| SPDW

/ SPDR Index Shares Funds - SPDR Portfolio Developed World ex-US ETF

|

|

|

|

0.38

|

1.07 |

15.48

|

12.40 |

6.4378 |

-2.6310 |

| IBM

/ International Business Machines Corporation

|

|

|

|

0.04

|

0.00 |

11.77

|

18.55 |

4.8926 |

-1.6421 |

| AVLV

/ American Century ETF Trust - Avantis U.S. Large Cap Value ETF

|

|

|

|

0.16

|

19.73 |

11.05

|

25.23 |

4.5938 |

-1.2142 |

| RPV

/ Invesco Exchange-Traded Fund Trust - Invesco S&P 500 Pure Value ETF

|

|

|

|

0.08

|

15.99 |

7.65

|

17.76 |

3.1815 |

-1.0961 |

| IWF

/ iShares Trust - iShares Russell 1000 Growth ETF

|

|

|

|

0.02

|

20.70 |

6.84

|

41.93 |

2.8430 |

-0.3288 |

| SPIB

/ SPDR Series Trust - SPDR Portfolio Intermediate Term Corporate Bond ETF

|

|

|

|

0.20

|

10.15 |

6.83

|

11.28 |

2.8389 |

-1.2006 |

| AVES

/ American Century ETF Trust - Avantis Emerging Markets Value ETF

|

|

|

|

0.12

|

10.94 |

6.39

|

25.98 |

2.6550 |

-0.6824 |

| JHMB

/ John Hancock Exchange-Traded Fund Trust - John Hancock Mortgage-Backed Securities ETF

|

|

|

|

0.28

|

23.09 |

6.19

|

22.95 |

3.7948 |

0.4796 |

| SPHQ

/ Invesco Exchange-Traded Fund Trust - Invesco S&P 500 Quality ETF

|

|

|

|

0.08

|

11.56 |

5.38

|

19.86 |

2.2359 |

-0.7183 |

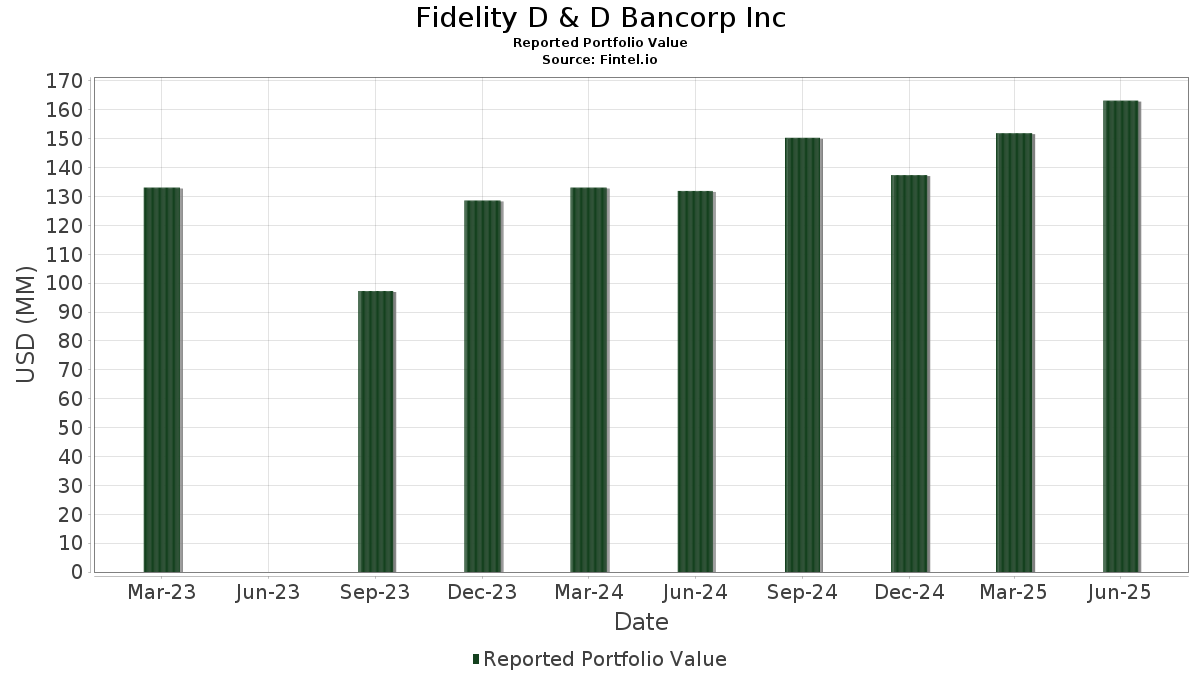

| FDBC

/ Fidelity D & D Bancorp, Inc.

|

|

|

|

0.11

|

14.41 |

5.23

|

26.47 |

2.1750 |

-0.5477 |

| VIG

/ Vanguard Specialized Funds - Vanguard Dividend Appreciation ETF

|

|

|

|

0.03

|

13.62 |

5.12

|

19.90 |

2.1295 |

-0.6832 |

| CMDT

/ PIMCO ETF Trust - PIMCO Commodity Strategy Active Exchange-Traded Fund

|

|

|

|

0.17

|

9.70 |

4.31

|

5.84 |

1.7920 |

-0.8886 |

| MSFT

/ Microsoft Corporation

|

|

|

|

0.01

|

-5.13 |

4.17

|

25.72 |

1.7338 |

-0.4499 |

| SHY

/ iShares Trust - iShares 1-3 Year Treasury Bond ETF

|

|

|

|

0.05

|

20.12 |

3.98

|

20.30 |

2.4404 |

0.2613 |

| AVUV

/ American Century ETF Trust - Avantis U.S. Small Cap Value ETF

|

|

|

|

0.04

|

29.51 |

3.40

|

35.36 |

1.4148 |

-0.2403 |

| AVDV

/ American Century ETF Trust - Avantis International Small Cap Value ETF

|

|

|

|

0.04

|

-0.81 |

3.16

|

12.76 |

1.3152 |

-0.5317 |

| TLH

/ iShares Trust - iShares 10-20 Year Treasury Bond ETF

|

|

|

|

0.03

|

30.99 |

3.11

|

28.28 |

1.2941 |

-0.3033 |

| VIOO

/ Vanguard Admiral Funds - Vanguard S&P Small-Cap 600 ETF

|

|

|

|

0.03

|

16.94 |

3.06

|

22.64 |

1.2703 |

-0.3695 |

| EMLC

/ VanEck ETF Trust - VanEck J.P. Morgan EM Local Currency Bond ETF

|

|

|

|

0.09

|

2.00 |

2.35

|

8.39 |

0.9772 |

-0.4506 |

| AVGO

/ Broadcom Inc.

|

|

|

|

0.01

|

0.00 |

2.07

|

64.68 |

1.2685 |

0.4408 |

| HONT

/ Honat Bancorp, Inc.

|

|

|

|

0.02

|

-3.08 |

1.81

|

-1.37 |

0.7511 |

-0.4546 |

| AAPL

/ Apple Inc.

|

|

|

|

0.01

|

-12.53 |

1.72

|

-19.21 |

0.7136 |

-0.6849 |

| JSML

/ Janus Detroit Street Trust - Janus Henderson Small Cap Growth Alpha ETF

|

|

|

|

0.03

|

27.18 |

1.69

|

40.95 |

0.7029 |

-0.0867 |

| XMPT

/ VanEck ETF Trust - VanEck CEF Muni Income ETF

|

|

|

|

0.08

|

-82.26 |

1.68

|

-82.79 |

0.6981 |

-5.7233 |

| JPM

/ JPMorgan Chase & Co.

|

|

|

|

0.01

|

-9.40 |

1.68

|

7.03 |

0.6967 |

-0.3336 |

| PNC

/ The PNC Financial Services Group, Inc.

|

|

|

|

0.01

|

-4.69 |

1.56

|

1.04 |

0.6485 |

-0.3673 |

| XOM

/ Exxon Mobil Corporation

|

|

|

|

0.01

|

11.25 |

1.51

|

0.87 |

0.6287 |

-0.3585 |

| SPYG

/ SPDR Series Trust - SPDR Portfolio S&P 500 Growth ETF

|

|

|

|

0.02

|

0.00 |

1.45

|

18.60 |

0.6049 |

-0.2026 |

| VEA

/ Vanguard Tax-Managed Funds - Vanguard FTSE Developed Markets ETF

|

|

|

|

0.02

|

21.55 |

1.36

|

36.38 |

0.5642 |

-0.0911 |

| ET

/ Energy Transfer LP - Limited Partnership

|

|

|

|

0.07

|

0.00 |

1.33

|

-2.50 |

0.5519 |

-0.3442 |

| SPY

/ SPDR S&P 500 ETF

|

|

|

|

0.00

|

0.00 |

1.28

|

10.46 |

0.5315 |

-0.2304 |

| AMZN

/ Amazon.com, Inc.

|

|

|

|

0.01

|

-1.65 |

1.18

|

13.40 |

0.4892 |

-0.1938 |

| VTI

/ Vanguard Index Funds - Vanguard Total Stock Market ETF

|

|

|

|

0.00

|

-0.24 |

1.02

|

10.29 |

0.4236 |

-0.1843 |

| ADP

/ Automatic Data Processing, Inc.

|

|

|

|

0.00

|

-21.36 |

0.89

|

-20.67 |

0.3720 |

-0.3700 |

| PPL

/ PPL Corporation

|

|

|

|

0.02

|

-6.30 |

0.84

|

-12.08 |

0.3512 |

-0.2811 |

| MUB

/ iShares Trust - iShares National Muni Bond ETF

|

|

|

|

0.01

|

-52.90 |

0.84

|

-53.38 |

0.3475 |

-0.8315 |

| PG

/ The Procter & Gamble Company

|

|

|

|

0.01

|

-11.26 |

0.81

|

-17.03 |

0.3365 |

-0.3058 |

| EFA

/ iShares Trust - iShares MSCI EAFE ETF

|

|

|

|

0.01

|

0.00 |

0.75

|

9.45 |

0.3131 |

-0.1402 |

| PM

/ Philip Morris International Inc.

|

|

|

|

0.00

|

-26.64 |

0.66

|

-15.84 |

0.2763 |

-0.2434 |

| PGR

/ The Progressive Corporation

|

|

|

|

0.00

|

-5.95 |

0.65

|

-11.26 |

0.2719 |

-0.2136 |

| MCD

/ McDonald's Corporation

|

|

|

|

0.00

|

-10.27 |

0.64

|

-16.05 |

0.2653 |

-0.2352 |

| DIA

/ SPDR Dow Jones Industrial Average ETF Trust

|

|

|

|

0.00

|

-5.92 |

0.63

|

-1.25 |

0.2622 |

-0.1582 |

| IWD

/ iShares Trust - iShares Russell 1000 Value ETF

|

|

|

|

0.00

|

0.00 |

0.60

|

3.25 |

0.2514 |

-0.1342 |

| CVX

/ Chevron Corporation

|

|

|

|

0.00

|

-13.40 |

0.56

|

-25.90 |

0.2309 |

-0.2623 |

| WMT

/ Walmart Inc.

|

|

|

|

0.01

|

-16.82 |

0.51

|

-7.48 |

0.2111 |

-0.1497 |

| AXP

/ American Express Company

|

|

|

|

0.00

|

0.00 |

0.50

|

18.62 |

0.3049 |

0.0286 |

| GOOG

/ Alphabet Inc.

|

|

|

|

0.00

|

-0.72 |

0.49

|

12.84 |

0.2048 |

-0.0829 |

| VUG

/ Vanguard Index Funds - Vanguard Growth ETF

|

|

|

|

0.00

|

|

0.48

|

|

0.2007 |

0.2007 |

| NEE

/ NextEra Energy, Inc.

|

|

|

|

0.01

|

3.72 |

0.44

|

1.63 |

0.1819 |

-0.1017 |

| VBR

/ Vanguard Index Funds - Vanguard Small-Cap Value ETF

|

|

|

|

0.00

|

-56.39 |

0.43

|

-54.37 |

0.1802 |

-0.4449 |

| JNJ

/ Johnson & Johnson

|

|

|

|

0.00

|

-27.22 |

0.43

|

-33.02 |

0.1791 |

-0.2440 |

| ABBV

/ AbbVie Inc.

|

|

|

|

0.00

|

-31.30 |

0.41

|

-39.14 |

0.1702 |

-0.2726 |

| HD

/ The Home Depot, Inc.

|

|

|

|

0.00

|

-1.01 |

0.40

|

-1.00 |

0.1649 |

-0.0988 |

| GS

/ The Goldman Sachs Group, Inc.

|

|

|

|

0.00

|

-8.75 |

0.39

|

18.13 |

0.1627 |

-0.0552 |

| GRMN

/ Garmin Ltd.

|

|

|

|

0.00

|

0.00 |

0.39

|

-3.97 |

0.1611 |

-0.1043 |

| LMT

/ Lockheed Martin Corporation

|

|

|

|

0.00

|

0.00 |

0.37

|

3.62 |

0.1550 |

-0.0817 |

| MA

/ Mastercard Incorporated

|

|

|

|

0.00

|

0.00 |

0.37

|

2.49 |

0.1540 |

-0.0838 |

| NVDA

/ NVIDIA Corporation

|

|

|

|

0.00

|

0.00 |

0.37

|

45.42 |

0.2242 |

0.0590 |

| MO

/ Altria Group, Inc.

|

|

|

|

0.01

|

-6.02 |

0.37

|

-8.29 |

0.1521 |

-0.1102 |

| VTV

/ Vanguard Index Funds - Vanguard Value ETF

|

|

|

|

0.00

|

3.32 |

0.36

|

5.93 |

0.1484 |

-0.0739 |

| GE

/ General Electric Company

|

|

|

|

0.00

|

-15.44 |

0.35

|

8.64 |

0.1465 |

-0.0668 |

| KO

/ The Coca-Cola Company

|

|

|

|

0.00

|

0.00 |

0.35

|

-1.14 |

0.1441 |

-0.0869 |

| MRK

/ Merck & Co., Inc.

|

|

|

|

0.00

|

-11.09 |

0.34

|

-21.71 |

0.1412 |

-0.1439 |

| VWO

/ Vanguard International Equity Index Funds - Vanguard FTSE Emerging Markets ETF

|

|

|

|

0.01

|

13.30 |

0.34

|

23.90 |

0.1401 |

-0.0391 |

| GT

/ The Goodyear Tire & Rubber Company

|

|

|

|

0.03

|

0.00 |

0.33

|

12.20 |

0.1380 |

-0.0567 |

| COST

/ Costco Wholesale Corporation

|

|

|

|

0.00

|

0.00 |

0.33

|

4.76 |

0.1375 |

-0.0705 |

| META

/ Meta Platforms, Inc.

|

|

|

|

0.00

|

0.00 |

0.33

|

28.02 |

0.1369 |

-0.0324 |

| ETN

/ Eaton Corporation plc

|

|

|

|

0.00

|

0.00 |

0.33

|

31.33 |

0.1362 |

-0.0280 |

| APD

/ Air Products and Chemicals, Inc.

|

|

|

|

0.00

|

-21.79 |

0.33

|

-25.40 |

0.1359 |

-0.1518 |

| BLK

/ BlackRock, Inc.

|

|

|

|

0.00

|

1.65 |

0.32

|

12.94 |

0.1344 |

-0.0544 |

| CL

/ Colgate-Palmolive Company

|

|

|

|

0.00

|

-5.92 |

0.32

|

-8.60 |

0.1328 |

-0.0976 |

| MDLZ

/ Mondelez International, Inc.

|

|

|

|

0.00

|

-2.08 |

0.32

|

-2.76 |

0.1321 |

-0.0828 |

| RTX

/ RTX Corporation

|

|

|

|

0.00

|

-24.43 |

0.31

|

-16.84 |

0.1295 |

-0.1167 |

| LNKB

/ LINKBANCORP, Inc.

|

|

|

|

0.04

|

0.00 |

0.29

|

8.09 |

0.1222 |

-0.0573 |

| EFV

/ iShares Trust - iShares MSCI EAFE Value ETF

|

|

|

|

0.00

|

|

0.29

|

|

0.1782 |

0.1782 |

| LOW

/ Lowe's Companies, Inc.

|

|

|

|

0.00

|

-35.19 |

0.29

|

-38.46 |

0.1201 |

-0.1883 |

| KD

/ Kyndryl Holdings, Inc.

|

|

|

|

0.01

|

0.00 |

0.28

|

33.49 |

0.1179 |

-0.0218 |

| MPC

/ Marathon Petroleum Corporation

|

|

|

|

0.00

|

10.56 |

0.28

|

26.34 |

0.1179 |

-0.0302 |

| V

/ Visa Inc.

|

|

|

|

0.00

|

-2.46 |

0.28

|

-1.06 |

0.1171 |

-0.0705 |

| SPSM

/ SPDR Series Trust - SPDR Portfolio S&P 600 Small Cap ETF

|

|

|

|

0.01

|

|

0.28

|

|

0.1701 |

0.1701 |

| T

/ AT&T Inc.

|

|

|

|

0.01

|

-13.70 |

0.27

|

-11.65 |

0.1136 |

-0.0901 |

| MCRI

/ Monarch Casino & Resort, Inc.

|

|

|

|

0.00

|

0.00 |

0.26

|

11.16 |

0.1078 |

-0.0457 |

| AGG

/ iShares Trust - iShares Core U.S. Aggregate Bond ETF

|

|

|

|

0.00

|

|

0.26

|

|

0.1581 |

0.1581 |

| HON

/ Honeywell International Inc.

|

|

|

|

0.00

|

0.00 |

0.26

|

9.83 |

0.1071 |

-0.0471 |

| VZ

/ Verizon Communications Inc.

|

|

|

|

0.01

|

-9.31 |

0.25

|

-13.70 |

0.1052 |

-0.0873 |

| LLY

/ Eli Lilly and Company

|

|

|

|

0.00

|

0.00 |

0.25

|

-5.66 |

0.1040 |

-0.0705 |

| TXN

/ Texas Instruments Incorporated

|

|

|

|

0.00

|

3.73 |

0.24

|

19.80 |

0.1007 |

-0.0323 |

| WINN

/ Harbor ETF Trust - Harbor Long-Term Growers ETF

|

|

|

|

0.01

|

-50.00 |

0.24

|

-40.50 |

0.0990 |

-0.1647 |

| IWR

/ iShares Trust - iShares Russell Mid-Cap ETF

|

|

|

|

0.00

|

-14.30 |

0.23

|

-7.35 |

0.0947 |

-0.0671 |

| COP

/ ConocoPhillips

|

|

|

|

0.00

|

2.53 |

0.22

|

-12.25 |

0.0923 |

-0.0745 |

| MKC

/ McCormick & Company, Incorporated

|

|

|

|

0.00

|

-2.94 |

0.22

|

-10.57 |

0.0917 |

-0.0707 |

| IVV

/ iShares Trust - iShares Core S&P 500 ETF

|

|

|

|

0.00

|

|

0.22

|

|

0.0914 |

0.0914 |

| BA

/ The Boeing Company

|

|

|

|

0.00

|

-13.07 |

0.22

|

2.84 |

0.0904 |

-0.0502 |

| AMGN

/ Amgen Inc.

|

|

|

|

0.00

|

-14.05 |

0.22

|

-23.13 |

0.0902 |

-0.0952 |

| WEC

/ WEC Energy Group, Inc.

|

|

|

|

0.00

|

-8.76 |

0.22

|

-12.90 |

0.0902 |

-0.0735 |

| DVY

/ iShares Trust - iShares Select Dividend ETF

|

|

|

|

0.00

|

-6.65 |

0.21

|

-7.76 |

0.0891 |

-0.0637 |

| PFIS

/ Peoples Financial Services Corp.

|

|

|

|

0.00

|

-44.75 |

0.21

|

-46.75 |

0.0887 |

-0.1777 |

| EMR

/ Emerson Electric Co.

|

|

|

|

0.00

|

|

0.21

|

|

0.1293 |

0.1293 |

| JCI

/ Johnson Controls International plc

|

|

|

|

0.00

|

|

0.21

|

|

0.1283 |

0.1283 |

| BAC

/ Bank of America Corporation

|

|

|

|

0.00

|

-12.84 |

0.21

|

-6.28 |

0.0870 |

-0.0615 |

| ADBE

/ Adobe Inc.

|

|

|

|

0.00

|

-40.22 |

0.21

|

-39.88 |

0.0856 |

-0.1391 |

| NBTB

/ NBT Bancorp Inc.

|

|

|

|

0.00

|

0.00 |

0.21

|

-2.84 |

0.0853 |

-0.0541 |

| CSCO

/ Cisco Systems, Inc.

|

|

|

|

0.00

|

-40.60 |

0.20

|

-33.00 |

0.0844 |

-0.1157 |

| VIOV

/ Vanguard Admiral Funds - Vanguard S&P Small-Cap 600 Value ETF

|

|

|

|

0.00

|

0.00 |

0.20

|

-8.64 |

0.0839 |

-0.0626 |

| NSANY

/ Nissan Motor Co., Ltd. - Depositary Receipt (Common Stock)

|

|

|

|

0.01

|

|

0.05

|

|

0.0202 |

0.0202 |

| BPPTU

/ BP Prudhoe Bay Royalty Trust

|

|

|

|

0.02

|

0.00 |

0.01

|

-9.09 |

0.0044 |

-0.0033 |

| DPLS

/ DarkPulse, Inc.

|

|

|

|

0.42

|

0.00 |

0.00

|

|

0.0001 |

-0.0001 |

| AEPT

/ American Environmental Partners, Inc.

|

|

|

|

0.04

|

-99.43 |

0.00

|

-100.00 |

0.0000 |

-0.0122 |

| ABT

/ Abbott Laboratories

|

|

|

|

0.00

|

-100.00 |

0.00

|

|

|

0.0000 |

| PEP

/ PepsiCo, Inc.

|

|

|

|

0.00

|

-100.00 |

0.00

|

|

|

0.0000 |

| ACN

/ Accenture plc

|

|

|

|

0.00

|

-100.00 |

0.00

|

-100.00 |

|

-0.1530 |

| VNQ

/ Vanguard Specialized Funds - Vanguard Real Estate ETF

|

|

|

|

0.00

|

-100.00 |

0.00

|

|

|

0.0000 |

| CAT

/ Caterpillar Inc.

|

|

|

|

0.00

|

-100.00 |

0.00

|

|

|

0.0000 |

![]() .

.