Mga Batayang Estadistika

| Nilai Portofolio | $ 2,692,902,390 |

| Posisi Saat Ini | 252 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

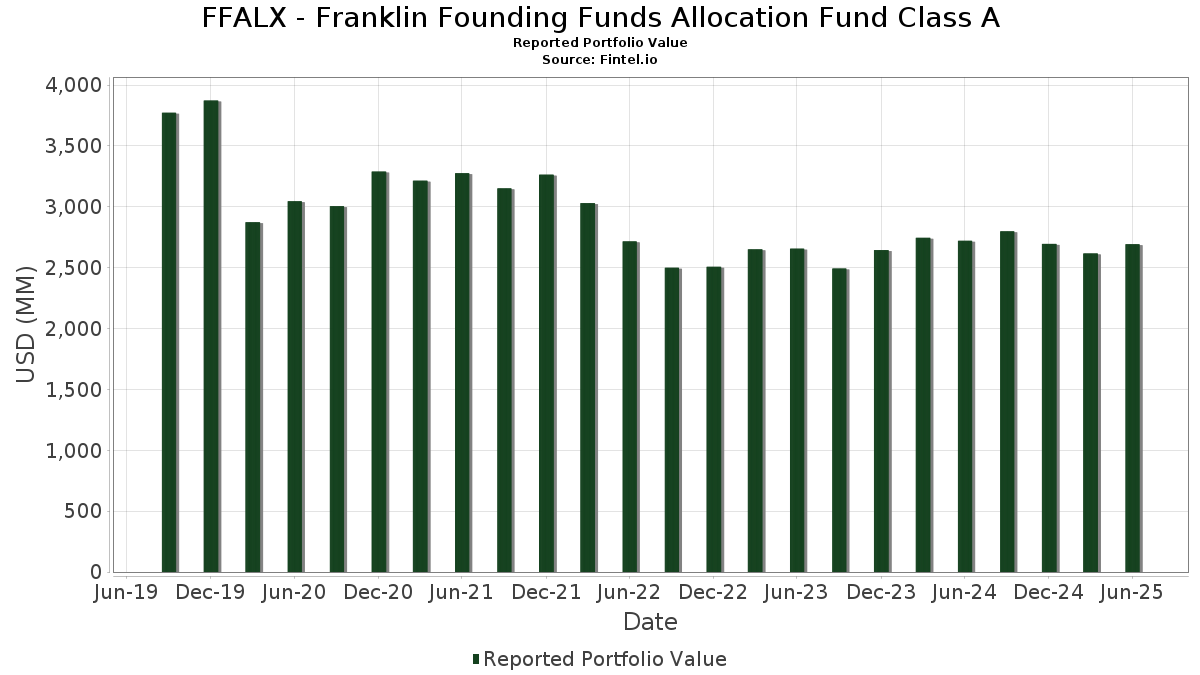

FFALX - Franklin Founding Funds Allocation Fund Class A telah mengungkapkan total kepemilikan 252 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 2,692,902,390 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama FFALX - Franklin Founding Funds Allocation Fund Class A adalah Institutional Fiduciary Trust - Institutional Fiduciary Trust Money Market Portfolio (US:INFXX) , NVIDIA Corporation (US:NVDA) , Apple Inc. (US:AAPL) , Microsoft Corporation (US:MSFT) , and Booking Holdings Inc. (US:BKNG) . Posisi baru FFALX - Franklin Founding Funds Allocation Fund Class A meliputi: Bundesrepublik Deutschland Bundesanleihe (DE:DE0001102598) , UK TSY GILT (GB:GB00BL6C7720) , UNITED KINGDOM GILT /GBP/ REGD REG S 4.62500000 (GB:GB00BPJJKN53) , AIB Group plc (IE:A5G) , and Canadian Government Bond (CA:CA135087P329) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 156.37 | 156.37 | 5.6563 | 5.3147 | |

| 21.06 | 0.7618 | 0.7618 | ||

| 2.43 | 20.08 | 0.7264 | 0.7264 | |

| 15.20 | 0.5497 | 0.5497 | ||

| 13.13 | 0.4751 | 0.4751 | ||

| 13.05 | 0.4721 | 0.4721 | ||

| 12.18 | 0.4408 | 0.4408 | ||

| 12.18 | 0.4408 | 0.4408 | ||

| 0.01 | 12.29 | 0.4445 | 0.3915 | |

| 0.48 | 75.20 | 2.7201 | 0.3860 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 13.96 | 0.5051 | -1.4072 | ||

| 18.24 | 0.6599 | -0.9716 | ||

| 25.15 | 0.9096 | -0.8787 | ||

| 0.34 | 69.02 | 2.4966 | -0.7199 | |

| 0.45 | 9.96 | 0.3604 | -0.7102 | |

| 0.29 | 8.29 | 0.2997 | -0.5394 | |

| 0.07 | 8.41 | 0.3041 | -0.3764 | |

| 0.01 | 3.96 | 0.1434 | -0.3496 | |

| 0.20 | 37.08 | 1.3413 | -0.3112 | |

| 0.01 | 3.78 | 0.1366 | -0.2792 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-26 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| INFXX / Institutional Fiduciary Trust - Institutional Fiduciary Trust Money Market Portfolio | 156.37 | 1,635.93 | 156.37 | 1,636.05 | 5.6563 | 5.3147 | |||

| NVDA / NVIDIA Corporation | 0.48 | -16.19 | 75.20 | 22.17 | 2.7201 | 0.3860 | |||

| AAPL / Apple Inc. | 0.34 | -11.90 | 69.02 | -18.63 | 2.4966 | -0.7199 | |||

| MSFT / Microsoft Corporation | 0.13 | -5.02 | 62.21 | 25.85 | 2.2504 | 0.3758 | |||

| BKNG / Booking Holdings Inc. | 0.01 | 0.00 | 54.40 | 25.66 | 1.9677 | 0.3262 | |||

| FLSP / Franklin Templeton ETF Trust - Franklin Systematic Style Premia ETF | 2.23 | 0.00 | 53.62 | -1.83 | 1.9397 | -0.1318 | |||

| JNJ / Johnson & Johnson | 0.29 | 0.00 | 44.30 | -7.89 | 1.6025 | -0.2214 | |||

| GOOGL / Alphabet Inc. | 0.23 | -13.72 | 39.76 | -1.68 | 1.4384 | -0.0953 | |||

| ABBV / AbbVie Inc. | 0.20 | -3.95 | 37.08 | -14.91 | 1.3413 | -0.3112 | |||

| META / Meta Platforms, Inc. | 0.05 | 0.00 | 37.01 | 28.06 | 1.3389 | 0.2428 | |||

| DE0001102598 / Bundesrepublik Deutschland Bundesanleihe | 36.01 | 10.68 | 1.3026 | 0.0687 | |||||

| MO / Altria Group, Inc. | 0.57 | -10.79 | 33.57 | -12.85 | 1.2145 | -0.2465 | |||

| AMZN / Amazon.com, Inc. | 0.15 | -16.48 | 33.14 | -3.69 | 1.1989 | -0.1062 | |||

| UCG / UniCredit S.p.A. | 0.47 | 0.00 | 31.61 | 19.51 | 1.1435 | 0.1404 | |||

| GB00BL6C7720 / UK TSY GILT | 31.50 | 6.86 | 1.1393 | 0.0217 | |||||

| KLAC / KLA Corporation | 0.03 | 0.00 | 30.13 | 31.77 | 1.0898 | 0.2227 | |||

| Franklin BSP Private Credit Fund, Class Advisor / (US35242N2027) | 2.78 | 0.00 | 29.42 | 0.10 | 1.0644 | -0.0504 | |||

| NFLX / Netflix, Inc. | 0.02 | -13.55 | 29.04 | 24.14 | 1.0506 | 0.1634 | |||

| FVJ / Fortescue Ltd | 2.88 | 0.00 | 28.97 | 3.86 | 1.0479 | -0.0099 | |||

| U.S. Treasury Notes / DBT (US91282CJW29) | 25.15 | -46.68 | 0.9096 | -0.8787 | |||||

| WMB / The Williams Companies, Inc. | 0.38 | 0.00 | 23.95 | 5.10 | 0.8664 | 0.0022 | |||

| CSCO / Cisco Systems, Inc. | 0.32 | 0.00 | 22.12 | 12.43 | 0.8003 | 0.0541 | |||

| GB00BPJJKN53 / UNITED KINGDOM GILT /GBP/ REGD REG S 4.62500000 | 21.16 | 7.92 | 0.7653 | 0.0219 | |||||

| U.S. Treasury Notes / DBT (US91282CNE74) | 21.06 | 0.7618 | 0.7618 | ||||||

| ABT / Abbott Laboratories | 0.15 | 0.00 | 20.97 | 2.53 | 0.7584 | -0.0170 | |||

| A5G / AIB Group plc | 2.43 | 20.08 | 0.7264 | 0.7264 | |||||

| EMLC / VanEck ETF Trust - VanEck J.P. Morgan EM Local Currency Bond ETF | 0.77 | 0.00 | 19.60 | 6.24 | 0.7091 | 0.0094 | |||

| SU / Suncor Energy Inc. | 0.52 | 0.00 | 19.51 | -3.26 | 0.7057 | -0.0590 | |||

| C / Citigroup Inc. | 0.23 | -20.08 | 19.45 | -4.17 | 0.7037 | -0.0661 | |||

| 5831 / Shizuoka Financial Group,Inc. | 19.16 | 4.96 | 0.6930 | 0.0009 | |||||

| 9999 / NetEase, Inc. | 0.71 | 0.00 | 19.10 | 31.19 | 0.6910 | 0.1388 | |||

| CA135087P329 / Canadian Government Bond | 19.08 | 3.96 | 0.6903 | -0.0058 | |||||

| AZO / AutoZone, Inc. | 0.01 | 0.00 | 18.88 | -2.64 | 0.6828 | -0.0524 | |||

| INFY / Infosys Limited - Depositary Receipt (Common Stock) | 0.99 | 0.00 | 18.40 | 1.53 | 0.6655 | -0.0216 | |||

| U.S. Treasury Notes / DBT (US91282CLF67) | 18.37 | -24.72 | 0.6645 | -0.2608 | |||||

| U.S. Treasury Notes / DBT (US91282CLF67) | 18.37 | -24.72 | 0.6645 | -0.2608 | |||||

| RCRIT N / Recruit Holdings Co., Ltd. | 0.31 | 0.00 | 18.32 | 13.50 | 0.6626 | 0.0506 | |||

| US91282CFF32 / United States Treasury Note/Bond | 18.24 | -57.60 | 0.6599 | -0.9716 | |||||

| PODD / Insulet Corporation | 0.06 | -8.67 | 17.89 | 9.27 | 0.6470 | 0.0262 | |||

| DE0001102507 / Bundesrepublik Deutschland Bundesanleihe | 17.57 | 10.47 | 0.6356 | 0.0324 | |||||

| 2454 / MediaTek Inc. | 0.41 | 0.00 | 17.53 | -0.58 | 0.6339 | -0.0346 | |||

| GB00B1VWPJ53 / United Kingdom Gilt | 17.19 | 7.32 | 0.6220 | 0.0144 | |||||

| US3132DWJE49 / Freddie Mac Pool | 17.07 | -1.83 | 0.6174 | -0.0419 | |||||

| AVGO / Broadcom Inc. | 0.06 | 3.07 | 16.80 | 69.71 | 0.6076 | 0.2323 | |||

| Asian Development Bank / DBT (US045167GE77) | 16.59 | -0.19 | 0.6002 | -0.0302 | |||||

| V / Visa Inc. | 0.05 | 0.00 | 16.28 | 1.31 | 0.5888 | -0.0205 | |||

| MELI / MercadoLibre, Inc. | 0.01 | 0.00 | 15.38 | 33.98 | 0.5564 | 0.1210 | |||

| CA135087Q491 / CANADIAN GOVERNMENT 3.250000% 09/01/2028 | 15.37 | 4.93 | 0.5562 | 0.0005 | |||||

| US912828ZQ64 / United States Treasury Note/Bond - When Issued | 15.20 | 0.5497 | 0.5497 | ||||||

| MA / Mastercard Incorporated | 0.03 | 0.00 | 15.14 | 2.53 | 0.5477 | -0.0124 | |||

| IGQ5 / 3i Group plc | 0.27 | 15.72 | 15.02 | 39.28 | 0.5434 | 0.1344 | |||

| 000270 / Kia Corporation | 0.21 | 191.02 | 14.75 | 229.24 | 0.5336 | 0.3637 | |||

| KR / The Kroger Co. | 0.20 | 0.00 | 14.23 | 5.97 | 0.5146 | 0.0055 | |||

| ISP / Intesa Sanpaolo S.p.A. | 2.47 | -31.65 | 14.22 | -23.60 | 0.5144 | -0.1915 | |||

| U.S. Treasury Bonds / DBT (US912810UD80) | 13.96 | -72.31 | 0.5051 | -1.4072 | |||||

| IAG / iA Financial Corporation Inc. | 0.12 | 0.00 | 13.67 | 15.44 | 0.4943 | 0.0454 | |||

| CA135087Q236 / Canadian Government Bond | 13.63 | 3.75 | 0.4929 | -0.0052 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 13.63 | -5.54 | 0.4929 | -0.0541 | |||||

| TKY / Tokyo Electron Limited | 0.07 | 0.00 | 13.42 | 39.66 | 0.4856 | 0.1211 | |||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 13.13 | 0.4751 | 0.4751 | ||||||

| GWW / W.W. Grainger, Inc. | 0.01 | 0.00 | 13.06 | 5.30 | 0.4725 | 0.0021 | |||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 13.05 | 0.4721 | 0.4721 | ||||||

| SEIC / SEI Investments Company | 0.14 | 0.00 | 12.82 | 15.75 | 0.4639 | 0.0438 | |||

| LBLCF / Loblaw Companies Limited | 0.08 | 0.00 | 12.60 | 18.04 | 0.4559 | 0.0510 | |||

| IDXX / IDEXX Laboratories, Inc. | 0.02 | 0.00 | 12.54 | 27.71 | 0.4538 | 0.0813 | |||

| PETR4 / Petróleo Brasileiro S.A. - Petrobras - Preferred Stock | 1.99 | 0.00 | 12.52 | -12.28 | 0.4527 | -0.0884 | |||

| DP4B / A.P. Møller - Mærsk A/S | 0.01 | 742.86 | 12.29 | 770.87 | 0.4445 | 0.3915 | |||

| DE0001174068 / CHINA UNIVERSAL EX INC | 12.18 | 0.4408 | 0.4408 | ||||||

| DE0001174068 / CHINA UNIVERSAL EX INC | 12.18 | 0.4408 | 0.4408 | ||||||

| FICO / Fair Isaac Corporation | 0.01 | 0.00 | 12.04 | -0.88 | 0.4356 | -0.0251 | |||

| WMT / Walmart Inc. | 0.12 | 0.00 | 11.46 | 11.38 | 0.4146 | 0.0244 | |||

| CHKP / Check Point Software Technologies Ltd. | 0.05 | 204.94 | 10.80 | 341.69 | 0.3905 | 0.2987 | |||

| DBK / Deutsche Bank Aktiengesellschaft | 0.36 | 0.00 | 10.57 | 24.37 | 0.3824 | 0.0601 | |||

| TSLA / Tesla, Inc. | 0.03 | -23.86 | 10.56 | -6.67 | 0.3819 | -0.0471 | |||

| ITSA4 / Itaúsa S.A. - Preferred Stock | 5.12 | 0.00 | 10.32 | 21.71 | 0.3733 | 0.0517 | |||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 0.04 | 0.00 | 10.14 | 36.44 | 0.3667 | 0.0849 | |||

| 5831 / Shizuoka Financial Group,Inc. | 10.01 | 0.3623 | 0.3623 | ||||||

| INGA / ING Groep N.V. - Depositary Receipt (Common Stock) | 0.45 | -68.45 | 9.96 | -64.71 | 0.3604 | -0.7102 | |||

| TXN / Texas Instruments Incorporated | 0.05 | 0.00 | 9.92 | 15.54 | 0.3589 | 0.0332 | |||

| Chobani Holdco II LLC / DBT (US169918AA77) | 9.67 | 2.65 | 0.3497 | -0.0074 | |||||

| ANET / Arista Networks Inc | 0.09 | 0.00 | 9.55 | 32.06 | 0.3453 | 0.0712 | |||

| GILD / Gilead Sciences, Inc. | 0.08 | 0.00 | 9.38 | -1.05 | 0.3393 | -0.0202 | |||

| RYSD / NatWest Group plc | 1.32 | 80.45 | 9.26 | 114.65 | 0.3350 | 0.1714 | |||

| DTE / Deutsche Telekom AG | 0.25 | -14.53 | 9.26 | -15.27 | 0.3350 | -0.0795 | |||

| MTG / MGIC Investment Corporation | 0.33 | 0.00 | 9.14 | 12.35 | 0.3305 | 0.0221 | |||

| NRG / NRG Energy, Inc. | 0.06 | 0.00 | 9.12 | 68.23 | 0.3300 | 0.1244 | |||

| US92556HAB33 / ViacomCBS Inc | 9.09 | 1.18 | 0.3288 | -0.0119 | |||||

| BBSE3 / BB Seguridade Participações S.A. | 1.38 | 359.35 | 9.08 | 335.43 | 0.3286 | 0.2502 | |||

| US904678AY53 / UniCredit SpA | 8.96 | 1.75 | 0.3242 | -0.0098 | |||||

| ABBVD / AbbVie Inc. - Depositary Receipt (Common Stock) | 8.84 | -1.00 | 0.3199 | -0.0189 | |||||

| NOVN / Novartis AG | 0.07 | 0.00 | 8.72 | 9.27 | 0.3155 | 0.0128 | |||

| 3034 / Novatek Microelectronics Corp. | 0.47 | 0.00 | 8.69 | 12.20 | 0.3144 | 0.0206 | |||

| US595620AP00 / MidAmerican Energy Co. | 8.63 | 0.01 | 0.3121 | -0.0150 | |||||

| ODFL / Old Dominion Freight Line, Inc. | 0.05 | 0.00 | 8.58 | -1.91 | 0.3102 | -0.0213 | |||

| GSK / GSK plc | 0.45 | 0.00 | 8.51 | -0.22 | 0.3080 | -0.0156 | |||

| XRO / Xero Limited | 0.07 | 0.00 | 8.48 | 21.05 | 0.3066 | 0.0411 | |||

| BABA / Alibaba Group Holding Limited - Depositary Receipt (Common Stock) | 0.07 | -45.38 | 8.41 | -53.15 | 0.3041 | -0.3764 | |||

| AU0000101792 / AUSTRALIAN GOVERNMENT BONDS REGS 11/31 1 | 8.32 | 8.47 | 0.3010 | 0.0101 | |||||

| LULU / lululemon athletica inc. | 0.03 | 0.00 | 8.30 | -16.07 | 0.3004 | -0.0748 | |||

| HIA1 / Hitachi, Ltd. | 0.29 | -69.75 | 8.29 | -62.55 | 0.2997 | -0.5394 | |||

| US55037AAB44 / Lundin Energy Finance BV | 8.21 | 1.42 | 0.2971 | -0.0100 | |||||

| NOW / ServiceNow, Inc. | 0.01 | 0.00 | 8.16 | 29.13 | 0.2951 | 0.0555 | |||

| 005930 / Samsung Electronics Co., Ltd. | 0.18 | 99.50 | 8.11 | 90.39 | 0.2933 | 0.1420 | |||

| CTAS / Cintas Corporation | 0.04 | 0.00 | 7.91 | 8.45 | 0.2861 | 0.0095 | |||

| 002271 / Beijing Oriental Yuhong Waterproof Technology Co., Ltd. | 5.07 | 0.00 | 7.60 | -20.33 | 0.2750 | -0.0868 | |||

| RR. / Rolls-Royce Holdings plc | 0.57 | -52.82 | 7.57 | 16.22 | 0.2737 | 0.0384 | |||

| PTOTETOE0012 / Portugal Obrigacoes do Tesouro OT | 7.50 | 8.84 | 0.2712 | 0.0100 | |||||

| US378272AY43 / Glencore Funding LLC 2.50%, Due 09/01/2030 | 7.34 | 2.39 | 0.2655 | -0.0063 | |||||

| AD / Koninklijke Ahold Delhaize N.V. | 0.18 | 0.00 | 7.33 | 11.82 | 0.2653 | 0.0165 | |||

| IBE / Iberdrola, S.A. | 0.38 | 0.00 | 7.21 | 19.12 | 0.2610 | 0.0313 | |||

| CL / Colgate-Palmolive Company | 0.08 | 0.00 | 7.15 | -2.99 | 0.2585 | -0.0208 | |||

| JPM / JPMorgan Chase & Co. | 0.02 | -20.89 | 7.14 | -6.51 | 0.2581 | -0.0313 | |||

| Crescent Energy Finance LLC / DBT (US45344LAE39) | 7.13 | 0.2578 | 0.2578 | ||||||

| ACO5 / Atlas Copco AB (publ) | 0.50 | 0.00 | 7.10 | 1.21 | 0.2568 | -0.0092 | |||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 7.09 | -2.65 | 0.2565 | -0.0197 | |||||

| US04505AAA79 / Ashtead Capital Inc | 7.07 | 1.67 | 0.2559 | -0.0080 | |||||

| MTD / Mettler-Toledo International Inc. | 0.01 | 0.00 | 7.00 | -0.53 | 0.2533 | -0.0136 | |||

| US03938LBC72 / ArcelorMittal SA | 6.90 | 1.14 | 0.2495 | -0.0091 | |||||

| SPG / Simon Property Group, Inc. | 0.04 | 0.00 | 6.79 | -3.19 | 0.2455 | -0.0204 | |||

| CND10005QTD8 / China Government Bond | 6.75 | 1.44 | 0.2441 | -0.0082 | |||||

| US874060AW64 / Takeda Pharmaceutical Co Ltd | 6.62 | 0.58 | 0.2396 | -0.0102 | |||||

| US82620KAL70 / Siemens Financieringsmaatschappij NV | 6.60 | 0.47 | 0.2389 | -0.0104 | |||||

| FLIN / Franklin Templeton ETF Trust - Franklin FTSE India ETF | 0.17 | 0.00 | 6.57 | 8.11 | 0.2378 | 0.0072 | |||

| PLTR / Palantir Technologies Inc. | 0.05 | 6.55 | 0.2369 | 0.2369 | |||||

| PINS / Pinterest, Inc. | 0.18 | 0.00 | 6.52 | 15.69 | 0.2358 | 0.0221 | |||

| BRSTNCNTB4U6 / BRAZIL 6.0% 8/15/2026 (FTIPS) | 6.41 | 4.31 | 0.2319 | -0.0012 | |||||

| VOD / Vodafone Group Public Limited Company | 5.94 | 0.00 | 6.36 | 13.92 | 0.2300 | 0.0183 | |||

| US136385AX99 / Canadian Natural Resources Ltd | 6.34 | 0.64 | 0.2293 | -0.0095 | |||||

| US01609WAT99 / Alibaba Group Holding Ltd | 6.19 | 0.95 | 0.2240 | -0.0087 | |||||

| RS / Reliance, Inc. | 0.02 | 0.00 | 6.16 | 8.72 | 0.2229 | 0.0079 | |||

| ADBE / Adobe Inc. | 0.02 | 0.00 | 6.14 | 0.87 | 0.2222 | -0.0087 | |||

| Cerdia Finanz GmbH / DBT (US15679GAC69) | 6.05 | 0.2189 | 0.2189 | ||||||

| GOB / Compagnie de Saint-Gobain S.A. | 0.05 | 0.00 | 5.93 | 17.93 | 0.2144 | 0.0238 | |||

| FR0014002WK3 / French Republic Government Bond OAT | 5.72 | 11.26 | 0.2069 | 0.0119 | |||||

| AMI / Aurelia Metals Limited | 5.68 | 10.02 | 0.2054 | 0.0097 | |||||

| MBG / Mercedes-Benz Group AG | 0.10 | 0.00 | 5.67 | -1.37 | 0.2051 | -0.0129 | |||

| PXT / Parex Resources Inc. | 0.55 | 0.00 | 5.64 | 9.54 | 0.2040 | 0.0088 | |||

| NN / NN Group N.V. | 0.08 | 0.00 | 5.63 | 19.60 | 0.2038 | 0.0251 | |||

| IL0011974909 / Oddity Tech Ltd | 0.07 | 0.00 | 5.57 | 74.48 | 0.2014 | 0.0804 | |||

| 6B6 / monday.com Ltd. | 0.02 | 0.00 | 5.55 | 29.34 | 0.2006 | 0.0380 | |||

| RHP Hotel Properties LP / RHP Finance Corp. / DBT (US749571AL97) | 5.51 | 0.1992 | 0.1992 | ||||||

| FR0013359239 / Orange SA | 5.49 | 0.1986 | 0.1986 | ||||||

| US251526CD98 / Deutsche Bank AG/New York NY | 5.44 | 1.72 | 0.1969 | -0.0060 | |||||

| 8630 / Sompo Holdings, Inc. | 0.18 | 0.00 | 5.40 | -1.03 | 0.1952 | -0.0116 | |||

| US00774MAV72 / AerCap Ireland Capital DAC / AerCap Global Aviation Trust | 5.39 | 0.82 | 0.1948 | -0.0077 | |||||

| UNA / Unilever PLC | 0.09 | 0.00 | 5.37 | 2.28 | 0.1944 | -0.0049 | |||

| GE / General Electric Company | 0.02 | 0.00 | 5.33 | 28.59 | 0.1926 | 0.0356 | |||

| RL / Ralph Lauren Corporation | 0.02 | 0.00 | 5.29 | 24.28 | 0.1913 | 0.0299 | |||

| 5Y0 / Kuaishou Technology | 0.65 | 0.00 | 5.24 | 15.75 | 0.1896 | 0.0179 | |||

| FR0012993103 / French Republic Government Bond OAT | 5.21 | 10.54 | 0.1886 | 0.0097 | |||||

| US20030NDH17 / Comcast Corp | 5.21 | 1.22 | 0.1885 | -0.0067 | |||||

| US71654QCG55 / Petroleos Mexicanos | 5.20 | 1.50 | 0.1882 | -0.0062 | |||||

| TEX / Terex Corporation | 5.19 | 3.24 | 0.1877 | -0.0029 | |||||

| US912810SN90 / UNITED STATES TREASURY BOND 1.25% 05/15/2050 | 5.18 | 0.1873 | 0.1873 | ||||||

| 857 / PetroChina Company Limited | 5.95 | 5.12 | 0.1854 | 0.1854 | |||||

| U.S. Treasury Bonds / DBT (US912810UK24) | 5.12 | 0.1853 | 0.1853 | ||||||

| US3132DWHS52 / FEDERAL HOME LOAN MORTGAGE CORPORATION | 5.05 | -1.69 | 0.1827 | -0.0121 | |||||

| 4507 / Shionogi & Co., Ltd. | 0.28 | 0.00 | 5.04 | 19.24 | 0.1823 | 0.0220 | |||

| FLHY / Franklin Templeton ETF Trust - Franklin High Yield Corporate ETF | 0.20 | 0.00 | 4.99 | 2.17 | 0.1806 | -0.0047 | |||

| EXPD / Expeditors International of Washington, Inc. | 0.04 | 0.00 | 4.98 | -4.98 | 0.1800 | -0.0186 | |||

| FUH / Subaru Corporation | 0.28 | 46.03 | 4.88 | 41.37 | 0.1767 | 0.0456 | |||

| ND5 / Nitto Denko Corporation | 0.25 | 0.00 | 4.87 | 4.40 | 0.1760 | -0.0007 | |||

| BE0000354630 / Kingdom of Belgium Government Bond | 4.83 | 10.96 | 0.1747 | 0.0096 | |||||

| BRK.B / Berkshire Hathaway Inc. | 0.01 | -4.23 | 4.68 | -12.65 | 0.1694 | -0.0339 | |||

| TEAM / Atlassian Corporation | 0.02 | 0.00 | 4.67 | -4.28 | 0.1689 | -0.0161 | |||

| US046353AT52 / AstraZeneca PLC | 4.63 | 0.72 | 0.1676 | -0.0069 | |||||

| US980236AQ66 / Woodside Finance Ltd | 4.60 | 0.13 | 0.1663 | -0.0078 | |||||

| 5831 / Shizuoka Financial Group,Inc. | 4.51 | 0.1633 | 0.1633 | ||||||

| LMT / Lockheed Martin Corporation | 0.01 | 0.00 | 4.51 | 3.68 | 0.1631 | -0.0018 | |||

| US46590XAM83 / JBS USA LUX SA/JBS FOOD CO/JBS USA | 4.48 | 1.87 | 0.1619 | -0.0047 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 4.44 | -4.60 | 0.1607 | -0.0159 | |||||

| 5803 / Fujikura Ltd. | 0.08 | 0.00 | 4.41 | 42.06 | 0.1595 | 0.0418 | |||

| DASH / DoorDash, Inc. | 0.02 | 0.00 | 4.27 | 34.90 | 0.1544 | 0.0344 | |||

| RIG2 / Richter Gedeon Vegyészeti Gyár Nyilvánosan Muködo Rt. | 0.14 | 0.00 | 4.21 | 7.02 | 0.1521 | 0.0031 | |||

| DKS / DICK'S Sporting Goods, Inc. | 0.02 | 0.00 | 4.16 | -1.86 | 0.1504 | -0.0103 | |||

| FAST / Fastenal Company | 0.10 | 100.00 | 4.08 | 8.31 | 0.1475 | 0.0047 | |||

| US3132DWBY84 / Freddie Mac Pool | 4.06 | 0.1469 | 0.1469 | ||||||

| SPF / Spotify Technology S.A. | 0.01 | 4.06 | 0.1469 | 0.1469 | |||||

| HRI / Herc Holdings Inc. | 4.05 | 0.1465 | 0.1465 | ||||||

| 3064 / MonotaRO Co., Ltd. | 0.20 | 0.00 | 4.01 | 5.36 | 0.1452 | 0.0008 | |||

| CAT / Caterpillar Inc. | 0.01 | -74.10 | 3.96 | -69.51 | 0.1434 | -0.3496 | |||

| LLY / Eli Lilly and Company | 0.00 | -40.02 | 3.89 | -43.39 | 0.1406 | -0.1198 | |||

| 1925 / Daiwa House Industry Co., Ltd. | 0.11 | 0.00 | 3.88 | 3.88 | 0.1405 | -0.0013 | |||

| REL N / RELX PLC | 0.07 | 0.00 | 3.86 | 7.89 | 0.1395 | 0.0040 | |||

| BEZQ / Bezeq The Israel Telecommunication Corp. Ltd | 2.22 | 0.00 | 3.79 | 15.74 | 0.1370 | 0.0129 | |||

| ERIE / Erie Indemnity Company | 0.01 | -58.38 | 3.78 | -65.56 | 0.1366 | -0.2792 | |||

| 3P7 / Pandora A/S | 0.02 | 0.00 | 3.77 | 14.96 | 0.1365 | 0.0120 | |||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 3.77 | -1.83 | 0.1362 | -0.0093 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 3.77 | -1.83 | 0.1362 | -0.0093 | |||||

| PKY1 / Orlen S.A. | 0.16 | 3.72 | 0.1347 | 0.1347 | |||||

| ADANIENSOL / Adani Energy Solutions Limited | 3.67 | 9.29 | 0.1328 | 0.0054 | |||||

| ADANIENSOL / Adani Energy Solutions Limited | 3.67 | 9.29 | 0.1328 | 0.0054 | |||||

| ASMLF / ASML Holding N.V. | 0.00 | 0.00 | 3.67 | 21.09 | 0.1327 | 0.0178 | |||

| US3140XJT942 / FNCL UMBS 3.0 FS3275 04-01-52 | 3.67 | -2.50 | 0.1327 | -0.0100 | |||||

| LRCX / Lam Research Corporation | 0.04 | 0.00 | 3.62 | 33.93 | 0.1310 | 0.0284 | |||

| YAL / Yancoal Australia Ltd | 0.95 | 3.61 | 0.1305 | 0.1305 | |||||

| HIW / Highwoods Properties, Inc. | 0.12 | 0.00 | 3.58 | 4.89 | 0.1296 | 0.0001 | |||

| XP / XP Inc. | 0.18 | 3.57 | 0.1293 | 0.1293 | |||||

| QCOM / QUALCOMM Incorporated | 0.02 | 0.00 | 3.56 | 3.67 | 0.1286 | -0.0014 | |||

| PINC / Premier, Inc. | 0.16 | 0.00 | 3.55 | 13.73 | 0.1283 | 0.0100 | |||

| IDEXY / Industria de Diseño Textil, S.A. - Depositary Receipt (Common Stock) | 0.07 | 0.00 | 3.53 | 4.78 | 0.1276 | -0.0001 | |||

| PYPL / PayPal Holdings, Inc. | 0.05 | 0.00 | 3.53 | 13.88 | 0.1276 | 0.0102 | |||

| US00774MAY12 / AerCap Ireland Capital DAC / AerCap Global Aviation Trust | 3.49 | 2.17 | 0.1263 | -0.0033 | |||||

| CDNS / Cadence Design Systems, Inc. | 0.01 | 0.00 | 3.49 | 21.15 | 0.1262 | 0.0170 | |||

| SHOP / Shopify Inc. | 0.03 | -16.97 | 3.49 | -10.04 | 0.1261 | -0.0168 | |||

| MAT / Mattel, Inc. | 0.18 | 0.00 | 3.47 | 1.49 | 0.1255 | -0.0041 | |||

| US251526CE71 / DEUTSCHE BANK AG NEW YORK BNCH 2.129%/VAR 11/24/2026 | 3.46 | 0.79 | 0.1250 | -0.0050 | |||||

| DBX / Dropbox, Inc. | 0.12 | 0.00 | 3.40 | 7.09 | 0.1230 | 0.0026 | |||

| CTSH / Cognizant Technology Solutions Corporation | 0.04 | 0.00 | 3.39 | 1.98 | 0.1228 | -0.0034 | |||

| CNSWF / Constellation Software Inc. | 0.00 | 3.38 | 0.1222 | 0.1222 | |||||

| ITW / Illinois Tool Works Inc. | 0.01 | 0.00 | 3.37 | -0.33 | 0.1219 | -0.0063 | |||

| CTVA / Corteva, Inc. | 0.05 | 3.37 | 0.1218 | 0.1218 | |||||

| 1919 / COSCO SHIPPING Holdings Co., Ltd. | 1.93 | 3.37 | 0.1218 | 0.1218 | |||||

| AMAT / Applied Materials, Inc. | 0.02 | 0.00 | 3.35 | 26.16 | 0.1211 | 0.0205 | |||

| KMB / Kimberly-Clark Corporation | 0.03 | 0.00 | 3.34 | -9.35 | 0.1209 | -0.0189 | |||

| STE / STERIS plc | 0.01 | 3.31 | 0.1196 | 0.1196 | |||||

| JBSS32 / JBS N.V. - Depositary Receipt (Common Stock) | 0.23 | 3.29 | 0.1191 | 0.1191 | |||||

| GM / General Motors Company | 0.07 | 0.00 | 3.21 | 4.62 | 0.1163 | -0.0002 | |||

| LOW / Lowe's Companies, Inc. | 0.01 | 0.00 | 3.03 | -4.86 | 0.1098 | -0.0112 | |||

| SHW / The Sherwin-Williams Company | 0.01 | 0.00 | 3.03 | -1.69 | 0.1096 | -0.0072 | |||

| HD / The Home Depot, Inc. | 0.01 | 0.00 | 3.02 | 0.03 | 0.1094 | -0.0052 | |||

| HUBS / HubSpot, Inc. | 0.01 | 0.00 | 3.01 | -2.56 | 0.1089 | -0.0083 | |||

| KUI / Kumba Iron Ore Limited | 0.18 | 2.96 | 0.1070 | 0.1070 | |||||

| 4519 / Chugai Pharmaceutical Co., Ltd. | 0.06 | 2.94 | 0.1063 | 0.1063 | |||||

| NL0015001RG8 / Netherlands Government Bond | 2.92 | 9.93 | 0.1057 | 0.0049 | |||||

| US92857WAQ33 / Vodafone Group 6.15% Notes Due 2037 | 2.88 | 1.30 | 0.1041 | -0.0036 | |||||

| DECK / Deckers Outdoor Corporation | 0.03 | -42.51 | 2.83 | -47.01 | 0.1024 | -0.1001 | |||

| CA / Carrefour SA | 0.20 | -53.02 | 2.83 | -53.65 | 0.1023 | -0.1291 | |||

| LSTR / Landstar System, Inc. | 0.02 | 0.00 | 2.55 | -7.47 | 0.0923 | -0.0122 | |||

| US25830JAA97 / Dornoch Debt Merger Sub Inc | 2.52 | 1.82 | 0.0912 | -0.0027 | |||||

| US3140XGX460 / FNMA 30YR UMBS SUPER | 2.51 | -2.11 | 0.0909 | -0.0064 | |||||

| FI4000507231 / FINNISH GOV'T | 2.47 | 10.72 | 0.0893 | 0.0047 | |||||

| DE0001174068 / CHINA UNIVERSAL EX INC | 2.41 | 0.0872 | 0.0872 | ||||||

| TLKM / Perusahaan Perseroan (Persero) PT Telekomunikasi Indonesia Tbk | 13.35 | 0.00 | 2.28 | 17.80 | 0.0826 | 0.0091 | |||

| NVO / Novo Nordisk A/S - Depositary Receipt (Common Stock) | 0.03 | 0.00 | 2.24 | 1.31 | 0.0811 | -0.0028 | |||

| FMCC / Federal Home Loan Mortgage Corporation | 2.17 | -4.86 | 0.0786 | -0.0080 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 2.17 | -4.86 | 0.0786 | -0.0080 | |||||

| ES0000012B47 / Spain Government Bond | 1.95 | 11.16 | 0.0706 | 0.0040 | |||||

| US39843UAA07 / Grifols Escrow Issuer SA | 1.79 | 4.07 | 0.0648 | -0.0005 | |||||

| Amvest RCF Custodian BV / DBT (XS2906244525) | 1.67 | 9.96 | 0.0603 | 0.0028 | |||||

| FI4000517677 / FINLAND REPUBLIC OF 0.5% 04/15/2043 144A REGS | 1.51 | 10.39 | 0.0546 | 0.0027 | |||||

| Jane Street Group / JSG Finance, Inc. / DBT (US47077WAC29) | 1.29 | 2.38 | 0.0468 | -0.0011 | |||||

| US85172FAR01 / Springleaf Finance Corp 5.375% 11/15/2029 | 1.29 | 3.37 | 0.0466 | -0.0007 | |||||

| US46590XAP15 / JBS USA LUX SA / JBS USA Food Co / JBS USA Finance Inc | 1.15 | 1.68 | 0.0415 | -0.0013 | |||||

| Franklin BSP Real Estate Debt BDC / (N/A) | 0.03 | 0.91 | 0.0329 | 0.0329 | |||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.66 | 0.0240 | 0.0240 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.13 | 0.0046 | 0.0046 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.13 | 0.0046 | 0.0046 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.01 | -0.0004 | -0.0004 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.36 | -0.0130 | -0.0130 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -1.70 | -0.0614 | -0.0614 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -2.31 | -0.0837 | -0.0837 |