Mga Batayang Estadistika

| Nilai Portofolio | $ 413,235,693 |

| Posisi Saat Ini | 117 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

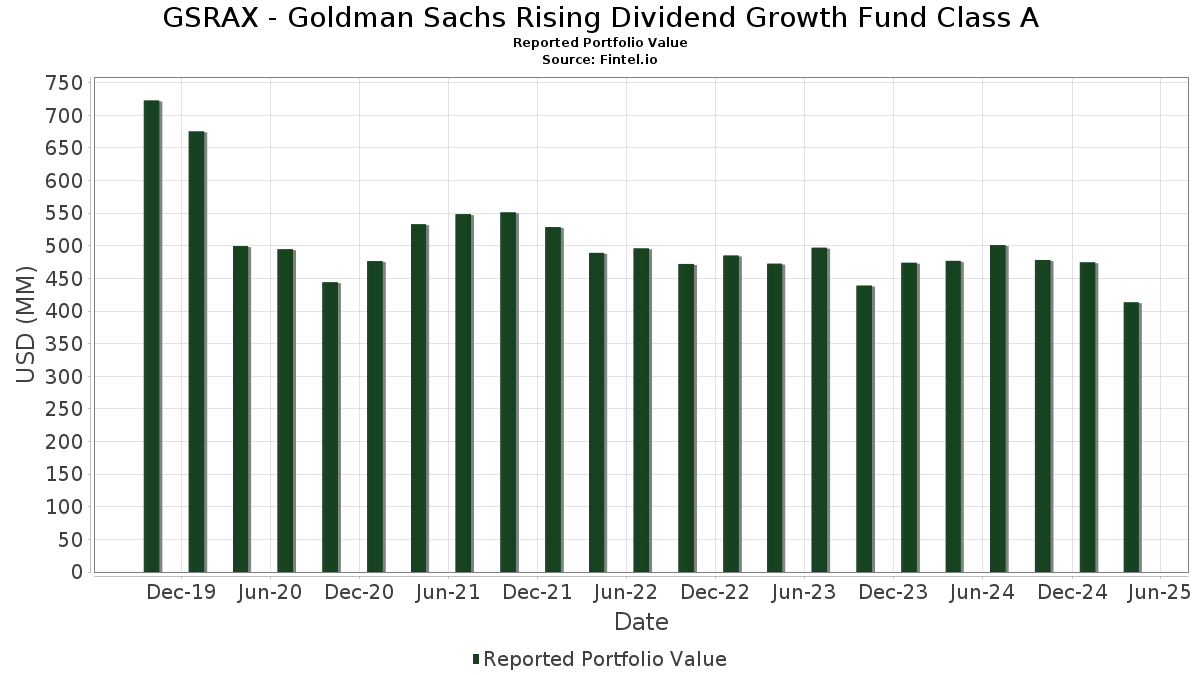

GSRAX - Goldman Sachs Rising Dividend Growth Fund Class A telah mengungkapkan total kepemilikan 117 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 413,235,693 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama GSRAX - Goldman Sachs Rising Dividend Growth Fund Class A adalah Comcast Corporation (US:CMCSA) , NextEra Energy, Inc. (US:NEE) , MPLX LP - Limited Partnership (US:MPLX) , Goldman Sachs Financial Square Funds - Government Fund (US:US38148U6192) , and Energy Transfer LP - Limited Partnership (US:ET) . Posisi baru GSRAX - Goldman Sachs Rising Dividend Growth Fund Class A meliputi: Venture Global, Inc. (US:VG) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.03 | 2.47 | 0.5952 | 0.3185 | |

| 1.50 | 1.50 | 0.3613 | 0.2925 | |

| 0.09 | 6.80 | 1.6388 | 0.2682 | |

| 0.01 | 6.16 | 1.4837 | 0.2665 | |

| 0.07 | 4.85 | 1.1672 | 0.2639 | |

| 0.02 | 4.06 | 0.9785 | 0.2485 | |

| 0.28 | 9.57 | 2.3054 | 0.2423 | |

| 0.06 | 4.48 | 1.0789 | 0.2415 | |

| 0.08 | 4.38 | 1.0561 | 0.2241 | |

| 0.01 | 6.89 | 1.6592 | 0.2126 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 7.69 | 7.69 | 1.8537 | -0.5236 | |

| 0.45 | 7.41 | 1.7851 | -0.2792 | |

| 0.01 | 4.05 | 0.9754 | -0.2602 | |

| 0.01 | 1.35 | 0.3243 | -0.2468 | |

| 0.02 | 5.93 | 1.4281 | -0.2426 | |

| 0.04 | 3.74 | 0.9018 | -0.2138 | |

| 0.05 | 3.91 | 0.9429 | -0.2104 | |

| 0.01 | 4.11 | 0.9901 | -0.1969 | |

| 0.06 | 3.59 | 0.8655 | -0.1917 | |

| 0.04 | 2.86 | 0.6896 | -0.1762 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-06-17 untuk periode pelaporan 2025-04-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| CMCSA / Comcast Corporation | 0.28 | -4.12 | 9.57 | -2.59 | 2.3054 | 0.2423 | |||

| NEE / NextEra Energy, Inc. | 0.13 | -7.27 | 8.88 | -13.34 | 2.1384 | -0.0127 | |||

| MPLX / MPLX LP - Limited Partnership | 0.16 | -12.84 | 8.03 | -14.65 | 1.9357 | -0.0414 | |||

| US38148U6192 / Goldman Sachs Financial Square Funds - Government Fund | 7.69 | -32.02 | 7.69 | -32.03 | 1.8537 | -0.5236 | |||

| ET / Energy Transfer LP - Limited Partnership | 0.45 | -6.66 | 7.41 | -24.62 | 1.7851 | -0.2792 | |||

| INTU / Intuit Inc. | 0.01 | -4.15 | 6.89 | 0.00 | 1.6592 | 0.2126 | |||

| MSFT / Microsoft Corporation | 0.02 | -4.11 | 6.83 | -8.68 | 1.6457 | 0.0747 | |||

| APH / Amphenol Corporation | 0.09 | -4.12 | 6.80 | 4.25 | 1.6388 | 0.2682 | |||

| EPD / Enterprise Products Partners L.P. - Limited Partnership | 0.22 | -13.90 | 6.50 | -21.14 | 1.5662 | -0.1653 | |||

| ORCL / Oracle Corporation | 0.05 | -4.12 | 6.45 | -20.67 | 1.5528 | -0.1535 | |||

| KLAC / KLA Corporation | 0.01 | -4.13 | 6.36 | -8.74 | 1.5322 | 0.0685 | |||

| ROP / Roper Technologies, Inc. | 0.01 | -4.12 | 6.25 | -6.72 | 1.5061 | 0.0986 | |||

| SUN / Sunoco LP - Limited Partnership | 0.11 | -18.63 | 6.24 | -15.99 | 1.5021 | -0.0568 | |||

| LLY / Eli Lilly and Company | 0.01 | -4.13 | 6.16 | 6.26 | 1.4837 | 0.2665 | |||

| LRCX / Lam Research Corporation | 0.08 | -4.12 | 6.05 | -15.22 | 1.4565 | -0.0411 | |||

| ACN / Accenture plc | 0.02 | -4.11 | 5.93 | -25.48 | 1.4281 | -0.2426 | |||

| NVDA / NVIDIA Corporation | 0.05 | -4.12 | 5.92 | -13.03 | 1.4252 | -0.0033 | |||

| ABBV / AbbVie Inc. | 0.03 | -4.12 | 5.83 | 1.71 | 1.4051 | 0.2009 | |||

| AMAT / Applied Materials, Inc. | 0.04 | -4.12 | 5.82 | -19.88 | 1.4024 | -0.1235 | |||

| MSI / Motorola Solutions, Inc. | 0.01 | -4.13 | 5.72 | -10.03 | 1.3785 | 0.0428 | |||

| V / Visa Inc. | 0.02 | -4.11 | 5.69 | -3.07 | 1.3699 | 0.1379 | |||

| TXN / Texas Instruments Incorporated | 0.04 | -4.13 | 5.68 | -16.88 | 1.3690 | -0.0669 | |||

| AMGN / Amgen Inc. | 0.02 | -4.13 | 5.47 | -2.29 | 1.3180 | 0.1422 | |||

| MA / Mastercard Incorporated | 0.01 | -4.15 | 5.44 | -5.42 | 1.3107 | 0.1026 | |||

| PAA / Plains All American Pipeline, L.P. - Limited Partnership | 0.29 | -12.19 | 5.14 | -22.57 | 1.2383 | -0.1558 | |||

| SCHW / The Charles Schwab Corporation | 0.06 | -4.12 | 5.13 | -5.66 | 1.2363 | 0.0940 | |||

| COST / Costco Wholesale Corporation | 0.01 | -4.20 | 5.10 | -2.78 | 1.2298 | 0.1272 | |||

| MPWR / Monolithic Power Systems, Inc. | 0.01 | -4.14 | 5.08 | -10.80 | 1.2238 | 0.0278 | |||

| TJX / The TJX Companies, Inc. | 0.04 | -4.13 | 5.01 | -1.14 | 1.2069 | 0.1427 | |||

| IPG / The Interpublic Group of Companies, Inc. | 0.20 | -4.12 | 5.00 | -15.99 | 1.2037 | -0.0454 | |||

| NYT / The New York Times Company | 0.10 | -3.31 | 5.00 | -7.29 | 1.2034 | 0.0718 | |||

| MDLZ / Mondelez International, Inc. | 0.07 | -4.12 | 4.85 | 12.65 | 1.1672 | 0.2639 | |||

| MMC / Marsh & McLennan Companies, Inc. | 0.02 | -4.11 | 4.78 | -0.31 | 1.1524 | 0.1446 | |||

| WES / Western Midstream Partners, LP - Limited Partnership | 0.12 | -5.06 | 4.68 | -13.24 | 1.1275 | -0.0055 | |||

| SHW / The Sherwin-Williams Company | 0.01 | -4.14 | 4.66 | -5.55 | 1.1226 | 0.0866 | |||

| HD / The Home Depot, Inc. | 0.01 | -4.12 | 4.66 | -16.10 | 1.1226 | -0.0438 | |||

| FAST / Fastenal Company | 0.06 | -4.12 | 4.51 | 5.99 | 1.0874 | 0.1931 | |||

| KR / The Kroger Co. | 0.06 | -4.12 | 4.48 | 12.34 | 1.0789 | 0.2415 | |||

| ROL / Rollins, Inc. | 0.08 | -4.12 | 4.38 | 10.65 | 1.0561 | 0.2241 | |||

| AXP / American Express Company | 0.02 | -4.13 | 4.36 | -19.54 | 1.0507 | -0.0877 | |||

| CDW / CDW Corporation | 0.03 | -4.13 | 4.30 | -22.70 | 1.0361 | -0.1325 | |||

| LOW / Lowe's Companies, Inc. | 0.02 | -3.07 | 4.30 | -16.67 | 1.0357 | -0.0478 | |||

| MCO / Moody's Corporation | 0.01 | -4.10 | 4.29 | -12.98 | 1.0338 | -0.0020 | |||

| DHR / Danaher Corporation | 0.02 | -4.14 | 4.27 | -14.22 | 1.0293 | -0.0167 | |||

| ZTS / Zoetis Inc. | 0.03 | -4.13 | 4.21 | -12.28 | 1.0137 | 0.0064 | |||

| UNH / UnitedHealth Group Incorporated | 0.01 | -4.13 | 4.11 | -27.30 | 0.9901 | -0.1969 | |||

| AMT / American Tower Corporation | 0.02 | -4.12 | 4.06 | 16.86 | 0.9785 | 0.2485 | |||

| DFS / Discover Financial Services | 0.02 | -4.14 | 4.06 | -12.92 | 0.9777 | -0.0011 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.01 | -4.11 | 4.05 | -31.19 | 0.9754 | -0.2602 | |||

| HPQ / HP Inc. | 0.16 | -3.99 | 4.03 | -24.47 | 0.9704 | -0.1495 | |||

| SBUX / Starbucks Corporation | 0.05 | -4.13 | 3.91 | -28.74 | 0.9429 | -0.2104 | |||

| HSY / The Hershey Company | 0.02 | -4.13 | 3.77 | 7.38 | 0.9080 | 0.1710 | |||

| NTAP / NetApp, Inc. | 0.04 | -4.13 | 3.74 | -29.52 | 0.9018 | -0.2138 | |||

| HUM / Humana Inc. | 0.01 | -4.10 | 3.72 | -14.24 | 0.8952 | -0.0147 | |||

| HESM / Hess Midstream LP | 0.10 | -3.28 | 3.62 | -11.24 | 0.8731 | 0.0155 | |||

| STZ / Constellation Brands, Inc. | 0.02 | -4.13 | 3.61 | -0.58 | 0.8704 | 0.1074 | |||

| NKE / NIKE, Inc. | 0.06 | -2.70 | 3.59 | -28.63 | 0.8655 | -0.1917 | |||

| DOX / Amdocs Limited | 0.04 | -4.12 | 3.59 | -3.70 | 0.8646 | 0.0820 | |||

| NXST / Nexstar Media Group, Inc. | 0.02 | -4.13 | 3.54 | -6.35 | 0.8527 | 0.0588 | |||

| DPZ / Domino's Pizza, Inc. | 0.01 | -4.07 | 3.41 | 4.73 | 0.8222 | 0.1379 | |||

| TSCO / Tractor Supply Company | 0.07 | -4.12 | 3.39 | -10.72 | 0.8169 | 0.0193 | |||

| WSO / Watsco, Inc. | 0.01 | -4.09 | 3.29 | -7.85 | 0.7923 | 0.0428 | |||

| RS / Reliance, Inc. | 0.01 | -4.11 | 3.13 | -4.52 | 0.7534 | 0.0655 | |||

| LII / Lennox International Inc. | 0.01 | -4.12 | 3.12 | -11.50 | 0.7508 | 0.0111 | |||

| SNX / TD SYNNEX Corporation | 0.03 | -4.13 | 3.11 | -25.47 | 0.7497 | -0.1271 | |||

| FCNCA / First Citizens BancShares, Inc. | 0.00 | -3.91 | 3.06 | -22.45 | 0.7372 | -0.0916 | |||

| DLB / Dolby Laboratories, Inc. | 0.04 | -4.12 | 2.97 | -12.06 | 0.7152 | 0.0062 | |||

| FDS / FactSet Research Systems Inc. | 0.01 | -4.13 | 2.96 | -12.67 | 0.7129 | 0.0014 | |||

| GGG / Graco Inc. | 0.04 | -4.12 | 2.92 | -7.03 | 0.7038 | 0.0438 | |||

| BMI / Badger Meter, Inc. | 0.01 | -2.36 | 2.88 | 0.81 | 0.6937 | 0.0937 | |||

| SWKS / Skyworks Solutions, Inc. | 0.04 | -4.12 | 2.86 | -30.57 | 0.6896 | -0.1762 | |||

| TROW / T. Rowe Price Group, Inc. | 0.03 | -4.12 | 2.76 | -27.37 | 0.6656 | -0.1335 | |||

| WSM / Williams-Sonoma, Inc. | 0.02 | -4.11 | 2.74 | -29.92 | 0.6604 | -0.1611 | |||

| EXR / Extra Space Storage Inc. | 0.02 | -4.11 | 2.70 | -8.76 | 0.6503 | 0.0289 | |||

| MAS / Masco Corporation | 0.04 | -4.12 | 2.63 | -26.70 | 0.6330 | -0.1199 | |||

| AOS / A. O. Smith Corporation | 0.04 | -4.12 | 2.54 | -3.31 | 0.6129 | 0.0603 | |||

| BBY / Best Buy Co., Inc. | 0.04 | -4.11 | 2.53 | -25.51 | 0.6093 | -0.1038 | |||

| AFG / American Financial Group, Inc. | 0.02 | -4.12 | 2.48 | -11.10 | 0.5967 | 0.0118 | |||

| DTM / DT Midstream, Inc. | 0.03 | 95.04 | 2.47 | 87.55 | 0.5952 | 0.3185 | |||

| MKTX / MarketAxess Holdings Inc. | 0.01 | -1.91 | 2.28 | -1.51 | 0.5488 | 0.0632 | |||

| CCOI / Cogent Communications Holdings, Inc. | 0.04 | -2.67 | 2.25 | -29.79 | 0.5424 | -0.1310 | |||

| PRI / Primerica, Inc. | 0.01 | -4.09 | 2.24 | -13.38 | 0.5398 | -0.0035 | |||

| WTS / Watts Water Technologies, Inc. | 0.01 | -4.11 | 2.21 | -3.67 | 0.5315 | 0.0506 | |||

| LFUS / Littelfuse, Inc. | 0.01 | -4.09 | 2.03 | -26.64 | 0.4889 | -0.0921 | |||

| CGNX / Cognex Corporation | 0.07 | -4.12 | 2.00 | -34.38 | 0.4814 | -0.1583 | |||

| TTC / The Toro Company | 0.03 | -4.12 | 1.99 | -21.36 | 0.4790 | -0.0521 | |||

| ELS / Equity LifeStyle Properties, Inc. | 0.03 | -5.28 | 1.97 | -6.27 | 0.4757 | 0.0333 | |||

| WMB / The Williams Companies, Inc. | 0.03 | 33.96 | 1.90 | 41.52 | 0.4585 | 0.1761 | |||

| EVR / Evercore Inc. | 0.01 | -4.14 | 1.90 | -32.43 | 0.4583 | -0.1330 | |||

| LNG / Cheniere Energy, Inc. | 0.01 | -30.30 | 1.69 | -27.99 | 0.4061 | -0.0854 | |||

| DDS / Dillard's, Inc. | 0.00 | -4.18 | 1.67 | -29.04 | 0.4021 | -0.0919 | |||

| LSTR / Landstar System, Inc. | 0.01 | -4.00 | 1.58 | -21.83 | 0.3799 | -0.0435 | |||

| POWI / Power Integrations, Inc. | 0.03 | -2.63 | 1.51 | -23.26 | 0.3634 | -0.0494 | |||

| US38141W2733 / Goldman Sachs Financial Square Funds - Government Fund | 1.50 | 358.22 | 1.50 | 358.41 | 0.3613 | 0.2925 | |||

| RHI / Robert Half Inc. | 0.03 | -4.12 | 1.44 | -34.46 | 0.3465 | -0.1143 | |||

| TRGP / Targa Resources Corp. | 0.01 | -42.99 | 1.35 | -50.50 | 0.3243 | -0.2468 | |||

| ALTM / Arcadium Lithium plc | 0.03 | 22.36 | 1.18 | -21.54 | 0.2855 | -0.0315 | |||

| CQP / Cheniere Energy Partners, L.P. - Limited Partnership | 0.02 | -14.29 | 1.17 | -17.91 | 0.2818 | -0.0174 | |||

| IPAR / Interparfums, Inc. | 0.01 | -4.09 | 1.16 | -25.72 | 0.2804 | -0.0488 | |||

| GEL / Genesis Energy, L.P. - Limited Partnership | 0.08 | -20.55 | 1.06 | 3.71 | 0.2560 | 0.0409 | |||

| LZB / La-Z-Boy Incorporated | 0.03 | -4.12 | 0.99 | -19.76 | 0.2379 | -0.0206 | |||

| PZZA / Papa John's International, Inc. | 0.03 | -4.12 | 0.95 | -16.34 | 0.2296 | -0.0096 | |||

| USAC / USA Compression Partners, LP - Limited Partnership | 0.04 | -1.35 | 0.91 | -9.62 | 0.2195 | 0.0076 | |||

| SPH / Suburban Propane Partners, L.P. - Limited Partnership | 0.04 | -10.77 | 0.82 | -15.69 | 0.1982 | -0.0067 | |||

| OKE / ONEOK, Inc. | 0.01 | -30.65 | 0.79 | -41.42 | 0.1893 | -0.0922 | |||

| GLP / Global Partners LP - Limited Partnership | 0.01 | -11.58 | 0.76 | -16.37 | 0.1824 | -0.0076 | |||

| AROC / Archrock, Inc. | 0.03 | 1.76 | 0.73 | -14.72 | 0.1759 | -0.0040 | |||

| BKV / BKV Corporation | 0.04 | 16.42 | 0.73 | -13.93 | 0.1758 | -0.0021 | |||

| CRI / Carter's, Inc. | 0.02 | -4.12 | 0.70 | -41.30 | 0.1676 | -0.0810 | |||

| KGS / Kodiak Gas Services, Inc. | 0.02 | 163.36 | 0.66 | 91.33 | 0.1596 | 0.0869 | |||

| DKL / Delek Logistics Partners, LP - Limited Partnership | 0.02 | 12.69 | 0.63 | 2.10 | 0.1520 | 0.0221 | |||

| OXM / Oxford Industries, Inc. | 0.01 | -4.13 | 0.60 | -44.42 | 0.1454 | -0.0827 | |||

| AESI / Atlas Energy Solutions Inc. | 0.03 | 81.38 | 0.37 | 7.04 | 0.0880 | 0.0162 | |||

| EXE / Expand Energy Corporation | 0.00 | 38.67 | 0.30 | 53.30 | 0.0729 | 0.0330 | |||

| VG / Venture Global, Inc. | 0.01 | 0.12 | 0.0296 | 0.0296 | |||||

| CVS / CVS Health Corporation | 0.00 | 0.00 | 0.00 | 0.0000 | 0.0000 | ||||

| S+P500 EMINI FUT JUN25 / DE (000000000) | -0.06 | -0.0135 | -0.0135 |