Mga Batayang Estadistika

| Nilai Portofolio | $ 1,329,829,934 |

| Posisi Saat Ini | 199 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

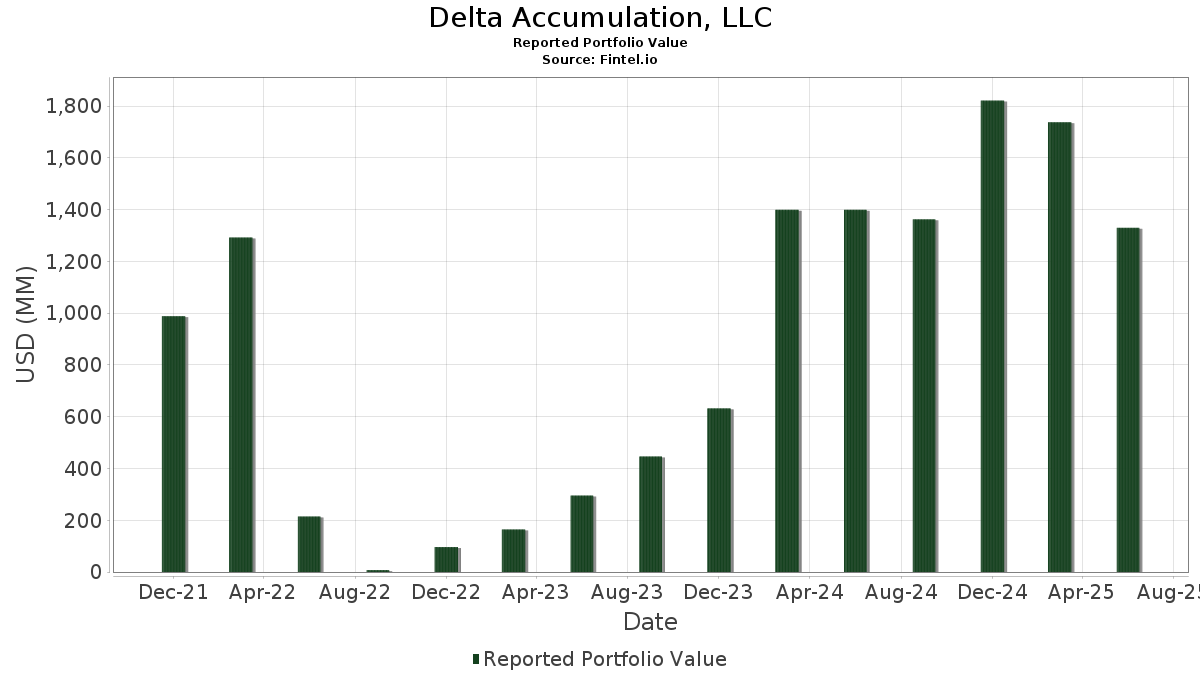

Delta Accumulation, LLC telah mengungkapkan total kepemilikan 199 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 1,329,829,934 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Delta Accumulation, LLC adalah JPMorgan Chase & Co. (US:JPM) , Costco Wholesale Corporation (US:COST) , JPMorgan Chase & Co. (US:JPM) , Walmart Inc. (US:WMT) , and Costco Wholesale Corporation (US:COST) . Posisi baru Delta Accumulation, LLC meliputi: Costco Wholesale Corporation (US:COST) , Altria Group, Inc. (US:MO) , Altria Group, Inc. (US:MO) , Monster Beverage Corporation (US:MNST) , and Monster Beverage Corporation (US:MNST) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.86 | 181.53 | 13.6506 | 6.2095 | |

| 0.04 | 32.54 | 2.4466 | 2.4466 | |

| 0.18 | 20.24 | 1.5217 | 1.3474 | |

| 0.44 | 91.81 | 6.9038 | 1.2550 | |

| 0.06 | 25.42 | 1.9116 | 1.2437 | |

| 0.17 | 18.30 | 1.3763 | 1.2020 | |

| 0.01 | 18.21 | 1.3693 | 0.8747 | |

| 0.26 | 52.85 | 3.9743 | 0.7208 | |

| 0.09 | 14.04 | 1.0558 | 0.5464 | |

| 0.02 | 9.74 | 0.7324 | 0.4763 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.12 | 103.90 | 7.8130 | -6.3037 | |

| 0.06 | 50.00 | 3.7599 | -3.7602 | |

| 0.01 | 20.20 | 1.5187 | -2.6516 | |

| 0.01 | 23.70 | 1.7819 | -0.9950 | |

| 0.00 | 20.94 | 1.5745 | -0.9675 | |

| 0.01 | 3.31 | 0.2488 | -0.7485 | |

| 0.00 | 0.00 | -0.6513 | ||

| 0.00 | 19.96 | 1.5011 | -0.6224 | |

| 0.00 | 1.11 | 0.0832 | -0.5681 | |

| 0.01 | 4.09 | 0.3077 | -0.5636 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-13 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| JPM / JPMorgan Chase & Co. | Put | 0.86 | 4,479.26 | 181.53 | 40.39 | 13.6506 | 6.2095 | ||

| COST / Costco Wholesale Corporation | Put | 0.12 | -57.64 | 103.90 | -57.64 | 7.8130 | -6.3037 | ||

| JPM / JPMorgan Chase & Co. | Call | 0.44 | 2,215.96 | 91.81 | -6.47 | 6.9038 | 1.2550 | ||

| WMT / Walmart Inc. | Put | 0.26 | 1,883.33 | 52.85 | -6.51 | 3.9743 | 0.7208 | ||

| COST / Costco Wholesale Corporation | Call | 0.06 | -61.74 | 50.00 | -61.74 | 3.7599 | -3.7602 | ||

| COST / Costco Wholesale Corporation | 0.04 | 32.54 | 2.4466 | 2.4466 | |||||

| WMT / Walmart Inc. | Call | 0.01 | 0.00 | 32.04 | -27.55 | 2.4095 | -0.1358 | ||

| PGR / The Progressive Corporation | Put | 0.04 | 248.28 | 28.45 | -25.22 | 2.1391 | -0.0500 | ||

| PM / Philip Morris International Inc. | Put | 0.06 | 379.03 | 25.42 | 119.05 | 1.9116 | 1.2437 | ||

| WMB / The Williams Companies, Inc. | Put | 0.02 | -85.44 | 24.64 | -6.04 | 1.8530 | 0.3437 | ||

| SPY / SPDR S&P 500 ETF | Call | 0.01 | -46.08 | 23.70 | -50.89 | 1.7819 | -0.9950 | ||

| QQQ / Invesco QQQ Trust, Series 1 | Put | 0.00 | -78.95 | 20.94 | -52.60 | 1.5745 | -0.9675 | ||

| CAH / Cardinal Health, Inc. | Put | 0.18 | 568.25 | 20.24 | 568.30 | 1.5217 | 1.3474 | ||

| SPY / SPDR S&P 500 ETF | Put | 0.01 | -46.08 | 20.20 | -72.13 | 1.5187 | -2.6516 | ||

| QQQ / Invesco QQQ Trust, Series 1 | Call | 0.00 | -91.58 | 19.96 | -45.90 | 1.5011 | -0.6224 | ||

| BK / The Bank of New York Mellon Corporation | Put | 0.27 | 5.56 | 19.39 | 5.55 | 1.4579 | 0.4009 | ||

| CAH / Cardinal Health, Inc. | Call | 0.17 | 504.38 | 18.30 | 504.43 | 1.3763 | 1.2020 | ||

| PGR / The Progressive Corporation | Call | 0.01 | 0.00 | 18.27 | -18.83 | 1.3739 | 0.0786 | ||

| PM / Philip Morris International Inc. | Call | 0.01 | 0.00 | 18.21 | 111.87 | 1.3693 | 0.8747 | ||

| BK / The Bank of New York Mellon Corporation | Call | 0.22 | 6.78 | 16.06 | 6.78 | 1.2077 | 0.3422 | ||

| TMUS / T-Mobile US, Inc. | Put | 0.02 | -40.27 | 14.61 | -38.86 | 1.0987 | -0.2766 | ||

| WMB / The Williams Companies, Inc. | Call | 0.02 | 0.00 | 14.32 | -18.46 | 1.0769 | 0.0662 | ||

| ICE / Intercontinental Exchange, Inc. | Put | 0.09 | 160.12 | 14.04 | 58.61 | 1.0558 | 0.5464 | ||

| ALL / The Allstate Corporation | Call | 0.07 | -12.40 | 12.99 | -12.40 | 0.9769 | 0.1234 | ||

| ALL / The Allstate Corporation | Put | 0.07 | -12.40 | 12.99 | -12.40 | 0.9769 | 0.1234 | ||

| ICE / Intercontinental Exchange, Inc. | Call | 0.08 | 83.87 | 12.82 | 45.09 | 0.9640 | 0.4555 | ||

| LMT / Lockheed Martin Corporation | Call | 0.02 | 405.41 | 10.93 | -36.82 | 0.8220 | -0.1738 | ||

| CL / Colgate-Palmolive Company | Call | 0.10 | -22.63 | 10.68 | -22.63 | 0.8033 | 0.0087 | ||

| TMUS / T-Mobile US, Inc. | Call | 0.00 | 0.00 | 10.05 | -38.20 | 0.7557 | -0.1801 | ||

| MCK / McKesson Corporation | Put | 0.02 | 1,415.38 | 9.74 | 118.93 | 0.7324 | 0.4763 | ||

| CME / CME Group Inc. | Put | 0.04 | 164.90 | 8.83 | 164.97 | 0.6637 | 0.4720 | ||

| CME / CME Group Inc. | Call | 0.04 | 164.90 | 8.83 | 164.97 | 0.6637 | 0.4720 | ||

| TJX / The TJX Companies, Inc. | Put | 0.02 | 0.00 | 8.67 | 16.96 | 0.6523 | 0.2255 | ||

| TJX / The TJX Companies, Inc. | Call | 0.02 | 0.00 | 8.67 | 16.96 | 0.6523 | 0.2255 | ||

| MCK / McKesson Corporation | Call | 0.02 | 1,092.31 | 7.66 | 187.11 | 0.5763 | 0.4226 | ||

| MSFT / Microsoft Corporation | Call | 0.00 | 0.00 | 7.49 | 304.70 | 0.5630 | 0.4565 | ||

| MSFT / Microsoft Corporation | Put | 0.00 | 0.00 | 7.49 | 304.70 | 0.5630 | 0.4565 | ||

| COR / Cencora, Inc. | Put | 0.03 | 374.19 | 6.62 | 374.34 | 0.4976 | 0.4173 | ||

| STZ / Constellation Brands, Inc. | Call | 0.02 | 0.00 | 6.55 | 0.00 | 0.4922 | 0.1155 | ||

| STZ / Constellation Brands, Inc. | Put | 0.02 | 0.00 | 6.16 | 0.00 | 0.4631 | 0.1087 | ||

| COR / Cencora, Inc. | Call | 0.03 | 308.06 | 5.69 | 308.17 | 0.4282 | 0.3479 | ||

| T / AT&T Inc. | Put | 0.02 | 0.00 | 5.69 | 95.36 | 0.4278 | 0.2602 | ||

| T / AT&T Inc. | Call | 0.02 | 0.00 | 5.69 | 95.36 | 0.4278 | 0.2602 | ||

| WFC / Wells Fargo & Company | Put | 0.05 | 2.67 | 5.68 | -20.42 | 0.4273 | 0.0164 | ||

| AXP / American Express Company | Call | 0.02 | -59.96 | 5.61 | -59.97 | 0.4221 | -0.3847 | ||

| MRK / Merck & Co., Inc. | Call | 0.01 | 0.00 | 5.42 | -27.73 | 0.4073 | -0.0240 | ||

| JPM / JPMorgan Chase & Co. | 0.02 | 575,000.00 | 4.85 | 0.3648 | 0.3647 | ||||

| DHR / Danaher Corporation | Call | 0.02 | -16.26 | 4.73 | -16.25 | 0.3554 | 0.0306 | ||

| CSCO / Cisco Systems, Inc. | Call | 0.09 | 307.18 | 4.53 | 307.28 | 0.3406 | 0.2766 | ||

| CSCO / Cisco Systems, Inc. | Put | 0.09 | 307.18 | 4.53 | 307.28 | 0.3406 | 0.2766 | ||

| MA / Mastercard Incorporated | Put | 0.01 | 378.95 | 4.49 | 16.67 | 0.3379 | 0.1162 | ||

| PAYX / Paychex, Inc. | Put | 0.01 | 0.00 | 4.47 | 105.61 | 0.3360 | 0.2109 | ||

| PAYX / Paychex, Inc. | Call | 0.01 | 0.00 | 4.47 | 105.61 | 0.3360 | 0.2109 | ||

| DE / Deere & Company | Call | 0.01 | 62.90 | 4.22 | 62.93 | 0.3170 | 0.1681 | ||

| DE / Deere & Company | Put | 0.01 | 62.90 | 4.22 | 62.93 | 0.3170 | 0.1681 | ||

| GS / The Goldman Sachs Group, Inc. | Put | 0.01 | -66.80 | 4.11 | -66.80 | 0.3090 | -0.4033 | ||

| C / Citigroup Inc. | Call | 0.07 | -27.91 | 4.11 | -27.91 | 0.3088 | -0.0190 | ||

| C / Citigroup Inc. | Put | 0.07 | -27.91 | 4.11 | -27.91 | 0.3088 | -0.0190 | ||

| LMT / Lockheed Martin Corporation | Put | 0.01 | 169.23 | 4.09 | -72.98 | 0.3077 | -0.5636 | ||

| MA / Mastercard Incorporated | Call | 0.01 | 321.05 | 3.95 | 19.41 | 0.2971 | 0.1067 | ||

| V / Visa Inc. | Put | 0.00 | 0.00 | 3.93 | 1.42 | 0.2957 | 0.0726 | ||

| BAC / Bank of America Corporation | Put | 0.10 | 18.37 | 3.91 | 18.37 | 0.2942 | 0.1040 | ||

| BAC / Bank of America Corporation | Call | 0.10 | 18.37 | 3.91 | 18.37 | 0.2942 | 0.1040 | ||

| KO / The Coca-Cola Company | Put | 0.05 | 0.00 | 3.84 | 0.00 | 0.2886 | 0.0677 | ||

| KO / The Coca-Cola Company | Call | 0.05 | 0.00 | 3.84 | 0.00 | 0.2886 | 0.0677 | ||

| V / Visa Inc. | Call | 0.00 | 0.00 | 3.79 | 1.47 | 0.2853 | 0.0701 | ||

| CBOE / Cboe Global Markets, Inc. | Put | 0.02 | 3.69 | 0.2773 | 0.2773 | ||||

| CBOE / Cboe Global Markets, Inc. | Call | 0.02 | 3.69 | 0.2773 | 0.2773 | ||||

| AAPL / Apple Inc. | Call | 0.01 | -22.11 | 3.45 | -22.11 | 0.2593 | 0.0045 | ||

| IBM / International Business Machines Corporation | Put | 0.02 | -17.30 | 3.38 | -17.29 | 0.2544 | 0.0190 | ||

| C.WSA / Citigroup, Inc. | Call | 0.00 | -69.57 | 3.32 | -69.57 | 0.2499 | -0.3785 | ||

| C.WSA / Citigroup, Inc. | Put | 0.00 | -69.57 | 3.32 | -69.57 | 0.2499 | -0.3785 | ||

| AXP / American Express Company | Put | 0.01 | -80.91 | 3.31 | -80.91 | 0.2488 | -0.7485 | ||

| ABT / Abbott Laboratories | Call | 0.03 | 0.00 | 3.27 | 0.00 | 0.2461 | 0.0577 | ||

| ABT / Abbott Laboratories | Put | 0.03 | 0.00 | 3.27 | 0.00 | 0.2461 | 0.0577 | ||

| IWM / iShares Trust - iShares Russell 2000 ETF | Call | 0.01 | 79.27 | 3.25 | 31.30 | 0.2442 | 0.1018 | ||

| FAST / Fastenal Company | Call | 0.09 | 381.08 | 3.18 | 140.58 | 0.2390 | 0.1630 | ||

| FAST / Fastenal Company | Put | 0.09 | 381.08 | 3.18 | 140.58 | 0.2390 | 0.1630 | ||

| CL / Colgate-Palmolive Company | Put | 0.03 | -77.22 | 3.15 | -77.22 | 0.2365 | -0.5580 | ||

| LOW / Lowe's Companies, Inc. | Call | 0.01 | 96.55 | 3.09 | -22.46 | 0.2322 | 0.0031 | ||

| RTX / RTX Corporation | Call | 0.01 | 0.00 | 2.87 | 302.10 | 0.2159 | 0.1748 | ||

| RTX / RTX Corporation | Put | 0.01 | 0.00 | 2.87 | 302.10 | 0.2159 | 0.1748 | ||

| OKE / ONEOK, Inc. | Call | 0.01 | -72.68 | 2.87 | -69.42 | 0.2159 | -0.3243 | ||

| WFC / Wells Fargo & Company | Call | 0.02 | 0.00 | 2.86 | -34.82 | 0.2154 | -0.0376 | ||

| PNC / The PNC Financial Services Group, Inc. | Call | 0.01 | 82.93 | 2.77 | -56.15 | 0.2085 | -0.1553 | ||

| HCA / HCA Healthcare, Inc. | Call | 0.01 | -17.28 | 2.72 | -17.28 | 0.2048 | 0.0153 | ||

| BMY / Bristol-Myers Squibb Company | Call | 0.05 | -28.04 | 2.70 | -28.04 | 0.2027 | -0.0129 | ||

| BMY / Bristol-Myers Squibb Company | Put | 0.05 | -43.80 | 2.70 | -43.81 | 0.2027 | -0.0733 | ||

| CMI / Cummins Inc. | Call | 0.01 | -45.14 | 2.56 | -45.15 | 0.1924 | -0.0760 | ||

| FI / Fiserv, Inc. | Call | 0.01 | 0.00 | 2.52 | 0.00 | 0.1891 | 0.0444 | ||

| MRK / Merck & Co., Inc. | Put | 0.02 | 117.82 | 2.50 | -56.35 | 0.1879 | -0.1415 | ||

| WELL / Welltower Inc. | Call | 0.00 | 0.00 | 2.50 | 0.00 | 0.1877 | 0.0441 | ||

| WELL / Welltower Inc. | Put | 0.00 | 0.00 | 2.50 | 0.00 | 0.1877 | 0.0441 | ||

| AFL / Aflac Incorporated | Put | 0.02 | 0.00 | 2.49 | 0.00 | 0.1875 | 0.0440 | ||

| AFL / Aflac Incorporated | Call | 0.02 | 0.00 | 2.49 | 0.00 | 0.1875 | 0.0440 | ||

| IBM / International Business Machines Corporation | Call | 0.01 | -32.32 | 2.45 | -32.33 | 0.1845 | -0.0241 | ||

| SPGI / S&P Global Inc. | Call | 0.00 | 0.00 | 2.38 | 0.00 | 0.1787 | 0.0419 | ||

| SPGI / S&P Global Inc. | Put | 0.00 | 0.00 | 2.38 | 0.00 | 0.1787 | 0.0419 | ||

| MMM / 3M Company | Put | 0.00 | 0.00 | 2.34 | 0.00 | 0.1758 | 0.0413 | ||

| GS / The Goldman Sachs Group, Inc. | Call | 0.00 | -77.62 | 2.33 | -77.62 | 0.1750 | -0.4234 | ||

| ADP / Automatic Data Processing, Inc. | Call | 0.01 | 37.70 | 2.32 | 37.68 | 0.1748 | 0.0777 | ||

| ADP / Automatic Data Processing, Inc. | Put | 0.01 | 37.70 | 2.32 | 37.68 | 0.1748 | 0.0777 | ||

| DRI / Darden Restaurants, Inc. | Call | 0.01 | 605.00 | 2.31 | 605.49 | 0.1740 | 0.1551 | ||

| DRI / Darden Restaurants, Inc. | Put | 0.01 | 605.00 | 2.31 | 605.49 | 0.1740 | 0.1551 | ||

| MCD / McDonald's Corporation | Put | 0.01 | 2.19 | 0.1649 | 0.1649 | ||||

| MCD / McDonald's Corporation | Call | 0.01 | 2.19 | 0.1649 | 0.1649 | ||||

| AIG / American International Group, Inc. | Put | 0.03 | 231.46 | 2.16 | 231.80 | 0.1624 | 0.1249 | ||

| AIG / American International Group, Inc. | Call | 0.03 | 231.46 | 2.16 | 231.80 | 0.1624 | 0.1249 | ||

| LNG / Cheniere Energy, Inc. | Put | 0.01 | 100.00 | 2.12 | 100.00 | 0.1596 | 0.0985 | ||

| DHR / Danaher Corporation | Put | 0.01 | -62.56 | 2.11 | -62.57 | 0.1589 | -0.1659 | ||

| FI / Fiserv, Inc. | Put | 0.01 | -18.57 | 2.05 | -18.57 | 0.1540 | 0.0093 | ||

| KR / The Kroger Co. | Call | 0.04 | 467.74 | 2.02 | 467.89 | 0.1517 | 0.1312 | ||

| KR / The Kroger Co. | Put | 0.04 | 467.74 | 2.02 | 467.89 | 0.1517 | 0.1312 | ||

| MMM / 3M Company | Call | 0.00 | 0.00 | 1.76 | 0.00 | 0.1326 | 0.0311 | ||

| HCA / HCA Healthcare, Inc. | Put | 0.00 | -46.91 | 1.75 | -46.93 | 0.1314 | -0.0580 | ||

| HSY / The Hershey Company | Call | 0.01 | -50.60 | 1.57 | -50.61 | 0.1183 | -0.0650 | ||

| HSY / The Hershey Company | Put | 0.01 | -50.60 | 1.57 | -50.61 | 0.1183 | -0.0650 | ||

| PNC / The PNC Financial Services Group, Inc. | 0.01 | 0.02 | 1.52 | 0.07 | 0.1141 | 0.0268 | |||

| PNC / The PNC Financial Services Group, Inc. | Put | 0.01 | 0.00 | 1.52 | -80.67 | 0.1140 | -0.3371 | ||

| META / Meta Platforms, Inc. | 0.00 | 0.00 | 1.52 | 0.00 | 0.1139 | 0.0267 | |||

| GD / General Dynamics Corporation | Call | 0.01 | -9.09 | 1.51 | -9.09 | 0.1136 | 0.0180 | ||

| GD / General Dynamics Corporation | Put | 0.01 | -9.09 | 1.51 | -9.09 | 0.1136 | 0.0180 | ||

| WM / Waste Management, Inc. | Call | 0.00 | 0.00 | 1.39 | -33.04 | 0.1046 | -0.0149 | ||

| WM / Waste Management, Inc. | Put | 0.00 | 0.00 | 1.39 | -33.04 | 0.1046 | -0.0149 | ||

| PANW / Palo Alto Networks, Inc. | 0.01 | 0.00 | 1.33 | 0.00 | 0.0999 | 0.0234 | |||

| ABBV / AbbVie Inc. | Put | 0.01 | -76.17 | 1.30 | -76.18 | 0.0980 | -0.2168 | ||

| ABBV / AbbVie Inc. | Call | 0.01 | -76.17 | 1.30 | -76.18 | 0.0980 | -0.2168 | ||

| SHW / The Sherwin-Williams Company | Call | 0.00 | 0.00 | 1.30 | 0.00 | 0.0976 | 0.0229 | ||

| NSC / Norfolk Southern Corporation | Call | 0.00 | 0.00 | 1.29 | -21.22 | 0.0972 | 0.0028 | ||

| NSC / Norfolk Southern Corporation | Put | 0.00 | 0.00 | 1.29 | -21.22 | 0.0972 | 0.0028 | ||

| FIS / Fidelity National Information Services, Inc. | Put | 0.02 | -71.27 | 1.29 | -71.29 | 0.0970 | -0.1614 | ||

| FIS / Fidelity National Information Services, Inc. | Call | 0.02 | -71.27 | 1.29 | -71.29 | 0.0970 | -0.1614 | ||

| EA / Electronic Arts Inc. | Put | 0.01 | -30.51 | 1.18 | -30.50 | 0.0884 | -0.0090 | ||

| EA / Electronic Arts Inc. | Call | 0.01 | -30.51 | 1.18 | -30.50 | 0.0884 | -0.0090 | ||

| HD / The Home Depot, Inc. | Put | 0.00 | -14.71 | 1.18 | -14.67 | 0.0884 | 0.0091 | ||

| HD / The Home Depot, Inc. | Call | 0.00 | -14.71 | 1.18 | -14.67 | 0.0884 | 0.0091 | ||

| QQQ / Invesco QQQ Trust, Series 1 | 0.00 | 3.68 | 1.17 | 3.64 | 0.0878 | 0.0230 | |||

| CTSH / Cognizant Technology Solutions Corporation | Call | 0.01 | 0.00 | 1.15 | 0.00 | 0.0865 | 0.0203 | ||

| CTSH / Cognizant Technology Solutions Corporation | Put | 0.01 | 0.00 | 1.15 | 0.00 | 0.0865 | 0.0203 | ||

| GWW / W.W. Grainger, Inc. | Call | 0.00 | -50.00 | 1.14 | -50.02 | 0.0859 | -0.0456 | ||

| GWW / W.W. Grainger, Inc. | Put | 0.00 | -50.00 | 1.14 | -50.02 | 0.0859 | -0.0456 | ||

| HLT / Hilton Worldwide Holdings Inc. | Call | 0.00 | -90.22 | 1.11 | -90.23 | 0.0832 | -0.5681 | ||

| LNG / Cheniere Energy, Inc. | Call | 0.01 | 0.00 | 1.06 | 0.00 | 0.0798 | 0.0187 | ||

| HCA / HCA Healthcare, Inc. | 0.00 | 0.00 | 1.02 | 0.00 | 0.0764 | 0.0179 | |||

| GILD / Gilead Sciences, Inc. | Call | 0.01 | 0.00 | 0.97 | 0.00 | 0.0731 | 0.0172 | ||

| GILD / Gilead Sciences, Inc. | Put | 0.01 | 0.00 | 0.97 | 0.00 | 0.0731 | 0.0172 | ||

| CMI / Cummins Inc. | Put | 0.00 | -79.31 | 0.97 | -79.31 | 0.0730 | -0.1971 | ||

| PEP / PepsiCo, Inc. | Put | 0.01 | 0.87 | 0.0652 | 0.0652 | ||||

| PEP / PepsiCo, Inc. | Call | 0.01 | 0.87 | 0.0652 | 0.0652 | ||||

| USB / U.S. Bancorp | Call | 0.02 | 420.59 | 0.81 | -16.08 | 0.0609 | 0.0053 | ||

| AMGN / Amgen Inc. | Call | 0.00 | -78.26 | 0.81 | -78.27 | 0.0606 | -0.1527 | ||

| AMGN / Amgen Inc. | Put | 0.00 | -78.26 | 0.81 | -78.27 | 0.0606 | -0.1527 | ||

| IWM / iShares Trust - iShares Russell 2000 ETF | Put | 0.00 | -38.60 | 0.77 | -68.74 | 0.0581 | -0.0842 | ||

| YUM / Yum! Brands, Inc. | Put | 0.01 | 0.00 | 0.77 | -66.68 | 0.0578 | -0.0749 | ||

| YUM / Yum! Brands, Inc. | Call | 0.01 | 0.00 | 0.77 | -66.68 | 0.0578 | -0.0749 | ||

| MSFT / Microsoft Corporation | 0.00 | 0.12 | 0.70 | 0.14 | 0.0527 | 0.0124 | |||

| LOW / Lowe's Companies, Inc. | Put | 0.00 | -41.86 | 0.68 | -82.76 | 0.0509 | -0.1751 | ||

| NVDA / NVIDIA Corporation | 0.01 | 10.82 | 0.67 | 10.71 | 0.0506 | 0.0157 | |||

| PRU / Prudential Financial, Inc. | Put | 0.01 | 0.00 | 0.65 | 0.00 | 0.0492 | 0.0115 | ||

| PRU / Prudential Financial, Inc. | Call | 0.01 | 0.00 | 0.65 | 0.00 | 0.0492 | 0.0115 | ||

| MO / Altria Group, Inc. | Put | 0.01 | 0.64 | 0.0484 | 0.0484 | ||||

| MO / Altria Group, Inc. | Call | 0.01 | 0.64 | 0.0484 | 0.0484 | ||||

| ROST / Ross Stores, Inc. | Put | 0.00 | 192.86 | 0.62 | -25.39 | 0.0464 | -0.0012 | ||

| ROST / Ross Stores, Inc. | Call | 0.00 | 192.86 | 0.62 | -25.39 | 0.0464 | -0.0012 | ||

| DD / DuPont de Nemours, Inc. | Call | 0.01 | -81.27 | 0.61 | -81.29 | 0.0456 | -0.1406 | ||

| TRV / The Travelers Companies, Inc. | Put | 0.00 | -53.70 | 0.59 | -53.72 | 0.0440 | -0.0287 | ||

| TRV / The Travelers Companies, Inc. | Call | 0.00 | -53.70 | 0.59 | -53.72 | 0.0440 | -0.0287 | ||

| EMR / Emerson Electric Co. | Call | 0.01 | 0.00 | 0.58 | 0.00 | 0.0436 | 0.0102 | ||

| ELV / Elevance Health, Inc. | Call | 0.00 | 0.00 | 0.57 | 0.00 | 0.0430 | 0.0101 | ||

| TSN / Tyson Foods, Inc. | Call | 0.01 | -83.73 | 0.53 | -86.01 | 0.0399 | -0.1781 | ||

| MA / Mastercard Incorporated | 0.00 | 0.10 | 0.51 | 0.20 | 0.0381 | 0.0090 | |||

| ABNB / Airbnb, Inc. | 0.00 | 0.00 | 0.49 | 0.00 | 0.0367 | 0.0086 | |||

| ABNB / Airbnb, Inc. | Put | 0.00 | 0.00 | 0.48 | 0.00 | 0.0362 | 0.0085 | ||

| MNST / Monster Beverage Corporation | Call | 0.01 | 0.46 | 0.0345 | 0.0345 | ||||

| MNST / Monster Beverage Corporation | Put | 0.01 | 0.46 | 0.0345 | 0.0345 | ||||

| KMI / Kinder Morgan, Inc. | Call | 0.02 | 0.00 | 0.45 | -86.62 | 0.0336 | -0.1583 | ||

| KMI / Kinder Morgan, Inc. | Put | 0.02 | 0.00 | 0.45 | -86.62 | 0.0336 | -0.1583 | ||

| APD / Air Products and Chemicals, Inc. | Put | 0.00 | -86.02 | 0.39 | -86.02 | 0.0291 | -0.1302 | ||

| APD / Air Products and Chemicals, Inc. | Call | 0.00 | -86.02 | 0.39 | -86.02 | 0.0291 | -0.1302 | ||

| TSLA / Tesla, Inc. | 0.00 | 0.00 | 0.36 | 0.00 | 0.0274 | 0.0064 | |||

| BSX / Boston Scientific Corporation | Put | 0.00 | 0.00 | 0.35 | 0.00 | 0.0265 | 0.0062 | ||

| BSX / Boston Scientific Corporation | Call | 0.00 | 0.00 | 0.35 | 0.00 | 0.0265 | 0.0062 | ||

| TSLA / Tesla, Inc. | Put | 0.00 | 0.31 | 0.0236 | 0.0236 | ||||

| MS / Morgan Stanley | Call | 0.00 | -50.91 | 0.28 | -86.84 | 0.0212 | -0.1018 | ||

| UNH / UnitedHealth Group Incorporated | Call | 0.00 | -75.00 | 0.23 | -80.07 | 0.0176 | -0.0497 | ||

| BAC / Bank of America Corporation | 0.01 | 0.55 | 0.23 | 0.89 | 0.0170 | 0.0041 | |||

| BA / The Boeing Company | Call | 0.00 | 0.00 | 0.21 | 0.00 | 0.0160 | 0.0038 | ||

| SGOV / iShares Trust - iShares 0-3 Month Treasury Bond ETF | 0.00 | -31.23 | 0.20 | -31.36 | 0.0149 | -0.0017 | |||

| SYK / Stryker Corporation | Put | 0.00 | 0.00 | 0.14 | 0.00 | 0.0109 | 0.0026 | ||

| SYK / Stryker Corporation | Call | 0.00 | 0.00 | 0.14 | 0.00 | 0.0109 | 0.0026 | ||

| TFC / Truist Financial Corporation | Call | 0.00 | 0.00 | 0.09 | 0.00 | 0.0071 | 0.0017 | ||

| TSN / Tyson Foods, Inc. | 0.00 | 0.84 | 0.01 | 0.00 | 0.0005 | 0.0001 | |||

| WFC / Wells Fargo & Company | 0.00 | 0.00 | 0.00 | 0.00 | 0.0003 | 0.0001 | |||

| TFC / Truist Financial Corporation | 0.00 | 0.00 | 0.00 | 0.00 | 0.0001 | 0.0000 | |||

| SBUX / Starbucks Corporation | 0.00 | 0.00 | 0.00 | 0.00 | 0.0001 | 0.0000 | |||

| TCOM / Trip.com Group Limited - Depositary Receipt (Common Stock) | 0.00 | 0.00 | 0.00 | 0.00 | 0.0001 | 0.0000 | |||

| GIS / General Mills, Inc. | 0.00 | 0.00 | 0.00 | 0.0000 | 0.0000 | ||||

| DG / Dollar General Corporation | 0.00 | 0.00 | 0.00 | 0.0000 | 0.0000 | ||||

| BMY / Bristol-Myers Squibb Company | 0.00 | 0.00 | 0.00 | 0.0000 | 0.0000 | ||||

| MAR / Marriott International, Inc. | Call | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| PANW / Palo Alto Networks, Inc. | Put | 0.00 | -100.00 | 0.00 | -100.00 | -0.0757 | |||

| UNP / Union Pacific Corporation | Put | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| CHRW / C.H. Robinson Worldwide, Inc. | Put | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| EMR / Emerson Electric Co. | Put | 0.00 | -100.00 | 0.00 | -100.00 | -0.0334 | |||

| NOC / Northrop Grumman Corporation | Put | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| PG / The Procter & Gamble Company | Put | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| MAR / Marriott International, Inc. | Put | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| CHRW / C.H. Robinson Worldwide, Inc. | Call | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| ELV / Elevance Health, Inc. | Put | 0.00 | -100.00 | 0.00 | -100.00 | -0.0329 | |||

| UNH / UnitedHealth Group Incorporated | Put | 0.00 | -100.00 | 0.00 | -100.00 | -0.0673 | |||

| TSN / Tyson Foods, Inc. | Put | 0.00 | -100.00 | 0.00 | -100.00 | -0.2180 | |||

| NOC / Northrop Grumman Corporation | Call | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| NVDA / NVIDIA Corporation | Put | 0.00 | -100.00 | 0.00 | -100.00 | -0.0349 | |||

| META / Meta Platforms, Inc. | Put | 0.00 | -100.00 | 0.00 | -100.00 | -0.0428 | |||

| MET / MetLife, Inc. | Put | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| HLT / Hilton Worldwide Holdings Inc. | Put | 0.00 | -100.00 | 0.00 | -100.00 | -0.6513 | |||

| RJF / Raymond James Financial, Inc. | Put | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| TSLA / Tesla, Inc. | Call | 0.00 | -100.00 | 0.00 | -100.00 | -0.0060 | |||

| TFC / Truist Financial Corporation | Put | 0.00 | -100.00 | 0.00 | -100.00 | -0.0054 | |||

| SHW / The Sherwin-Williams Company | Put | 0.00 | -100.00 | 0.00 | -100.00 | -0.0747 | |||

| DD / DuPont de Nemours, Inc. | Put | 0.00 | -100.00 | 0.00 | -100.00 | -0.1862 | |||

| USB / U.S. Bancorp | 0.00 | -100.00 | 0.00 | -100.00 | -0.0881 | ||||

| MS / Morgan Stanley | Put | 0.00 | -100.00 | 0.00 | -100.00 | -0.1560 | |||

| USB / U.S. Bancorp | Put | 0.00 | -100.00 | 0.00 | -100.00 | -0.1434 | |||

| PG / The Procter & Gamble Company | Call | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| MET / MetLife, Inc. | Call | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| OKE / ONEOK, Inc. | Put | 0.00 | -100.00 | 0.00 | -100.00 | -0.4966 | |||

| AAPL / Apple Inc. | Put | 0.00 | -100.00 | 0.00 | -100.00 | -0.2548 | |||

| RJF / Raymond James Financial, Inc. | Call | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| UNP / Union Pacific Corporation | Call | 0.00 | -100.00 | 0.00 | 0.0000 |