Mga Batayang Estadistika

| Nilai Portofolio | $ 496,233,741 |

| Posisi Saat Ini | 511 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

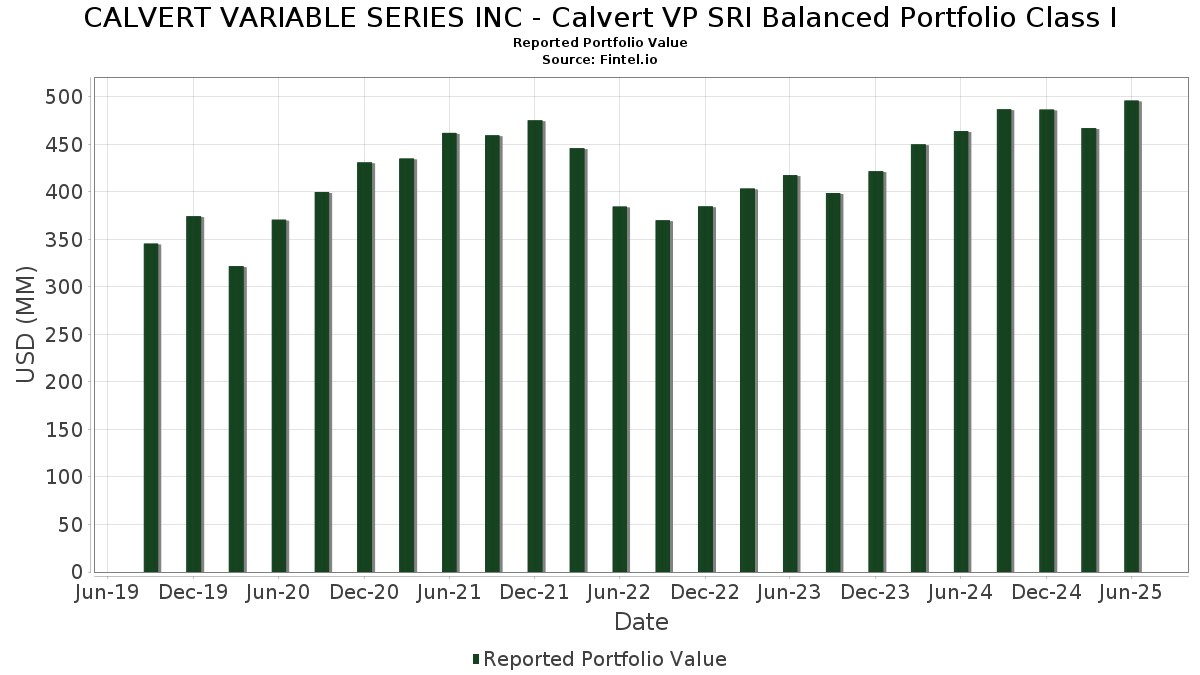

CALVERT VARIABLE SERIES INC - Calvert VP SRI Balanced Portfolio Class I telah mengungkapkan total kepemilikan 511 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 496,233,741 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama CALVERT VARIABLE SERIES INC - Calvert VP SRI Balanced Portfolio Class I adalah Morgan Stanley Institutional Liquidity Funds Government Portfolio, Institutional Class (US:US61747C7074) , Microsoft Corporation (US:MSFT) , NVIDIA Corporation (US:NVDA) , Uniform Mortgage-Backed Security, TBA (US:US01F0526727) , and Edwards Lifesciences Corporation (US:EW) . Posisi baru CALVERT VARIABLE SERIES INC - Calvert VP SRI Balanced Portfolio Class I meliputi: Uniform Mortgage-Backed Security, TBA (US:US01F0526727) , TREASURY BOND (US:US912810TF57) , Uniform Mortgage-Backed Security, TBA (US:US01F0606750) , United States Treasury Note/Bond (US:US91282CGQ87) , and Quest Diagnostics Incorporated (US:DGX) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 21.69 | 4.8200 | 3.4693 | ||

| 16.83 | 3.7396 | 3.1434 | ||

| 30.78 | 30.78 | 6.8405 | 2.3266 | |

| 0.14 | 22.67 | 5.0388 | 1.3819 | |

| 0.05 | 23.92 | 5.3167 | 1.0717 | |

| 4.92 | 1.0937 | 0.9121 | ||

| 0.04 | 10.31 | 2.2907 | 0.7242 | |

| 0.01 | 2.66 | 0.5909 | 0.5909 | |

| 0.02 | 2.34 | 0.5207 | 0.5207 | |

| 0.01 | 2.03 | 0.4510 | 0.4510 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.08 | 15.61 | 3.4696 | -0.7291 | |

| 0.02 | 4.32 | 0.9612 | -0.5512 | |

| 0.02 | 2.78 | 0.6189 | -0.5229 | |

| 0.13 | 2.59 | 0.5747 | -0.3225 | |

| 0.01 | 2.84 | 0.6308 | -0.3219 | |

| 0.15 | 5.73 | 1.2731 | -0.3215 | |

| 0.01 | 1.56 | 0.3474 | -0.2696 | |

| 4.79 | 4.79 | 1.0635 | -0.2343 | |

| 0.01 | 4.44 | 0.9875 | -0.1777 | |

| 0.03 | 4.45 | 0.9893 | -0.1768 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-25 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US61747C7074 / Morgan Stanley Institutional Liquidity Funds Government Portfolio, Institutional Class | 30.78 | 60.33 | 30.78 | 60.32 | 6.8405 | 2.3266 | |||

| MSFT / Microsoft Corporation | 0.05 | 0.00 | 23.92 | 32.50 | 5.3167 | 1.0717 | |||

| NVDA / NVIDIA Corporation | 0.14 | 0.00 | 22.67 | 45.78 | 5.0388 | 1.3819 | |||

| US01F0526727 / Uniform Mortgage-Backed Security, TBA | 21.69 | 277.41 | 4.8200 | 3.4693 | |||||

| EW / Edwards Lifesciences Corporation | 16.83 | 527.33 | 3.7396 | 3.1434 | |||||

| AAPL / Apple Inc. | 0.08 | -5.35 | 15.61 | -12.58 | 3.4696 | -0.7291 | |||

| AMZN / Amazon.com, Inc. | 0.07 | 2.18 | 14.43 | 17.82 | 3.2065 | 0.3272 | |||

| GOOG / Alphabet Inc. | 0.07 | -7.57 | 12.77 | 4.95 | 2.8386 | -0.0230 | |||

| AVGO / Broadcom Inc. | 0.04 | -6.03 | 10.31 | 54.70 | 2.2907 | 0.7242 | |||

| U.S. Treasury Notes / DBT (US91282CMP31) | 9.20 | 0.14 | 2.0452 | -0.1153 | |||||

| V / Visa Inc. | 0.02 | 6.84 | 7.21 | 8.25 | 1.6019 | 0.0362 | |||

| NFLX / Netflix, Inc. | 0.01 | 0.00 | 6.70 | 43.61 | 1.4881 | 0.3918 | |||

| BKR / Baker Hughes Company | 0.15 | -3.18 | 5.73 | -15.54 | 1.2731 | -0.3215 | |||

| US912810TF57 / TREASURY BOND | 5.47 | -1.99 | 1.2163 | -0.0966 | |||||

| COOP / Mr. Cooper Group Inc. | 0.04 | -3.54 | 5.28 | 20.33 | 1.1734 | 0.1418 | |||

| TRU / TransUnion | 0.06 | 0.00 | 5.24 | 6.03 | 1.1657 | 0.0027 | |||

| ALL / The Allstate Corporation | 0.03 | 0.00 | 5.17 | -2.78 | 1.1499 | -0.1014 | |||

| FOUR / Shift4 Payments, Inc. | 0.05 | 14.76 | 5.16 | 39.20 | 1.1476 | 0.2754 | |||

| KO / The Coca-Cola Company | 0.07 | 0.00 | 5.06 | -1.23 | 1.1241 | -0.0798 | |||

| WMT / Walmart Inc. | 0.05 | 0.00 | 4.95 | 11.37 | 1.0996 | 0.0551 | |||

| US01F0606750 / Uniform Mortgage-Backed Security, TBA | 4.92 | 537.31 | 1.0937 | 0.9121 | |||||

| ICE / Intercontinental Exchange, Inc. | 0.03 | 10.46 | 4.84 | 17.49 | 1.0765 | 0.1071 | |||

| US8575093013 / State Street Navigator Securities Lending Government Money Market Portfolio | 4.79 | -13.30 | 4.79 | -13.30 | 1.0635 | -0.2343 | |||

| LRCX / Lam Research Corporation | 0.05 | 0.00 | 4.78 | 33.89 | 1.0625 | 0.2230 | |||

| TW / Tradeweb Markets Inc. | 0.03 | -8.98 | 4.45 | -10.26 | 0.9893 | -0.1768 | |||

| LLY / Eli Lilly and Company | 0.01 | -5.00 | 4.44 | -10.33 | 0.9875 | -0.1777 | |||

| ABBV / AbbVie Inc. | 0.02 | -24.10 | 4.32 | -32.77 | 0.9612 | -0.5512 | |||

| AJG / Arthur J. Gallagher & Co. | 0.01 | 0.00 | 4.16 | -7.29 | 0.9249 | -0.1304 | |||

| SPGI / S&P Global Inc. | 0.01 | 0.00 | 4.06 | 3.78 | 0.9024 | -0.0176 | |||

| ABT / Abbott Laboratories | 0.03 | -9.51 | 4.01 | -7.22 | 0.8917 | -0.1251 | |||

| PANW / Palo Alto Networks, Inc. | 0.02 | 0.00 | 3.81 | 19.95 | 0.8460 | 0.0997 | |||

| FICO / Fair Isaac Corporation | 0.00 | 89.73 | 3.48 | 88.10 | 0.7731 | 0.3382 | |||

| US91282CGQ87 / United States Treasury Note/Bond | 3.48 | 4.73 | 0.7730 | -0.0081 | |||||

| FSV / FirstService Corporation | 0.02 | 0.00 | 3.44 | 5.23 | 0.7646 | -0.0041 | |||

| CARR / Carrier Global Corporation | 0.05 | 0.00 | 3.44 | 15.44 | 0.7645 | 0.0639 | |||

| MAR / Marriott International, Inc. | 0.01 | 0.00 | 3.36 | 14.71 | 0.7469 | 0.0580 | |||

| TJX / The TJX Companies, Inc. | 0.03 | -12.05 | 3.33 | -10.83 | 0.7410 | -0.1382 | |||

| ETN / Eaton Corporation plc | 0.01 | 30.99 | 3.32 | 72.11 | 0.7379 | 0.2841 | |||

| APH / Amphenol Corporation | 0.03 | 24.72 | 3.29 | 87.78 | 0.7309 | 0.3191 | |||

| BJ / BJ's Wholesale Club Holdings, Inc. | 0.03 | 0.00 | 3.20 | -5.49 | 0.7115 | -0.0850 | |||

| BKNG / Booking Holdings Inc. | 0.00 | -26.67 | 3.18 | -7.84 | 0.7077 | -0.1048 | |||

| ADP / Automatic Data Processing, Inc. | 0.01 | 21.18 | 3.18 | 22.29 | 0.7060 | 0.0953 | |||

| AME / AMETEK, Inc. | 0.02 | 0.00 | 3.17 | 5.11 | 0.7038 | -0.0045 | |||

| ADI / Analog Devices, Inc. | 0.01 | 0.00 | 3.17 | 18.01 | 0.7036 | 0.0729 | |||

| HEI / HEICO Corporation | 0.01 | -15.04 | 3.15 | 4.27 | 0.6998 | -0.0101 | |||

| LIN / Linde plc | 0.01 | 0.00 | 3.05 | 0.76 | 0.6778 | -0.0339 | |||

| CEG / Constellation Energy Corporation | 0.01 | 0.00 | 2.97 | 60.14 | 0.6600 | 0.2238 | |||

| WCN / Waste Connections, Inc. | 0.02 | -7.10 | 2.93 | -11.13 | 0.6515 | -0.1241 | |||

| BURL / Burlington Stores, Inc. | 0.01 | -28.24 | 2.84 | -29.94 | 0.6308 | -0.3219 | |||

| SNPS / Synopsys, Inc. | 0.01 | 52.78 | 2.82 | 82.70 | 0.6267 | 0.2637 | |||

| GOOGL / Alphabet Inc. | 0.02 | -49.68 | 2.78 | -42.66 | 0.6189 | -0.5229 | |||

| ZTS / Zoetis Inc. | 0.02 | 16.45 | 2.76 | 10.31 | 0.6135 | 0.0250 | |||

| EW / Edwards Lifesciences Corporation | 0.03 | 0.00 | 2.68 | 7.88 | 0.5962 | 0.0117 | |||

| DGX / Quest Diagnostics Incorporated | 0.01 | 2.66 | 0.5909 | 0.5909 | |||||

| IT / Gartner, Inc. | 0.01 | 0.00 | 2.63 | -3.70 | 0.5840 | -0.0576 | |||

| OWL / Blue Owl Capital Inc. | 0.13 | -29.31 | 2.59 | -32.24 | 0.5747 | -0.3225 | |||

| ISRG / Intuitive Surgical, Inc. | 0.00 | -16.98 | 2.39 | -8.88 | 0.5314 | -0.0858 | |||

| BAH / Booz Allen Hamilton Holding Corporation | 0.02 | 2.34 | 0.5207 | 0.5207 | |||||

| CSGP / CoStar Group, Inc. | 0.03 | 0.00 | 2.07 | 1.52 | 0.4603 | -0.0196 | |||

| HUM / Humana Inc. | 0.01 | 2.03 | 0.4510 | 0.4510 | |||||

| PH / Parker-Hannifin Corporation | 0.00 | -30.95 | 2.03 | -20.65 | 0.4502 | -0.1501 | |||

| SPF / Spotify Technology S.A. | 0.00 | 0.00 | 2.00 | 39.51 | 0.4434 | 0.1072 | |||

| UNH / UnitedHealth Group Incorporated | 0.01 | 0.00 | 1.56 | -40.45 | 0.3474 | -0.2696 | |||

| US500769JQ84 / KFW | 1.47 | 0.89 | 0.3274 | -0.0159 | |||||

| U.S. Treasury Bonds / DBT (US912810UJ50) | 1.34 | 0.22 | 0.2985 | -0.0166 | |||||

| HASI / HA Sustainable Infrastructure Capital, Inc. | 1.22 | 0.2704 | 0.2704 | ||||||

| US3136B3DE75 / Fannie Mae - ACES | 1.21 | 0.50 | 0.2691 | -0.0141 | |||||

| US45905U6L39 / International Bank for Reconstruction & Development | 1.19 | 0.25 | 0.2654 | -0.0147 | |||||

| US91282CFH97 / United States Treasury Note/Bond | 1.13 | 0.62 | 0.2516 | -0.0131 | |||||

| US68377WAA99 / Oportun Issuance Trust 2021-C | 1.04 | -20.69 | 0.2311 | -0.0770 | |||||

| US37959GAB32 / Global Atlantic Fin Co | 1.02 | 32.34 | 0.2276 | 0.0456 | |||||

| US298785HM16 / European Investment Bank | 1.00 | 0.71 | 0.2222 | -0.0112 | |||||

| US3137HAD860 / Freddie Mac Multifamily Structured Pass Through Certificates | 0.99 | 0.30 | 0.2205 | -0.0121 | |||||

| US91282CBZ32 / United States Treasury Note/Bond | 0.96 | 1.17 | 0.2123 | -0.0097 | |||||

| US89117F8Z56 / Toronto-Dominion Bank/The | 0.93 | 0.98 | 0.2064 | -0.0099 | |||||

| US161175BT05 / Charter Communications Operating LLC / Charter Communications Operating Capital | 0.92 | 6.21 | 0.2052 | 0.0006 | |||||

| US3136B75M95 / Federal National Mortgage Association, Series 2020-M1, Class A2 | 0.90 | 1.69 | 0.2010 | -0.0081 | |||||

| U.S. Treasury Bonds / DBT (US912810UE63) | 0.90 | -10.57 | 0.1994 | -0.0366 | |||||

| US817743AA56 / N/A | 0.88 | 0.11 | 0.1964 | -0.0112 | |||||

| US3140QSSX04 / Fannie Mae Pool | 0.87 | -1.13 | 0.1939 | -0.0136 | |||||

| US3136BQCX56 / FANNIE MAE-ACES FNA 2023-M1S A2 | 0.84 | 0.24 | 0.1873 | -0.0102 | |||||

| US06051GHD43 / Bank of America Corp | 0.84 | 0.84 | 0.1869 | -0.0091 | |||||

| U.S. Treasury Notes / DBT (US91282CKS97) | 0.82 | -0.24 | 0.1833 | -0.0111 | |||||

| US298785JN70 / European Investment Bank | 0.82 | 1.49 | 0.1813 | -0.0075 | |||||

| BNH / Brookfield Finance Inc. - Corporate Bond/Note | 0.78 | 0.1727 | 0.1727 | ||||||

| Foundry JV Holdco LLC / DBT (US350930AH62) | 0.76 | 47.28 | 0.1683 | 0.0473 | |||||

| US25267TAN19 / DIAMOND ISSUER SHINE 2021-1A A | 0.74 | 0.27 | 0.1640 | -0.0092 | |||||

| CA125491AG54 / CI FINANCIAL CO | 0.73 | 0.1612 | 0.1612 | ||||||

| AU3FN0029609 / AAI Ltd | 0.72 | 1.27 | 0.1600 | -0.0072 | |||||

| Castlelake Aircraft Structured Trust 2025-1 / ABS-O (US14856VAA52) | 0.71 | -1.25 | 0.1582 | -0.0112 | |||||

| US12803RAC88 / CaixaBank SA | 0.70 | 1.15 | 0.1566 | -0.0072 | |||||

| KD / Kyndryl Holdings, Inc. | 0.69 | 2.98 | 0.1537 | -0.0041 | |||||

| US92212KAC09 / Vantage Data Centers LLC | 0.69 | 1.02 | 0.1535 | -0.0071 | |||||

| Navigator 2024-1 Aviation Ltd / ABS-O (US63943DAA72) | 0.69 | -2.00 | 0.1527 | -0.0123 | |||||

| Enact Holdings Inc / DBT (US29249EAA73) | 0.69 | 1.18 | 0.1523 | -0.0070 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.68 | -18.62 | 0.1517 | -0.0455 | |||||

| US808513CH62 / Charles Schwab Corp/The | 0.68 | 1.64 | 0.1516 | -0.0062 | |||||

| U.S. Treasury Notes / DBT (US91282CJZ59) | 0.68 | 0.45 | 0.1503 | -0.0082 | |||||

| US716973AG71 / Pfizer Investment Enterprises Pte Ltd | 0.67 | 0.1495 | 0.1495 | ||||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 0.67 | 0.60 | 0.1486 | -0.0076 | |||||

| BNP / BNP Paribas SA | 0.67 | 0.1483 | 0.1483 | ||||||

| GMZB / Ally Financial Inc. - Preferred Stock | 0.65 | 119.19 | 0.1448 | 0.0748 | |||||

| Government National Mortgage Association / ABS-MBS (US38384MG683) | 0.65 | 0.62 | 0.1448 | -0.0075 | |||||

| US05609VAG05 / BX Commercial Mortgage Trust 2021-VOLT | 0.64 | -2.58 | 0.1429 | -0.0122 | |||||

| US91282CGH88 / United States Treasury Note/Bond | 0.63 | 0.48 | 0.1396 | -0.0073 | |||||

| US86772RAA32 / Sunrun Jupiter Issuer 2022-1, LLC 4.75%, Due 07/30/2057 | 0.63 | 0.00 | 0.1394 | -0.0081 | |||||

| J1EF34 / Jefferies Financial Group Inc. - Depositary Receipt (Common Stock) | 0.62 | 2.66 | 0.1372 | -0.0043 | |||||

| Citadel LP / DBT (US17288XAC83) | 0.61 | 6.41 | 0.1365 | 0.0006 | |||||

| US095623AB04 / BlueHub Loan Fund Inc | 0.61 | 0.17 | 0.1350 | -0.0077 | |||||

| U.S. Treasury Notes / DBT (US91282CMM00) | 0.60 | -2.58 | 0.1342 | -0.0116 | |||||

| US05492PAJ75 / BAMLL Commercial Mortgage Securities Trust 2019-BPR | 0.59 | 3.16 | 0.1305 | -0.0035 | |||||

| US19521UAA16 / Cologix Data Centers US Issuer LLC | 0.58 | 1.05 | 0.1291 | -0.0060 | |||||

| Goddard Funding LLC / ABS-O (US380241AC35) | 0.58 | 0.00 | 0.1281 | -0.0075 | |||||

| US06051GGF00 / Bank of America Corp | 0.58 | 0.52 | 0.1280 | -0.0069 | |||||

| AASET 2025-1 / ABS-O (US00258PAA12) | 0.57 | -0.87 | 0.1272 | -0.0086 | |||||

| US46115HBV87 / INTESA SANPAOLO SPA | 0.57 | 1.07 | 0.1260 | -0.0059 | |||||

| Cloud Capital Holdco LP / ABS-O (US102104AA49) | 0.55 | 0.55 | 0.1229 | -0.0065 | |||||

| US74841CAB72 / Quicken Loans LLC / Quicken Loans Co-Issuer Inc | 0.55 | 10.42 | 0.1225 | 0.0050 | |||||

| US345397C684 / Ford Motor Credit Co. LLC | 0.55 | 0.92 | 0.1216 | -0.0059 | |||||

| US912810TC27 / United States Treasury Note/Bond | 0.55 | -2.15 | 0.1216 | -0.0098 | |||||

| MRX / Marex Group plc | 0.55 | 81.40 | 0.1215 | 0.0507 | |||||

| US91282CBS98 / United States Treasury Note/Bond | 0.54 | 1.12 | 0.1209 | -0.0056 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 0.54 | 0.1207 | 0.1207 | ||||||

| US045167EJ82 / Asian Development Bank | 0.53 | 0.76 | 0.1178 | -0.0058 | |||||

| LOANDEPOT GMSR Trust / ABS-O (US53946TAD46) | 0.53 | 0.1173 | 0.1173 | ||||||

| US3137FGZH15 / Freddie Mac Multifamily Structured Pass Through Certificates | 0.52 | 0.58 | 0.1166 | -0.0061 | |||||

| US30227FAG54 / Extended Stay America Trust | 0.52 | -0.77 | 0.1145 | -0.0076 | |||||

| Horizon Aircraft Finance IV Ltd / ABS-O (US43990EAA91) | 0.51 | 0.00 | 0.1136 | -0.0067 | |||||

| INTOWN 2025-STAY Mortgage Trust / ABS-MBS (US46117WAG78) | 0.51 | 0.40 | 0.1126 | -0.0060 | |||||

| US87164DVJ61 / Synovus Bank/Columbus GA | 0.50 | 0.60 | 0.1110 | -0.0057 | |||||

| US37046US851 / General Motors Financial Co Inc | 0.49 | 2.07 | 0.1098 | -0.0042 | |||||

| US62548QAD34 / Multifamily Connecticut Avenue Securities Trust 2020-01 | 0.49 | -1.21 | 0.1093 | -0.0077 | |||||

| ORL Trust 2024-GLKS / ABS-MBS (US67120DAA37) | 0.49 | -0.20 | 0.1090 | -0.0065 | |||||

| WFC / Wells Fargo & Company - Depositary Receipt (Common Stock) | 0.49 | 0.83 | 0.1086 | -0.0053 | |||||

| US89788MAP77 / Truist Financial Corp | 0.49 | 1.46 | 0.1082 | -0.0045 | |||||

| US83546DAG34 / Sonic Capital LLC | 0.49 | 0.21 | 0.1081 | -0.0060 | |||||

| Vantage Data Centers Germany Borrower Lux Sarl / ABS-O (XS3045501718) | 0.49 | 0.1080 | 0.1080 | ||||||

| ATHS / Athene Holding Ltd. - Corporate Bond/Note | 0.48 | 0.1077 | 0.1077 | ||||||

| AS Mileage Plan IP Ltd / DBT (US00218QAA85) | 0.48 | 86.87 | 0.1076 | 0.0466 | |||||

| Belrose Funding Trust II / DBT (US08079KAA25) | 0.48 | 0.1073 | 0.1073 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.48 | -5.30 | 0.1073 | -0.0125 | |||||

| US05533UAF57 / BBVA Bancomer SA/Texas | 0.48 | 1.05 | 0.1069 | -0.0050 | |||||

| US26884UAE91 / EPR Properties | 0.48 | 15.18 | 0.1063 | 0.0087 | |||||

| US64966HMV95 / City of New York, Fiscal Year 2010, Build America Bonds, Series Subseries A-2 | 0.48 | 0.21 | 0.1057 | -0.0058 | |||||

| US55903VBC63 / Warnermedia Holdings Inc | 0.47 | -15.08 | 0.1052 | -0.0258 | |||||

| US172967MU24 / CITIGROUP INC JR SUBORDINA 12/99 VAR | 0.47 | 54.75 | 0.1051 | 0.0331 | |||||

| BBVA Mexico SA Institucion De Banca Multiple Grupo Financiero BBVA Mexico/TX / DBT (US07336UAB98) | 0.47 | 1.53 | 0.1037 | -0.0045 | |||||

| US91282CBC47 / United States Treasury Note/Bond | 0.47 | 0.87 | 0.1036 | -0.0051 | |||||

| US76134KAA25 / Retained Vantage Data Centers Issuer LLC | 0.47 | 0.00 | 0.1035 | -0.0061 | |||||

| US88104LAE39 / TERRAFORM POWER OPERATIN | 0.46 | 2.25 | 0.1013 | -0.0035 | |||||

| LPL Holdings Inc / DBT (US50212YAQ70) | 0.45 | 0.1001 | 0.1001 | ||||||

| US87165BAG86 / Synchrony Financial | 0.45 | 0.00 | 0.0999 | -0.0058 | |||||

| US22003BAP13 / CORPORATE OFFICE PPTYS LP 2.9% 12/01/2033 | 0.45 | 1.58 | 0.0998 | -0.0043 | |||||

| US3136B6XJ73 / Fannie Mae-Aces | 0.45 | 0.45 | 0.0995 | -0.0052 | |||||

| US87020PAX50 / Swedbank AB | 0.45 | -0.22 | 0.0992 | -0.0060 | |||||

| US05565AM341 / BNP Paribas SA | 0.44 | 2.08 | 0.0984 | -0.0036 | |||||

| GWT 2024-WLF2 / ABS-MBS (US362414AA28) | 0.44 | 0.23 | 0.0984 | -0.0054 | |||||

| US12659XAA46 / Credit Suisse Mortgage Capital Certificates | 0.44 | 64.55 | 0.0981 | 0.0351 | |||||

| US3136AY2C66 / FNMA ACES, Series 2017-M13, Class A2 | 0.44 | 0.23 | 0.0977 | -0.0054 | |||||

| BIIB / Biogen Inc. - Depositary Receipt (Common Stock) | 0.43 | 0.0962 | 0.0962 | ||||||

| TX Trust 2024-HOU / ABS-MBS (US90216DAA00) | 0.43 | -0.47 | 0.0951 | -0.0060 | |||||

| US904678AU32 / UniCredit SpA | 0.43 | 0.47 | 0.0951 | -0.0049 | |||||

| US68267HAA59 / OneMain Financial Issuance Trust, Series 2022-S1, Class A | 0.42 | -14.02 | 0.0942 | -0.0216 | |||||

| SDR Commercial Mortgage Trust 2024-DSNY / ABS-MBS (US811304AA27) | 0.42 | 0.24 | 0.0936 | -0.0051 | |||||

| US62547NAB55 / COMMERCIAL MORTGAGE BACKED SECURITIES | 0.42 | -3.68 | 0.0933 | -0.0091 | |||||

| Nuveen LLC / DBT (US67080LAD73) | 0.42 | 1.71 | 0.0928 | -0.0037 | |||||

| US20754WAC91 / CORP CMO | 0.42 | 0.24 | 0.0925 | -0.0052 | |||||

| US26884UAF66 / EPR Properties | 0.41 | -28.72 | 0.0917 | -0.0444 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.41 | 0.0912 | 0.0912 | ||||||

| NYCT Trust 2024-3ELV / ABS-MBS (US62956HAA41) | 0.41 | 0.00 | 0.0906 | -0.0051 | |||||

| US81180WBM29 / Seagate HDD Cayman | 0.40 | -6.05 | 0.0900 | -0.0114 | |||||

| US830867AB33 / Delta Air Lines Inc / SkyMiles IP Ltd | 0.40 | 0.75 | 0.0891 | -0.0045 | |||||

| US13032UVD70 / CALIFORNIA ST HLTH FACS FING AUTH REVENUE | 0.40 | 0.51 | 0.0885 | -0.0048 | |||||

| US19260MAA45 / Coinstar Funding LLC Series 2017-1 | 0.40 | 0.25 | 0.0881 | -0.0048 | |||||

| US25265LAA89 / Diamond Infrastructure Funding LLC | 0.39 | 0.25 | 0.0878 | -0.0047 | |||||

| Global Atlantic Fin Co / DBT (US37959GAG29) | 0.39 | 0.26 | 0.0867 | -0.0047 | |||||

| US86745PAA12 / SNVA_20-2A | 0.39 | -1.27 | 0.0862 | -0.0063 | |||||

| US258261AA48 / DORIS DUKE CHARITABLE FOUNDATION/THE 2.345000% 07/01/2050 | 0.39 | -3.01 | 0.0862 | -0.0077 | |||||

| 421915EH8 / Health Care Ppty Investor 5.65% Notes 12/15/13 | 0.39 | 1.32 | 0.0857 | -0.0038 | |||||

| Planet Fitness Master Issuer LLC / ABS-O (US72703PAF09) | 0.38 | 0.26 | 0.0847 | -0.0048 | |||||

| Brookfield Finance Inc / DBT (US11271LAN29) | 0.38 | 0.53 | 0.0838 | -0.0045 | |||||

| US06051GLV94 / Bank of America Corp. | 0.38 | -0.27 | 0.0837 | -0.0050 | |||||

| US30227FAA84 / Extended Stay America Trust | 0.38 | -0.79 | 0.0834 | -0.0056 | |||||

| US345397C353 / Ford Motor Credit Co LLC | 0.37 | 0.27 | 0.0822 | -0.0046 | |||||

| US86745YAA29 / SUNNOVA HELIOS XII ISSUER LLC SNVA 2023-B A | 0.37 | -5.87 | 0.0821 | -0.0102 | |||||

| US05609VAL99 / BX Commercial Mortgage Trust 2021-VOLT | 0.37 | -2.14 | 0.0811 | -0.0067 | |||||

| US87166FAD50 / Synchrony Bank | 0.36 | -0.28 | 0.0804 | -0.0048 | |||||

| US92939GAJ67 / WFLD 2014-MONT Mortgage Trust | 0.36 | 0.56 | 0.0801 | -0.0043 | |||||

| US536797AG85 / LITHIA MOTORS INC 3.875% 06/01/2029 144A | 0.36 | 4.40 | 0.0791 | -0.0013 | |||||

| US88104LAG86 / TerraForm Power Operating LLC | 0.35 | 2.92 | 0.0786 | -0.0022 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.35 | 0.0782 | 0.0782 | ||||||

| US64016NAA54 / NEIGHBORLY ISSUER LLC NBLY 2021 1A A2 144A | 0.35 | -0.85 | 0.0779 | -0.0052 | |||||

| Gilead Aviation LLC / ABS-O (US37556TAA43) | 0.35 | 0.00 | 0.0773 | -0.0044 | |||||

| US14732KAA97 / Cascade MH Asset Trust, Series 2022-MH1, Class A | 0.34 | -0.86 | 0.0766 | -0.0053 | |||||

| US13032UVF29 / CALIFORNIA ST HLTH FACS FING AUTH REVENUE | 0.34 | 0.29 | 0.0764 | -0.0040 | |||||

| NRM FNT1 Excess LLC / ABS-O (US62956YAA73) | 0.34 | -5.82 | 0.0758 | -0.0093 | |||||

| US57582RJN70 / Massachusetts (State of), Series 2016 F, GO Bonds | 0.34 | -0.29 | 0.0757 | -0.0046 | |||||

| US05492PAN87 / BAMLL Commercial Mortgage Securities Trust 2019-BPR | 0.34 | 169.84 | 0.0756 | 0.0459 | |||||

| US19521UAC71 / Cologix Data Centers US Issuer LLC | 0.34 | 0.90 | 0.0748 | -0.0037 | |||||

| US70339PAA75 / Pattern Energy Operations LP / Pattern Energy Operations Inc | 0.33 | 4.08 | 0.0739 | -0.0012 | |||||

| US912810SW99 / United States Treasury Note/Bond | 0.33 | -2.08 | 0.0736 | -0.0058 | |||||

| US3618BDJM88 / Ginnie Mae II Pool | 0.33 | -0.90 | 0.0732 | -0.0048 | |||||

| US458140CB48 / Intel Corp | 0.32 | -34.35 | 0.0719 | -0.0440 | |||||

| US37046US851 / General Motors Financial Co Inc | 0.32 | 1.90 | 0.0714 | -0.0027 | |||||

| Global Atlantic Fin Co / DBT (US37959GAF46) | 0.32 | 0.94 | 0.0713 | -0.0034 | |||||

| US912810TD00 / United States Treasury Note/Bond | 0.32 | -3.33 | 0.0710 | -0.0066 | |||||

| US3138LEDP30 / Fannie Mae Pool | 0.32 | -0.31 | 0.0708 | -0.0043 | |||||

| US03444RAB42 / Andrew W Mellon Foundation/The | 0.31 | 1.29 | 0.0699 | -0.0031 | |||||

| US3617UUSS88 / Ginnie Mae II Pool | 0.31 | -2.49 | 0.0697 | -0.0058 | |||||

| US233046AN14 / DB Master Finance LLC | 0.31 | 0.65 | 0.0692 | -0.0035 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.31 | 0.0683 | 0.0683 | ||||||

| US53079EBM57 / Liberty Mutual Group Inc | 0.31 | 1.67 | 0.0680 | -0.0027 | |||||

| US 5YR NOTE (CBT) SEP25 / DIR (000000000) | 0.31 | 0.0678 | 0.0678 | ||||||

| USB / U.S. Bancorp - Depositary Receipt (Common Stock) | 0.30 | 0.0673 | 0.0673 | ||||||

| US15089QAX25 / CORP. NOTE | 0.30 | 1.69 | 0.0667 | -0.0028 | |||||

| INFA / Informatica Inc. | 0.30 | 0.34 | 0.0663 | -0.0037 | |||||

| Gates Global LLC 2024 Term Loan B5 / LON (US36740UAY82) | 0.30 | 1.02 | 0.0662 | -0.0033 | |||||

| USI Inc 2024 Term Loan D / LON (US90351NAR61) | 0.30 | 0.34 | 0.0660 | -0.0035 | |||||

| NJ 2025-WBRK / ABS-MBS (US65486BAG68) | 0.30 | 0.00 | 0.0659 | -0.0039 | |||||

| US05602HAA14 / BPR Trust 2022-SSP | 0.30 | -0.34 | 0.0657 | -0.0040 | |||||

| JW Commercial Mortgage Trust 2024-MRCO / ABS-MBS (US46657XAC02) | 0.29 | 0.00 | 0.0655 | -0.0038 | |||||

| US87332PAA84 / TYSN 2023-CRNR A VAR 12/10/2038 144A | 0.29 | 1.38 | 0.0653 | -0.0029 | |||||

| US912810TQ13 / United States Treasury Note/Bond | 0.29 | -2.34 | 0.0651 | -0.0053 | |||||

| US92855HAA32 / Vivint Solar Financing VII LLC, Series 2020-1A, Class A | 0.29 | 1.39 | 0.0650 | -0.0028 | |||||

| ESNT / Essent Group Ltd. | 0.29 | 0.69 | 0.0645 | -0.0034 | |||||

| US91282CCH25 / United States Treasury Note/Bond | 0.28 | 1.44 | 0.0627 | -0.0028 | |||||

| US13032UVE53 / CALIFORNIA ST HLTH FACS FING AUTH REVENUE | 0.28 | 0.36 | 0.0625 | -0.0034 | |||||

| US83162CYQ04 / United States Small Business Administration | 0.28 | -7.92 | 0.0621 | -0.0092 | |||||

| HLTN Commercial Mortgage Trust 2024-DPLO / ABS-MBS (US40424UAA51) | 0.28 | 0.00 | 0.0612 | -0.0035 | |||||

| US476681AA97 / Jersey Mike's Funding | 0.28 | 0.00 | 0.0612 | -0.0036 | |||||

| ANG.PRD / American National Group Inc. - Preferred Stock | 0.27 | 0.0611 | 0.0611 | ||||||

| US26209XAD30 / DRIVEN BRANDS FUNDING LLC | 0.27 | 1.49 | 0.0607 | -0.0027 | |||||

| US23802WAG69 / DataBank Issuer | 0.27 | 0.74 | 0.0605 | -0.0030 | |||||

| Oscar US Funding XVI LLC / ABS-O (US68784GAB95) | 0.27 | -30.67 | 0.0599 | -0.0315 | |||||

| US20848FAA84 / Conservation Fund | 0.27 | 0.75 | 0.0598 | -0.0031 | |||||

| US30334RAA23 / FS 23-4SZN A 144A 7.06626% 11-10-27 | 0.27 | 0.00 | 0.0597 | -0.0035 | |||||

| US02005NBU37 / Ally Financial Inc | 0.26 | 1.15 | 0.0587 | -0.0027 | |||||

| NextGear Floorplan Master Owner Trust / ABS-O (US65341KBZ84) | 0.26 | 0.00 | 0.0586 | -0.0034 | |||||

| US3136AV6R53 / Fannie Mae Grantor Trust 2017-T1 | 0.26 | 0.77 | 0.0585 | -0.0029 | |||||

| US05533UAH14 / BBVA Bancomer SA/Texas | 0.26 | 0.78 | 0.0579 | -0.0029 | |||||

| US45823TAL08 / Intact Financial Corp | 0.26 | 0.0576 | 0.0576 | ||||||

| US912810SP49 / United States Treasury Note/Bond | 0.26 | -2.64 | 0.0573 | -0.0051 | |||||

| US20754JAC80 / CORP CMO | 0.26 | -3.75 | 0.0573 | -0.0055 | |||||

| US05492PAL22 / BAMLL_19-BPR | 0.26 | 24.15 | 0.0573 | 0.0085 | |||||

| ACA / Crédit Agricole S.A. | 0.25 | 0.0566 | 0.0566 | ||||||

| US34531XAB01 / Ford Foundation/The | 0.25 | -2.68 | 0.0566 | -0.0048 | |||||

| US72703PAC77 / Planet Fitness Master Issuer LLC | 0.25 | 0.80 | 0.0561 | -0.0027 | |||||

| US7976465P76 / City & County of San Francisco CA | 0.25 | -0.79 | 0.0560 | -0.0035 | |||||

| US15135BAT89 / CORPORATE BONDS | 0.25 | 1.63 | 0.0556 | -0.0023 | |||||

| U.S. Treasury Notes / DBT (US91282CLF67) | 0.25 | 0.0556 | 0.0556 | ||||||

| US81527CAP23 / Sedgwick Claims Management Services Inc | 0.25 | 0.40 | 0.0555 | -0.0030 | |||||

| TK Elevator Midco GmbH 2025 USD Term Loan B / LON (XAD9000BAJ17) | 0.25 | 0.0554 | 0.0554 | ||||||

| Epicor Software Corporation 2024 Term Loan E / LON (US29426NAZ78) | 0.25 | 0.40 | 0.0553 | -0.0031 | |||||

| Medline Borrower LP 2024 USD Add-on Term Loan B / LON (US58503UAF03) | 0.25 | 0.40 | 0.0553 | -0.0030 | |||||

| Trans Union LLC 2024 Term Loan B9 / LON (US89334GBG82) | 0.25 | 0.00 | 0.0553 | -0.0031 | |||||

| US61945LAB99 / Mosaic Solar Loan Trust 2019-2 | 0.25 | -3.88 | 0.0553 | -0.0055 | |||||

| Les Schwab Tire Centers 2025 Term Loan B / LON (US50220KAD63) | 0.25 | 0.00 | 0.0552 | -0.0033 | |||||

| US12511BAC63 / CCC Intelligent Solutions Inc | 0.25 | 0.00 | 0.0551 | -0.0032 | |||||

| AmWINS Group Inc 2025 Term Loan B / LON (US03234TBA51) | 0.25 | 0.41 | 0.0551 | -0.0029 | |||||

| Cajun Global LLC / ABS-O (US12803PAC23) | 0.25 | 2.92 | 0.0550 | -0.0015 | |||||

| US61947DAC39 / Mosaic Solar Loan Trust 2021-1 | 0.25 | -8.24 | 0.0546 | -0.0082 | |||||

| US3137FXLX44 / Freddie Mac Multifamily Structured Pass Through Certificates | 0.24 | 1.67 | 0.0543 | -0.0023 | |||||

| US15135BAX91 / Centene Corp | 0.24 | 14.22 | 0.0536 | 0.0040 | |||||

| APi Group DE Inc 2025 Term Loan / LON (US00186XAN30) | 0.24 | 0.42 | 0.0532 | -0.0029 | |||||

| US708692BY34 / Pennsylvania Economic Development Financing Authority | 0.24 | 0.0528 | 0.0528 | ||||||

| US88224QAA58 / TCBI 4 05/06/31 | 0.23 | -0.43 | 0.0518 | -0.0031 | |||||

| US912810TN81 / United States Treasury Note/Bond | 0.23 | -6.50 | 0.0512 | -0.0067 | |||||

| MetroNet Infrastructure Issuer LLC / ABS-O (US59170JAG31) | 0.23 | 0.00 | 0.0505 | -0.0030 | |||||

| Government National Mortgage Association / ABS-MBS (US38384CBT53) | 0.22 | 0.0498 | 0.0498 | ||||||

| US6903534C81 / Overseas Private Investment Corporation 3.52%, Due 09/20/2032 | 0.22 | -2.63 | 0.0495 | -0.0043 | |||||

| US29375CAB54 / Enterprise Fleet Financing 2023-1 LLC | 0.22 | -24.83 | 0.0492 | -0.0202 | |||||

| US50212YAD67 / LPL Holdings Inc | 0.22 | -33.73 | 0.0490 | -0.0292 | |||||

| US68389XBX21 / ORACLE CORP SR UNSECURED 04/50 3.6 | 0.22 | 0.0490 | 0.0490 | ||||||

| US31418CQB36 / Federal National Mortgage Association | 0.22 | -3.14 | 0.0482 | -0.0043 | |||||

| US92212KAD81 / Vantage Data Centers Issuer LLC | 0.22 | 0.47 | 0.0480 | -0.0024 | |||||

| US05565AS207 / BNP Paribas SA | 0.21 | 0.00 | 0.0477 | -0.0026 | |||||

| Zegona Finance PLC / DBT (US98927UAA51) | 0.21 | 0.0475 | 0.0475 | ||||||

| Subway Funding LLC / ABS-O (US864300AG32) | 0.21 | 0.47 | 0.0474 | -0.0024 | |||||

| CABK / CaixaBank, S.A. | 0.21 | 1.46 | 0.0465 | -0.0021 | |||||

| US912810TB44 / T 1 7/8 11/15/51 | 0.20 | -3.32 | 0.0455 | -0.0043 | |||||

| US05964HAS40 / Banco Santander SA | 0.20 | 0.50 | 0.0452 | -0.0024 | |||||

| US3140J8NG48 / UMBS, 30 Year | 0.20 | -0.98 | 0.0451 | -0.0030 | |||||

| US3617UM5N21 / Ginnie Mae II Pool | 0.20 | -3.81 | 0.0449 | -0.0046 | |||||

| US904678AF64 / UniCredit SpA | 0.20 | 0.50 | 0.0448 | -0.0024 | |||||

| Bank of America Corp / DBT (US06051GMM86) | 0.20 | 1.01 | 0.0448 | -0.0021 | |||||

| US46115HBU05 / INTESA SANPAOLO SPA | 0.20 | -0.50 | 0.0448 | -0.0028 | |||||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 0.20 | 1.52 | 0.0446 | -0.0019 | |||||

| Raizen Fuels Finance SA / DBT (US75102XAB29) | 0.20 | -0.99 | 0.0445 | -0.0030 | |||||

| US904678AS85 / UniCredit SpA | 0.20 | 1.02 | 0.0442 | -0.0020 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 0.20 | 1.02 | 0.0441 | -0.0021 | |||||

| US911759NH72 / United States Department of Housing and Urban Development | 0.20 | 0.51 | 0.0441 | -0.0022 | |||||

| US86744VAA98 / Sunnova Helios IX Issuer LLC | 0.20 | -9.17 | 0.0441 | -0.0074 | |||||

| US911759NL84 / United States Department of Housing and Urban Development | 0.20 | 0.00 | 0.0439 | -0.0026 | |||||

| US86746EAA55 / HELIOS ISSUER LLC SER 2021-A CL A REGD 144A P/P 1.80000000 | 0.20 | -2.48 | 0.0439 | -0.0037 | |||||

| US05609VAJ44 / BX Commercial Mortgage Trust 2021-VOLT | 0.20 | -2.49 | 0.0437 | -0.0037 | |||||

| UZE / Array Digital Infrastructure, Inc. - Corporate Bond/Note | 0.01 | 0.00 | 0.20 | -7.14 | 0.0435 | -0.0060 | |||

| Kreditanstalt fuer Wiederaufbau / DBT (US500769KD52) | 0.20 | 0.52 | 0.0435 | -0.0023 | |||||

| US13032UVL96 / CALIFORNIA ST HLTH FACS FING AUTH REVENUE | 0.19 | 0.00 | 0.0433 | -0.0024 | |||||

| US912810SZ21 / United States Treasury Note/Bond | 0.19 | -3.48 | 0.0433 | -0.0040 | |||||

| US902613AD01 / UBS Group AG | 0.19 | 3.19 | 0.0431 | -0.0011 | |||||

| US912810TG31 / U.S. Treasury Bonds | 0.19 | -3.02 | 0.0430 | -0.0039 | |||||

| US3140X5CD30 / Fannie Mae Pool | 0.19 | -2.54 | 0.0428 | -0.0035 | |||||

| US00253XAA90 / American Airlines Inc/AAdvantage Loyalty IP Ltd | 0.19 | -20.00 | 0.0428 | -0.0138 | |||||

| US86772HAA59 / Sunrun Demeter Issuer 2021-2 | 0.19 | 0.52 | 0.0427 | -0.0023 | |||||

| ANG.PRD / American National Group Inc. - Preferred Stock | 0.19 | -20.08 | 0.0426 | -0.0136 | |||||

| US14040HBJ32 / Capital One Financial Corp. | 0.19 | 0.00 | 0.0422 | -0.0023 | |||||

| Aircastle Ltd / Aircastle Ireland DAC / DBT (US00929JAA43) | 0.19 | 1.07 | 0.0421 | -0.0021 | |||||

| US860630AG72 / Stifel Financial Corp | 0.19 | -25.98 | 0.0419 | -0.0180 | |||||

| US13032UVG02 / CALIFORNIA ST HLTH FACS FING AUTH REVENUE | 0.19 | 0.53 | 0.0418 | -0.0022 | |||||

| US3618AUD540 / Ginnie Mae II Pool | 0.19 | -0.53 | 0.0417 | -0.0025 | |||||

| FHN.PRF / First Horizon Corporation - Preferred Stock | 0.19 | -26.95 | 0.0417 | -0.0186 | |||||

| US3137FG6Q37 / FHLMC, Multifamily Structured Pass-Through Certificates, Series W5FX, Class AFX | 0.19 | 0.54 | 0.0417 | -0.0021 | |||||

| Raizen Fuels Finance SA / DBT (US75102XAD84) | 0.19 | -1.58 | 0.0417 | -0.0031 | |||||

| Ally Bank Auto Credit-Linked Notes Series 2024-B / ABS-O (US02007G4C45) | 0.19 | -10.95 | 0.0416 | -0.0078 | |||||

| US26884UAG40 / EPR Properties | 0.19 | 108.99 | 0.0414 | 0.0204 | |||||

| US12569QAA85 / CHNGE_23-4 | 0.19 | -11.48 | 0.0411 | -0.0082 | |||||

| US15135BAV36 / CENTENE CORP 3.375% 02/15/2030 | 0.18 | 1.67 | 0.0408 | -0.0016 | |||||

| BPYPO / Brookfield Property Partners L.P. - Preferred Stock | 0.01 | 0.00 | 0.18 | 9.70 | 0.0404 | 0.0014 | |||

| US65246QAA76 / NZES_21-GNT1 | 0.18 | -3.78 | 0.0396 | -0.0041 | |||||

| US38384AF656 / Government National Mortgage Association | 0.18 | -1.12 | 0.0392 | -0.0028 | |||||

| ORL Trust 2024-GLKS / ABS-MBS (US67120DAG07) | 0.18 | 0.00 | 0.0391 | -0.0024 | |||||

| SERVPRO Master Issuer LLC / ABS-O (US817743AJ65) | 0.17 | 0.58 | 0.0385 | -0.0020 | |||||

| US86772FAA93 / SUNRUN ATLAS ISSUER 2019-2 LLC SER 2019-2 CL A REGD 144A P/P 3.61000000 | 0.17 | 0.58 | 0.0383 | -0.0021 | |||||

| Oportun Issuance Trust 2025-A / ABS-O (US68377TAB44) | 0.17 | 0.00 | 0.0382 | -0.0022 | |||||

| BPYPN / Brookfield Property Partners L.P. - Preferred Stock | 0.01 | 0.00 | 0.17 | 4.94 | 0.0378 | -0.0004 | |||

| US97064FAB13 / Willis Engine Structured Trust V | 0.17 | -2.86 | 0.0378 | -0.0034 | |||||

| U.S. Treasury Bonds / DBT (US912810TX63) | 0.17 | -3.45 | 0.0375 | -0.0035 | |||||

| US38384AG647 / Government National Mortgage Association | 0.17 | -0.59 | 0.0375 | -0.0025 | |||||

| US345397D674 / FORD MOTOR CREDIT CO LLC SR UNSEC 7.122% 11-07-33 | 0.17 | 1.85 | 0.0367 | -0.0015 | |||||

| US34417MAB37 / FOCUS Brands Funding LLC | 0.16 | 0.00 | 0.0366 | -0.0021 | |||||

| US02772AAA79 / American National Group Inc | 0.16 | 48.62 | 0.0360 | 0.0103 | |||||

| US18539UAE55 / Clearway Energy Operating LLC | 0.16 | 5.33 | 0.0351 | -0.0004 | |||||

| US30227FAJ93 / Extended Stay America Trust | 0.15 | -0.65 | 0.0344 | -0.0023 | |||||

| US91282CHX20 / United States Treasury Note/Bond | 0.15 | 0.65 | 0.0342 | -0.0018 | |||||

| AIG / American International Group, Inc. - Depositary Receipt (Common Stock) | 0.15 | 0.0341 | 0.0341 | ||||||

| US631060CR97 / NARRAGANSETT BAY RI COMMISSION WSTWTR SYS REVENUE | 0.15 | 1.32 | 0.0341 | -0.0015 | |||||

| US418751AE33 / HAT Holdings I LLC / HAT Holdings II LLC | 0.15 | 0.66 | 0.0340 | -0.0016 | |||||

| HXL / Hexcel Corporation | 0.15 | 0.0339 | 0.0339 | ||||||

| US20754RAJ59 / Connecticut Avenue Securities Trust, Series 2021-R01, Class 1B2 | 0.15 | 0.00 | 0.0332 | -0.0020 | |||||

| US81761TAC99 / ServiceMaster Funding LLC | 0.15 | 1.36 | 0.0331 | -0.0016 | |||||

| Subway Funding LLC / ABS-O (US864300AJ70) | 0.15 | 0.68 | 0.0331 | -0.0018 | |||||

| INTOWN 2025-STAY Mortgage Trust / ABS-MBS (US46117WAE21) | 0.15 | 0.00 | 0.0331 | -0.0018 | |||||

| US91282CHC82 / United States Treasury Note/Bond | 0.15 | 0.68 | 0.0331 | -0.0017 | |||||

| US91282CHY03 / United States Treasury Note/Bond | 0.14 | -7.14 | 0.0318 | -0.0045 | |||||

| U.S. Treasury Bonds / DBT (US912810TZ12) | 0.14 | -2.05 | 0.0318 | -0.0026 | |||||

| SNV.PRD / Synovus Financial Corp. - Preferred Stock | 0.14 | 105.80 | 0.0317 | 0.0153 | |||||

| US38237HAA59 / GoodLeap Sustainable Home Solutions Trust 2021-5 | 0.14 | 0.71 | 0.0317 | -0.0017 | |||||

| US81761TAA34 / SERVICEMASTER BRANDS SERV 2020 1 A2I 144A | 0.14 | 0.00 | 0.0313 | -0.0016 | |||||

| US3140XARZ79 / Fannie Mae Pool | 0.14 | -3.45 | 0.0313 | -0.0030 | |||||

| AIG / American International Group, Inc. - Depositary Receipt (Common Stock) | 0.14 | 0.0312 | 0.0312 | ||||||

| PNCS34 / The PNC Financial Services Group, Inc. - Depositary Receipt (Common Stock) | 0.14 | -59.24 | 0.0309 | -0.0493 | |||||

| XS2554581830 / ASR Nederland NV | 0.14 | 9.60 | 0.0306 | 0.0011 | |||||

| US912810TR95 / United States Treasury Note/Bond | 0.13 | -36.36 | 0.0297 | -0.0196 | |||||

| US02005NBM11 / Ally Financial Inc | 0.13 | 3.17 | 0.0291 | -0.0006 | |||||

| US797412DS99 / SAN DIEGO CNTY CA WTR AUTH | 0.13 | 2.38 | 0.0287 | -0.0010 | |||||

| US68377GAA40 / OPTN_21-B | 0.13 | -23.81 | 0.0285 | -0.0111 | |||||

| AS Mileage Plan IP Ltd / DBT (US00218QAB68) | 0.13 | 0.00 | 0.0284 | -0.0015 | |||||

| US169926AC67 / CHNGE Mortgage Trust 2023-2 | 0.13 | -16.45 | 0.0282 | -0.0077 | |||||

| US91282CAE12 / United States Treasury Note/Bond | 0.13 | 12.50 | 0.0281 | 0.0014 | |||||

| US20451NAG60 / Compass Minerals International, Inc. | 0.13 | -43.44 | 0.0278 | -0.0242 | |||||

| US631060CS70 / NARRAGANSETT BAY RI COMMISSION WSTWTR SYS REVENUE | 0.12 | 1.64 | 0.0276 | -0.0012 | |||||

| NRM FHT1 Excess Owner LLC / ABS-MBS (US64832EAA73) | 0.12 | -4.65 | 0.0275 | -0.0030 | |||||

| US68377WAB72 / Oportun Issuance Trust 2021-C | 0.12 | -21.15 | 0.0275 | -0.0092 | |||||

| US912810TL26 / TREASURY BOND | 0.12 | -51.20 | 0.0272 | -0.0317 | |||||

| LHOME Mortgage Trust 2024-RTL1 / ABS-MBS (US50205DAA72) | 0.12 | 0.00 | 0.0269 | -0.0016 | |||||

| Government National Mortgage Association / ABS-MBS (US38385BP536) | 0.12 | -1.68 | 0.0262 | -0.0020 | |||||

| US61946CAA09 / MSAIC_19-1A | 0.12 | -4.13 | 0.0258 | -0.0026 | |||||

| US631060CU27 / NARRAGANSETT BAY RI COMMISSION WSTWTR SYS REVENUE | 0.12 | 1.77 | 0.0256 | -0.0011 | |||||

| US797412DT72 / SAN DIEGO CNTY CA WTR AUTH | 0.11 | 1.80 | 0.0252 | -0.0009 | |||||

| Apollo Debt Solutions BDC / DBT (US03770DAD57) | 0.11 | 0.90 | 0.0250 | -0.0013 | |||||

| US911759NJ39 / United States Department of Housing and Urban Development | 0.11 | 0.00 | 0.0248 | -0.0013 | |||||

| US254845JZ44 / District of Columbia, Water and Sewer Authority, Public Utility, Senior Lien, Series 2014A | 0.11 | -2.63 | 0.0247 | -0.0022 | |||||

| XS2680929788 / Retained Vantage Data Centers Issuer LLC | 0.11 | 5.77 | 0.0245 | -0.0001 | |||||

| U.S. Treasury Bonds / DBT (US912810UB25) | 0.11 | -2.68 | 0.0244 | -0.0020 | |||||

| US86773PAA66 / SUNRN_19-1A | 0.11 | -6.84 | 0.0244 | -0.0031 | |||||

| US631060CT53 / NARRAGANSETT BAY RI COMMISSION WSTWTR SYS REVENUE | 0.11 | 1.89 | 0.0242 | -0.0010 | |||||

| US91282CBL46 / United States Treasury Note/Bond | 0.11 | -74.82 | 0.0239 | -0.0768 | |||||

| Stream Innovations 2024-1 Issuer Trust / ABS-O (US86324CAB72) | 0.11 | 0.95 | 0.0236 | -0.0011 | |||||

| US85022WAP95 / SpringCastle America Funding LLC | 0.10 | -8.04 | 0.0231 | -0.0033 | |||||

| US35564KRE19 / Freddie Mac Structured Agency Credit Risk Debt Notes | 0.10 | -16.26 | 0.0229 | -0.0061 | |||||

| Avis Budget Rental Car Funding AESOP LLC / ABS-O (US05377RJM79) | 0.10 | 1.00 | 0.0226 | -0.0010 | |||||

| Center Street Lending Resi-Investor ABS Mortgage Trust 2024-RTL1 / ABS-MBS (US15169CAA62) | 0.10 | 0.00 | 0.0226 | -0.0012 | |||||

| Government National Mortgage Association / ABS-MBS (US38384KQ959) | 0.10 | 1.00 | 0.0225 | -0.0012 | |||||

| NYMT Loan Trust Series 2024-BPL1 / ABS-MBS (US62956MAA36) | 0.10 | -0.99 | 0.0224 | -0.0014 | |||||

| GWT 2024-WLF2 / ABS-MBS (US362414AG97) | 0.10 | 0.00 | 0.0223 | -0.0013 | |||||

| ORL Trust 2024-GLKS / ABS-MBS (US67120DAL91) | 0.10 | 0.00 | 0.0222 | -0.0013 | |||||

| US35564TBE91 / Freddie Mac STACR Trust 2019-DNA3 | 0.10 | 0.00 | 0.0218 | -0.0013 | |||||

| US440405AE86 / Horizon Aircraft Finance I Ltd | 0.10 | -12.04 | 0.0213 | -0.0043 | |||||

| US20753WAE66 / Connecticut Avenue Securities Trust, Series 2019-R07, Class 1B1 | 0.09 | -4.08 | 0.0210 | -0.0021 | |||||

| US25265LAE02 / Diamond Infrastructure Funding LLC | 0.09 | 0.00 | 0.0208 | -0.0011 | |||||

| US26982AAC80 / Eagle RE 2021-2 Ltd | 0.09 | -22.03 | 0.0205 | -0.0074 | |||||

| US912810TJ79 / United States Treasury Note/Bond | 0.09 | -3.19 | 0.0204 | -0.0019 | |||||

| Oaktree Strategic Credit Fund / DBT (US67403AAB52) | 0.09 | -1.09 | 0.0204 | -0.0013 | |||||

| BX Trust 2025-GW / ABS-MBS (US12433GAJ58) | 0.09 | 0.0201 | 0.0201 | ||||||

| US59982XAC92 / Mill City Solar Loan 2020-1 Ltd | 0.09 | -5.26 | 0.0200 | -0.0023 | |||||

| Cloud Capital Holdco LP / ABS-O (US102104AC05) | 0.09 | 0.00 | 0.0190 | -0.0012 | |||||

| OXYD / Occidental Petroleum Corporation - Depositary Receipt (Common Stock) | 0.08 | 0.0187 | 0.0187 | ||||||

| US91282CJR34 / United States Treasury Note/Bond - When Issued | 0.08 | 1.22 | 0.0185 | -0.0009 | |||||

| US26208LAD01 / DRIVEN BRANDS FUNDING LLC | 0.08 | 0.00 | 0.0180 | -0.0011 | |||||

| TX Trust 2024-HOU / ABS-MBS (US90216DAL64) | 0.08 | 0.00 | 0.0174 | -0.0010 | |||||

| US233046AF89 / DB Master Finance LLC | 0.08 | 1.30 | 0.0174 | -0.0008 | |||||

| US91282CHE49 / United States Treasury Note/Bond | 0.07 | 0.00 | 0.0166 | -0.0009 | |||||

| US95058XAE85 / Wendy's Funding LLC, Series 2018-1A, Class A2II | 0.07 | 1.41 | 0.0161 | -0.0008 | |||||

| US62955MAB28 / NRZ Excess Spread-Collateralized Notes | 0.07 | -5.33 | 0.0159 | -0.0019 | |||||

| US88339FAB94 / Theorem Funding Trust 2022-2 | 0.07 | -1.41 | 0.0158 | -0.0011 | |||||

| US 10YR NOTE (CBT)SEP25 / DIR (000000000) | 0.07 | 0.0157 | 0.0157 | ||||||

| US3618B54N96 / Ginnie Mae II Pool | 0.07 | 0.00 | 0.0157 | -0.0010 | |||||

| US91282CHT18 / US TNOTE 3.875% DUE 08/15/2033 | 0.07 | 0.00 | 0.0155 | -0.0008 | |||||

| NEXT34 / NextEra Energy, Inc. - Depositary Receipt (Common Stock) | 0.07 | 43.75 | 0.0155 | 0.0040 | |||||

| MetroNet Infrastructure Issuer LLC / ABS-O (US59170JAH14) | 0.07 | 0.00 | 0.0155 | -0.0009 | |||||

| US437307AD33 / Home RE 2021-1 Ltd | 0.07 | -29.03 | 0.0148 | -0.0071 | |||||

| US02401LAA26 / American Assets Trust LP | 0.07 | -10.81 | 0.0147 | -0.0027 | |||||

| US3132ACM806 / Freddie Mac Pool | 0.07 | -1.52 | 0.0146 | -0.0010 | |||||

| US912828Z948 / United States Treasury Note/Bond | 0.06 | 1.61 | 0.0141 | -0.0006 | |||||

| US22003BAM81 / Corporate Office Properties LP | 0.06 | 1.67 | 0.0138 | -0.0005 | |||||

| US69120VAU52 / BLUE OWL CREDIT 7.75 1/29 | 0.06 | 0.00 | 0.0137 | -0.0007 | |||||

| Bell Telephone Co of Canada or Bell Canada / DBT (US0778FPAP47) | 0.06 | 1.67 | 0.0137 | -0.0005 | |||||

| US35564KDX46 / Freddie Mac Structured Agency Credit Risk Debt Notes | 0.06 | 0.00 | 0.0137 | -0.0009 | |||||

| US61946PAB94 / MSAIC 2020 2A B 144A | 0.06 | -3.17 | 0.0137 | -0.0012 | |||||

| US ULTRA BOND CBT SEP25 / DIR (000000000) | 0.06 | 0.0135 | 0.0135 | ||||||

| US91282CHQ78 / United States Treasury Note/Bond | 0.06 | 0.00 | 0.0135 | -0.0007 | |||||

| US3133KRL514 / Freddie Mac Pool | 0.06 | 0.00 | 0.0135 | -0.0008 | |||||

| US35564KDY29 / Freddie Mac Structured Agency Credit Risk Debt Notes | 0.06 | 1.69 | 0.0135 | -0.0005 | |||||

| US61946TAC99 / Mosaic Solar Loan Trust 2021-3 | 0.06 | -3.33 | 0.0129 | -0.0014 | |||||

| US20754HAD08 / Connecticut Avenue Securities Trust, Series 2019-R05, Class 1B1 | 0.06 | -3.39 | 0.0127 | -0.0013 | |||||

| Lendbuzz Securitization Trust 2025-2 / ABS-O (US52611JAD28) | 0.06 | 0.0123 | 0.0123 | ||||||

| US742855AA76 / Prodigy Finance CM2021-1 Designated Activity Co | 0.05 | -11.48 | 0.0122 | -0.0024 | |||||

| US61946PAA12 / 1.44% 20 Aug 2046 | 0.05 | -3.64 | 0.0119 | -0.0011 | |||||

| US418751AD59 / HAT Holdings I LLC / HAT Holdings II LLC | 0.05 | 3.92 | 0.0118 | -0.0003 | |||||

| US20754FAL67 / Connecticut Avenue Securities Trust, Series 2019-R01, Class 2B1 | 0.05 | -3.77 | 0.0115 | -0.0011 | |||||

| 53219LAH2 / LifePoint Health, Inc. Bond | 0.05 | 8.51 | 0.0115 | 0.0002 | |||||

| US57767XAB64 / Mav Acquisition Corp. | 0.05 | 2.04 | 0.0113 | -0.0003 | |||||

| US57638P1049 / MasterBrand, Inc. | 0.05 | 47.06 | 0.0111 | 0.0029 | |||||

| Focus Financial Partners LLC / DBT (US34417VAA52) | 0.05 | 0.0111 | 0.0111 | ||||||

| Clarios Global LP / Clarios US Finance Co / DBT (US18060TAD72) | 0.05 | 0.0111 | 0.0111 | ||||||

| US830867AA59 / Delta Air Lines Inc / SkyMiles IP Ltd | 0.05 | -33.78 | 0.0111 | -0.0065 | |||||

| US81254UAK25 / Seaspan Corp | 0.05 | 4.26 | 0.0110 | -0.0001 | |||||

| US3140NNS970 / Fannie Mae Pool | 0.05 | -28.99 | 0.0109 | -0.0053 | |||||

| US59565JAA97 / MIDAS OPCO HOLDINGS LLC | 0.05 | 0.0109 | 0.0109 | ||||||

| US83545GBD34 / Sonic Automotive Inc | 0.05 | 4.35 | 0.0108 | 0.0004 | |||||

| US039524AA11 / ARCHES BUYER INC 4.25% 06/01/2028 144A | 0.05 | 0.0106 | 0.0106 | ||||||

| US15089QAY08 / Celanese US Holdings LLC | 0.05 | 0.00 | 0.0106 | -0.0004 | |||||

| ENVIVA LLC / STIV (000000000) | 0.00 | 0.05 | 0.0105 | 0.0105 | |||||

| US579063AB46 / Condor Merger Sub Inc | 0.05 | 0.0105 | 0.0105 | ||||||

| Ellucian Holdings Inc / DBT (US289178AA37) | 0.05 | 0.0103 | 0.0103 | ||||||

| Tricolor Auto Securitization Trust 2024-3 / ABS-O (US89617AAA34) | 0.05 | -30.30 | 0.0102 | -0.0054 | |||||

| CCO / Clear Channel Outdoor Holdings, Inc. | 0.05 | 4.65 | 0.0101 | -0.0001 | |||||

| US72815LAA52 / Playtika Holding Corp | 0.05 | 0.0101 | 0.0101 | ||||||

| US832248BB38 / Smithfield Foods, Inc. | 0.05 | 2.27 | 0.0101 | -0.0005 | |||||

| US84055BAA17 / South32 Treasury Ltd | 0.05 | 2.27 | 0.0100 | -0.0006 | |||||

| US912810SU34 / United States Treasury Note/Bond | 0.04 | -2.22 | 0.0099 | -0.0009 | |||||

| US85236KAE29 / Stack Infrastructure Issuer LLC | 0.04 | 0.00 | 0.0098 | -0.0005 | |||||

| US315289AC26 / Ferrellgas Escrow LLC / FG Operating Finance Escrow Corp | 0.04 | 0.0093 | 0.0093 | ||||||

| US53948LAC19 / Loanpal Solar Loan 2021-1 Ltd | 0.04 | -6.82 | 0.0093 | -0.0012 | |||||

| US912828ZQ64 / United States Treasury Note/Bond - When Issued | 0.04 | 700.00 | 0.0090 | 0.0076 | |||||

| US552848AG81 / MGIC Investment Corp | 0.04 | -76.88 | 0.0089 | -0.0319 | |||||

| US3137HABQ81 / Freddie Mac REMICS | 0.04 | -2.50 | 0.0089 | -0.0006 | |||||

| US93710WAA36 / WASH Multifamily Acquisition Inc | 0.04 | 0.00 | 0.0089 | -0.0005 | |||||

| US3618AUEB03 / Ginnie Mae II Pool | 0.04 | -4.88 | 0.0088 | -0.0009 | |||||

| US912810SC36 / United States Treas Bds Bond | 0.04 | -2.50 | 0.0088 | -0.0007 | |||||

| VB-S1 Issuer LLC - VBTEL / ABS-O (US91823ABG58) | 0.04 | 0.00 | 0.0086 | -0.0005 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.04 | 0.00 | 0.0085 | -0.0005 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.04 | -16.28 | 0.0082 | -0.0021 | |||||

| US26208LAE83 / DRIVEN BRANDS FUNDING LLC | 0.04 | 0.00 | 0.0081 | -0.0005 | |||||

| UZD / Array Digital Infrastructure, Inc. - Corporate Bond/Note | 0.00 | 67.06 | 0.03 | 65.00 | 0.0074 | 0.0027 | |||

| US91282CCS89 / United States Treasury Note/Bond | 0.03 | 0.0070 | 0.0070 | ||||||

| US61946NAA63 / Mosaic Solar Loan Trust 2020-1 | 0.03 | -3.23 | 0.0069 | -0.0007 | |||||

| US61946NAB47 / Mosaic Solar Loan Trust 2020-1 | 0.03 | -3.23 | 0.0068 | -0.0006 | |||||

| US91282CDF59 / U.S. Treasury Notes | 0.03 | 0.00 | 0.0066 | -0.0003 | |||||

| US912810TS78 / United States Treasury Note/Bond | 0.03 | 0.0062 | 0.0059 | ||||||

| US91282CCR07 / U.S. Treasury Notes | 0.03 | 0.00 | 0.0061 | -0.0003 | |||||

| US LONG BOND(CBT) SEP25 / DIR (000000000) | 0.03 | 0.0060 | 0.0060 | ||||||

| US35566CBD65 / Freddie Mac STACR REMIC Trust 2020-DNA6 | 0.03 | -3.70 | 0.0060 | -0.0004 | |||||

| US38384BXQ93 / Government National Mortgage Association | 0.03 | -3.85 | 0.0058 | -0.0004 | |||||

| US38384BS699 / Government National Mortgage Association | 0.03 | -3.85 | 0.0058 | -0.0004 | |||||

| US69120VAU52 / BLUE OWL CREDIT 7.75 1/29 | 0.03 | 0.0057 | 0.0057 | ||||||

| US37959GAD97 / Global Atlantic Fin Co | 0.02 | -90.16 | 0.0055 | -0.0520 | |||||

| Government National Mortgage Association / ABS-MBS (US38384MAU18) | 0.02 | 0.00 | 0.0055 | -0.0003 | |||||

| US12803VAA35 / CAJUN 2021-1 A2 11/51 | 0.02 | 0.00 | 0.0055 | -0.0002 | |||||

| US Acute Care Solutions LLC / DBT (US90367UAD37) | 0.02 | 0.0053 | 0.0053 | ||||||

| US91282CHB00 / TREASURY NOTE | 0.02 | 0.00 | 0.0051 | -0.0003 | |||||

| US74736KAJ07 / Qorvo, Inc. | 0.02 | 0.0050 | 0.0050 | ||||||

| Champ Acquisition Corp / DBT (US15807XAA81) | 0.02 | 0.0047 | 0.0047 | ||||||

| US61946UAD46 / Mosaic Solar Loan Trust 2022-2 | 0.02 | -9.09 | 0.0047 | -0.0007 | |||||

| US11135EAA29 / Broadstone Net Lease LLC | 0.02 | 0.00 | 0.0045 | -0.0002 | |||||

| Oaktree Strategic Credit Fund / DBT (US67403AAE91) | 0.02 | 0.00 | 0.0039 | -0.0002 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.02 | 0.00 | 0.0036 | -0.0002 | |||||

| US69546LAA70 / PAID_21-2 | 0.01 | -44.00 | 0.0032 | -0.0027 | |||||

| US708692BY34 / Pennsylvania Economic Development Financing Authority | 0.01 | 0.0029 | 0.0029 | ||||||

| US20754KAF84 / Fannie Mae Connecticut Avenue Securities | 0.01 | 0.00 | 0.0028 | -0.0002 | |||||

| US46642MAG33 / JP Morgan Chase Commercial Mortgage Securities Trust 2014-DSTY | 0.01 | -29.41 | 0.0028 | -0.0013 | |||||

| US53219LAV18 / LifePoint Health Inc | 0.01 | 0.0026 | 0.0026 | ||||||

| Fortitude Group Holdings LLC / DBT (US34966XAA63) | 0.01 | -77.27 | 0.0023 | -0.0082 | |||||

| US912810RX81 / United States Treas Bds Bond | 0.01 | 0.00 | 0.0022 | -0.0002 | |||||

| US882925AA84 / Theorem Funding Trust 2022-3 | 0.01 | -58.82 | 0.0017 | -0.0024 | |||||

| US91282CFL00 / Treasury, United States Department of | 0.01 | 16.67 | 0.0016 | -0.0001 | |||||

| US 2YR NOTE (CBT) SEP25 / DIR (000000000) | 0.01 | 0.0015 | 0.0015 | ||||||

| US69547PAA75 / Pagaya AI Debt Selection Trust, Series 2021-HG1, Class A | 0.00 | -50.00 | 0.0007 | -0.0008 | |||||

| US46642MAJ71 / JP Morgan Chase Commercial Mortgage Securities Trust 2014-DSTY | 0.00 | -50.00 | 0.0004 | -0.0001 | |||||

| US912810FT08 / United States Treasury Note/Bond | 0.00 | 0.00 | 0.0002 | -0.0000 | |||||

| US91282CAV37 / United States Treasury Note/Bond | 0.00 | -100.00 | 0.0002 | -0.0110 | |||||

| US912810SN90 / UNITED STATES TREASURY BOND 1.25% 05/15/2050 | 0.00 | 0.0001 | 0.0001 | ||||||

| US 10YR ULTRA FUT SEP25 / DIR (000000000) | 0.00 | 0.0001 | 0.0001 | ||||||

| ESC GCB144A ENVIVA PAR / DBT (294ESCAA6) | 0.00 | 0.0000 | -0.0000 | ||||||

| BNP / BNP Paribas SA | -0.00 | -0.0002 | -0.0002 | ||||||

| US 10YR NOTE (CBT)SEP25 / DIR (000000000) | -0.00 | -0.0003 | -0.0003 | ||||||

| BNP / BNP Paribas SA | -0.00 | -0.0006 | -0.0006 | ||||||

| US LONG BOND(CBT) SEP25 / DIR (000000000) | -0.01 | -0.0020 | -0.0020 | ||||||

| BNP / BNP Paribas SA | -0.01 | -0.0023 | -0.0023 | ||||||

| US 2YR NOTE (CBT) SEP25 / DIR (000000000) | -0.02 | -0.0047 | -0.0047 | ||||||

| US ULTRA BOND CBT SEP25 / DIR (000000000) | -0.02 | -0.0049 | -0.0049 | ||||||

| US 10YR ULTRA FUT SEP25 / DIR (000000000) | -0.07 | -0.0151 | -0.0151 |