 0.2313 | ||||||

| XS2014291616 / Volkswagen Leasing GmbH | 0.17 | 0.2301 | 0.2301 | ||||||

| Morgan Stanley Residential Mortgage Loan Trust, Series 2025-NQM1, Class A1 / ABS-MBS (US617932AA69) | 0.17 | -5.11 | 0.2295 | -0.0076 | |||||

| PL0000105391 / Republic of Poland Government Bond | 0.16 | 84.88 | 0.2187 | 0.1022 | |||||

| SAIF Securitization Trust, Series 2024-CES1, Class A1 / ABS-MBS (US78436VAA98) | 0.16 | -7.14 | 0.2144 | -0.0126 | |||||

| US12551YAA10 / CIFC 2018-3A A | 0.16 | -17.02 | 0.2135 | -0.0400 | |||||

| ZAG000077470 / Republic of South Africa Government Bond | 0.16 | 96.20 | 0.2128 | 0.1054 | |||||

| MX0MGO0001D6 / Mexican Bonos Desarr Fixed Rate, Series M | 0.15 | 86.59 | 0.2105 | 0.1001 | |||||

| U.S. Treasury 5-Year Note / DIR (N/A) | 0.15 | 0.2069 | 0.2069 | ||||||

| Bellis Acquisition Co. plc / DBT (XS2811958839) | 0.15 | 7.19 | 0.2050 | 0.0170 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.15 | -2.61 | 0.2039 | -0.0021 | |||||

| US12482NAN12 / CBAM 2019-10 Ltd | 0.15 | -17.32 | 0.2037 | -0.0373 | |||||

| XS2636324274 / British Telecommunications PLC | 0.15 | 7.30 | 0.2012 | 0.0163 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.15 | 0.2009 | 0.2009 | ||||||

| SDAL Trust, Series 2025-DAL, Class A / ABS-MBS (US78437RAA77) | 0.15 | 0.1987 | 0.1987 | ||||||

| XS2696093033 / Pinnacle Bidco plc | 0.15 | 6.62 | 0.1985 | 0.0150 | |||||

| Edge Finco plc / DBT (XS2914010157) | 0.14 | 8.40 | 0.1956 | 0.0185 | |||||

| BlueMountain CLO Ltd., Series 2018-3A, Class A1R / ABS-CBDO (US09630AAN63) | 0.14 | -12.42 | 0.1937 | -0.0231 | |||||

| Cross Mortgage Trust, Series 2025-H1, Class M1 / ABS-MBS (US22758NAF42) | 0.14 | 0.71 | 0.1935 | 0.0048 | |||||

| CD&R Firefly Bidco plc / DBT (XS2798887076) | 0.14 | 7.63 | 0.1930 | 0.0159 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.14 | -9.09 | 0.1926 | -0.0150 | |||||

| XS2592804194 / Teva Pharmaceutical Finance Netherlands II BV | 0.14 | 10.24 | 0.1922 | 0.0213 | |||||

| BX Commercial Mortgage Trust, Series 2024-BRBK, Class D / ABS-MBS (US05613NAL10) | 0.14 | 0.00 | 0.1920 | 0.0036 | |||||

| JW Trust, Series 2024-BERY, Class A / ABS-MBS (US46676AAA16) | 0.14 | 0.72 | 0.1916 | 0.0036 | |||||

| HILT Commercial Mortgage Trust, Series 2024-ORL, Class A / ABS-MBS (US403956AA32) | 0.14 | 0.72 | 0.1916 | 0.0036 | |||||

| Fontainebleau Miami Beach Mortgage Trust, Series 2024-FBLU, Class A / ABS-MBS (US34461WAA80) | 0.14 | 0.00 | 0.1915 | 0.0035 | |||||

| BMP, Series 2024-MF23, Class E / ABS-MBS (US05593JAJ97) | 0.14 | 0.72 | 0.1909 | 0.0051 | |||||

| BRAVO Residential Funding Trust, Series 2025-NQM2, Class A1 / ABS-MBS (US10569NAC56) | 0.14 | -6.08 | 0.1908 | -0.0089 | |||||

| CNA / Centrica plc | 0.14 | 6.15 | 0.1899 | 0.0151 | |||||

| US90278MBF32 / COMMERCIAL MORTGAGE BACKED SECURITIES | 0.14 | 0.73 | 0.1899 | 0.0054 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.14 | -4.20 | 0.1884 | -0.0051 | |||||

| US92332YAB74 / Venture Global LNG, Inc. | 0.14 | 3.03 | 0.1861 | 0.0075 | |||||

| XS2351480996 / Deuce Finco Plc | 0.14 | 7.94 | 0.1861 | 0.0158 | |||||

| XS1716248197 / HSBC Holdings PLC | 0.14 | 0.1861 | 0.1861 | ||||||

| BX Commercial Mortgage Trust, Series 2024-BRBK, Class A / ABS-MBS (US05613NAA54) | 0.14 | 0.00 | 0.1858 | 0.0042 | |||||

| XS2400445362 / Bracken MidCo1 PLC | 0.14 | 6.30 | 0.1858 | 0.0147 | |||||

| MX0MGO000193 / MEX BONOS DESARR FIX RT BONDS 09/26 7 | 0.14 | 87.50 | 0.1852 | 0.0877 | |||||

| Angel Oak Mortgage Trust, Series 2025-1, Class A1 / ABS-MBS (US034934AA73) | 0.14 | -2.88 | 0.1851 | -0.0021 | |||||

| PTPP / PT PP (Persero) Tbk | 0.13 | 332.26 | 0.1842 | 0.1422 | |||||

| XS2470988101 / Market Bidco Finco PLC | 0.13 | 8.94 | 0.1840 | 0.0182 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.13 | -2.92 | 0.1824 | -0.0022 | |||||

| Cross Mortgage Trust, Series 2025-H1, Class A1 / ABS-MBS (US22758NAA54) | 0.13 | -3.65 | 0.1819 | -0.0029 | |||||

| XS2397447538 / BCP V Modular Services Finance II plc | 0.13 | 8.20 | 0.1814 | 0.0165 | |||||

| XS1996438948 / Virgin Media Secured Finance PLC | 0.13 | 10.00 | 0.1810 | 0.0194 | |||||

| US29374FAC77 / EFF 22-3 A3 144A 4.29% 07-20-29/03-22-27 | 0.13 | 0.00 | 0.1804 | 0.0036 | |||||

| XS2342058034 / Allied Universal Holdco LLC/Allied Universal Finance Corp/Atlas Luxco 4 Sarl | 0.13 | 8.26 | 0.1800 | 0.0168 | |||||

| Var Energi ASA / DBT (XS2708134023) | 0.13 | 10.26 | 0.1769 | 0.0184 | |||||

| US68269HAB15 / ONEMAIN FINANCIAL ISSUANCE TRUST 2023-2 6.17% 09/15/2036 144A | 0.13 | 0.00 | 0.1765 | 0.0025 | |||||

| Aston Martin Capital Holdings Ltd. / DBT (XS2788344419) | 0.13 | 5.83 | 0.1750 | 0.0133 | |||||

| US83207DAA63 / SMB PRIVATE EDUCATION LOAN TRUST 2023-C SER 2023-C CL A1A REGD 144A P/P 5.67000000 | 0.13 | -4.51 | 0.1746 | -0.0053 | |||||

| US68269HAE53 / OneMain Financial Issuance Trust, Series 2023-2A, Class A2 | 0.13 | 0.79 | 0.1739 | 0.0039 | |||||

| Eutelsat SA / DBT (XS2796660384) | 0.13 | 0.1737 | 0.1737 | ||||||

| Kronos International, Inc. / DBT (XS2763521643) | 0.13 | 8.62 | 0.1735 | 0.0166 | |||||

| XS2734938249 / EPHIOS SUBCO SARL /EUR/ REGD REG S 7.87500000 | 0.13 | 9.57 | 0.1733 | 0.0185 | |||||

| US63942BAA26 / Navient Private Education Refi Loan Trust 2021-A | 0.13 | -6.67 | 0.1731 | -0.0086 | |||||

| XS2081020872 / Heathrow Finance PLC | 0.13 | 7.69 | 0.1727 | 0.0147 | |||||

| XS2582389156 / Telefonica Europe BV | 0.13 | 10.53 | 0.1726 | 0.0185 | |||||

| BX Trust, Series 2024-CNYN, Class A / ABS-MBS (US05612HAA95) | 0.13 | -0.79 | 0.1726 | 0.0018 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.13 | -5.30 | 0.1720 | -0.0061 | |||||

| ETE / National Bank of Greece S.A. | 0.13 | 9.65 | 0.1719 | 0.0185 | |||||

| Iliad Holding SASU / DBT (XS2810807094) | 0.13 | 10.62 | 0.1718 | 0.0189 | |||||

| XS2615937187 / Allwyn Entertainment Financing UK PLC | 0.13 | 10.62 | 0.1712 | 0.0190 | |||||

| US55293BAB18 / MHP 2021-STOR | 0.12 | 0.81 | 0.1710 | 0.0040 | |||||

| US05609TAA88 / BX Trust, Series 2022-VAMF, Class A | 0.12 | 0.00 | 0.1709 | 0.0038 | |||||

| US85236WCE49 / STWD Trust | 0.12 | 0.00 | 0.1709 | 0.0039 | |||||

| BRAVO Residential Funding Trust, Series 2024-NQM7, Class A1 / ABS-MBS (US105698AC83) | 0.12 | -12.06 | 0.1703 | -0.0202 | |||||

| XS2620212386 / ENGINEERING SPA /EUR/ REGD REG S 11.12500000 | 0.12 | 8.77 | 0.1702 | 0.0169 | |||||

| XS2615562274 / Gruenenthal GmbH | 0.12 | 10.71 | 0.1700 | 0.0190 | |||||

| FR0013283371 / RCI Banque SA | 0.12 | 9.82 | 0.1695 | 0.0183 | |||||

| XS2644942737 / SCIL IV LLC / SCIL USA Holdings LLC | 0.12 | 8.85 | 0.1694 | 0.0170 | |||||

| XS2621830681 / Emerald Debt Merger Sub LLC | 0.12 | 10.81 | 0.1693 | 0.0197 | |||||

| XS2628988730 / OLYMPUS WTR US HLDG CORP /EUR/ REGD REG S 9.62500000 | 0.12 | 9.82 | 0.1692 | 0.0179 | |||||

| FR0014001YB0 / Iliad SA | 0.12 | 9.82 | 0.1691 | 0.0179 | |||||

| 6618 / JD Health International Inc. | 0.12 | 10.81 | 0.1691 | 0.0199 | |||||

| XS2606019383 / IHO Verwaltungs GmbH | 0.12 | 9.82 | 0.1687 | 0.0170 | |||||

| XS2690055996 / Banijay Entertainment SASU | 0.12 | 9.82 | 0.1684 | 0.0167 | |||||

| FIGRE Trust, Series 2024-SL1, Class A1 / ABS-O (US31684JAA43) | 0.12 | -7.52 | 0.1684 | -0.0108 | |||||

| OEG Finance plc / DBT (XS2906227785) | 0.12 | 10.81 | 0.1683 | 0.0184 | |||||

| Nidda Healthcare Holding GmbH / DBT (XS2854896797) | 0.12 | 8.93 | 0.1682 | 0.0166 | |||||

| XS2358483258 / Vmed O2 UK Financing I PLC | 0.12 | 10.91 | 0.1681 | 0.0201 | |||||

| Lottomatica Group SpA / DBT (XS2824643220) | 0.12 | 9.91 | 0.1677 | 0.0184 | |||||

| Boels Topholding BV / DBT (XS2806449190) | 0.12 | 10.91 | 0.1672 | 0.0185 | |||||

| Helios Software Holdings, Inc. / DBT (XS2808407188) | 0.12 | 11.01 | 0.1667 | 0.0192 | |||||

| Q-Park Holding I BV / DBT (XS2848642984) | 0.12 | 11.01 | 0.1664 | 0.0191 | |||||

| XS2624554320 / OI European Group BV | 0.12 | 10.00 | 0.1664 | 0.0172 | |||||

| Ardonagh Finco Ltd. / DBT (XS2765406371) | 0.12 | 10.00 | 0.1656 | 0.0173 | |||||

| Iliad Holding SASU / DBT (XS2943818059) | 0.12 | 11.11 | 0.1655 | 0.0195 | |||||

| PRY / Prysmian S.p.A. | 0.12 | 0.1654 | 0.1654 | ||||||

| Dynamo Newco II GmbH / DBT (XS2910523716) | 0.12 | 10.09 | 0.1652 | 0.0180 | |||||

| Vmed O2 UK Financing I plc / DBT (XS2796600307) | 0.12 | 12.15 | 0.1651 | 0.0207 | |||||

| FR00140063V5 / ELECTRICITE DE FRANCE RT SCRIP 12/31/49 | 0.12 | 0.1648 | 0.1648 | ||||||

| Wintershall Dea Finance 2 BV / DBT (XS3066590574) | 0.12 | 0.1646 | 0.1646 | ||||||

| Opal Bidco SAS / DBT (XS3037643304) | 0.12 | 0.1644 | 0.1644 | ||||||

| ING / ING Groep N.V. - Depositary Receipt (Common Stock) | 0.12 | -72.58 | 0.1640 | -0.4200 | |||||

| DUKB34 / Duke Energy Corporation - Depositary Receipt (Common Stock) | 0.12 | 10.19 | 0.1636 | 0.0180 | |||||

| DUKB34 / Duke Energy Corporation - Depositary Receipt (Common Stock) | 0.12 | 10.19 | 0.1636 | 0.0180 | |||||

| XS2397198487 / Kaixo Bondco Telecom SA | 0.12 | 10.19 | 0.1634 | 0.0173 | |||||

| IPD 3 BV / DBT (XS3067907140) | 0.12 | 0.1634 | 0.1634 | ||||||

| INEOS Finance plc / DBT (XS2762276967) | 0.12 | 8.18 | 0.1633 | 0.0145 | |||||

| B1LL34 / Ball Corporation - Depositary Receipt (Common Stock) | 0.12 | 0.1633 | 0.1633 | ||||||

| Banque Federative du Credit Mutuel SA / DBT (FR001400WJH9) | 0.12 | 11.21 | 0.1632 | 0.0185 | |||||

| Darling Global Finance BV / DBT (XS3101875931) | 0.12 | 0.1631 | 0.1631 | ||||||

| Volkswagen Financial Services AG / DBT (XS2941360963) | 0.12 | 0.1629 | 0.1629 | ||||||

| Fressnapf Holding SE / DBT (XS2910536452) | 0.12 | 10.28 | 0.1628 | 0.0176 | |||||

| Goldstory SAS / DBT (XS2761222400) | 0.12 | 9.26 | 0.1628 | 0.0165 | |||||

| Volkswagen International Finance NV / DBT (XS3071335478) | 0.12 | 0.1627 | 0.1627 | ||||||

| XS2436585355 / FIS Fabbrica Italiana Sintetici SpA | 0.12 | 9.26 | 0.1625 | 0.0172 | |||||

| Arena Luxembourg Finance SARL / DBT (XS3038490176) | 0.12 | 9.26 | 0.1624 | 0.0170 | |||||

| E / Eni S.p.A. - Depositary Receipt (Common Stock) | 0.12 | 10.28 | 0.1624 | 0.0185 | |||||

| Fibercop SpA / DBT (XS3104481257) | 0.12 | 0.1622 | 0.1622 | ||||||

| Gruenenthal GmbH / DBT (XS2951378434) | 0.12 | 13.46 | 0.1622 | 0.0217 | |||||

| XS2622212707 / CEDACRI MERGECO SPA /EUR/ REGD V/R REG S 8.88200000 | 0.12 | 9.26 | 0.1622 | 0.0161 | |||||

| SHA0 / Schaeffler AG | 0.12 | 10.28 | 0.1622 | 0.0172 | |||||

| Pachelbel Bidco SpA / DBT (XS2816639095) | 0.12 | 9.26 | 0.1620 | 0.0157 | |||||

| XS2451802768 / Bayer AG | 0.12 | 15.69 | 0.1619 | 0.0104 | |||||

| Lion/Polaris Lux 4 SA / DBT (XS2852970529) | 0.12 | 10.28 | 0.1619 | 0.0169 | |||||

| Lion/Polaris Lux 4 SA / DBT (XS2852970529) | 0.12 | 10.28 | 0.1619 | 0.0169 | |||||

| Traton Finance Luxembourg SA / DBT (DE000A3LKBD0) | 0.12 | 9.26 | 0.1617 | 0.0157 | |||||

| Bubbles Bidco SpA / DBT (XS2904658429) | 0.12 | 9.26 | 0.1617 | 0.0164 | |||||

| SGL Group ApS / DBT (NO0013183624) | 0.12 | 8.26 | 0.1614 | 0.0144 | |||||

| TeamSystem SpA / DBT (XS2864287466) | 0.12 | 8.33 | 0.1614 | 0.0159 | |||||

| Fibercop SpA / DBT (XS3104481414) | 0.12 | 0.1614 | 0.1614 | ||||||

| Irca SpA / DBT (XS2947181769) | 0.12 | 8.33 | 0.1614 | 0.0160 | |||||

| Wintershall Dea Finance BV / DBT (XS2908095172) | 0.12 | 5.41 | 0.1613 | -0.0386 | |||||

| Daimler Truck International Finance BV / DBT (XS3081821699) | 0.12 | 0.1612 | 0.1612 | ||||||

| Daimler Truck International Finance BV / DBT (XS3081821699) | 0.12 | 0.1612 | 0.1612 | ||||||

| United Group BV / DBT (XS2758099779) | 0.12 | 9.35 | 0.1611 | 0.0160 | |||||

| Almaviva-The Italian Innovation Co. SpA, Series JUN / DBT (XS3110309492) | 0.12 | 0.1611 | 0.1611 | ||||||

| PTEDPLOM0017 / EDP - Energias de Portugal SA | 0.12 | 9.35 | 0.1611 | 0.0167 | |||||

| Jefferies GmbH / DBT (XS2863580473) | 0.12 | 8.33 | 0.1609 | 0.0157 | |||||

| INEOS Quattro Finance 2 plc / DBT (XS2719090636) | 0.12 | 6.36 | 0.1605 | -0.0032 | |||||

| Telefonica Emisiones SA / DBT (XS3103696087) | 0.12 | 0.1603 | 0.1603 | ||||||

| Maxam Prill SARL / DBT (XS3107119003) | 0.12 | 0.1602 | 0.1602 | ||||||

| SMB Private Education Loan Trust, Series 2024-A, Class A1A / ABS-O (US831943AA30) | 0.12 | -3.33 | 0.1601 | -0.0017 | |||||

| XS2405483301 / FAURECIA /EUR/ REGD REG S 2.75000000 | 0.12 | 11.54 | 0.1590 | 0.0187 | |||||

| US05609WAA18 / BX Trust, Series 2022-IND, Class A | 0.12 | -7.26 | 0.1587 | -0.0084 | |||||

| Bertrand Franchise Finance SAS / DBT (XS2831749481) | 0.12 | 6.48 | 0.1579 | 0.0122 | |||||

| XS2332250708 / Organon Finance 1 LLC | 0.11 | 11.76 | 0.1571 | 0.0189 | |||||

| XS2416413339 / COOPERATIEVE RAB | 0.11 | 0.1568 | 0.1568 | ||||||

| Fedrigoni SpA / DBT (XS2748964850) | 0.11 | 6.54 | 0.1567 | 0.0119 | |||||

| XS1684385591 / SoftBank Group Corp | 0.11 | 9.62 | 0.1567 | 0.0163 | |||||

| US693981AA03 / PRKCM 2023-AFC1 TRUST SER 2023-AFC1 CL A1 V/R REGD 144A P/P 6.59800000 | 0.11 | -6.61 | 0.1559 | -0.0076 | |||||

| SoFi Consumer Loan Program Trust, Series 2025-1, Class A / ABS-O (US83406YAA91) | 0.11 | -22.07 | 0.1558 | -0.0392 | |||||

| US83208AAE38 / SMB PRIVATE EDUCATION LOAN TRUST 2021-C SMB 2021-C B | 0.11 | -10.40 | 0.1544 | -0.0138 | |||||

| XS2189356996 / Ardagh Packaging Finance PLC / Ardagh Holdings USA Inc | 0.11 | 13.13 | 0.1543 | 0.0200 | |||||

| US81180WBM29 / Seagate HDD Cayman | 0.11 | 0.00 | 0.1542 | 0.0030 | |||||

| Lendmark Funding Trust, Series 2024-1A, Class D / ABS-O (US52603DAD57) | 0.11 | -0.88 | 0.1540 | 0.0011 | |||||

| US466330AA51 / JP MORGAN CHASE COMMERCIAL MORTGAGE SECURITIES COR JPMCC 2021-MHC A | 0.11 | -8.20 | 0.1540 | -0.0108 | |||||

| XS2353073161 / Poste Italiane SpA | 0.11 | 11.00 | 0.1529 | 0.0172 | |||||

| BX Commercial Mortgage Trust, Series 2024-MF, Class A / ABS-MBS (US05612EAA64) | 0.11 | 0.00 | 0.1517 | 0.0030 | |||||

| XS2310411090 / Citycon Treasury BV | 0.11 | 11.11 | 0.1516 | 0.0180 | |||||

| US64828EAC93 / NRZT_19-NQM4 | 0.11 | -10.57 | 0.1513 | -0.0144 | |||||

| XS2298381307 / Kleopatra Finco Sarl | 0.11 | 10.00 | 0.1511 | 0.0167 | |||||

| XS2069016165 / Ziggo BV | 0.11 | 12.24 | 0.1511 | 0.0191 | |||||

| US097751CA78 / Bombardier, Inc. | 0.11 | 2.86 | 0.1481 | 0.0064 | |||||

| COL17CT03672 / Colombian TES | 0.11 | 75.41 | 0.1475 | 0.0654 | |||||

| US92676XAG25 / Viking Cruises Ltd | 0.11 | 0.94 | 0.1473 | 0.0038 | |||||

| BRAVO Residential Funding Trust, Series 2024-NQM3, Class A1 / ABS-MBS (US10569LAA35) | 0.11 | -7.76 | 0.1470 | -0.0094 | |||||

| MX0MGO0001F1 / Mexican Bonos | 0.11 | 146.51 | 0.1463 | 0.0878 | |||||

| XS2272845798 / VZ Vendor Financing II BV | 0.11 | 10.42 | 0.1463 | 0.0164 | |||||

| XS2362416617 / SOFTBANK GROUP CORP 3.875% 07/06/2032 REGS | 0.11 | -47.00 | 0.1462 | -0.1226 | |||||

| XS2198191962 / Vertical Holdco GmbH | 0.11 | 9.28 | 0.1454 | 0.0144 | |||||

| US70932MAD92 / PennyMac Financial Services Inc | 0.11 | 1.92 | 0.1453 | 0.0054 | |||||

| US12543DBN93 / CHS/Community Health Systems Inc | 0.11 | 0.1450 | 0.1450 | ||||||

| US410345AQ54 / Hanesbrands Inc | 0.11 | 0.00 | 0.1448 | 0.0032 | |||||

| US19424WAB37 / COLLEGE AVE STUDENT LOANS 2021-C LLC CASL 2021-C A2 | 0.11 | -2.78 | 0.1447 | -0.0014 | |||||

| US29450YAA73 / EquipmentShare.com, Inc. | 0.11 | 1.94 | 0.1445 | 0.0053 | |||||

| S2TW34 / Starwood Property Trust, Inc. - Depositary Receipt (Common Stock) | 0.11 | 2.94 | 0.1439 | 0.0061 | |||||

| US855170AA41 / Star Parent Inc | 0.11 | 7.14 | 0.1439 | 0.0114 | |||||

| Global Partners LP / DBT (US37954FAK03) | 0.11 | 0.1439 | 0.1439 | ||||||

| AREIT Ltd., Series 2025-CRE10, Class A / ABS-CBDO (US00193DAA63) | 0.10 | 0.00 | 0.1435 | 0.0025 | |||||

| LoanCore 2025 Issuer LLC, Series 2025-CRE8, Class A / ABS-MBS (US53947FAA93) | 0.10 | 0.00 | 0.1432 | 0.0024 | |||||

| Allied Universal Holdco LLC / DBT (US019576AD90) | 0.10 | 2.97 | 0.1429 | 0.0068 | |||||

| US071705AA56 / Bausch & Lomb Escrow Corp | 0.10 | 0.97 | 0.1428 | 0.0033 | |||||

| BAHA Trust, Series 2024-MAR, Class C / ABS-MBS (US05493XAG51) | 0.10 | 0.97 | 0.1427 | 0.0039 | |||||

| US55318EAA82 / MIRA Trust 2023-MILE | 0.10 | 0.00 | 0.1424 | 0.0020 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.10 | -6.36 | 0.1422 | -0.0065 | |||||

| Panther Escrow Issuer LLC / DBT (US69867RAA59) | 0.10 | 1.98 | 0.1421 | 0.0052 | |||||

| Freedom Mortgage Holdings LLC / DBT (US35641AAA60) | 0.10 | 1.98 | 0.1421 | 0.0056 | |||||

| US431318BC74 / Hilcorp Energy I LP / Hilcorp Finance Co. | 0.10 | 0.98 | 0.1419 | 0.0042 | |||||

| US053773BH95 / Avis Budget Car Rental LLC / Avis Budget Finance Inc | 0.10 | 6.19 | 0.1417 | 0.0105 | |||||

| US46284VAP67 / Iron Mountain, Inc. | 0.10 | 0.98 | 0.1416 | 0.0042 | |||||

| THC / Tenet Healthcare Corporation | 0.10 | 1.98 | 0.1415 | 0.0052 | |||||

| US01883LAF04 / ALLIANT HOLD / CO-ISSUER REGD 144A P/P 7.00000000 | 0.10 | 3.00 | 0.1415 | 0.0067 | |||||

| GGAM Finance Ltd. / DBT (US36170JAD81) | 0.10 | 1.98 | 0.1414 | 0.0054 | |||||

| WLN / Worldline SA | 0.10 | -6.36 | 0.1413 | -0.0070 | |||||

| US17291NAA90 / Citigroup Commercial Mortgage Trust 2023-SMRT | 0.10 | 0.98 | 0.1413 | 0.0040 | |||||

| Quikrete Holdings, Inc. / DBT (US74843PAB67) | 0.10 | 4.04 | 0.1412 | 0.0074 | |||||

| CVS / CVS Health Corporation - Depositary Receipt (Common Stock) | 0.10 | 0.1411 | 0.1411 | ||||||

| US947075AU14 / Weatherford International Ltd | 0.10 | 0.1410 | 0.1410 | ||||||

| SATS / EchoStar Corporation | 0.10 | -1.90 | 0.1409 | -0.0003 | |||||

| A1ES34 / The AES Corporation - Depositary Receipt (Common Stock) | 0.10 | 2.00 | 0.1409 | 0.0052 | |||||

| US171484AJ78 / Churchill Downs Inc | 0.10 | 2.00 | 0.1406 | 0.0051 | |||||

| US92841HAA05 / VistaJet Malta Finance PLC / Vista Management Holding Inc | 0.10 | 4.08 | 0.1406 | 0.0076 | |||||

| USU8302LAH16 / Tallgrass Energy Partners L.P./ Tallgrass Energy Finance Corp. | 0.10 | 2.00 | 0.1406 | 0.0055 | |||||

| US12008RAR84 / Builders FirstSource Inc | 0.10 | 2.00 | 0.1406 | 0.0058 | |||||

| US18060TAC99 / Clarios Global LP / Clarios US Finance Co | 0.10 | 0.99 | 0.1404 | 0.0041 | |||||

| Caesars Entertainment, Inc. / DBT (US12769GAC42) | 0.10 | 3.03 | 0.1404 | 0.0064 | |||||

| US65342QAM42 / NEXTERA ENERGY OPERATING REGD 144A P/P 7.25000000 | 0.10 | 0.1402 | 0.1402 | ||||||

| USA Compression Partners LP / DBT (US91740PAG37) | 0.10 | 0.99 | 0.1402 | 0.0035 | |||||

| US01309QAA67 / Albertsons Cos., Inc./Safeway, Inc./New Albertsons LP/Albertsons LLC | 0.10 | 0.99 | 0.1401 | 0.0038 | |||||

| ARI Fleet Lease Trust, Series 2023-B, Class A3 / ABS-O (US04033GAC15) | 0.10 | 0.00 | 0.1399 | 0.0022 | |||||

| US18972EAB11 / Clydesdale Acquisition Holdings, Inc. | 0.10 | 0.99 | 0.1399 | 0.0036 | |||||

| WLN / Worldline SA | 0.10 | 0.1399 | 0.1399 | ||||||

| Regional Management Issuance Trust, Series 2024-1, Class A / ABS-O (US758983AA85) | 0.10 | 0.00 | 0.1399 | 0.0028 | |||||

| US29103CAA62 / Emerald Debt Merger Sub LLC | 0.10 | 2.00 | 0.1398 | 0.0054 | |||||

| Nationstar Mortgage Holdings, Inc. / DBT (US63861CAG42) | 0.10 | 0.99 | 0.1397 | 0.0035 | |||||

| US893647BR70 / TransDigm, Inc. | 0.10 | 0.1397 | 0.1397 | ||||||

| Mariner Finance issuance Trust, Series 2024-BA, Class C / ABS-O (US56847GAC78) | 0.10 | 0.99 | 0.1396 | 0.0035 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.10 | -12.93 | 0.1393 | -0.0172 | |||||

| US668771AK49 / NortonLifeLock Inc | 0.10 | 0.00 | 0.1392 | 0.0032 | |||||

| US30251GBE61 / FMG RESOURCES AUGUST 2006 | 0.10 | 3.06 | 0.1392 | 0.0066 | |||||

| M1GM34 / MGM Resorts International - Depositary Receipt (Common Stock) | 0.10 | 2.02 | 0.1392 | 0.0061 | |||||

| XS2293681685 / Orsted AS | 0.10 | 8.60 | 0.1391 | 0.0132 | |||||

| US12429TAD63 / Mauser Packaging Solutions Holding Co | 0.10 | 3.06 | 0.1390 | 0.0073 | |||||

| PRPM Trust, Series 2025-NQM1, Class M1A / ABS-MBS (US74391EAD31) | 0.10 | 0.00 | 0.1390 | 0.0026 | |||||

| Republic Finance Issuance Trust, Series 2024-B, Class A / ABS-O (US76042GAA22) | 0.10 | 0.00 | 0.1388 | 0.0029 | |||||

| US914906AY80 / Univision Communications, Inc. | 0.10 | 1.00 | 0.1388 | 0.0040 | |||||

| US812127AA61 / Sealed Air Corp. | 0.10 | 1.00 | 0.1388 | 0.0042 | |||||

| Rogers Communications, Inc. / DBT (US775109DH13) | 0.10 | 0.1387 | 0.1387 | ||||||

| US237266AJ06 / Darling Ingredients Inc | 0.10 | 0.1386 | 0.1386 | ||||||

| CIM Trust, Series 2025-I1, Class M1 / ABS-MBS (US12571DAD75) | 0.10 | 0.00 | 0.1385 | 0.0024 | |||||

| MCR Mortgage Trust, Series 2024-TWA, Class A / ABS-MBS (US582923AA66) | 0.10 | 0.00 | 0.1385 | 0.0025 | |||||

| Venture Global LNG, Inc. / DBT (US92332YAE14) | 0.10 | 0.1383 | 0.1383 | ||||||

| Celanese US Holdings LLC / DBT (US15089QBA13) | 0.10 | 4.12 | 0.1382 | 0.0077 | |||||

| SCI / Service Corporation International | 0.10 | 0.1382 | 0.1382 | ||||||

| New Residential Mortgage Loan Trust, Series 2025-NQM1, Class M1 / ABS-MBS (US64832DAF87) | 0.10 | -0.99 | 0.1380 | 0.0019 | |||||

| US05610DAA00 / BX_23-DELC | 0.10 | 0.00 | 0.1377 | 0.0032 | |||||

| CZ0001006688 / Czech Republic Government Bond | 0.10 | 85.19 | 0.1376 | 0.0645 | |||||

| US57767XAA81 / Mav Acquisition Corp | 0.10 | 3.09 | 0.1376 | 0.0064 | |||||

| TransDigm, Inc. / DBT (US893647BW65) | 0.10 | 2.04 | 0.1375 | 0.0053 | |||||

| NYC Trust, Series 2024-3ELV, Class A / ABS-MBS (US62956HAA41) | 0.10 | 0.00 | 0.1375 | 0.0026 | |||||

| US603051AC70 / Mineral Resources Ltd | 0.10 | 2.04 | 0.1374 | 0.0046 | |||||

| BlueMountain CLO Ltd., Series 2018-3A, Class BR / ABS-CBDO (US09630AAS50) | 0.10 | 1.01 | 0.1372 | 0.0030 | |||||

| BOCA Commercial Mortgage Trust, Series 2024-BOCA, Class A / ABS-MBS (US096817AA90) | 0.10 | 0.00 | 0.1371 | 0.0022 | |||||

| US36267CAA36 / GS Mortgage Securities Corp Trust 2023-FUN | 0.10 | 0.00 | 0.1371 | 0.0027 | |||||

| US205768AS39 / Comstock Resources Inc | 0.10 | 3.09 | 0.1371 | 0.0057 | |||||

| Great Wolf Trust, Series 2024-WOLF, Class A / ABS-MBS (US39152MAA36) | 0.10 | 0.00 | 0.1370 | 0.0025 | |||||

| Cali, Series 2024-SUN, Class A / ABS-MBS (US12988DAA00) | 0.10 | 0.00 | 0.1370 | 0.0026 | |||||

| US12516WAA99 / CENT Trust 2023-CITY | 0.10 | 0.00 | 0.1370 | 0.0023 | |||||

| ARES1, Series 2024-IND2, Class A / ABS-MBS (US04021EAA47) | 0.10 | 1.01 | 0.1369 | 0.0029 | |||||

| SCG Mortgage Trust, Series 2024-MSP, Class A / ABS-MBS (US78436EAA73) | 0.10 | 0.00 | 0.1369 | 0.0024 | |||||

| US02406PBA75 / American Axle & Manufacturing Inc | 0.10 | 5.26 | 0.1369 | 0.0088 | |||||

| DK Trust, Series 2024-SPBX, Class D / ABS-MBS (US23346LAL27) | 0.10 | 1.01 | 0.1368 | 0.0028 | |||||

| US44332PAG63 / HUB International Ltd | 0.10 | 0.1368 | 0.1368 | ||||||

| SHR Trust, Series 2024-LXRY, Class A / ABS-MBS (US784234AA47) | 0.10 | 0.00 | 0.1367 | 0.0023 | |||||

| DC Trust, Series 2024-HLTN, Class D / ABS-MBS (US24022FAJ93) | 0.10 | -2.94 | 0.1367 | -0.0012 | |||||

| US00253XAB73 / American Airlines Inc/AAdvantage Loyalty IP Ltd | 0.10 | 2.06 | 0.1367 | 0.0052 | |||||

| US150190AB26 / Cedar Fair LP / Canada's Wonderland Co / Magnum Management Corp / Millennium Op | 0.10 | 1.02 | 0.1367 | 0.0039 | |||||

| FS Rialto Issuer LLC, Series 2025-FL10, Class A / ABS-CBDO (US30340KAA97) | 0.10 | 0.00 | 0.1365 | 0.0033 | |||||

| US65343HAA95 / Nexstar Escrow, Inc. | 0.10 | 1.02 | 0.1365 | 0.0041 | |||||

| US1248EPBT92 / CCO Holdings LLC / CCO Holdings Capital Corp | 0.10 | 1.02 | 0.1364 | 0.0040 | |||||

| US59151KAM09 / Methanex Corp | 0.10 | 1.02 | 0.1363 | 0.0046 | |||||

| US36262MAA62 / GSMS 2021-IP A 1ML+105 10/15/2036 144A | 0.10 | 0.00 | 0.1363 | 0.0029 | |||||

| US629377CH34 / NRG Energy, Inc. | 0.10 | 2.06 | 0.1361 | 0.0051 | |||||

| US57665RAG11 / Match Group Inc | 0.10 | 1.02 | 0.1361 | 0.0043 | |||||

| BX Commercial Mortgage Trust, Series 2024-BRBK, Class E / ABS-MBS (US05613NAN75) | 0.10 | 0.1360 | 0.1360 | ||||||

| US94989NBK28 / Wells Fargo Commercial Mortgage Trust, Series 2015-C30, Class B | 0.10 | 0.00 | 0.1360 | 0.0027 | |||||

| US57763RAC16 / Mauser Packaging Solutions Holding Co. | 0.10 | 0.1358 | 0.1358 | ||||||

| US03690AAH95 / ANTERO MIDSTREAM PARTNERS LP 5.375% 06/15/2029 144A | 0.10 | 2.06 | 0.1358 | 0.0044 | |||||

| US62482BAB80 / MOZART DEBT MERGER SUB INC | 0.10 | 4.21 | 0.1357 | 0.0068 | |||||

| Tricon Residential Trust, Series 2024-SFR3, Class A / ABS-O (US89616YAA29) | 0.10 | 1.02 | 0.1356 | 0.0036 | |||||

| US1248EPBX05 / CCO Holdings LLC / CCO Holdings Capital Corp | 0.10 | 2.06 | 0.1355 | 0.0051 | |||||

| US880349AU90 / Tenneco Inc | 0.10 | 3.16 | 0.1353 | 0.0071 | |||||

| US853496AD99 / Standard Industries Inc/NJ | 0.10 | 2.08 | 0.1353 | 0.0052 | |||||

| US18453HAA41 / Clear Channel Worldwide Holdings Inc 5.125% 08/15/2027 144A | 0.10 | 2.08 | 0.1352 | 0.0053 | |||||

| US513075BW03 / Lamar Media Corp | 0.10 | 1.03 | 0.1352 | 0.0045 | |||||

| HIH Trust, Series 2024-61P, Class A / ABS-MBS (US40444VAA98) | 0.10 | -2.00 | 0.1349 | -0.0001 | |||||

| US05352TAA79 / AVANTOR FUNDING INC 4.625% 07/15/2028 144A | 0.10 | 2.08 | 0.1343 | 0.0048 | |||||

| Preem Holdings AB / DBT (XS2493887264) | 0.10 | 0.1343 | 0.1343 | ||||||

| US893647BP15 / CORP. NOTE | 0.10 | 4.26 | 0.1342 | 0.0066 | |||||

| US82967NBL10 / Sirius XM Radio Inc | 0.10 | 2.08 | 0.1342 | 0.0040 | |||||

| US382550BN08 / Goodyear Tire & Rubber Co/The | 0.10 | 5.43 | 0.1337 | 0.0090 | |||||

| US36485MAL37 / Garda World Security Corp | 0.10 | 0.1335 | 0.1335 | ||||||

| JetBlue Airways Corp. / DBT (US476920AA15) | 0.10 | -1.02 | 0.1331 | 0.0004 | |||||

| US50190EAA29 / MAGLLC 4 7/8 05/01/29 | 0.10 | 4.30 | 0.1330 | 0.0069 | |||||

| BX Commercial Mortgage Trust, Series 2024-XL5, Class A / ABS-MBS (US05612GAA13) | 0.10 | -10.19 | 0.1330 | -0.0125 | |||||

| Foundation Finance Trust, Series 2024-2A, Class B / ABS-O (US35040VAB53) | 0.10 | -2.02 | 0.1328 | -0.0006 | |||||

| US36168QAP90 / GFL Environmental Inc | 0.10 | 3.19 | 0.1328 | 0.0061 | |||||

| US47077WAA62 / Jane Street Group / JSG Finance, Inc. | 0.10 | 3.19 | 0.1327 | 0.0058 | |||||

| OTEXCN / Open Text Corp | 0.10 | 2.13 | 0.1327 | 0.0061 | |||||

| US70052LAC72 / Park Intermediate Holdings LLC / PK Domestic Property LLC / PK Finance Co-Issuer | 0.10 | 3.23 | 0.1326 | 0.0071 | |||||

| US1248EPCD32 / CCO Holdings LLC / CCO Holdings Capital Corp. | 0.10 | 4.35 | 0.1325 | 0.0079 | |||||

| US56848DAA72 / Mariner Finance Issuance Trust 2021-A | 0.10 | 1.05 | 0.1325 | 0.0036 | |||||

| US88033GDR83 / Tenet Healthcare Corp | 0.10 | 4.35 | 0.1324 | -0.0525 | |||||

| US680665AK27 / Olin Corp | 0.10 | 2.13 | 0.1320 | 0.0054 | |||||

| US71376LAE02 / Performance Food Group, Inc. | 0.10 | 3.23 | 0.1319 | 0.0062 | |||||

| New Residential Mortgage Loan Trust, Series 2025-NQM1, Class A1 / ABS-MBS (US64832DAC56) | 0.10 | -1.03 | 0.1317 | 0.0008 | |||||

| US43284MAA62 / Hilton Grand Vacations Borrower Escrow LLC / Hilton Grand Vacations Borrower Esc | 0.10 | 3.23 | 0.1316 | 0.0056 | |||||

| US66977WAS89 / NOVA Chemicals Corp | 0.10 | 1.05 | 0.1316 | 0.0031 | |||||

| US87303TAA51 / N/A TTN 2021-MHC A | 0.10 | 1.05 | 0.1316 | 0.0027 | |||||

| US86765LAZ04 / Sunoco LP/Sunoco Finance Corp. | 0.10 | 3.23 | 0.1315 | 0.0058 | |||||

| US737446AQ74 / Post Holdings Inc | 0.10 | 3.23 | 0.1315 | 0.0060 | |||||

| US62482BAA08 / Mozart Debt Merger Sub Inc | 0.10 | 2.15 | 0.1312 | 0.0056 | |||||

| US70137WAL28 / Parkland Corp | 0.10 | 2.15 | 0.1310 | 0.0049 | |||||

| US69007TAE47 / Outfront Media Capital LLC / Outfront Media Capital Corp | 0.10 | 3.26 | 0.1309 | 0.0062 | |||||

| US19688FAA30 / COLT 2021-3 Mortgage Loan Trust | 0.10 | -3.06 | 0.1308 | -0.0016 | |||||

| Crescent Energy Finance LLC / DBT (US45344LAE39) | 0.10 | -1.04 | 0.1308 | 0.0012 | |||||

| US247361ZT81 / Delta Air Lines Inc | 0.10 | 2.15 | 0.1307 | 0.0049 | |||||

| XS2693304813 / Mobico Group plc | 0.10 | 0.1305 | 0.1305 | ||||||

| US65480CAC91 / NISSAN MOTOR ACCEPTANCE SR UNSECURED 144A 09/26 1.85 | 0.10 | 0.1305 | 0.1305 | ||||||

| US46284VAN10 / Iron Mountain, Inc. | 0.10 | 4.40 | 0.1303 | 0.0071 | |||||

| US75907UAA79 / Regional Management Issuance Trust 2021-2 | 0.10 | 1.06 | 0.1302 | 0.0035 | |||||

| US043436AX21 / Asbury Automotive Group Inc | 0.10 | 5.56 | 0.1302 | 0.0083 | |||||

| US78485GAA22 / SREIT 2021-FLWR A | 0.10 | 1.06 | 0.1301 | 0.0029 | |||||

| US74841CAA99 / Quicken Loans LLC / Quicken Loans Co-Issuer Inc | 0.10 | 3.26 | 0.1300 | 0.0060 | |||||

| US29272WAD11 / Energizer Holdings, Inc. | 0.09 | 1.08 | 0.1294 | 0.0042 | |||||

| US78410GAG91 / SBA Communications Corp | 0.09 | 0.1292 | 0.1292 | ||||||

| US579063AB46 / Condor Merger Sub Inc | 0.09 | 6.82 | 0.1292 | 0.0102 | |||||

| CLF / Cleveland-Cliffs Inc. | 0.09 | -1.05 | 0.1290 | -0.0000 | |||||

| US92553PBC59 / Viacom Inc Jr Sub Debenture Clbl Var Bond | 0.09 | -1.05 | 0.1288 | 0.0003 | |||||

| US911363AM11 / United Rentals North America Inc | 0.09 | 0.1286 | 0.1286 | ||||||

| BX Commercial Mortgage Trust, Series 2024-GPA3, Class C / ABS-MBS (US123910AE11) | 0.09 | 0.00 | 0.1284 | 0.0027 | |||||

| US44421GAA13 / Hudson Yards 2019-30HY Mortgage Trust | 0.09 | 1.09 | 0.1284 | 0.0041 | |||||

| US163851AF58 / Chemours Co/The | 0.09 | 1.09 | 0.1282 | 0.0043 | |||||

| PMT Loan Trust, Series 2024-INV1, Class A3 / ABS-MBS (US73015BAC90) | 0.09 | -3.12 | 0.1282 | -0.0014 | |||||

| US68245XAM11 / 1011778 BC ULC / New Red Finance Inc | 0.09 | 3.33 | 0.1275 | 0.0058 | |||||

| BAHA Trust, Series 2024-MAR, Class A / ABS-MBS (US05493XAA81) | 0.09 | 2.20 | 0.1275 | 0.0048 | |||||

| US1248EPCN14 / CORPORATE BONDS | 0.09 | 8.14 | 0.1274 | 0.0107 | |||||

| MFA Trust, Series 2024-NPL1, Class A1 / ABS-MBS (US58004YAA73) | 0.09 | -4.17 | 0.1265 | -0.0036 | |||||

| US44421MAA80 / Hudson Yards 2019-55HY Mortgage Trust | 0.09 | 2.22 | 0.1265 | 0.0045 | |||||

| US44106MAX02 / Service Properties Trust | 0.09 | 2.22 | 0.1264 | 0.0045 | |||||

| PRET Trust, Series 2025-RPL1, Class A1 / ABS-MBS (US69392FAA57) | 0.09 | -2.13 | 0.1263 | -0.0011 | |||||

| US31556TAC36 / Fertitta Entertainment LLC / Fertitta Entertainment Finance Co Inc | 0.09 | 0.1262 | 0.1262 | ||||||

| US72431PAA03 / NCI Building Systems Inc 8.00% 04/15/2026 144A | 0.09 | 0.1258 | 0.1258 | ||||||

| PRPM Trust, Series 2025-NQM1, Class A1 / ABS-MBS (US74391EAA91) | 0.09 | -6.19 | 0.1254 | -0.0056 | |||||

| US159864AJ65 / Charles River Laboratories International Inc | 0.09 | 2.25 | 0.1254 | 0.0051 | |||||

| A&D Mortgage Trust, Series 2024-NQM5, Class A1 / ABS-MBS (US00039KAC45) | 0.09 | -4.21 | 0.1253 | -0.0027 | |||||

| NYMT Trust, Series 2024-RR1, Class A / ABS-MBS (US62956VAA35) | 0.09 | -2.15 | 0.1252 | -0.0001 | |||||

| US08763QAA04 / BTNY2_18-1A | 0.09 | -28.91 | 0.1252 | -0.0477 | |||||

| COLT Mortgage Loan Trust, Series 2024-6, Class A1 / ABS-MBS (US19688XAA46) | 0.09 | -4.26 | 0.1241 | -0.0029 | |||||

| GCAT Trust, Series 2024-INV4, Class A2 / ABS-MBS (US367919AB34) | 0.09 | -6.25 | 0.1239 | -0.0055 | |||||

| BAMLL Trust, Series 2024-BHP, Class A / ABS-MBS (US05493WAA09) | 0.09 | 0.00 | 0.1237 | 0.0026 | |||||

| A&D Mortgage Trust, Series 2024-NQM4, Class A1 / ABS-MBS (US002939AC08) | 0.09 | -4.26 | 0.1234 | -0.0039 | |||||

| US72147KAH14 / Pilgrim's Pride Corp. | 0.09 | 3.45 | 0.1232 | 0.0050 | |||||

| Republic of Poland / DBT (PL0000116760) | 0.09 | 91.49 | 0.1231 | 0.0599 | |||||

| US78449HAB33 / SMB PRIVATE EDUCATION LOAN TRUST 2023-B SER 2023-B CL A1B V/R REGD 144A P/P 0.00000000 | 0.09 | -5.32 | 0.1231 | -0.0041 | |||||

| US670001AH91 / Novelis Corp | 0.09 | 3.49 | 0.1229 | 0.0061 | |||||

| US12434GAA31 / BX Commercial Mortgage Trust 2023-XL3 | 0.09 | 0.00 | 0.1228 | 0.0025 | |||||

| RCKT Mortgage Trust, Series 2024-CES8, Class A1A / ABS-MBS (US749421AA19) | 0.09 | -5.32 | 0.1224 | -0.0048 | |||||

| US11283YAD22 / Brookfield Residential Properties Inc / Brookfield Residential US Corp | 0.09 | 0.1221 | 0.1221 | ||||||

| Cross Mortgage Trust, Series 2024-H7, Class A1 / ABS-MBS (US22757CAA09) | 0.09 | -6.32 | 0.1221 | -0.0059 | |||||

| Towd Point Mortgage Trust, Series 2024-CES6, Class A1 / ABS-MBS (US891947AA14) | 0.09 | -5.32 | 0.1220 | -0.0053 | |||||

| Verus Securitization Trust, Series 2024-8, Class A1 / ABS-MBS (US92540PAA66) | 0.09 | -5.38 | 0.1215 | -0.0042 | |||||

| Verus Securitization Trust, Series 2024-R1, Class A1 / ABS-MBS (US924926AA67) | 0.09 | -5.38 | 0.1213 | -0.0048 | |||||

| US17328QAA94 / Citigroup Commercial Mortgage Trust 2020-420K | 0.09 | 2.33 | 0.1211 | 0.0049 | |||||

| Ellington Financial Mortgage Trust, Series 2024-NQM1, Class A1A / ABS-MBS (US26845DAA37) | 0.09 | -6.38 | 0.1210 | -0.0058 | |||||

| Angel Oak Mortgage Trust, Series 2024-12, Class A1 / ABS-MBS (US034932AA18) | 0.09 | -7.37 | 0.1209 | -0.0074 | |||||

| PRET LLC, Series 2024-NPL4, Class A1 / ABS-MBS (US74143RAA14) | 0.09 | -6.38 | 0.1208 | -0.0067 | |||||

| US92328MAC73 / Venture Global Calcasieu Pass LLC | 0.09 | 1.16 | 0.1196 | 0.0040 | |||||

| US55284PAF27 / MFA 2022-NQM1 Trust | 0.09 | 0.00 | 0.1189 | 0.0023 | |||||

| BX Commercial Mortgage Trust, Series 2024-PALM, Class A / ABS-MBS (US05612UAA07) | 0.09 | 0.00 | 0.1184 | 0.0025 | |||||

| OBX Trust, Series 2024-NQM15, Class A1 / ABS-MBS (US67449DAA72) | 0.09 | -8.51 | 0.1178 | -0.0090 | |||||

| SMB Private Education Loan Trust, Series 2024-A, Class A1B / ABS-O (US831943AB13) | 0.09 | -2.27 | 0.1177 | -0.0015 | |||||

| US67117PAA12 / OBX Trust, Series 2023-NQM3, Class A1 | 0.09 | -5.56 | 0.1176 | -0.0047 | |||||

| GS Mortgage-Backed Securities Trust, Series 2024-RPL2, Class A1 / ABS-MBS (US36269MAA99) | 0.09 | -1.16 | 0.1163 | 0.0001 | |||||

| COL17CT03342 / Colombian TES | 0.08 | 75.00 | 0.1163 | 0.0514 | |||||

| US28628DAA28 / ELFI GRADUATE LOAN PROGRAM 2023-A LLC 6.37% 02/04/2048 144A | 0.08 | -4.55 | 0.1155 | -0.0038 | |||||

| Deephaven Residential Mortgage Trust, Series 2024-1, Class A1 / ABS-MBS (US24380QAC69) | 0.08 | -6.67 | 0.1153 | -0.0057 | |||||

| US44106MAY84 / Service Properties Trust | 0.08 | 0.1150 | 0.1150 | ||||||

| US715638CE05 / REPUBLIC OF PERU SR UNSECURED REGS 02/29 5.94 | 0.08 | 0.1142 | 0.1142 | ||||||

| Verus Securitization Trust, Series 2024-INV1, Class A1 / ABS-MBS (US92540FAA84) | 0.08 | -6.74 | 0.1138 | -0.0069 | |||||

| US46648HAG83 / JP Morgan Mortgage Trust 2017-2 | 0.08 | -1.19 | 0.1136 | -0.0004 | |||||

| Government National Mortgage Association Variable Rate Notes, Series 2024-125, Class HF / ABS-MBS (US38384VMP93) | 0.08 | -3.53 | 0.1133 | -0.0011 | |||||

| XS2259808702 / National Express Group PLC | 0.08 | -33.33 | 0.1130 | -0.0529 | |||||

| IHRT / iHeartMedia, Inc. | 0.08 | 0.1124 | 0.1124 | ||||||

| Angel Oak Mortgage Trust, Series 2024-3, Class A1 / ABS-MBS (US03466HAA14) | 0.08 | -3.57 | 0.1121 | -0.0012 | |||||

| US193938AB31 / COLLEGE AVE STUDENT LOANS 2023-A LLC SER 2023-A CL A2 REGD 144A P/P 5.33000000 | 0.08 | -3.57 | 0.1114 | -0.0020 | |||||

| ELFI Graduate Loan Program LLC, Series 2024-A, Class A / ABS-O (US28627LAA52) | 0.08 | -5.81 | 0.1111 | -0.0054 | |||||

| Cross Mortgage Trust, Series 2024-H2, Class A1 / ABS-MBS (US22757BAA26) | 0.08 | -10.11 | 0.1107 | -0.0092 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.08 | -10.11 | 0.1104 | -0.0099 | |||||

| MCR Mortgage Trust, Series 2024-HTL, Class A / ABS-MBS (US55286PAA12) | 0.08 | 0.00 | 0.1101 | 0.0018 | |||||

| INV Mortgage Trust, Series 2024-IND, Class A / ABS-MBS (US45000DAA46) | 0.08 | 0.00 | 0.1094 | 0.0021 | |||||

| OBX Trust, Series 2019-EXP1, Class B1A / ABS-MBS (US67448QBA85) | 0.08 | -2.47 | 0.1086 | -0.0011 | |||||

| US03464XAB64 / Angel Oak Mortgage Trust, Series 2020-2, Class A2 | 0.08 | -4.82 | 0.1083 | -0.0044 | |||||

| US05609BAV18 / BX Trust 2021-LBA | 0.08 | 1.28 | 0.1081 | 0.0023 | |||||

| Sequoia Mortgage Trust, Series 2024-HYB1, Class A1A / ABS-MBS (US81749EAA38) | 0.08 | -10.23 | 0.1081 | -0.0111 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.08 | -9.30 | 0.1080 | -0.0085 | |||||

| OBX Trust, Series 2024-NQM11, Class A1 / ABS-MBS (US67119EAA47) | 0.08 | -9.30 | 0.1073 | -0.0093 | |||||

| US78448YAB74 / SMB PRIVATE EDUCATION LOAN TRUST | 0.08 | -3.75 | 0.1055 | -0.0022 | |||||

| US78450QAB95 / SMB Private Education Loan Trust, Series 2023-A, Class A1B | 0.08 | -3.75 | 0.1054 | -0.0026 | |||||

| PRPM Trust, Series 2024-NQM1, Class A1 / ABS-MBS (US693977AA82) | 0.08 | -8.43 | 0.1048 | -0.0077 | |||||

| US36170HAA86 / GCAT_22-NQM4 | 0.08 | -2.60 | 0.1035 | -0.0008 | |||||

| XROX / Xerox Holdings Corporation - Depositary Receipt (Common Stock) | 0.08 | 0.1033 | 0.1033 | ||||||

| US31573EAA91 / Ellington Financial Mortgage Trust, Series 2022-3, Class A1 | 0.08 | -2.60 | 0.1030 | -0.0015 | |||||

| US31572YAA64 / Ellington Financial Mortgage Trust 2022-2 | 0.07 | -2.63 | 0.1025 | -0.0002 | |||||

| DAL / Delta Air Lines, Inc. - Depositary Receipt (Common Stock) | 0.07 | 0.1018 | 0.1018 | ||||||

| Chase Home Lending Mortgage Trust, Series 2024-3, Class A4 / ABS-MBS (US16159HAD98) | 0.07 | -7.50 | 0.1017 | -0.0064 | |||||

| IDG000021809 / INDONESIA GOV'T | 0.07 | 64.44 | 0.1015 | 0.0407 | |||||

| US78450FAA57 / SMB Private Education Loan Trust 2022-A | 0.07 | -3.95 | 0.1008 | -0.0026 | |||||

| US43761JAA51 / HOMES Trust, Series 2023-NQM1, Class A1 | 0.07 | -4.00 | 0.0996 | -0.0019 | |||||

| OBX Trust, Series 2024-NQM4, Class A1 / ABS-MBS (US67118TAA25) | 0.07 | -7.69 | 0.0994 | -0.0057 | |||||

| US68389XBY04 / Oracle Corp | 0.07 | -34.86 | 0.0980 | -0.0497 | |||||

| US78448YAC57 / SMB Private Education Loan Trust 2021-A | 0.07 | -2.74 | 0.0976 | -0.0017 | |||||

| New Residential Mortgage Loan Trust, Series 2024-NQM1, Class A1 / ABS-MBS (US64828DAA54) | 0.07 | -9.09 | 0.0969 | -0.0071 | |||||

| US92539TAA16 / Verus Securitization Trust, Series 2023-4, Class A1 | 0.07 | -11.39 | 0.0965 | -0.0106 | |||||

| US67118LAD38 / OBX 2022-NQM9 Trust | 0.07 | -6.67 | 0.0964 | -0.0047 | |||||

| US64035GAA76 / Nelnet Student Loan Trust 2021-C | 0.07 | -6.67 | 0.0961 | -0.0057 | |||||

| LBA Trust, Series 2024-BOLT, Class A / ABS-MBS (US50177BAA52) | 0.07 | 1.45 | 0.0958 | 0.0020 | |||||

| CSTL Commercial Mortgage Trust, Series 2024-GATE, Class A / ABS-MBS (US22945JAA88) | 0.07 | 1.47 | 0.0957 | 0.0034 | |||||

| US03464UAB26 / Angel Oak Mortgage Trust 2023-6 | 0.07 | -4.17 | 0.0950 | -0.0029 | |||||

| US64034QAA67 / Nelnet Student Loan Trust | 0.07 | -8.11 | 0.0940 | -0.0058 | |||||

| IDG000009804 / Indonesia Treasury Bond | 0.07 | 74.36 | 0.0937 | 0.0401 | |||||

| US10568MAA27 / BRAVO Residential Funding Trust 2023-NQM1 | 0.07 | -5.56 | 0.0936 | -0.0042 | |||||

| US19688RAB50 / COLT Mortgage Loan Trust, Series 2023-3, Class A2 | 0.07 | -10.67 | 0.0930 | -0.0079 | |||||

| US92257BAA08 / Velocity Commercial Capital Loan Trust, Series 2022-3, Class A | 0.07 | -2.90 | 0.0923 | -0.0011 | |||||

| US78454XAC83 / SMB PRIVATE EDUCATION LOAN TRU SMB 2022 D B 144A | 0.07 | -4.29 | 0.0923 | -0.0025 | |||||

| Barclays Mortgage Loan Trust, Series 2024-NQM1, Class A1 / ABS-MBS (US06745AAA25) | 0.07 | -8.22 | 0.0917 | -0.0066 | |||||

| Radian Mortgage Capital Trust LLC, Series 2024-J1, Class A8 / ABS-MBS (US75023DAM83) | 0.07 | -10.81 | 0.0915 | -0.0090 | |||||

| US10569JAA88 / BRAVO_22-NQM3 | 0.07 | -5.71 | 0.0914 | -0.0038 | |||||

| New Residential Mortgage Loan Trust, Series 2022-NQM5, Class A1 / ABS-MBS (US64831VAA08) | 0.07 | -4.35 | 0.0913 | -0.0025 | |||||

| US19688NAA63 / COLT 2023-1 Mortgage Loan Trust | 0.07 | -9.59 | 0.0911 | -0.0074 | |||||

| US92538UAA97 / Verus Securitization Trust, Series 2022-3, Class A1 | 0.07 | -1.49 | 0.0909 | 0.0001 | |||||

| US74166MAC01 / Prime Security Services Borrrower, LLC / Prime Finance, Inc. | 0.06 | 1.59 | 0.0880 | 0.0021 | |||||

| Barings Equipment Finance LLC, Series 2025-A, Class A4 / ABS-O (US06764MAD65) | 0.06 | 0.00 | 0.0875 | 0.0019 | |||||

| gategroup Finance Luxembourg SA / DBT (CH0353945394) | 0.06 | 0.0848 | 0.0848 | ||||||

| US12598UAA43 / COLT 2023-2 Mortgage Loan Trust | 0.06 | -7.58 | 0.0848 | -0.0045 | |||||

| VEGAS Trust, Series 2024-TI, Class A / ABS-MBS (US92254AAA51) | 0.06 | 0.00 | 0.0832 | 0.0020 | |||||

| BFLD Commercial Mortgage Trust, Series 2024-UNIV, Class A / ABS-MBS (US08861RAA95) | 0.06 | 1.69 | 0.0822 | 0.0016 | |||||

| Mercedes-Benz International Finance BV / DBT (DE000A4EB2X2) | 0.06 | 0.0819 | 0.0819 | ||||||

| DAL / Delta Air Lines, Inc. - Depositary Receipt (Common Stock) | 0.06 | 0.0812 | 0.0812 | ||||||

| TVC / Tennessee Valley Authority - Preferred Stock | 0.06 | -1.69 | 0.0801 | 0.0000 | |||||

| US92539GAA94 / Verus Securitization Trust 2023-3 | 0.06 | -9.37 | 0.0800 | -0.0071 | |||||

| US63942TAB17 / Navient Student Loan Trust | 0.06 | -10.77 | 0.0800 | -0.0075 | |||||

| US03765XAG16 / Apidos CLO XXII | 0.06 | -7.94 | 0.0794 | -0.0066 | |||||

| US14310MAW73 / Carlyle Global Market Strategies CLO 2014-1 Ltd | 0.06 | -24.00 | 0.0788 | -0.0226 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.06 | -3.51 | 0.0756 | -0.0022 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.05 | -5.26 | 0.0750 | -0.0019 | |||||

| GreenSky Home Improvement Issuer Trust, Series 2024-2, Class A2 / ABS-O (US39571XAB01) | 0.05 | -36.47 | 0.0741 | -0.0408 | |||||

| MYBMS1900047 / Malaysia Government Bond | 0.05 | 0.0729 | 0.0729 | ||||||

| CZ0001007033 / CZECH REPUBLIC | 0.05 | 82.14 | 0.0711 | 0.0329 | |||||

| Atrium Hotel Portfolio Trust, Series 2024-ATRM, Class A / ABS-MBS (US04963XAA28) | 0.05 | 2.04 | 0.0697 | 0.0026 | |||||

| Rossini SARL / DBT (XS2854309684) | 0.05 | -53.70 | 0.0690 | -0.0770 | |||||

| SELF Commercial Mortgage Trust, Series 2024-STRG, Class A / ABS-MBS (US81631WAA45) | 0.05 | 0.00 | 0.0688 | 0.0016 | |||||

| US69701NAA46 / Palmer Square Loan Funding Ltd | 0.05 | -33.33 | 0.0688 | -0.0321 | |||||

| US28166LAA26 / EDvestinU Private Education Loan Issue No 3 LLC | 0.05 | -5.66 | 0.0687 | -0.0034 | |||||

| IVW / Meta Platforms, Inc. - Depositary Receipt (Common Stock) | 0.05 | 128.57 | 0.0667 | 0.0377 | |||||

| Angel Oak Mortgage Trust, Series 2025-2, Class A1 / ABS-MBS (US03466QAA13) | 0.05 | -4.00 | 0.0665 | -0.0008 | |||||

| US63939XAD30 / Navient Private Education Loan Trust 2017-A | 0.05 | -15.79 | 0.0657 | -0.0119 | |||||

| Republic of Poland / DBT (PL0000116851) | 0.05 | 80.77 | 0.0654 | 0.0302 | |||||

| XS2406727151 / LUNE HOLDINGS SARL /EUR/ REGD REG S 5.62500000 | 0.05 | -41.25 | 0.0648 | -0.0435 | |||||

| US05552UAA25 / BINOM Securitization Trust 2021-INV1 | 0.05 | -4.17 | 0.0635 | -0.0014 | |||||

| FR0013457942 / Atos SE | 0.05 | 0.0629 | 0.0629 | ||||||

| XS0154961188 / Unique Pub Finance Co PLC/The | 0.05 | 7.14 | 0.0629 | 0.0052 | |||||

| GoodLeap Home Improvement Solutions Trust, Series 2025-1A, Class A / ABS-O (US38237EAA29) | 0.05 | -8.16 | 0.0628 | -0.0043 | |||||

| BRSTNCLTN7U7 / BRAZIL LETRAS DO TESOURO NACIONAL 0% 01/01/2026 | 0.04 | 83.33 | 0.0614 | 0.0290 | |||||

| MX0MGO0001F1 / Mexican Bonos | 0.04 | -60.38 | 0.0582 | -0.0881 | |||||

| Volkswagen Financial Services AG / DBT (XS2837886014) | 0.04 | 7.89 | 0.0572 | 0.0056 | |||||

| US83208AAA16 / SMB PRIVATE EDUCATION LOAN TRUST 2021-C SMB 2021-C APT1 | 0.04 | -4.76 | 0.0557 | -0.0016 | |||||

| Nestle Finance International Ltd. / DBT (XS2717309855) | 0.04 | 0.0551 | 0.0551 | ||||||

| GS Mortgage Securities Corp. Trust, Series 2024-RVR, Class D / ABS-MBS (US36272JAJ25) | 0.04 | 0.00 | 0.0548 | 0.0010 | |||||

| US12567RAA86 / CIM Trust 2021-R6 | 0.04 | -2.50 | 0.0539 | -0.0012 | |||||

| Government National Mortgage Association Variable Rate Notes, Series 2024-96, Class FL / ABS-MBS (US38384PC321) | 0.04 | -2.50 | 0.0538 | -0.0012 | |||||

| US88167AAE10 / Teva Pharmaceutical Fin Neth 10/01/2026 3.150 Bond | 0.04 | 0.0535 | 0.0535 | ||||||

| XS2473721210 / Goldman Sachs Group, Inc | 0.04 | 0.0528 | 0.0528 | ||||||

| MX0MGO0000R8 / Mexican Bonos | 0.04 | 270.00 | 0.0517 | 0.0369 | |||||

| US19424KAA16 / College Ave Student Loans 2021-A LLC | 0.04 | -5.13 | 0.0516 | -0.0019 | |||||

| US222070AE41 / Coty Inc | 0.04 | 0.00 | 0.0506 | 0.0010 | |||||

| U.S. Treasury 2-Year Note / DIR (N/A) | 0.04 | 0.0504 | 0.0504 | ||||||

| US693304BC00 / PECO Energy Co | 0.04 | 0.0500 | 0.0500 | ||||||

| US532457CH90 / ELI LILLY AND COMPANY | 0.04 | 0.0497 | 0.0497 | ||||||

| XS2374595044 / Volkswagen Financial Services AG | 0.04 | 0.0496 | 0.0496 | ||||||

| US404119CL13 / HCA Inc | 0.04 | -14.29 | 0.0495 | -0.0072 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 0.04 | 66.67 | 0.0492 | 0.0198 | |||||

| US031162DU18 / Amgen Inc | 0.04 | 0.0492 | 0.0492 | ||||||

| US11135FBG54 / Broadcom Inc | 0.04 | 0.0491 | 0.0491 | ||||||

| US74456QCM69 / Public Service Electric and Gas Co | 0.04 | 0.0489 | 0.0489 | ||||||

| US78449QAB32 / SMB PRIVATE EDUCATION LOAN TRUST 2018-C SMB 2018-C A2A | 0.04 | -14.63 | 0.0489 | -0.0070 | |||||

| Republic of Philippines / DBT (PH0000058281) | 0.04 | 0.0488 | 0.0488 | ||||||

| US513075BW03 / Lamar Media Corp | 0.04 | 0.0487 | 0.0487 | ||||||

| US33767BAC37 / FIRSTENERGY TRANSMISSION SR UNSECURED 144A 04/49 4.55 | 0.04 | 0.0487 | 0.0487 | ||||||

| US00185AAG94 / Aon PLC | 0.04 | 0.0487 | 0.0487 | ||||||

| US00287YCB39 / AbbVie Inc | 0.04 | 0.0485 | 0.0485 | ||||||

| US30303M8J41 / Meta Platforms, Inc. | 0.04 | 0.0484 | 0.0484 | ||||||

| US12189LBH33 / BURLINGTON NORTHERN SANTA FE LLC | 0.04 | 0.0484 | 0.0484 | ||||||

| US00115AAP49 / AEP Transmission Co LLC | 0.04 | 0.0482 | 0.0482 | ||||||

| Hungary Government Bond / DBT (HU0000406624) | 0.03 | 88.89 | 0.0467 | 0.0222 | |||||

| IDG000011602 / Indonesia Treasury Bond | 0.03 | 73.68 | 0.0464 | 0.0207 | |||||

| US64035DAD84 / Nelnet Student Loan Trust 2021-A | 0.03 | -5.88 | 0.0448 | -0.0021 | |||||

| W1BD34 / Warner Bros. Discovery, Inc. - Depositary Receipt (Common Stock) | 0.03 | 0.0447 | 0.0447 | ||||||

| Atrium Hotel Portfolio Trust, Series 2024-ATRM, Class E / ABS-MBS (US04963XAL82) | 0.03 | -3.23 | 0.0421 | 0.0002 | |||||

| US64829KBW99 / New Residential Mortgage Loan Trust 2017-2 | 0.03 | 0.0418 | 0.0418 | ||||||

| OIS / DIR (N/A) | 0.03 | 0.0387 | 0.0387 | ||||||

| ZAG000125980 / Republic of South Africa Government Bond | 0.03 | -6.67 | 0.0385 | -0.0029 | |||||

| ORCL / Oracle Corporation - Depositary Receipt (Common Stock) | 0.03 | 0.0375 | 0.0375 | ||||||

| T-Mobile USA, Inc. / DBT (US87264ADN28) | 0.03 | 0.0375 | 0.0375 | ||||||

| R2037 / South Africa - Sovereign or Government Agency Debt | 0.03 | 0.0359 | 0.0359 | ||||||

| Government National Mortgage Association Variable Rate Notes, Series 2024-51, Class TF / ABS-MBS (US38384KUP47) | 0.03 | -3.70 | 0.0357 | -0.0008 | |||||

| US161175BC79 / Charter Communications Operating LLC / Charter Communications Operating Capital | 0.03 | 0.0350 | 0.0350 | ||||||

| Rocket Cos., Inc. / DBT (US77311WAB72) | 0.03 | 0.0350 | 0.0350 | ||||||

| Rocket Cos., Inc. / DBT (US77311WAA99) | 0.03 | 0.0349 | 0.0349 | ||||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.02 | -4.00 | 0.0331 | -0.0011 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.02 | -8.00 | 0.0324 | -0.0015 | |||||

| U.S. Treasury Long Bond / DIR (N/A) | 0.02 | 0.0319 | 0.0319 | ||||||

| US161175CG74 / Charter Communications Operating LLC / Charter Communications Operating Capital | 0.02 | -77.53 | 0.0282 | -0.0915 | |||||

| ADLER Financing SARL, Series 1.5L / DBT (DE000A4D6JB3) | 0.02 | -29.63 | 0.0271 | -0.0103 | |||||

| Republic of Poland / DBT (PL0000117024) | 0.01 | 100.00 | 0.0195 | 0.0088 | |||||

| XRAY34 / DENTSPLY SIRONA Inc. - Depositary Receipt (Common Stock) | 0.01 | 0.0179 | 0.0179 | ||||||

| US042859AA69 / Arroyo Mortgage Trust 2019-1 | 0.01 | -7.69 | 0.0171 | -0.0010 | |||||

| CDI / DCR (N/A) | 0.01 | 0.0156 | 0.0156 | ||||||

| TRSIBOXX / DIR (N/A) | 0.01 | 0.0148 | 0.0148 | ||||||

| SOP / DIR (N/A) | 0.01 | 0.0145 | 0.0145 | ||||||

| US760942BF85 / Uruguay Government International Bond | 0.01 | 125.00 | 0.0132 | 0.0067 | |||||

| US64828EAA38 / New Residential Mortgage Loan Trust 2019-NQM4 | 0.01 | -10.00 | 0.0131 | -0.0013 | |||||

| Philippine Government Bond / DBT (PH0000060345) | 0.01 | 0.0114 | 0.0114 | ||||||

| CDI / DCR (N/A) | 0.01 | 0.0112 | 0.0112 | ||||||

| TRT061124T11 / Turkey Government Bond | 0.01 | -41.67 | 0.0109 | -0.0060 | |||||

| OIS / DIR (N/A) | 0.01 | 0.0107 | 0.0107 | ||||||

| W1HR34 / Whirlpool Corporation - Depositary Receipt (Common Stock) | 0.01 | 0.0096 | 0.0096 | ||||||

| Delek Logistics Partners LP / DBT (US24665FAE25) | 0.01 | 0.0095 | 0.0095 | ||||||

| US92857WBW91 / Vodafone Group PLC | 0.01 | 0.00 | 0.0088 | 0.0004 | |||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.01 | 0.0084 | 0.0084 | ||||||

| W1HR34 / Whirlpool Corporation - Depositary Receipt (Common Stock) | 0.01 | 0.0083 | 0.0083 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.01 | 0.0073 | 0.0073 | ||||||

| US75907VAA52 / Regional Management Issuance Trust, Series 2021-1, Class A | 0.01 | -72.22 | 0.0073 | -0.0174 | |||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.01 | 0.0070 | 0.0070 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0067 | 0.0067 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0058 | 0.0058 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0051 | 0.0051 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0050 | 0.0050 | ||||||

| US63939CAD92 / NAVIENT PRIVATE EDUCATION LOAN TRUST 2014-A NAVSL 2014-AA A3 | 0.00 | -86.67 | 0.0038 | -0.0175 | |||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0034 | 0.0034 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0030 | 0.0030 | ||||||

| Euro-Bund / DIR (DE000F1NGF53) | 0.00 | 0.0030 | 0.0030 | ||||||

| NDIRS / DIR (N/A) | 0.00 | 0.0021 | 0.0021 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0021 | 0.0021 | ||||||

| MX0MGO0000H9 / Mexican Bonos | 0.00 | -92.86 | 0.0021 | -0.0170 | |||||

| TRSIBOXX / DIR (N/A) | 0.00 | 0.0020 | 0.0020 | ||||||

| NDIRS / DIR (N/A) | 0.00 | 0.0020 | 0.0020 | ||||||

| US64829CAD02 / New Residential Mortgage Loan Trust 2015-1 | 0.00 | -85.71 | 0.0020 | -0.0075 | |||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0019 | 0.0019 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0019 | 0.0019 | ||||||

| OIS / DIR (N/A) | 0.00 | 0.0018 | 0.0018 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0015 | 0.0015 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0015 | 0.0015 | ||||||

| NDIRS / DIR (N/A) | 0.00 | 0.0015 | 0.0015 | ||||||

| NDIRS / DIR (N/A) | 0.00 | 0.0015 | 0.0015 | ||||||

| IRS / DIR (N/A) | 0.00 | 0.0013 | 0.0013 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0013 | 0.0013 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0011 | 0.0011 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0010 | 0.0010 | ||||||

| OIS / DIR (N/A) | 0.00 | 0.0010 | 0.0010 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0009 | 0.0009 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0009 | 0.0009 | ||||||

| OIS / DIR (N/A) | 0.00 | 0.0009 | 0.0009 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0009 | 0.0009 | ||||||

| NDIRS / DIR (N/A) | 0.00 | 0.0009 | 0.0009 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0008 | 0.0008 | ||||||

| SOP / DIR (N/A) | 0.00 | 0.0007 | 0.0007 | ||||||

| IRS / DIR (N/A) | 0.00 | 0.0007 | 0.0007 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0007 | 0.0007 | ||||||

| NDIRS / DIR (N/A) | 0.00 | 0.0007 | 0.0007 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0006 | 0.0006 | ||||||

| NDIRS / DIR (N/A) | 0.00 | 0.0006 | 0.0006 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0005 | 0.0005 | ||||||

| IRS / DIR (N/A) | 0.00 | 0.0005 | 0.0005 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0005 | 0.0005 | ||||||

| NDIRS / DIR (N/A) | 0.00 | 0.0005 | 0.0005 | ||||||

| IRS / DIR (N/A) | 0.00 | 0.0004 | 0.0004 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0004 | 0.0004 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0004 | 0.0004 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0004 | 0.0004 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0004 | 0.0004 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0004 | 0.0004 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0004 | 0.0004 | ||||||

| Euro-Schatz / DIR (DE000F1NGF79) | 0.00 | 0.0003 | 0.0003 | ||||||

| IRS / DIR (N/A) | 0.00 | 0.0003 | 0.0003 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0003 | 0.0003 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0003 | 0.0003 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0003 | 0.0003 | ||||||

| NDIRS / DIR (N/A) | 0.00 | 0.0003 | 0.0003 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0002 | 0.0002 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0002 | 0.0002 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0002 | 0.0002 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0002 | 0.0002 | ||||||

| IRS / DIR (N/A) | 0.00 | 0.0002 | 0.0002 | ||||||

| IRS / DIR (N/A) | 0.00 | 0.0002 | 0.0002 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0002 | 0.0002 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0002 | 0.0002 | ||||||

| Euro-Bobl / DIR (DE000F1NGF61) | 0.00 | 0.0002 | 0.0002 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0002 | 0.0002 | ||||||

| NDIRS / DIR (N/A) | 0.00 | 0.0002 | 0.0002 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0002 | 0.0002 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0002 | 0.0002 | ||||||

| OIS / DIR (N/A) | 0.00 | 0.0002 | 0.0002 | ||||||

| IRS / DIR (N/A) | 0.00 | 0.0002 | 0.0002 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0001 | 0.0001 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0001 | 0.0001 | ||||||

| IRS / DIR (N/A) | 0.00 | 0.0001 | 0.0001 | ||||||

| IRS / DIR (N/A) | 0.00 | 0.0001 | 0.0001 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0001 | 0.0001 | ||||||

| NDIRS / DIR (N/A) | 0.00 | 0.0001 | 0.0001 | ||||||

| IRS / DIR (N/A) | 0.00 | 0.0001 | 0.0001 | ||||||

| NDIRS / DIR (N/A) | 0.00 | 0.0001 | 0.0001 | ||||||

| NDIRS / DIR (N/A) | 0.00 | 0.0001 | 0.0001 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0001 | 0.0001 | ||||||

| NDIRS / DIR (N/A) | 0.00 | 0.0001 | 0.0001 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0001 | 0.0001 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0001 | 0.0001 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0001 | 0.0001 | ||||||

| OIS / DIR (N/A) | 0.00 | 0.0001 | 0.0001 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0001 | 0.0001 | ||||||

| NDIRS / DIR (N/A) | 0.00 | 0.0001 | 0.0001 | ||||||

| IRS / DIR (N/A) | 0.00 | 0.0001 | 0.0001 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0000 | 0.0000 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0000 | 0.0000 | ||||||

| IRS / DIR (N/A) | 0.00 | 0.0000 | 0.0000 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0000 | 0.0000 | ||||||

| OIS / DIR (N/A) | 0.00 | 0.0000 | 0.0000 | ||||||

| IRS / DIR (N/A) | 0.00 | 0.0000 | 0.0000 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0000 | 0.0000 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0000 | 0.0000 | ||||||

| OIS / DIR (N/A) | 0.00 | 0.0000 | 0.0000 | ||||||

| IRS / DIR (N/A) | 0.00 | 0.0000 | 0.0000 | ||||||

| IRS / DIR (N/A) | 0.00 | 0.0000 | 0.0000 | ||||||

| NDIRS / DIR (N/A) | 0.00 | 0.0000 | 0.0000 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0000 | 0.0000 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0000 | 0.0000 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0000 | 0.0000 | ||||||

| NDIRS / DIR (N/A) | 0.00 | 0.0000 | 0.0000 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0000 | 0.0000 | ||||||

| IRS / DIR (N/A) | 0.00 | 0.0000 | 0.0000 | ||||||

| OIS / DIR (N/A) | 0.00 | 0.0000 | 0.0000 | ||||||

| IRS / DIR (N/A) | 0.00 | 0.0000 | 0.0000 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0000 | 0.0000 | ||||||

| NDIRS / DIR (N/A) | 0.00 | 0.0000 | 0.0000 | ||||||

| IRS / DIR (N/A) | 0.00 | 0.0000 | 0.0000 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0000 | 0.0000 | ||||||

| IRS / DIR (N/A) | 0.00 | 0.0000 | 0.0000 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0000 | 0.0000 | ||||||

| OIS / DIR (N/A) | 0.00 | 0.0000 | 0.0000 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0000 | 0.0000 | ||||||

| NDIRS / DIR (N/A) | 0.00 | 0.0000 | 0.0000 | ||||||

| OIS / DIR (N/A) | 0.00 | 0.0000 | 0.0000 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0000 | 0.0000 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0000 | 0.0000 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0000 | 0.0000 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0000 | 0.0000 | ||||||

| NDIRS / DIR (N/A) | 0.00 | 0.0000 | 0.0000 | ||||||

| OIS / DIR (N/A) | 0.00 | 0.0000 | 0.0000 | ||||||

| OIS / DIR (N/A) | 0.00 | 0.0000 | 0.0000 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0000 | 0.0000 | ||||||

| IRS / DIR (N/A) | 0.00 | 0.0000 | 0.0000 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0000 | 0.0000 | ||||||

| NDIRS / DIR (N/A) | 0.00 | 0.0000 | 0.0000 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0000 | 0.0000 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0000 | 0.0000 | ||||||

| NDIRS / DIR (N/A) | 0.00 | 0.0000 | 0.0000 | ||||||

| OIS / DIR (N/A) | 0.00 | 0.0000 | 0.0000 | ||||||

| NDIRS / DIR (N/A) | 0.00 | -0.0000 | -0.0000 | ||||||

| SOP / DIR (N/A) | 0.00 | -0.0000 | -0.0000 | ||||||

| NDIRS / DIR (N/A) | 0.00 | -0.0000 | -0.0000 | ||||||

| NDIRS / DIR (N/A) | 0.00 | -0.0000 | -0.0000 | ||||||

| NDIRS / DIR (N/A) | 0.00 | -0.0000 | -0.0000 | ||||||

| NDIRS / DIR (N/A) | -0.00 | -0.0000 | -0.0000 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.00 | -0.0000 | -0.0000 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.00 | -0.0000 | -0.0000 | ||||||

| NDIRS / DIR (N/A) | -0.00 | -0.0000 | -0.0000 | ||||||

| IRS / DIR (N/A) | -0.00 | -0.0000 | -0.0000 | ||||||

| IRS / DIR (N/A) | -0.00 | -0.0000 | -0.0000 | ||||||

| OIS / DIR (N/A) | -0.00 | -0.0000 | -0.0000 | ||||||

| IRS / DIR (N/A) | -0.00 | -0.0000 | -0.0000 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.00 | -0.0000 | -0.0000 | ||||||

| IRS / DIR (N/A) | -0.00 | -0.0000 | -0.0000 | ||||||

| NDIRS / DIR (N/A) | -0.00 | -0.0000 | -0.0000 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.00 | -0.0000 | -0.0000 | ||||||

| IRS / DIR (N/A) | -0.00 | -0.0000 | -0.0000 | ||||||

| IRS / DIR (N/A) | -0.00 | -0.0000 | -0.0000 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.00 | -0.0000 | -0.0000 | ||||||

| IRS / DIR (N/A) | -0.00 | -0.0000 | -0.0000 | ||||||

| IRS / DIR (N/A) | -0.00 | -0.0000 | -0.0000 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.00 | -0.0000 | -0.0000 | ||||||

| OIS / DIR (N/A) | -0.00 | -0.0000 | -0.0000 | ||||||

| IRS / DIR (N/A) | -0.00 | -0.0000 | -0.0000 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.00 | -0.0000 | -0.0000 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.00 | -0.0000 | -0.0000 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.00 | -0.0000 | -0.0000 | ||||||

| IRS / DIR (N/A) | -0.00 | -0.0000 | -0.0000 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.00 | -0.0000 | -0.0000 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.00 | -0.0000 | -0.0000 | ||||||

| IRS / DIR (N/A) | -0.00 | -0.0000 | -0.0000 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.00 | -0.0000 | -0.0000 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.00 | -0.0000 | -0.0000 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.00 | -0.0000 | -0.0000 | ||||||

| OIS / DIR (N/A) | -0.00 | -0.0000 | -0.0000 | ||||||

| OIS / DIR (N/A) | -0.00 | -0.0000 | -0.0000 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.00 | -0.0000 | -0.0000 | ||||||

| NDIRS / DIR (N/A) | -0.00 | -0.0000 | -0.0000 | ||||||

| IRS / DIR (N/A) | -0.00 | -0.0000 | -0.0000 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.00 | -0.0000 | -0.0000 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.00 | -0.0000 | -0.0000 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.00 | -0.0000 | -0.0000 | ||||||

| OIS / DIR (N/A) | -0.00 | -0.0000 | -0.0000 | ||||||

| OIS / DIR (N/A) | -0.00 | -0.0000 | -0.0000 | ||||||

| IRS / DIR (N/A) | -0.00 | -0.0000 | -0.0000 | ||||||

| IRS / DIR (N/A) | -0.00 | -0.0000 | -0.0000 | ||||||

| IRS / DIR (N/A) | -0.00 | -0.0000 | -0.0000 | ||||||

| IRS / DIR (N/A) | -0.00 | -0.0000 | -0.0000 | ||||||

| IRS / DIR (N/A) | -0.00 | -0.0000 | -0.0000 | ||||||

| OIS / DIR (N/A) | -0.00 | -0.0000 | -0.0000 | ||||||

| IRS / DIR (N/A) | -0.00 | -0.0000 | -0.0000 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.00 | -0.0001 | -0.0001 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.00 | -0.0001 | -0.0001 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.00 | -0.0001 | -0.0001 | ||||||

| IRS / DIR (N/A) | -0.00 | -0.0001 | -0.0001 | ||||||

| OIS / DIR (N/A) | -0.00 | -0.0001 | -0.0001 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.00 | -0.0001 | -0.0001 | ||||||

| OIS / DIR (N/A) | -0.00 | -0.0001 | -0.0001 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.00 | -0.0001 | -0.0001 | ||||||

| IRS / DIR (N/A) | -0.00 | -0.0001 | -0.0001 | ||||||

| IRS / DIR (N/A) | -0.00 | -0.0001 | -0.0001 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.00 | -0.0001 | -0.0001 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.00 | -0.0001 | -0.0001 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.00 | -0.0001 | -0.0001 | ||||||

| IRS / DIR (N/A) | -0.00 | -0.0001 | -0.0001 | ||||||

| IRS / DIR (N/A) | -0.00 | -0.0001 | -0.0001 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.00 | -0.0001 | -0.0001 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.00 | -0.0001 | -0.0001 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.00 | -0.0001 | -0.0001 | ||||||

| IRS / DIR (N/A) | -0.00 | -0.0001 | -0.0001 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.00 | -0.0001 | -0.0001 | ||||||

| OIS / DIR (N/A) | -0.00 | -0.0001 | -0.0001 | ||||||

| NDIRS / DIR (N/A) | -0.00 | -0.0001 | -0.0001 | ||||||

| NDIRS / DIR (N/A) | -0.00 | -0.0001 | -0.0001 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.00 | -0.0001 | -0.0001 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.00 | -0.0001 | -0.0001 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.00 | -0.0001 | -0.0001 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.00 | -0.0001 | -0.0001 | ||||||

| IRS / DIR (N/A) | -0.00 | -0.0001 | -0.0001 | ||||||

| NDIRS / DIR (N/A) | -0.00 | -0.0001 | -0.0001 | ||||||

| IRS / DIR (N/A) | -0.00 | -0.0001 | -0.0001 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.00 | -0.0002 | -0.0002 | ||||||

| IRS / DIR (N/A) | -0.00 | -0.0002 | -0.0002 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.00 | -0.0002 | -0.0002 | ||||||

| IRS / DIR (N/A) | -0.00 | -0.0002 | -0.0002 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.00 | -0.0002 | -0.0002 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.00 | -0.0002 | -0.0002 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.00 | -0.0002 | -0.0002 | ||||||

| IRS / DIR (N/A) | -0.00 | -0.0002 | -0.0002 | ||||||

| IRS / DIR (N/A) | -0.00 | -0.0002 | -0.0002 | ||||||