Mga Batayang Estadistika

| Nilai Portofolio | $ 385,131,324 |

| Posisi Saat Ini | 46 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

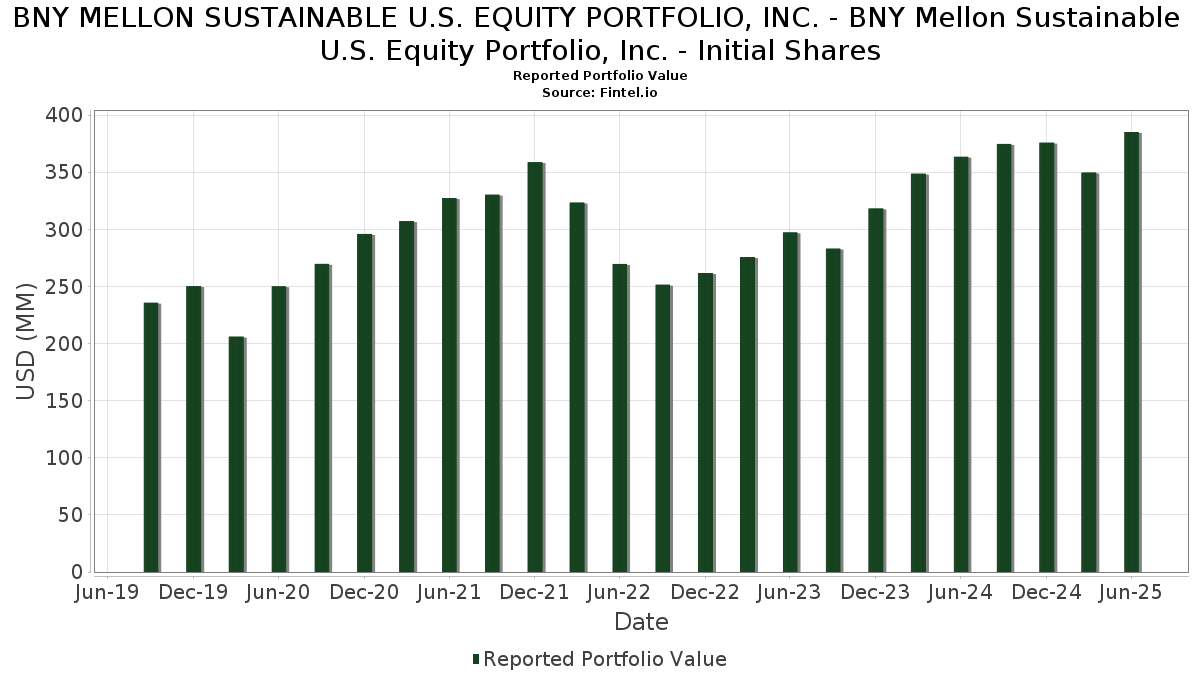

BNY MELLON SUSTAINABLE U.S. EQUITY PORTFOLIO, INC. - BNY Mellon Sustainable U.S. Equity Portfolio, Inc. - Initial Shares telah mengungkapkan total kepemilikan 46 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 385,131,324 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama BNY MELLON SUSTAINABLE U.S. EQUITY PORTFOLIO, INC. - BNY Mellon Sustainable U.S. Equity Portfolio, Inc. - Initial Shares adalah NVIDIA Corporation (US:NVDA) , Microsoft Corporation (US:MSFT) , Apple Inc. (US:AAPL) , Amazon.com, Inc. (US:AMZN) , and JPMorgan Chase & Co. (US:JPM) . Posisi baru BNY MELLON SUSTAINABLE U.S. EQUITY PORTFOLIO, INC. - BNY Mellon Sustainable U.S. Equity Portfolio, Inc. - Initial Shares meliputi: Walmart Inc. (US:WMT) , Bentley Systems, Incorporated (US:BSY) , The Estée Lauder Companies Inc. (US:EL) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.24 | 38.00 | 9.8700 | 2.2137 | |

| 0.07 | 6.93 | 1.7992 | 1.7992 | |

| 0.07 | 32.35 | 8.4043 | 1.2321 | |

| 0.08 | 4.16 | 1.0802 | 1.0802 | |

| 0.05 | 3.94 | 1.0243 | 1.0243 | |

| 3.51 | 3.51 | 0.9121 | 0.9121 | |

| 0.01 | 7.07 | 1.8361 | 0.6383 | |

| 0.03 | 8.11 | 2.1058 | 0.6182 | |

| 0.02 | 4.95 | 1.2854 | 0.4025 | |

| 0.02 | 11.92 | 3.0964 | 0.3669 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.11 | 22.60 | 5.8715 | -1.3168 | |

| 0.01 | 3.23 | 0.8397 | -0.7326 | |

| 0.09 | 4.36 | 1.1330 | -0.5551 | |

| 0.08 | 14.27 | 3.7078 | -0.5179 | |

| 0.02 | 5.36 | 1.3933 | -0.4390 | |

| 0.03 | 5.72 | 1.4856 | -0.4106 | |

| 0.02 | 5.63 | 1.4629 | -0.3876 | |

| 0.06 | 5.63 | 1.4636 | -0.3161 | |

| 0.04 | 6.05 | 1.5706 | -0.3045 | |

| 0.03 | 5.02 | 1.3046 | -0.2622 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-26 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| NVDA / NVIDIA Corporation | 0.24 | -1.37 | 38.00 | 43.77 | 9.8700 | 2.2137 | |||

| MSFT / Microsoft Corporation | 0.07 | -1.37 | 32.35 | 30.69 | 8.4043 | 1.2321 | |||

| AAPL / Apple Inc. | 0.11 | -1.37 | 22.60 | -8.90 | 5.8715 | -1.3168 | |||

| AMZN / Amazon.com, Inc. | 0.08 | -1.37 | 18.27 | 13.73 | 4.7460 | 0.0918 | |||

| JPM / JPMorgan Chase & Co. | 0.05 | -1.37 | 15.81 | 16.56 | 4.1065 | 0.1774 | |||

| GOOGL / Alphabet Inc. | 0.08 | -14.13 | 14.27 | -2.14 | 3.7078 | -0.5179 | |||

| COST / Costco Wholesale Corporation | 0.01 | -1.37 | 12.04 | 3.23 | 3.1270 | -0.2512 | |||

| INTU / Intuit Inc. | 0.02 | -1.38 | 11.92 | 26.52 | 3.0964 | 0.3669 | |||

| GS / The Goldman Sachs Group, Inc. | 0.01 | -1.37 | 10.42 | 27.78 | 2.7061 | 0.3441 | |||

| BSX / Boston Scientific Corporation | 0.08 | -1.37 | 8.95 | 5.01 | 2.3252 | -0.1443 | |||

| MA / Mastercard Incorporated | 0.02 | -1.37 | 8.72 | 1.12 | 2.2662 | -0.2334 | |||

| CEG / Constellation Energy Corporation | 0.03 | -1.37 | 8.11 | 57.89 | 2.1058 | 0.6182 | |||

| IR / Ingersoll Rand Inc. | 0.09 | -1.37 | 7.57 | 2.50 | 1.9668 | -0.1730 | |||

| TT / Trane Technologies plc | 0.02 | -1.37 | 7.47 | 28.04 | 1.9405 | 0.2503 | |||

| GEV / GE Vernova Inc. | 0.01 | -1.37 | 7.07 | 70.97 | 1.8361 | 0.6383 | |||

| WMT / Walmart Inc. | 0.07 | 6.93 | 1.7992 | 1.7992 | |||||

| HUBB / Hubbell Incorporated | 0.02 | -1.37 | 6.72 | 21.72 | 1.7452 | 0.1462 | |||

| MU / Micron Technology, Inc. | 0.05 | -1.37 | 6.70 | 39.91 | 1.7395 | 0.3528 | |||

| WM / Waste Management, Inc. | 0.03 | -1.37 | 6.56 | -2.51 | 1.7049 | -0.2456 | |||

| TYIA / Johnson Controls International plc | 0.06 | -1.37 | 6.45 | 30.04 | 1.6767 | 0.2386 | |||

| NOW / ServiceNow, Inc. | 0.01 | -1.37 | 6.28 | 27.37 | 1.6323 | 0.2029 | |||

| CME / CME Group Inc. | 0.02 | 35.37 | 6.18 | 40.66 | 1.6041 | 0.3321 | |||

| ZTS / Zoetis Inc. | 0.04 | -1.37 | 6.05 | -6.58 | 1.5706 | -0.3045 | |||

| FHN / First Horizon Corporation | 0.28 | -1.37 | 5.99 | 7.67 | 1.5564 | -0.0558 | |||

| ACM / AECOM | 0.05 | -1.37 | 5.82 | 20.04 | 1.5125 | 0.1072 | |||

| ABBV / AbbVie Inc. | 0.03 | -1.37 | 5.72 | -12.64 | 1.4856 | -0.4106 | |||

| ALC / Alcon Inc. | 0.06 | -1.37 | 5.63 | -8.29 | 1.4636 | -0.3161 | |||

| AON / Aon plc | 0.02 | -1.37 | 5.63 | -11.84 | 1.4629 | -0.3876 | |||

| VLTO / Veralto Corporation | 0.06 | -1.37 | 5.60 | 2.17 | 1.4557 | -0.1333 | |||

| DHR / Danaher Corporation | 0.03 | -1.37 | 5.59 | -4.97 | 1.4515 | -0.2519 | |||

| NEE / NextEra Energy, Inc. | 0.08 | -1.37 | 5.38 | -3.41 | 1.3964 | -0.2161 | |||

| RNR / RenaissanceRe Holdings Ltd. | 0.02 | -16.21 | 5.36 | -15.20 | 1.3933 | -0.4390 | |||

| AIZ / Assurant, Inc. | 0.03 | -1.37 | 5.02 | -7.14 | 1.3046 | -0.2622 | |||

| TE Connectivity PLC / EC (IE000IVNQZ81) | 0.03 | -1.37 | 5.01 | 17.73 | 1.3023 | 0.0684 | |||

| DXCM / DexCom, Inc. | 0.06 | -1.37 | 5.01 | 26.06 | 1.3018 | 0.1501 | |||

| AVGO / Broadcom Inc. | 0.02 | -1.37 | 4.95 | 62.39 | 1.2854 | 0.4025 | |||

| SNPS / Synopsys, Inc. | 0.01 | -1.37 | 4.60 | 17.89 | 1.1951 | 0.0646 | |||

| LIN / Linde plc | 0.01 | -1.37 | 4.45 | -0.63 | 1.1556 | -0.1413 | |||

| BMY / Bristol-Myers Squibb Company | 0.09 | -1.37 | 4.36 | -25.15 | 1.1330 | -0.5551 | |||

| BSY / Bentley Systems, Incorporated | 0.08 | 4.16 | 1.0802 | 1.0802 | |||||

| CCK / Crown Holdings, Inc. | 0.04 | -1.37 | 4.06 | 13.81 | 1.0557 | 0.0210 | |||

| EL / The Estée Lauder Companies Inc. | 0.05 | 3.94 | 1.0243 | 1.0243 | |||||

| DREYFUS INSTITUTIONAL PREFERRED GOVERNMENT PLUS MONEY MARKET FUND / STIV (000000000) | 3.51 | 3.51 | 0.9121 | 0.9121 | |||||

| DAR / Darling Ingredients Inc. | 0.09 | 0.00 | 3.49 | 21.46 | 0.9057 | 0.0740 | |||

| UNH / UnitedHealth Group Incorporated | 0.01 | 0.00 | 3.23 | -40.45 | 0.8397 | -0.7326 | |||

| IP / International Paper Company | 0.07 | 0.00 | 3.17 | -12.23 | 0.8224 | -0.2225 |