Mga Batayang Estadistika

| Nilai Portofolio | $ 1,197,805,002 |

| Posisi Saat Ini | 77 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

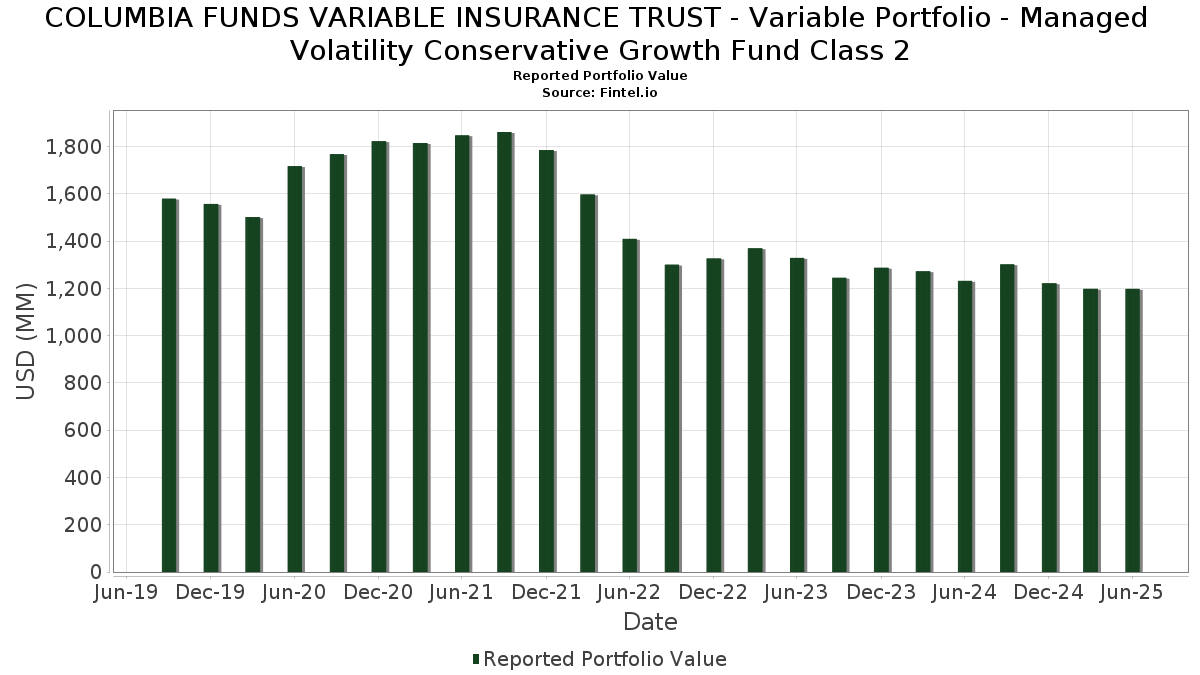

COLUMBIA FUNDS VARIABLE INSURANCE TRUST - Variable Portfolio - Managed Volatility Conservative Growth Fund Class 2 telah mengungkapkan total kepemilikan 77 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 1,197,805,002 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama COLUMBIA FUNDS VARIABLE INSURANCE TRUST - Variable Portfolio - Managed Volatility Conservative Growth Fund Class 2 adalah COLUMBIA SHORT TERM CASH FUND (US:19766H239) , VP - PARTNERS CORE BD FD CL1 (US:19766E129) , COLUMBIA VP - INTER BD FD CLASS 1 (US:19766E871) , CTIVP - TCW CORE PLUS BOND FD CL1 (US:19766L743) , and CTIVP - AMER CENT DIVERSE BD CLS 1 (US:19766E293) . Posisi baru COLUMBIA FUNDS VARIABLE INSURANCE TRUST - Variable Portfolio - Managed Volatility Conservative Growth Fund Class 2 meliputi: UMBS TBA (US:US01F0306781) , Edwards Lifesciences Corporation (IT:1EW) , Edwards Lifesciences Corporation (IT:1EW) , Edwards Lifesciences Corporation (IT:1EW) , and Edwards Lifesciences Corporation (IT:1EW) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 20.45 | 1.8124 | 1.3816 | ||

| 1.64 | 12.51 | 1.1091 | 1.1091 | |

| 190.69 | 190.65 | 16.8969 | 1.0333 | |

| 0.04 | 25.56 | 2.2654 | 0.3814 | |

| 0.04 | 25.46 | 2.2561 | 0.3369 | |

| 1.89 | 45.76 | 4.0556 | 0.2921 | |

| 0.38 | 44.27 | 3.9232 | 0.2157 | |

| 0.42 | 21.49 | 1.9047 | 0.2104 | |

| 0.29 | 18.52 | 1.6410 | 0.1867 | |

| 1.74 | 0.1541 | 0.1541 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 5.70 | 42.91 | 3.8032 | -0.8742 | |

| 8.67 | 0.7686 | -0.7657 | ||

| 22.79 | 2.0198 | -0.6847 | ||

| 0.24 | 23.81 | 2.1100 | -0.4550 | |

| 2.06 | 20.41 | 1.8092 | -0.4503 | |

| 0.11 | 12.51 | 1.1089 | -0.4329 | |

| 10.53 | 105.23 | 9.3262 | -0.4266 | |

| 9.99 | 88.23 | 7.8197 | -0.3737 | |

| 8.87 | 84.10 | 7.4533 | -0.3387 | |

| 0.17 | 14.51 | 1.2861 | -0.3186 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-22 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| 19766H239 / COLUMBIA SHORT TERM CASH FUND | 190.69 | 7.46 | 190.65 | 7.46 | 16.8969 | 1.0333 | |||

| 19766E129 / VP - PARTNERS CORE BD FD CL1 | 10.53 | -4.68 | 105.23 | -3.52 | 9.3262 | -0.4266 | |||

| 19766E871 / COLUMBIA VP - INTER BD FD CLASS 1 | 9.99 | -5.89 | 88.23 | -3.71 | 7.8197 | -0.3737 | |||

| 19766L743 / CTIVP - TCW CORE PLUS BOND FD CL1 | 8.87 | -4.82 | 84.10 | -3.50 | 7.4533 | -0.3387 | |||

| 19766E293 / CTIVP - AMER CENT DIVERSE BD CLS 1 | 7.63 | -4.58 | 71.07 | -3.12 | 6.2985 | -0.2609 | |||

| US19766E4180 / COLUMBIA VP - OVERSEAS CORE FD CL1 | 3.52 | -14.18 | 56.46 | -2.65 | 5.0042 | -0.1818 | |||

| 19766L495 / COLUMBIA VP SEL LARGE CAP EQ FD 1 | 1.89 | -2.23 | 45.76 | 8.72 | 4.0556 | 0.2921 | |||

| US19766E8140 / COLUMBIA VP DISCIPLINED CORE FD -1 | 0.38 | -2.57 | 44.27 | 6.76 | 3.9232 | 0.2157 | |||

| US19765R4442 / COLUMBIA VP LONG GOVT/CREDIT BD 1 | 5.70 | -17.97 | 42.91 | -17.97 | 3.8032 | -0.8742 | |||

| VOO / Vanguard Index Funds - Vanguard S&P 500 ETF | 0.04 | 9.76 | 25.56 | 21.31 | 2.2654 | 0.3814 | |||

| IVV / iShares Trust - iShares Core S&P 500 ETF | 0.04 | 7.33 | 25.46 | 18.60 | 2.2561 | 0.3369 | |||

| US19766E5419 / COLUMBIA VP US GOVT MORTGAGE | 2.67 | -4.99 | 24.52 | -3.73 | 2.1734 | -0.1043 | |||

| AGG / iShares Trust - iShares Core U.S. Aggregate Bond ETF | 0.24 | -17.24 | 23.81 | -17.00 | 2.1100 | -0.4550 | |||

| US01F0306781 / UMBS TBA | 22.79 | -27.37 | 2.0198 | -0.6847 | |||||

| US19766L7275 / CTIVPSM AQR INT CORE EQ FD CL1 | 1.82 | -9.13 | 21.81 | -3.58 | 1.9325 | -0.0895 | |||

| US19766E5179 / COLUMBIA VP LG CAP GRTH FD CLS 1 | 0.42 | -3.53 | 21.49 | 13.42 | 1.9047 | 0.2104 | |||

| 19766E475 / COLUMBIA VP SEL LG CAP VAL FD CLS | 0.43 | -6.02 | 20.74 | -0.30 | 1.8379 | -0.0220 | |||

| 1EW / Edwards Lifesciences Corporation | 20.45 | 320.70 | 1.8124 | 1.3816 | |||||

| 19766E640 / COLUMBIA VP LTD DUR BD- C | 2.06 | -20.60 | 20.41 | -19.21 | 1.8092 | -0.4503 | |||

| US19766L6103 / CTIVP - MORGAN STANLEY ADV FD CL1 | 0.29 | -5.82 | 18.52 | 13.85 | 1.6410 | 0.1867 | |||

| 19766E277 / CTIVP - LOOMIS SAYLES GRTH FD CL1 | 0.24 | -6.98 | 18.45 | 6.42 | 1.6347 | 0.0848 | |||

| US19766L3050 / CTIVP - MFS VALUE FUND CL1 | 0.39 | -4.98 | 18.25 | -1.13 | 1.6171 | -0.0330 | |||

| US19766L8265 / CTIVP - T ROWE LRG CAP VAL CL1 | 0.43 | -1.28 | 17.69 | -1.20 | 1.5674 | -0.0332 | |||

| 1EW / Edwards Lifesciences Corporation | 17.31 | -15.35 | 1.5342 | -0.2782 | |||||

| 19766E145 / CTIVP - OPPENHEIMER INTL GRTH CL1 | 1.29 | -8.10 | 16.41 | 2.85 | 1.4541 | 0.0278 | |||

| 19766E327 / CTIVP - DFA INTL VALUE CLS 1 | 1.37 | -8.04 | 16.38 | 0.08 | 1.4519 | -0.0117 | |||

| VCIT / Vanguard Scottsdale Funds - Vanguard Intermediate-Term Corporate Bond ETF | 0.17 | -20.27 | 14.51 | -19.14 | 1.2861 | -0.3186 | |||

| 19765R535 / VP COLUMBIA CONTRARIAN CORE | 0.25 | -4.13 | 14.10 | 6.98 | 1.2498 | 0.0711 | |||

| COLUMBIA VP - CORP BOND FD 1 / EC (19766E749) | 1.64 | 12.51 | 1.1091 | 1.1091 | |||||

| LQD / iShares Trust - iShares iBoxx $ Investment Grade Corporate Bond ETF | 0.11 | -28.05 | 12.51 | -27.44 | 1.1089 | -0.4329 | |||

| 19766E236 / CTIVP-MFS BLENDED RESEARCH EQ CL1 | 0.24 | -4.06 | 11.59 | 5.52 | 1.0275 | 0.0451 | |||

| 1EW / Edwards Lifesciences Corporation | 8.67 | -49.90 | 0.7686 | -0.7657 | |||||

| US19766L7929 / VP - PARTNERS SM CAP GR | 0.14 | 0.82 | 4.96 | 12.03 | 0.4392 | 0.0437 | |||

| 1EW / Edwards Lifesciences Corporation | 4.86 | -37.12 | 0.4308 | -0.2355 | |||||

| US19766L7762 / COLUMBIA VP-PART SM CAP VAL FD CL | 0.13 | 2.00 | 4.84 | 6.14 | 0.4289 | 0.0212 | |||

| US19765R6421 / Columbia Variable Portfolio - Small Company Growth Fund | 0.26 | -1.01 | 3.73 | 15.44 | 0.3306 | 0.0417 | |||

| US19765R3030 / Columbia Variable Portfolio - Small Cap Value Fund | 0.28 | 0.69 | 3.65 | 6.84 | 0.3239 | 0.0181 | |||

| US19766E6243 / COLUMBIA VP MID CAP GRO OPP - CL 1 | 0.05 | -5.84 | 3.18 | 17.70 | 0.2817 | 0.0402 | |||

| US19766L1070 / CTIVP - WESTFIELD MID CAP GRTH CL1 | 0.05 | -3.51 | 3.16 | 16.81 | 0.2796 | 0.0381 | |||

| US19766E5823 / COLUMBIA VP MID CAP VAL-CLS 1 | 0.07 | -3.28 | 3.13 | 2.43 | 0.2770 | 0.0041 | |||

| 19766E178 / CTIVP-VICTORY SYCAMORE EST VAL CL1 | 0.06 | 0.18 | 3.09 | 1.71 | 0.2743 | 0.0023 | |||

| US01F0404792 / UMBS TBA | 2.10 | -48.56 | 0.1864 | -0.1658 | |||||

| SPX US 12/18/26 P4600 / DE (000000000) | 1.74 | 0.1541 | 0.1541 | ||||||

| US01F0324768 / Uniform Mortgage-Backed Security, TBA | 1.45 | -48.98 | 0.1283 | -0.1162 | |||||

| SPX US 12/18/26 P5000 / DE (000000000) | 1.28 | 0.1132 | 0.1132 | ||||||

| DE000C4SA6R6 / EURO STOXX 50 Index | 1.17 | 0.1040 | 0.1040 | ||||||

| SPX US 12/18/26 P4700 / DE (000000000) | 1.07 | 0.0948 | 0.0948 | ||||||

| US01F0304703 / UMBS 15YR TBA(REG B) 3.0 UMBS TBA 07-01-35 | 0.91 | -34.75 | 0.0803 | -0.0393 | |||||

| SPX US 12/18/26 P4800 / DE (000000000) | 0.50 | 0.0444 | 0.0444 | ||||||

| DE000C4SA6R6 / EURO STOXX 50 Index | 0.39 | 0.0345 | 0.0345 | ||||||

| JAPANESE YEN / DFE (000000000) | 0.21 | 0.0189 | 0.0189 | ||||||

| BRITISH POUND / DFE (000000000) | 0.18 | 0.0158 | 0.0158 | ||||||

| SPX US 09/19/25 C6150 / DE (000000000) | 0.16 | 0.0145 | 0.0145 | ||||||

| EURO COUNTRIES / DFE (000000000) | 0.16 | 0.0142 | 0.0142 | ||||||

| DE000C4SA6R6 / EURO STOXX 50 Index | 0.15 | 0.0137 | 0.0137 | ||||||

| DE000C4SA6R6 / EURO STOXX 50 Index | 0.14 | 0.0128 | 0.0128 | ||||||

| DE000C4SA6R6 / EURO STOXX 50 Index | 0.07 | 0.0064 | 0.0064 | ||||||

| DE000C4SA6R6 / EURO STOXX 50 Index | 0.02 | 0.0020 | 0.0020 | ||||||

| DE000C4SA6R6 / EURO STOXX 50 Index | 0.02 | 0.0019 | 0.0019 | ||||||

| AUSTRALIA DOLLAR / DFE (000000000) | 0.01 | 0.0010 | 0.0010 | ||||||

| DE000C4SA6R6 / EURO STOXX 50 Index | 0.01 | 0.0010 | 0.0010 | ||||||

| NORWAY KRONA / DFE (000000000) | 0.01 | 0.0009 | 0.0009 | ||||||

| DE000C4SA6R6 / EURO STOXX 50 Index | 0.00 | 0.0003 | 0.0003 | ||||||

| CANADIAN DOLLAR / DFE (000000000) | 0.00 | 0.0002 | 0.0002 | ||||||

| DE000C4SA6R6 / EURO STOXX 50 Index | 0.00 | 0.0001 | 0.0001 | ||||||

| DE000C4SA6R6 / EURO STOXX 50 Index | -0.00 | -0.0000 | -0.0000 | ||||||

| DE000C4SA6R6 / EURO STOXX 50 Index | -0.00 | -0.0000 | -0.0000 | ||||||

| DE000C4SA6R6 / EURO STOXX 50 Index | -0.00 | -0.0001 | -0.0001 | ||||||

| DE000C4SA6R6 / EURO STOXX 50 Index | -0.04 | -0.0035 | -0.0035 | ||||||

| DE000C4SA6R6 / EURO STOXX 50 Index | -0.04 | -0.0035 | -0.0035 | ||||||

| DE000C4SA6R6 / EURO STOXX 50 Index | -0.04 | -0.0037 | -0.0037 | ||||||

| US DOLLARS / DFE (000000000) | -0.09 | -0.0075 | -0.0075 | ||||||

| SPX US 09/19/25 P6150 / DE (000000000) | -0.09 | -0.0082 | -0.0082 | ||||||

| US DOLLARS / DFE (000000000) | -0.12 | -0.0105 | -0.0105 | ||||||

| US DOLLARS / DFE (000000000) | -0.24 | -0.0211 | -0.0211 | ||||||

| DE000C4SA6R6 / EURO STOXX 50 Index | -0.24 | -0.0217 | -0.0217 | ||||||

| DE000C4SA6R6 / EURO STOXX 50 Index | -0.29 | -0.0256 | -0.0256 |