Mga Batayang Estadistika

| Nilai Portofolio | $ 173,092,599 |

| Posisi Saat Ini | 87 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

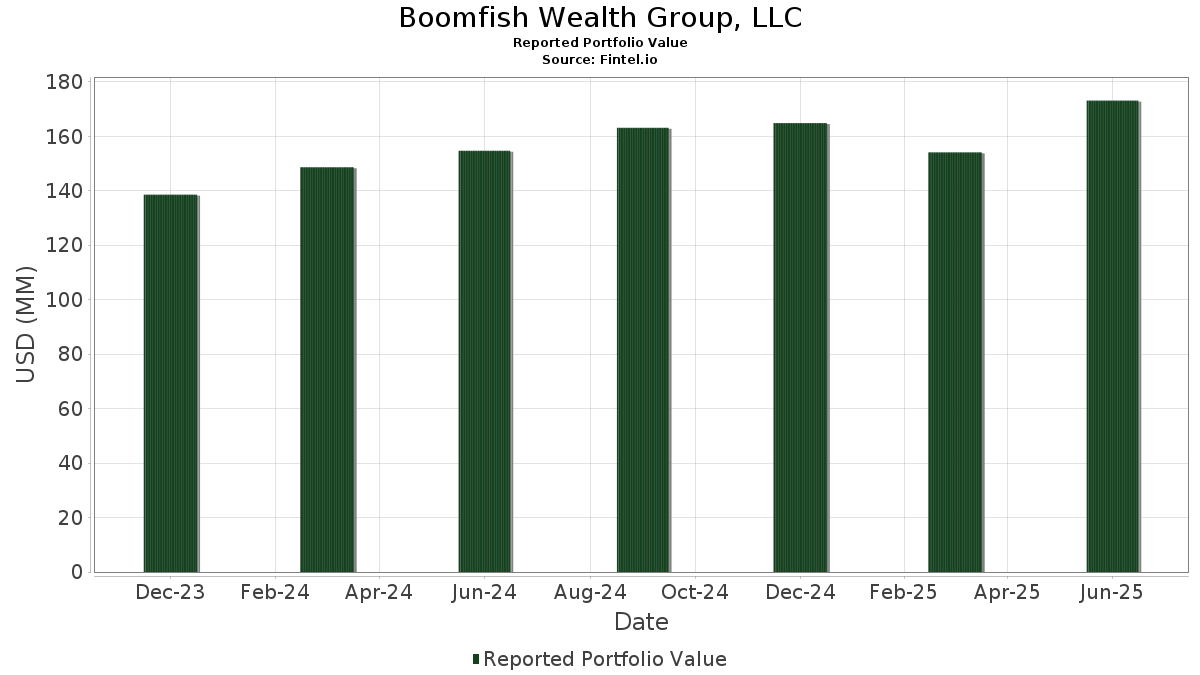

Boomfish Wealth Group, LLC telah mengungkapkan total kepemilikan 87 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 173,092,599 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Boomfish Wealth Group, LLC adalah SPDR Series Trust - SPDR Bloomberg 1-3 Month T-Bill ETF (US:BIL) , VanEck ETF Trust - VanEck Morningstar Wide Moat ETF (US:MOAT) , iShares Trust - iShares Core U.S. Aggregate Bond ETF (US:AGG) , Direxion Shares ETF Trust - Direxion Daily NVDA Bear 1X Shares (US:NVDD) , and Microsoft Corporation (US:MSFT) . Posisi baru Boomfish Wealth Group, LLC meliputi: iShares Trust - iShares Treasury Floating Rate Bond ETF (US:TFLO) , Monolithic Power Systems, Inc. (US:MPWR) , Koninklijke Philips N.V. - Depositary Receipt (Common Stock) (US:PHG) , Netflix, Inc. (US:NFLX) , and Vanguard Index Funds - Vanguard Total Stock Market ETF (US:VTI) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.04 | 5.66 | 3.2698 | 1.1120 | |

| 0.01 | 2.81 | 1.6252 | 1.0379 | |

| 0.02 | 1.20 | 0.6917 | 0.6917 | |

| 0.00 | 0.89 | 0.5121 | 0.5121 | |

| 0.01 | 4.31 | 2.4925 | 0.3909 | |

| 0.04 | 2.84 | 1.6436 | 0.3748 | |

| 0.03 | 3.21 | 1.8570 | 0.3358 | |

| 0.02 | 3.62 | 2.0915 | 0.2646 | |

| 0.00 | 3.20 | 1.8501 | 0.2644 | |

| 0.00 | 3.29 | 1.8980 | 0.2581 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.09 | 8.68 | 5.0119 | -1.0043 | |

| 0.01 | 1.61 | 0.9290 | -0.8152 | |

| 0.08 | 7.57 | 4.3732 | -0.4229 | |

| 0.05 | 4.22 | 2.4372 | -0.3543 | |

| 0.01 | 2.33 | 1.3485 | -0.2408 | |

| 0.02 | 1.94 | 1.1185 | -0.2351 | |

| 0.02 | 3.19 | 1.8438 | -0.2313 | |

| 0.02 | 1.77 | 1.0220 | -0.2267 | |

| 0.07 | 7.03 | 4.0610 | -0.2061 | |

| 0.02 | 2.30 | 1.3289 | -0.1882 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-07-24 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| BIL / SPDR Series Trust - SPDR Bloomberg 1-3 Month T-Bill ETF | 0.09 | -6.42 | 8.68 | -6.42 | 5.0119 | -1.0043 | |||

| MOAT / VanEck ETF Trust - VanEck Morningstar Wide Moat ETF | 0.08 | -3.89 | 7.57 | 2.42 | 4.3732 | -0.4229 | |||

| AGG / iShares Trust - iShares Core U.S. Aggregate Bond ETF | 0.07 | 6.61 | 7.03 | 6.92 | 4.0610 | -0.2061 | |||

| NVDD / Direxion Shares ETF Trust - Direxion Daily NVDA Bear 1X Shares | 0.04 | 16.77 | 5.66 | 70.25 | 3.2698 | 1.1120 | |||

| MSFT / Microsoft Corporation | 0.01 | 0.56 | 4.31 | 33.23 | 2.4925 | 0.3909 | |||

| TLT / iShares Trust - iShares 20+ Year Treasury Bond ETF | 0.05 | 1.17 | 4.22 | -1.93 | 2.4372 | -0.3543 | |||

| AMZN / Amazon.com, Inc. | 0.02 | 11.53 | 3.62 | 28.60 | 2.0915 | 0.2646 | |||

| V / Visa Inc. | 0.01 | 10.00 | 3.47 | 11.42 | 2.0063 | -0.0161 | |||

| META / Meta Platforms, Inc. | 0.00 | 1.53 | 3.29 | 30.05 | 1.8980 | 0.2581 | |||

| PANW / Palo Alto Networks, Inc. | 0.02 | 1.62 | 3.28 | 21.85 | 1.8949 | 0.1481 | |||

| MELI / MercadoLibre, Inc. | 0.00 | -6.96 | 3.21 | 24.62 | 1.8573 | 0.1835 | |||

| ANET / Arista Networks Inc | 0.03 | 3.85 | 3.21 | 37.17 | 1.8570 | 0.3358 | |||

| NOW / ServiceNow, Inc. | 0.00 | 1.50 | 3.20 | 31.07 | 1.8501 | 0.2644 | |||

| AAPL / Apple Inc. | 0.02 | 8.07 | 3.19 | -0.19 | 1.8438 | -0.2313 | |||

| MA / Mastercard Incorporated | 0.01 | 1.61 | 3.09 | 4.19 | 1.7832 | -0.1397 | |||

| ICE / Intercontinental Exchange, Inc. | 0.02 | 1.94 | 3.07 | 8.44 | 1.7751 | -0.0641 | |||

| AMAT / Applied Materials, Inc. | 0.02 | 2.41 | 3.05 | 29.16 | 1.7607 | 0.2296 | |||

| GOOG / Alphabet Inc. | 0.02 | 4.48 | 3.04 | 18.64 | 1.7582 | 0.0932 | |||

| BKNG / Booking Holdings Inc. | 0.00 | -2.84 | 2.97 | 22.12 | 1.7159 | 0.1371 | |||

| VEEV / Veeva Systems Inc. | 0.01 | -3.87 | 2.94 | 19.54 | 1.6963 | 0.1020 | |||

| KLAC / KLA Corporation | 0.00 | -12.61 | 2.91 | 15.16 | 1.6814 | 0.0410 | |||

| FTNT / Fortinet, Inc. | 0.03 | 0.33 | 2.86 | 10.20 | 1.6542 | -0.0323 | |||

| MCHP / Microchip Technology Incorporated | 0.04 | 0.11 | 2.84 | 45.55 | 1.6436 | 0.3748 | |||

| ASML / ASML Holding N.V. - Depositary Receipt (Common Stock) | 0.00 | 2.38 | 2.82 | 23.81 | 1.6320 | 0.1514 | |||

| AVGO / Broadcom Inc. | 0.01 | 88.81 | 2.81 | 211.17 | 1.6252 | 1.0379 | |||

| LOW / Lowe's Companies, Inc. | 0.01 | 10.03 | 2.75 | 4.65 | 1.5862 | -0.1162 | |||

| CRM / Salesforce, Inc. | 0.01 | 6.68 | 2.56 | 8.38 | 1.4800 | -0.0538 | |||

| CSGP / CoStar Group, Inc. | 0.03 | 2.57 | 2.52 | 4.09 | 1.4551 | -0.1154 | |||

| LMT / Lockheed Martin Corporation | 0.01 | 2.85 | 2.49 | 6.60 | 1.4368 | -0.0770 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.01 | 30.46 | 2.44 | 6.31 | 1.4116 | -0.0801 | |||

| DPZ / Domino's Pizza, Inc. | 0.01 | 2.83 | 2.41 | 0.88 | 1.3894 | -0.1582 | |||

| ADBE / Adobe Inc. | 0.01 | 17.50 | 2.37 | 18.52 | 1.3683 | 0.0715 | |||

| BRK.A / Berkshire Hathaway Inc. | 0.00 | 20.42 | 2.34 | 9.82 | 1.3504 | -0.0307 | |||

| VRTX / Vertex Pharmaceuticals Incorporated | 0.01 | 3.80 | 2.33 | -4.66 | 1.3485 | -0.2408 | |||

| WDAY / Workday, Inc. | 0.01 | 3.68 | 2.33 | 6.58 | 1.3480 | -0.0732 | |||

| EXPD / Expeditors International of Washington, Inc. | 0.02 | 3.56 | 2.30 | -1.58 | 1.3289 | -0.1882 | |||

| RTX / RTX Corporation | 0.01 | -2.94 | 1.96 | 7.00 | 1.1302 | -0.0564 | |||

| XOM / Exxon Mobil Corporation | 0.02 | 2.41 | 1.94 | -7.15 | 1.1185 | -0.2351 | |||

| BAC / Bank of America Corporation | 0.04 | 4.55 | 1.89 | 18.52 | 1.0947 | 0.0574 | |||

| ENB / Enbridge Inc. | 0.04 | 4.59 | 1.82 | 7.02 | 1.0486 | -0.0525 | |||

| DLR / Digital Realty Trust, Inc. | 0.01 | 3.12 | 1.80 | 25.51 | 1.0379 | 0.1086 | |||

| HON / Honeywell International Inc. | 0.01 | 3.72 | 1.79 | 14.09 | 1.0347 | 0.0158 | |||

| UPS / United Parcel Service, Inc. | 0.02 | 0.18 | 1.77 | -8.11 | 1.0220 | -0.2267 | |||

| MDLZ / Mondelez International, Inc. | 0.02 | 4.46 | 1.68 | 3.84 | 0.9697 | -0.0795 | |||

| ECL / Ecolab Inc. | 0.01 | 4.80 | 1.68 | 11.36 | 0.9687 | -0.0083 | |||

| UNP / Union Pacific Corporation | 0.01 | 6.30 | 1.67 | 3.54 | 0.9640 | -0.0820 | |||

| ROP / Roper Technologies, Inc. | 0.00 | 4.89 | 1.65 | 0.85 | 0.9556 | -0.1089 | |||

| JNJ / Johnson & Johnson | 0.01 | 5.10 | 1.64 | -3.19 | 0.9459 | -0.1518 | |||

| PAYX / Paychex, Inc. | 0.01 | 4.52 | 1.62 | -1.46 | 0.9384 | -0.1313 | |||

| APD / Air Products and Chemicals, Inc. | 0.01 | 6.41 | 1.62 | 1.83 | 0.9336 | -0.0969 | |||

| NEE / NextEra Energy, Inc. | 0.02 | 4.48 | 1.61 | 2.29 | 0.9312 | -0.0912 | |||

| UNH / UnitedHealth Group Incorporated | 0.01 | 0.45 | 1.61 | -40.16 | 0.9290 | -0.8152 | |||

| AMGN / Amgen Inc. | 0.01 | 5.07 | 1.60 | -5.83 | 0.9234 | -0.1782 | |||

| ACN / Accenture plc | 0.01 | 7.09 | 1.60 | 2.57 | 0.9230 | -0.0878 | |||

| PEP / PepsiCo, Inc. | 0.01 | 19.98 | 1.56 | 5.63 | 0.9006 | -0.0569 | |||

| TFLO / iShares Trust - iShares Treasury Floating Rate Bond ETF | 0.02 | 1.20 | 0.6917 | 0.6917 | |||||

| COST / Costco Wholesale Corporation | 0.00 | 72.74 | 1.10 | 81.02 | 0.6342 | 0.2403 | |||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 0.00 | -4.03 | 1.06 | 30.94 | 0.6115 | 0.0869 | |||

| TSLA / Tesla, Inc. | 0.00 | -2.03 | 1.04 | 20.07 | 0.6019 | 0.0388 | |||

| ADSK / Autodesk, Inc. | 0.00 | -1.37 | 0.96 | 16.61 | 0.5519 | 0.0203 | |||

| XYZ / Block, Inc. | 0.01 | -1.16 | 0.90 | 23.53 | 0.5219 | 0.0475 | |||

| HD / The Home Depot, Inc. | 0.00 | 0.67 | 0.89 | 0.68 | 0.5124 | -0.0592 | |||

| MPWR / Monolithic Power Systems, Inc. | 0.00 | 0.89 | 0.5121 | 0.5121 | |||||

| CDNS / Cadence Design Systems, Inc. | 0.00 | -2.18 | 0.89 | 18.47 | 0.5116 | 0.0267 | |||

| TSCO / Tractor Supply Company | 0.02 | 0.66 | 0.83 | -3.62 | 0.4770 | -0.0788 | |||

| PG / The Procter & Gamble Company | 0.01 | -11.56 | 0.80 | -17.32 | 0.4634 | -0.1662 | |||

| DHR / Danaher Corporation | 0.00 | 6.24 | 0.79 | 2.47 | 0.4547 | -0.0442 | |||

| GOOGL / Alphabet Inc. | 0.00 | 16.02 | 0.45 | 32.26 | 0.2610 | 0.0392 | |||

| PHG / Koninklijke Philips N.V. - Depositary Receipt (Common Stock) | 0.02 | 0.44 | 0.2549 | 0.2549 | |||||

| CORP / PIMCO ETF Trust - PIMCO Investment Grade Corporate Bond Index Exchange-Traded Fund | 0.00 | -2.44 | 0.42 | -1.86 | 0.2448 | -0.0355 | |||

| JPM / JPMorgan Chase & Co. | 0.00 | 62.15 | 0.41 | 91.51 | 0.2346 | 0.0970 | |||

| NFLX / Netflix, Inc. | 0.00 | 0.40 | 0.2298 | 0.2298 | |||||

| PLTR / Palantir Technologies Inc. | 0.00 | 2.70 | 0.38 | 65.79 | 0.2189 | 0.0706 | |||

| SPY / SPDR S&P 500 ETF | 0.00 | 18.95 | 0.38 | 31.47 | 0.2174 | 0.0315 | |||

| BSX / Boston Scientific Corporation | 0.00 | 0.00 | 0.36 | 6.53 | 0.2079 | -0.0114 | |||

| KO / The Coca-Cola Company | 0.01 | -22.07 | 0.35 | -23.04 | 0.2046 | -0.0940 | |||

| WMT / Walmart Inc. | 0.00 | 2.86 | 0.35 | 14.66 | 0.2035 | 0.0039 | |||

| CVX / Chevron Corporation | 0.00 | 0.00 | 0.27 | -14.64 | 0.1588 | -0.0496 | |||

| ABBV / AbbVie Inc. | 0.00 | 0.29 | 0.26 | -11.34 | 0.1496 | -0.0396 | |||

| CP / Canadian Pacific Kansas City Limited | 0.00 | 0.00 | 0.25 | 13.36 | 0.1422 | 0.0007 | |||

| VTI / Vanguard Index Funds - Vanguard Total Stock Market ETF | 0.00 | 0.23 | 0.1326 | 0.1326 | |||||

| VOO / Vanguard Index Funds - Vanguard S&P 500 ETF | 0.00 | 0.22 | 0.1293 | 0.1293 | |||||

| SPLG / SPDR Series Trust - SPDR Portfolio S&P 500 ETF | 0.00 | -1.00 | 0.22 | 9.36 | 0.1288 | -0.0034 | |||

| GBTC / Grayscale Bitcoin Trust (BTC) | 0.00 | 0.22 | 0.1276 | 0.1276 | |||||

| CAT / Caterpillar Inc. | 0.00 | 0.21 | 0.1207 | 0.1207 | |||||

| XPRO / Expro Group Holdings N.V. | 0.00 | 0.00 | 0.21 | -21.89 | 0.1196 | -0.0525 | |||

| ESPR / Esperion Therapeutics, Inc. | 0.05 | 29.46 | 0.04 | -12.00 | 0.0258 | -0.0069 | |||

| SBUX / Starbucks Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| TER / Teradyne, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| RY / Royal Bank of Canada | 0.00 | -100.00 | 0.00 | 0.0000 |