Mga Batayang Estadistika

| Nilai Portofolio | $ 213,458,543 |

| Posisi Saat Ini | 41 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

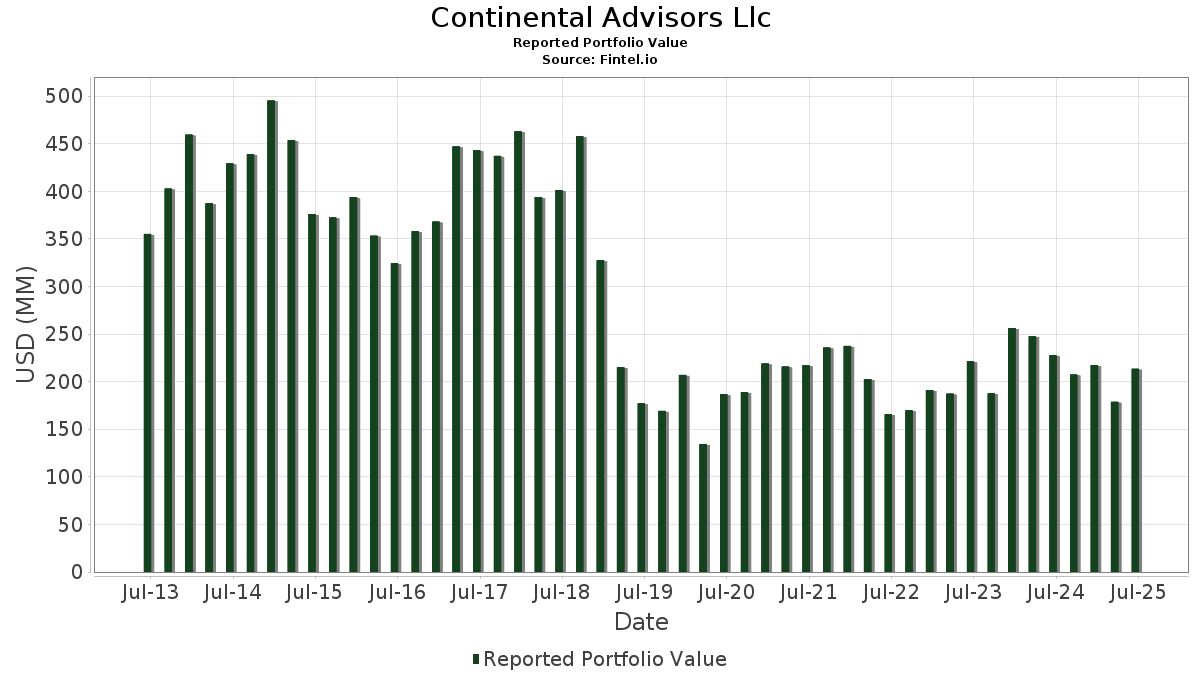

Continental Advisors Llc telah mengungkapkan total kepemilikan 41 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 213,458,543 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Continental Advisors Llc adalah SPDR S&P 500 ETF (US:SPY) , The Western Union Company (US:WU) , Pfizer Inc. (US:PFE) , Viatris Inc. (US:VTRS) , and Capital One Financial Corporation (US:COF) . Posisi baru Continental Advisors Llc meliputi: Barrick Mining Corporation (US:B) , Barrick Mining Corporation (US:B) , loanDepot, Inc. (US:LDI) , United Community Banks, Inc. (US:UCB) , and Seacoast Banking Corporation of Florida (US:SBCF) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.08 | 48.38 | 22.6637 | 13.2750 | |

| 0.17 | 3.56 | 1.6690 | 1.6690 | |

| 0.08 | 1.67 | 0.7803 | 0.7803 | |

| 0.04 | 8.79 | 4.1170 | 0.3749 | |

| 0.52 | 0.66 | 0.3074 | 0.3074 | |

| 0.35 | 8.41 | 3.9405 | 0.2545 | |

| 0.02 | 0.54 | 0.2512 | 0.2512 | |

| 0.04 | 3.04 | 1.4258 | 0.2371 | |

| 0.18 | 4.16 | 1.9503 | 0.2057 | |

| 0.01 | 0.35 | 0.1634 | 0.1634 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.88 | 7.44 | 3.4862 | -2.6395 | |

| 0.37 | 8.90 | 4.1714 | -1.8585 | |

| 1.24 | 10.41 | 4.8771 | -1.6707 | |

| 0.55 | 4.90 | 2.2967 | -1.2313 | |

| 0.04 | 3.98 | 1.8629 | -0.9497 | |

| 0.00 | 0.00 | -0.6306 | ||

| 0.09 | 8.26 | 3.8703 | -0.5380 | |

| 0.98 | 8.79 | 4.1183 | -0.4838 | |

| 0.08 | 3.70 | 1.7333 | -0.4671 | |

| 0.14 | 3.87 | 1.8138 | -0.4593 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-19 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| SPY / SPDR S&P 500 ETF | Put | 0.08 | 161.00 | 48.38 | 188.28 | 22.6637 | 13.2750 | ||

| WU / The Western Union Company | Call | 1.24 | 11.77 | 10.41 | -11.05 | 4.8771 | -1.6707 | ||

| PFE / Pfizer Inc. | 0.37 | -13.64 | 8.90 | -17.39 | 4.1714 | -1.8585 | |||

| VTRS / Viatris Inc. | 0.98 | 4.24 | 8.79 | 6.87 | 4.1183 | -0.4838 | |||

| COF / Capital One Financial Corporation | 0.04 | 10.72 | 8.79 | 31.40 | 4.1170 | 0.3749 | |||

| PFE / Pfizer Inc. | Call | 0.35 | 33.46 | 8.41 | 27.67 | 3.9405 | 0.2545 | ||

| UBER / Uber Technologies, Inc. | 0.09 | -18.12 | 8.26 | 4.85 | 3.8703 | -0.5380 | |||

| FHI / Federated Hermes, Inc. | 0.18 | 0.00 | 7.88 | 8.70 | 3.6929 | -0.3640 | |||

| WU / The Western Union Company | 0.88 | -14.60 | 7.44 | -32.04 | 3.4862 | -2.6395 | |||

| TFC / Truist Financial Corporation | 0.17 | 3.46 | 7.10 | 8.08 | 3.3265 | -0.3489 | |||

| WFC / Wells Fargo & Company | 0.08 | 0.00 | 6.66 | 11.60 | 3.1193 | -0.2185 | |||

| C / Citigroup Inc. | 0.07 | 0.00 | 6.21 | 19.92 | 2.9084 | 0.0117 | |||

| TEVA / Teva Pharmaceutical Industries Limited - Depositary Receipt (Common Stock) | 0.34 | 0.00 | 5.72 | 9.06 | 2.6783 | -0.2549 | |||

| VTRS / Viatris Inc. | Call | 0.55 | -24.17 | 4.90 | -22.26 | 2.2967 | -1.2313 | ||

| LVS / Las Vegas Sands Corp. | 0.10 | 5.25 | 4.37 | 18.55 | 2.0450 | -0.0152 | |||

| NTRS / Northern Trust Corporation | 0.03 | 0.00 | 4.29 | 28.52 | 2.0077 | 0.1422 | |||

| CNNE / Cannae Holdings, Inc. | 0.20 | -5.94 | 4.26 | 7.01 | 1.9948 | -0.2318 | |||

| RF / Regions Financial Corporation | 0.18 | 23.34 | 4.16 | 33.52 | 1.9503 | 0.2057 | |||

| GILD / Gilead Sciences, Inc. | 0.04 | -20.06 | 3.98 | -20.91 | 1.8629 | -0.9497 | |||

| PRGO / Perrigo Company plc | 0.14 | 0.00 | 3.87 | -4.73 | 1.8138 | -0.4593 | |||

| AMLP / ALPS ETF Trust - Alerian MLP ETF | 0.08 | 0.00 | 3.70 | -5.95 | 1.7333 | -0.4671 | |||

| XRAY / DENTSPLY SIRONA Inc. | 0.23 | 24.30 | 3.59 | 32.13 | 1.6819 | 0.1617 | |||

| B / Barrick Mining Corporation | 0.17 | 3.56 | 1.6690 | 1.6690 | |||||

| JPM / JPMorgan Chase & Co. | 0.01 | 0.00 | 3.11 | 18.19 | 1.4580 | -0.0152 | |||

| XLE / The Select Sector SPDR Trust - The Energy Select Sector SPDR Fund | 0.04 | 0.00 | 3.10 | -9.24 | 1.4502 | -0.4581 | |||

| XBI / SPDR Series Trust - SPDR S&P Biotech ETF | 0.04 | 40.08 | 3.04 | 43.27 | 1.4258 | 0.2371 | |||

| BKD / Brookdale Senior Living Inc. | 0.38 | 0.00 | 2.67 | 11.16 | 1.2508 | -0.0927 | |||

| SHEL / Shell plc - Depositary Receipt (Common Stock) | 0.04 | 0.00 | 2.57 | -3.92 | 1.2046 | -0.2926 | |||

| IEMG / iShares, Inc. - iShares Core MSCI Emerging Markets ETF | 0.04 | 0.00 | 2.45 | 11.27 | 1.1474 | -0.0845 | |||

| GS / The Goldman Sachs Group, Inc. | 0.00 | 0.00 | 2.33 | 29.59 | 1.0918 | 0.0854 | |||

| IVZ / Invesco Ltd. | 0.13 | 0.00 | 2.08 | 3.96 | 0.9729 | -0.1448 | |||

| RPAY / Repay Holdings Corporation | 0.40 | 18.70 | 1.92 | 2.67 | 0.9008 | -0.1465 | |||

| SSB / SouthState Corporation | 0.02 | 0.00 | 1.70 | -0.87 | 0.7981 | -0.1632 | |||

| B / Barrick Mining Corporation | Call | 0.08 | 1.67 | 0.7803 | 0.7803 | ||||

| LDI / loanDepot, Inc. | 0.52 | 0.66 | 0.3074 | 0.3074 | |||||

| FBNC / First Bancorp | 0.01 | 0.00 | 0.55 | 9.96 | 0.2588 | -0.0226 | |||

| UCB / United Community Banks, Inc. | 0.02 | 0.54 | 0.2512 | 0.2512 | |||||

| RVSB / Riverview Bancorp, Inc. | 0.09 | -13.31 | 0.47 | -15.54 | 0.2216 | -0.0920 | |||

| PROV / Provident Financial Holdings, Inc. | 0.02 | 0.00 | 0.37 | 6.27 | 0.1750 | -0.0217 | |||

| VBTX / Veritex Holdings, Inc. | 0.01 | 0.35 | 0.1634 | 0.1634 | |||||

| SBCF / Seacoast Banking Corporation of Florida | 0.01 | 0.25 | 0.1165 | 0.1165 | |||||

| XRAY / DENTSPLY SIRONA Inc. | Call | 0.00 | -100.00 | 0.00 | -100.00 | -0.1973 | |||

| GOLD / Barrick Mining Corporation | Call | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| PRGO / Perrigo Company plc | Call | 0.00 | -100.00 | 0.00 | -100.00 | -0.6306 | |||

| GOLD / Barrick Mining Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| CAH / Cardinal Health, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 |