Mga Batayang Estadistika

| Nilai Portofolio | $ 125,268,892 |

| Posisi Saat Ini | 87 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

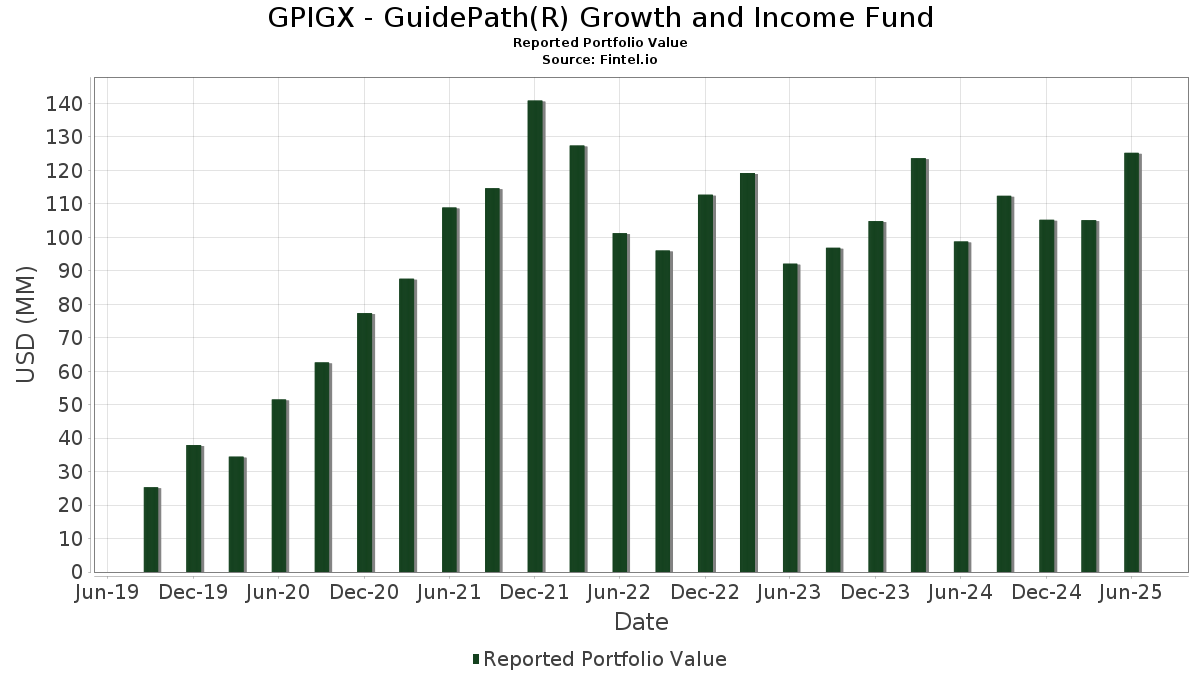

GPIGX - GuidePath(R) Growth and Income Fund telah mengungkapkan total kepemilikan 87 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 125,268,892 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama GPIGX - GuidePath(R) Growth and Income Fund adalah Vanguard Whitehall Funds - Vanguard High Dividend Yield ETF (US:VYM) , Vanguard Whitehall Funds - Vanguard International High Dividend Yield ETF (US:VYMI) , Vanguard International Equity Index Funds - Vanguard Global ex-U.S. Real Estate ETF (US:VNQI) , iShares, Inc. - iShares Emerging Markets Dividend ETF (US:DVYE) , and Schwab Strategic Trust - Schwab U.S. Large-Cap ETF (US:SCHX) . Posisi baru GPIGX - GuidePath(R) Growth and Income Fund meliputi: Vanguard International Equity Index Funds - Vanguard Global ex-U.S. Real Estate ETF (US:VNQI) , UnitedHealth Group Incorporated (US:UNH) , Accenture plc (US:ACN) , The Cigna Group (US:CI) , and Omnicom Group Inc. (US:OMC) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 14.54 | 14.54 | 13.1313 | 13.1313 | |

| 0.12 | 5.60 | 5.0631 | 5.0631 | |

| 0.00 | 1.33 | 1.1992 | 1.1992 | |

| 0.00 | 1.28 | 1.1519 | 1.1519 | |

| 2.22 | 2.22 | 2.0064 | 0.8468 | |

| 0.00 | 0.78 | 0.7033 | 0.7033 | |

| 0.01 | 0.91 | 0.8188 | 0.6605 | |

| 0.01 | 1.88 | 1.6994 | 0.5803 | |

| 0.03 | 0.80 | 0.7227 | 0.5556 | |

| 0.01 | 0.60 | 0.5462 | 0.5462 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.14 | 3.38 | 3.0519 | -45.8036 | |

| 0.21 | 27.83 | 25.1449 | -3.5500 | |

| 0.01 | 0.57 | 0.5149 | -0.6423 | |

| 0.00 | 0.95 | 0.8594 | -0.5154 | |

| 0.01 | 0.37 | 0.3315 | -0.4953 | |

| 0.00 | 0.65 | 0.5878 | -0.4292 | |

| 0.00 | 0.57 | 0.5138 | -0.4115 | |

| 0.00 | 0.16 | 0.1481 | -0.3922 | |

| 0.01 | 1.60 | 1.4500 | -0.2511 | |

| 0.00 | 0.19 | 0.1696 | -0.1971 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-28 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| VYM / Vanguard Whitehall Funds - Vanguard High Dividend Yield ETF | 0.21 | -10.50 | 27.83 | -7.48 | 25.1449 | -3.5500 | |||

| Mount Vernon Liquid Assets Portfolio, LLC / STIV (N/A) | 14.54 | 14.54 | 13.1313 | 13.1313 | |||||

| VYMI / Vanguard Whitehall Funds - Vanguard International High Dividend Yield ETF | 0.14 | -1.88 | 10.87 | 6.66 | 9.8203 | 0.0999 | |||

| VNQI / Vanguard International Equity Index Funds - Vanguard Global ex-U.S. Real Estate ETF | 0.12 | 5.60 | 5.0631 | 5.0631 | |||||

| DVYE / iShares, Inc. - iShares Emerging Markets Dividend ETF | 0.19 | 1.36 | 5.46 | 6.41 | 4.9335 | 0.0386 | |||

| SCHX / Schwab Strategic Trust - Schwab U.S. Large-Cap ETF | 0.14 | -93.58 | 3.38 | -93.23 | 3.0519 | -45.8036 | |||

| MGMXX / JPMorgan Trust II - JPMorgan U.S. Government Money Market Fund IM | 2.22 | 82.67 | 2.22 | 82.72 | 2.0064 | 0.8468 | |||

| XOM / Exxon Mobil Corporation | 0.02 | 17.49 | 1.91 | 6.51 | 1.7286 | 0.0148 | |||

| CVX / Chevron Corporation | 0.01 | 26.61 | 1.91 | 8.35 | 1.7232 | 0.0444 | |||

| ABBV / AbbVie Inc. | 0.01 | 80.96 | 1.88 | 60.36 | 1.6994 | 0.5803 | |||

| HD / The Home Depot, Inc. | 0.01 | 5.47 | 1.85 | 5.52 | 1.6743 | -0.0011 | |||

| PG / The Procter & Gamble Company | 0.01 | -3.74 | 1.60 | -10.04 | 1.4500 | -0.2511 | |||

| KO / The Coca-Cola Company | 0.02 | -1.96 | 1.57 | -3.14 | 1.4194 | -0.1280 | |||

| IBM / International Business Machines Corporation | 0.01 | -0.97 | 1.48 | 17.37 | 1.3379 | 0.1347 | |||

| MCD / McDonald's Corporation | 0.00 | 58.63 | 1.44 | 48.45 | 1.2984 | 0.3744 | |||

| JNJ / Johnson & Johnson | 0.01 | 7.94 | 1.42 | -0.56 | 1.2834 | -0.0795 | |||

| PEP / PepsiCo, Inc. | 0.01 | 7.34 | 1.34 | -5.50 | 1.2112 | -0.1417 | |||

| UNH / UnitedHealth Group Incorporated | 0.00 | 1.33 | 1.1992 | 1.1992 | |||||

| QCOM / QUALCOMM Incorporated | 0.01 | 13.58 | 1.31 | 17.74 | 1.1877 | 0.1228 | |||

| CSCO / Cisco Systems, Inc. | 0.02 | 2.87 | 1.31 | 15.66 | 1.1810 | 0.1029 | |||

| ABT / Abbott Laboratories | 0.01 | -2.33 | 1.28 | 0.16 | 1.1567 | -0.0628 | |||

| ACN / Accenture plc | 0.00 | 1.28 | 1.1519 | 1.1519 | |||||

| CL / Colgate-Palmolive Company | 0.01 | -4.83 | 1.18 | -7.64 | 1.0697 | -0.1535 | |||

| MRK / Merck & Co., Inc. | 0.01 | 27.68 | 1.01 | 12.72 | 0.9124 | 0.0569 | |||

| VZ / Verizon Communications Inc. | 0.02 | 1.72 | 0.95 | -2.96 | 0.8598 | -0.0757 | |||

| TXN / Texas Instruments Incorporated | 0.00 | -42.87 | 0.95 | -34.00 | 0.8594 | -0.5154 | |||

| EMR / Emerson Electric Co. | 0.01 | 5.33 | 0.95 | 28.07 | 0.8575 | 0.1507 | |||

| BIL / SPDR Series Trust - SPDR Bloomberg 1-3 Month T-Bill ETF | 0.01 | 445.91 | 0.91 | 445.78 | 0.8188 | 0.6605 | |||

| CME / CME Group Inc. | 0.00 | 186.40 | 0.84 | 198.23 | 0.7602 | 0.4905 | |||

| PFE / Pfizer Inc. | 0.03 | 377.32 | 0.80 | 356.57 | 0.7227 | 0.5556 | |||

| CI / The Cigna Group | 0.00 | 0.78 | 0.7033 | 0.7033 | |||||

| MDLZ / Mondelez International, Inc. | 0.01 | 0.06 | 0.75 | -0.53 | 0.6807 | -0.0419 | |||

| BLK / BlackRock, Inc. | 0.00 | 8.45 | 0.73 | 20.36 | 0.6569 | 0.0800 | |||

| ADP / Automatic Data Processing, Inc. | 0.00 | -4.82 | 0.69 | -3.88 | 0.6274 | -0.0621 | |||

| NSC / Norfolk Southern Corporation | 0.00 | 1.69 | 0.68 | 9.90 | 0.6121 | 0.0241 | |||

| TYIA / Johnson Controls International plc | 0.01 | -2.42 | 0.66 | 28.65 | 0.5966 | 0.1070 | |||

| LOW / Lowe's Companies, Inc. | 0.00 | 9.99 | 0.65 | 4.64 | 0.5917 | -0.0054 | |||

| CAT / Caterpillar Inc. | 0.00 | -48.16 | 0.65 | -39.02 | 0.5878 | -0.4292 | |||

| CAH / Cardinal Health, Inc. | 0.00 | -3.06 | 0.64 | 18.18 | 0.5761 | 0.0615 | |||

| CMI / Cummins Inc. | 0.00 | 8.62 | 0.64 | 13.39 | 0.5743 | 0.0400 | |||

| AFL / Aflac Incorporated | 0.01 | 6.37 | 0.63 | 0.96 | 0.5712 | -0.0266 | |||

| MDT / Medtronic plc | 0.01 | 10.99 | 0.62 | 7.77 | 0.5639 | 0.0109 | |||

| APD / Air Products and Chemicals, Inc. | 0.00 | 9.73 | 0.61 | 4.84 | 0.5491 | -0.0033 | |||

| OMC / Omnicom Group Inc. | 0.01 | 0.60 | 0.5462 | 0.5462 | |||||

| DELL / Dell Technologies Inc. | 0.00 | 43.45 | 0.60 | 54.10 | 0.5430 | 0.1871 | |||

| KR / The Kroger Co. | 0.01 | 0.59 | 0.5297 | 0.5297 | |||||

| FERG / Ferguson Enterprises Inc. | 0.00 | 0.57 | 0.5168 | 0.5168 | |||||

| UNP / Union Pacific Corporation | 0.00 | 8.61 | 0.57 | 5.74 | 0.5163 | 0.0010 | |||

| COP / ConocoPhillips | 0.01 | -45.02 | 0.57 | -53.09 | 0.5149 | -0.6423 | |||

| HON / Honeywell International Inc. | 0.00 | -46.69 | 0.57 | -41.44 | 0.5138 | -0.4115 | |||

| KMI / Kinder Morgan, Inc. | 0.02 | -30.88 | 0.56 | 10.83 | 0.5089 | 0.0449 | |||

| UPS / United Parcel Service, Inc. | 0.01 | 18.50 | 0.53 | 8.81 | 0.4801 | 0.0140 | |||

| EIX / Edison International | 0.01 | 0.52 | 0.4704 | 0.4704 | |||||

| RF / Regions Financial Corporation | 0.02 | 16.36 | 0.51 | 26.12 | 0.4584 | 0.0741 | |||

| HIG / The Hartford Insurance Group, Inc. | 0.00 | 1.28 | 0.50 | 3.95 | 0.4520 | -0.0075 | |||

| HBAN / Huntington Bancshares Incorporated | 0.03 | 11.76 | 0.50 | 24.69 | 0.4477 | 0.0689 | |||

| SRE / Sempra | 0.01 | -2.85 | 0.48 | 3.04 | 0.4299 | -0.0101 | |||

| TGT / Target Corporation | 0.00 | 20.63 | 0.48 | 14.18 | 0.4295 | 0.0318 | |||

| YUM / Yum! Brands, Inc. | 0.00 | 16.65 | 0.46 | 9.76 | 0.4173 | 0.0162 | |||

| GIS / General Mills, Inc. | 0.01 | 6.68 | 0.45 | -7.45 | 0.4041 | -0.0574 | |||

| LMT / Lockheed Martin Corporation | 0.00 | -5.15 | 0.43 | -1.62 | 0.3853 | -0.0284 | |||

| ITW / Illinois Tool Works Inc. | 0.00 | 11.54 | 0.42 | 11.11 | 0.3799 | 0.0192 | |||

| AEE / Ameren Corporation | 0.00 | 4.25 | 0.39 | -0.51 | 0.3532 | -0.0207 | |||

| CFG / Citizens Financial Group, Inc. | 0.01 | 16.91 | 0.37 | 27.74 | 0.3370 | 0.0584 | |||

| CMCSA / Comcast Corporation | 0.01 | -56.24 | 0.37 | -57.74 | 0.3315 | -0.4953 | |||

| LYB / LyondellBasell Industries N.V. | 0.01 | 29.06 | 0.37 | 6.09 | 0.3312 | 0.0015 | |||

| USB / U.S. Bancorp | 0.01 | 11.10 | 0.36 | 18.95 | 0.3294 | 0.0373 | |||

| HPQ / HP Inc. | 0.01 | 19.62 | 0.34 | 5.86 | 0.3099 | 0.0003 | |||

| SBUX / Starbucks Corporation | 0.00 | 21.26 | 0.33 | 13.24 | 0.2941 | 0.0200 | |||

| DTE / DTE Energy Company | 0.00 | 3.90 | 0.33 | -0.31 | 0.2937 | -0.0178 | |||

| TRV / The Travelers Companies, Inc. | 0.00 | 1.35 | 0.28 | 2.55 | 0.2540 | -0.0076 | |||

| AEP / American Electric Power Company, Inc. | 0.00 | 2.50 | 0.28 | -2.78 | 0.2537 | -0.0215 | |||

| KVUE / Kenvue Inc. | 0.01 | 5.05 | 0.27 | -8.11 | 0.2457 | -0.0372 | |||

| KMB / Kimberly-Clark Corporation | 0.00 | -7.53 | 0.27 | -16.15 | 0.2446 | -0.0635 | |||

| WSO / Watsco, Inc. | 0.00 | 13.42 | 0.26 | -1.53 | 0.2326 | -0.0166 | |||

| PAYX / Paychex, Inc. | 0.00 | -6.39 | 0.24 | -11.91 | 0.2213 | -0.0434 | |||

| ED / Consolidated Edison, Inc. | 0.00 | 2.52 | 0.23 | -6.83 | 0.2100 | -0.0283 | |||

| MTB / M&T Bank Corporation | 0.00 | 11.28 | 0.23 | 20.97 | 0.2040 | 0.0257 | |||

| GD / General Dynamics Corporation | 0.00 | -1.15 | 0.20 | 5.85 | 0.1805 | 0.0003 | |||

| XEL / Xcel Energy Inc. | 0.00 | -49.24 | 0.19 | -51.30 | 0.1696 | -0.1971 | |||

| ADM / Archer-Daniels-Midland Company | 0.00 | -1.03 | 0.18 | 8.33 | 0.1652 | 0.0049 | |||

| CTRA / Coterra Energy Inc. | 0.01 | 23.13 | 0.17 | 8.50 | 0.1501 | 0.0035 | |||

| SYF / Synchrony Financial | 0.00 | -77.04 | 0.16 | -71.20 | 0.1481 | -0.3922 | |||

| GEN / Gen Digital Inc. | 0.00 | 9.04 | 0.12 | 21.21 | 0.1089 | 0.0137 | |||

| GRMN / Garmin Ltd. | 0.00 | 14.85 | 0.11 | 10.68 | 0.1035 | 0.0045 | |||

| CF / CF Industries Holdings, Inc. | 0.00 | -11.35 | 0.11 | 4.90 | 0.0967 | -0.0011 | |||

| FNF / Fidelity National Financial, Inc. | 0.00 | 0.06 | 0.0504 | 0.0504 |