Mga Batayang Estadistika

| Nilai Portofolio | $ 253,191,856 |

| Posisi Saat Ini | 140 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

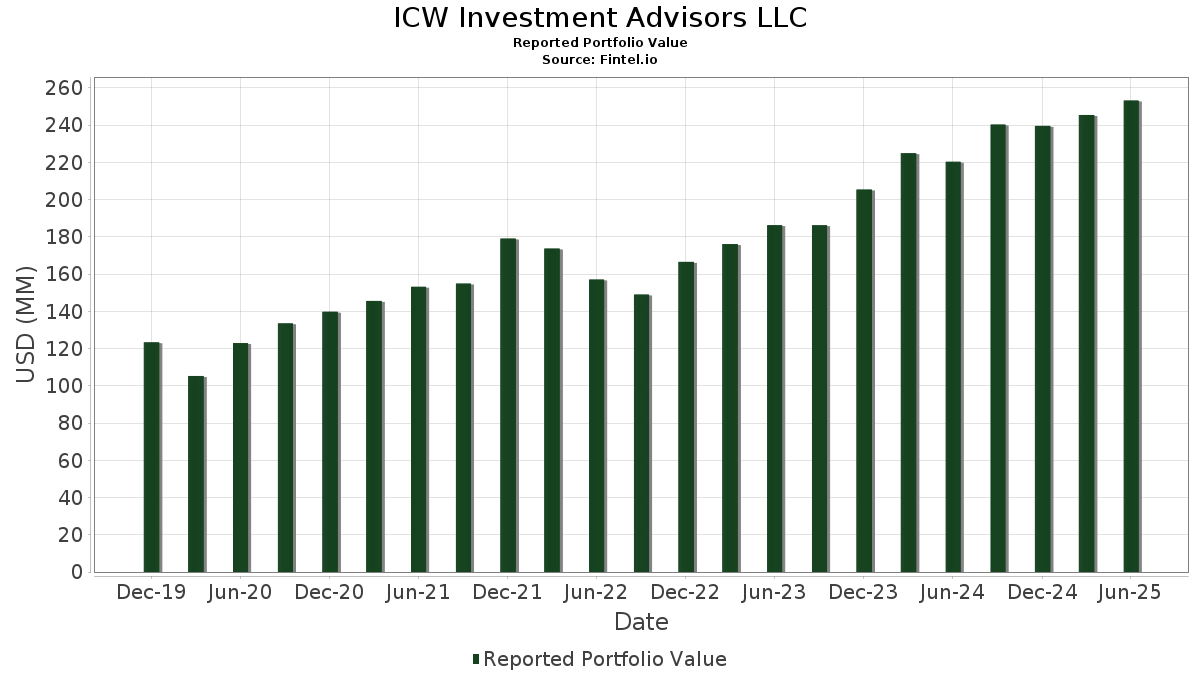

ICW Investment Advisors LLC telah mengungkapkan total kepemilikan 140 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 253,191,856 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama ICW Investment Advisors LLC adalah Microsoft Corporation (US:MSFT) , Mastercard Incorporated (US:MA) , Visa Inc. (US:V) , Costco Wholesale Corporation (US:COST) , and Apple Inc. (US:AAPL) . Posisi baru ICW Investment Advisors LLC meliputi: Cummins Inc. (US:CMI) , Ralliant Corporation (US:RAL) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.02 | 4.77 | 1.8842 | 0.7200 | |

| 0.02 | 7.68 | 3.0340 | 0.6688 | |

| 0.02 | 3.43 | 1.3554 | 0.4425 | |

| 0.02 | 1.68 | 0.6631 | 0.2237 | |

| 0.01 | 4.58 | 1.8078 | 0.2070 | |

| 0.02 | 3.91 | 1.5444 | 0.1981 | |

| 0.01 | 2.97 | 1.1743 | 0.1352 | |

| 0.01 | 2.15 | 0.8476 | 0.1330 | |

| 0.00 | 1.12 | 0.4436 | 0.1311 | |

| 0.02 | 2.72 | 1.0756 | 0.1284 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.01 | 4.62 | 1.8253 | -0.4056 | |

| 0.02 | 4.50 | 1.7765 | -0.2982 | |

| 0.00 | 1.03 | 0.4073 | -0.2437 | |

| 0.01 | 1.89 | 0.7459 | -0.2120 | |

| 0.01 | 1.58 | 0.6253 | -0.2104 | |

| 0.05 | 4.78 | 1.8890 | -0.1947 | |

| 0.03 | 5.29 | 2.0889 | -0.1934 | |

| 0.02 | 2.90 | 1.1459 | -0.1614 | |

| 0.02 | 2.21 | 0.8743 | -0.1567 | |

| 0.02 | 2.23 | 0.8812 | -0.1440 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-14 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MSFT / Microsoft Corporation | 0.02 | -0.14 | 7.68 | 32.32 | 3.0340 | 0.6688 | |||

| MA / Mastercard Incorporated | 0.01 | -0.31 | 5.68 | 2.20 | 2.2437 | -0.0207 | |||

| V / Visa Inc. | 0.02 | -0.68 | 5.67 | 0.64 | 2.2378 | -0.0561 | |||

| COST / Costco Wholesale Corporation | 0.01 | -0.56 | 5.48 | 4.09 | 2.1633 | 0.0193 | |||

| AAPL / Apple Inc. | 0.03 | 2.21 | 5.29 | -5.61 | 2.0889 | -0.1934 | |||

| VOO / Vanguard Index Funds - Vanguard S&P 500 ETF | 0.01 | -7.75 | 5.02 | 1.97 | 1.9813 | -0.0231 | |||

| ORLY / O'Reilly Automotive, Inc. | 0.05 | 1,386.41 | 4.78 | -6.49 | 1.8890 | -0.1947 | |||

| AVGO / Broadcom Inc. | 0.02 | 1.40 | 4.77 | 66.96 | 1.8842 | 0.7200 | |||

| LLY / Eli Lilly and Company | 0.01 | -10.57 | 4.62 | -15.61 | 1.8253 | -0.4056 | |||

| CASY / Casey's General Stores, Inc. | 0.01 | -0.92 | 4.58 | 16.49 | 1.8078 | 0.2070 | |||

| ABBV / AbbVie Inc. | 0.02 | -0.30 | 4.50 | -11.68 | 1.7765 | -0.2982 | |||

| ADP / Automatic Data Processing, Inc. | 0.01 | -0.66 | 3.92 | 0.28 | 1.5494 | -0.0444 | |||

| AMZN / Amazon.com, Inc. | 0.02 | 2.61 | 3.91 | 18.34 | 1.5444 | 0.1981 | |||

| WMT / Walmart Inc. | 0.04 | -0.20 | 3.89 | 11.16 | 1.5349 | 0.1105 | |||

| COR / Cencora, Inc. | 0.01 | -2.03 | 3.88 | 5.63 | 1.5334 | 0.0362 | |||

| ABT / Abbott Laboratories | 0.03 | -0.26 | 3.84 | 2.26 | 1.5165 | -0.0131 | |||

| HD / The Home Depot, Inc. | 0.01 | 1.08 | 3.62 | 1.12 | 1.4281 | -0.0288 | |||

| NVDA / NVIDIA Corporation | 0.02 | 5.06 | 3.43 | 53.17 | 1.3554 | 0.4425 | |||

| SHW / The Sherwin-Williams Company | 0.01 | 1.38 | 3.41 | -0.32 | 1.3451 | -0.0468 | |||

| LIN / Linde plc | 0.01 | 1.23 | 3.28 | 1.99 | 1.2957 | -0.0145 | |||

| TJX / The TJX Companies, Inc. | 0.03 | -0.61 | 3.18 | 0.79 | 1.2549 | -0.0296 | |||

| NOC / Northrop Grumman Corporation | 0.01 | 1.63 | 3.03 | -0.75 | 1.1956 | -0.0471 | |||

| FAST / Fastenal Company | 0.07 | 98.87 | 2.99 | 7.71 | 1.1808 | 0.0500 | |||

| MCD / McDonald's Corporation | 0.01 | 1.30 | 2.99 | -5.24 | 1.1791 | -0.1046 | |||

| RMD / ResMed Inc. | 0.01 | 1.14 | 2.97 | 16.59 | 1.1743 | 0.1352 | |||

| NVO / Novo Nordisk A/S - Depositary Receipt (Common Stock) | 0.04 | 2.27 | 2.91 | 1.67 | 1.1511 | -0.0169 | |||

| PEP / PepsiCo, Inc. | 0.02 | 2.67 | 2.90 | -9.60 | 1.1459 | -0.1614 | |||

| GOOGL / Alphabet Inc. | 0.02 | 2.78 | 2.72 | 17.17 | 1.0756 | 0.1284 | |||

| LMT / Lockheed Martin Corporation | 0.01 | 2.23 | 2.66 | 5.98 | 1.0499 | 0.0281 | |||

| YUM / Yum! Brands, Inc. | 0.02 | 1.29 | 2.61 | -4.61 | 1.0295 | -0.0839 | |||

| JNJ / Johnson & Johnson | 0.02 | 1.78 | 2.60 | -6.28 | 1.0264 | -0.1030 | |||

| XOM / Exxon Mobil Corporation | 0.02 | 1.66 | 2.60 | -7.84 | 1.0261 | -0.1225 | |||

| PG / The Procter & Gamble Company | 0.02 | 1.67 | 2.53 | -4.95 | 1.0008 | -0.0853 | |||

| GD / General Dynamics Corporation | 0.01 | 1.52 | 2.53 | 8.63 | 1.0000 | 0.0504 | |||

| AMGN / Amgen Inc. | 0.01 | 1.26 | 2.45 | -9.26 | 0.9679 | -0.1323 | |||

| KO / The Coca-Cola Company | 0.03 | 0.75 | 2.43 | -0.45 | 0.9582 | -0.0349 | |||

| ROST / Ross Stores, Inc. | 0.02 | 0.76 | 2.37 | 0.59 | 0.9371 | -0.0238 | |||

| SPY / SPDR S&P 500 ETF | 0.00 | -0.40 | 2.28 | 9.99 | 0.9003 | 0.0561 | |||

| ITW / Illinois Tool Works Inc. | 0.01 | 1.58 | 2.26 | 1.25 | 0.8932 | -0.0166 | |||

| CHD / Church & Dwight Co., Inc. | 0.02 | 1.56 | 2.23 | -11.33 | 0.8812 | -0.1440 | |||

| CVX / Chevron Corporation | 0.02 | 2.20 | 2.21 | -12.53 | 0.8743 | -0.1567 | |||

| SBUX / Starbucks Corporation | 0.02 | -0.38 | 2.19 | -6.96 | 0.8659 | -0.0939 | |||

| LHX / L3Harris Technologies, Inc. | 0.01 | 2.09 | 2.15 | 22.35 | 0.8476 | 0.1330 | |||

| FDS / FactSet Research Systems Inc. | 0.00 | 2.31 | 2.14 | 0.66 | 0.8433 | -0.0210 | |||

| RTX / RTX Corporation | 0.01 | 0.74 | 2.04 | 11.07 | 0.8044 | 0.0573 | |||

| DGX / Quest Diagnostics Incorporated | 0.01 | -0.22 | 1.99 | 5.96 | 0.7862 | 0.0207 | |||

| SYK / Stryker Corporation | 0.00 | 1.24 | 1.94 | 7.61 | 0.7652 | 0.0317 | |||

| O / Realty Income Corporation | 0.03 | 2.02 | 1.93 | 1.32 | 0.7604 | -0.0138 | |||

| RSG / Republic Services, Inc. | 0.01 | 1.11 | 1.91 | 2.96 | 0.7555 | -0.0013 | |||

| DOV / Dover Corporation | 0.01 | 2.08 | 1.91 | 6.47 | 0.7541 | 0.0234 | |||

| FI / Fiserv, Inc. | 0.01 | 2.87 | 1.89 | -19.69 | 0.7459 | -0.2120 | |||

| CL / Colgate-Palmolive Company | 0.02 | 2.49 | 1.88 | -0.58 | 0.7409 | -0.0277 | |||

| HSY / The Hershey Company | 0.01 | 2.49 | 1.85 | -0.54 | 0.7324 | -0.0273 | |||

| BCPC / Balchem Corporation | 0.01 | 0.82 | 1.85 | -3.29 | 0.7320 | -0.0488 | |||

| UL / Unilever PLC - Depositary Receipt (Common Stock) | 0.03 | 1.92 | 1.79 | 4.69 | 0.7053 | 0.0104 | |||

| ROL / Rollins, Inc. | 0.03 | 0.92 | 1.77 | 5.41 | 0.7009 | 0.0148 | |||

| MKC / McCormick & Company, Incorporated | 0.02 | 2.33 | 1.76 | -5.72 | 0.6960 | -0.0656 | |||

| CNI / Canadian National Railway Company | 0.02 | 0.93 | 1.71 | 7.70 | 0.6741 | 0.0287 | |||

| SO / The Southern Company | 0.02 | 0.81 | 1.71 | 0.65 | 0.6738 | -0.0165 | |||

| DCI / Donaldson Company, Inc. | 0.02 | 2.09 | 1.71 | 5.57 | 0.6737 | 0.0155 | |||

| APH / Amphenol Corporation | 0.02 | 3.39 | 1.68 | 55.75 | 0.6631 | 0.2237 | |||

| ACN / Accenture plc | 0.01 | 3.34 | 1.67 | -1.01 | 0.6612 | -0.0279 | |||

| GWW / W.W. Grainger, Inc. | 0.00 | 1.20 | 1.67 | 6.50 | 0.6600 | 0.0208 | |||

| ECL / Ecolab Inc. | 0.01 | 3.08 | 1.64 | 9.55 | 0.6485 | 0.0379 | |||

| EXPD / Expeditors International of Washington, Inc. | 0.01 | -0.36 | 1.62 | -5.32 | 0.6396 | -0.0573 | |||

| BDX / Becton, Dickinson and Company | 0.01 | 2.64 | 1.58 | -22.82 | 0.6253 | -0.2104 | |||

| CSCO / Cisco Systems, Inc. | 0.02 | -2.58 | 1.58 | 9.53 | 0.6222 | 0.0362 | |||

| NEE / NextEra Energy, Inc. | 0.02 | 3.81 | 1.54 | 1.65 | 0.6069 | -0.0089 | |||

| APD / Air Products and Chemicals, Inc. | 0.01 | 5.15 | 1.51 | 0.60 | 0.5977 | -0.0154 | |||

| WEC / WEC Energy Group, Inc. | 0.01 | 1.76 | 1.43 | -2.72 | 0.5650 | -0.0340 | |||

| HRL / Hormel Foods Corporation | 0.05 | 3.56 | 1.42 | 1.28 | 0.5617 | -0.0106 | |||

| MDT / Medtronic plc | 0.02 | 2.89 | 1.39 | -0.14 | 0.5491 | -0.0184 | |||

| ATR / AptarGroup, Inc. | 0.01 | 4.23 | 1.36 | 9.95 | 0.5368 | 0.0329 | |||

| JKHY / Jack Henry & Associates, Inc. | 0.01 | 4.33 | 1.35 | 2.97 | 0.5346 | -0.0010 | |||

| PM / Philip Morris International Inc. | 0.01 | -0.45 | 1.34 | 14.24 | 0.5295 | 0.0514 | |||

| AME / AMETEK, Inc. | 0.01 | 4.77 | 1.34 | 10.14 | 0.5277 | 0.0335 | |||

| GIS / General Mills, Inc. | 0.03 | 3.63 | 1.33 | -10.22 | 0.5245 | -0.0780 | |||

| UNP / Union Pacific Corporation | 0.01 | 6.01 | 1.28 | 3.22 | 0.5062 | 0.0005 | |||

| CLX / The Clorox Company | 0.01 | 3.88 | 1.28 | -15.29 | 0.5057 | -0.1101 | |||

| NKE / NIKE, Inc. | 0.02 | 0.09 | 1.26 | 12.01 | 0.4973 | 0.0393 | |||

| KDP / Keurig Dr Pepper Inc. | 0.04 | 3.95 | 1.24 | 0.40 | 0.4909 | -0.0133 | |||

| MO / Altria Group, Inc. | 0.02 | -1.07 | 1.23 | -3.31 | 0.4847 | -0.0326 | |||

| INTU / Intuit Inc. | 0.00 | 7.21 | 1.19 | 37.72 | 0.4716 | 0.1180 | |||

| TGT / Target Corporation | 0.01 | 0.96 | 1.19 | -4.56 | 0.4715 | -0.0381 | |||

| CARR / Carrier Global Corporation | 0.02 | 2.55 | 1.16 | 18.41 | 0.4598 | 0.0592 | |||

| PSA / Public Storage | 0.00 | 1.67 | 1.16 | -0.34 | 0.4596 | -0.0161 | |||

| KMB / Kimberly-Clark Corporation | 0.01 | 4.88 | 1.13 | -4.98 | 0.4447 | -0.0378 | |||

| META / Meta Platforms, Inc. | 0.00 | 14.35 | 1.12 | 46.41 | 0.4436 | 0.1311 | |||

| GPC / Genuine Parts Company | 0.01 | 2.01 | 1.11 | 3.95 | 0.4369 | 0.0031 | |||

| DHR / Danaher Corporation | 0.01 | 5.35 | 1.07 | 1.52 | 0.4213 | -0.0068 | |||

| UNH / UnitedHealth Group Incorporated | 0.00 | 8.36 | 1.03 | -35.44 | 0.4073 | -0.2437 | |||

| FLO / Flowers Foods, Inc. | 0.06 | 5.15 | 1.00 | -11.59 | 0.3948 | -0.0659 | |||

| QQQ / Invesco QQQ Trust, Series 1 | 0.00 | -0.61 | 0.99 | 16.88 | 0.3912 | 0.0460 | |||

| QCOM / QUALCOMM Incorporated | 0.01 | 5.10 | 0.96 | 8.96 | 0.3799 | 0.0202 | |||

| HEIA / Heico Corp. - Class A | 0.00 | 3.80 | 0.94 | 27.41 | 0.3709 | 0.0704 | |||

| GOOG / Alphabet Inc. | 0.01 | 0.09 | 0.94 | 13.71 | 0.3701 | 0.0342 | |||

| CPK / Chesapeake Utilities Corporation | 0.01 | 6.08 | 0.90 | -0.66 | 0.3571 | -0.0139 | |||

| ROP / Roper Technologies, Inc. | 0.00 | 5.89 | 0.89 | 1.72 | 0.3498 | -0.0048 | |||

| ZTS / Zoetis Inc. | 0.01 | 6.90 | 0.88 | 1.15 | 0.3464 | -0.0065 | |||

| NJR / New Jersey Resources Corporation | 0.02 | 5.34 | 0.86 | -3.82 | 0.3388 | -0.0243 | |||

| CTAS / Cintas Corporation | 0.00 | 4.11 | 0.84 | 12.84 | 0.3302 | 0.0285 | |||

| TXN / Texas Instruments Incorporated | 0.00 | 3.29 | 0.83 | 19.31 | 0.3297 | 0.0447 | |||

| NSC / Norfolk Southern Corporation | 0.00 | 6.25 | 0.81 | 14.97 | 0.3215 | 0.0327 | |||

| MGEE / MGE Energy, Inc. | 0.01 | 1.26 | 0.78 | -3.69 | 0.3098 | -0.0219 | |||

| BFB / Brown-Forman Corp. - Class B | 0.03 | 5.74 | 0.75 | -16.15 | 0.2976 | -0.0686 | |||

| ORCL / Oracle Corporation | 0.00 | 11.88 | 0.75 | 75.06 | 0.2968 | 0.1218 | |||

| JPM / JPMorgan Chase & Co. | 0.00 | 0.04 | 0.75 | 18.20 | 0.2953 | 0.0377 | |||

| RSP / Invesco Exchange-Traded Fund Trust - Invesco S&P 500 Equal Weight ETF | 0.00 | 2.68 | 0.74 | 7.74 | 0.2917 | 0.0124 | |||

| SPGI / S&P Global Inc. | 0.00 | 5.40 | 0.68 | 9.34 | 0.2684 | 0.0151 | |||

| OTIS / Otis Worldwide Corporation | 0.01 | 3.62 | 0.68 | -0.59 | 0.2675 | -0.0100 | |||

| MZTI / The Marzetti Company | 0.00 | 1.65 | 0.67 | 0.30 | 0.2645 | -0.0073 | |||

| IWR / iShares Trust - iShares Russell Mid-Cap ETF | 0.01 | -0.57 | 0.67 | 7.40 | 0.2642 | 0.0106 | |||

| BLK / BlackRock, Inc. | 0.00 | 14.16 | 0.67 | 26.76 | 0.2638 | 0.0488 | |||

| FTV / Fortive Corporation | 0.01 | 4.83 | 0.65 | -25.34 | 0.2585 | -0.0986 | |||

| CBSH / Commerce Bancshares, Inc. | 0.01 | 2.82 | 0.63 | 2.76 | 0.2504 | -0.0011 | |||

| DPZ / Domino's Pizza, Inc. | 0.00 | 5.49 | 0.61 | 3.54 | 0.2427 | 0.0007 | |||

| JJSF / J&J Snack Foods Corp. | 0.00 | -0.61 | 0.56 | -14.44 | 0.2201 | -0.0452 | |||

| ADI / Analog Devices, Inc. | 0.00 | 6.20 | 0.53 | 25.35 | 0.2111 | 0.0373 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.00 | 14.60 | 0.51 | -6.74 | 0.2024 | -0.0212 | |||

| CAT / Caterpillar Inc. | 0.00 | 7.15 | 0.49 | 26.10 | 0.1930 | 0.0351 | |||

| AWK / American Water Works Company, Inc. | 0.00 | 3.76 | 0.46 | -2.32 | 0.1836 | -0.0100 | |||

| D / Dominion Energy, Inc. | 0.01 | 2.06 | 0.44 | 2.79 | 0.1749 | -0.0005 | |||

| WSO / Watsco, Inc. | 0.00 | 8.12 | 0.41 | -6.25 | 0.1603 | -0.0158 | |||

| PAYX / Paychex, Inc. | 0.00 | 0.52 | 0.40 | -5.28 | 0.1562 | -0.0138 | |||

| ELV / Elevance Health, Inc. | 0.00 | -0.10 | 0.39 | -10.66 | 0.1560 | -0.0240 | |||

| TSCO / Tractor Supply Company | 0.01 | 12.77 | 0.39 | 8.08 | 0.1533 | 0.0069 | |||

| DG / Dollar General Corporation | 0.00 | 13.08 | 0.37 | 47.24 | 0.1480 | 0.0442 | |||

| ODFL / Old Dominion Freight Line, Inc. | 0.00 | 7.04 | 0.37 | 5.19 | 0.1442 | 0.0025 | |||

| CPRT / Copart, Inc. | 0.01 | 4.29 | 0.36 | -9.50 | 0.1431 | -0.0201 | |||

| CME / CME Group Inc. | 0.00 | 6.28 | 0.36 | 10.46 | 0.1419 | 0.0093 | |||

| HON / Honeywell International Inc. | 0.00 | -0.36 | 0.32 | 9.46 | 0.1281 | 0.0075 | |||

| SYY / Sysco Corporation | 0.00 | 0.20 | 0.30 | 1.36 | 0.1181 | -0.0024 | |||

| MTD / Mettler-Toledo International Inc. | 0.00 | 8.33 | 0.29 | 7.84 | 0.1145 | 0.0050 | |||

| AZN / AstraZeneca PLC - Depositary Receipt (Common Stock) | 0.00 | 0.00 | 0.28 | -5.10 | 0.1104 | -0.0094 | |||

| VRTX / Vertex Pharmaceuticals Incorporated | 0.00 | 5.04 | 0.27 | -3.60 | 0.1061 | -0.0074 | |||

| GGG / Graco Inc. | 0.00 | 5.22 | 0.23 | 8.33 | 0.0925 | 0.0044 | |||

| IJR / iShares Trust - iShares Core S&P Small-Cap ETF | 0.00 | -0.90 | 0.23 | 3.62 | 0.0908 | 0.0004 | |||

| CMI / Cummins Inc. | 0.00 | 0.23 | 0.0890 | 0.0890 | |||||

| STZ / Constellation Brands, Inc. | 0.00 | 0.16 | 0.21 | -11.44 | 0.0828 | -0.0134 | |||

| RAL / Ralliant Corporation | 0.00 | 0.20 | 0.0790 | 0.0790 | |||||

| SJM / The J. M. Smucker Company | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| WTRG / Essential Utilities, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 |