Mga Batayang Estadistika

| Nilai Portofolio | $ 1,740,974,772 |

| Posisi Saat Ini | 167 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

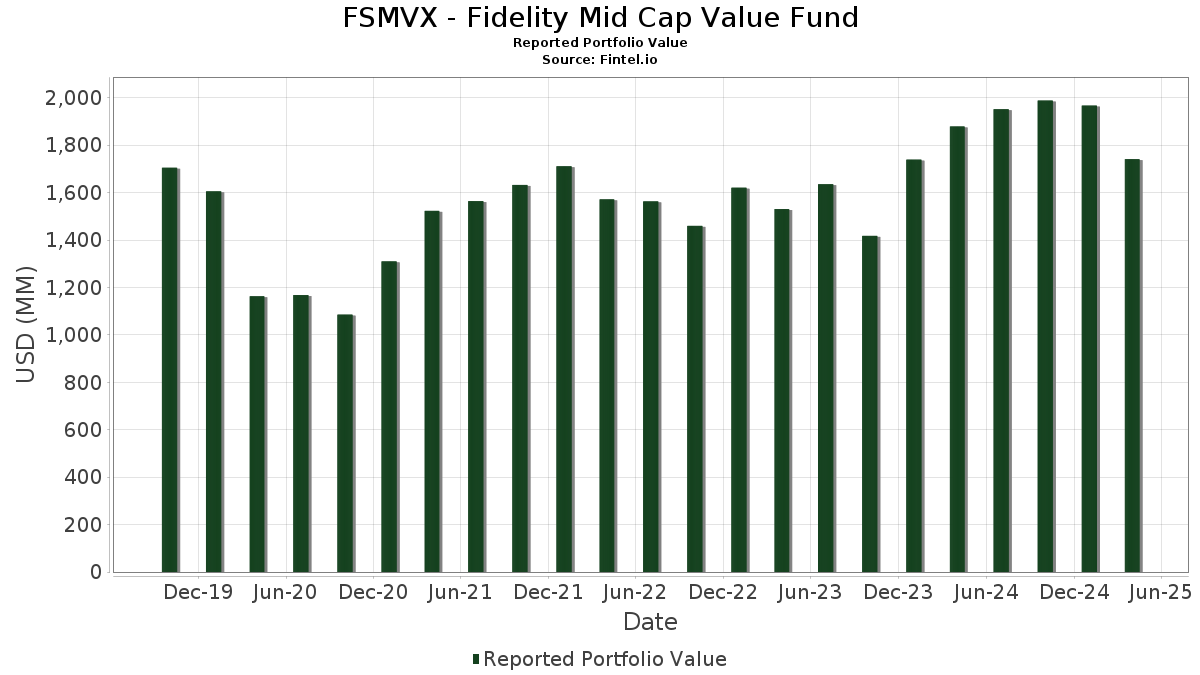

FSMVX - Fidelity Mid Cap Value Fund telah mengungkapkan total kepemilikan 167 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 1,740,974,772 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama FSMVX - Fidelity Mid Cap Value Fund adalah Fidelity Securities Lending Cash Central Fund (US:US31635A3032) , The Hartford Insurance Group, Inc. (US:HIG) , PG&E Corporation (US:PCG) , Sempra (US:SRE) , and Welltower Inc. (US:WELL) . Posisi baru FSMVX - Fidelity Mid Cap Value Fund meliputi: UDR, Inc. (US:UDR) , Crocs, Inc. (US:CROX) , The Mosaic Company (US:MOS) , James Hardie Industries plc (US:JHX) , and Kyndryl Holdings, Inc. (US:KD) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 67.07 | 67.08 | 4.0099 | 1.5491 | |

| 0.21 | 18.61 | 1.1123 | 0.8302 | |

| 0.32 | 13.25 | 0.7919 | 0.7919 | |

| 0.10 | 9.50 | 0.5677 | 0.5677 | |

| 0.30 | 9.07 | 0.5419 | 0.5419 | |

| 0.36 | 8.54 | 0.5108 | 0.5108 | |

| 0.25 | 8.44 | 0.5043 | 0.5043 | |

| 0.26 | 8.42 | 0.5031 | 0.5031 | |

| 0.13 | 8.35 | 0.4992 | 0.4992 | |

| 0.48 | 8.14 | 0.4866 | 0.4866 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.15 | 6.21 | 0.3710 | -0.6320 | |

| 0.00 | 0.00 | -0.5660 | ||

| 0.00 | 0.00 | -0.5153 | ||

| 0.05 | 12.10 | 0.7232 | -0.4386 | |

| 0.00 | 0.00 | -0.4058 | ||

| 0.61 | 7.15 | 0.4276 | -0.4047 | |

| 0.04 | 3.24 | 0.1934 | -0.3519 | |

| 0.00 | 0.00 | -0.3432 | ||

| 0.00 | 0.00 | -0.3388 | ||

| 0.16 | 19.77 | 1.1819 | -0.3373 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-06-26 untuk periode pelaporan 2025-04-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US31635A3032 / Fidelity Securities Lending Cash Central Fund | 67.07 | 42.03 | 67.08 | 42.03 | 4.0099 | 1.5491 | |||

| HIG / The Hartford Insurance Group, Inc. | 0.20 | 8.45 | 23.93 | 19.26 | 1.4304 | 0.3850 | |||

| PCG / PG&E Corporation | 1.32 | 0.00 | 21.80 | 5.56 | 1.3030 | 0.2271 | |||

| SRE / Sempra | 0.28 | 16.51 | 20.65 | 4.35 | 1.2343 | 0.2033 | |||

| WELL / Welltower Inc. | 0.13 | -13.98 | 20.18 | -3.83 | 1.2065 | 0.1130 | |||

| SUI / Sun Communities, Inc. | 0.16 | -31.06 | 19.77 | -32.19 | 1.1819 | -0.3373 | |||

| CH1300646267 / Bunge Global SA | 0.25 | 10.33 | 19.59 | 14.08 | 1.1712 | 0.2764 | |||

| USFD / US Foods Holding Corp. | 0.30 | 9.10 | 19.52 | 0.99 | 1.1668 | 0.1598 | |||

| SLM / SLM Corporation | 0.65 | 2.40 | 18.65 | 6.06 | 1.1148 | 0.1987 | |||

| STT / State Street Corporation | 0.21 | 246.25 | 18.61 | 321.14 | 1.1123 | 0.8302 | |||

| MTB / M&T Bank Corporation | 0.11 | 37.19 | 18.41 | 15.73 | 1.1006 | 0.2717 | |||

| DFS / Discover Financial Services | 0.10 | 7.37 | 18.36 | -2.47 | 1.0974 | 0.1167 | |||

| THC / Tenet Healthcare Corporation | 0.13 | 11.38 | 18.04 | 13.01 | 1.0787 | 0.2467 | |||

| UGI / UGI Corporation | 0.54 | -12.84 | 17.64 | -7.00 | 1.0548 | 0.0662 | |||

| RS / Reliance, Inc. | 0.06 | 46.12 | 17.35 | 45.48 | 1.0372 | 0.4158 | |||

| TRV / The Travelers Companies, Inc. | 0.06 | 39.02 | 16.56 | 49.77 | 0.9900 | 0.4139 | |||

| ES / Eversource Energy | 0.28 | 48.64 | 16.52 | 53.27 | 0.9878 | 0.4261 | |||

| LNG / Cheniere Energy, Inc. | 0.07 | 25.27 | 16.39 | 29.44 | 0.9795 | 0.3200 | |||

| PSA / Public Storage | 0.05 | 66.53 | 16.17 | 67.62 | 0.9665 | 0.4639 | |||

| ET / Energy Transfer LP - Limited Partnership | 0.98 | 9.84 | 16.16 | -11.30 | 0.9661 | 0.0168 | |||

| SMURFIT WESTROCK PLC / EC (IE00028FXN24) | 0.38 | 24.97 | 16.13 | -1.09 | 0.9643 | 0.1146 | |||

| RGA / Reinsurance Group of America, Incorporated | 0.08 | 8.31 | 15.87 | -10.96 | 0.9484 | 0.0200 | |||

| CTVA / Corteva, Inc. | 0.25 | -17.16 | 15.77 | -21.32 | 0.9430 | -0.1016 | |||

| WLK / Westlake Corporation | 0.16 | 5.43 | 15.08 | -14.72 | 0.9017 | -0.0199 | |||

| WDC / Western Digital Corporation | 0.34 | 44.06 | 14.99 | -2.99 | 0.8959 | 0.0910 | |||

| PFSI / PennyMac Financial Services, Inc. | 0.15 | 1.86 | 14.44 | -5.20 | 0.8632 | 0.0696 | |||

| CPT / Camden Property Trust | 0.13 | -19.28 | 14.29 | -19.22 | 0.8544 | -0.0674 | |||

| CNC / Centene Corporation | 0.24 | 116.01 | 14.13 | 101.91 | 0.8447 | 0.4801 | |||

| FCNCA / First Citizens BancShares, Inc. | 0.01 | 3.95 | 14.06 | -16.11 | 0.8402 | -0.0328 | |||

| PLD / Prologis, Inc. | 0.14 | -11.43 | 13.86 | -24.09 | 0.8288 | -0.1228 | |||

| EVRG / Evergy, Inc. | 0.20 | 26.57 | 13.77 | 43.08 | 0.8233 | 0.1492 | |||

| GXO / GXO Logistics, Inc. | 0.38 | 47.45 | 13.64 | 17.58 | 0.8152 | 0.2109 | |||

| WCC / WESCO International, Inc. | 0.08 | 9.74 | 13.59 | -3.34 | 0.8126 | 0.0799 | |||

| AHR / American Healthcare REIT, Inc. | 0.42 | 16.51 | 13.55 | 32.96 | 0.8101 | 0.2790 | |||

| AFG / American Financial Group, Inc. | 0.11 | 11.34 | 13.43 | 3.27 | 0.8026 | 0.1252 | |||

| COKE / Coca-Cola Consolidated, Inc. | 0.01 | -30.77 | 13.42 | -31.37 | 0.8024 | -0.2166 | |||

| UDR / UDR, Inc. | 0.32 | 13.25 | 0.7919 | 0.7919 | |||||

| BLDR / Builders FirstSource, Inc. | 0.11 | 1.30 | 13.07 | -27.56 | 0.7814 | -0.1587 | |||

| LAUR / Laureate Education, Inc. | 0.65 | 0.00 | 12.97 | 7.22 | 0.7753 | 0.1450 | |||

| R / Ryder System, Inc. | 0.09 | 0.00 | 12.93 | -13.64 | 0.7728 | -0.0071 | |||

| US7587501039 / Regal-Beloit Corp. | 0.12 | 10.18 | 12.72 | -26.54 | 0.7603 | -0.1417 | |||

| PSX / Phillips 66 | 0.12 | 131.88 | 12.72 | 98.10 | 0.7602 | 0.4239 | |||

| APO / Apollo Global Management, Inc. | 0.09 | 30.92 | 12.54 | 4.50 | 0.7496 | 0.1244 | |||

| CRH / CRH plc | 0.13 | 13.16 | 12.47 | 9.04 | 0.7455 | 0.1496 | |||

| SSNC / SS&C Technologies Holdings, Inc. | 0.16 | 11.88 | 12.39 | 4.48 | 0.7407 | 0.1228 | |||

| NRG / NRG Energy, Inc. | 0.11 | -12.53 | 12.24 | -6.43 | 0.7317 | 0.0501 | |||

| JLL / Jones Lang LaSalle Incorporated | 0.05 | -48.99 | 12.10 | -27.08 | 0.7232 | -0.4386 | |||

| CIEN / Ciena Corporation | 0.18 | 56.54 | 11.97 | 20.64 | 0.7158 | 0.1987 | |||

| OMF / OneMain Holdings, Inc. | 0.25 | 2.67 | 11.96 | -12.99 | 0.7151 | -0.0012 | |||

| EME / EMCOR Group, Inc. | 0.03 | 21.66 | 11.71 | 8.80 | 0.6997 | 0.1392 | |||

| STLD / Steel Dynamics, Inc. | 0.09 | -23.28 | 11.54 | -22.37 | 0.6901 | -0.0847 | |||

| UFPI / UFP Industries, Inc. | 0.12 | 78.98 | 11.42 | 52.99 | 0.6829 | 0.2938 | |||

| ON / ON Semiconductor Corporation | 0.28 | 28.68 | 11.24 | -2.39 | 0.6719 | 0.0719 | |||

| FQVLF / First Quantum Minerals Ltd. | 0.83 | 0.00 | 11.18 | 7.28 | 0.6681 | 0.1253 | |||

| TRGP / Targa Resources Corp. | 0.06 | 70.43 | 11.04 | 48.00 | 0.6601 | 0.2713 | |||

| XPO / XPO, Inc. | 0.10 | 1.59 | 10.85 | -19.35 | 0.6486 | -0.0523 | |||

| STZ / Constellation Brands, Inc. | 0.06 | 27.07 | 10.65 | 31.82 | 0.6368 | 0.2157 | |||

| G / Genpact Limited | 0.21 | 7.29 | 10.57 | 10.75 | 0.6321 | 0.1347 | |||

| FSLR / First Solar, Inc. | 0.08 | 25.19 | 10.57 | -5.98 | 0.6318 | 0.0461 | |||

| RJF / Raymond James Financial, Inc. | 0.08 | 2.56 | 10.43 | -16.58 | 0.6235 | -0.0279 | |||

| WAL / Western Alliance Bancorporation | 0.15 | 0.00 | 10.38 | -20.67 | 0.6205 | -0.0612 | |||

| CI / The Cigna Group | 0.03 | 5.90 | 10.37 | 22.40 | 0.6200 | 0.1785 | |||

| GTES / Gates Industrial Corporation plc | 0.54 | 20.92 | 10.29 | 10.57 | 0.6152 | 0.1303 | |||

| SNX / TD SYNNEX Corporation | 0.09 | 30.20 | 10.27 | 1.23 | 0.6139 | 0.0853 | |||

| OC / Owens Corning | 0.07 | 39.88 | 10.25 | 10.21 | 0.6128 | 0.1282 | |||

| CNH / CNH Industrial N.V. | 0.88 | -4.51 | 10.19 | -14.22 | 0.6090 | -0.0098 | |||

| JBL / Jabil Inc. | 0.07 | 2.82 | 10.14 | -7.22 | 0.6063 | 0.0368 | |||

| DLTR / Dollar Tree, Inc. | 0.12 | -21.96 | 10.14 | -1.29 | 0.6061 | 0.0682 | |||

| ACHC / Acadia Healthcare Company, Inc. | 0.43 | 26.67 | 10.11 | -34.29 | 0.6046 | -0.1974 | |||

| GMS / GMS Inc. | 0.14 | 0.00 | 10.05 | -13.14 | 0.6009 | -0.0021 | |||

| US21871X1090 / Corebridge Financial, Inc. | 0.34 | -4.56 | 10.05 | -16.23 | 0.6006 | -0.0243 | |||

| PVH / PVH Corp. | 0.15 | 71.87 | 10.03 | 32.31 | 0.5996 | 0.2046 | |||

| BLD / TopBuild Corp. | 0.03 | 31.75 | 9.82 | 13.71 | 0.5870 | 0.1370 | |||

| ALLY / Ally Financial Inc. | 0.30 | 18.25 | 9.69 | -0.90 | 0.5795 | 0.0698 | |||

| CTRI / Centuri Holdings, Inc. | 0.53 | 10.69 | 9.59 | -10.77 | 0.5735 | 0.0133 | |||

| SOLV / Solventum Corporation | 0.14 | 11.09 | 9.53 | -0.81 | 0.5700 | 0.0691 | |||

| CROX / Crocs, Inc. | 0.10 | 9.50 | 0.5677 | 0.5677 | |||||

| CLNX / Cellnex Telecom, S.A. | 0.23 | 0.00 | 9.43 | 20.83 | 0.5635 | 0.1570 | |||

| SCI / Service Corporation International | 0.12 | -20.35 | 9.41 | -18.53 | 0.5627 | -0.0393 | |||

| SGI / Somnigroup International Inc. | 0.15 | 1.12 | 9.39 | -2.21 | 0.5612 | 0.0610 | |||

| GPK / Graphic Packaging Holding Company | 0.37 | 41.49 | 9.36 | 26.71 | 0.5595 | 0.1727 | |||

| GAP / The Gap, Inc. | 0.42 | 21.55 | 9.10 | 10.59 | 0.5442 | 0.1153 | |||

| HSIC / Henry Schein, Inc. | 0.14 | -23.61 | 9.10 | -37.96 | 0.5441 | -0.2203 | |||

| MOS / The Mosaic Company | 0.30 | 9.07 | 0.5419 | 0.5419 | |||||

| QDEL / QuidelOrtho Corporation | 0.33 | 21.17 | 9.05 | -22.52 | 0.5411 | -0.0676 | |||

| TEX / Terex Corporation | 0.25 | 17.04 | 8.97 | -14.34 | 0.5362 | -0.0093 | |||

| EWBC / East West Bancorp, Inc. | 0.10 | -8.86 | 8.89 | -24.28 | 0.5315 | -0.0803 | |||

| REXR / Rexford Industrial Realty, Inc. | 0.27 | -8.51 | 8.86 | -25.53 | 0.5295 | -0.0902 | |||

| ARW / Arrow Electronics, Inc. | 0.08 | -29.65 | 8.85 | -32.78 | 0.5292 | -0.1570 | |||

| IP / International Paper Company | 0.19 | -6.63 | 8.82 | -23.32 | 0.5271 | -0.0721 | |||

| ICLR / ICON Public Limited Company | 0.06 | 52.13 | 8.66 | 15.72 | 0.5178 | 0.1278 | |||

| OUT / OUTFRONT Media Inc. | 0.57 | 10.06 | 8.62 | -9.50 | 0.5154 | 0.0190 | |||

| JHX / James Hardie Industries plc | 0.36 | 8.54 | 0.5108 | 0.5108 | |||||

| OVV / Ovintiv Inc. | 0.25 | 8.44 | 0.5043 | 0.5043 | |||||

| KD / Kyndryl Holdings, Inc. | 0.26 | 8.42 | 0.5031 | 0.5031 | |||||

| WSC / WillScot Holdings Corporation | 0.33 | 19.11 | 8.36 | -19.27 | 0.4999 | -0.0398 | |||

| UHALB / U-Haul Holding Company - Series N | 0.15 | 0.00 | 8.35 | -15.35 | 0.4993 | -0.0148 | |||

| HAS / Hasbro, Inc. | 0.13 | 8.35 | 0.4992 | 0.4992 | |||||

| CVS / CVS Health Corporation | 0.12 | -27.24 | 8.29 | -14.06 | 0.4953 | -0.0070 | |||

| PATK / Patrick Industries, Inc. | 0.11 | 1,403.30 | 8.23 | 1,092.61 | 0.4919 | 0.4559 | |||

| SIG / Signet Jewelers Limited | 0.14 | 13.98 | 8.22 | 14.11 | 0.4913 | 0.1161 | |||

| ENR / Siemens Energy AG | 0.11 | -9.12 | 8.15 | 17.89 | 0.4872 | 0.1270 | |||

| GO / Grocery Outlet Holding Corp. | 0.48 | 8.14 | 0.4866 | 0.4866 | |||||

| BGC / BGC Group, Inc. | 0.90 | -9.37 | 8.14 | -13.93 | 0.4864 | -0.0061 | |||

| ATMU / Atmus Filtration Technologies Inc. | 0.23 | 44.18 | 8.12 | 19.54 | 0.4856 | 0.1315 | |||

| MTX / Minerals Technologies Inc. | 0.16 | 56.39 | 8.01 | 5.20 | 0.4789 | 0.0822 | |||

| WBS / Webster Financial Corporation | 0.17 | 59.57 | 8.01 | 25.29 | 0.4787 | 0.1457 | |||

| HGV / Hilton Grand Vacations Inc. | 0.23 | 45.50 | 7.83 | 18.77 | 0.4680 | 0.1245 | |||

| FTI / TechnipFMC plc | 0.28 | -8.68 | 7.82 | -14.40 | 0.4676 | -0.0085 | |||

| KBH / KB Home | 0.14 | -27.17 | 7.76 | -41.35 | 0.4641 | -0.2257 | |||

| LNTH / Lantheus Holdings, Inc. | 0.07 | -11.55 | 7.75 | -0.23 | 0.4634 | 0.0585 | |||

| LBRDK / Liberty Broadband Corporation | 0.08 | -6.60 | 7.67 | 10.13 | 0.4587 | 0.0957 | |||

| MOH / Molina Healthcare, Inc. | 0.02 | 14.67 | 7.67 | 20.79 | 0.4584 | 0.1277 | |||

| COHR / Coherent Corp. | 0.12 | 107.88 | 7.63 | 47.77 | 0.4564 | 0.1872 | |||

| LAD / Lithia Motors, Inc. | 0.03 | -3.34 | 7.63 | -24.76 | 0.4563 | -0.0723 | |||

| BCO / The Brink's Company | 0.09 | 66.51 | 7.60 | 59.21 | 0.4541 | 0.2055 | |||

| KBR / KBR, Inc. | 0.14 | 7.55 | 0.4514 | 0.4514 | |||||

| AMTM / Amentum Holdings, Inc. | 0.34 | -20.07 | 7.46 | -16.83 | 0.4457 | -0.0214 | |||

| AES / The AES Corporation | 0.74 | 7.31 | 7.38 | -2.44 | 0.4414 | 0.0470 | |||

| EXC / Exelon Corporation | 0.16 | -53.73 | 7.36 | -45.75 | 0.4402 | -0.2670 | |||

| OSK / Oshkosh Corporation | 0.09 | 7.35 | 0.4396 | 0.4396 | |||||

| FA / First Advantage Corporation | 0.52 | 31.27 | 7.33 | -1.97 | 0.4384 | 0.0486 | |||

| DAR / Darling Ingredients Inc. | 0.23 | 3.62 | 7.27 | -14.71 | 0.4349 | -0.0119 | |||

| UPBD / Upbound Group, Inc. | 0.37 | 15.63 | 7.27 | -21.57 | 0.4348 | -0.0484 | |||

| CVE / Cenovus Energy Inc. | 0.61 | -44.95 | 7.15 | -55.22 | 0.4276 | -0.4047 | |||

| SJM / The J. M. Smucker Company | 0.06 | -26.79 | 7.15 | -20.36 | 0.4275 | -0.0404 | |||

| KDP / Keurig Dr Pepper Inc. | 0.20 | -46.17 | 7.04 | -41.99 | 0.4210 | -0.2116 | |||

| DOX / Amdocs Limited | 0.08 | -22.59 | 7.04 | -22.25 | 0.4210 | -0.0509 | |||

| AER / AerCap Holdings N.V. | 0.07 | -10.57 | 7.00 | -0.84 | 0.4182 | 0.0506 | |||

| FCFS / FirstCash Holdings, Inc. | 0.05 | -59.61 | 6.93 | -50.43 | 0.4140 | -0.3139 | |||

| AVT / Avnet, Inc. | 0.15 | 3.23 | 6.91 | 27.29 | 0.4132 | 0.0761 | |||

| NXST / Nexstar Media Group, Inc. | 0.05 | 6.98 | 6.88 | 4.50 | 0.4112 | 0.0682 | |||

| PAG / Penske Automotive Group, Inc. | 0.04 | 0.00 | 6.85 | -6.01 | 0.4095 | 0.0297 | |||

| EIX / Edison International | 0.13 | -44.37 | 6.80 | -44.88 | 0.4067 | -0.2363 | |||

| IFSPF / Interfor Corporation | 0.70 | 0.00 | 6.73 | -17.65 | 0.4021 | -0.0235 | |||

| IRM / Iron Mountain Incorporated | 0.07 | 49.50 | 6.66 | 8.34 | 0.3983 | 0.0762 | |||

| MEOH / Methanex Corporation | 0.21 | 13.91 | 6.66 | -31.72 | 0.3982 | -0.1101 | |||

| SCHW / The Charles Schwab Corporation | 0.08 | 6.62 | 0.3956 | 0.3956 | |||||

| ALSN / Allison Transmission Holdings, Inc. | 0.07 | -1.68 | 6.48 | -22.84 | 0.3871 | -0.0502 | |||

| COMP / Compass, Inc. | 0.84 | -18.41 | 6.47 | -13.11 | 0.3866 | -0.0012 | |||

| PRGS / Progress Software Corporation | 0.10 | -16.45 | 6.27 | -12.62 | 0.3749 | 0.0009 | |||

| WFRD / Weatherford International plc | 0.15 | -50.98 | 6.21 | -67.77 | 0.3710 | -0.6320 | |||

| EPAM / EPAM Systems, Inc. | 0.04 | -6.64 | 6.18 | -42.32 | 0.3696 | -0.1888 | |||

| VOYA / Voya Financial, Inc. | 0.10 | 11.46 | 6.16 | -7.06 | 0.3684 | 0.0229 | |||

| COLD / Americold Realty Trust, Inc. | 0.32 | -13.84 | 6.14 | -23.74 | 0.3670 | -0.0525 | |||

| CEG / Constellation Energy Corporation | 0.03 | -10.14 | 6.14 | -33.08 | 0.3669 | -0.1109 | |||

| MLKN / MillerKnoll, Inc. | 0.37 | 2.54 | 6.03 | -25.06 | 0.3604 | -0.0588 | |||

| ACI / Albertsons Companies, Inc. | 0.27 | -26.53 | 6.02 | -19.45 | 0.3599 | -0.0296 | |||

| CNM / Core & Main, Inc. | 0.11 | -16.91 | 5.95 | -22.45 | 0.3559 | -0.0441 | |||

| PCAR / PACCAR Inc | 0.07 | -21.15 | 5.94 | -32.97 | 0.3548 | -0.1375 | |||

| VST / Vistra Corp. | 0.04 | 13.74 | 5.79 | -12.25 | 0.3464 | 0.0023 | |||

| RUSHA / Rush Enterprises, Inc. | 0.11 | -7.75 | 5.77 | -22.57 | 0.3447 | -0.0433 | |||

| HRI / Herc Holdings Inc. | 0.05 | 89.78 | 5.69 | 1.83 | 0.3402 | 0.0490 | |||

| PRMB / Primo Brands Corporation | 0.17 | 0.00 | 5.64 | 0.93 | 0.3369 | 0.0460 | |||

| CPRI / Capri Holdings Limited | 0.37 | 69.15 | 5.63 | 28.88 | 0.3367 | 0.1078 | |||

| CNXC / Concentrix Corporation | 0.10 | -31.66 | 5.26 | -33.27 | 0.3143 | -0.0961 | |||

| MEGEF / MEG Energy Corp. | 0.37 | -1.40 | 5.15 | -15.64 | 0.3080 | -0.0102 | |||

| NATL / NCR Atleos Corporation | 0.18 | -12.09 | 5.04 | -22.96 | 0.3011 | -0.0395 | |||

| BNTX / BioNTech SE - Depositary Receipt (Common Stock) | 0.05 | 12.35 | 4.93 | -5.45 | 0.2945 | 0.0230 | |||

| XYZ / Block, Inc. | 0.08 | -27.82 | 4.75 | -53.54 | 0.2838 | -0.2485 | |||

| PM / Philip Morris International Inc. | 0.03 | -49.63 | 4.71 | -33.71 | 0.2817 | -0.0887 | |||

| LAMR / Lamar Advertising Company | 0.04 | -9.04 | 4.36 | 25.81 | 0.2606 | 0.0095 | |||

| ASO / Academy Sports and Outdoors, Inc. | 0.11 | -2.83 | 4.14 | -30.00 | 0.2475 | -0.0607 | |||

| CNR / Core Natural Resources, Inc. | 0.04 | -61.33 | 3.24 | -69.08 | 0.1934 | -0.3519 | |||

| PACS / PACS Group, Inc. | 0.31 | -1.10 | 2.95 | -34.46 | 0.1765 | -0.0582 | |||

| ASGN / ASGN Incorporated | 0.04 | -48.90 | 2.21 | -70.82 | 0.1320 | -0.2623 | |||

| SNDK.V / Sandisk Corporation | 0.04 | 1.26 | 0.0752 | 0.0752 | |||||

| CWH / Camping World Holdings, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.4058 | ||||

| MRNA / Moderna, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.2263 | ||||

| PRGO / Perrigo Company plc | 0.00 | -100.00 | 0.00 | -100.00 | -0.3388 | ||||

| APD / Air Products and Chemicals, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.5153 | ||||

| MKSI / MKS Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.5660 | ||||

| MWA / Mueller Water Products, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.3432 | ||||

| RKT / Rocket Companies, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0848 | ||||

| NXT / Nextracker Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.2800 | ||||

| WOR / Worthington Enterprises, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0113 | ||||

| LPX / Louisiana-Pacific Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.2627 |