Mga Batayang Estadistika

| Nilai Portofolio | $ 2,420,975,788 |

| Posisi Saat Ini | 67 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

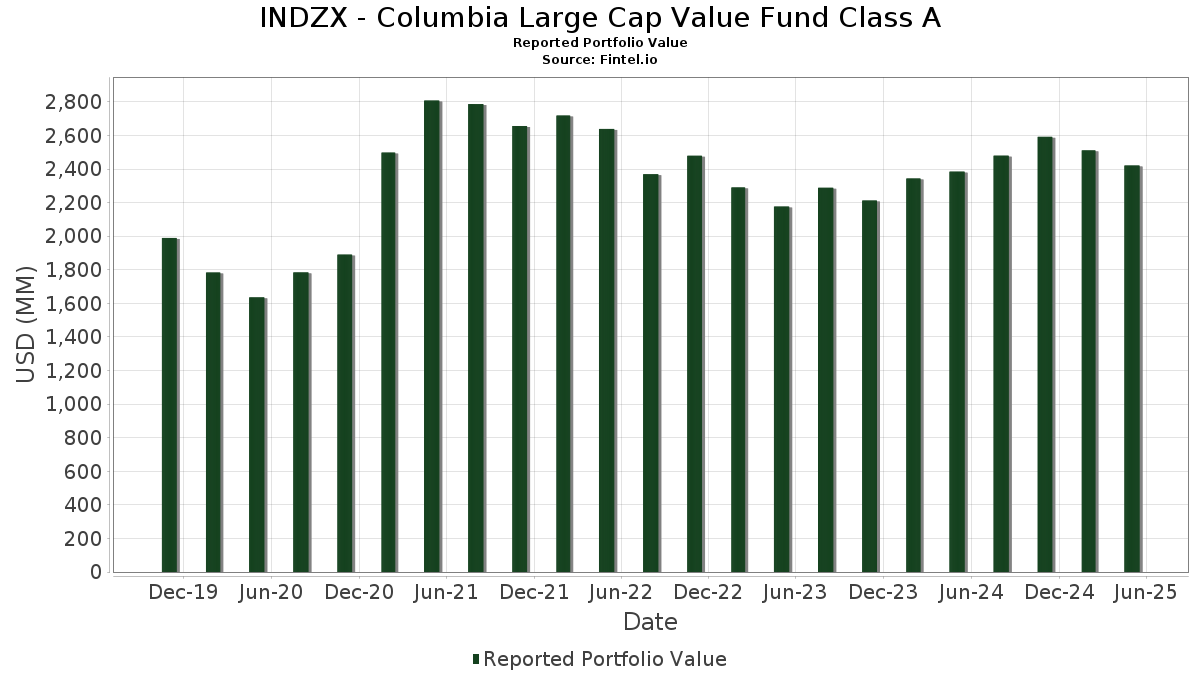

INDZX - Columbia Large Cap Value Fund Class A telah mengungkapkan total kepemilikan 67 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 2,420,975,788 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama INDZX - Columbia Large Cap Value Fund Class A adalah JPMorgan Chase & Co. (US:JPM) , Berkshire Hathaway Inc. (US:BRK.B) , Walmart Inc. (US:WMT) , Exxon Mobil Corporation (US:XOM) , and Philip Morris International Inc. (US:PM) . Posisi baru INDZX - Columbia Large Cap Value Fund Class A meliputi: UnitedHealth Group Incorporated (US:UNH) , Dell Technologies Inc. (US:DELL) , EQT Corporation (US:EQT) , LyondellBasell Industries N.V. (US:LYB) , and .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.10 | 28.83 | 1.1898 | 1.1898 | |

| 0.25 | 27.84 | 1.1488 | 1.1488 | |

| 0.39 | 21.27 | 0.8779 | 0.8779 | |

| 0.34 | 19.44 | 0.8021 | 0.8021 | |

| 0.47 | 28.32 | 1.1687 | 0.6853 | |

| 0.37 | 66.75 | 2.7544 | 0.4574 | |

| 0.63 | 41.53 | 1.7139 | 0.4548 | |

| 0.11 | 42.50 | 1.7537 | 0.4198 | |

| 0.11 | 45.69 | 1.8857 | 0.3817 | |

| 0.23 | 48.39 | 1.9968 | 0.3416 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.24 | 26.13 | 1.0784 | -0.8650 | |

| 0.16 | 80.89 | 3.3379 | -0.4329 | |

| 0.08 | 26.75 | 1.1038 | -0.3329 | |

| 0.14 | 41.61 | 1.7170 | -0.3087 | |

| 0.72 | 34.71 | 1.4323 | -0.2832 | |

| 1.20 | 33.32 | 1.3749 | -0.1769 | |

| 0.11 | 23.58 | 0.9729 | -0.1648 | |

| 0.04 | 25.12 | 1.0367 | -0.1599 | |

| 0.66 | 67.92 | 2.8027 | -0.1558 | |

| 0.42 | 46.98 | 1.9385 | -0.1512 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-07-25 untuk periode pelaporan 2025-05-31. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| JPM / JPMorgan Chase & Co. | 0.37 | -0.64 | 98.76 | -0.88 | 4.0756 | 0.1123 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.16 | -13.01 | 80.89 | -14.68 | 3.3379 | -0.4329 | |||

| WMT / Walmart Inc. | 0.74 | -0.63 | 72.83 | -0.52 | 3.0053 | 0.0934 | |||

| XOM / Exxon Mobil Corporation | 0.66 | -0.63 | 67.92 | -8.69 | 2.8027 | -0.1558 | |||

| PM / Philip Morris International Inc. | 0.37 | -0.62 | 66.75 | 15.58 | 2.7544 | 0.4574 | |||

| PG / The Procter & Gamble Company | 0.32 | -0.62 | 54.72 | -2.88 | 2.2582 | 0.0171 | |||

| LIN / Linde plc | 0.11 | -0.62 | 52.51 | -0.51 | 2.1669 | 0.0676 | |||

| C / Citigroup Inc. | 0.67 | -0.62 | 50.52 | -6.38 | 2.0847 | -0.0616 | |||

| BA / The Boeing Company | 0.23 | -2.06 | 48.39 | 16.28 | 1.9968 | 0.3416 | |||

| DIS / The Walt Disney Company | 0.42 | -9.99 | 46.98 | -10.59 | 1.9385 | -0.1512 | |||

| TT / Trane Technologies plc | 0.11 | -0.65 | 45.69 | 20.85 | 1.8857 | 0.3817 | |||

| VRTX / Vertex Pharmaceuticals Incorporated | 0.10 | 11.16 | 44.91 | 2.42 | 1.8534 | 0.1091 | |||

| BK / The Bank of New York Mellon Corporation | 0.50 | -0.64 | 44.30 | -1.01 | 1.8279 | 0.0480 | |||

| KO / The Coca-Cola Company | 0.61 | -0.63 | 44.02 | 0.61 | 1.8167 | 0.0762 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.11 | 66.40 | 42.50 | 26.72 | 1.7537 | 0.4198 | |||

| CB / Chubb Limited | 0.14 | -21.52 | 41.61 | -18.30 | 1.7170 | -0.3087 | |||

| NVT / nVent Electric plc | 0.63 | 20.32 | 41.53 | 31.21 | 1.7139 | 0.4548 | |||

| LRCX / Lam Research Corporation | 0.51 | -0.63 | 40.80 | 4.61 | 1.6836 | 0.1324 | |||

| CI / The Cigna Group | 0.12 | -0.64 | 39.26 | 1.87 | 1.6203 | 0.0871 | |||

| ETR / Entergy Corporation | 0.47 | -0.63 | 39.12 | -5.22 | 1.6145 | -0.0274 | |||

| GS / The Goldman Sachs Group, Inc. | 0.06 | -0.62 | 38.79 | -4.10 | 1.6007 | -0.0082 | |||

| GLW / Corning Incorporated | 0.77 | -0.63 | 38.29 | -1.74 | 1.5802 | 0.0301 | |||

| VLO / Valero Energy Corporation | 0.29 | -0.64 | 37.96 | -1.98 | 1.5663 | 0.0261 | |||

| ICE / Intercontinental Exchange, Inc. | 0.21 | -0.62 | 37.56 | 3.15 | 1.5500 | 0.1016 | |||

| XEL / Xcel Energy Inc. | 0.53 | -0.63 | 37.49 | -3.39 | 1.5471 | 0.0036 | |||

| AVGO / Broadcom Inc. | 0.15 | -0.65 | 37.21 | 20.60 | 1.5354 | 0.3082 | |||

| NOC / Northrop Grumman Corporation | 0.08 | -0.65 | 37.04 | 4.31 | 1.5284 | 0.1160 | |||

| MSFT / Microsoft Corporation | 0.08 | -0.62 | 36.87 | 15.24 | 1.5217 | 0.2490 | |||

| WELL / Welltower Inc. | 0.23 | -0.64 | 35.79 | -0.15 | 1.4770 | 0.0513 | |||

| BMY / Bristol-Myers Squibb Company | 0.72 | -0.62 | 34.71 | -19.53 | 1.4323 | -0.2832 | |||

| AEE / Ameren Corporation | 0.35 | -0.62 | 34.01 | -5.20 | 1.4037 | -0.0235 | |||

| MMC / Marsh & McLennan Companies, Inc. | 0.15 | -0.62 | 33.93 | -2.36 | 1.4001 | 0.0179 | |||

| MS / Morgan Stanley | 0.26 | -0.64 | 33.70 | -4.43 | 1.3906 | -0.0119 | |||

| EQIX / Equinix, Inc. | 0.04 | -0.53 | 33.42 | -2.27 | 1.3791 | 0.0190 | |||

| T / AT&T Inc. | 1.20 | -15.80 | 33.32 | -14.60 | 1.3749 | -0.1769 | |||

| LVS / Las Vegas Sands Corp. | 0.80 | -0.62 | 32.87 | -8.51 | 1.3563 | -0.0726 | |||

| PH / Parker-Hannifin Corporation | 0.05 | -0.61 | 32.24 | -1.18 | 1.3303 | 0.0327 | |||

| IR / Ingersoll Rand Inc. | 0.39 | -0.63 | 32.14 | -4.31 | 1.3264 | -0.0097 | |||

| NSC / Norfolk Southern Corporation | 0.13 | -0.61 | 32.13 | -0.06 | 1.3257 | 0.0472 | |||

| TMUS / T-Mobile US, Inc. | 0.12 | -0.64 | 30.03 | -10.77 | 1.2393 | -0.0994 | |||

| PNC / The PNC Financial Services Group, Inc. | 0.17 | -0.64 | 29.59 | -10.02 | 1.2209 | -0.0869 | |||

| GOOGL / Alphabet Inc. | 0.17 | -0.64 | 29.30 | 0.21 | 1.2091 | 0.0461 | |||

| BAX / Baxter International Inc. | 0.95 | -0.63 | 29.06 | -12.17 | 1.1991 | -0.1169 | |||

| UNH / UnitedHealth Group Incorporated | 0.10 | 28.83 | 1.1898 | 1.1898 | |||||

| NKE / NIKE, Inc. | 0.47 | 205.49 | 28.32 | 133.04 | 1.1687 | 0.6853 | |||

| MRK / Merck & Co., Inc. | 0.37 | 27.32 | 28.29 | 6.05 | 1.1675 | 0.1064 | |||

| DELL / Dell Technologies Inc. | 0.25 | 27.84 | 1.1488 | 1.1488 | |||||

| MTB / M&T Bank Corporation | 0.15 | -0.60 | 27.32 | -5.31 | 1.1275 | -0.0202 | |||

| CMI / Cummins Inc. | 0.08 | -15.19 | 26.75 | -25.95 | 1.1038 | -0.3329 | |||

| EPAM / EPAM Systems, Inc. | 0.15 | 41.47 | 26.72 | 19.75 | 1.1028 | 0.2152 | |||

| SWK / Stanley Black & Decker, Inc. | 0.40 | 21.03 | 26.47 | -8.48 | 1.0924 | -0.0581 | |||

| EOG / EOG Resources, Inc. | 0.24 | -37.46 | 26.13 | -46.52 | 1.0784 | -0.8650 | |||

| 19766H239 / COLUMBIA SHORT TERM CASH FUND | 25.83 | -3.48 | 25.82 | -3.51 | 1.0655 | 0.0012 | |||

| MA / Mastercard Incorporated | 0.04 | -17.82 | 25.12 | -16.49 | 1.0367 | -0.1599 | |||

| NTR / Nutrien Ltd. | 0.42 | -23.50 | 24.69 | -13.76 | 1.0187 | -0.1199 | |||

| DOC / Healthpeak Properties, Inc. | 1.39 | -0.63 | 24.16 | -15.44 | 0.9969 | -0.1395 | |||

| MMM / 3M Company | 0.16 | -0.62 | 23.63 | -4.96 | 0.9752 | -0.0138 | |||

| FDX / FedEx Corporation | 0.11 | -0.64 | 23.58 | -17.58 | 0.9729 | -0.1648 | |||

| ZBH / Zimmer Biomet Holdings, Inc. | 0.26 | -0.62 | 23.53 | -12.19 | 0.9710 | -0.0949 | |||

| CMCSA / Comcast Corporation | 0.63 | -0.63 | 21.73 | -4.26 | 0.8966 | -0.0061 | |||

| EQT / EQT Corporation | 0.39 | 21.27 | 0.8779 | 0.8779 | |||||

| GAP / The Gap, Inc. | 0.91 | -13.64 | 20.30 | -14.78 | 0.8378 | -0.1098 | |||

| LYB / LyondellBasell Industries N.V. | 0.34 | 19.44 | 0.8021 | 0.8021 | |||||

| BMRN / BioMarin Pharmaceutical Inc. | 0.32 | -0.62 | 18.47 | -18.90 | 0.7623 | -0.1437 | |||

| THC / Tenet Healthcare Corporation | 0.11 | -0.65 | 18.01 | 32.45 | 0.7431 | 0.2023 | |||

| BILL / BILL Holdings, Inc. | 0.41 | 35.15 | 17.72 | 6.95 | 0.7311 | 0.0722 | |||

| QRVO / Qorvo, Inc. | 0.20 | -24.44 | 15.39 | -20.98 | 0.6352 | -0.1396 |