Mga Batayang Estadistika

| Nilai Portofolio | $ 124,171,752 |

| Posisi Saat Ini | 39 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

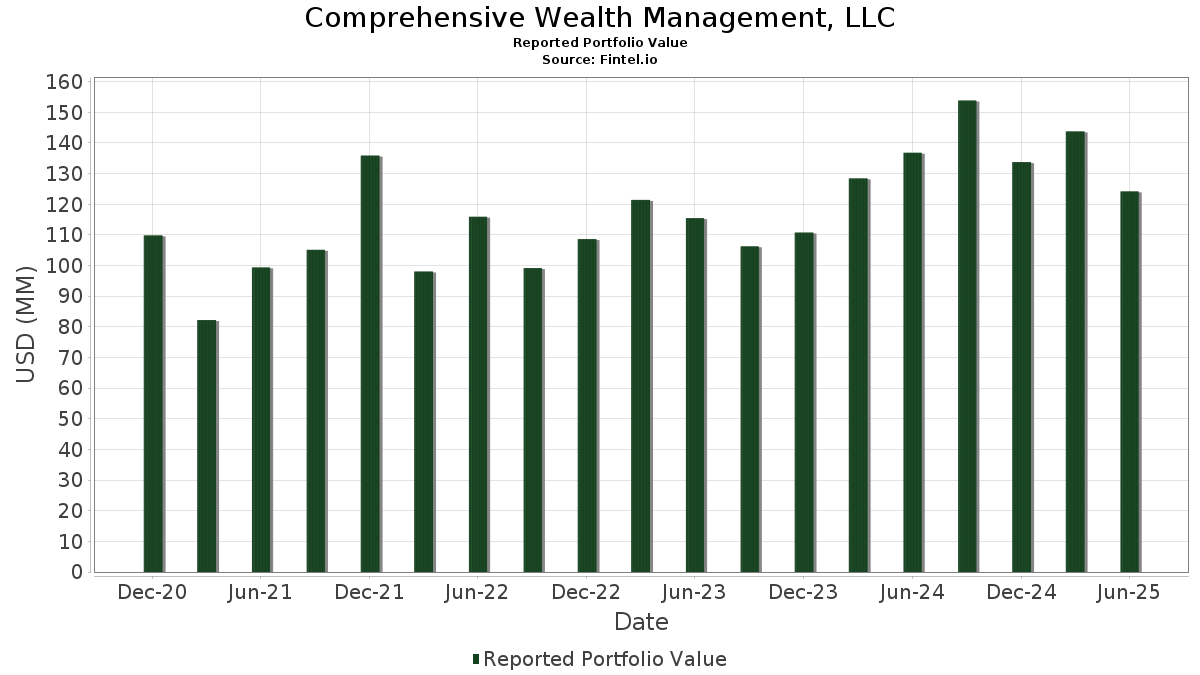

Comprehensive Wealth Management, LLC telah mengungkapkan total kepemilikan 39 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 124,171,752 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Comprehensive Wealth Management, LLC adalah First Trust Exchange-Traded Fund IV - First Trust Long Duration Opportunities ETF (US:LGOV) , American Century ETF Trust - American Century Diversified Corporate Bond ETF (US:KORP) , SPDR Series Trust - SPDR Portfolio Intermediate Term Treasury ETF (US:SPTI) , The Select Sector SPDR Trust - The Technology Select Sector SPDR Fund (US:XLK) , and Guinness Atkinson Funds - SmartETFs Asia Pacific Dividend Builder ETF (US:ADIV) . Posisi baru Comprehensive Wealth Management, LLC meliputi: American Century ETF Trust - American Century Diversified Corporate Bond ETF (US:KORP) , Vanguard International Equity Index Funds - Vanguard Total World Stock ETF (US:VT) , iShares Trust - iShares Currency Hedged MSCI Eurozone ETF (US:HEZU) , Franklin Templeton ETF Trust - Franklin Senior Loan ETF (US:FLBL) , and Schwab Strategic Trust - Schwab Intermediate-Term U.S. Treasury ETF (US:SCHR) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 1.58 | 33.84 | 27.2552 | 20.6466 | |

| 0.52 | 24.62 | 19.8239 | 19.8239 | |

| 0.29 | 5.04 | 4.0587 | 2.4257 | |

| 0.05 | 4.36 | 3.5111 | 2.4059 | |

| 0.11 | 4.17 | 3.3577 | 2.2588 | |

| 0.06 | 3.15 | 2.5386 | 2.1835 | |

| 0.02 | 2.70 | 2.1754 | 2.1754 | |

| 0.02 | 5.92 | 4.7703 | 1.4501 | |

| 0.03 | 1.07 | 0.8626 | 0.8626 | |

| 0.01 | 1.62 | 1.3011 | 0.7460 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.28 | 8.14 | 6.5569 | -6.5005 | |

| 0.01 | 0.45 | 0.3631 | -0.2990 | |

| 0.01 | 1.08 | 0.8716 | -0.2420 | |

| 0.01 | 0.45 | 0.3636 | -0.1964 | |

| 0.01 | 0.60 | 0.4854 | -0.1001 | |

| 0.03 | 1.37 | 1.1030 | -0.0516 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-11 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.