Mga Batayang Estadistika

| Nilai Portofolio | $ 8,854,000 |

| Posisi Saat Ini | 21 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

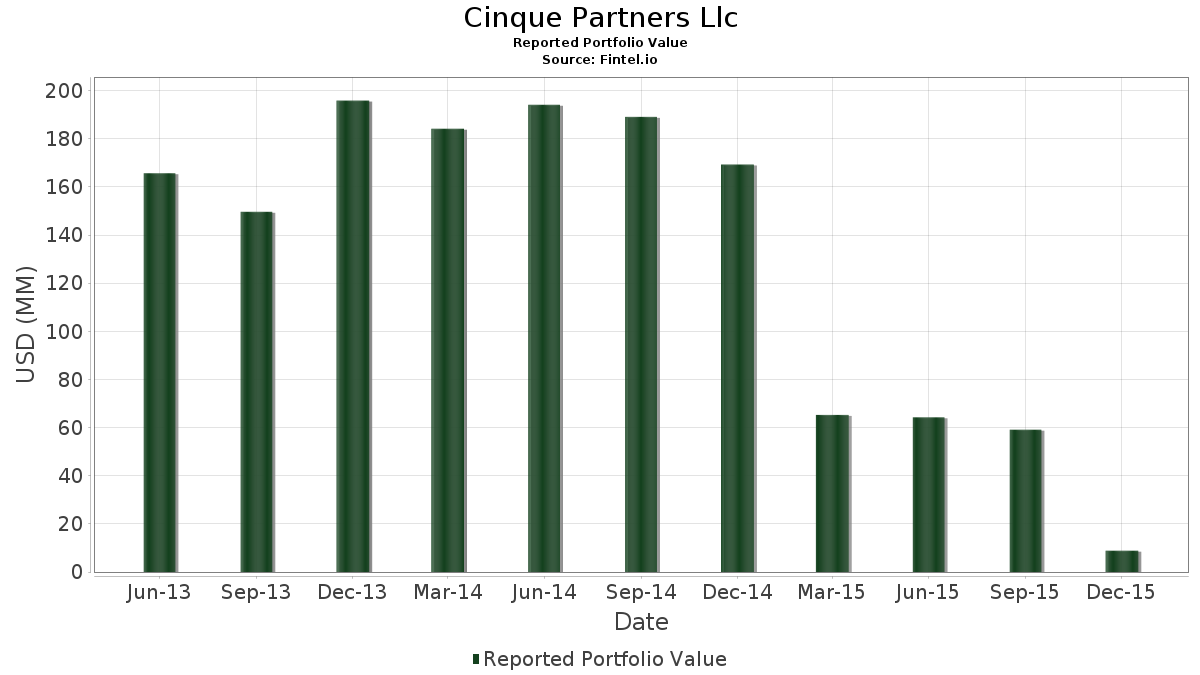

Cinque Partners Llc telah mengungkapkan total kepemilikan 21 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 8,854,000 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Cinque Partners Llc adalah SPDR S&P 500 ETF (US:SPY) , iShares Trust - iShares U.S. Technology ETF (US:IYW) , The Select Sector SPDR Trust - The Industrial Select Sector SPDR Fund (US:XLI) , The Select Sector SPDR Trust - The Financial Select Sector SPDR Fund (US:XLF) , and The Select Sector SPDR Trust - The Health Care Select Sector SPDR Fund (US:XLV) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.01 | 1.38 | 15.6314 | 6.6430 | |

| 0.01 | 1.01 | 11.4525 | 4.6051 | |

| 0.03 | 0.73 | 8.2336 | 3.5424 | |

| 0.00 | 0.26 | 2.9252 | 2.9252 | |

| 0.01 | 0.70 | 7.8834 | 2.8151 | |

| 0.01 | 0.74 | 8.3465 | 2.7438 | |

| 0.00 | 0.38 | 4.2806 | 1.6170 | |

| 0.01 | 0.24 | 2.6655 | 1.6136 | |

| 0.00 | 0.46 | 5.2293 | 1.5866 | |

| 0.01 | 0.34 | 3.8514 | 1.2775 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.00 | 0.00 | -1.5254 | ||

| 0.00 | 0.00 | -1.3901 | ||

| 0.00 | 0.00 | -1.3715 | ||

| 0.00 | 0.00 | -1.3343 | ||

| 0.00 | 0.00 | -1.2734 | ||

| 0.00 | 0.00 | -1.2633 | ||

| 0.00 | 0.00 | -1.2058 | ||

| 0.00 | 0.00 | -1.1364 | ||

| 0.00 | 0.00 | -1.1364 | ||

| 0.00 | 0.00 | -1.1128 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2016-02-12 untuk periode pelaporan 2015-12-31. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| SPY / SPDR S&P 500 ETF | 0.01 | -75.52 | 1.38 | -73.96 | 15.6314 | 6.6430 | |||

| IYW / iShares Trust - iShares U.S. Technology ETF | 0.01 | -76.86 | 1.01 | -74.96 | 11.4525 | 4.6051 | |||

| XLI / The Select Sector SPDR Trust - The Industrial Select Sector SPDR Fund | 0.01 | -79.01 | 0.74 | -77.69 | 8.3465 | 2.7438 | |||

| XLF / The Select Sector SPDR Trust - The Financial Select Sector SPDR Fund | 0.03 | -75.01 | 0.73 | -73.72 | 8.2336 | 3.5424 | |||

| XLV / The Select Sector SPDR Trust - The Health Care Select Sector SPDR Fund | 0.01 | -78.59 | 0.70 | -76.71 | 7.8834 | 2.8151 | |||

| CVS / CVS Health Corporation | 0.00 | -78.77 | 0.46 | -78.51 | 5.2293 | 1.5866 | |||

| TRV / The Travelers Companies, Inc. | 0.00 | -78.78 | 0.38 | -75.94 | 4.2806 | 1.6170 | |||

| T / AT&T Inc. | 0.01 | -78.77 | 0.34 | -77.60 | 3.8514 | 1.2775 | |||

| WBA / Walgreens Boots Alliance, Inc. | 0.00 | -78.77 | 0.34 | -78.22 | 3.8401 | 1.2002 | |||

| GM / General Motors Company | 0.01 | -78.94 | 0.27 | -76.14 | 3.0269 | 1.1277 | |||

| DIS / The Walt Disney Company | 0.00 | -78.78 | 0.27 | -78.19 | 3.0269 | 0.9485 | |||

| XLY / The Select Sector SPDR Trust - The Consumer Discretionary Select Sector SPDR Fund | 0.00 | 0.00 | 0.26 | 2.9252 | 2.9252 | ||||

| ALL / The Allstate Corporation | 0.00 | -78.77 | 0.24 | -77.39 | 2.6993 | 0.9118 | |||

| XLB / The Select Sector SPDR Trust - The Materials Select Sector SPDR Fund | 0.01 | -65.20 | 0.24 | -62.06 | 2.6655 | 1.6136 | |||

| F / Ford Motor Company | 0.02 | -78.94 | 0.24 | -78.13 | 2.6655 | 0.8407 | |||

| VLO / Valero Energy Corporation | 0.00 | -84.70 | 0.22 | -82.03 | 2.4622 | 0.4108 | |||

| ORCL / Oracle Corporation | 0.01 | -78.77 | 0.22 | -78.51 | 2.4509 | 0.7428 | |||

| HD / The Home Depot, Inc. | 0.00 | -78.94 | 0.22 | -75.87 | 2.4396 | 0.9260 | |||

| AAPL / Apple Inc. | 0.00 | -78.78 | 0.21 | -79.79 | 2.3379 | 0.6062 | |||

| 018490100 / Allergan plc | 0.00 | -78.79 | 0.20 | -75.60 | 2.2927 | 0.8857 | |||

| INTC / Intel Corporation | 0.01 | -84.17 | 0.20 | -81.95 | 2.2589 | 0.3851 | |||

| SBUX / Starbucks Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -1.3343 | ||||

| MRK / Merck & Co., Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.8354 | ||||

| GILD / Gilead Sciences, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.3901 | ||||

| XLU / The Select Sector SPDR Trust - The Utilities Select Sector SPDR Fund | 0.00 | -100.00 | 0.00 | -100.00 | -1.0350 | ||||

| PFE / Pfizer Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.9927 | ||||

| DHR / Danaher Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -1.1128 | ||||

| ESRX / Express Scripts Holding Co. | 0.00 | -100.00 | 0.00 | -100.00 | -1.2058 | ||||

| ARRS / ARRIS International plc | 0.00 | -100.00 | 0.00 | -100.00 | -1.0570 | ||||

| AEP / American Electric Power Company, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.3715 | ||||

| CF / CF Industries Holdings, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.7965 | ||||

| HP / Helmerich & Payne, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.7796 | ||||

| CSCO / Cisco Systems, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.0079 | ||||

| WMT / Walmart Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.5254 | ||||

| MNKKQ / Mallinckrodt Plc | 0.00 | -100.00 | 0.00 | -100.00 | -0.5598 | ||||

| AVGO / Broadcom Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.0620 | ||||

| KMX / CarMax, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.1026 | ||||

| GS / The Goldman Sachs Group, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.9132 | ||||

| NOV / NOV Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.8540 | ||||

| CVX / Chevron Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.8845 | ||||

| RTX / RTX Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.8676 | ||||

| JPM / JPMorgan Chase & Co. | 0.00 | -100.00 | 0.00 | -100.00 | -1.0045 | ||||

| XOM / Exxon Mobil Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.9690 | ||||

| COP / ConocoPhillips | 0.00 | -100.00 | 0.00 | -100.00 | -0.6020 | ||||

| JCI / Johnson Controls International plc | 0.00 | -100.00 | 0.00 | -100.00 | -1.0874 | ||||

| CAM / Cameron International Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -1.2734 | ||||

| C / Citigroup Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.9893 | ||||

| CELG / Celgene Corp. | 0.00 | -100.00 | 0.00 | -100.00 | -1.0485 | ||||

| GOOGL / Alphabet Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.0620 | ||||

| AMGN / Amgen Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.1364 | ||||

| LYB / LyondellBasell Industries N.V. | 0.00 | -100.00 | 0.00 | -100.00 | -0.8997 | ||||

| VIAB / Viacom, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.1364 | ||||

| RE / Everest Re Group Ltd | 0.00 | -100.00 | 0.00 | -100.00 | -1.2633 | ||||

| ACN / Accenture plc | 0.00 | -100.00 | 0.00 | -100.00 | -1.0586 | ||||

| UNP / Union Pacific Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.9792 | ||||

| CMCSA / Comcast Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -1.0773 | ||||

| MSFT / Microsoft Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -1.0502 | ||||

| AIG / American International Group, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.0299 |