Mga Batayang Estadistika

| Nilai Portofolio | $ 253,768,923 |

| Posisi Saat Ini | 69 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

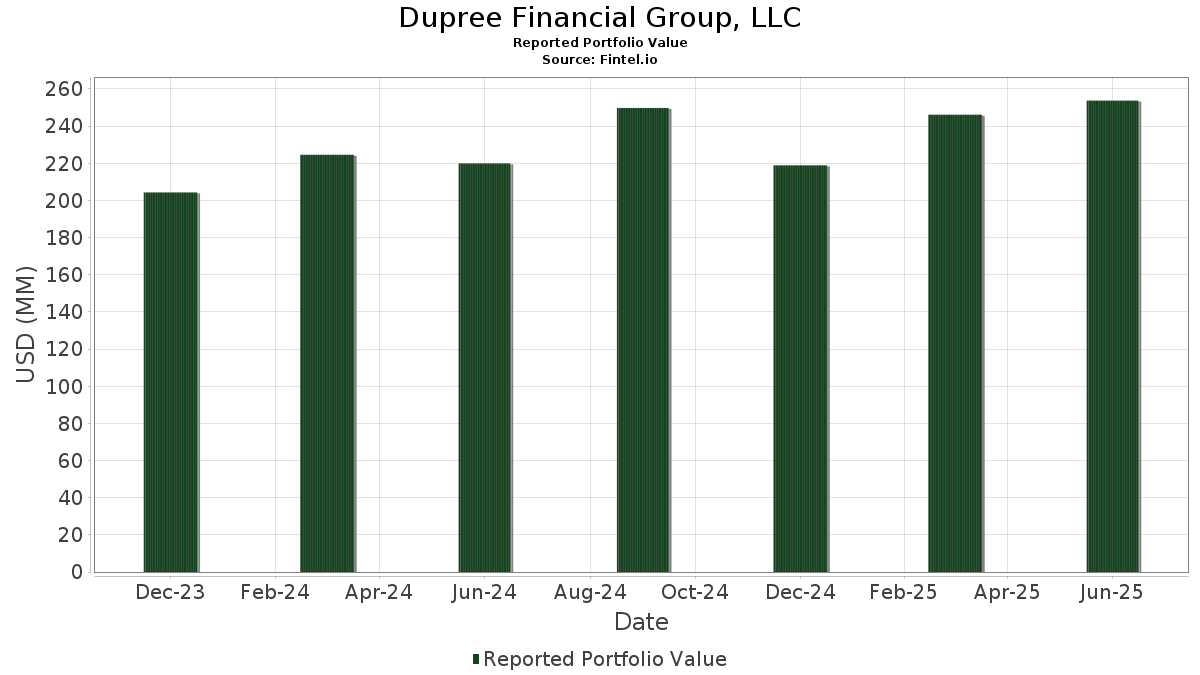

Dupree Financial Group, LLC telah mengungkapkan total kepemilikan 69 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 253,768,923 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Dupree Financial Group, LLC adalah AGNC Investment Corp. (US:AGNC) , Enbridge Inc. - Preferred Stock (US:EBGEF) , British American Tobacco p.l.c. - Depositary Receipt (Common Stock) (US:BTI) , Kinder Morgan, Inc. (US:KMI) , and Cincinnati Financial Corporation (US:CINF) . Posisi baru Dupree Financial Group, LLC meliputi: Synchrony Financial (US:SYF) , Macy's, Inc. (US:M) , Meta Platforms, Inc. (US:META) , UnitedHealth Group Incorporated (US:UNH) , and Diamondback Energy, Inc. (US:FANG) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.39 | 11.38 | 4.4828 | 4.4828 | |

| 0.11 | 7.10 | 2.7980 | 2.7980 | |

| 0.52 | 6.12 | 2.4097 | 2.4097 | |

| 0.06 | 7.03 | 2.0323 | 2.0323 | |

| 0.01 | 4.29 | 1.6919 | 1.6919 | |

| 0.01 | 3.08 | 1.2121 | 1.2121 | |

| 0.02 | 2.92 | 1.1501 | 1.1501 | |

| 0.02 | 2.71 | 1.0667 | 1.0667 | |

| 0.02 | 5.92 | 1.7120 | 0.5610 | |

| 0.02 | 7.28 | 2.1048 | 0.5465 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.33 | 15.06 | 4.3542 | -2.9983 | |

| 0.31 | 14.91 | 4.3107 | -2.3014 | |

| 0.22 | 9.66 | 2.7941 | -2.1973 | |

| 0.13 | 4.16 | 1.2028 | -1.9990 | |

| 0.12 | 6.89 | 1.9931 | -1.4467 | |

| 0.05 | 7.28 | 2.1053 | -1.4123 | |

| 0.24 | 6.10 | 1.7634 | -1.1333 | |

| 0.08 | 5.21 | 1.5054 | -1.1050 | |

| 0.00 | 9.74 | 3.8375 | -0.9997 | |

| 0.21 | 8.14 | 2.3532 | -0.9835 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-07-30 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| AGNC / AGNC Investment Corp. | 2.21 | 9.87 | 20.35 | 5.39 | 8.0179 | 0.1758 | |||

| EBGEF / Enbridge Inc. - Preferred Stock | 0.33 | -18.66 | 15.06 | -16.81 | 4.3542 | -2.9983 | |||

| BTI / British American Tobacco p.l.c. - Depositary Receipt (Common Stock) | 0.31 | -19.95 | 14.91 | -8.42 | 4.3107 | -2.3014 | |||

| KMI / Kinder Morgan, Inc. | 0.39 | 11.38 | 4.4828 | 4.4828 | |||||

| CINF / Cincinnati Financial Corporation | 0.08 | 43.31 | 11.30 | 44.48 | 3.2689 | 0.0904 | |||

| MELI / MercadoLibre, Inc. | 0.00 | -38.96 | 9.74 | -18.22 | 3.8375 | -0.9997 | |||

| VZ / Verizon Communications Inc. | 0.22 | -17.56 | 9.66 | -21.36 | 2.7941 | -2.1973 | |||

| ORI / Old Republic International Corporation | 0.21 | 1.08 | 8.14 | -0.94 | 2.3532 | -0.9835 | |||

| CVX / Chevron Corporation | 0.05 | -1.77 | 7.28 | -15.93 | 2.1053 | -1.4123 | |||

| CMI / Cummins Inc. | 0.02 | 81.60 | 7.28 | 89.75 | 2.1048 | 0.5465 | |||

| SYF / Synchrony Financial | 0.11 | 7.10 | 2.7980 | 2.7980 | |||||

| EOG / EOG Resources, Inc. | 0.06 | 7.03 | 2.0323 | 2.0323 | |||||

| O / Realty Income Corporation | 0.12 | -18.04 | 6.89 | -18.60 | 1.9931 | -1.4467 | |||

| M / Macy's, Inc. | 0.52 | 6.12 | 2.4097 | 2.4097 | |||||

| KHC / The Kraft Heinz Company | 0.24 | 0.79 | 6.10 | -14.47 | 1.7634 | -1.1333 | |||

| NLY / Annaly Capital Management, Inc. | 0.32 | -1.23 | 5.94 | -8.48 | 1.7167 | -0.9182 | |||

| ITW / Illinois Tool Works Inc. | 0.02 | 109.58 | 5.92 | 108.97 | 1.7120 | 0.5610 | |||

| BP / BP p.l.c. - Depositary Receipt (Common Stock) | 0.19 | 110.70 | 5.65 | 86.64 | 1.6328 | 0.4037 | |||

| BXMT / Blackstone Mortgage Trust, Inc. | 0.29 | 3.52 | 5.55 | -0.38 | 1.6043 | -0.6576 | |||

| ASO / Academy Sports and Outdoors, Inc. | 0.12 | 103.07 | 5.53 | 99.53 | 1.5983 | 0.4729 | |||

| DHI / D.R. Horton, Inc. | 0.04 | 0.73 | 5.35 | 2.16 | 1.5456 | -0.5801 | |||

| WPC / W. P. Carey Inc. | 0.08 | -18.04 | 5.21 | -19.00 | 1.5054 | -1.1050 | |||

| T / AT&T Inc. | 0.17 | -20.63 | 5.03 | -18.80 | 1.9821 | -0.5336 | |||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 0.02 | -1.53 | 4.44 | 34.38 | 1.7481 | 0.4069 | |||

| META / Meta Platforms, Inc. | 0.01 | 4.29 | 1.6919 | 1.6919 | |||||

| CNQ / Canadian Natural Resources Limited | 0.13 | -48.24 | 4.16 | -47.23 | 1.2028 | -1.9990 | |||

| AAPL / Apple Inc. | 0.02 | -2.94 | 3.86 | -10.36 | 1.1164 | -0.6330 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.01 | -5.04 | 3.73 | -13.39 | 1.0774 | -0.6700 | |||

| VIG / Vanguard Specialized Funds - Vanguard Dividend Appreciation ETF | 0.02 | -0.56 | 3.46 | 4.95 | 1.0003 | -0.3390 | |||

| BEN / Franklin Resources, Inc. | 0.14 | -0.67 | 3.24 | 23.09 | 0.9372 | -0.1326 | |||

| UNH / UnitedHealth Group Incorporated | 0.01 | 3.08 | 1.2121 | 1.2121 | |||||

| CAVA / CAVA Group, Inc. | 0.03 | 70.45 | 2.94 | 66.14 | 0.8514 | 0.1315 | |||

| FANG / Diamondback Energy, Inc. | 0.02 | 2.92 | 1.1501 | 1.1501 | |||||

| PLTR / Palantir Technologies Inc. | 0.02 | 2.71 | 1.0667 | 1.0667 | |||||

| AMZN / Amazon.com, Inc. | 0.01 | -2.53 | 2.44 | 12.40 | 0.7052 | -0.1762 | |||

| ANF / Abercrombie & Fitch Co. | 0.02 | 1.14 | 1.68 | 9.73 | 0.6626 | 0.0401 | |||

| FNDF / Schwab Strategic Trust - Schwab Fundamental International Equity ETF | 0.04 | -7.63 | 1.59 | 2.32 | 0.4595 | -0.1716 | |||

| RSP / Invesco Exchange-Traded Fund Trust - Invesco S&P 500 Equal Weight ETF | 0.01 | -3.00 | 1.40 | 1.81 | 0.4057 | -0.1543 | |||

| XOM / Exxon Mobil Corporation | 0.01 | -7.48 | 1.12 | -16.12 | 0.3237 | -0.2185 | |||

| MSFT / Microsoft Corporation | 0.00 | 25.49 | 1.01 | 66.28 | 0.2924 | 0.0454 | |||

| VOO / Vanguard Index Funds - Vanguard S&P 500 ETF | 0.00 | -1.27 | 0.92 | 9.09 | 0.2674 | -0.0768 | |||

| DVY / iShares Trust - iShares Select Dividend ETF | 0.01 | -2.13 | 0.80 | -3.16 | 0.2309 | -0.1042 | |||

| SPHQ / Invesco Exchange-Traded Fund Trust - Invesco S&P 500 Quality ETF | 0.01 | -1.41 | 0.78 | 5.95 | 0.2268 | -0.0740 | |||

| JPM / JPMorgan Chase & Co. | 0.00 | 0.00 | 0.74 | 18.33 | 0.2128 | -0.0401 | |||

| GJR / Strats Trust For Procter & Gambel Security - Preferred Security | 0.00 | 27.80 | 0.67 | 19.57 | 0.1944 | -0.0342 | |||

| FBND / Fidelity Merrimack Street Trust - Fidelity Total Bond ETF | 0.01 | -1.55 | 0.65 | -1.36 | 0.1894 | -0.0803 | |||

| IJR / iShares Trust - iShares Core S&P Small-Cap ETF | 0.01 | -2.54 | 0.65 | 1.87 | 0.1894 | -0.0718 | |||

| CSX / CSX Corporation | 0.02 | 0.00 | 0.60 | 11.05 | 0.1744 | -0.0466 | |||

| BYON / Beyond, Inc. | 0.09 | -1.22 | 0.59 | 17.30 | 0.1708 | -0.0340 | |||

| GE / General Electric Company | 0.00 | 2.39 | 0.50 | 31.91 | 0.1435 | -0.0096 | |||

| GNR / SPDR Index Shares Funds - SPDR S&P Global Natural Resources ETF | 0.01 | -1.71 | 0.49 | 0.00 | 0.1419 | -0.0572 | |||

| LLY / Eli Lilly and Company | 0.00 | 4.99 | 0.48 | -0.84 | 0.1375 | -0.0574 | |||

| NFLX / Netflix, Inc. | 0.00 | 0.00 | 0.47 | 43.64 | 0.1868 | 0.0527 | |||

| HD / The Home Depot, Inc. | 0.00 | 0.00 | 0.44 | 0.00 | 0.1277 | -0.0516 | |||

| NVDA / NVIDIA Corporation | 0.00 | 0.40 | 0.1171 | 0.1171 | |||||

| IGV / iShares Trust - iShares Expanded Tech-Software Sector ETF | 0.00 | -1.07 | 0.39 | 22.05 | 0.1136 | -0.0175 | |||

| MMM / 3M Company | 0.00 | -8.05 | 0.39 | -4.85 | 0.1136 | -0.0538 | |||

| PEP / PepsiCo, Inc. | 0.00 | 0.00 | 0.39 | -11.99 | 0.1534 | -0.0262 | |||

| MRK / Merck & Co., Inc. | 0.00 | -0.44 | 0.38 | -12.38 | 0.1087 | -0.0652 | |||

| DFAR / Dimensional ETF Trust - Dimensional US Real Estate ETF | 0.01 | -3.18 | 0.35 | -4.41 | 0.1005 | -0.0473 | |||

| AVGO / Broadcom Inc. | 0.00 | -5.91 | 0.33 | 55.50 | 0.1281 | 0.0429 | |||

| GEV / GE Vernova Inc. | 0.00 | 0.25 | 0.0997 | 0.0997 | |||||

| SR / Spire Inc. | 0.00 | 0.00 | 0.25 | -6.79 | 0.0716 | -0.0362 | |||

| KO / The Coca-Cola Company | 0.00 | -4.06 | 0.23 | -4.98 | 0.0663 | -0.0320 | |||

| IBM / International Business Machines Corporation | 0.00 | -35.03 | 0.23 | -22.95 | 0.0651 | -0.0537 | |||

| IVV / iShares Trust - iShares Core S&P 500 ETF | 0.00 | -13.59 | 0.22 | -4.33 | 0.0640 | -0.0300 | |||

| PZZA / Papa John's International, Inc. | 0.00 | 0.21 | 0.0599 | 0.0599 | |||||

| COST / Costco Wholesale Corporation | 0.00 | -25.54 | 0.21 | -22.05 | 0.0809 | -0.0260 | |||

| WMT / Walmart Inc. | 0.00 | 0.20 | 0.0799 | 0.0799 | |||||

| UPS / United Parcel Service, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| HUM / Humana Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| VVV / Valvoline Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| ONL / Orion Properties Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| CHCO / City Holding Company | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| EP.PRC / El Paso Energy Capital Trust I - Preferred Security | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| MPC / Marathon Petroleum Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| MBI / MBIA Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| EG / Everest Group, Ltd. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| RDDT / Reddit, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.5975 | ||||

| KIRK / Kirkland's, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| WBD / Warner Bros. Discovery, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| TSLA / Tesla, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 |