Mga Batayang Estadistika

| Nilai Portofolio | $ 919,827,416 |

| Posisi Saat Ini | 855 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

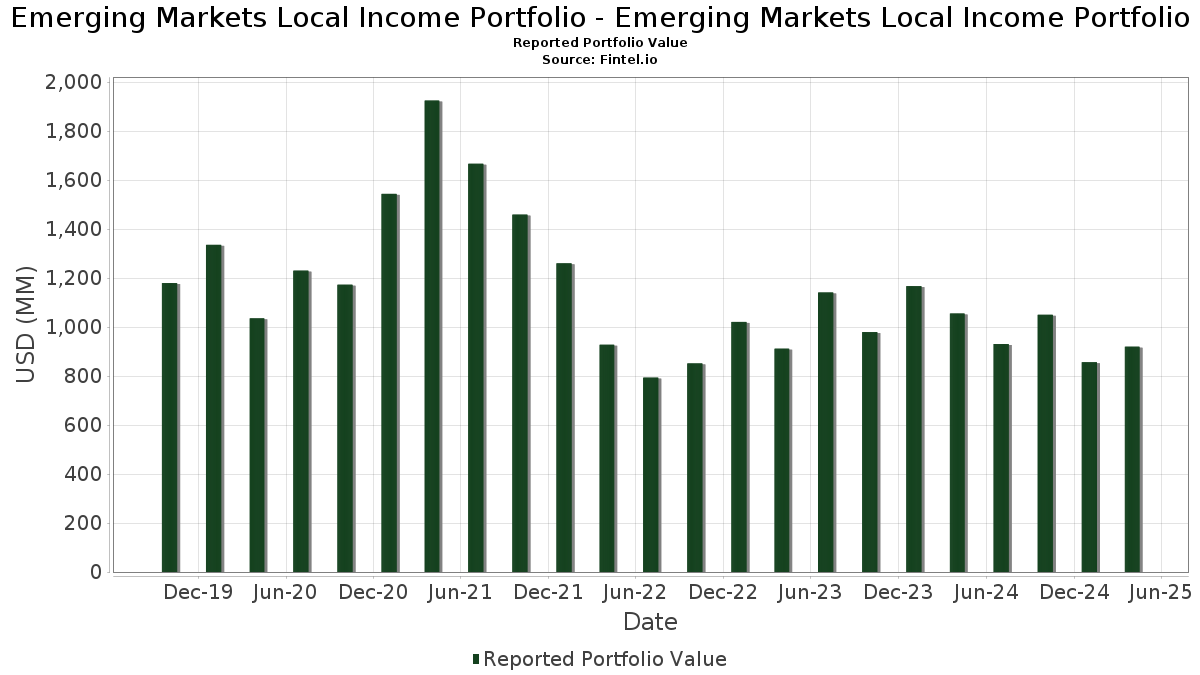

Emerging Markets Local Income Portfolio - Emerging Markets Local Income Portfolio telah mengungkapkan total kepemilikan 855 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 919,827,416 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Emerging Markets Local Income Portfolio - Emerging Markets Local Income Portfolio adalah Morgan Stanley Institutional Liquidity Funds Government Portfolio, Institutional Class (US:US61747C7074) , South Africa - Corporate Bond/Note (ZA:R2035) , BRAZIL LTN BRL 0.0% 07-01-25 (BR:BRSTNCLTN7Z6) , Peru - Corporate Bond/Note (PE:SB12AGO34) , and Romania Government Bond (RO:RO7P95F9FNY6) . Posisi baru Emerging Markets Local Income Portfolio - Emerging Markets Local Income Portfolio meliputi: South Africa - Corporate Bond/Note (ZA:R2035) , BRAZIL LTN BRL 0.0% 07-01-25 (BR:BRSTNCLTN7Z6) , Peru - Corporate Bond/Note (PE:SB12AGO34) , Romania Government Bond (RO:RO7P95F9FNY6) , and Mexican Bonos (MX:MX0MGO0000J5) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 49.84 | 4.9655 | 4.9655 | ||

| 102.42 | 102.42 | 10.2053 | 4.1825 | |

| 20.00 | 1.9928 | 1.9928 | ||

| 13.97 | 1.3915 | 1.3915 | ||

| 10.78 | 1.0743 | 1.0743 | ||

| 10.78 | 1.0739 | 1.0739 | ||

| 10.77 | 1.0733 | 1.0733 | ||

| 10.26 | 1.0227 | 1.0227 | ||

| 13.40 | 1.3356 | 0.9381 | ||

| 8.82 | 0.8787 | 0.8787 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 4.13 | 0.4113 | -3.1702 | ||

| 22.60 | 2.2515 | -2.1142 | ||

| 7.10 | 0.7069 | -1.4595 | ||

| 22.62 | 2.2542 | -1.4454 | ||

| -10.77 | -1.0734 | -1.0734 | ||

| -10.77 | -1.0733 | -1.0733 | ||

| -10.77 | -1.0731 | -1.0731 | ||

| 0.94 | 0.0937 | -0.8910 | ||

| 0.81 | 0.0811 | -0.6473 | ||

| 1.17 | 0.1170 | -0.5927 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-06-23 untuk periode pelaporan 2025-04-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US61747C7074 / Morgan Stanley Institutional Liquidity Funds Government Portfolio, Institutional Class | 102.42 | 81.93 | 102.42 | 81.93 | 10.2053 | 4.1825 | |||

| U.S. Treasury Bills / STIV (US912797NN35) | 49.84 | 4.9655 | 4.9655 | ||||||

| Republic of Poland Government Bond / DBT (PL0000117024) | 26.59 | 12.29 | 2.6495 | 0.1162 | |||||

| R2035 / South Africa - Corporate Bond/Note | 22.62 | -34.58 | 2.2542 | -1.4454 | |||||

| XS2318315921 / Asian Infrastructure Investment Bank/The | 22.60 | -44.63 | 2.2515 | -2.1142 | |||||

| BRSTNCLTN7Z6 / BRAZIL LTN BRL 0.0% 07-01-25 | 21.37 | 6.12 | 2.1293 | -0.0250 | |||||

| XS2170852847 / Synlab Bondco PLC | 20.27 | -14.36 | 2.0194 | -0.5124 | |||||

| U.S. Treasury Bills / STIV (US912797ND52) | 20.00 | 1.9928 | 1.9928 | ||||||

| SB12AGO34 / Peru - Corporate Bond/Note | 16.13 | 1.52 | 1.6076 | -0.0926 | |||||

| RO7P95F9FNY6 / Romania Government Bond | 14.42 | 10.56 | 1.4370 | 0.0414 | |||||

| U.S. Treasury Bills / STIV (US912797NM51) | 13.97 | 1.3915 | 1.3915 | ||||||

| MX0MGO0000J5 / Mexican Bonos | 13.86 | -20.12 | 1.3812 | -0.4752 | |||||

| PTPP / PT PP (Persero) Tbk | 13.40 | 260.71 | 1.3356 | 0.9381 | |||||

| IDG000020900 / INDONESIA GOV'T | 13.14 | -7.44 | 1.3096 | -0.2095 | |||||

| TH062303I602 / Thailand Government Bond | 13.07 | 5.01 | 1.3026 | -0.0291 | |||||

| XS2655862014 / EUROPE ASIA INVESTMENT FINANCE | 12.94 | -0.89 | 1.2896 | -0.1073 | |||||

| ROGSHSTVFMX2 / Romania Government Bond | 12.63 | 10.39 | 1.2587 | 0.0346 | |||||

| ZAG000125980 / Republic of South Africa Government Bond | 12.47 | -2.81 | 1.2424 | -0.1300 | |||||

| IDG000012303 / Indonesia Treasury Bond | 12.44 | -1.50 | 1.2395 | -0.1116 | |||||

| R2044 / South Africa - Sovereign or Government Agency Debt | 12.33 | -3.10 | 1.2281 | -0.1326 | |||||

| Uzbek Industrial and Construction Bank ATB / DBT (XS2855478496) | 12.25 | -0.87 | 1.2201 | -0.1013 | |||||

| MX0MGO0000R8 / Mexican Bonos | 11.92 | 10.72 | 1.1877 | 0.0359 | |||||

| XS1151974877 / Ethiopia International Bond | 11.20 | 5.95 | 1.1159 | -0.0149 | |||||

| RSMFRSD86176 / Serbia Treasury Bonds | 10.96 | -15.18 | 1.0918 | -0.2902 | |||||

| PEP01000C2Z1 / Peru Government Bond | 10.94 | -2.06 | 1.0904 | -0.1049 | |||||

| AMGB1129A332 / Republic of Armenia Treasury Bonds | 10.93 | 3.41 | 1.0892 | -0.0418 | |||||

| US715638CE05 / REPUBLIC OF PERU SR UNSECURED REGS 02/29 5.94 | 10.91 | 29.28 | 1.0871 | 0.1843 | |||||

| IDG000011602 / Indonesia Treasury Bond | 10.88 | -1.39 | 1.0837 | -0.0961 | |||||

| DGZ / DB Gold Short ETN | 10.78 | 1.0743 | 1.0743 | ||||||

| BMIET5NT1 EATON VANCE / DFE (000000000) | 10.78 | 1.0739 | 1.0739 | ||||||

| DGZ / DB Gold Short ETN | 10.77 | 1.0733 | 1.0733 | ||||||

| XS1303929894 / Ukraine Government International Bond | 10.76 | 8.62 | 1.0725 | 0.0124 | |||||

| PTPP / PT PP (Persero) Tbk | 10.26 | 1.0227 | 1.0227 | ||||||

| IDG000021809 / INDONESIA GOV'T | 9.93 | 78.32 | 0.9898 | 0.3938 | |||||

| Paraguay Government International Bond / DBT (US699149AP51) | 9.32 | -19.47 | 0.9288 | -0.3096 | |||||

| XS2443892281 / Dominican Republic International Bond | 9.05 | 2.31 | 0.9013 | -0.0446 | |||||

| R2032 / South Africa - Corporate Bond/Note | 9.03 | 0.79 | 0.9001 | -0.0587 | |||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 8.82 | 0.8787 | 0.8787 | ||||||

| Albanian Government Bond / DBT (AL000A3L0YB0) | 8.61 | 13.88 | 0.8583 | 0.0491 | |||||

| U.S. Treasury Bills / STIV (US912797LB15) | 7.99 | 0.7958 | 0.7958 | ||||||

| RO1J9H39WKT4 / ROMANIA GOVERNMENT BOND /RON/ REGD SER 5Y 4.25000000 | 7.78 | 2.54 | 0.7752 | -0.0364 | |||||

| USL8450FAA95 / Simpar Finance S.a.r.l | 7.55 | 2.37 | 0.7522 | -0.0367 | |||||

| ROHRVN7NLNO2 / Romania Government Bond | 7.16 | 9.88 | 0.7135 | 0.0163 | |||||

| R2037 / South Africa - Sovereign or Government Agency Debt | 7.10 | -64.96 | 0.7069 | -1.4595 | |||||

| Albanian Government Bond / DBT (AL000A3LTAW4) | 7.04 | 11.54 | 0.7013 | 0.0262 | |||||

| US25714RCZ55 / Dominican Republic International Bond | 6.98 | 3.93 | 0.6951 | -0.0230 | |||||

| U.S. Treasury Bills / STIV (US912797NP82) | 6.47 | 0.6450 | 0.6450 | ||||||

| Montenegro Government International Bond / DBT (XS3037625319) | 6.34 | 0.6321 | 0.6321 | ||||||

| XS2189251031 / Uzbek Industrial and Construction Bank ATB via Daryo Finance BV | 6.18 | -0.05 | 0.6155 | -0.0457 | |||||

| Nigeria OMO Bill / STIV (NGO2Z2705258) | 5.37 | -1.65 | 0.5346 | -0.0489 | |||||

| Colombian TES / DBT (COL17CT03938) | 5.33 | 0.5309 | 0.5309 | ||||||

| XS2023698553 / Banque Centrale de Tunisie International Bond | 5.17 | 8.70 | 0.5152 | 0.0063 | |||||

| Honduras Government International Bond / DBT (USP5178RAE82) | 5.17 | 0.5149 | 0.5149 | ||||||

| Sri Lanka Government Bonds / DBT (LKB00428J159) | 4.87 | 0.21 | 0.4855 | -0.0347 | |||||

| IDG000018805 / INDOGB 7.125 06/15/42 FR92 | 4.77 | -1.24 | 0.4750 | -0.0415 | |||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 4.69 | 0.4674 | 0.4674 | ||||||

| BJSDSX2 / Alicorp SAA | 4.66 | -32.29 | 0.4644 | -0.2719 | |||||

| Albanian Government Bond / DBT (AL000A3L0PN3) | 4.53 | 10.60 | 0.4512 | 0.0131 | |||||

| US25714PER55 / Dominican Republic Central Bank Notes | 4.53 | -28.10 | 0.4511 | -0.2225 | |||||

| ROAW5KY5CD78 / Romania Government Bond | 4.50 | 11.26 | 0.4479 | 0.0157 | |||||

| TRT051033T12 / TURKIYE GOVERNMENT BOND 26.200000% 10/05/2033 | 4.33 | -39.59 | 0.4311 | -0.3350 | |||||

| SAGB / Republic of South Africa Government Bond | 4.13 | -87.67 | 0.4113 | -3.1702 | |||||

| MYBMY1900052 / Malaysia Government Bond | 4.01 | 5.47 | 0.4000 | -0.0072 | |||||

| National Bank of Uzbekistan / DBT (XS2853544802) | 3.92 | 0.28 | 0.3907 | -0.0276 | |||||

| Development Bank of Kazakhstan JSC / DBT (US48129VAC00) | 3.79 | -56.73 | 0.3780 | -0.5598 | |||||

| Benin Government International Bond / DBT (XS2759982064) | 3.79 | -29.61 | 0.3772 | -0.1981 | |||||

| BRSTNCNTF1P8 / Brazil Notas do Tesouro Nacional Serie F | 3.74 | 5.20 | 0.3728 | -0.0076 | |||||

| US70338LAA70 / Patrimonio Autonomo Union Del Sur | 3.68 | -4.44 | 0.3671 | -0.0454 | |||||

| Uzbek Industrial and Construction Bank ATB / DBT (XS3025929269) | 3.66 | 0.3651 | 0.3651 | ||||||

| RO1227DBN011 / Romania Government Bond | 3.56 | 10.56 | 0.3549 | 0.0102 | |||||

| Nigeria OMO Bill / STIV (NGO8A0710250) | 3.50 | -2.02 | 0.3489 | -0.0334 | |||||

| USP06518AH06 / Bahamas Government International Bond | 3.45 | 0.3439 | 0.3439 | ||||||

| PURCHASED MXN / SOLD USD / DFE (000000000) | 3.41 | 0.3401 | 0.3401 | ||||||

| TRT190728T18 / Turkey Government Bond | 3.41 | -38.58 | 0.3399 | -0.2543 | |||||

| Suriname Government International Bond / DBT (USP68788AC53) | 3.24 | 989.90 | 0.3226 | 0.2908 | |||||

| US486661AF87 / Kazakhstan Government International Bond | 3.03 | -4.96 | 0.3016 | -0.0391 | |||||

| MX0MGO0001E4 / Mexican Bonos | 2.98 | 11.40 | 0.2971 | 0.0107 | |||||

| Montenegro Government International Bond / DBT (XS2779850630) | 2.91 | -1.89 | 0.2900 | -0.0274 | |||||

| Sri Lanka Government Bonds / DBT (LKB01534I155) | 2.81 | 0.2797 | 0.2797 | ||||||

| Suriname Government International Bond / DBT (USP68788AD37) | 2.68 | 5.67 | 0.2673 | -0.0043 | |||||

| XS2286298711 / Benin Government International Bond | 2.67 | -46.46 | 0.2662 | -0.2678 | |||||

| CZ0001007033 / CZECH REPUBLIC | 2.66 | 10.52 | 0.2649 | 0.0075 | |||||

| IDG000014101 / Indonesia Treasury Bond | 2.45 | -1.33 | 0.2441 | -0.0215 | |||||

| US87938YAA73 / Telefonica del Peru SAA | 2.34 | -44.45 | 0.2331 | -0.2175 | |||||

| USP48864AQ80 / Barbados Government International Bond | 2.27 | 0.2265 | 0.2265 | ||||||

| PEP01000C4L7 / Peru Government Bond | 2.25 | 0.58 | 0.2237 | -0.0151 | |||||

| Suriname Government International Bond / DBT (US86886PAD42) | 2.22 | 2.83 | 0.2207 | -0.0098 | |||||

| AMGB3029A522 / Republic of Armenia Treasury Bonds | 2.20 | 4.60 | 0.2197 | -0.0058 | |||||

| 88WE / Angolan Government International Bond | 2.18 | 0.2170 | 0.2170 | ||||||

| XS2436896273 / Dominican Republic International Bond | 2.15 | 2.72 | 0.2144 | -0.0098 | |||||

| HU0000404165 / Hungary Government Bond | 2.14 | 8.68 | 0.2132 | 0.0025 | |||||

| European Bank for Reconstruction & Development / DBT (XS2800009578) | 2.07 | -48.85 | 0.2061 | -0.2264 | |||||

| AMGB3129A504 / Republic of Armenia Treasury Bonds | 2.03 | 4.58 | 0.2025 | -0.0054 | |||||

| USP7807HAR68 / Petroleos de Venezuela SA | 2.03 | -3.24 | 0.2021 | -0.0222 | |||||

| Sri Lanka Government Bonds / DBT (LKB00832L158) | 2.01 | 0.2007 | 0.2007 | ||||||

| Ipoteka-Bank ATIB / DBT (XS2808393370) | 2.01 | 14.21 | 0.2002 | 0.0120 | |||||

| Paraguay Government International Bond / DBT (USP75744AP07) | 2.00 | -4.62 | 0.1998 | -0.0250 | |||||

| TH062303D603 / Thailand Government Bond | 2.00 | 0.1991 | 0.1991 | ||||||

| US25714PEW41 / Dominican Republic International Bond | 2.00 | -18.92 | 0.1990 | -0.0645 | |||||

| Mongolia Government International Bond / DBT (USY6142NAJ73) | 1.93 | 0.1922 | 0.1922 | ||||||

| XS1953916290 / Republic of Uzbekistan Bond | 1.87 | 0.1865 | 0.1865 | ||||||

| XS1796266754 / Ivory Coast Government International Bond | 1.86 | 0.87 | 0.1852 | -0.0119 | |||||

| PURCHASED INR / SOLD USD / DFE (000000000) | 1.82 | 0.1809 | 0.1809 | ||||||

| Sri Lanka Government Bonds / DBT (LKB00730J158) | 1.80 | 226.50 | 0.1793 | 0.1203 | |||||

| US25714PEU84 / Dominican Republic Central Bank Notes | 1.80 | 3.45 | 0.1791 | -0.0068 | |||||

| Bahamas Government International Bond / DBT (USP06518AC19) | 1.75 | 0.1743 | 0.1743 | ||||||

| XS2360598630 / Republic of Cameroon International Bond | 1.62 | 34.11 | 0.1615 | 0.0322 | |||||

| Long: SMIBCBKA6 IRS CNY R F 2.39750 2 CCPNDF / Short: SMIBCBKA6 IRS CNY P V 00MCNRR 1 CCPNDF / DIR (000000000) | 1.61 | 0.1605 | 0.1605 | ||||||

| Nigeria OMO Bill / STIV (NGO7A3009256) | 1.46 | -65.12 | 0.1450 | -0.3013 | |||||

| ROZBOC49U096 / Romania Government Bond | 1.43 | 8.84 | 0.1423 | 0.0019 | |||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 1.39 | 0.1387 | 0.1387 | ||||||

| Paraguay Government International Bond / DBT (US699149BX76) | 1.38 | 0.1379 | 0.1379 | ||||||

| XS2199272662 / Jordan Government International Bond | 1.38 | 0.1371 | 0.1371 | ||||||

| XS1819680528 / Angolan Government International Bond | 1.35 | 0.1349 | 0.1349 | ||||||

| Nigeria OMO Bill / STIV (NGO2A1908252) | 1.35 | -2.25 | 0.1342 | -0.0132 | |||||

| Long: SMID7MYE1 IRS THB R F 2.48300 BMID7MYF8 CCPNDFOIS / Short: SMID7MYE1 IRS THB P V 12MTHOR BMID7MYG6 CCPNDFOIS / DIR (000000000) | 1.34 | 0.1333 | 0.1333 | ||||||

| Albanian Government Bond / DBT (AL000A4D54G1) | 1.26 | 0.1252 | 0.1252 | ||||||

| PTPP / PT PP (Persero) Tbk | 1.23 | -1.12 | 0.1230 | -0.0106 | |||||

| Nigeria OMO Bill / STIV (NGO9Y2005251) | 1.17 | -82.30 | 0.1170 | -0.5927 | |||||

| European Bank for Reconstruction & Development / DBT (XS2778917190) | 1.17 | -19.34 | 0.1168 | -0.0387 | |||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 1.17 | 0.1167 | 0.1167 | ||||||

| XS0559237796 / Lebanon Government International Bond | 1.17 | 10.32 | 0.1161 | 0.0031 | |||||

| Nigeria OMO Bill / STIV (NGO6Z1706258) | 1.09 | -38.80 | 0.1083 | -0.0817 | |||||

| Albanian Government Bond / DBT (AL000A3LUHP1) | 1.08 | 10.37 | 0.1072 | 0.0029 | |||||

| XS1419879686 / Lebanon Government International Bond | 1.07 | 496.09 | 0.1063 | 0.0871 | |||||

| IDG000012501 / Indonesia Treasury Bond | 1.03 | -0.48 | 0.1023 | -0.0080 | |||||

| XS2278994418 / BENIN INTL GOV BOND 4.875000% 01/19/2032 | 0.99 | -33.02 | 0.0990 | -0.0598 | |||||

| US486661AF87 / Kazakhstan Government International Bond | 0.99 | -3.23 | 0.0987 | -0.0108 | |||||

| Itau BBA International PLC / SN (XS2742662955) | 0.98 | -2.10 | 0.0977 | -0.0095 | |||||

| PEP01000C5I0 / BONOS DE TESORERIA | 0.94 | -92.15 | 0.0937 | -0.8910 | |||||

| Albanian Government Bond / DBT (AL000A3L7VG0) | 0.94 | 24.70 | 0.0936 | 0.0130 | |||||

| HU0000404991 / Hungary Government Bond | 0.94 | 7.35 | 0.0932 | -0.0001 | |||||

| US922646AS37 / Venezuela Government International Bond | 0.93 | -8.56 | 0.0926 | -0.0161 | |||||

| Bono Del Tesoro Nacional Capitalizable en Pesos / DBT (AR0647336129) | 0.92 | 0.0918 | 0.0918 | ||||||

| Long: SMIE8TBR9 IRS MXN R F 8.88000 BMIE8TBS7 CCPOIS / Short: SMIE8TBR9 IRS MXN P V 00MTIEF BMIE8TBT5 CCPOIS / DIR (000000000) | 0.91 | 0.0905 | 0.0905 | ||||||

| Long: SMICJT382 IRS THB R F 2.94400 BMICJT390 CCPNDFOIS / Short: SMICJT382 IRS THB P V 12MTHOR BMICJT3A7 CCPNDFOIS / DIR (000000000) | 0.90 | 0.0893 | 0.0893 | ||||||

| Long: SMIDBRSQ5 IRS PLN R F 5.42250 BMIDBRSR3 CCPVANILLA / Short: SMIDBRSQ5 IRS PLN P V 06MWIBOR BMIDBRSS1 CCPVANILLA / DIR (000000000) | 0.88 | 0.0875 | 0.0875 | ||||||

| XS0250882478 / Lebanon Government International Bond | 0.87 | 63.48 | 0.0870 | 0.0298 | |||||

| XS2270576700 / Montenegro Government International Bond | 0.86 | 10.53 | 0.0859 | 0.0025 | |||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0.85 | 0.0851 | 0.0851 | ||||||

| Long: SMIBCKQ36 IRS CNY R F 2.46500 2 CCPNDF / Short: SMIBCKQ36 IRS CNY P V 00MCNRR 1 CCPNDF / DIR (000000000) | 0.83 | 0.0822 | 0.0822 | ||||||

| USP5015VAQ97 / REPUBLIC OF GUATEMALA 6.600000% 06/13/2036 | 0.82 | 0.0820 | 0.0820 | ||||||

| Long: SMID7N3V5 IRS THB R F 2.17600 BMID7N3W3 CCPNDFOIS / Short: SMID7N3V5 IRS THB P V 12MTHOR BMID7N3X1 CCPNDFOIS / DIR (000000000) | 0.82 | 0.0819 | 0.0819 | ||||||

| US25714WBR34 / Dominican Republic International Bond | 0.81 | -88.06 | 0.0811 | -0.6473 | |||||

| XS1577950311 / Jordan Government International Bond | 0.78 | 0.0773 | 0.0773 | ||||||

| USP7807HAT25 / Petroleos de Venezuela SA | 0.76 | -3.18 | 0.0758 | -0.0083 | |||||

| PURCHASED THB / SOLD USD / DFE (000000000) | 0.76 | 0.0757 | 0.0757 | ||||||

| XS2490821126 / Dominican Republic International Bond | 0.71 | 5.47 | 0.0712 | -0.0013 | |||||

| USP17625AB33 / Venezuela Government International Bond | 0.71 | -4.57 | 0.0708 | -0.0089 | |||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.70 | 0.0695 | 0.0695 | ||||||

| ARARGE520718 / Argentina Treasury Bill 05/28/2020 TBLM | 0.68 | 0.0674 | 0.0674 | ||||||

| ARARGE520718 / Argentina Treasury Bill 05/28/2020 TBLM | 0.67 | 0.0673 | 0.0673 | ||||||

| US29766LAA44 / Federal Democratic Republic of Ethiopia | 0.66 | 2.18 | 0.0656 | -0.0032 | |||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0.64 | 0.0643 | 0.0643 | ||||||

| BA100RSRSOF9 / Republic of Srpska Treasury Bond | 0.64 | 9.93 | 0.0640 | 0.0015 | |||||

| ZAG000096173 / Republic of South Africa Government Bond | 0.63 | -3.83 | 0.0625 | -0.0073 | |||||

| XS0294364954 / Petroleos de Venezuela SA | 0.61 | -4.55 | 0.0607 | -0.0075 | |||||

| XS2490786113 / Dominican Republic Central Bank Notes | 0.59 | 4.98 | 0.0588 | -0.0014 | |||||

| PURCHASED USD / SOLD ZAR / DFE (000000000) | 0.59 | 0.0583 | 0.0583 | ||||||

| VENZ / Venezuela Government International Bond | 0.56 | -12.62 | 0.0560 | -0.0128 | |||||

| Albanian Treasury Bill / STIV (AL000A4D7SN1) | 0.55 | 0.0551 | 0.0551 | ||||||

| AMGN36294269 / Republic of Armenia Treasury Bonds | 0.55 | 2.62 | 0.0548 | -0.0025 | |||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | 0.54 | 0.0542 | 0.0542 | ||||||

| Bono Del Tesoro Nacional Capitalizable en Pesos / DBT (AR0071678673) | 0.53 | 0.0532 | 0.0532 | ||||||

| PURCHASED MXN / SOLD USD / DFE (000000000) | 0.53 | 0.0528 | 0.0528 | ||||||

| Long: SMIE8X6L9 IRS INR R F 5.95100 BMIE8X6M7 CCPNDFOIS / Short: SMIE8X6L9 IRS INR P V 06MMIBOR BMIE8X6N5 CCPNDFOIS / DIR (000000000) | 0.52 | 0.0516 | 0.0516 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0.51 | 0.0511 | 0.0511 | ||||||

| Albanian Government Bond / DBT (AL000A3L1EF1) | 0.49 | 13.36 | 0.0490 | 0.0025 | |||||

| Albanian Government Bond / DBT (AL000A4D6JW3) | 0.49 | 0.0487 | 0.0487 | ||||||

| Long: SMICVDZF2 IRS CNY R F 2.33900 BMICVDZG0 CCPNDF / Short: SMICVDZF2 IRS CNY P V 00MCNRR BMICVDZH8 CCPNDF / DIR (000000000) | 0.48 | 0.0483 | 0.0483 | ||||||

| Long: SMIC9ZAX6 IRS CNY R F 2.47500 BMIC9ZAY4 CCPNDF / Short: SMIC9ZAX6 IRS CNY P V 00MCNRR BMIC9ZAZ1 CCPNDF / DIR (000000000) | 0.47 | 0.0464 | 0.0464 | ||||||

| Montenegro Government International Bond / DBT (US857305AA45) | 0.46 | -1.91 | 0.0461 | -0.0044 | |||||

| Long: SMIDBSS75 IRS PLN R F 5.50000 BMIDBSS83 CCPVANILLA / Short: SMIDBSS75 IRS PLN P V 06MWIBOR BMIDBSS91 CCPVANILLA / DIR (000000000) | 0.46 | 0.0459 | 0.0459 | ||||||

| GHGGOG069915 / Ghana Government Bond | 0.45 | 0.0445 | 0.0445 | ||||||

| Long: SMID6F6S7 IRS INR R F 6.23300 BMID6F6T5 CCPNDFOIS / Short: SMID6F6S7 IRS INR P V 06MMIBOR BMID6F6U2 CCPNDFOIS / DIR (000000000) | 0.45 | 0.0445 | 0.0445 | ||||||

| TRT061124T11 / Turkey Government Bond | 0.44 | -50.94 | 0.0443 | -0.0525 | |||||

| TRT061124T11 / Turkey Government Bond | 0.44 | -84.10 | 0.0443 | -0.2546 | |||||

| IDG000009606 / Indonesia Treasury Bond | 0.42 | -1.40 | 0.0421 | -0.0037 | |||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0.42 | 0.0420 | 0.0420 | ||||||

| Long: SMIDAWJS1 IRS CZK R F 3.64500 BMIDAWJT9 CCPVANILLA / Short: SMIDAWJS1 IRS CZK P V 06MPRIBO BMIDAWJU6 CCPVANILLA / DIR (000000000) | 0.42 | 0.0417 | 0.0417 | ||||||

| Nigeria OMO Bill / STIV (NGO7Z1006251) | 0.41 | -1.69 | 0.0407 | -0.0038 | |||||

| GHGGOG069972 / Ghana Government Bond | 0.40 | 138.46 | 0.0402 | 0.0221 | |||||

| US86886PAC68 / Suriname Government International Bond | 0.39 | -3.44 | 0.0392 | -0.0044 | |||||

| Long: BMIDMW025 IRS MYR R F 3.63900 BMIDMW033 NDF / Short: BMIDMW025 IRS MYR P V 03MKLIBO BMIDMW041 NDF / DIR (000000000) | 0.39 | 0.0392 | 0.0392 | ||||||

| Long: SMIE71CL3 IRS MXN R F 9.11000 BMIE71CM1 CCPOIS / Short: SMIE71CL3 IRS MXN P V 00MTIEF BMIE71CN9 CCPOIS / DIR (000000000) | 0.39 | 0.0390 | 0.0390 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | 0.39 | 0.0389 | 0.0389 | ||||||

| PURCHASED INR / SOLD USD / DFE (000000000) | 0.38 | 0.0382 | 0.0382 | ||||||

| PURCHASED INR / SOLD USD / DFE (000000000) | 0.38 | 0.0379 | 0.0379 | ||||||

| Long: SMIB3FEL0 IRS PLN R F 5.18870 2 CCPVANILLA / Short: SMIB3FEL0 IRS PLN P V 06MWIBOR 1 CCPVANILLA / DIR (000000000) | 0.37 | 0.0365 | 0.0365 | ||||||

| Benin Government International Bond / DBT (XS2976334222) | 0.37 | 0.0365 | 0.0365 | ||||||

| GHGGOG069964 / Ghana Government Bond | 0.36 | 44.05 | 0.0362 | 0.0092 | |||||

| Long: SMIDBUU51 IRS PLN R F 5.40500 BMIDBUU69 CCPVANILLA / Short: SMIDBUU51 IRS PLN P V 06MWIBOR BMIDBUU77 CCPVANILLA / DIR (000000000) | 0.36 | 0.0357 | 0.0357 | ||||||

| PURCHASED MYR / SOLD USD / DFE (000000000) | 0.36 | 0.0356 | 0.0356 | ||||||

| XS0493540297 / Lebanon Government International Bond | 0.35 | 297.75 | 0.0354 | 0.0258 | |||||

| Long: SMIE0UEK6 IRS INR R F 6.01200 BMIE0UEL4 CCPNDFOIS / Short: SMIE0UEK6 IRS INR P V 06MMIBOR BMIE0UEM2 CCPNDFOIS / DIR (000000000) | 0.34 | 0.0338 | 0.0338 | ||||||

| Ghana Cocoa Bond / DBT (GHGCMB071664) | 0.33 | 23.51 | 0.0331 | 0.0044 | |||||

| US917288BL51 / Uruguay Government International Bond | 0.33 | 4.44 | 0.0328 | -0.0009 | |||||

| PURCHASED THB / SOLD USD / DFE (000000000) | 0.33 | 0.0328 | 0.0328 | ||||||

| Sri Lanka Government Bonds / DBT (LKB02033F013) | 0.33 | 0.0324 | 0.0324 | ||||||

| Long: SMIE4XCP7 IRS INR R F 6.28000 BMIE4XCQ5 CCPNDFOIS / Short: SMIE4XCP7 IRS INR P V 06MMIBOR BMIE4XCR3 CCPNDFOIS / DIR (000000000) | 0.32 | 0.0317 | 0.0317 | ||||||

| GHGGOG069923 / Ghana Government Bond | 0.32 | 0.0317 | 0.0317 | ||||||

| PURCHASED MXN / SOLD USD / DFE (000000000) | 0.32 | 0.0316 | 0.0316 | ||||||

| Long: SMIC4QGF4 IRS CNY R F 2.49300 2 CCPNDF / Short: SMIC4QGF4 IRS CNY P V 00MCNRR 1 CCPNDF / DIR (000000000) | 0.31 | 0.0310 | 0.0310 | ||||||

| Ghana Cocoa Bond / DBT (GHGCMB071656) | 0.30 | 25.42 | 0.0300 | 0.0043 | |||||

| Long: SMIBR1691 IRS CZK R F 5.38570 2 CCPVANILLA / Short: SMIBR1691 IRS CZK P V 06MPRIBO 1 CCPVANILLA / DIR (000000000) | 0.30 | 0.0297 | 0.0297 | ||||||

| PURCHASED TWD / SOLD USD / DFE (000000000) | 0.29 | 0.0292 | 0.0292 | ||||||

| GHGGOG069956 / Ghana Government Bond | 0.29 | 105.67 | 0.0289 | 0.0138 | |||||

| XS0217249126 / Venezuela Government International Bond | 0.29 | -8.28 | 0.0288 | -0.0048 | |||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.29 | 0.0284 | 0.0284 | ||||||

| USP7807HAQ85 / Petroleos de Venezuela SA | 0.28 | -1.74 | 0.0282 | -0.0027 | |||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0.28 | 0.0281 | 0.0281 | ||||||

| GHGGOG070004 / Ghana Government Bond | 0.28 | 44.33 | 0.0279 | 0.0071 | |||||

| XS0944226637 / Lebanon Government International Bond | 0.28 | -50.88 | 0.0278 | -0.0330 | |||||

| PURCHASED MYR / SOLD USD / DFE (000000000) | 0.27 | 0.0268 | 0.0268 | ||||||

| PURCHASED ZAR / SOLD USD / DFE (000000000) | 0.27 | 0.0265 | 0.0265 | ||||||

| PURCHASED SGD / SOLD USD / DFE (000000000) | 0.26 | 0.0260 | 0.0260 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.26 | 0.0257 | 0.0257 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0.26 | 0.0256 | 0.0256 | ||||||

| PURCHASED MXN / SOLD USD / DFE (000000000) | 0.26 | 0.0256 | 0.0256 | ||||||

| PURCHASED INR / SOLD USD / DFE (000000000) | 0.26 | 0.0255 | 0.0255 | ||||||

| PURCHASED UZS / SOLD USD / DFE (000000000) | 0.25 | 0.0253 | 0.0253 | ||||||

| XS0859367194 / Lebanon Government International Bond | 0.25 | 620.00 | 0.0252 | 0.0213 | |||||

| BMID0PTL1 EATON VANCE / DFE (000000000) | 0.25 | 0.0248 | 0.0248 | ||||||

| Long: SMIBCBKD0 IRS CNY R F 2.40250 2 CCPNDF / Short: SMIBCBKD0 IRS CNY P V 00MCNRR 1 CCPNDF / DIR (000000000) | 0.25 | 0.0246 | 0.0246 | ||||||

| GHGGOG069949 / Ghana Government Bond | 0.24 | 98.33 | 0.0237 | 0.0108 | |||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.24 | 0.0237 | 0.0237 | ||||||

| TRT081128T15 / TURKIYE GOVERNMENT BOND 31.080000% 11/08/2028 | 0.23 | -22.37 | 0.0229 | -0.0087 | |||||

| XS0294367205 / Petroleos de Venezuela SA | 0.23 | -4.22 | 0.0227 | -0.0027 | |||||

| US917288BL51 / Uruguay Government International Bond | 0.22 | 5.69 | 0.0223 | -0.0003 | |||||

| PURCHASED UZS / SOLD USD / DFE (000000000) | 0.21 | 0.0211 | 0.0211 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | 0.21 | 0.0210 | 0.0210 | ||||||

| Long: SMIEC2MS9 IRS INR R F 6.20500 BMIEC2MT7 CCPNDFOIS / Short: SMIEC2MS9 IRS INR P V 06MMIBOR BMIEC2MU4 CCPNDFOIS / DIR (000000000) | 0.21 | 0.0207 | 0.0207 | ||||||

| XS2446175577 / Angolan Government International Bond | 0.21 | 0.0206 | 0.0206 | ||||||

| PURCHASED MXN / SOLD USD / DFE (000000000) | 0.21 | 0.0205 | 0.0205 | ||||||

| USP97475AJ95 / Venezuela Government International Bond | 0.20 | -0.98 | 0.0203 | -0.0017 | |||||

| USP7807HAP03 / Petroleos de Venezuela SA | 0.20 | 2.01 | 0.0202 | -0.0011 | |||||

| XS1052421150 / LEBANESE REP MED TERM NTS 144A 5.8% 04/14/2020 REGS | 0.20 | 126.97 | 0.0202 | 0.0106 | |||||

| PURCHASED MYR / SOLD USD / DFE (000000000) | 0.20 | 0.0202 | 0.0202 | ||||||

| USP97475AN08 / Venezuela Government International Bond | 0.20 | -3.37 | 0.0201 | -0.0023 | |||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0.20 | 0.0200 | 0.0200 | ||||||

| Long: SMIDXR3K1 IRS INR R F 5.92500 BMIDXR3L9 CCPNDFOIS / Short: SMIDXR3K1 IRS INR P V 06MMIBOR BMIDXR3M7 CCPNDFOIS / DIR (000000000) | 0.20 | 0.0199 | 0.0199 | ||||||

| XS0471464023 / Seychelles International Bond | 0.20 | 0.51 | 0.0198 | -0.0013 | |||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0.20 | 0.0196 | 0.0196 | ||||||

| Mongolia Government International Bond / DBT (US60937LAJ44) | 0.19 | 0.0192 | 0.0192 | ||||||

| Long: SMIELEXS1 IRS INR R F 5.95300 BMIELEXT9 CCPNDFOIS / Short: SMIELEXS1 IRS INR P V 06MMIBOR BMIELEXU6 CCPNDFOIS / DIR (000000000) | 0.19 | 0.0192 | 0.0192 | ||||||

| BNP / BNP Paribas SA | 0.19 | 0.0189 | 0.0189 | ||||||

| Albanian Government Bond / DBT (AL000A3L7AH2) | 0.19 | 0.0188 | 0.0188 | ||||||

| Long: SMIDBUU85 IRS PLN R F 5.53000 BMIDBUU93 CCPVANILLA / Short: SMIDBUU85 IRS PLN P V 06MWIBOR BMIDBUUA0 CCPVANILLA / DIR (000000000) | 0.19 | 0.0185 | 0.0185 | ||||||

| Long: SMICS0YP3 IRS CNY R F 2.38100 BMICS0YQ1 CCPNDF / Short: SMICS0YP3 IRS CNY P V 00MCNRR BMICS0YR9 CCPNDF / DIR (000000000) | 0.18 | 0.0184 | 0.0184 | ||||||

| Long: SMICBUL46 IRS CNY R F 2.28600 BMICBUL53 CCPNDF / Short: SMICBUL46 IRS CNY P V 00MCNRR BMICBUL61 CCPNDF / DIR (000000000) | 0.18 | 0.0181 | 0.0181 | ||||||

| Long: SMICBUL79 IRS CNY R F 2.28100 BMICBUL87 CCPNDF / Short: SMICBUL79 IRS CNY P V 00MCNRR BMICBUL95 CCPNDF / DIR (000000000) | 0.18 | 0.0180 | 0.0180 | ||||||

| Long: SMIELJX50 IRS BRL R F 14.78250 BMIELJX68 CCPNDFPREDISWAP / Short: SMIELJX50 IRS BRL P V 00MBRCDI BMIELJX76 CCPNDFPREDISWAP / DIR (000000000) | 0.18 | 0.0177 | 0.0177 | ||||||

| PURCHASED MYR / SOLD USD / DFE (000000000) | 0.18 | 0.0176 | 0.0176 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | 0.17 | 0.0172 | 0.0172 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.17 | 0.0171 | 0.0171 | ||||||

| Long: SMIEK6SS5 IRS INR R F 6.01100 BMIEK6ST3 CCPNDFOIS / Short: SMIEK6SS5 IRS INR P V 06MMIBOR BMIEK6SU0 CCPNDFOIS / DIR (000000000) | 0.17 | 0.0170 | 0.0170 | ||||||

| Long: BMIELLPL9 IRS MYR R F 3.49000 BMIELLPM7 NDF / Short: BMIELLPL9 IRS MYR P V 03MKLIBO BMIELLPN5 NDF / DIR (000000000) | 0.17 | 0.0169 | 0.0169 | ||||||

| USP17625AE71 / Venezuela Government International Bond | 0.17 | -6.70 | 0.0167 | -0.0026 | |||||

| PURCHASED THB / SOLD USD / DFE (000000000) | 0.17 | 0.0166 | 0.0166 | ||||||

| Long: BMICUXGX1 IRS CNY R F 2.35000 BMICUXGY9 NDF / Short: BMICUXGX1 IRS CNY P V 00MCNRR BMICUXGZ6 NDF / DIR (000000000) | 0.17 | 0.0166 | 0.0166 | ||||||

| Long: BMIELUKR1 IRS MYR R F 3.48000 BMIELUKS9 NDF / Short: BMIELUKR1 IRS MYR P V 03MKLIBO BMIELUKT7 NDF / DIR (000000000) | 0.17 | 0.0165 | 0.0165 | ||||||

| GHGGOG070020 / Ghana Government Bond | 0.17 | 0.0164 | 0.0164 | ||||||

| Long: SMIEJXL22 IRS MXN R F 8.41950 BMIEJXL30 CCPOIS / Short: SMIEJXL22 IRS MXN P V 01MTIEF BMIEJXL48 CCPOIS / DIR (000000000) | 0.16 | 0.0160 | 0.0160 | ||||||

| Long: SMID0M5R1 IRS CNY R F 2.21400 BMID0M5S9 CCPNDF / Short: SMID0M5R1 IRS CNY P V 00MCNRR BMID0M5T7 CCPNDF / DIR (000000000) | 0.16 | 0.0158 | 0.0158 | ||||||

| GHGGOG069931 / Ghana Government Bond | 0.16 | 0.0158 | 0.0158 | ||||||

| TRT130733T17 / Turkey Government Bond | 0.16 | -65.26 | 0.0155 | -0.0325 | |||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.15 | 0.0154 | 0.0154 | ||||||

| PURCHASED MYR / SOLD USD / DFE (000000000) | 0.15 | 0.0153 | 0.0153 | ||||||

| Long: SMIDJYLY2 IRS PLN R F 5.02000 BMIDJYLZ9 CCPVANILLA / Short: SMIDJYLY2 IRS PLN P V 06MWIBOR BMIDJYM05 CCPVANILLA / DIR (000000000) | 0.15 | 0.0152 | 0.0152 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.15 | 0.0151 | 0.0151 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.15 | 0.0151 | 0.0151 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.15 | 0.0149 | 0.0149 | ||||||

| USP17625AA59 / Venezuela Government International Bond | 0.15 | -10.84 | 0.0148 | -0.0030 | |||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0.15 | 0.0147 | 0.0147 | ||||||

| Long: SMIDJZLA1 IRS CNY R F 2.03050 BMIDJZLB9 CCPNDF / Short: SMIDJZLA1 IRS CNY P V 00MCNRR BMIDJZLC7 CCPNDF / DIR (000000000) | 0.15 | 0.0147 | 0.0147 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0.15 | 0.0145 | 0.0145 | ||||||

| US486661AF87 / Kazakhstan Government International Bond | 0.14 | -10.06 | 0.0143 | -0.0027 | |||||

| PURCHASED SGD / SOLD USD / DFE (000000000) | 0.14 | 0.0142 | 0.0142 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0.14 | 0.0142 | 0.0142 | ||||||

| PURCHASED INR / SOLD USD / DFE (000000000) | 0.14 | 0.0142 | 0.0142 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.14 | 0.0137 | 0.0137 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0.14 | 0.0135 | 0.0135 | ||||||

| BMID0VS88 EATON VANCE / DFE (000000000) | 0.13 | 0.0133 | 0.0133 | ||||||

| Long: SMIEF2555 IRS THB R F 1.97000 BMIEF2563 CCPNDFOIS / Short: SMIEF2555 IRS THB P V 12MTHOR BMIEF2571 CCPNDFOIS / DIR (000000000) | 0.13 | 0.0132 | 0.0132 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0.13 | 0.0132 | 0.0132 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.13 | 0.0132 | 0.0132 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.13 | 0.0131 | 0.0131 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.13 | 0.0131 | 0.0131 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.13 | 0.0130 | 0.0130 | ||||||

| PURCHASED THB / SOLD USD / DFE (000000000) | 0.13 | 0.0130 | 0.0130 | ||||||

| PURCHASED UZS / SOLD USD / DFE (000000000) | 0.13 | 0.0130 | 0.0130 | ||||||

| BMID18J62 EATON VANCE / DFE (000000000) | 0.13 | 0.0129 | 0.0129 | ||||||

| Long: SMIEFTDG3 IRS INR R F 6.07300 BMIEFTDH1 CCPNDFOIS / Short: SMIEFTDG3 IRS INR P V 06MMIBOR BMIEFTDJ7 CCPNDFOIS / DIR (000000000) | 0.13 | 0.0128 | 0.0128 | ||||||

| PURCHASED KES / SOLD USD / DFE (000000000) | 0.12 | 0.0123 | 0.0123 | ||||||

| PDVSA / Petroleos de Venezuela SA | 0.12 | 0.00 | 0.0120 | -0.0009 | |||||

| Long: SMIDZPE62 IRS INR R F 5.94100 BMIDZPE70 CCPNDFOIS / Short: SMIDZPE62 IRS INR P V 06MMIBOR BMIDZPE88 CCPNDFOIS / DIR (000000000) | 0.12 | 0.0119 | 0.0119 | ||||||

| Long: SMIED9US4 IRS KRW R F 2.72500 BMIED9UT2 CCPNDF / Short: SMIED9US4 IRS KRW P V 03MKSDA BMIED9UU9 CCPNDF / DIR (000000000) | 0.12 | 0.0116 | 0.0116 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | 0.12 | 0.0115 | 0.0115 | ||||||

| USP17625AD98 / Venezuela Government International Bond | 0.11 | -8.94 | 0.0112 | -0.0020 | |||||

| PURCHASED KES / SOLD USD / DFE (000000000) | 0.11 | 0.0110 | 0.0110 | ||||||

| PURCHASED USD / SOLD ZAR / DFE (000000000) | 0.11 | 0.0109 | 0.0109 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.11 | 0.0108 | 0.0108 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0.11 | 0.0105 | 0.0105 | ||||||

| Long: SMIBVC3L8 IRS CZK R F 4.61170 2 CCPVANILLA / Short: SMIBVC3L8 IRS CZK P V 06MPRIBO 1 CCPVANILLA / DIR (000000000) | 0.10 | 0.0101 | 0.0101 | ||||||

| XS2366832496 / Benin Government International Bond | 0.10 | 0.0100 | 0.0100 | ||||||

| US486661AF87 / Kazakhstan Government International Bond | 0.10 | -10.19 | 0.0097 | -0.0019 | |||||

| GHGGOG069998 / Ghana Government Bond | 0.10 | 159.46 | 0.0096 | 0.0056 | |||||

| Long: SMIEQG2A4 IRS INR R F 5.80900 BMIEQG2B2 CCPNDFOIS / Short: SMIEQG2A4 IRS INR P V 06MMIBOR BMIEQG2C0 CCPNDFOIS / DIR (000000000) | 0.10 | 0.0096 | 0.0096 | ||||||

| XS0793155911 / Lebanon Government International Bond | 0.10 | 6.74 | 0.0096 | -0.0000 | |||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.09 | 0.0093 | 0.0093 | ||||||

| PURCHASED USD / SOLD ZAR / DFE (000000000) | 0.09 | 0.0092 | 0.0092 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | 0.09 | 0.0091 | 0.0091 | ||||||

| XS1586230309 / Lebanon Government International Bond | 0.09 | 7.23 | 0.0089 | 0.0000 | |||||

| PURCHASED TRY / SOLD USD / DFE (000000000) | 0.09 | 0.0089 | 0.0089 | ||||||

| Long: SMIEQTG37 IRS KRW R F 2.50700 BMIEQTG45 CCPNDF / Short: SMIEQTG37 IRS KRW P V 03MKSDA BMIEQTG52 CCPNDF / DIR (000000000) | 0.09 | 0.0087 | 0.0087 | ||||||

| Long: SMIE8NTP7 IRS INR R F 6.00450 BMIE8NTQ5 CCPNDFOIS / Short: SMIE8NTP7 IRS INR P V 06MMIBOR BMIE8NTR3 CCPNDFOIS / DIR (000000000) | 0.09 | 0.0087 | 0.0087 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | 0.09 | 0.0086 | 0.0086 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0.09 | 0.0085 | 0.0085 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.08 | 0.0084 | 0.0084 | ||||||

| PURCHASED ZAR / SOLD USD / DFE (000000000) | 0.08 | 0.0084 | 0.0084 | ||||||

| Long: SMIED1QZ0 IRS KRW R F 2.60000 BMIED1R06 CCPNDF / Short: SMIED1QZ0 IRS KRW P V 03MKSDA BMIED1R14 CCPNDF / DIR (000000000) | 0.08 | 0.0083 | 0.0083 | ||||||

| VEZM / REPUBLIC OF VENEZUELA SR UNSECURED REGS 12/20 6 | 0.08 | -8.89 | 0.0083 | -0.0014 | |||||

| PURCHASED ZAR / SOLD USD / DFE (000000000) | 0.08 | 0.0082 | 0.0082 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.08 | 0.0082 | 0.0082 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0.08 | 0.0082 | 0.0082 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0.08 | 0.0080 | 0.0080 | ||||||

| PURCHASED MXN / SOLD USD / DFE (000000000) | 0.08 | 0.0080 | 0.0080 | ||||||

| USP17625AC16 / Venezuela Government International Bond | 0.08 | -10.11 | 0.0080 | -0.0015 | |||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.08 | 0.0079 | 0.0079 | ||||||

| DGZ / DB Gold Short ETN | 0.08 | 0.0079 | 0.0079 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.08 | 0.0079 | 0.0079 | ||||||

| Long: SMIELU2C4 IRS CNY R F 1.65950 BMIELU2D2 CCPNDF / Short: SMIELU2C4 IRS CNY P V 00MCNRR BMIELU2E0 CCPNDF / DIR (000000000) | 0.08 | 0.0078 | 0.0078 | ||||||

| PURCHASED TWD / SOLD USD / DFE (000000000) | 0.08 | 0.0076 | 0.0076 | ||||||

| Long: SMIE9EMZ1 IRS INR R F 5.93300 BMIE9EN07 CCPNDFOIS / Short: SMIE9EMZ1 IRS INR P V 06MMIBOR BMIE9EN15 CCPNDFOIS / DIR (000000000) | 0.08 | 0.0076 | 0.0076 | ||||||

| PURCHASED USD / SOLD CNH / DFE (000000000) | 0.08 | 0.0076 | 0.0076 | ||||||

| PURCHASED INR / SOLD USD / DFE (000000000) | 0.08 | 0.0075 | 0.0075 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.07 | 0.0075 | 0.0075 | ||||||

| US922646BL74 / Venezuela Government International Bond | 0.07 | 10.45 | 0.0074 | 0.0001 | |||||

| BMIEE3AP4 EATON VANCE / DFE (000000000) | 0.07 | 0.0072 | 0.0072 | ||||||

| BMIEG7UC0 EATON VANCE / DFE (000000000) | 0.07 | 0.0071 | 0.0071 | ||||||

| PURCHASED CNH / SOLD USD / DFE (000000000) | 0.07 | 0.0070 | 0.0070 | ||||||

| DGZ / DB Gold Short ETN | 0.07 | 0.0070 | 0.0070 | ||||||

| PURCHASED IDR / SOLD USD / DFE (000000000) | 0.07 | 0.0069 | 0.0069 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0.07 | 0.0069 | 0.0069 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0.07 | 0.0069 | 0.0069 | ||||||

| PURCHASED UZS / SOLD USD / DFE (000000000) | 0.07 | 0.0069 | 0.0069 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0.07 | 0.0068 | 0.0068 | ||||||

| Long: SMIELEU21 IRS CNY R F 1.57850 BMIELEU39 CCPNDF / Short: SMIELEU21 IRS CNY P V 00MCNRR BMIELEU47 CCPNDF / DIR (000000000) | 0.07 | 0.0067 | 0.0067 | ||||||

| DGZ / DB Gold Short ETN | 0.07 | 0.0067 | 0.0067 | ||||||

| GHGGOG070012 / Ghana Government Bond | 0.07 | 0.0066 | 0.0066 | ||||||

| Long: SMICA0VL4 IRS CZK R F 4.15000 BMICA0VM2 CCPVANILLA / Short: SMICA0VL4 IRS CZK P V 06MPRIBO BMICA0VN0 CCPVANILLA / DIR (000000000) | 0.07 | 0.0066 | 0.0066 | ||||||

| PURCHASED RUB / SOLD USD / DFE (000000000) | 0.06 | 0.0065 | 0.0065 | ||||||

| PURCHASED USD / SOLD IDR / DFE (000000000) | 0.06 | 0.0063 | 0.0063 | ||||||

| Long: BMIEPP868 IRS MYR R F 3.46000 BMIEPP876 NDF / Short: BMIEPP868 IRS MYR P V 03MKLIBO BMIEPP884 NDF / DIR (000000000) | 0.06 | 0.0063 | 0.0063 | ||||||

| Long: SMIEF2621 IRS THB R F 1.96500 BMIEF2639 CCPNDFOIS / Short: SMIEF2621 IRS THB P V 12MTHOR BMIEF2647 CCPNDFOIS / DIR (000000000) | 0.06 | 0.0062 | 0.0062 | ||||||

| Long: BMIE0KG26 IRS MYR R F 3.45800 BMIE0KG34 NDF / Short: BMIE0KG26 IRS MYR P V 03MKLIBO BMIE0KG42 NDF / DIR (000000000) | 0.06 | 0.0060 | 0.0060 | ||||||

| PURCHASED RUB / SOLD USD / DFE (000000000) | 0.06 | 0.0059 | 0.0059 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0.06 | 0.0059 | 0.0059 | ||||||

| PURCHASED RUB / SOLD USD / DFE (000000000) | 0.06 | 0.0059 | 0.0059 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.06 | 0.0058 | 0.0058 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.06 | 0.0057 | 0.0057 | ||||||

| XS0114831273 / Banque Centrale de Tunisie | 0.06 | 9.62 | 0.0057 | 0.0001 | |||||

| Long: SMIDDGGW7 IRS BRL R F 13.20219 BMIDDGGX5 CCPNDFPREDISWAP / Short: SMIDDGGW7 IRS BRL P V 00MBRCDI BMIDDGGY3 CCPNDFPREDISWAP / DIR (000000000) | 0.06 | 0.0057 | 0.0057 | ||||||

| BNP / BNP Paribas SA | 0.06 | 0.0057 | 0.0057 | ||||||

| PURCHASED THB / SOLD USD / DFE (000000000) | 0.06 | 0.0057 | 0.0057 | ||||||

| Long: SMIEDFPS6 IRS KRW R F 2.71750 BMIEDFPT4 CCPNDF / Short: SMIEDFPS6 IRS KRW P V 03MKSDA BMIEDFPU1 CCPNDF / DIR (000000000) | 0.06 | 0.0057 | 0.0057 | ||||||

| PURCHASED IDR / SOLD USD / DFE (000000000) | 0.05 | 0.0053 | 0.0053 | ||||||

| PURCHASED IDR / SOLD USD / DFE (000000000) | 0.05 | 0.0052 | 0.0052 | ||||||

| Long: SMIDZPBT5 IRS INR R F 5.94300 BMIDZPBU2 CCPNDFOIS / Short: SMIDZPBT5 IRS INR P V 06MMIBOR BMIDZPBV0 CCPNDFOIS / DIR (000000000) | 0.05 | 0.0052 | 0.0052 | ||||||

| Long: SMIC3AVT3 IRS THB R F 1.69000 2 CCPNDFOIS / Short: SMIC3AVT3 IRS THB P V 00MTHOR 1 CCPNDFOIS / DIR (000000000) | 0.05 | 0.0052 | 0.0052 | ||||||

| US486661AF87 / Kazakhstan Government International Bond | 0.05 | -5.56 | 0.0052 | -0.0007 | |||||

| PURCHASED USD / SOLD ZAR / DFE (000000000) | 0.05 | 0.0051 | 0.0051 | ||||||

| Long: BMIE3L4T5 IRS MYR R F 3.58200 BMIE3L4U2 NDF / Short: BMIE3L4T5 IRS MYR P V 03MKLIBO BMIE3L4V0 NDF / DIR (000000000) | 0.05 | 0.0051 | 0.0051 | ||||||

| PURCHASED IDR / SOLD USD / DFE (000000000) | 0.05 | 0.0050 | 0.0050 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.05 | 0.0050 | 0.0050 | ||||||

| PURCHASED RUB / SOLD USD / DFE (000000000) | 0.05 | 0.0050 | 0.0050 | ||||||

| PURCHASED USD / SOLD TRY / DFE (000000000) | 0.05 | 0.0049 | 0.0049 | ||||||

| XS1419879504 / Lebanon Government International Bond | 0.05 | 0.0049 | 0.0049 | ||||||

| PURCHASED USD / SOLD CNH / DFE (000000000) | 0.05 | 0.0048 | 0.0048 | ||||||

| PURCHASED ZAR / SOLD USD / DFE (000000000) | 0.05 | 0.0048 | 0.0048 | ||||||

| Long: SMIEF2704 IRS THB R F 1.95800 BMIEF2712 CCPNDFOIS / Short: SMIEF2704 IRS THB P V 12MTHOR BMIEF2720 CCPNDFOIS / DIR (000000000) | 0.05 | 0.0048 | 0.0048 | ||||||

| Long: SMICJT358 IRS THB R F 2.95300 BMICJT366 CCPNDFOIS / Short: SMICJT358 IRS THB P V 12MTHOR BMICJT374 CCPNDFOIS / DIR (000000000) | 0.05 | 0.0048 | 0.0048 | ||||||

| PURCHASED ZAR / SOLD USD / DFE (000000000) | 0.05 | 0.0047 | 0.0047 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.05 | 0.0047 | 0.0047 | ||||||

| Long: SMIERHEA8 IRS ZAR R F 7.70890 BMIERHEB6 CCPVANILLA / Short: SMIERHEA8 IRS ZAR P V 03MJIBAR BMIERHEC4 CCPVANILLA / DIR (000000000) | 0.05 | 0.0047 | 0.0047 | ||||||

| Long: SMIEC05F0 IRS CZK R F 3.63550 BMIEC05G8 CCPVANILLA / Short: SMIEC05F0 IRS CZK P V 06MPRIBO BMIEC05H6 CCPVANILLA / DIR (000000000) | 0.05 | 0.0046 | 0.0046 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.05 | 0.0046 | 0.0046 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0.05 | 0.0046 | 0.0046 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0.05 | 0.0046 | 0.0046 | ||||||

| PURCHASED MXN / SOLD USD / DFE (000000000) | 0.05 | 0.0046 | 0.0046 | ||||||

| PURCHASED USD / SOLD CNH / DFE (000000000) | 0.05 | 0.0046 | 0.0046 | ||||||

| PURCHASED MXN / SOLD USD / DFE (000000000) | 0.05 | 0.0045 | 0.0045 | ||||||

| EURO-BUXL 30Y BND JUN25 / DIR (000000000) | 0.05 | 0.0045 | 0.0045 | ||||||

| PURCHASED TRY / SOLD USD / DFE (000000000) | 0.04 | 0.0045 | 0.0045 | ||||||

| Long: SMIEALPT4 IRS INR R F 6.06900 BMIEALPU1 CCPNDFOIS / Short: SMIEALPT4 IRS INR P V 06MMIBOR BMIEALPV9 CCPNDFOIS / DIR (000000000) | 0.04 | 0.0044 | 0.0044 | ||||||

| Long: SMIEALP64 IRS INR R F 6.07500 BMIEALP72 CCPNDFOIS / Short: SMIEALP64 IRS INR P V 06MMIBOR BMIEALP80 CCPNDFOIS / DIR (000000000) | 0.04 | 0.0044 | 0.0044 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.04 | 0.0043 | 0.0043 | ||||||

| Long: SMIE1T6S0 IRS CZK R F 3.55950 BMIE1T6T8 CCPVANILLA / Short: SMIE1T6S0 IRS CZK P V 06MPRIBO BMIE1T6U5 CCPVANILLA / DIR (000000000) | 0.04 | 0.0043 | 0.0043 | ||||||

| Long: SMIED9SS7 IRS KRW R F 2.71000 BMIED9ST5 CCPNDF / Short: SMIED9SS7 IRS KRW P V 03MKSDA BMIED9SU2 CCPNDF / DIR (000000000) | 0.04 | 0.0042 | 0.0042 | ||||||

| BMIEEULU1 EATON VANCE / DFE (000000000) | 0.04 | 0.0042 | 0.0042 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | 0.04 | 0.0042 | 0.0042 | ||||||

| Long: SMIET4UW9 IRS HUF R F 6.15000 BMIET4UX7 CCPVANILLA / Short: SMIET4UW9 IRS HUF P V 06MBUBOR BMIET4UY5 CCPVANILLA / DIR (000000000) | 0.04 | 0.0042 | 0.0042 | ||||||

| BNP / BNP Paribas SA | 0.04 | 0.0041 | 0.0041 | ||||||

| BA100RSRSOH5 / Republic of Srpska Treasury Bond | 0.04 | 10.81 | 0.0041 | 0.0001 | |||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0.04 | 0.0041 | 0.0041 | ||||||

| PURCHASED SGD / SOLD USD / DFE (000000000) | 0.04 | 0.0041 | 0.0041 | ||||||

| PURCHASED ZAR / SOLD USD / DFE (000000000) | 0.04 | 0.0040 | 0.0040 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0.04 | 0.0040 | 0.0040 | ||||||

| Long: SMIEEULF4 IRS KRW R F 2.60000 BMIEEULG2 CCPNDF / Short: SMIEEULF4 IRS KRW P V 03MKSDA BMIEEULH0 CCPNDF / DIR (000000000) | 0.04 | 0.0040 | 0.0040 | ||||||

| XS1313647841 / Lebanon Government International Bond | 0.04 | 0.0040 | 0.0040 | ||||||

| XS1720803326 / Lebanon Government International Bond | 0.04 | 0.0039 | 0.0039 | ||||||

| PURCHASED UZS / SOLD USD / DFE (000000000) | 0.04 | 0.0038 | 0.0038 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.04 | 0.0038 | 0.0038 | ||||||

| DGZ / DB Gold Short ETN | 0.04 | 0.0038 | 0.0038 | ||||||

| PURCHASED TRY / SOLD USD / DFE (000000000) | 0.04 | 0.0037 | 0.0037 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0.04 | 0.0037 | 0.0037 | ||||||

| PURCHASED UZS / SOLD USD / DFE (000000000) | 0.04 | 0.0036 | 0.0036 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.04 | 0.0036 | 0.0036 | ||||||

| Long: BMIEQHJ06 IRS MYR R F 3.44500 BMIEQHJ14 NDF / Short: BMIEQHJ06 IRS MYR P V 03MKLIBO BMIEQHJ22 NDF / DIR (000000000) | 0.04 | 0.0036 | 0.0036 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0.04 | 0.0036 | 0.0036 | ||||||

| Long: SMIEALNY5 IRS INR R F 6.08400 BMIEALNZ2 CCPNDFOIS / Short: SMIEALNY5 IRS INR P V 06MMIBOR BMIEALP07 CCPNDFOIS / DIR (000000000) | 0.04 | 0.0035 | 0.0035 | ||||||

| BNP / BNP Paribas SA | 0.04 | 0.0035 | 0.0035 | ||||||

| Long: SMIED1UF9 IRS KRW R F 2.61000 BMIED1UG7 CCPNDF / Short: SMIED1UF9 IRS KRW P V 03MKSDA BMIED1UH5 CCPNDF / DIR (000000000) | 0.03 | 0.0034 | 0.0034 | ||||||

| PURCHASED IDR / SOLD USD / DFE (000000000) | 0.03 | 0.0034 | 0.0034 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0.03 | 0.0034 | 0.0034 | ||||||

| XS1196417569 / Lebanon Government International Bond | 0.03 | 50.00 | 0.0033 | 0.0010 | |||||

| BA100RSRSOG7 / Republic of Srpska Treasury Bond | 0.03 | 10.00 | 0.0033 | 0.0001 | |||||

| PURCHASED USD / SOLD ZAR / DFE (000000000) | 0.03 | 0.0032 | 0.0032 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.03 | 0.0032 | 0.0032 | ||||||

| PURCHASED KES / SOLD USD / DFE (000000000) | 0.03 | 0.0032 | 0.0032 | ||||||

| PURCHASED UZS / SOLD USD / DFE (000000000) | 0.03 | 0.0032 | 0.0032 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.03 | 0.0032 | 0.0032 | ||||||

| Long: SMIEQTG60 IRS KRW R F 2.51300 BMIEQTG78 CCPNDF / Short: SMIEQTG60 IRS KRW P V 03MKSDA BMIEQTG86 CCPNDF / DIR (000000000) | 0.03 | 0.0032 | 0.0032 | ||||||

| PURCHASED MYR / SOLD USD / DFE (000000000) | 0.03 | 0.0032 | 0.0032 | ||||||

| BA100RSRSOE2 / Republic of Srpska Treasury Bond | 0.03 | 7.14 | 0.0031 | 0.0001 | |||||

| PURCHASED USD / SOLD CNH / DFE (000000000) | 0.03 | 0.0031 | 0.0031 | ||||||

| PURCHASED INR / SOLD USD / DFE (000000000) | 0.03 | 0.0030 | 0.0030 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.03 | 0.0030 | 0.0030 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.03 | 0.0030 | 0.0030 | ||||||

| PURCHASED USD / SOLD CNH / DFE (000000000) | 0.03 | 0.0030 | 0.0030 | ||||||

| DGZ / DB Gold Short ETN | 0.03 | 0.0029 | 0.0029 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.03 | 0.0029 | 0.0029 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.03 | 0.0028 | 0.0028 | ||||||

| Long: SMIEQSGQ8 IRS INR R F 5.78120 BMIEQSGR6 CCPNDFOIS / Short: SMIEQSGQ8 IRS INR P V 06MMIBOR BMIEQSGS4 CCPNDFOIS / DIR (000000000) | 0.03 | 0.0028 | 0.0028 | ||||||

| PURCHASED MXN / SOLD USD / DFE (000000000) | 0.03 | 0.0028 | 0.0028 | ||||||

| PURCHASED USD / SOLD IDR / DFE (000000000) | 0.03 | 0.0027 | 0.0027 | ||||||

| XS0859366899 / Lebanon Government International Bond | 0.03 | 8.00 | 0.0027 | -0.0000 | |||||

| PURCHASED IDR / SOLD USD / DFE (000000000) | 0.03 | 0.0027 | 0.0027 | ||||||

| XS1586230051 / Lebanon Government International Bond | 0.03 | 8.33 | 0.0027 | -0.0000 | |||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.03 | 0.0026 | 0.0026 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.03 | 0.0026 | 0.0026 | ||||||

| PURCHASED USD / SOLD CNH / DFE (000000000) | 0.03 | 0.0026 | 0.0026 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.03 | 0.0026 | 0.0026 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.03 | 0.0026 | 0.0026 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.03 | 0.0025 | 0.0025 | ||||||

| PURCHASED UZS / SOLD USD / DFE (000000000) | 0.03 | 0.0025 | 0.0025 | ||||||

| XS1419879769 / Lebanon Government International Bond | 0.02 | 0.0025 | 0.0025 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.02 | 0.0025 | 0.0025 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.02 | 0.0024 | 0.0024 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.02 | 0.0023 | 0.0023 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | 0.02 | 0.0023 | 0.0023 | ||||||

| PURCHASED MYR / SOLD USD / DFE (000000000) | 0.02 | 0.0023 | 0.0023 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.02 | 0.0022 | 0.0022 | ||||||

| XS1586230481 / Lebanon Government International Bond | 0.02 | -67.19 | 0.0021 | -0.0048 | |||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.02 | 0.0021 | 0.0021 | ||||||

| PURCHASED INR / SOLD USD / DFE (000000000) | 0.02 | 0.0020 | 0.0020 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.02 | 0.0019 | 0.0019 | ||||||

| BA100RSRSOI3 / Republic of Srpska Treasury Bond | 0.02 | 12.50 | 0.0018 | 0.0000 | |||||

| PURCHASED USD / SOLD CNH / DFE (000000000) | 0.02 | 0.0018 | 0.0018 | ||||||

| Long: SMIESUPQ1 IRS SGD R F 1.95700 BMIESUPR9 CCPOIS / Short: SMIESUPQ1 IRS SGD P V 06MSORA BMIESUPS7 CCPOIS / DIR (000000000) | 0.02 | 0.0018 | 0.0018 | ||||||

| Long: SMIEQFZN2 IRS CNY R F 1.58100 BMIEQFZP7 CCPNDF / Short: SMIEQFZN2 IRS CNY P V 00MCNRR BMIEQFZQ5 CCPNDF / DIR (000000000) | 0.02 | 0.0018 | 0.0018 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.02 | 0.0018 | 0.0018 | ||||||

| DGZ / DB Gold Short ETN | 0.02 | 0.0017 | 0.0017 | ||||||

| Long: SMIEALQL0 IRS INR R F 6.06200 BMIEALQM8 CCPNDFOIS / Short: SMIEALQL0 IRS INR P V 06MMIBOR BMIEALQN6 CCPNDFOIS / DIR (000000000) | 0.02 | 0.0017 | 0.0017 | ||||||

| PURCHASED USD / SOLD IDR / DFE (000000000) | 0.02 | 0.0017 | 0.0017 | ||||||

| Long: SMIEQSGZ8 IRS INR R F 5.78100 BMIEQSH04 CCPNDFOIS / Short: SMIEQSGZ8 IRS INR P V 06MMIBOR BMIEQSH12 CCPNDFOIS / DIR (000000000) | 0.02 | 0.0017 | 0.0017 | ||||||

| Long: SMIEGHUB0 IRS KRW R F 2.56500 BMIEGHUC8 CCPNDF / Short: SMIEGHUB0 IRS KRW P V 03MKSDA BMIEGHUD6 CCPNDF / DIR (000000000) | 0.02 | 0.0017 | 0.0017 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.02 | 0.0017 | 0.0017 | ||||||

| PURCHASED USD / SOLD CNH / DFE (000000000) | 0.02 | 0.0017 | 0.0017 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.02 | 0.0016 | 0.0016 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.02 | 0.0016 | 0.0016 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0.02 | 0.0016 | 0.0016 | ||||||

| PURCHASED USD / SOLD CNH / DFE (000000000) | 0.02 | 0.0016 | 0.0016 | ||||||

| PURCHASED TRY / SOLD USD / DFE (000000000) | 0.02 | 0.0016 | 0.0016 | ||||||

| PURCHASED USD / SOLD CNH / DFE (000000000) | 0.02 | 0.0016 | 0.0016 | ||||||

| PURCHASED USD / SOLD TRY / DFE (000000000) | 0.02 | 0.0016 | 0.0016 | ||||||

| Long: BMIED0Q17 IRS COP R V 12MCPIBR BMIED0Q33 CCPNDFOIS / Short: BMIED0Q17 IRS COP P F 8.44500 BMIED0Q25 CCPNDFOIS / DIR (000000000) | 0.02 | 0.0015 | 0.0015 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0.01 | 0.0015 | 0.0015 | ||||||

| PURCHASED TRY / SOLD USD / DFE (000000000) | 0.01 | 0.0015 | 0.0015 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.01 | 0.0014 | 0.0014 | ||||||

| PURCHASED PLN / SOLD EUR / DFE (000000000) | 0.01 | 0.0014 | 0.0014 | ||||||

| PURCHASED USD / SOLD CNH / DFE (000000000) | 0.01 | 0.0014 | 0.0014 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.01 | 0.0014 | 0.0014 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.01 | 0.0014 | 0.0014 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.01 | 0.0013 | 0.0013 | ||||||

| XS1396347566 / Lebanon Government International Bond | 0.01 | 0.0013 | 0.0013 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0.01 | 0.0013 | 0.0013 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.01 | 0.0012 | 0.0012 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0.01 | 0.0012 | 0.0012 | ||||||

| PURCHASED UYU / SOLD USD / DFE (000000000) | 0.01 | 0.0012 | 0.0012 | ||||||

| PURCHASED USD / SOLD IDR / DFE (000000000) | 0.01 | 0.0012 | 0.0012 | ||||||

| Long: SMIEHFL98 IRS CNY R F 1.49500 BMIEHFLA5 CCPNDF / Short: SMIEHFL98 IRS CNY P V 00MCNRR BMIEHFLB3 CCPNDF / DIR (000000000) | 0.01 | 0.0012 | 0.0012 | ||||||

| PURCHASED USD / SOLD CNH / DFE (000000000) | 0.01 | 0.0012 | 0.0012 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.01 | 0.0012 | 0.0012 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.01 | 0.0011 | 0.0011 | ||||||

| Long: SMIES6CJ4 IRS INR R F 5.70020 BMIES6CK1 CCPNDFOIS / Short: SMIES6CJ4 IRS INR P V 06MMIBOR BMIES6CL9 CCPNDFOIS / DIR (000000000) | 0.01 | 0.0011 | 0.0011 | ||||||

| PURCHASED USD / SOLD CNH / DFE (000000000) | 0.01 | 0.0011 | 0.0011 | ||||||

| Long: SMIEHH964 IRS CNY R F 1.50200 BMIEHH972 CCPNDF / Short: SMIEHH964 IRS CNY P V 00MCNRR BMIEHH980 CCPNDF / DIR (000000000) | 0.01 | 0.0011 | 0.0011 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.01 | 0.0011 | 0.0011 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.01 | 0.0010 | 0.0010 | ||||||

| Long: SMIETMLA7 IRS CNY R F 1.44325 BMIETMLC3 CCPNDF / Short: SMIETMLA7 IRS CNY P V 00MCNRR BMIETMLD1 CCPNDF / DIR (000000000) | 0.01 | 0.0010 | 0.0010 | ||||||

| PURCHASED EGP / SOLD USD / DFE (000000000) | 0.01 | 0.0010 | 0.0010 | ||||||

| BMIEGDTB1 EATON VANCE / DFE (000000000) | 0.01 | 0.0009 | 0.0009 | ||||||

| PURCHASED USD / SOLD CNH / DFE (000000000) | 0.01 | 0.0009 | 0.0009 | ||||||

| PURCHASED USD / SOLD CNH / DFE (000000000) | 0.01 | 0.0009 | 0.0009 | ||||||

| PURCHASED USD / SOLD THB / DFE (000000000) | 0.01 | 0.0009 | 0.0009 | ||||||

| Long: SMIEHH9R8 IRS CNY R F 1.51470 BMIEHH9S6 CCPNDF / Short: SMIEHH9R8 IRS CNY P V 00MCNRR BMIEHH9T4 CCPNDF / DIR (000000000) | 0.01 | 0.0009 | 0.0009 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | 0.01 | 0.0009 | 0.0009 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.01 | 0.0008 | 0.0008 | ||||||

| PURCHASED USD / SOLD KZT / DFE (000000000) | 0.01 | 0.0008 | 0.0008 | ||||||

| Long: SMIEHB9R1 IRS CNY R F 1.51000 BMIEHB9S9 CCPNDF / Short: SMIEHB9R1 IRS CNY P V 00MCNRR BMIEHB9T7 CCPNDF / DIR (000000000) | 0.01 | 0.0008 | 0.0008 | ||||||

| Long: SMIERGTA4 IRS ILS R F 3.87750 BMIERGTB2 CCPVANILLA / Short: SMIERGTA4 IRS ILS P V 03MTELBO BMIERGTC0 CCPVANILLA / DIR (000000000) | 0.01 | 0.0008 | 0.0008 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.01 | 0.0008 | 0.0008 | ||||||

| PURCHASED USD / SOLD CNH / DFE (000000000) | 0.01 | 0.0008 | 0.0008 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.01 | 0.0007 | 0.0007 | ||||||

| PURCHASED INR / SOLD USD / DFE (000000000) | 0.01 | 0.0007 | 0.0007 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | 0.01 | 0.0007 | 0.0007 | ||||||

| Long: SMIES6CT2 IRS INR R F 5.70400 BMIES6CU9 CCPNDFOIS / Short: SMIES6CT2 IRS INR P V 06MMIBOR BMIES6CV7 CCPNDFOIS / DIR (000000000) | 0.01 | 0.0007 | 0.0007 | ||||||

| PURCHASED USD / SOLD IDR / DFE (000000000) | 0.01 | 0.0007 | 0.0007 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0.01 | 0.0007 | 0.0007 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.01 | 0.0007 | 0.0007 | ||||||

| Long: SMIEHFGP8 IRS CNY R F 1.49250 BMIEHFGQ6 CCPNDF / Short: SMIEHFGP8 IRS CNY P V 00MCNRR BMIEHFGR4 CCPNDF / DIR (000000000) | 0.01 | 0.0007 | 0.0007 | ||||||

| Long: SMIEU0677 IRS BRL R F 13.52000 BMIEU0685 CCPNDFPREDISWAP / Short: SMIEU0677 IRS BRL P V 00MBRCDI BMIEU0693 CCPNDFPREDISWAP / DIR (000000000) | 0.01 | 0.0007 | 0.0007 | ||||||

| Long: SMIEHAM72 IRS CNY R F 1.52000 BMIEHAM80 CCPNDF / Short: SMIEHAM72 IRS CNY P V 00MCNRR BMIEHAM98 CCPNDF / DIR (000000000) | 0.01 | 0.0007 | 0.0007 | ||||||

| Long: SMICVJHD4 IRS CZK R F 3.53620 BMICVJHE2 CCPVANILLA / Short: SMICVJHD4 IRS CZK P V 06MPRIBO BMICVJHF9 CCPVANILLA / DIR (000000000) | 0.01 | 0.0006 | 0.0006 | ||||||

| PURCHASED USD / SOLD CNH / DFE (000000000) | 0.01 | 0.0006 | 0.0006 | ||||||

| Long: SMIEHB9U4 IRS CNY R F 1.51500 BMIEHB9V2 CCPNDF / Short: SMIEHB9U4 IRS CNY P V 00MCNRR BMIEHB9W0 CCPNDF / DIR (000000000) | 0.01 | 0.0006 | 0.0006 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | 0.01 | 0.0006 | 0.0006 | ||||||

| PURCHASED USD / SOLD CNH / DFE (000000000) | 0.01 | 0.0006 | 0.0006 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.01 | 0.0006 | 0.0006 | ||||||

| Long: SMIEHBBM9 IRS CNY R F 1.50300 BMIEHBBN7 CCPNDF / Short: SMIEHBBM9 IRS CNY P V 00MCNRR BMIEHBBP2 CCPNDF / DIR (000000000) | 0.01 | 0.0006 | 0.0006 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.01 | 0.0006 | 0.0006 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0.01 | 0.0006 | 0.0006 | ||||||

| Long: SMIEGKYZ6 IRS CNY R F 1.45800 BMIEGKZ02 CCPNDF / Short: SMIEGKYZ6 IRS CNY P V 00MCNRR BMIEGKZ10 CCPNDF / DIR (000000000) | 0.01 | 0.0006 | 0.0006 | ||||||

| Long: SMIEHFJ83 IRS CNY R F 1.50000 BMIEHFJ91 CCPNDF / Short: SMIEHFJ83 IRS CNY P V 00MCNRR BMIEHFJA8 CCPNDF / DIR (000000000) | 0.01 | 0.0005 | 0.0005 | ||||||

| PURCHASED USD / SOLD IDR / DFE (000000000) | 0.01 | 0.0005 | 0.0005 | ||||||

| PURCHASED USD / SOLD CNH / DFE (000000000) | 0.01 | 0.0005 | 0.0005 | ||||||

| PURCHASED USD / SOLD CNH / DFE (000000000) | 0.01 | 0.0005 | 0.0005 | ||||||

| PURCHASED USD / SOLD TRY / DFE (000000000) | 0.01 | 0.0005 | 0.0005 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.00 | 0.0005 | 0.0005 | ||||||

| PURCHASED RON / SOLD EUR / DFE (000000000) | 0.00 | 0.0005 | 0.0005 | ||||||

| PURCHASED USD / SOLD CNH / DFE (000000000) | 0.00 | 0.0004 | 0.0004 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.00 | 0.0004 | 0.0004 | ||||||

| PURCHASED USD / SOLD CNH / DFE (000000000) | 0.00 | 0.0004 | 0.0004 | ||||||

| PURCHASED EGP / SOLD USD / DFE (000000000) | 0.00 | 0.0004 | 0.0004 | ||||||

| PURCHASED USD / SOLD IDR / DFE (000000000) | 0.00 | 0.0004 | 0.0004 | ||||||

| PURCHASED USD / SOLD CNH / DFE (000000000) | 0.00 | 0.0003 | 0.0003 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.00 | 0.0003 | 0.0003 | ||||||

| PURCHASED KZT / SOLD USD / DFE (000000000) | 0.00 | 0.0003 | 0.0003 | ||||||

| PURCHASED USD / SOLD CNH / DFE (000000000) | 0.00 | 0.0003 | 0.0003 | ||||||

| PURCHASED USD / SOLD IDR / DFE (000000000) | 0.00 | 0.0003 | 0.0003 | ||||||

| Long: SMIEQTQ44 IRS THB R F 1.41300 BMIEQTQ51 CCPNDFOIS / Short: SMIEQTQ44 IRS THB P V 12MTHOR BMIEQTQ69 CCPNDFOIS / DIR (000000000) | 0.00 | 0.0003 | 0.0003 | ||||||

| DGZ / DB Gold Short ETN | 0.00 | 0.0003 | 0.0003 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.00 | 0.0003 | 0.0003 | ||||||

| PURCHASED CZK / SOLD EUR / DFE (000000000) | 0.00 | 0.0003 | 0.0003 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.00 | 0.0002 | 0.0002 | ||||||

| Long: SMIE9ZXJ8 IRS CNY R F 1.43500 BMIE9ZXK5 CCPNDF / Short: SMIE9ZXJ8 IRS CNY P V 00MCNRR BMIE9ZXL3 CCPNDF / DIR (000000000) | 0.00 | 0.0002 | 0.0002 | ||||||

| PURCHASED USD / SOLD CNH / DFE (000000000) | 0.00 | 0.0002 | 0.0002 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.00 | 0.0002 | 0.0002 | ||||||

| PURCHASED USD / SOLD IDR / DFE (000000000) | 0.00 | 0.0002 | 0.0002 | ||||||

| PURCHASED IDR / SOLD USD / DFE (000000000) | 0.00 | 0.0001 | 0.0001 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.00 | 0.0001 | 0.0001 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.00 | 0.0001 | 0.0001 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.00 | 0.0001 | 0.0001 | ||||||

| Long: BMIEUGCQ3 IRS PLN R V 06MWIBOR BMIEUGCS9 CCPVANILLA / Short: BMIEUGCQ3 IRS PLN P F 4.26550 BMIEUGCR1 CCPVANILLA / DIR (000000000) | 0.00 | 0.0001 | 0.0001 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.00 | 0.0001 | 0.0001 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.00 | 0.0001 | 0.0001 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.00 | 0.0001 | 0.0001 | ||||||

| Long: SMIEQTGD5 IRS THB R F 1.41000 BMIEQTGE3 CCPNDFOIS / Short: SMIEQTGD5 IRS THB P V 12MTHOR BMIEQTGF0 CCPNDFOIS / DIR (000000000) | 0.00 | 0.0001 | 0.0001 | ||||||

| PURCHASED USD / SOLD IDR / DFE (000000000) | 0.00 | 0.0001 | 0.0001 | ||||||

| PURCHASED EGP / SOLD USD / DFE (000000000) | 0.00 | 0.0001 | 0.0001 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.00 | 0.0000 | 0.0000 | ||||||

| PURCHASED EGP / SOLD USD / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | ||||||

| Long: SMIEQSGH8 IRS THB R F 1.40630 BMIEQSGJ4 CCPNDFOIS / Short: SMIEQSGH8 IRS THB P V 12MTHOR BMIEQSGK1 CCPNDFOIS / DIR (000000000) | 0.00 | 0.0000 | 0.0000 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.00 | 0.0000 | 0.0000 | ||||||

| PURCHASED EGP / SOLD USD / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | ||||||

| Long: SEV4QYQB2 IRS CLP R F 4.18000 2 CCPNDFCAMARAPROMEDIO / Short: SEV4QYQB2 IRS CLP P V 06MCLICP 1 CCPNDFCAMARAPROMEDIO / DIR (000000000) | 0.00 | -0.0000 | -0.0000 | ||||||

| PURCHASED USD / SOLD SGD / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | ||||||

| Long: SMIERBZS9 IRS THB R F 1.40500 BMIERBZT7 CCPNDFOIS / Short: SMIERBZS9 IRS THB P V 12MTHOR BMIERBZU4 CCPNDFOIS / DIR (000000000) | -0.00 | -0.0000 | -0.0000 | ||||||

| Long: SMIEQX4H0 IRS THB R F 1.40350 BMIEQX4J6 CCPNDFOIS / Short: SMIEQX4H0 IRS THB P V 12MTHOR BMIEQX4K3 CCPNDFOIS / DIR (000000000) | -0.00 | -0.0000 | -0.0000 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | -0.00 | -0.0000 | -0.0000 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | -0.00 | -0.0000 | -0.0000 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | -0.00 | -0.0001 | -0.0001 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | -0.00 | -0.0001 | -0.0001 | ||||||

| PURCHASED USD / SOLD PEN / DFE (000000000) | -0.00 | -0.0001 | -0.0001 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | -0.00 | -0.0001 | -0.0001 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | -0.00 | -0.0001 | -0.0001 | ||||||

| PURCHASED TRY / SOLD USD / DFE (000000000) | -0.00 | -0.0001 | -0.0001 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | -0.00 | -0.0001 | -0.0001 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | -0.00 | -0.0001 | -0.0001 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | -0.00 | -0.0001 | -0.0001 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | -0.00 | -0.0001 | -0.0001 | ||||||

| PURCHASED USD / SOLD JPY / DFE (000000000) | -0.00 | -0.0001 | -0.0001 | ||||||

| PURCHASED CLP / SOLD USD / DFE (000000000) | -0.00 | -0.0002 | -0.0002 | ||||||

| PURCHASED USD / SOLD TRY / DFE (000000000) | -0.00 | -0.0002 | -0.0002 | ||||||

| Long: SMIEREUD1 IRS THB R F 1.39000 BMIEREUE9 CCPNDFOIS / Short: SMIEREUD1 IRS THB P V 12MTHOR BMIEREUF6 CCPNDFOIS / DIR (000000000) | -0.00 | -0.0002 | -0.0002 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | -0.00 | -0.0002 | -0.0002 | ||||||

| Long: SMIERFN61 IRS THB R F 1.36400 BMIERFN79 CCPNDFOIS / Short: SMIERFN61 IRS THB P V 12MTHOR BMIERFN87 CCPNDFOIS / DIR (000000000) | -0.00 | -0.0002 | -0.0002 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | -0.00 | -0.0002 | -0.0002 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | -0.00 | -0.0002 | -0.0002 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | -0.00 | -0.0002 | -0.0002 | ||||||

| PURCHASED COP / SOLD USD / DFE (000000000) | -0.00 | -0.0002 | -0.0002 | ||||||

| Long: BMICACCM7 IRS CLP R V 00MCLICP BMICACCP0 CCPNDFCAMARAPROMEDIO / Short: BMICACCM7 IRS CLP P F 5.23150 BMICACCN5 CCPNDFCAMARAPROMEDIO / DIR (000000000) | -0.00 | -0.0003 | -0.0003 | ||||||

| PURCHASED USD / SOLD TRY / DFE (000000000) | -0.00 | -0.0003 | -0.0003 | ||||||

| PURCHASED EUR / SOLD RON / DFE (000000000) | -0.00 | -0.0003 | -0.0003 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | -0.00 | -0.0003 | -0.0003 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | -0.00 | -0.0003 | -0.0003 | ||||||

| PURCHASED USD / SOLD TRY / DFE (000000000) | -0.00 | -0.0003 | -0.0003 | ||||||

| PURCHASED USD / SOLD TRY / DFE (000000000) | -0.00 | -0.0003 | -0.0003 | ||||||

| PURCHASED USD / SOLD EGP / DFE (000000000) | -0.00 | -0.0003 | -0.0003 | ||||||

| PURCHASED USD / SOLD PEN / DFE (000000000) | -0.00 | -0.0003 | -0.0003 | ||||||

| DGZ / DB Gold Short ETN | -0.00 | -0.0003 | -0.0003 | ||||||

| Long: SMIDWYFY4 IRS CLP R F 4.54500 BMIDWYFZ1 CCPNDFCAMARAPROMEDIO / Short: SMIDWYFY4 IRS CLP P V 00MCLICP BMIDWYG07 CCPNDFCAMARAPROMEDIO / DIR (000000000) | -0.00 | -0.0004 | -0.0004 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0.00 | -0.0004 | -0.0004 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0.00 | -0.0004 | -0.0004 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0.00 | -0.0004 | -0.0004 | ||||||

| PURCHASED USD / SOLD MXN / DFE (000000000) | -0.00 | -0.0004 | -0.0004 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0.00 | -0.0004 | -0.0004 | ||||||

| PURCHASED USD / SOLD MXN / DFE (000000000) | -0.00 | -0.0004 | -0.0004 | ||||||

| PURCHASED USD / SOLD IDR / DFE (000000000) | -0.00 | -0.0004 | -0.0004 | ||||||

| BMIEGDTC9 EATON VANCE / DFE (000000000) | -0.00 | -0.0004 | -0.0004 | ||||||

| Long: SMIEQY9V2 IRS THB R F 1.36600 BMIEQY9W0 CCPNDFOIS / Short: SMIEQY9V2 IRS THB P V 12MTHOR BMIEQY9X8 CCPNDFOIS / DIR (000000000) | -0.00 | -0.0004 | -0.0004 | ||||||

| PURCHASED USD / SOLD MXN / DFE (000000000) | -0.00 | -0.0004 | -0.0004 | ||||||

| EURO-BUND FUTURE JUN25 / DIR (000000000) | -0.00 | -0.0004 | -0.0004 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | -0.00 | -0.0005 | -0.0005 | ||||||

| PURCHASED USD / SOLD SGD / DFE (000000000) | -0.00 | -0.0005 | -0.0005 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | -0.00 | -0.0005 | -0.0005 | ||||||

| Long: SMIERF0M1 IRS THB R F 1.37500 BMIERF0N9 CCPNDFOIS / Short: SMIERF0M1 IRS THB P V 12MTHOR BMIERF0P4 CCPNDFOIS / DIR (000000000) | -0.01 | -0.0006 | -0.0006 | ||||||

| Long: BMIEMLWY2 TRS COP R F .00000 ACI05MPY0 BOND TRS / Short: BMIEMLWY2 TRS COP P V 00MDTF DTF RATE 90D NON COMPOUNDING / DIR (000000000) | -0.01 | -0.0006 | -0.0006 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | -0.01 | -0.0006 | -0.0006 | ||||||

| PURCHASED CNH / SOLD USD / DFE (000000000) | -0.01 | -0.0007 | -0.0007 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | -0.01 | -0.0007 | -0.0007 | ||||||

| PURCHASED EUR / SOLD RON / DFE (000000000) | -0.01 | -0.0008 | -0.0008 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | -0.01 | -0.0008 | -0.0008 | ||||||

| BMIEGDTF2 EATON VANCE / DFE (000000000) | -0.01 | -0.0008 | -0.0008 | ||||||

| PURCHASED CNH / SOLD USD / DFE (000000000) | -0.01 | -0.0008 | -0.0008 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | -0.01 | -0.0008 | -0.0008 | ||||||

| PURCHASED USD / SOLD EGP / DFE (000000000) | -0.01 | -0.0008 | -0.0008 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0.01 | -0.0009 | -0.0009 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | -0.01 | -0.0009 | -0.0009 | ||||||

| PURCHASED PEN / SOLD USD / DFE (000000000) | -0.01 | -0.0009 | -0.0009 | ||||||

| PURCHASED USD / SOLD SGD / DFE (000000000) | -0.01 | -0.0010 | -0.0010 | ||||||

| PURCHASED USD / SOLD TRY / DFE (000000000) | -0.01 | -0.0011 | -0.0011 | ||||||

| PURCHASED KZT / SOLD USD / DFE (000000000) | -0.01 | -0.0011 | -0.0011 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | -0.01 | -0.0012 | -0.0012 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0.01 | -0.0012 | -0.0012 | ||||||

| Long: SMIEU6526 IRS COP R F 8.24000 BMIEU6534 CCPNDFOIS / Short: SMIEU6526 IRS COP P V 03MCPIBR BMIEU6542 CCPNDFOIS / DIR (000000000) | -0.01 | -0.0012 | -0.0012 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | -0.01 | -0.0013 | -0.0013 | ||||||

| PURCHASED USD / SOLD EGP / DFE (000000000) | -0.01 | -0.0013 | -0.0013 | ||||||

| PURCHASED USD / SOLD EGP / DFE (000000000) | -0.01 | -0.0013 | -0.0013 | ||||||

| US 2YR NOTE (CBT) JUN25 / DIR (000000000) | -0.01 | -0.0013 | -0.0013 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | -0.01 | -0.0013 | -0.0013 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | -0.01 | -0.0014 | -0.0014 | ||||||

| PURCHASED USD / SOLD SGD / DFE (000000000) | -0.01 | -0.0014 | -0.0014 | ||||||

| PURCHASED USD / SOLD SGD / DFE (000000000) | -0.01 | -0.0015 | -0.0015 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | -0.01 | -0.0015 | -0.0015 | ||||||

| Long: SMIE2SK14 IRS COP R F 8.44500 BMIE2SK22 CCPNDFOIS / Short: SMIE2SK14 IRS COP P V 12MCPIBR BMIE2SK30 CCPNDFOIS / DIR (000000000) | -0.02 | -0.0015 | -0.0015 | ||||||

| Long: BMIE57HA1 IRS CLP R V 00MCLICP BMIE57HC7 CCPNDFCAMARAPROMEDIO / Short: BMIE57HA1 IRS CLP P F 5.35000 BMIE57HB9 CCPNDFCAMARAPROMEDIO / DIR (000000000) | -0.02 | -0.0016 | -0.0016 | ||||||

| PURCHASED PEN / SOLD USD / DFE (000000000) | -0.02 | -0.0016 | -0.0016 | ||||||

| Long: BMIE56YV8 IRS CLP R V 00MCLICP BMIE56YX4 CCPNDFCAMARAPROMEDIO / Short: BMIE56YV8 IRS CLP P F 5.33000 BMIE56YW6 CCPNDFCAMARAPROMEDIO / DIR (000000000) | -0.02 | -0.0016 | -0.0016 | ||||||

| BMIEEULV9 EATON VANCE / DFE (000000000) | -0.02 | -0.0016 | -0.0016 | ||||||

| PURCHASED USD / SOLD UZS / DFE (000000000) | -0.02 | -0.0017 | -0.0017 | ||||||

| PURCHASED USD / SOLD UZS / DFE (000000000) | -0.02 | -0.0017 | -0.0017 | ||||||

| Long: BMIEGHUE4 IRS KRW R V 03MKSDA BMIEGHUG9 CCPNDF / Short: BMIEGHUE4 IRS KRW P F 2.63000 BMIEGHUF1 CCPNDF / DIR (000000000) | -0.02 | -0.0017 | -0.0017 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | -0.02 | -0.0017 | -0.0017 | ||||||

| Long: SEV4NL799 IRS CLP R F 2.87000 2 CCPNDFCAMARAPROMEDIO / Short: SEV4NL799 IRS CLP P V 06MCLICP 1 CCPNDFCAMARAPROMEDIO / DIR (000000000) | -0.02 | -0.0017 | -0.0017 | ||||||

| PURCHASED IDR / SOLD USD / DFE (000000000) | -0.02 | -0.0017 | -0.0017 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | -0.02 | -0.0017 | -0.0017 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | -0.02 | -0.0018 | -0.0018 | ||||||

| PURCHASED USD / SOLD TRY / DFE (000000000) | -0.02 | -0.0018 | -0.0018 | ||||||

| Long: BMIEUBRC9 IRS PLN R V 06MWIBOR BMIEUBRE5 CCPVANILLA / Short: BMIEUBRC9 IRS PLN P F 4.30978 BMIEUBRD7 CCPVANILLA / DIR (000000000) | -0.02 | -0.0018 | -0.0018 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | -0.02 | -0.0019 | -0.0019 | ||||||

| Long: SEV54GJL8 IRS PLN R F 3.87000 2 CCPVANILLA / Short: SEV54GJL8 IRS PLN P V 06MWIBOR 1 CCPVANILLA / DIR (000000000) | -0.02 | -0.0019 | -0.0019 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | -0.02 | -0.0020 | -0.0020 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | -0.02 | -0.0021 | -0.0021 | ||||||

| PURCHASED USD / SOLD UZS / DFE (000000000) | -0.02 | -0.0021 | -0.0021 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | -0.02 | -0.0022 | -0.0022 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | -0.02 | -0.0022 | -0.0022 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | -0.02 | -0.0023 | -0.0023 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | -0.02 | -0.0024 | -0.0024 | ||||||

| BMIEEULT4 EATON VANCE / DFE (000000000) | -0.02 | -0.0024 | -0.0024 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0.02 | -0.0025 | -0.0025 | ||||||

| BNP / BNP Paribas SA | -0.03 | -0.0027 | -0.0027 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | -0.03 | -0.0027 | -0.0027 | ||||||

| EURO-SCHATZ FUT JUN25 / DIR (000000000) | -0.03 | -0.0028 | -0.0028 | ||||||

| PURCHASED USD / SOLD TRY / DFE (000000000) | -0.03 | -0.0029 | -0.0029 | ||||||

| PURCHASED USD / SOLD RUB / DFE (000000000) | -0.03 | -0.0030 | -0.0030 | ||||||

| DGZ / DB Gold Short ETN | -0.03 | -0.0030 | -0.0030 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0.03 | -0.0030 | -0.0030 | ||||||

| PURCHASED USD / SOLD RUB / DFE (000000000) | -0.03 | -0.0030 | -0.0030 | ||||||

| PURCHASED USD / SOLD TRY / DFE (000000000) | -0.03 | -0.0031 | -0.0031 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | -0.03 | -0.0031 | -0.0031 | ||||||

| Long: BMIED1UC6 IRS KRW R V 03MKSDA BMIED1UE2 CCPNDF / Short: BMIED1UC6 IRS KRW P F 2.70000 BMIED1UD4 CCPNDF / DIR (000000000) | -0.03 | -0.0032 | -0.0032 | ||||||

| BMIEE3D48 EATON VANCE / DFE (000000000) | -0.03 | -0.0032 | -0.0032 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | -0.03 | -0.0033 | -0.0033 | ||||||

| Long: SMIDDGGT4 IRS BRL R F 13.10424 BMIDDGGU1 CCPNDFPREDISWAP / Short: SMIDDGGT4 IRS BRL P V 00MBRCDI BMIDDGGV9 CCPNDFPREDISWAP / DIR (000000000) | -0.03 | -0.0033 | -0.0033 | ||||||

| BMIEG7UA4 EATON VANCE / DFE (000000000) | -0.03 | -0.0033 | -0.0033 | ||||||

| US 10YR ULTRA FUT JUN25 / DIR (000000000) | -0.03 | -0.0033 | -0.0033 | ||||||