Mga Batayang Estadistika

| Nilai Portofolio | $ 39,614,472 |

| Posisi Saat Ini | 140 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

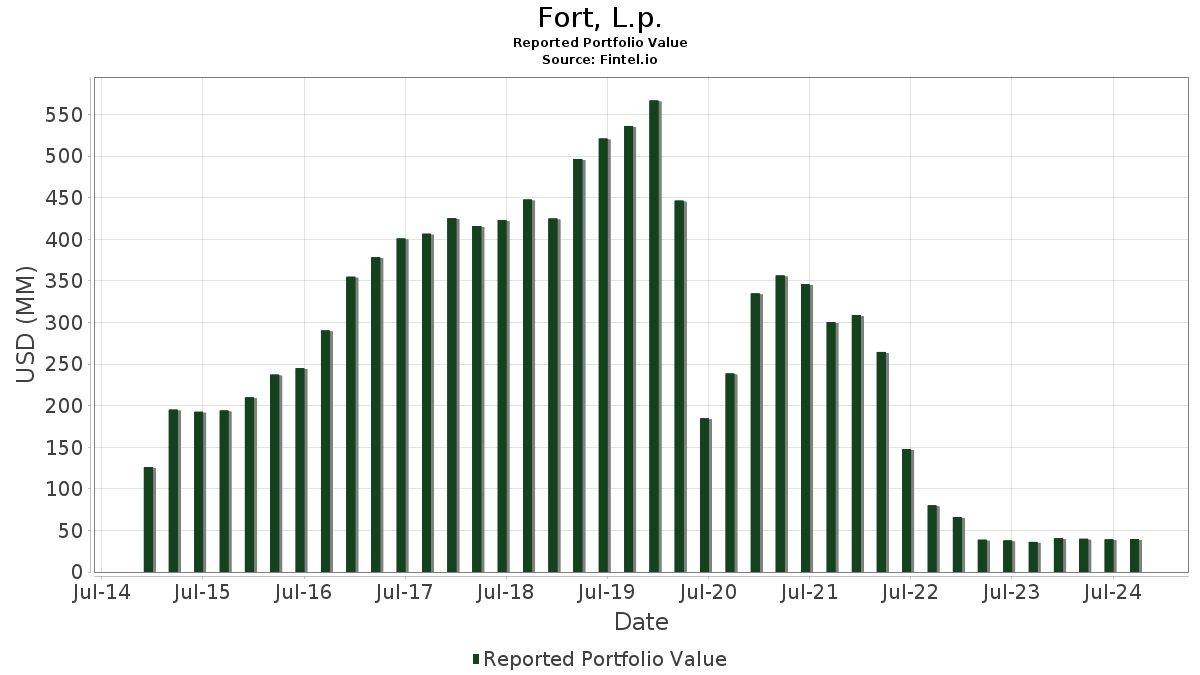

Fort, L.p. telah mengungkapkan total kepemilikan 140 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 39,614,472 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Fort, L.p. adalah Apple Inc. (US:AAPL) , Microsoft Corporation (US:MSFT) , Alphabet Inc. (US:GOOGL) , Meta Platforms, Inc. (US:META) , and Walmart Inc. (US:WMT) . Posisi baru Fort, L.p. meliputi: TE Connectivity plc (US:TEL) , Dropbox, Inc. (US:DBX) , Skyworks Solutions, Inc. (US:SWKS) , Ferguson Enterprises Inc. (US:FERG) , and .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.00 | 0.31 | 0.7737 | 0.7737 | |

| 0.00 | 0.27 | 0.6777 | 0.6777 | |

| 0.00 | 0.26 | 0.6441 | 0.6441 | |

| 0.00 | 0.25 | 0.6423 | 0.6423 | |

| 0.00 | 0.24 | 0.6044 | 0.6044 | |

| 0.00 | 0.23 | 0.5930 | 0.5930 | |

| 0.00 | 0.23 | 0.5925 | 0.5925 | |

| 0.00 | 0.23 | 0.5914 | 0.5914 | |

| 0.00 | 0.23 | 0.5910 | 0.5910 | |

| 0.00 | 0.23 | 0.5714 | 0.5714 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.00 | 0.00 | -0.8504 | ||

| 0.00 | 0.00 | -0.7321 | ||

| 0.00 | 0.00 | -0.6217 | ||

| 0.00 | 0.00 | -0.5921 | ||

| 0.00 | 0.00 | -0.5817 | ||

| 0.00 | 0.00 | -0.5764 | ||

| 0.00 | 0.00 | -0.5523 | ||

| 0.00 | 0.00 | -0.5520 | ||

| 0.00 | 0.00 | -0.5318 | ||

| 0.00 | 0.20 | 0.5068 | -0.4278 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2024-10-29 untuk periode pelaporan 2024-09-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| AAPL / Apple Inc. | 0.00 | -5.79 | 1.06 | 4.22 | 2.6791 | 0.0733 | |||

| MSFT / Microsoft Corporation | 0.00 | -6.09 | 0.94 | -9.61 | 2.3777 | -0.2882 | |||

| GOOGL / Alphabet Inc. | 0.00 | -5.97 | 0.70 | -14.32 | 1.7676 | -0.3252 | |||

| META / Meta Platforms, Inc. | 0.00 | -10.60 | 0.62 | 1.47 | 1.5722 | 0.0020 | |||

| WMT / Walmart Inc. | 0.01 | -7.60 | 0.44 | 10.25 | 1.1150 | 0.0893 | |||

| HD / The Home Depot, Inc. | 0.00 | -1.86 | 0.36 | 15.61 | 0.9165 | 0.1122 | |||

| GE / General Electric Company | 0.00 | -11.80 | 0.36 | 4.72 | 0.8969 | 0.0280 | |||

| ABBV / AbbVie Inc. | 0.00 | -6.72 | 0.35 | 7.36 | 0.8853 | 0.0497 | |||

| IBM / International Business Machines Corporation | 0.00 | -8.94 | 0.34 | 16.21 | 0.8527 | 0.1101 | |||

| GJR / Strats Trust For Procter & Gambel Security - Preferred Security | 0.00 | -4.85 | 0.34 | 0.00 | 0.8495 | -0.0122 | |||

| KO / The Coca-Cola Company | 0.00 | -4.63 | 0.33 | 7.74 | 0.8448 | 0.0495 | |||

| T / AT&T Inc. | 0.02 | -6.65 | 0.33 | 7.49 | 0.8335 | 0.0473 | |||

| RTX / RTX Corporation | 0.00 | -2.91 | 0.33 | 17.20 | 0.8270 | 0.1116 | |||

| JNJ / Johnson & Johnson | 0.00 | -2.91 | 0.32 | 7.67 | 0.8178 | 0.0477 | |||

| PM / Philip Morris International Inc. | 0.00 | -5.46 | 0.32 | 13.33 | 0.8167 | 0.0858 | |||

| K / Kellanova | 0.00 | -5.57 | 0.32 | 32.10 | 0.8115 | 0.1889 | |||

| GDDY / GoDaddy Inc. | 0.00 | -18.06 | 0.32 | -8.09 | 0.8042 | -0.0824 | |||

| ALSN / Allison Transmission Holdings, Inc. | 0.00 | -10.07 | 0.31 | 13.82 | 0.7923 | 0.0867 | |||

| ORCL / Oracle Corporation | 0.00 | -7.44 | 0.31 | 11.79 | 0.7919 | 0.0732 | |||

| LMT / Lockheed Martin Corporation | 0.00 | -7.27 | 0.31 | 16.36 | 0.7909 | 0.1001 | |||

| EBAY / eBay Inc. | 0.00 | -7.18 | 0.31 | 12.64 | 0.7881 | 0.0780 | |||

| CVLT / Commvault Systems, Inc. | 0.00 | -24.91 | 0.31 | -4.89 | 0.7868 | -0.0525 | |||

| MSI / Motorola Solutions, Inc. | 0.00 | -11.23 | 0.31 | 3.34 | 0.7809 | 0.0153 | |||

| COST / Costco Wholesale Corporation | 0.00 | 9.12 | 0.31 | 13.70 | 0.7765 | 0.0849 | |||

| SHW / The Sherwin-Williams Company | 0.00 | 0.31 | 0.7737 | 0.7737 | |||||

| CTAS / Cintas Corporation | 0.00 | 245.01 | 0.31 | 1.66 | 0.7728 | 0.0005 | |||

| BKNG / Booking Holdings Inc. | 0.00 | -7.69 | 0.30 | -1.62 | 0.7656 | -0.0251 | |||

| FICO / Fair Isaac Corporation | 0.00 | -28.77 | 0.30 | -7.06 | 0.7653 | -0.0689 | |||

| LIN / Linde plc | 0.00 | -7.17 | 0.30 | 1.00 | 0.7632 | -0.0037 | |||

| TJX / The TJX Companies, Inc. | 0.00 | -7.22 | 0.30 | -1.00 | 0.7513 | -0.0176 | |||

| ACN / Accenture plc | 0.00 | -4.35 | 0.30 | 11.74 | 0.7451 | 0.0673 | |||

| QCOM / QUALCOMM Incorporated | 0.00 | -10.99 | 0.29 | -24.23 | 0.7443 | -0.2485 | |||

| HRB / H&R Block, Inc. | 0.00 | 0.37 | 0.29 | 17.60 | 0.7424 | 0.1026 | |||

| EME / EMCOR Group, Inc. | 0.00 | -27.91 | 0.29 | -15.07 | 0.7412 | -0.1426 | |||

| GRMN / Garmin Ltd. | 0.00 | -13.00 | 0.29 | -5.79 | 0.7403 | -0.0581 | |||

| CRM / Salesforce, Inc. | 0.00 | -2.10 | 0.29 | 4.27 | 0.7400 | 0.0203 | |||

| CSCO / Cisco Systems, Inc. | 0.01 | -0.02 | 0.29 | 11.88 | 0.7381 | 0.0701 | |||

| MAS / Masco Corporation | 0.00 | -7.85 | 0.29 | 15.94 | 0.7363 | 0.0930 | |||

| RACE / Ferrari N.V. | 0.00 | -10.79 | 0.29 | 2.83 | 0.7358 | 0.0095 | |||

| NTAP / NetApp, Inc. | 0.00 | -12.51 | 0.29 | -16.18 | 0.7346 | -0.1530 | |||

| CL / Colgate-Palmolive Company | 0.00 | -8.85 | 0.29 | -2.69 | 0.7314 | -0.0290 | |||

| ABT / Abbott Laboratories | 0.00 | -3.25 | 0.29 | 6.27 | 0.7284 | 0.0328 | |||

| MO / Altria Group, Inc. | 0.01 | -4.52 | 0.29 | 7.09 | 0.7246 | 0.0381 | |||

| HLT / Hilton Worldwide Holdings Inc. | 0.00 | -10.39 | 0.29 | -5.30 | 0.7227 | -0.0512 | |||

| APH / Amphenol Corporation | 0.00 | -11.81 | 0.29 | -14.63 | 0.7224 | -0.1361 | |||

| FFIV / F5, Inc. | 0.00 | -4.15 | 0.28 | 22.41 | 0.7182 | 0.1241 | |||

| MRK / Merck & Co., Inc. | 0.00 | -3.85 | 0.28 | -11.84 | 0.7158 | -0.1069 | |||

| GILD / Gilead Sciences, Inc. | 0.00 | -1.35 | 0.28 | 20.51 | 0.7141 | 0.1136 | |||

| MANH / Manhattan Associates, Inc. | 0.00 | -7.47 | 0.28 | 5.62 | 0.7131 | 0.0283 | |||

| CHKP / Check Point Software Technologies Ltd. | 0.00 | -9.03 | 0.28 | 6.44 | 0.7111 | 0.0330 | |||

| DECK / Deckers Outdoor Corporation | 0.00 | 394.68 | 0.28 | -18.55 | 0.7108 | -0.1734 | |||

| CAT / Caterpillar Inc. | 0.00 | -5.64 | 0.28 | 11.07 | 0.7099 | 0.0604 | |||

| XOM / Exxon Mobil Corporation | 0.00 | -19.02 | 0.28 | -17.65 | 0.7093 | -0.1627 | |||

| AYI / Acuity Inc. | 0.00 | -11.93 | 0.28 | 0.36 | 0.7084 | -0.0064 | |||

| MDT / Medtronic plc | 0.00 | -2.33 | 0.28 | 11.60 | 0.7057 | 0.0654 | |||

| PEP / PepsiCo, Inc. | 0.00 | -1.56 | 0.28 | 1.46 | 0.7023 | 0.0008 | |||

| HPQ / HP Inc. | 0.01 | -2.58 | 0.28 | -0.36 | 0.6978 | -0.0111 | |||

| DD / DuPont de Nemours, Inc. | 0.00 | -3.66 | 0.27 | 6.61 | 0.6933 | 0.0344 | |||

| OMC / Omnicom Group Inc. | 0.00 | -5.53 | 0.27 | 8.84 | 0.6861 | 0.0474 | |||

| GD / General Dynamics Corporation | 0.00 | -8.67 | 0.27 | -4.93 | 0.6828 | -0.0448 | |||

| REGN / Regeneron Pharmaceuticals, Inc. | 0.00 | -10.76 | 0.27 | -10.60 | 0.6820 | -0.0926 | |||

| JNPR / Juniper Networks, Inc. | 0.01 | -7.91 | 0.27 | -1.47 | 0.6804 | -0.0201 | |||

| CMCSA / Comcast Corporation | 0.01 | 16.11 | 0.27 | 23.96 | 0.6796 | 0.1233 | |||

| OTIS / Otis Worldwide Corporation | 0.00 | -4.46 | 0.27 | 3.46 | 0.6793 | 0.0118 | |||

| CLX / The Clorox Company | 0.00 | -0.66 | 0.27 | 18.58 | 0.6785 | 0.0985 | |||

| FTNT / Fortinet, Inc. | 0.00 | 0.27 | 0.6777 | 0.6777 | |||||

| ADBE / Adobe Inc. | 0.00 | -3.90 | 0.27 | -10.37 | 0.6771 | -0.0892 | |||

| BMY / Bristol-Myers Squibb Company | 0.01 | 3.54 | 0.27 | 28.99 | 0.6762 | 0.1448 | |||

| CCEP / Coca-Cola Europacific Partners PLC | 0.00 | -6.20 | 0.27 | 1.52 | 0.6741 | 0.0000 | |||

| ROL / Rollins, Inc. | 0.01 | -6.33 | 0.27 | -2.92 | 0.6726 | -0.0295 | |||

| HON / Honeywell International Inc. | 0.00 | -3.88 | 0.27 | -6.99 | 0.6721 | -0.0601 | |||

| MAR / Marriott International, Inc. | 0.00 | -6.57 | 0.27 | -3.99 | 0.6696 | -0.0369 | |||

| ADI / Analog Devices, Inc. | 0.00 | -13.91 | 0.26 | -13.44 | 0.6688 | -0.1122 | |||

| ROST / Ross Stores, Inc. | 0.00 | -7.55 | 0.26 | -4.36 | 0.6653 | -0.0390 | |||

| MDLZ / Mondelez International, Inc. | 0.00 | -1.55 | 0.26 | 11.02 | 0.6619 | 0.0565 | |||

| KMB / Kimberly-Clark Corporation | 0.00 | -3.93 | 0.26 | -1.14 | 0.6583 | -0.0164 | |||

| GIS / General Mills, Inc. | 0.00 | -1.89 | 0.26 | 14.54 | 0.6575 | 0.0756 | |||

| ITW / Illinois Tool Works Inc. | 0.00 | -2.08 | 0.26 | 8.37 | 0.6556 | 0.0420 | |||

| AOS / A. O. Smith Corporation | 0.00 | -4.10 | 0.26 | 5.31 | 0.6531 | 0.0246 | |||

| KEYS / Keysight Technologies, Inc. | 0.00 | -1.81 | 0.26 | 14.16 | 0.6523 | 0.0729 | |||

| CTSH / Cognizant Technology Solutions Corporation | 0.00 | -3.59 | 0.26 | 9.44 | 0.6443 | 0.0475 | |||

| TEL / TE Connectivity plc | 0.00 | 0.26 | 0.6441 | 0.6441 | |||||

| TMUS / T-Mobile US, Inc. | 0.00 | 0.25 | 0.6423 | 0.6423 | |||||

| GTES / Gates Industrial Corporation plc | 0.01 | 9.26 | 0.25 | 21.63 | 0.6390 | 0.1049 | |||

| PAYX / Paychex, Inc. | 0.00 | -3.43 | 0.25 | 9.09 | 0.6382 | 0.0463 | |||

| VRSK / Verisk Analytics, Inc. | 0.00 | -5.52 | 0.25 | -5.97 | 0.6365 | -0.0505 | |||

| A / Agilent Technologies, Inc. | 0.00 | -1.57 | 0.25 | 13.00 | 0.6364 | 0.0642 | |||

| EXPD / Expeditors International of Washington, Inc. | 0.00 | -2.54 | 0.25 | 2.45 | 0.6359 | 0.0078 | |||

| SNX / TD SYNNEX Corporation | 0.00 | 18.82 | 0.25 | 23.65 | 0.6353 | 0.1144 | |||

| HOLX / Hologic, Inc. | 0.00 | -3.23 | 0.25 | 6.36 | 0.6338 | 0.0286 | |||

| FTXP / Foothills Exploration, Inc. | 0.00 | -28.06 | 0.25 | -32.43 | 0.6314 | -0.3159 | |||

| BKR / Baker Hughes Company | 0.01 | 1.37 | 0.25 | 4.20 | 0.6274 | 0.0170 | |||

| YUM / Yum! Brands, Inc. | 0.00 | -3.00 | 0.25 | 2.48 | 0.6271 | 0.0058 | |||

| EA / Electronic Arts Inc. | 0.00 | -5.31 | 0.25 | -2.36 | 0.6261 | -0.0250 | |||

| QGEN / Qiagen N.V. | 0.01 | -2.79 | 0.25 | 7.86 | 0.6243 | 0.0373 | |||

| GGG / Graco Inc. | 0.00 | -2.84 | 0.25 | 6.99 | 0.6201 | 0.0340 | |||

| G / Genpact Limited | 0.01 | -0.54 | 0.24 | 21.39 | 0.6168 | 0.1007 | |||

| CHD / Church & Dwight Co., Inc. | 0.00 | -3.62 | 0.24 | -2.81 | 0.6122 | -0.0253 | |||

| AMAT / Applied Materials, Inc. | 0.00 | -24.76 | 0.24 | -35.64 | 0.6120 | -0.3511 | |||

| SNA / Snap-on Incorporated | 0.00 | -4.13 | 0.24 | 6.61 | 0.6114 | 0.0281 | |||

| CHE / Chemed Corporation | 0.00 | -4.76 | 0.24 | 5.73 | 0.6068 | 0.0237 | |||

| LOGI / Logitech International S.A. | 0.00 | -8.68 | 0.24 | -15.55 | 0.6055 | -0.1202 | |||

| KHC / The Kraft Heinz Company | 0.01 | -1.64 | 0.24 | 7.17 | 0.6054 | 0.0328 | |||

| LOW / Lowe's Companies, Inc. | 0.00 | 0.24 | 0.6044 | 0.6044 | |||||

| LSTR / Landstar System, Inc. | 0.00 | -1.33 | 0.24 | 0.85 | 0.6003 | -0.0021 | |||

| DOX / Amdocs Limited | 0.00 | -0.22 | 0.24 | 10.75 | 0.6000 | 0.0501 | |||

| CAH / Cardinal Health, Inc. | 0.00 | -11.25 | 0.24 | 0.00 | 0.5962 | -0.0096 | |||

| NXPI / NXP Semiconductors N.V. | 0.00 | -11.83 | 0.24 | -21.33 | 0.5962 | -0.1723 | |||

| CDW / CDW Corporation | 0.00 | -2.25 | 0.24 | -0.84 | 0.5958 | -0.0153 | |||

| LYB / LyondellBasell Industries N.V. | 0.00 | -1.41 | 0.24 | -0.84 | 0.5933 | -0.0152 | |||

| ECL / Ecolab Inc. | 0.00 | 0.23 | 0.5930 | 0.5930 | |||||

| NKE / NIKE, Inc. | 0.00 | 0.23 | 0.5925 | 0.5925 | |||||

| KFY / Korn Ferry | 0.00 | 0.23 | 0.5914 | 0.5914 | |||||

| WAB / Westinghouse Air Brake Technologies Corporation | 0.00 | 0.23 | 0.5910 | 0.5910 | |||||

| EMR / Emerson Electric Co. | 0.00 | -12.78 | 0.23 | -13.38 | 0.5900 | -0.1006 | |||

| MNST / Monster Beverage Corporation | 0.00 | 0.79 | 0.23 | 4.95 | 0.5900 | 0.0218 | |||

| MCK / McKesson Corporation | 0.00 | -9.55 | 0.23 | -23.41 | 0.5791 | -0.1876 | |||

| VRSN / VeriSign, Inc. | 0.00 | 0.42 | 0.23 | 7.51 | 0.5783 | 0.0319 | |||

| NSIT / Insight Enterprises, Inc. | 0.00 | -22.40 | 0.23 | -15.56 | 0.5763 | -0.1170 | |||

| MLI / Mueller Industries, Inc. | 0.00 | -18.23 | 0.23 | 6.10 | 0.5724 | 0.0272 | |||

| ITT / ITT Inc. | 0.00 | -7.62 | 0.23 | 7.11 | 0.5722 | 0.0297 | |||

| ADP / Automatic Data Processing, Inc. | 0.00 | 0.23 | 0.5714 | 0.5714 | |||||

| BDX / Becton, Dickinson and Company | 0.00 | 0.23 | 0.5703 | 0.5703 | |||||

| EXEL / Exelixis, Inc. | 0.01 | 0.23 | 0.5686 | 0.5686 | |||||

| DBX / Dropbox, Inc. | 0.01 | 0.22 | 0.5643 | 0.5643 | |||||

| ELV / Elevance Health, Inc. | 0.00 | -5.13 | 0.22 | -8.68 | 0.5579 | -0.0633 | |||

| BRC / Brady Corporation | 0.00 | 0.22 | 0.5556 | 0.5556 | |||||

| ROK / Rockwell Automation, Inc. | 0.00 | 0.12 | 0.22 | -2.23 | 0.5543 | -0.0212 | |||

| ZBH / Zimmer Biomet Holdings, Inc. | 0.00 | 1.10 | 0.22 | 0.46 | 0.5513 | -0.0044 | |||

| DLB / Dolby Laboratories, Inc. | 0.00 | 0.60 | 0.22 | -3.12 | 0.5500 | -0.0238 | |||

| LOPE / Grand Canyon Education, Inc. | 0.00 | -8.44 | 0.21 | -7.02 | 0.5360 | -0.0493 | |||

| SWKS / Skyworks Solutions, Inc. | 0.00 | 0.21 | 0.5338 | 0.5338 | |||||

| GNTX / Gentex Corporation | 0.01 | -0.47 | 0.21 | -12.61 | 0.5268 | -0.0824 | |||

| AVY / Avery Dennison Corporation | 0.00 | 0.20 | 0.5166 | 0.5166 | |||||

| MSM / MSC Industrial Direct Co., Inc. | 0.00 | 0.20 | 0.5114 | 0.5114 | |||||

| ALV / Autoliv, Inc. | 0.00 | -1.24 | 0.20 | -13.73 | 0.5089 | -0.0896 | |||

| FERG / Ferguson Enterprises Inc. | 0.00 | 0.20 | 0.5088 | 0.5088 | |||||

| CVS / CVS Health Corporation | 0.00 | 0.20 | 0.5087 | 0.5087 | |||||

| MMM / 3M Company | 0.00 | 0.20 | 0.5086 | 0.5086 | |||||

| LRCX / Lam Research Corporation | 0.00 | -28.28 | 0.20 | -45.21 | 0.5068 | -0.4278 | |||

| AVGO / Broadcom Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.8504 | ||||

| AME / AMETEK, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| MPLX / MPLX LP - Limited Partnership | 0.00 | -100.00 | 0.00 | -100.00 | -0.5318 | ||||

| INCY / Incyte Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.5921 | ||||

| VVV / Valvoline Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| CVX / Chevron Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| MCHP / Microchip Technology Incorporated | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| CDNS / Cadence Design Systems, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.5520 | ||||

| ETN / Eaton Corporation plc | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| LLY / Eli Lilly and Company | 0.00 | -100.00 | 0.00 | -100.00 | -0.7321 | ||||

| STX / Seagate Technology Holdings plc | 0.00 | -100.00 | 0.00 | -100.00 | -0.5523 | ||||

| VRTX / Vertex Pharmaceuticals Incorporated | 0.00 | -100.00 | 0.00 | -100.00 | -0.5817 | ||||

| IT / Gartner, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.6217 | ||||

| FERG / Ferguson Enterprises Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| TEL / TE Connectivity plc | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| ORLY / O'Reilly Automotive, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| AZO / AutoZone, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.5764 |