Mga Batayang Estadistika

| Nilai Portofolio | $ 194,566,401 |

| Posisi Saat Ini | 121 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

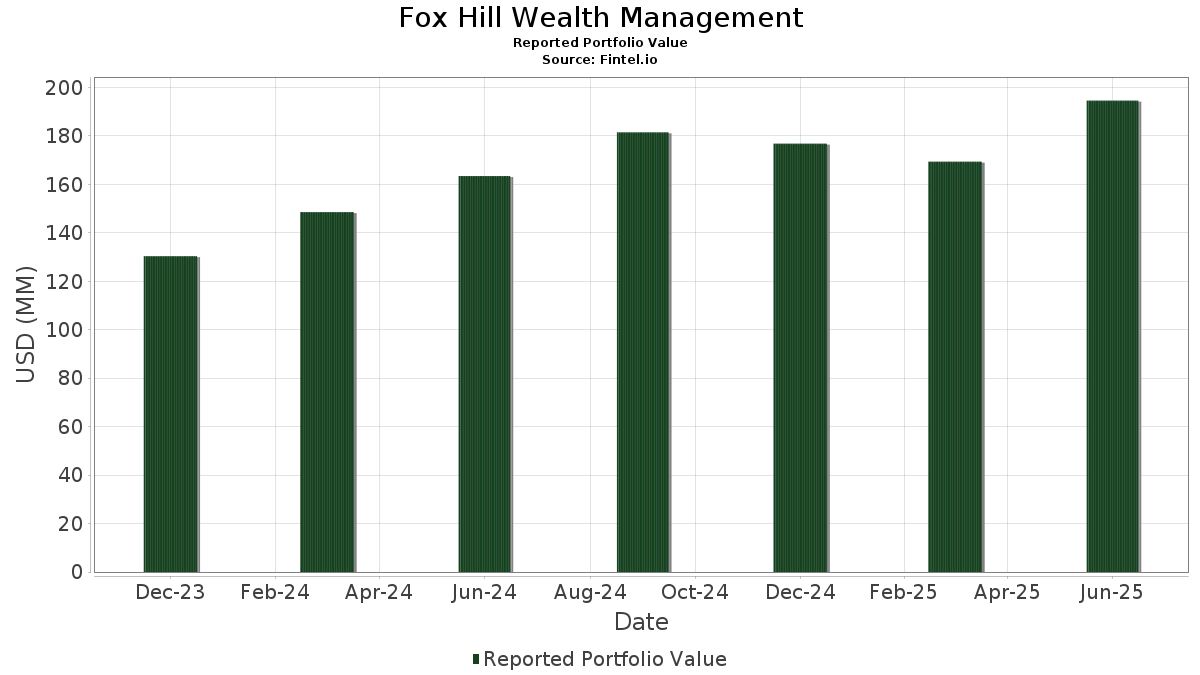

Fox Hill Wealth Management telah mengungkapkan total kepemilikan 121 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 194,566,401 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Fox Hill Wealth Management adalah Microsoft Corporation (US:MSFT) , NVIDIA Corporation (US:NVDA) , Apple Inc. (US:AAPL) , Netflix, Inc. (US:NFLX) , and Eli Lilly and Company (US:LLY) . Posisi baru Fox Hill Wealth Management meliputi: Uber Technologies, Inc. (US:UBER) , The Progressive Corporation (US:PGR) , GE Vernova Inc. (US:GEV) , CoreWeave, Inc. (US:CRWV) , and The Coca-Cola Company (US:KO) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.07 | 10.85 | 5.5779 | 2.0356 | |

| 0.12 | 4.82 | 2.4764 | 1.6877 | |

| 0.03 | 3.16 | 1.6242 | 1.6242 | |

| 0.04 | 21.02 | 10.8018 | 1.4889 | |

| 0.01 | 2.60 | 1.3377 | 1.3377 | |

| 0.01 | 2.49 | 1.2784 | 1.2784 | |

| 0.04 | 5.65 | 2.9055 | 0.9548 | |

| 0.01 | 7.40 | 3.8015 | 0.6609 | |

| 0.00 | 0.92 | 0.4708 | 0.4708 | |

| 0.01 | 0.86 | 0.4411 | 0.4411 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.04 | 8.96 | 4.6041 | -1.8540 | |

| 0.00 | 0.23 | 0.1203 | -1.4404 | |

| 0.00 | 0.28 | 0.1435 | -1.3638 | |

| 0.02 | 5.14 | 2.6419 | -0.9598 | |

| 0.01 | 7.22 | 3.7090 | -0.8403 | |

| 0.00 | 1.91 | 0.9798 | -0.7353 | |

| 0.00 | 0.83 | 0.4260 | -0.4307 | |

| 0.01 | 3.69 | 1.8982 | -0.3588 | |

| 0.03 | 3.36 | 1.7285 | -0.3571 | |

| 0.00 | 3.39 | 1.7440 | -0.2594 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-07-07 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MSFT / Microsoft Corporation | 0.04 | 0.56 | 21.02 | 33.25 | 10.8018 | 1.4889 | |||

| NVDA / NVIDIA Corporation | 0.07 | 24.09 | 10.85 | 80.90 | 5.5779 | 2.0356 | |||

| AAPL / Apple Inc. | 0.04 | -11.33 | 8.96 | -18.10 | 4.6041 | -1.8540 | |||

| NFLX / Netflix, Inc. | 0.01 | -3.17 | 7.40 | 39.05 | 3.8015 | 0.6609 | |||

| LLY / Eli Lilly and Company | 0.01 | -0.77 | 7.22 | -6.33 | 3.7090 | -0.8403 | |||

| META / Meta Platforms, Inc. | 0.01 | 2.91 | 5.79 | 31.82 | 2.9766 | 0.3822 | |||

| AMZN / Amazon.com, Inc. | 0.03 | 4.11 | 5.74 | 20.06 | 2.9500 | 0.1273 | |||

| PLTR / Palantir Technologies Inc. | 0.04 | 5.94 | 5.65 | 71.15 | 2.9055 | 0.9548 | |||

| GLD / SPDR Gold Trust | 0.02 | -20.35 | 5.14 | -15.74 | 2.6419 | -0.9598 | |||

| SMR / NuScale Power Corporation | 0.12 | 29.11 | 4.82 | 260.90 | 2.4764 | 1.6877 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.01 | 5.92 | 3.69 | -3.38 | 1.8982 | -0.3588 | |||

| ANET / Arista Networks Inc | 0.04 | 4.36 | 3.60 | 37.84 | 1.8498 | 0.3078 | |||

| APH / Amphenol Corporation | 0.03 | -6.52 | 3.43 | 40.74 | 1.7615 | 0.3237 | |||

| COST / Costco Wholesale Corporation | 0.00 | -4.46 | 3.39 | 0.00 | 1.7440 | -0.2594 | |||

| BJ / BJ's Wholesale Club Holdings, Inc. | 0.03 | 0.74 | 3.36 | -4.78 | 1.7285 | -0.3571 | |||

| DUK / Duke Energy Corporation | 0.03 | 4.11 | 3.32 | 0.73 | 1.7076 | -0.2400 | |||

| ORCL / Oracle Corporation | 0.02 | -1.83 | 3.30 | 53.53 | 1.6982 | 0.4274 | |||

| UBER / Uber Technologies, Inc. | 0.03 | 3.16 | 1.6242 | 1.6242 | |||||

| TJX / The TJX Companies, Inc. | 0.03 | 2.14 | 3.11 | 3.56 | 1.6008 | -0.1751 | |||

| VST / Vistra Corp. | 0.02 | -5.94 | 3.02 | 55.25 | 1.5515 | 0.4033 | |||

| TMUS / T-Mobile US, Inc. | 0.01 | 2.60 | 1.3377 | 1.3377 | |||||

| PANW / Palo Alto Networks, Inc. | 0.01 | 2.11 | 2.52 | 22.45 | 1.2953 | 0.0801 | |||

| NSC / Norfolk Southern Corporation | 0.01 | -0.13 | 2.52 | 7.93 | 1.2948 | -0.0833 | |||

| ETN / Eaton Corporation plc | 0.01 | 2.74 | 2.52 | 34.91 | 1.2936 | 0.1922 | |||

| PGR / The Progressive Corporation | 0.01 | 2.49 | 1.2784 | 1.2784 | |||||

| LMT / Lockheed Martin Corporation | 0.01 | 0.86 | 2.49 | 4.59 | 1.2779 | -0.1259 | |||

| XLU / The Select Sector SPDR Trust - The Utilities Select Sector SPDR Fund | 0.03 | 1.23 | 2.24 | 4.87 | 1.1508 | -0.1102 | |||

| NI / NiSource Inc. | 0.05 | 2.26 | 1.97 | 2.88 | 1.0104 | -0.1176 | |||

| SLV / iShares Silver Trust | 0.06 | -1.03 | 1.93 | 4.78 | 0.9922 | -0.0956 | |||

| NOC / Northrop Grumman Corporation | 0.00 | -32.79 | 1.91 | -34.37 | 0.9798 | -0.7353 | |||

| ETR / Entergy Corporation | 0.02 | 3.88 | 1.83 | 0.99 | 0.9416 | -0.1294 | |||

| AEE / Ameren Corporation | 0.02 | 3.52 | 1.78 | -1.00 | 0.9173 | -0.1469 | |||

| PEG / Public Service Enterprise Group Incorporated | 0.02 | 5.56 | 1.73 | 8.00 | 0.8882 | -0.0567 | |||

| FTNT / Fortinet, Inc. | 0.02 | 0.25 | 1.71 | 10.11 | 0.8792 | -0.0382 | |||

| WEC / WEC Energy Group, Inc. | 0.02 | 2.83 | 1.71 | -1.67 | 0.8771 | -0.1478 | |||

| PG / The Procter & Gamble Company | 0.01 | 0.23 | 1.67 | -6.30 | 0.8562 | -0.1935 | |||

| AVGO / Broadcom Inc. | 0.01 | -18.21 | 1.66 | 34.68 | 0.8545 | 0.1255 | |||

| MCD / McDonald's Corporation | 0.01 | 70.42 | 1.56 | 59.55 | 0.8028 | 0.2243 | |||

| POR / Portland General Electric Company | 0.04 | 7.21 | 1.51 | -2.32 | 0.7780 | -0.1371 | |||

| WMT / Walmart Inc. | 0.02 | -0.29 | 1.47 | 11.03 | 0.7558 | -0.0260 | |||

| DVY / iShares Trust - iShares Select Dividend ETF | 0.01 | 1.40 | 1.47 | 0.27 | 0.7534 | -0.1097 | |||

| NEE / NextEra Energy, Inc. | 0.02 | 4.18 | 1.45 | 2.04 | 0.7461 | -0.0940 | |||

| RTX / RTX Corporation | 0.01 | 1.13 | 1.44 | 11.50 | 0.7377 | -0.0224 | |||

| RACE / Ferrari N.V. | 0.00 | 3.86 | 1.30 | 19.14 | 0.6659 | 0.0237 | |||

| CAT / Caterpillar Inc. | 0.00 | 3.48 | 1.27 | 21.79 | 0.6525 | 0.0371 | |||

| IBM / International Business Machines Corporation | 0.00 | -3.33 | 1.24 | 14.59 | 0.6379 | -0.0016 | |||

| PCG / PG&E Corporation | 0.09 | 10.16 | 1.20 | -10.62 | 0.6191 | -0.1766 | |||

| PHO / Invesco Exchange-Traded Fund Trust - Invesco Water Resources ETF | 0.02 | -0.85 | 1.20 | 7.42 | 0.6179 | -0.0428 | |||

| DVA / DaVita Inc. | 0.01 | -2.81 | 1.18 | -9.50 | 0.6074 | -0.1636 | |||

| SMH / VanEck ETF Trust - VanEck Semiconductor ETF | 0.00 | 2.79 | 1.16 | 35.71 | 0.5958 | 0.0910 | |||

| TIP / iShares Trust - iShares TIPS Bond ETF | 0.01 | -1.40 | 1.04 | -2.35 | 0.5349 | -0.0943 | |||

| GOOGL / Alphabet Inc. | 0.01 | 0.51 | 1.04 | 14.62 | 0.5321 | -0.0015 | |||

| GEV / GE Vernova Inc. | 0.00 | 0.92 | 0.4708 | 0.4708 | |||||

| IGF / iShares Trust - iShares Global Infrastructure ETF | 0.01 | 1.08 | 0.88 | 9.41 | 0.4548 | -0.0226 | |||

| GE / General Electric Company | 0.00 | 72.11 | 0.87 | 121.74 | 0.4458 | 0.2144 | |||

| CRWV / CoreWeave, Inc. | 0.01 | 0.86 | 0.4411 | 0.4411 | |||||

| CEG / Constellation Energy Corporation | 0.00 | -24.20 | 0.85 | 21.40 | 0.4375 | 0.0233 | |||

| KO / The Coca-Cola Company | 0.01 | 0.83 | 0.4268 | 0.4268 | |||||

| MCK / McKesson Corporation | 0.00 | -47.54 | 0.83 | -42.90 | 0.4260 | -0.4307 | |||

| INSP / Inspire Medical Systems, Inc. | 0.01 | 23.76 | 0.76 | 0.80 | 0.3898 | -0.0543 | |||

| XME / SPDR Series Trust - SPDR S&P Metals & Mining ETF | 0.01 | 0.65 | 0.71 | 20.92 | 0.3655 | 0.0180 | |||

| PSQ / ProShares Trust - ProShares Short QQQ | 0.02 | 21.56 | 0.61 | 0.83 | 0.3141 | -0.0442 | |||

| OKLO / Oklo Inc. | 0.01 | 0.59 | 0.3013 | 0.3013 | |||||

| TLTW / iShares Trust - iShares 20+ Year Treasury Bond BuyWrite Strategy ETF | 0.02 | -1.26 | 0.58 | -4.96 | 0.2958 | -0.0614 | |||

| CMG / Chipotle Mexican Grill, Inc. | 0.01 | -2.78 | 0.57 | 8.71 | 0.2953 | -0.0167 | |||

| CVX / Chevron Corporation | 0.00 | -7.94 | 0.54 | -21.22 | 0.2789 | -0.1277 | |||

| QCOM / QUALCOMM Incorporated | 0.00 | 109.30 | 0.54 | 117.41 | 0.2764 | 0.1301 | |||

| IHI / iShares Trust - iShares U.S. Medical Devices ETF | 0.01 | -3.48 | 0.51 | 0.40 | 0.2604 | -0.0374 | |||

| ABT / Abbott Laboratories | 0.00 | -0.56 | 0.48 | 1.90 | 0.2479 | -0.0314 | |||

| DOG / ProShares Trust - ProShares Short Dow30 | 0.02 | 0.01 | 0.46 | -5.59 | 0.2346 | -0.0511 | |||

| US252131AK39 / CONV. NOTE | 0.47 | 0.00 | 0.46 | 0.66 | 0.2345 | -0.0332 | |||

| ADBE / Adobe Inc. | 0.00 | -18.20 | 0.45 | -17.43 | 0.2315 | -0.0908 | |||

| AVIV / American Century ETF Trust - Avantis International Large Cap Value ETF | 0.01 | -1.05 | 0.44 | 8.66 | 0.2261 | -0.0130 | |||

| HD / The Home Depot, Inc. | 0.00 | 0.00 | 0.44 | 0.23 | 0.2247 | -0.0332 | |||

| ASTS / AST SpaceMobile, Inc. | 0.01 | 1.98 | 0.44 | 110.14 | 0.2237 | 0.1011 | |||

| NVO / Novo Nordisk A/S - Depositary Receipt (Common Stock) | 0.01 | -3.52 | 0.43 | -4.06 | 0.2185 | -0.0433 | |||

| ERJ / Embraer S.A. - Depositary Receipt (Common Stock) | 0.01 | -34.92 | 0.42 | -19.81 | 0.2146 | -0.0929 | |||

| WTAI / WisdomTree Trust - WisdomTree Artificial Intelligence and Innovation Fund | 0.02 | -0.92 | 0.39 | 28.29 | 0.2006 | 0.0207 | |||

| XOM / Exxon Mobil Corporation | 0.00 | -6.12 | 0.38 | -14.93 | 0.1936 | -0.0678 | |||

| OXY / Occidental Petroleum Corporation | 0.01 | -3.74 | 0.37 | -18.08 | 0.1890 | -0.0760 | |||

| SH / ProShares Trust - ProShares Short S&P500 | 0.01 | -0.11 | 0.36 | -10.92 | 0.1846 | -0.0538 | |||

| DHR / Danaher Corporation | 0.00 | -3.13 | 0.33 | -6.52 | 0.1697 | -0.0391 | |||

| ITA / iShares Trust - iShares U.S. Aerospace & Defense ETF | 0.00 | 0.33 | 0.1696 | 0.1696 | |||||

| COIN / Coinbase Global, Inc. | 0.00 | 0.32 | 0.1668 | 0.1668 | |||||

| AIT / Applied Industrial Technologies, Inc. | 0.00 | -2.15 | 0.32 | 0.96 | 0.1633 | -0.0225 | |||

| VRTX / Vertex Pharmaceuticals Incorporated | 0.00 | 0.89 | 0.30 | -7.32 | 0.1563 | -0.0375 | |||

| RSG / Republic Services, Inc. | 0.00 | 22.71 | 0.30 | 24.69 | 0.1561 | 0.0126 | |||

| SPY / SPDR S&P 500 ETF | 0.00 | 2.58 | 0.30 | 13.46 | 0.1516 | -0.0021 | |||

| US45784PAK75 / CONV. NOTE | 0.20 | -3.76 | 0.29 | 7.06 | 0.1481 | -0.0108 | |||

| URI / United Rentals, Inc. | 0.00 | 0.00 | 0.28 | 20.00 | 0.1452 | 0.0064 | |||

| XLK / The Select Sector SPDR Trust - The Technology Select Sector SPDR Fund | 0.00 | 0.64 | 0.28 | 23.35 | 0.1441 | 0.0099 | |||

| ISRG / Intuitive Surgical, Inc. | 0.00 | -90.03 | 0.28 | -89.07 | 0.1435 | -1.3638 | |||

| XLE / The Select Sector SPDR Trust - The Energy Select Sector SPDR Fund | 0.00 | 0.62 | 0.27 | -8.67 | 0.1411 | -0.0364 | |||

| NOW / ServiceNow, Inc. | 0.00 | -54.58 | 0.25 | -41.47 | 0.1310 | -0.1256 | |||

| US94419LAM37 / CONV. NOTE | 0.25 | 0.00 | 0.25 | 1.65 | 0.1269 | -0.0161 | |||

| GOOG / Alphabet Inc. | 0.00 | -92.20 | 0.23 | -91.15 | 0.1203 | -1.4404 | |||

| BSX / Boston Scientific Corporation | 0.00 | 1.78 | 0.23 | 8.13 | 0.1166 | -0.0070 | |||

| SU / Suncor Energy Inc. | 0.01 | -11.98 | 0.23 | -14.77 | 0.1159 | -0.0405 | |||

| THNQ / Exchange Traded Concepts Trust - ROBO Global Artificial Intelligence ETF | 0.00 | 0.22 | 0.1147 | 0.1147 | |||||

| SHLD / Global X Funds - Global X Defense Tech ETF | 0.00 | 0.22 | 0.1134 | 0.1134 | |||||

| LH / Labcorp Holdings Inc. | 0.00 | 0.21 | 0.1070 | 0.1070 | |||||

| IGSB / iShares Trust - iShares 1-5 Year Investment Grade Corporate Bond ETF | 0.00 | 0.10 | 0.20 | 0.50 | 0.1047 | -0.0146 | |||

| IBIT / iShares Bitcoin Trust ETF | 0.00 | 0.20 | 0.1028 | 0.1028 | |||||

| SHOP / Shopify Inc. | 0.14 | 0.00 | 0.15 | 1.38 | 0.0757 | -0.0100 | |||

| RCAT / Red Cat Holdings, Inc. | 0.02 | -6.95 | 0.12 | 15.53 | 0.0614 | 0.0002 | |||

| US163092AF65 / CONVERTIBLE ZERO | 0.12 | 0.00 | 0.09 | -9.80 | 0.0476 | -0.0127 | |||

| SEDG / SolarEdge Technologies, Inc. | 0.09 | -6.45 | 0.08 | -5.62 | 0.0433 | -0.0098 | |||

| US707569AU31 / PENN NATIONAL GAMING INC CONV 2.75% 05/15/2026 | 0.08 | -5.00 | 0.08 | -3.70 | 0.0404 | -0.0075 | |||

| US596278AB74 / CONV. NOTE | 0.07 | -1.45 | 0.08 | -8.43 | 0.0396 | -0.0096 | |||

| US25470MAB54 / DISH Network Corp. 3.375% Bond | 0.09 | 0.00 | 0.07 | 0.00 | 0.0369 | -0.0052 | |||

| US852234AJ27 / CONVERTIBLE ZERO | 0.06 | 0.00 | 0.06 | 0.00 | 0.0313 | -0.0045 | |||

| MMT / MFS Multimarket Income Trust | 0.01 | 0.00 | 0.06 | 1.75 | 0.0299 | -0.0041 | |||

| US298736AL30 / Euronet Worldwide Inc | 0.06 | 0.00 | 0.05 | -7.41 | 0.0258 | -0.0063 | |||

| US90353TAJ97 / CONVERTIBLE ZERO | 0.03 | 0.00 | 0.03 | 13.79 | 0.0170 | -0.0006 | |||

| US29355AAK34 / CONVERTIBLE ZERO | 0.03 | 0.00 | 0.02 | -4.00 | 0.0126 | -0.0024 | |||

| US30212PBE43 / CONVERTIBLE ZERO | 0.02 | 0.00 | 0.02 | 0.00 | 0.0114 | -0.0019 | |||

| US55024UAD19 / CONV. NOTE | 0.02 | 0.00 | 0.02 | 16.67 | 0.0109 | -0.0001 | |||

| US87918AAF21 / CONV. NOTE | 0.02 | 0.00 | 0.02 | 0.00 | 0.0099 | -0.0014 | |||

| US819047AB70 / CONVERTIBLE ZERO | 0.02 | 0.00 | 0.02 | 20.00 | 0.0093 | 0.0000 | |||

| US679295AD75 / Okta Inc | 0.01 | 0.00 | 0.01 | 0.00 | 0.0066 | -0.0009 | |||

| US94419LAF85 / CONV. NOTE | 0.01 | 0.00 | 0.01 | 0.00 | 0.0063 | -0.0008 | |||

| CAVA / CAVA Group, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| US122017AB26 / CONV. NOTE | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| US98980GAB86 / CONV. NOTE | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| US63845RAB33 / CONV. NOTE | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| US457669AB50 / INSMED INC CONV 0.75% 06/01/2028 | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| US09857LAN82 / CONV. NOTE | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| US98954MAH43 / ZILLOW GROUP INC CONV 2.75% 05/15/2025 | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| IQ / iQIYI, Inc. - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | -100.00 | -0.0659 | ||||

| US844741BG22 / Southwest Airlines Co | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| US009066AB74 / CONVERTIBLE ZERO | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| US156727AB58 / Cerence Inc | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| US697435AF27 / CONV. NOTE | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| US23804LAB99 / CONV. NOTE | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| US753422AD66 / CONV. NOTE | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| ALL / The Allstate Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| US090043AB64 / CONVERTIBLE ZERO | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| US55087PAB04 / CONV. NOTE | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| US338307AD33 / CONV. NOTE | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| US443573AD20 / CONV. NOTE | 0.00 | -100.00 | 0.00 | 0.0000 |