Mga Batayang Estadistika

| Nilai Portofolio | $ 91,482,000 |

| Posisi Saat Ini | 110 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

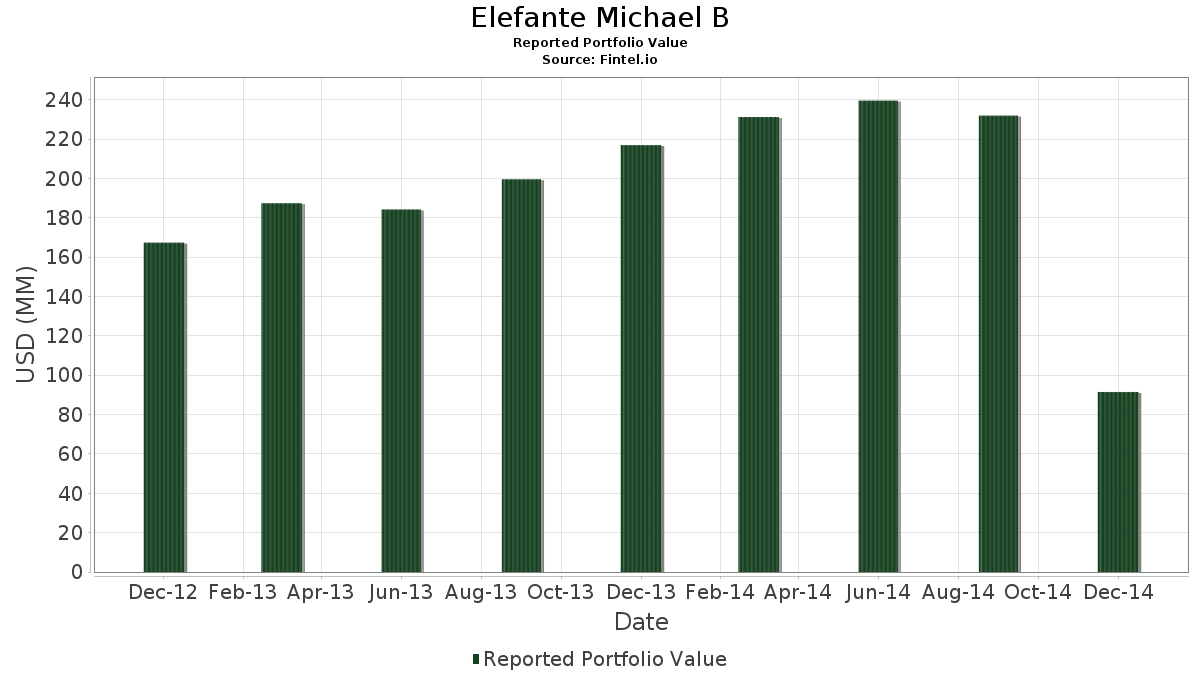

Elefante Michael B telah mengungkapkan total kepemilikan 110 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 91,482,000 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Elefante Michael B adalah CVS Health Corporation (US:CVS) , The Procter & Gamble Company (US:PG) , Johnson & Johnson (US:JNJ) , Novartis AG - Depositary Receipt (Common Stock) (US:NVS) , and Canadian National Railway Company (US:CNI) . Posisi baru Elefante Michael B meliputi: CDK Global Inc (US:CDK) , Cracker Barrel Old Country Store, Inc. (US:CBRL) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.02 | 1.31 | 1.4374 | 0.8299 | |

| 0.03 | 2.76 | 3.0148 | 0.8222 | |

| 0.01 | 1.10 | 1.2013 | 0.7598 | |

| 0.01 | 1.08 | 1.1773 | 0.7194 | |

| 0.05 | 1.14 | 1.2505 | 0.6550 | |

| 0.01 | 0.86 | 0.9455 | 0.5993 | |

| 0.04 | 3.23 | 3.5307 | 0.5154 | |

| 0.01 | 0.41 | 0.4536 | 0.4536 | |

| 0.01 | 0.66 | 0.7193 | 0.4304 | |

| 0.01 | 0.38 | 0.4099 | 0.4099 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.01 | 0.70 | 0.7696 | -0.9142 | |

| 0.00 | 0.00 | -0.7611 | ||

| 0.02 | 1.29 | 1.4134 | -0.7460 | |

| 0.00 | 0.00 | -0.6882 | ||

| 0.04 | 2.93 | 3.2061 | -0.5246 | |

| 0.01 | 1.07 | 1.1663 | -0.5037 | |

| 0.01 | 1.28 | 1.3992 | -0.4623 | |

| 0.07 | 1.95 | 2.1272 | -0.4518 | |

| 0.00 | 0.54 | 0.5870 | -0.4384 | |

| 0.02 | 1.61 | 1.7643 | -0.4275 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2015-02-13 untuk periode pelaporan 2014-12-31. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| CVS / CVS Health Corporation | 0.04 | -65.83 | 3.70 | -58.65 | 4.0401 | 0.1862 | |||

| PG / The Procter & Gamble Company | 0.04 | -57.55 | 3.23 | -53.81 | 3.5307 | 0.5154 | |||

| JNJ / Johnson & Johnson | 0.03 | -61.55 | 3.19 | -62.28 | 3.4925 | -0.1597 | |||

| NVS / Novartis AG - Depositary Receipt (Common Stock) | 0.03 | -63.07 | 3.07 | -63.65 | 3.3591 | -0.2866 | |||

| CNI / Canadian National Railway Company | 0.04 | -65.10 | 2.93 | -66.10 | 3.2061 | -0.5246 | |||

| MMM / 3M Company | 0.02 | -62.79 | 2.85 | -56.84 | 3.1197 | 0.2683 | |||

| XOM / Exxon Mobil Corporation | 0.03 | -44.82 | 2.76 | -45.76 | 3.0148 | 0.8222 | |||

| AAPL / Apple Inc. | 0.02 | -65.57 | 2.60 | -62.27 | 2.8421 | -0.1292 | |||

| EMR / Emerson Electric Co. | 0.04 | -62.63 | 2.55 | -63.14 | 2.7874 | -0.1955 | |||

| NSRGY / Nestlé S.A. - Depositary Receipt (Common Stock) | 0.03 | -62.31 | 2.55 | -62.65 | 2.7863 | -0.1565 | |||

| ATR / AptarGroup, Inc. | 0.04 | -59.48 | 2.42 | -55.41 | 2.6420 | 0.3050 | |||

| MA / Mastercard Incorporated | 0.03 | -70.26 | 2.34 | -65.33 | 2.5557 | -0.3523 | |||

| ADP / Automatic Data Processing, Inc. | 0.03 | -64.30 | 2.32 | -59.17 | 2.5316 | 0.0859 | |||

| INTC / Intel Corporation | 0.05 | -67.45 | 1.99 | -66.08 | 2.1742 | -0.3539 | |||

| NVZMF / Novozymes A/S | 0.05 | -64.89 | 1.98 | -65.85 | 2.1676 | -0.3363 | |||

| FISV / Fiserv, Inc. | 0.03 | -65.88 | 1.97 | -62.54 | 2.1556 | -0.1142 | |||

| EMC / Global X Funds - Global X Emerging Markets Great Consumer ETF | 0.07 | -67.99 | 1.95 | -67.46 | 2.1272 | -0.4518 | |||

| ORCL / Oracle Corporation | 0.04 | -70.42 | 1.82 | -65.24 | 1.9862 | -0.2681 | |||

| QCOM / QUALCOMM Incorporated | 0.02 | -63.32 | 1.75 | -63.51 | 1.9173 | -0.1554 | |||

| NXPI / NXP Semiconductors N.V. | 0.02 | -62.17 | 1.68 | -57.78 | 1.8386 | 0.1207 | |||

| PEP / PepsiCo, Inc. | 0.02 | -68.74 | 1.61 | -68.25 | 1.7643 | -0.4275 | |||

| RTX / RTX Corporation | 0.01 | -62.58 | 1.61 | -59.27 | 1.7588 | 0.0556 | |||

| CVX / Chevron Corporation | 0.01 | -65.49 | 1.61 | -67.55 | 1.7566 | -0.3786 | |||

| JCI / Johnson Controls International plc | 0.03 | -61.81 | 1.54 | -58.05 | 1.6834 | 0.1005 | |||

| ABT / Abbott Laboratories | 0.03 | -58.55 | 1.54 | -55.13 | 1.6790 | 0.2031 | |||

| PPL / Pembina Pipeline Corporation | 0.04 | -62.04 | 1.38 | -67.21 | 1.5041 | -0.3052 | |||

| GIS / General Mills, Inc. | 0.02 | -11.72 | 1.31 | -6.67 | 1.4374 | 0.8299 | |||

| HD / The Home Depot, Inc. | 0.01 | -57.98 | 1.30 | -51.91 | 1.4200 | 0.2553 | |||

| SLB / Schlumberger Limited | 0.02 | -69.27 | 1.29 | -74.18 | 1.4134 | -0.7460 | |||

| ROK / Rockwell Automation, Inc. | 0.01 | -70.68 | 1.28 | -70.35 | 1.3992 | -0.4623 | |||

| IPGP / IPG Photonics Corporation | 0.02 | -70.24 | 1.24 | -67.58 | 1.3511 | -0.2926 | |||

| GE / General Electric Company | 0.05 | -16.02 | 1.14 | -17.16 | 1.2505 | 0.6550 | |||

| CSCO / Cisco Systems, Inc. | 0.04 | -59.66 | 1.10 | -55.43 | 1.2068 | 0.1387 | |||

| HON / Honeywell International Inc. | 0.01 | -0.05 | 1.10 | 7.32 | 1.2013 | 0.7598 | |||

| DOW / Dow Inc. | 0.01 | -1.46 | 1.08 | 1.41 | 1.1773 | 0.7194 | |||

| PRGO / Perrigo Company plc | 0.01 | -75.25 | 1.07 | -72.45 | 1.1663 | -0.5037 | |||

| MSFT / Microsoft Corporation | 0.02 | -66.52 | 0.97 | -66.45 | 1.0614 | -0.1865 | |||

| TGT / Target Corporation | 0.01 | -69.64 | 0.96 | -63.21 | 1.0483 | -0.0758 | |||

| ABBV / AbbVie Inc. | 0.01 | -5.03 | 0.86 | 7.72 | 0.9455 | 0.5993 | |||

| IBM / International Business Machines Corporation | 0.00 | -49.28 | 0.72 | -57.13 | 0.7925 | 0.0634 | |||

| HP / Helmerich & Payne, Inc. | 0.01 | -73.82 | 0.70 | -81.97 | 0.7696 | -0.9142 | |||

| MRK / Merck & Co., Inc. | 0.01 | -38.57 | 0.69 | -41.23 | 0.7510 | 0.2469 | |||

| NSC / Norfolk Southern Corporation | 0.01 | 0.00 | 0.66 | -1.79 | 0.7193 | 0.4304 | |||

| ABB / ABB Ltd. - ADR | 0.03 | -71.44 | 0.55 | -73.02 | 0.5990 | -0.2767 | |||

| ILMN / Illumina, Inc. | 0.00 | -79.94 | 0.54 | -77.42 | 0.5870 | -0.4384 | |||

| BMY / Bristol-Myers Squibb Company | 0.01 | -7.77 | 0.54 | 6.35 | 0.5859 | 0.3686 | |||

| NVO / Novo Nordisk A/S - Depositary Receipt (Common Stock) | 0.01 | 0.00 | 0.47 | -11.07 | 0.5094 | 0.2834 | |||

| GPC / Genuine Parts Company | 0.00 | -1.37 | 0.46 | 20.00 | 0.5050 | 0.3390 | |||

| UNFI / United Natural Foods, Inc. | 0.01 | -59.13 | 0.46 | -48.60 | 0.5028 | 0.1169 | |||

| RPM / RPM International Inc. | 0.01 | -0.68 | 0.45 | 10.10 | 0.4886 | 0.3136 | |||

| XLNX / Xilinx, Inc. | 0.01 | -73.81 | 0.41 | -73.29 | 0.4536 | 0.4536 | |||

| COP / ConocoPhillips | 0.01 | -0.09 | 0.40 | -9.98 | 0.4340 | 0.2438 | |||

| ANSS / ANSYS, Inc. | 0.00 | 1.19 | 0.38 | 9.74 | 0.4187 | 0.2682 | |||

| COST / Costco Wholesale Corporation | 0.00 | -30.88 | 0.38 | -22.02 | 0.4143 | 0.2047 | |||

| CDK / CDK Global Inc | 0.01 | 0.38 | 0.4099 | 0.4099 | |||||

| IONS / Ionis Pharmaceuticals, Inc. | 0.01 | -70.50 | 0.37 | -53.16 | 0.4045 | 0.4045 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | -54.63 | 0.37 | -50.67 | 0.4023 | 0.0806 | |||

| RHHBY / Roche Holding AG - Depositary Receipt (Common Stock) | 0.01 | -68.52 | 0.36 | -71.04 | 0.3935 | -0.1424 | |||

| CTSH / Cognizant Technology Solutions Corporation | 0.01 | -0.38 | 0.35 | 17.23 | 0.3793 | 0.2517 | |||

| NEOG / Neogen Corporation | 0.01 | -0.37 | 0.33 | 25.28 | 0.3629 | 0.2486 | |||

| LECO / Lincoln Electric Holdings, Inc. | 0.00 | -1.35 | 0.33 | -1.51 | 0.3574 | 0.2143 | |||

| PCP / Precision Castparts Corporation | 0.00 | -2.57 | 0.32 | -0.93 | 0.3498 | 0.2105 | |||

| TROW / T. Rowe Price Group, Inc. | 0.00 | -0.27 | 0.31 | 9.41 | 0.3432 | 0.2195 | |||

| HES / Hess Corporation | 0.00 | 0.00 | 0.29 | -21.75 | 0.3225 | 0.1599 | |||

| PFE / Pfizer Inc. | 0.01 | -3.63 | 0.27 | 1.51 | 0.2940 | 0.1798 | |||

| NTRS / Northern Trust Corporation | 0.00 | -0.38 | 0.26 | -1.50 | 0.2875 | 0.1724 | |||

| AKAM / Akamai Technologies, Inc. | 0.00 | -0.36 | 0.26 | 4.80 | 0.2864 | 0.1786 | |||

| DE / Deere & Company | 0.00 | -36.96 | 0.26 | -32.10 | 0.2798 | 0.1173 | |||

| US6550441058 / Noble Energy, Inc. | 0.01 | -0.19 | 0.25 | -30.73 | 0.2711 | 0.1167 | |||

| NEE / NextEra Energy, Inc. | 0.00 | -0.43 | 0.25 | 12.73 | 0.2711 | 0.1762 | |||

| PAYX / Paychex, Inc. | 0.01 | -0.29 | 0.24 | 3.91 | 0.2613 | 0.1621 | |||

| COL / Rockwell Collins, Inc. | 0.00 | 0.22 | 0.2383 | 0.2383 | |||||

| FFIV / F5, Inc. | 0.00 | -0.30 | 0.22 | 9.60 | 0.2372 | 0.1518 | |||

| T / AT&T Inc. | 0.01 | -0.16 | 0.21 | -4.91 | 0.2328 | 0.1362 | |||

| JPM / JPMorgan Chase & Co. | 0.00 | -48.04 | 0.21 | -46.02 | 0.2296 | 0.0618 | |||

| PSX / Phillips 66 | 0.00 | 0.00 | 0.20 | -12.05 | 0.2153 | 0.1188 | |||

| HAR / Harman International Industries, Inc. | 0.00 | -0.54 | 0.20 | 8.29 | 0.2142 | 0.2142 | |||

| US40425J1016 / HMS Holdings Corp. | 0.01 | -6.38 | 0.19 | 4.86 | 0.2121 | 0.1323 | |||

| PEAK / Healthpeak Properties, Inc. | 0.00 | -8.77 | 0.19 | 1.64 | 0.2033 | 0.1244 | |||

| XCEMX / Clearbridge Energy MLP Fund Inc | 0.01 | -0.16 | 0.17 | -1.17 | 0.1847 | 0.1847 | |||

| UFPI / UFP Industries, Inc. | 0.00 | 0.00 | 0.16 | 24.62 | 0.1771 | 0.1210 | |||

| GOOGL / Alphabet Inc. | 0.00 | -45.13 | 0.16 | -50.61 | 0.1760 | 0.0354 | |||

| SIVB / SVB Financial Group | 0.00 | -0.72 | 0.16 | 3.23 | 0.1749 | 0.1081 | |||

| GOOG / Alphabet Inc. | 0.00 | -45.13 | 0.16 | -50.00 | 0.1749 | 0.0369 | |||

| STT / State Street Corporation | 0.00 | -67.79 | 0.16 | -65.65 | 0.1716 | -0.0254 | |||

| FRC / First Republic Bank | 0.00 | 8.44 | 0.15 | 14.07 | 0.1683 | 0.1101 | |||

| 748356102 / Questar Corp. | 0.01 | -0.99 | 0.15 | 11.85 | 0.1651 | 0.1068 | |||

| LMT / Lockheed Martin Corporation | 0.00 | -1.30 | 0.15 | 3.55 | 0.1596 | 0.1596 | |||

| KRFT / | 0.00 | -1.29 | 0.14 | 9.92 | 0.1574 | 0.1574 | |||

| SRCL / Stericycle, Inc. | 0.00 | 15.34 | 0.14 | 30.00 | 0.1563 | 0.1563 | |||

| MCHP / Microchip Technology Incorporated | 0.00 | -9.65 | 0.14 | -14.02 | 0.1541 | 0.1541 | |||

| SBNY / Signature Bank | 0.00 | 0.00 | 0.14 | 12.50 | 0.1476 | 0.0958 | |||

| ATGE / Adtalem Global Education Inc. | 0.00 | -0.54 | 0.13 | 10.08 | 0.1432 | 0.1432 | |||

| TSCO / Tractor Supply Company | 0.00 | -0.63 | 0.12 | 27.84 | 0.1355 | 0.0937 | |||

| US74733V1008 / QEP Resources, Inc. | 0.01 | -0.41 | 0.12 | -34.92 | 0.1345 | 0.0530 | |||

| ACC / American Campus Communities Inc. | 0.00 | -13.21 | 0.12 | -1.68 | 0.1279 | 0.1279 | |||

| MD / Pediatrix Medical Group, Inc. | 0.00 | -0.56 | 0.12 | 20.62 | 0.1279 | 0.0861 | |||

| NWL / Newell Brands Inc. | 0.00 | -0.86 | 0.11 | 9.00 | 0.1191 | 0.1191 | |||

| BP / BP p.l.c. - Depositary Receipt (Common Stock) | 0.00 | -0.37 | 0.10 | -13.56 | 0.1115 | 0.1115 | |||

| ZTS / Zoetis Inc. | 0.00 | 13.41 | 0.10 | 31.58 | 0.1093 | 0.1093 | |||

| SCL / Stepan Company | 0.00 | -48.48 | 0.09 | -53.23 | 0.0951 | 0.0149 | |||

| MIDD / The Middleby Corporation | 0.00 | 0.00 | 0.04 | 12.50 | 0.0492 | 0.0492 | |||

| MO / Altria Group, Inc. | 0.00 | -1.67 | 0.03 | 3.57 | 0.0317 | 0.0196 | |||

| CINF / Cincinnati Financial Corporation | 0.00 | -1.08 | 0.02 | 9.09 | 0.0262 | 0.0167 | |||

| CBRL / Cracker Barrel Old Country Store, Inc. | 0.00 | 0.02 | 0.0251 | 0.0251 | |||||

| 758766109 / Regal Entertainment Group | 0.00 | 0.00 | 0.02 | 9.52 | 0.0251 | 0.0251 | |||

| PM / Philip Morris International Inc. | 0.00 | -2.00 | 0.02 | -4.76 | 0.0219 | 0.0128 | |||

| NHI / National Health Investors, Inc. | 0.00 | -3.51 | 0.02 | 18.75 | 0.0208 | 0.0208 | |||

| PBCT / People`s United Financial Inc | 0.00 | 9.43 | 0.02 | 20.00 | 0.0197 | 0.0197 | |||

| VZ / Verizon Communications Inc. | 0.00 | 0.00 | 0.02 | -5.56 | 0.0186 | 0.0186 | |||

| THOMAS WHITE INTERNATIONAL FUN / Equity Mutual Fu (543917702) | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| KO / The Coca-Cola Company | 0.00 | -100.00 | 0.00 | -100.00 | -0.0634 | ||||

| COV / | 0.00 | -100.00 | 0.00 | -100.00 | -0.2384 | ||||

| CL / Colgate-Palmolive Company | 0.00 | -100.00 | 0.00 | -100.00 | -0.0522 | ||||

| XYL / Xylem Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.3743 | ||||

| ALNY / Alnylam Pharmaceuticals, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.2639 | ||||

| AXP / American Express Company | 0.00 | -100.00 | 0.00 | -100.00 | -0.0556 | ||||

| IVV / iShares Trust - iShares Core S&P 500 ETF | 0.00 | -100.00 | 0.00 | -100.00 | -0.1194 | ||||

| SJM / The J. M. Smucker Company | 0.00 | -100.00 | 0.00 | -100.00 | -0.1436 | ||||

| UNP / Union Pacific Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.1013 | ||||

| LH / Labcorp Holdings Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.7611 | ||||

| SPY / SPDR S&P 500 ETF | 0.00 | -100.00 | 0.00 | -100.00 | -0.6882 | ||||

| 61166W101 / Monsanto Co. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0906 | ||||

| TYG / Tortoise Energy Infrastructure Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.0095 | ||||

| USB / U.S. Bancorp | 0.00 | -100.00 | 0.00 | -100.00 | -0.0022 | ||||

| MKTX / MarketAxess Holdings Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0229 | ||||

| AMGN / Amgen Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0711 | ||||

| HIBB / Hibbett, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| WMT / Walmart Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.2617 | ||||

| COF / Capital One Financial Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.0871 | ||||

| CNL / Collective Mining Ltd. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| WFM / Whole Foods Market, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.1052 | ||||

| WLL / Whiting Petroleum Corp (New) | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| MCD / McDonald's Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.0052 | ||||

| CYN / Cyngn Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| KMB / Kimberly-Clark Corporation | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| GLW / Corning Incorporated | 0.00 | -100.00 | 0.00 | -100.00 | -0.1112 | ||||

| CGNX / Cognex Corporation | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| VFC / V.F. Corporation | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| DIS / The Walt Disney Company | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| GSK / GSK plc - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| SYK / Stryker Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.1104 | ||||

| SYY / Sysco Corporation | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| WFC / Wells Fargo & Company | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| STKL / SunOpta Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| TEVA / Teva Pharmaceutical Industries Limited - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | -100.00 | -0.0694 | ||||

| VDMAX / Virtus Opportunities Trust - Virtus KAR Developing Markets Fd USD Cls A | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| VANGUARD TAX MANAGED INTERNATI / Equity Mutual Fu (92206J107) | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 |