Mga Batayang Estadistika

| Nilai Portofolio | $ 2,405,580,000 |

| Posisi Saat Ini | 60 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

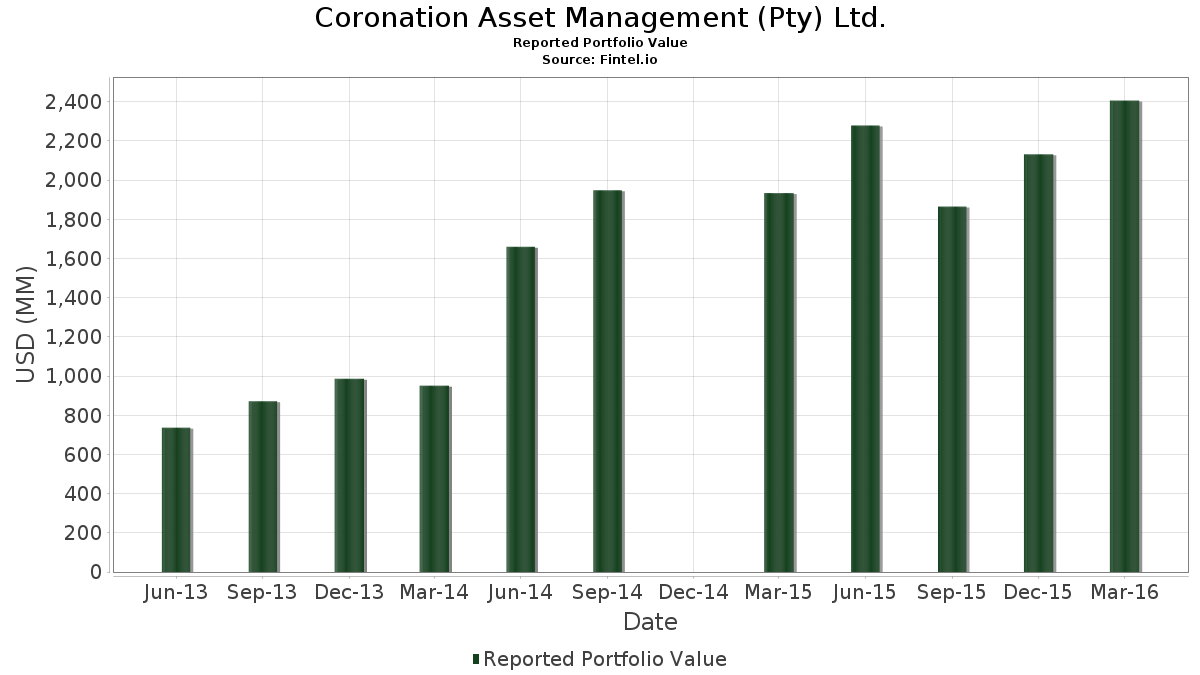

Coronation Asset Management (Pty) Ltd. telah mengungkapkan total kepemilikan 60 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 2,405,580,000 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Coronation Asset Management (Pty) Ltd. adalah Baidu, Inc. - Depositary Receipt (Common Stock) (US:BIDU) , Tata Motors Ltd. - ADR (US:TTM) , JD.com, Inc. - Depositary Receipt (Common Stock) (US:JD) , Trip.com Group Limited - Depositary Receipt (Common Stock) (US:TCOM) , and Cognizant Technology Solutions Corporation (US:CTSH) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.50 | 71.29 | 2.9635 | 2.9635 | |

| 2.84 | 48.60 | 2.0204 | 2.0204 | |

| 1.19 | 31.30 | 1.3010 | 1.3010 | |

| 0.74 | 28.52 | 1.1855 | 1.1177 | |

| 3.66 | 162.09 | 6.7379 | 0.6277 | |

| 0.06 | 11.91 | 0.4949 | 0.4949 | |

| 0.17 | 11.35 | 0.4717 | 0.4717 | |

| 1.82 | 51.00 | 2.1199 | 0.4391 | |

| 0.37 | 9.41 | 0.3914 | 0.3914 | |

| 0.44 | 26.91 | 1.1186 | 0.3422 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 7.92 | 209.85 | 8.7236 | -1.7784 | |

| 0.02 | 4.65 | 0.1932 | -1.6519 | |

| 7.56 | 219.71 | 9.1335 | -1.0437 | |

| 0.66 | 22.76 | 0.9463 | -0.9832 | |

| 1.21 | 59.94 | 2.4915 | -0.9161 | |

| 1.22 | 233.75 | 9.7169 | -0.8213 | |

| 0.01 | 0.21 | 0.0088 | -0.6692 | |

| 0.19 | 15.96 | 0.6633 | -0.6240 | |

| 0.51 | 31.40 | 1.3051 | -0.4405 | |

| 0.07 | 54.92 | 2.2830 | -0.3253 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2016-05-09 untuk periode pelaporan 2016-03-31. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| BIDU / Baidu, Inc. - Depositary Receipt (Common Stock) | 1.22 | 3.07 | 233.75 | 4.07 | 9.7169 | -0.8213 | |||

| TTM / Tata Motors Ltd. - ADR | 7.56 | 2.76 | 219.71 | 1.29 | 9.1335 | -1.0437 | |||

| JD / JD.com, Inc. - Depositary Receipt (Common Stock) | 7.92 | 14.15 | 209.85 | -6.25 | 8.7236 | -1.7784 | |||

| TCOM / Trip.com Group Limited - Depositary Receipt (Common Stock) | 3.66 | 30.28 | 162.09 | 24.46 | 6.7379 | 0.6277 | |||

| CTSH / Cognizant Technology Solutions Corporation | 1.74 | 16.02 | 109.28 | 21.20 | 4.5426 | 0.3122 | |||

| BAP / Credicorp Ltd. | 0.73 | -13.17 | 95.73 | 16.89 | 3.9797 | 0.1370 | |||

| V / Visa Inc. | 1.09 | 26.66 | 83.67 | 24.91 | 3.4782 | 0.3354 | |||

| NTES / NetEase, Inc. - Depositary Receipt (Common Stock) | 0.50 | 0.00 | 71.29 | 2.9635 | 2.9635 | ||||

| KSU / Kansas City Southern | 0.76 | -1.52 | 65.07 | 12.70 | 2.7049 | -0.0040 | |||

| MLCO / Melco Resorts & Entertainment Limited - Depositary Receipt (Common Stock) | 3.79 | 15.51 | 62.60 | 13.51 | 2.6022 | 0.0148 | |||

| AABA / Altaba Inc | 1.66 | -0.99 | 61.07 | 9.58 | 2.5386 | -0.0762 | |||

| SOHU / Sohu.com Limited - Depositary Receipt (Common Stock) | 1.21 | -4.73 | 59.94 | -17.48 | 2.4915 | -0.9161 | |||

| GOOGL / Alphabet Inc. | 0.07 | 0.75 | 54.92 | -1.21 | 2.2830 | -0.3253 | |||

| KKR / KKR & Co. Inc. | 3.71 | 32.29 | 54.55 | 24.65 | 2.2677 | 0.2144 | |||

| BX / Blackstone Inc. | 1.82 | 48.39 | 51.00 | 42.35 | 2.1199 | 0.4391 | |||

| APO / Apollo Global Management, Inc. | 2.84 | 10.48 | 48.60 | 24.60 | 2.0204 | 2.0204 | |||

| AMZN / Amazon.com, Inc. | 0.07 | 21.55 | 44.27 | 6.75 | 1.8404 | -0.1054 | |||

| WBA / Walgreens Boots Alliance, Inc. | 0.51 | 5.91 | 42.82 | 4.78 | 1.7802 | -0.1375 | |||

| CBD / Companhia Brasileira De Distribuicao - Depositary Receipt (Common Stock) | 2.99 | -22.23 | 41.55 | 2.83 | 1.7272 | -0.1686 | |||

| ARCO / Arcos Dorados Holdings Inc. | 10.13 | -8.54 | 37.97 | 10.28 | 1.5785 | -0.0370 | |||

| BKNG / Booking Holdings Inc. | 0.03 | 8.27 | 35.63 | 9.46 | 1.4812 | -0.0461 | |||

| 34958B106 / Fortress Investment Group LLC | 7.34 | 12.72 | 35.10 | 5.85 | 1.4593 | -0.0967 | |||

| AXP / American Express Company | 0.51 | -4.41 | 31.40 | -15.61 | 1.3051 | -0.4405 | |||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 1.19 | 0.00 | 31.30 | 1.3010 | 1.3010 | ||||

| LBTYA / Liberty Global Ltd. | 0.74 | 2,070.71 | 28.52 | 1,873.49 | 1.1855 | 1.1177 | |||

| MA / Mastercard Incorporated | 0.30 | 56.06 | 28.20 | 51.48 | 1.1723 | 0.2988 | |||

| AAPL / Apple Inc. | 0.25 | 50.66 | 27.71 | 56.00 | 1.1520 | 0.3185 | |||

| CMCSA / Comcast Corporation | 0.44 | 50.24 | 26.91 | 62.62 | 1.1186 | 0.3422 | |||

| PYPL / PayPal Holdings, Inc. | 0.66 | -3.47 | 25.39 | 2.93 | 1.0553 | -0.1019 | |||

| UNP / Union Pacific Corporation | 0.29 | 15.24 | 23.04 | 17.23 | 0.9578 | 0.0357 | |||

| EDU / New Oriental Education & Technology Group Inc. - Depositary Receipt (Common Stock) | 0.66 | -49.80 | 22.76 | -44.65 | 0.9463 | -0.9832 | |||

| TRIP / Tripadvisor, Inc. | 0.34 | 47.82 | 22.70 | 15.31 | 0.9438 | 0.0200 | |||

| FOXA / Fox Corporation | 0.80 | 4.22 | 22.51 | 7.93 | 0.9356 | -0.0428 | |||

| HOG / Harley-Davidson, Inc. | 0.42 | 23.48 | 21.44 | 39.64 | 0.8911 | 0.1708 | |||

| QCOM / QUALCOMM Incorporated | 0.36 | 8.71 | 18.18 | 11.22 | 0.7560 | -0.0112 | |||

| DISCK / Warner Bros.Discovery Inc - Series C | 0.63 | -19.39 | 16.98 | -13.70 | 0.7061 | -0.2173 | |||

| CG / The Carlyle Group Inc. | 1.01 | 72.57 | 16.97 | 86.49 | 0.7054 | 0.2785 | |||

| DG / Dollar General Corporation | 0.19 | -51.17 | 15.96 | -41.84 | 0.6633 | -0.6240 | |||

| AAL / American Airlines Group Inc. | 0.38 | 49.34 | 15.74 | 44.62 | 0.6544 | 0.1437 | |||

| URBN / Urban Outfitters, Inc. | 0.46 | -29.56 | 15.29 | 2.46 | 0.6358 | -0.0646 | |||

| RAD / Rite Aid Corp. | 1.85 | 21.45 | 15.07 | 26.26 | 0.6264 | 0.0664 | |||

| YUM / Yum! Brands, Inc. | 0.15 | 29.13 | 12.28 | 44.69 | 0.5106 | 0.1123 | |||

| LBRDA / Liberty Broadband Corporation | 0.06 | 0.00 | 11.91 | 0.4949 | 0.4949 | ||||

| ESRX / Express Scripts Holding Co. | 0.17 | 0.00 | 11.35 | 0.4717 | 0.4717 | ||||

| JPM / JPMorgan Chase & Co. | 0.19 | 11.18 | 11.23 | -0.28 | 0.4670 | -0.0616 | |||

| MSFT / Microsoft Corporation | 0.19 | 11.77 | 10.55 | 11.26 | 0.4386 | -0.0063 | |||

| BRX / Brixmor Property Group Inc. | 0.37 | 0.00 | 9.41 | 0.3914 | 0.3914 | ||||

| LPLA / LPL Financial Holdings Inc. | 0.31 | 31.52 | 7.74 | -23.52 | 0.3218 | -0.1531 | |||

| HAIN / The Hain Celestial Group, Inc. | 0.12 | 21.99 | 5.02 | 23.56 | 0.2086 | 0.0181 | |||

| FOX / Fox Corporation | 0.18 | -8.98 | 4.96 | -6.56 | 0.2061 | -0.0428 | |||

| TWC / Spectrum Management Holding Company LLC | 0.02 | -89.28 | 4.65 | -88.18 | 0.1932 | -1.6519 | |||

| META / Meta Platforms, Inc. | 0.03 | 0.00 | 3.56 | 0.1482 | 0.1482 | ||||

| 018490100 / Allergan plc | 0.01 | -73.71 | 1.53 | -77.46 | 0.0636 | -0.2547 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.01 | 0.00 | 1.42 | 7.50 | 0.0590 | -0.0029 | |||

| AKO.A / Embotelladora Andina S.A. - Depositary Receipt (Common Stock) | 0.06 | 0.00 | 1.02 | 4.18 | 0.0425 | -0.0035 | |||

| US31680Q1040 / 58.com Inc. | 0.02 | 313.68 | 0.97 | 248.56 | 0.0403 | 0.0272 | |||

| WTW / Willis Towers Watson Public Limited Company | 0.01 | 0.00 | 0.84 | 0.0348 | 0.0348 | ||||

| VIPS / Vipshop Holdings Limited - Depositary Receipt (Common Stock) | 0.02 | 0.00 | 0.22 | 0.0091 | 0.0091 | ||||

| INFY / Infosys Limited - Depositary Receipt (Common Stock) | 0.01 | -98.71 | 0.21 | -98.54 | 0.0088 | -0.6692 | |||

| IBN / ICICI Bank Limited - Depositary Receipt (Common Stock) | 0.02 | 22.81 | 0.17 | 11.76 | 0.0071 | -0.0001 | |||

| GDX / VanEck ETF Trust - VanEck Gold Miners ETF | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 |