Mga Batayang Estadistika

| Nilai Portofolio | $ 679,604,160 |

| Posisi Saat Ini | 43 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

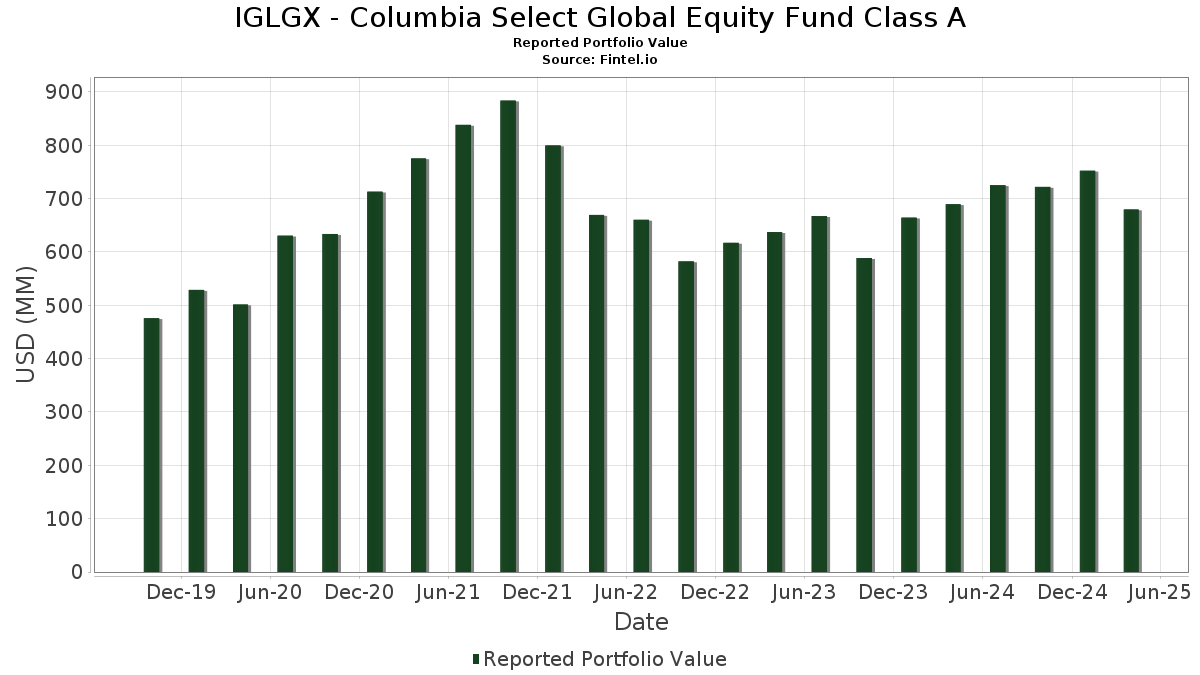

IGLGX - Columbia Select Global Equity Fund Class A telah mengungkapkan total kepemilikan 43 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 679,604,160 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama IGLGX - Columbia Select Global Equity Fund Class A adalah Microsoft Corporation (US:MSFT) , Mastercard Incorporated (US:MA) , NVIDIA Corporation (US:NVDA) , Linde plc (US:LIN) , and Amazon.com, Inc. (US:AMZN) . Posisi baru IGLGX - Columbia Select Global Equity Fund Class A meliputi: Walmart Inc. (US:WMT) , SAP SE (AT:SAP) , Hitachi, Ltd. (US:HTHIF) , E.ON SE (US:ENAKF) , and Deutsche Telekom AG (US:DTEGF) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.22 | 21.51 | 3.1603 | 3.1603 | |

| 0.06 | 17.76 | 2.6091 | 2.6091 | |

| 0.58 | 14.28 | 2.0985 | 2.0985 | |

| 0.27 | 29.37 | 4.3147 | 1.7967 | |

| 0.47 | 23.27 | 3.4195 | 1.3674 | |

| 0.45 | 7.90 | 1.1602 | 1.1602 | |

| 0.18 | 6.62 | 0.9719 | 0.9719 | |

| 0.11 | 6.61 | 0.9705 | 0.9705 | |

| 0.14 | 6.55 | 0.9630 | 0.9630 | |

| 0.05 | 7.94 | 1.1667 | 0.9392 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 3.98 | 3.98 | 0.5850 | -2.3320 | |

| 0.00 | 0.00 | -1.6231 | ||

| 0.02 | 11.27 | 1.6560 | -1.0560 | |

| 0.00 | 0.00 | -1.0249 | ||

| 0.00 | 0.00 | -1.0243 | ||

| 0.15 | 26.92 | 3.9555 | -0.9427 | |

| 0.85 | 24.23 | 3.5593 | -0.9062 | |

| 0.30 | 21.21 | 3.1162 | -0.7769 | |

| 0.03 | 11.83 | 1.7381 | -0.5338 | |

| 0.00 | 0.00 | -0.4578 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-06-25 untuk periode pelaporan 2025-04-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MSFT / Microsoft Corporation | 0.15 | -2.09 | 57.41 | -6.76 | 8.4346 | 0.2373 | |||

| MA / Mastercard Incorporated | 0.07 | -8.32 | 38.66 | -9.54 | 5.6806 | -0.0099 | |||

| NVDA / NVIDIA Corporation | 0.27 | 71.17 | 29.37 | 55.28 | 4.3147 | 1.7967 | |||

| LIN / Linde plc | 0.06 | -3.07 | 27.40 | -1.52 | 4.0259 | 0.3213 | |||

| AMZN / Amazon.com, Inc. | 0.15 | -5.69 | 26.92 | -26.82 | 3.9555 | -0.9427 | |||

| RELX / RELX PLC - Depositary Receipt (Common Stock) | 0.45 | -14.70 | 24.82 | -6.25 | 3.6470 | 0.1219 | |||

| TSMWF / Taiwan Semiconductor Manufacturing Company Limited | 0.85 | -14.93 | 24.23 | -27.77 | 3.5593 | -0.9062 | |||

| HWM / Howmet Aerospace Inc. | 0.17 | -3.42 | 24.12 | 5.74 | 3.5434 | 0.5066 | |||

| V / Visa Inc. | 0.07 | 0.00 | 23.94 | 1.08 | 3.5180 | 0.3641 | |||

| EXPGY / Experian plc - Depositary Receipt (Common Stock) | 0.47 | 49.51 | 23.27 | 51.00 | 3.4195 | 1.3674 | |||

| WMT / Walmart Inc. | 0.22 | 21.51 | 3.1603 | 3.1603 | |||||

| LRCX / Lam Research Corporation | 0.30 | -17.97 | 21.21 | -27.46 | 3.1162 | -0.7769 | |||

| KEY N / Keyence Corporation | 0.05 | -15.37 | 19.57 | -17.85 | 2.8747 | -0.2964 | |||

| GOOGL / Alphabet Inc. | 0.12 | 0.00 | 18.62 | -22.16 | 2.7354 | -0.4493 | |||

| SAP / SAP SE | 0.06 | 17.76 | 2.6091 | 2.6091 | |||||

| PGR / The Progressive Corporation | 0.06 | 0.00 | 17.30 | 14.32 | 2.5410 | 0.5269 | |||

| PODD / Insulet Corporation | 0.06 | 0.00 | 14.91 | -9.38 | 2.1913 | 0.0002 | |||

| HTHIF / Hitachi, Ltd. | 0.58 | 14.28 | 2.0985 | 2.0985 | |||||

| WCN / Waste Connections, Inc. | 0.07 | -7.73 | 14.27 | -0.77 | 2.0959 | 0.1818 | |||

| TGOPY / 3i Group plc - Depositary Receipt (Common Stock) | 0.24 | 0.00 | 13.68 | 18.00 | 2.0094 | 0.4662 | |||

| SBGSY / Schneider Electric S.E. - Depositary Receipt (Common Stock) | 0.06 | 0.00 | 13.19 | -7.88 | 1.9374 | 0.0316 | |||

| XGR2 / Compass Group PLC | 0.38 | 0.00 | 12.89 | -2.14 | 1.8937 | 0.1400 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.03 | -3.40 | 11.83 | -30.67 | 1.7381 | -0.5338 | |||

| ICE / Intercontinental Exchange, Inc. | 0.07 | 15.52 | 11.49 | 21.41 | 1.6883 | 0.4281 | |||

| META / Meta Platforms, Inc. | 0.02 | -30.54 | 11.27 | -44.67 | 1.6560 | -1.0560 | |||

| MUV2 / Münchener Rückversicherungs-Gesellschaft Aktiengesellschaft in München | 0.02 | 0.00 | 11.11 | 26.31 | 1.6328 | 0.4613 | |||

| ORXCF / ORIX Corporation | 0.54 | 0.00 | 10.78 | -5.03 | 1.5838 | 0.0725 | |||

| LLY / Eli Lilly and Company | 0.01 | 0.00 | 10.37 | 10.84 | 1.5235 | 0.2779 | |||

| HDFCB / HDFC Bank Ltd | 0.41 | 0.00 | 9.42 | 16.05 | 1.3833 | 0.3031 | |||

| SW / Smurfit Westrock Plc | 0.22 | -4.06 | 9.33 | -24.07 | 1.3713 | -0.2651 | |||

| BSX / Boston Scientific Corporation | 0.09 | 15.67 | 9.00 | 16.26 | 1.3226 | 0.2916 | |||

| ISRG / Intuitive Surgical, Inc. | 0.02 | 0.00 | 8.89 | -9.81 | 1.3064 | -0.0062 | |||

| PSORF / Pearson plc | 0.54 | 0.00 | 8.74 | -3.37 | 1.2834 | 0.0798 | |||

| ABT / Abbott Laboratories | 0.06 | 0.00 | 8.20 | 2.21 | 1.2043 | 0.1365 | |||

| LSE N / London Stock Exchange Group plc | 0.05 | 344.12 | 7.94 | 364.87 | 1.1667 | 0.9392 | |||

| ENAKF / E.ON SE | 0.45 | 7.90 | 1.1602 | 1.1602 | |||||

| 42W / The Weir Group PLC | 0.24 | -14.06 | 7.16 | -13.16 | 1.0520 | -0.0458 | |||

| UNP / Union Pacific Corporation | 0.03 | 0.00 | 6.72 | -12.96 | 0.9875 | -0.0407 | |||

| DTEGF / Deutsche Telekom AG | 0.18 | 6.62 | 0.9719 | 0.9719 | |||||

| TRPCF / Trip.com Group Limited | 0.11 | 6.61 | 0.9705 | 0.9705 | |||||

| BYDDF / BYD Company Limited | 0.14 | 6.55 | 0.9630 | 0.9630 | |||||

| HLT / Hilton Worldwide Holdings Inc. | 0.03 | 0.00 | 6.37 | -11.95 | 0.9354 | -0.0273 | |||

| 19766H239 / COLUMBIA SHORT TERM CASH FUND | 3.98 | -81.82 | 3.98 | -81.83 | 0.5850 | -2.3320 | |||

| AVGO / Broadcom Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.6231 | ||||

| COO / The Cooper Companies, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.0243 | ||||

| RNECF / Renesas Electronics Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -1.0249 | ||||

| PHOENIXLTD / The Phoenix Mills Limited | 0.00 | -100.00 | 0.00 | -100.00 | -0.4578 |