Mga Batayang Estadistika

| Nilai Portofolio | $ 18,425,386 |

| Posisi Saat Ini | 72 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

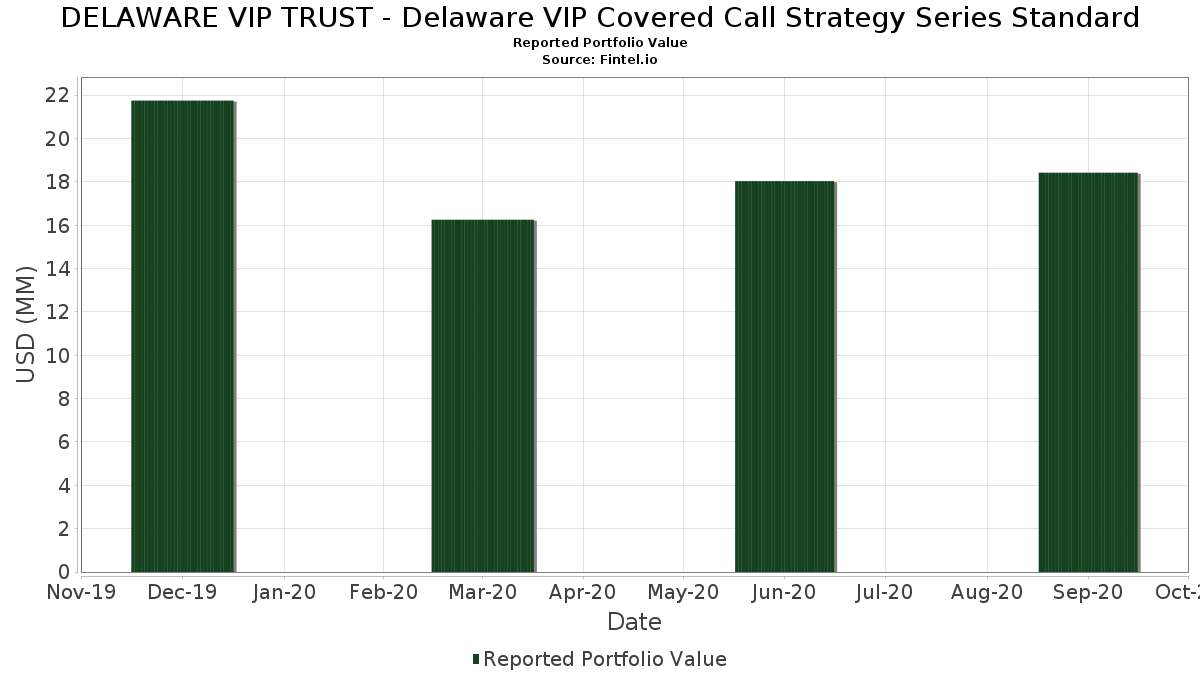

DELAWARE VIP TRUST - Delaware VIP Covered Call Strategy Series Standard telah mengungkapkan total kepemilikan 72 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 18,425,386 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama DELAWARE VIP TRUST - Delaware VIP Covered Call Strategy Series Standard adalah Apple Inc. (US:AAPL) , Microsoft Corporation (US:MSFT) , The Home Depot, Inc. (US:HD) , Mastercard Incorporated (US:MA) , and Broadcom Inc. (US:AVGO) . Posisi baru DELAWARE VIP TRUST - Delaware VIP Covered Call Strategy Series Standard meliputi: NextEra Energy, Inc. (US:NEE) , PPG Industries, Inc. (US:PPG) , Booking Holdings Inc. (US:BKNG) , Verizon Communications Inc. (US:VZ) , and .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.00 | 0.42 | 2.2595 | 2.2595 | |

| 0.00 | 0.38 | 2.0539 | 2.0539 | |

| 0.00 | 0.34 | 1.8568 | 1.8568 | |

| 0.01 | 1.58 | 8.5477 | 1.4559 | |

| 0.00 | 0.26 | 1.4206 | 1.4206 | |

| 0.00 | 0.82 | 4.4312 | 0.5577 | |

| 0.02 | 0.52 | 2.8318 | 0.5157 | |

| 0.00 | 0.84 | 4.5475 | 0.5156 | |

| 0.00 | 0.76 | 4.1219 | 0.4644 | |

| 0.01 | 0.80 | 4.3396 | 0.3903 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.00 | 0.00 | -2.1378 | ||

| 0.00 | 0.00 | -2.1018 | ||

| 0.00 | 0.00 | -2.0376 | ||

| 0.01 | 0.35 | 1.8792 | -1.8968 | |

| 0.00 | 0.00 | -1.7973 | ||

| 0.00 | 0.00 | -1.2880 | ||

| 0.00 | 0.00 | -1.0276 | ||

| 0.01 | 0.45 | 2.4631 | -0.7176 | |

| 0.01 | 0.43 | 2.3445 | -0.6292 | |

| 0.00 | 0.46 | 2.5112 | -0.3395 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2020-11-25 untuk periode pelaporan 2020-09-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| AAPL / Apple Inc. | 0.01 | 288.57 | 1.58 | 23.43 | 8.5477 | 1.4559 | |||

| MSFT / Microsoft Corporation | 0.01 | 0.00 | 1.47 | 3.37 | 7.9903 | 0.0778 | |||

| HD / The Home Depot, Inc. | 0.00 | -7.32 | 1.06 | 2.73 | 5.7272 | 0.0223 | |||

| MA / Mastercard Incorporated | 0.00 | -10.71 | 0.85 | 2.18 | 4.5882 | -0.0106 | |||

| AVGO / Broadcom Inc. | 0.00 | 0.00 | 0.84 | 15.45 | 4.5475 | 0.5156 | |||

| COST / Costco Wholesale Corporation | 0.00 | 0.00 | 0.82 | 17.07 | 4.4312 | 0.5577 | |||

| TXN / Texas Instruments Incorporated | 0.01 | 0.00 | 0.80 | 12.38 | 4.3396 | 0.3903 | |||

| C.WSA / Citigroup, Inc. | 0.00 | 0.00 | 0.79 | 3.55 | 4.2818 | 0.0509 | |||

| META / Meta Platforms, Inc. | 0.00 | 0.00 | 0.76 | 15.35 | 4.1219 | 0.4644 | |||

| GOOGL / Alphabet Inc. | 0.00 | 0.00 | 0.73 | 3.24 | 3.9769 | 0.0388 | |||

| MDT / Medtronic plc | 0.01 | 0.00 | 0.73 | 13.42 | 3.9479 | 0.3825 | |||

| BMY / Bristol-Myers Squibb Company | 0.01 | 0.00 | 0.67 | 2.61 | 3.6319 | 0.0067 | |||

| LMT / Lockheed Martin Corporation | 0.00 | 0.00 | 0.65 | 5.00 | 3.5361 | 0.0904 | |||

| BX / Blackstone Inc. | 0.01 | 0.00 | 0.53 | -7.80 | 2.8896 | -0.3204 | |||

| GLW / Corning Incorporated | 0.02 | 0.00 | 0.52 | 25.24 | 2.8318 | 0.5157 | |||

| MRK / Merck & Co., Inc. | 0.01 | 0.00 | 0.51 | 7.31 | 2.7911 | 0.1281 | |||

| BA / The Boeing Company | 0.00 | 0.00 | 0.46 | -9.94 | 2.5112 | -0.3395 | |||

| RTX / RTX Corporation | 0.01 | 0.00 | 0.46 | -6.50 | 2.4982 | -0.2399 | |||

| MDLZ / Mondelez International, Inc. | 0.01 | -29.46 | 0.45 | -20.80 | 2.4631 | -0.7176 | |||

| CVX / Chevron Corporation | 0.01 | 0.00 | 0.43 | -19.25 | 2.3445 | -0.6292 | |||

| SYY / Sysco Corporation | 0.01 | 0.00 | 0.42 | 13.66 | 2.2624 | 0.2283 | |||

| NEE / NextEra Energy, Inc. | 0.00 | 0.42 | 2.2595 | 2.2595 | |||||

| WHR / Whirlpool Corporation | 0.00 | -24.14 | 0.40 | 7.73 | 2.1956 | 0.1091 | |||

| V / Visa Inc. | 0.00 | 0.00 | 0.40 | 3.37 | 2.1705 | 0.0246 | |||

| PPG / PPG Industries, Inc. | 0.00 | 0.38 | 2.0539 | 2.0539 | |||||

| ORCL / Oracle Corporation | 0.01 | -52.85 | 0.35 | -49.04 | 1.8792 | -1.8968 | |||

| BKNG / Booking Holdings Inc. | 0.00 | 0.34 | 1.8568 | 1.8568 | |||||

| UPS / United Parcel Service, Inc. | 0.00 | -25.00 | 0.30 | 12.41 | 1.6278 | 0.1457 | |||

| VZ / Verizon Communications Inc. | 0.00 | 0.26 | 1.4206 | 1.4206 | |||||

| UNP / Union Pacific Corporation | 0.00 | -29.41 | 0.24 | -17.77 | 1.2821 | -0.3143 | |||

| T / AT&T Inc. | 0.01 | 0.00 | 0.19 | -5.45 | 1.0367 | -0.0883 | |||

| US38141W2733 / Goldman Sachs Financial Square Funds - Government Fund | 0.08 | 2.69 | 0.08 | 3.80 | 0.4457 | 0.0015 | |||

| TFDXX / Blackrock Liquidity Funds - BlackRock Liquidity Funds FedFund Portfolio Institutional Class | 0.08 | 2.69 | 0.08 | 3.80 | 0.4457 | 0.0015 | |||

| US61747C7074 / Morgan Stanley Institutional Liquidity Funds Government Portfolio, Institutional Class | 0.08 | 2.69 | 0.08 | 3.80 | 0.4457 | 0.0015 | |||

| FIGXX / Fidelity Colchester Street Trust - Fidelity Institutional Money Market Funds Government Portfolio Class I | 0.08 | 2.69 | 0.08 | 3.80 | 0.4457 | 0.0015 | |||

| STZ / Constellation Brands, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -2.1378 | ||||

| SPY / SPDR S&P 500 ETF | 0.00 | -100.00 | 0.00 | -100.00 | -1.0276 | ||||

| TJX / The TJX Companies, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.7973 | ||||

| SYK / Stryker Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -2.1018 | ||||

| CAT / Caterpillar Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -2.0376 | ||||

| NUE / Nucor Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -1.2880 | ||||

| AT&T INC / DE (000000000) | -0.00 | -0.0038 | -0.0038 | ||||||

| MONDELEZ INTERNATIONAL INC / DE (000000000) | -0.00 | -0.0071 | -0.0071 | ||||||

| VERIZON COMMUNICATIONS INC / DE (000000000) | -0.00 | -0.0124 | -0.0124 | ||||||

| CHEVRON CORP / DE (000000000) | -0.00 | -0.0179 | -0.0179 | ||||||

| MERCK & CO INC / DE (000000000) | -0.00 | -0.0219 | -0.0219 | ||||||

| RAYTHEON TECHNOLOGIES CORP / DE (000000000) | -0.01 | -0.0302 | -0.0302 | ||||||

| PPG INDUSTRIES INC / DE (000000000) | -0.01 | -0.0404 | -0.0404 | ||||||

| BLACKSTONE GROUP INC/THE / DE (000000000) | -0.01 | -0.0405 | -0.0405 | ||||||

| BLACKSTONE GROUP INC/THE / DE (000000000) | -0.01 | -0.0405 | -0.0405 | ||||||

| BOEING CO/THE / DE (000000000) | -0.01 | -0.0445 | -0.0445 | ||||||

| BOEING CO/THE / DE (000000000) | -0.01 | -0.0445 | -0.0445 | ||||||

| NEXTERA ENERGY INC / DE (000000000) | -0.01 | -0.0521 | -0.0521 | ||||||

| VISA INC / DE (000000000) | -0.01 | -0.0543 | -0.0543 | ||||||

| BOOKING HOLDINGS INC / DE (000000000) | -0.01 | -0.0552 | -0.0552 | ||||||

| ORACLE CORP / DE (000000000) | -0.01 | -0.0600 | -0.0600 | ||||||

| MICROSOFT CORP / DE (000000000) | -0.01 | -0.0679 | -0.0679 | ||||||

| MICROSOFT CORP / DE (000000000) | -0.01 | -0.0679 | -0.0679 | ||||||

| LOCKHEED MARTIN CORP / DE (000000000) | -0.01 | -0.0701 | -0.0701 | ||||||

| FACEBOOK INC / DE (000000000) | -0.02 | -0.0814 | -0.0814 | ||||||

| BRISTOL-MYERS SQUIBB CO / DE (000000000) | -0.02 | -0.0843 | -0.0843 | ||||||

| BRISTOL-MYERS SQUIBB CO / DE (000000000) | -0.02 | -0.0843 | -0.0843 | ||||||

| ALPHABET INC / DE (000000000) | -0.02 | -0.0971 | -0.0971 | ||||||

| APPLE INC / DE (000000000) | -0.02 | -0.1068 | -0.1068 | ||||||

| APPLE INC / DE (000000000) | -0.02 | -0.1068 | -0.1068 | ||||||

| C1BO34 / Cboe Global Markets, Inc. - Depositary Receipt (Common Stock) | -0.02 | -0.1109 | -0.1109 | ||||||

| UNITED PARCEL SERVICE INC / DE (000000000) | -0.02 | -0.1238 | -0.1238 | ||||||

| TEXAS INSTRUMENTS INC / DE (000000000) | -0.02 | -0.1337 | -0.1337 | ||||||

| CORNING INC / DE (000000000) | -0.03 | -0.1402 | -0.1402 | ||||||

| UNION PACIFIC CORP / DE (000000000) | -0.03 | -0.1565 | -0.1565 | ||||||

| HOME DEPOT INC/THE / DE (000000000) | -0.03 | -0.1572 | -0.1572 | ||||||

| C1BO34 / Cboe Global Markets, Inc. - Depositary Receipt (Common Stock) | -0.03 | -0.1873 | -0.1873 | ||||||

| WHIRLPOOL CORP / DE (000000000) | -0.04 | -0.1947 | -0.1947 | ||||||

| WHIRLPOOL CORP / DE (000000000) | -0.04 | -0.1947 | -0.1947 | ||||||

| COSTCO WHOLESALE CORP / DE (000000000) | -0.04 | -0.2178 | -0.2178 | ||||||

| C1BO34 / Cboe Global Markets, Inc. - Depositary Receipt (Common Stock) | -0.05 | -0.2721 | -0.2721 | ||||||

| MASTERCARD INC / DE (000000000) | -0.06 | -0.3239 | -0.3239 | ||||||

| MEDTRONIC PLC / DE (000000000) | -0.06 | -0.3248 | -0.3248 |