Mga Batayang Estadistika

| Nilai Portofolio | $ 133,254,828 |

| Posisi Saat Ini | 80 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

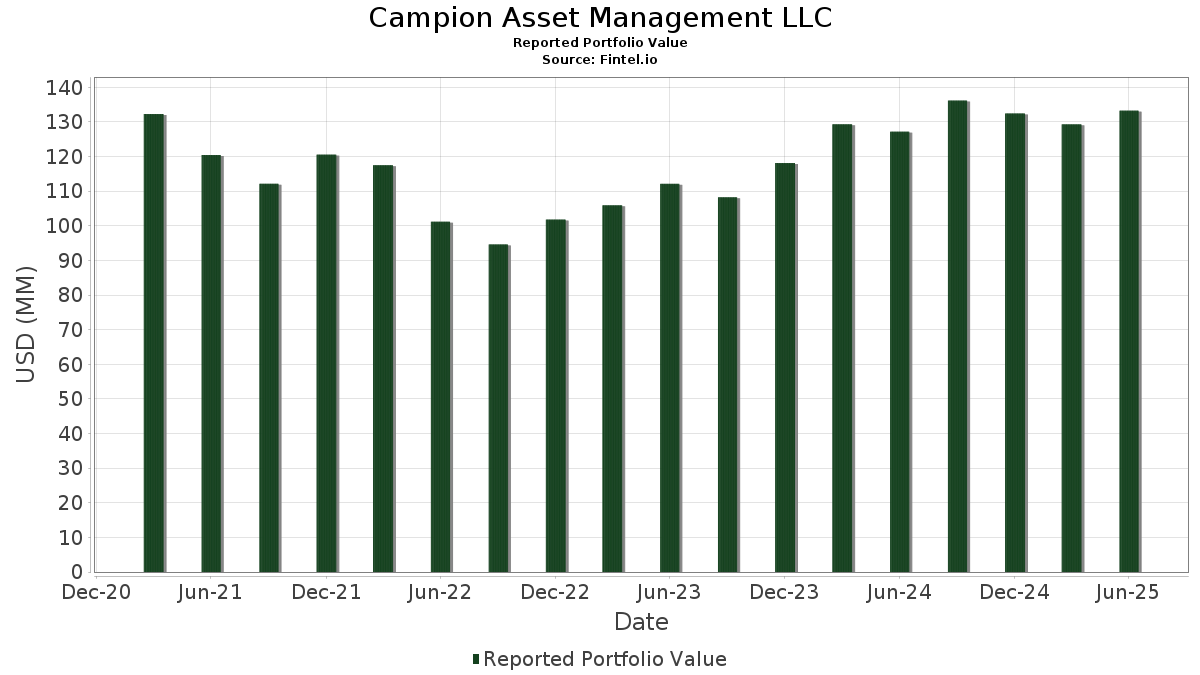

Campion Asset Management LLC telah mengungkapkan total kepemilikan 80 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 133,254,828 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Campion Asset Management LLC adalah iShares Trust - iShares Russell 1000 ETF (US:IWB) , iShares Trust - iShares Core S&P Mid-Cap ETF (US:IJH) , iShares Trust - iShares Core S&P 500 ETF (US:IVV) , iShares Trust - iShares Russell Mid-Cap ETF (US:IWR) , and Vanguard Tax-Managed Funds - Vanguard FTSE Developed Markets ETF (US:VEA) . Posisi baru Campion Asset Management LLC meliputi: SPDR Series Trust - SPDR S&P Aerospace & Defense ETF (US:XAR) , Meta Platforms, Inc. (US:META) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.02 | 10.75 | 8.0702 | 1.0342 | |

| 0.18 | 11.26 | 8.4488 | 0.8197 | |

| 0.15 | 8.55 | 6.4196 | 0.6629 | |

| 0.01 | 2.77 | 2.0765 | 0.4615 | |

| 0.03 | 3.81 | 2.8621 | 0.4506 | |

| 0.03 | 11.30 | 8.4795 | 0.4184 | |

| 0.11 | 9.69 | 7.2718 | 0.2815 | |

| 0.00 | 0.81 | 0.6102 | 0.2282 | |

| 0.00 | 0.90 | 0.6784 | 0.2070 | |

| 0.02 | 2.98 | 2.2340 | 0.1944 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.02 | 3.60 | 2.6984 | -0.4426 | |

| 0.02 | 1.90 | 1.4283 | -0.2303 | |

| 0.00 | 2.32 | 1.7421 | -0.2073 | |

| 0.08 | 6.78 | 5.0917 | -0.1977 | |

| 0.01 | 0.89 | 0.6706 | -0.1597 | |

| 0.01 | 1.48 | 1.1072 | -0.1485 | |

| 0.01 | 0.76 | 0.5731 | -0.1151 | |

| 0.01 | 0.53 | 0.3966 | -0.1056 | |

| 0.00 | 0.96 | 0.7203 | -0.0997 | |

| 0.01 | 0.78 | 0.5823 | -0.0835 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-07-17 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| IWB / iShares Trust - iShares Russell 1000 ETF | 0.03 | -2.07 | 11.30 | 8.40 | 8.4795 | 0.4184 | |||

| IJH / iShares Trust - iShares Core S&P Mid-Cap ETF | 0.18 | 7.38 | 11.26 | 14.13 | 8.4488 | 0.8197 | |||

| IVV / iShares Trust - iShares Core S&P 500 ETF | 0.02 | 6.97 | 10.75 | 18.20 | 8.0702 | 1.0342 | |||

| IWR / iShares Trust - iShares Russell Mid-Cap ETF | 0.11 | -0.84 | 9.69 | 7.20 | 7.2718 | 0.2815 | |||

| VEA / Vanguard Tax-Managed Funds - Vanguard FTSE Developed Markets ETF | 0.15 | 2.47 | 8.55 | 14.93 | 6.4196 | 0.6629 | |||

| LMT / Lockheed Martin Corporation | 0.02 | 0.00 | 8.05 | 3.67 | 6.0409 | 0.0362 | |||

| VNQ / Vanguard Specialized Funds - Vanguard Real Estate ETF | 0.08 | 0.86 | 6.78 | -0.80 | 5.0917 | -0.1977 | |||

| IJR / iShares Trust - iShares Core S&P Small-Cap ETF | 0.04 | 4.67 | 4.26 | 9.39 | 3.1991 | 0.1853 | |||

| IGM / iShares Trust - iShares Expanded Tech Sector ETF | 0.03 | -1.28 | 3.81 | 22.29 | 2.8621 | 0.4506 | |||

| AAPL / Apple Inc. | 0.02 | -4.15 | 3.60 | -11.48 | 2.6984 | -0.4426 | |||

| IWM / iShares Trust - iShares Russell 2000 ETF | 0.02 | 0.52 | 3.45 | 8.74 | 2.5855 | 0.1350 | |||

| IJJ / iShares Trust - iShares S&P Mid-Cap 400 Value ETF | 0.03 | -1.18 | 3.42 | 2.00 | 2.5629 | -0.0267 | |||

| VWO / Vanguard International Equity Index Funds - Vanguard FTSE Emerging Markets ETF | 0.07 | 0.96 | 3.39 | 10.31 | 2.5453 | 0.1678 | |||

| VOX / Vanguard World Fund - Vanguard Communication Services ETF | 0.02 | -2.06 | 2.98 | 12.86 | 2.2340 | 0.1944 | |||

| MSFT / Microsoft Corporation | 0.01 | 0.00 | 2.77 | 32.52 | 2.0765 | 0.4615 | |||

| LLY / Eli Lilly and Company | 0.00 | -2.42 | 2.32 | -7.90 | 1.7421 | -0.2073 | |||

| XOM / Exxon Mobil Corporation | 0.02 | -2.09 | 1.90 | -11.24 | 1.4283 | -0.2303 | |||

| PG / The Procter & Gamble Company | 0.01 | -2.80 | 1.48 | -9.12 | 1.1072 | -0.1485 | |||

| EFV / iShares Trust - iShares MSCI EAFE Value ETF | 0.02 | 0.00 | 1.39 | 7.69 | 1.0407 | 0.0449 | |||

| JPM / JPMorgan Chase & Co. | 0.00 | -3.80 | 1.35 | 13.72 | 1.0143 | 0.0949 | |||

| EMXC / iShares, Inc. - iShares MSCI Emerging Markets ex China ETF | 0.02 | 0.82 | 1.22 | 15.57 | 0.9133 | 0.0987 | |||

| V / Visa Inc. | 0.00 | -1.96 | 1.06 | -0.65 | 0.7985 | -0.0300 | |||

| IJS / iShares Trust - iShares S&P Small-Cap 600 Value ETF | 0.01 | -1.64 | 1.04 | 0.38 | 0.7830 | -0.0208 | |||

| CSCO / Cisco Systems, Inc. | 0.01 | -0.25 | 0.99 | 12.15 | 0.7419 | 0.0601 | |||

| RTX / RTX Corporation | 0.01 | -3.57 | 0.98 | 6.31 | 0.7339 | 0.0224 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | -0.75 | 0.96 | -9.53 | 0.7203 | -0.0997 | |||

| ORCL / Oracle Corporation | 0.00 | -5.16 | 0.90 | 48.44 | 0.6784 | 0.2070 | |||

| CVX / Chevron Corporation | 0.01 | -2.76 | 0.89 | -16.78 | 0.6706 | -0.1597 | |||

| AVGO / Broadcom Inc. | 0.00 | 0.00 | 0.81 | 64.91 | 0.6102 | 0.2282 | |||

| JNJ / Johnson & Johnson | 0.01 | -2.14 | 0.78 | -9.88 | 0.5823 | -0.0835 | |||

| MAA / Mid-America Apartment Communities, Inc. | 0.01 | -2.82 | 0.76 | -14.17 | 0.5731 | -0.1151 | |||

| GOOGL / Alphabet Inc. | 0.00 | -0.76 | 0.74 | 13.08 | 0.5521 | 0.0490 | |||

| VOO / Vanguard Index Funds - Vanguard S&P 500 ETF | 0.00 | 15.73 | 0.72 | 27.96 | 0.5426 | 0.1055 | |||

| MCD / McDonald's Corporation | 0.00 | 0.00 | 0.64 | -6.59 | 0.4795 | -0.0488 | |||

| ABT / Abbott Laboratories | 0.00 | -4.43 | 0.63 | -2.02 | 0.4736 | -0.0245 | |||

| UNM / Unum Group | 0.01 | 0.00 | 0.63 | -0.94 | 0.4727 | -0.0187 | |||

| SYK / Stryker Corporation | 0.00 | -0.65 | 0.61 | 5.57 | 0.4557 | 0.0109 | |||

| TXN / Texas Instruments Incorporated | 0.00 | 0.00 | 0.59 | 15.52 | 0.4417 | 0.0477 | |||

| VZ / Verizon Communications Inc. | 0.01 | -3.20 | 0.56 | -7.55 | 0.4225 | -0.0490 | |||

| EXC / Exelon Corporation | 0.01 | -2.10 | 0.53 | -7.84 | 0.3977 | -0.0466 | |||

| PSA / Public Storage | 0.00 | -0.17 | 0.53 | -2.22 | 0.3977 | -0.0211 | |||

| COP / ConocoPhillips | 0.01 | -4.75 | 0.53 | -18.64 | 0.3966 | -0.1056 | |||

| NOC / Northrop Grumman Corporation | 0.00 | -0.95 | 0.52 | -3.33 | 0.3932 | -0.0257 | |||

| AMGN / Amgen Inc. | 0.00 | -3.69 | 0.50 | -13.60 | 0.3769 | -0.0731 | |||

| NVDD / Direxion Shares ETF Trust - Direxion Daily NVDA Bear 1X Shares | 0.00 | 0.00 | 0.49 | 46.11 | 0.3664 | 0.1074 | |||

| XLY / The Select Sector SPDR Trust - The Consumer Discretionary Select Sector SPDR Fund | 0.00 | -0.04 | 0.49 | 9.93 | 0.3661 | 0.0232 | |||

| ALL / The Allstate Corporation | 0.00 | -3.42 | 0.48 | -6.21 | 0.3630 | -0.0354 | |||

| AMZN / Amazon.com, Inc. | 0.00 | 0.46 | 0.48 | 15.87 | 0.3624 | 0.0400 | |||

| WFC / Wells Fargo & Company | 0.01 | -6.37 | 0.48 | 4.58 | 0.3606 | 0.0050 | |||

| WMT / Walmart Inc. | 0.00 | -0.61 | 0.48 | 10.85 | 0.3604 | 0.0249 | |||

| PSX / Phillips 66 | 0.00 | -1.38 | 0.48 | -4.58 | 0.3595 | -0.0293 | |||

| CI / The Cigna Group | 0.00 | -3.04 | 0.47 | -2.47 | 0.3560 | -0.0206 | |||

| DUK / Duke Energy Corporation | 0.00 | -3.73 | 0.45 | -6.83 | 0.3378 | -0.0360 | |||

| MRK / Merck & Co., Inc. | 0.01 | -2.39 | 0.44 | -14.03 | 0.3271 | -0.0645 | |||

| SO / The Southern Company | 0.00 | -0.25 | 0.41 | -0.49 | 0.3076 | -0.0106 | |||

| TM / Toyota Motor Corporation - Depositary Receipt (Common Stock) | 0.00 | -4.22 | 0.40 | -6.51 | 0.3021 | -0.0310 | |||

| BR / Broadridge Financial Solutions, Inc. | 0.00 | 0.00 | 0.38 | 0.26 | 0.2854 | -0.0080 | |||

| IWD / iShares Trust - iShares Russell 1000 Value ETF | 0.00 | 0.00 | 0.38 | 3.29 | 0.2832 | 0.0005 | |||

| IBM / International Business Machines Corporation | 0.00 | 0.00 | 0.37 | 18.41 | 0.2805 | 0.0367 | |||

| XLE / The Select Sector SPDR Trust - The Energy Select Sector SPDR Fund | 0.00 | -2.76 | 0.37 | -11.82 | 0.2805 | -0.0471 | |||

| ELV / Elevance Health, Inc. | 0.00 | -2.14 | 0.36 | -12.56 | 0.2671 | -0.0474 | |||

| NSC / Norfolk Southern Corporation | 0.00 | -0.23 | 0.34 | 7.72 | 0.2520 | 0.0111 | |||

| ZTS / Zoetis Inc. | 0.00 | -4.60 | 0.32 | -9.52 | 0.2425 | -0.0341 | |||

| IVE / iShares Trust - iShares S&P 500 Value ETF | 0.00 | -2.96 | 0.32 | -0.31 | 0.2402 | -0.0086 | |||

| GOOG / Alphabet Inc. | 0.00 | 0.00 | 0.32 | 13.62 | 0.2383 | 0.0220 | |||

| IYW / iShares Trust - iShares U.S. Technology ETF | 0.00 | 0.00 | 0.31 | 23.41 | 0.2341 | 0.0385 | |||

| STAG / STAG Industrial, Inc. | 0.01 | -0.15 | 0.31 | 0.32 | 0.2323 | -0.0064 | |||

| D / Dominion Energy, Inc. | 0.01 | -3.77 | 0.29 | -3.03 | 0.2164 | -0.0135 | |||

| APD / Air Products and Chemicals, Inc. | 0.00 | 0.00 | 0.28 | -4.38 | 0.2138 | -0.0166 | |||

| PPL / PPL Corporation | 0.01 | -6.02 | 0.28 | -11.82 | 0.2077 | -0.0350 | |||

| UNP / Union Pacific Corporation | 0.00 | 0.00 | 0.28 | -2.47 | 0.2072 | -0.0121 | |||

| MMM / 3M Company | 0.00 | -9.21 | 0.27 | -5.96 | 0.2015 | -0.0192 | |||

| LYB / LyondellBasell Industries N.V. | 0.00 | -3.64 | 0.26 | -20.73 | 0.1954 | -0.0589 | |||

| URI / United Rentals, Inc. | 0.00 | 0.00 | 0.26 | 19.91 | 0.1951 | 0.0278 | |||

| IWV / iShares Trust - iShares Russell 3000 ETF | 0.00 | -1.14 | 0.24 | 9.46 | 0.1827 | 0.0104 | |||

| O / Realty Income Corporation | 0.00 | 0.00 | 0.24 | -0.82 | 0.1815 | -0.0068 | |||

| MLM / Martin Marietta Materials, Inc. | 0.00 | 0.00 | 0.24 | 14.98 | 0.1792 | 0.0184 | |||

| BAC / Bank of America Corporation | 0.00 | -10.48 | 0.23 | 1.80 | 0.1696 | -0.0026 | |||

| XAR / SPDR Series Trust - SPDR S&P Aerospace & Defense ETF | 0.00 | 0.22 | 0.1651 | 0.1651 | |||||

| META / Meta Platforms, Inc. | 0.00 | 0.20 | 0.1523 | 0.1523 | |||||

| ARKB / ARK 21Shares Bitcoin ETF | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| GIS / General Mills, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| MSTR / Strategy Inc | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| UNH / UnitedHealth Group Incorporated | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| LTC / LTC Properties, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 |