Mga Batayang Estadistika

| Nilai Portofolio | $ 79,893,759 |

| Posisi Saat Ini | 102 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

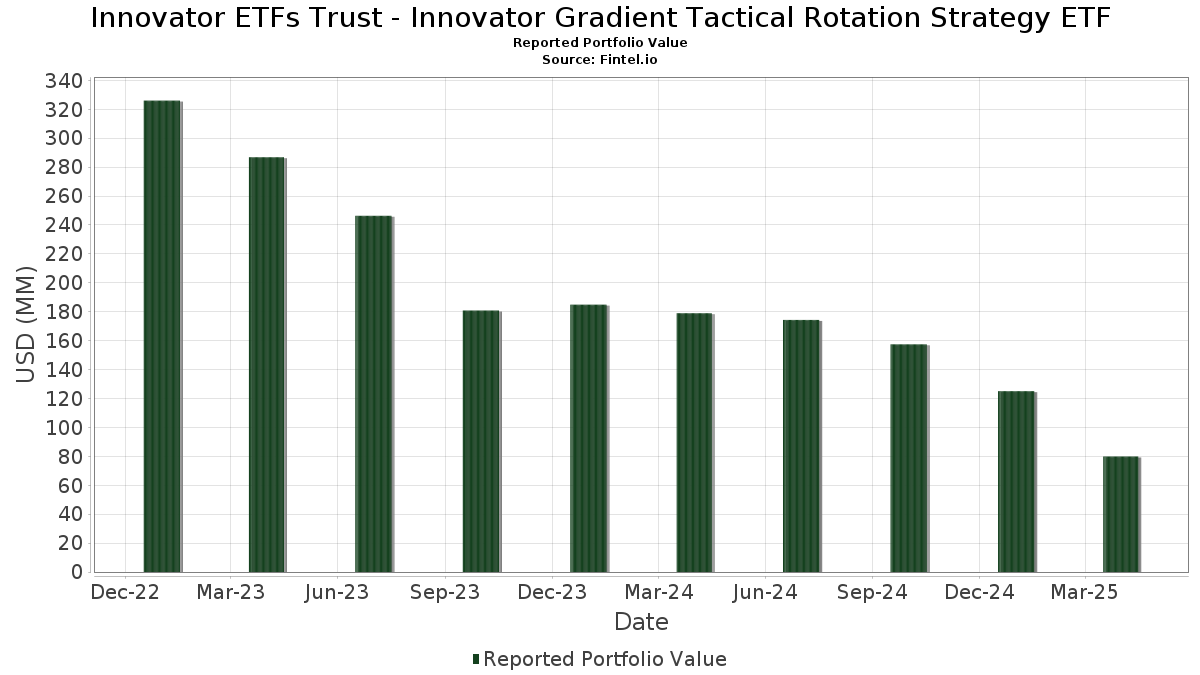

Innovator ETFs Trust - Innovator Gradient Tactical Rotation Strategy ETF telah mengungkapkan total kepemilikan 102 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 79,893,759 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Innovator ETFs Trust - Innovator Gradient Tactical Rotation Strategy ETF adalah The Coca-Cola Company (US:KO) , Berkshire Hathaway Inc. (US:BRK.B) , Republic Services, Inc. (US:RSG) , Marsh & McLennan Companies, Inc. (US:MMC) , and Atmos Energy Corporation (US:ATO) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 5.88 | 5.88 | 7.9266 | 7.9266 | |

| 0.00 | 0.97 | 1.3110 | 1.2251 | |

| 0.01 | 0.92 | 1.2447 | 1.2017 | |

| 0.02 | 0.88 | 1.1896 | 1.1499 | |

| 0.01 | 0.87 | 1.1708 | 1.1421 | |

| 0.01 | 0.89 | 1.1992 | 1.1360 | |

| 0.00 | 0.85 | 1.1435 | 1.1089 | |

| 0.01 | 0.84 | 1.1345 | 1.0962 | |

| 0.02 | 0.84 | 1.1298 | 1.0816 | |

| 0.00 | 0.85 | 1.1504 | 1.0637 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.00 | 0.00 | -5.9968 | ||

| 0.00 | 0.00 | -2.1960 | ||

| 0.00 | 0.00 | -2.0084 | ||

| 0.00 | 0.00 | -0.4445 | ||

| 0.00 | 0.00 | -0.3657 | ||

| 0.00 | 0.00 | -0.3487 | ||

| 0.00 | 0.00 | -0.3286 | ||

| 0.00 | 1.00 | 1.3472 | -0.3227 | |

| 0.00 | 0.00 | -0.2890 | ||

| 0.00 | 0.00 | -0.2486 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-06-24 untuk periode pelaporan 2025-04-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| Mount Vernon Liquid Assets Portfolio, LLC / STIV (N/A) | 5.88 | 5.88 | 7.9266 | 7.9266 | |||||

| KO / The Coca-Cola Company | 0.01 | 57.65 | 1.01 | 80.21 | 1.3645 | 0.8863 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | -55.22 | 1.00 | -49.08 | 1.3472 | -0.3227 | |||

| RSG / Republic Services, Inc. | 0.00 | 733.55 | 0.97 | 871.00 | 1.3110 | 1.2251 | |||

| MMC / Marsh & McLennan Companies, Inc. | 0.00 | 269.20 | 0.93 | 285.12 | 1.2576 | 1.0507 | |||

| ATO / Atmos Energy Corporation | 0.01 | 1,518.31 | 0.92 | 1,744.00 | 1.2447 | 1.2017 | |||

| ED / Consolidated Edison, Inc. | 0.01 | 896.84 | 0.89 | 1,101.35 | 1.1992 | 1.1360 | |||

| FE / FirstEnergy Corp. | 0.02 | 1,656.36 | 0.88 | 1,815.22 | 1.1896 | 1.1499 | |||

| CME / CME Group Inc. | 0.00 | 283.96 | 0.88 | 351.03 | 1.1810 | 1.0152 | |||

| LIN / Linde plc | 0.00 | 76.61 | 0.87 | 79.55 | 1.1725 | 0.7599 | |||

| EVRG / Evergy, Inc. | 0.01 | 2,292.57 | 0.87 | 2,527.27 | 1.1708 | 1.1421 | |||

| COR / Cencora, Inc. | 0.00 | 628.50 | 0.85 | 743.56 | 1.1504 | 1.0637 | |||

| CL / Colgate-Palmolive Company | 0.01 | 396.19 | 0.85 | 429.19 | 1.1495 | 1.0119 | |||

| VRSN / VeriSign, Inc. | 0.00 | 1,489.95 | 0.85 | 2,017.50 | 1.1435 | 1.1089 | |||

| CMS / CMS Energy Corporation | 0.01 | 1,574.49 | 0.84 | 1,768.89 | 1.1345 | 1.0962 | |||

| PPL / PPL Corporation | 0.02 | 1,263.46 | 0.84 | 1,394.64 | 1.1298 | 1.0816 | |||

| ADP / Automatic Data Processing, Inc. | 0.00 | 195.16 | 0.83 | 193.59 | 1.1130 | 0.8730 | |||

| DUK / Duke Energy Corporation | 0.01 | 283.49 | 0.82 | 318.27 | 1.1128 | 0.9446 | |||

| PG / The Procter & Gamble Company | 0.01 | -5.62 | 0.82 | -7.62 | 1.1122 | 0.3524 | |||

| MDLZ / Mondelez International, Inc. | 0.01 | 293.15 | 0.82 | 364.20 | 1.1023 | 0.9516 | |||

| WEC / WEC Energy Group, Inc. | 0.01 | 923.55 | 0.81 | 1,039.44 | 1.0917 | 1.0307 | |||

| KDP / Keurig Dr Pepper Inc. | 0.02 | 807.51 | 0.81 | 882.93 | 1.0878 | 1.0175 | |||

| YUM / Yum! Brands, Inc. | 0.01 | 739.97 | 0.81 | 871.08 | 1.0875 | 1.0165 | |||

| JNJ / Johnson & Johnson | 0.01 | -6.21 | 0.81 | -3.59 | 1.0862 | 0.3743 | |||

| NI / NiSource Inc. | 0.02 | 1,827.89 | 0.80 | 1,958.97 | 1.0831 | 1.0493 | |||

| TJX / The TJX Companies, Inc. | 0.01 | 139.67 | 0.79 | 147.04 | 1.0708 | 0.7971 | |||

| O / Realty Income Corporation | 0.01 | 583.38 | 0.79 | 623.85 | 1.0651 | 0.9721 | |||

| GD / General Dynamics Corporation | 0.00 | 391.17 | 0.79 | 421.19 | 1.0619 | 0.9329 | |||

| L / Loews Corporation | 0.01 | 2,085.96 | 0.78 | 2,137.14 | 1.0574 | 1.0273 | |||

| ICE / Intercontinental Exchange, Inc. | 0.00 | 255.88 | 0.78 | 274.64 | 1.0563 | 0.8779 | |||

| CB / Chubb Limited | 0.00 | 217.87 | 0.78 | 235.34 | 1.0500 | 0.8517 | |||

| DTE / DTE Energy Company | 0.01 | 1,100.00 | 0.78 | 1,287.50 | 1.0489 | 1.0006 | |||

| ITW / Illinois Tool Works Inc. | 0.00 | 425.57 | 0.77 | 386.79 | 1.0443 | 0.9087 | |||

| SO / The Southern Company | 0.01 | 236.76 | 0.77 | 269.86 | 1.0435 | 0.8647 | |||

| PNW / Pinnacle West Capital Corporation | 0.01 | 3,023.08 | 0.77 | 3,409.09 | 1.0425 | 1.0232 | |||

| EXC / Exelon Corporation | 0.02 | 617.31 | 0.77 | 747.25 | 1.0405 | 0.9624 | |||

| BRO / Brown & Brown, Inc. | 0.01 | 1,173.43 | 0.76 | 1,262.50 | 1.0297 | 0.9813 | |||

| MO / Altria Group, Inc. | 0.01 | 233.15 | 0.76 | 279.10 | 1.0279 | 0.8558 | |||

| MCD / McDonald's Corporation | 0.00 | 45.42 | 0.76 | 61.02 | 1.0257 | 0.6234 | |||

| NOC / Northrop Grumman Corporation | 0.00 | 399.68 | 0.76 | 398.68 | 1.0230 | 0.8935 | |||

| MA / Mastercard Incorporated | 0.00 | -26.10 | 0.76 | -27.07 | 1.0216 | 0.1369 | |||

| JKHY / Jack Henry & Associates, Inc. | 0.00 | 2,511.38 | 0.76 | 2,506.90 | 1.0202 | 0.9954 | |||

| V / Visa Inc. | 0.00 | -44.76 | 0.75 | -44.17 | 1.0150 | -0.1330 | |||

| AEE / Ameren Corporation | 0.01 | 1,135.25 | 0.75 | 1,210.53 | 1.0086 | 0.9597 | |||

| SPGI / S&P Global Inc. | 0.00 | 106.21 | 0.75 | 97.62 | 1.0084 | 0.6864 | |||

| HON / Honeywell International Inc. | 0.00 | 137.67 | 0.74 | 123.49 | 1.0014 | 0.7186 | |||

| ORLY / O'Reilly Automotive, Inc. | 0.00 | 296.97 | 0.74 | 335.88 | 1.0003 | 0.8547 | |||

| AJG / Arthur J. Gallagher & Co. | 0.00 | 302.63 | 0.74 | 327.33 | 0.9927 | 0.8462 | |||

| AEP / American Electric Power Company, Inc. | 0.01 | 458.19 | 0.73 | 516.81 | 0.9911 | 0.8893 | |||

| BSX / Boston Scientific Corporation | 0.01 | 111.92 | 0.73 | 113.08 | 0.9889 | 0.6957 | |||

| KMB / Kimberly-Clark Corporation | 0.01 | 629.04 | 0.73 | 645.92 | 0.9862 | 0.9019 | |||

| LHX / L3Harris Technologies, Inc. | 0.00 | 664.52 | 0.73 | 693.48 | 0.9847 | 0.9063 | |||

| LNT / Alliant Energy Corporation | 0.01 | 1,921.67 | 0.72 | 2,026.47 | 0.9754 | 0.9460 | |||

| CHD / Church & Dwight Co., Inc. | 0.01 | 1,200.18 | 0.72 | 1,144.83 | 0.9739 | 0.9236 | |||

| VICI / VICI Properties Inc. | 0.02 | 837.21 | 0.72 | 915.49 | 0.9735 | 0.9125 | |||

| LMT / Lockheed Martin Corporation | 0.00 | 213.28 | 0.72 | 223.32 | 0.9731 | 0.7830 | |||

| REG / Regency Centers Corporation | 0.01 | 2,578.28 | 0.72 | 2,673.08 | 0.9726 | 0.9498 | |||

| RTX / RTX Corporation | 0.01 | 86.27 | 0.71 | 82.35 | 0.9628 | 0.6291 | |||

| VZ / Verizon Communications Inc. | 0.02 | 68.63 | 0.71 | 88.62 | 0.9625 | 0.6402 | |||

| WELL / Welltower Inc. | 0.00 | 246.15 | 0.71 | 287.50 | 0.9618 | 0.8049 | |||

| PEP / PepsiCo, Inc. | 0.01 | 67.74 | 0.71 | 51.17 | 0.9605 | 0.5586 | |||

| BR / Broadridge Financial Solutions, Inc. | 0.00 | 992.54 | 0.71 | 1,025.40 | 0.9573 | 0.9030 | |||

| FIS / Fidelity National Information Services, Inc. | 0.01 | 631.33 | 0.71 | 608.00 | 0.9563 | 0.8710 | |||

| WTW / Willis Towers Watson Public Limited Company | 0.00 | 897.83 | 0.71 | 841.33 | 0.9528 | 0.8883 | |||

| OTIS / Otis Worldwide Corporation | 0.01 | 703.29 | 0.71 | 710.34 | 0.9513 | 0.8772 | |||

| MSI / Motorola Solutions, Inc. | 0.00 | 319.16 | 0.70 | 294.94 | 0.9487 | 0.7964 | |||

| WM / Waste Management, Inc. | 0.00 | 257.67 | 0.70 | 280.33 | 0.9390 | 0.7825 | |||

| ROP / Roper Technologies, Inc. | 0.00 | 406.94 | 0.70 | 392.91 | 0.9383 | 0.8182 | |||

| SYY / Sysco Corporation | 0.01 | 769.82 | 0.70 | 758.02 | 0.9382 | 0.8687 | |||

| PAYX / Paychex, Inc. | 0.00 | 544.87 | 0.69 | 547.66 | 0.9355 | 0.8435 | |||

| WMT / Walmart Inc. | 0.01 | -28.63 | 0.69 | -29.32 | 0.9272 | 0.0991 | |||

| ABT / Abbott Laboratories | 0.01 | 32.19 | 0.68 | 35.18 | 0.9227 | 0.4914 | |||

| AVB / AvalonBay Communities, Inc. | 0.00 | 896.91 | 0.68 | 854.93 | 0.9148 | 0.8537 | |||

| VRSK / Verisk Analytics, Inc. | 0.00 | 608.70 | 0.68 | 634.78 | 0.9124 | 0.8336 | |||

| TMUS / T-Mobile US, Inc. | 0.00 | 144.83 | 0.67 | 159.46 | 0.9077 | 0.6868 | |||

| BDX / Becton, Dickinson and Company | 0.00 | 391.36 | 0.67 | 311.66 | 0.9059 | 0.7667 | |||

| HOLX / Hologic, Inc. | 0.01 | 2,074.72 | 0.67 | 1,663.16 | 0.9048 | 0.8723 | |||

| NDAQ / Nasdaq, Inc. | 0.01 | 830.19 | 0.67 | 768.83 | 0.9027 | 0.8364 | |||

| XOM / Exxon Mobil Corporation | 0.01 | -36.85 | 0.67 | -37.63 | 0.9022 | -0.0103 | |||

| UDR / UDR, Inc. | 0.02 | 2,209.05 | 0.66 | 2,264.29 | 0.8935 | 0.8691 | |||

| VLTO / Veralto Corporation | 0.01 | 1,121.81 | 0.66 | 1,037.93 | 0.8914 | 0.8417 | |||

| GIS / General Mills, Inc. | 0.01 | 815.77 | 0.66 | 765.79 | 0.8887 | 0.8238 | |||

| EXPD / Expeditors International of Washington, Inc. | 0.01 | 1,774.92 | 0.66 | 1,725.00 | 0.8867 | 0.8558 | |||

| AVY / Avery Dennison Corporation | 0.00 | 1,983.15 | 0.66 | 1,826.47 | 0.8847 | 0.8556 | |||

| SYK / Stryker Corporation | 0.00 | 123.50 | 0.65 | 113.73 | 0.8826 | 0.6217 | |||

| MDT / Medtronic plc | 0.01 | 162.17 | 0.65 | 145.28 | 0.8770 | 0.6507 | |||

| BLK / BlackRock, Inc. | 0.00 | 114.16 | 0.65 | 82.07 | 0.8768 | 0.5727 | |||

| COST / Costco Wholesale Corporation | 0.00 | -35.67 | 0.65 | -34.71 | 0.8733 | 0.0286 | |||

| ECL / Ecolab Inc. | 0.00 | 347.48 | 0.65 | 351.75 | 0.8726 | 0.7501 | |||

| CSCO / Cisco Systems, Inc. | 0.01 | 22.85 | 0.64 | 16.88 | 0.8700 | 0.4005 | |||

| PPG / PPG Industries, Inc. | 0.01 | 1,011.13 | 0.64 | 950.82 | 0.8647 | 0.8126 | |||

| BK / The Bank of New York Mellon Corporation | 0.01 | 378.19 | 0.64 | 349.30 | 0.8610 | 0.7395 | |||

| AON / Aon plc | 0.00 | 251.32 | 0.61 | 237.36 | 0.8289 | 0.6731 | |||

| AIZ / Assurant, Inc. | 0.00 | 2,597.44 | 0.61 | 2,332.00 | 0.8205 | 0.7990 | |||

| FRT / Federal Realty Investment Trust | 0.01 | 3,564.57 | 0.60 | 3,068.42 | 0.8133 | 0.7971 | |||

| CVX / Chevron Corporation | 0.00 | 14.74 | 0.60 | 4.75 | 0.8029 | 0.3184 | |||

| FI / Fiserv, Inc. | 0.00 | 142.06 | 0.58 | 106.79 | 0.7822 | 0.5434 | |||

| HLT / Hilton Worldwide Holdings Inc. | 0.00 | 357.27 | 0.57 | 304.23 | 0.7746 | 0.6531 | |||

| UNP / Union Pacific Corporation | 0.00 | 91.40 | 0.57 | 66.96 | 0.7706 | 0.4785 | |||

| CTSH / Cognizant Technology Solutions Corporation | 0.01 | 554.73 | 0.54 | 484.95 | 0.7348 | 0.6553 | |||

| LYB / LyondellBasell Industries N.V. | 0.01 | 1,401.01 | 0.52 | 1,077.27 | 0.6989 | 0.6606 | |||

| US BANK MMDA - USBGFS 9 / STIV (N/A) | 0.17 | 0.17 | 0.2262 | 0.2262 | |||||

| COO / The Cooper Companies, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0375 | ||||

| GDDY / GoDaddy Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0580 | ||||

| FLT / Corpay, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0519 | ||||

| GEV / GE Vernova Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.2001 | ||||

| PLTR / Palantir Technologies Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.3286 | ||||

| AMCR / Amcor plc | 0.00 | -100.00 | 0.00 | -100.00 | -0.0273 | ||||

| VST / Vistra Corp. | 0.00 | -100.00 | 0.00 | -100.00 | -0.1111 | ||||

| AVGO / Broadcom Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -2.0084 | ||||

| CAT / Caterpillar Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.3487 | ||||

| HWM / Howmet Aerospace Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0999 | ||||

| AMD / Advanced Micro Devices, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.3657 | ||||

| TPL / Texas Pacific Land Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.0486 | ||||

| MHK / Mohawk Industries, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0124 | ||||

| KEYS / Keysight Technologies, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0602 | ||||

| J / Jacobs Solutions Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0339 | ||||

| ODFL / Old Dominion Freight Line, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0678 | ||||

| TMO / Thermo Fisher Scientific Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.4445 | ||||

| CNC / Centene Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.0628 | ||||

| KKR / KKR & Co. Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.2192 | ||||

| NCLH / Norwegian Cruise Line Holdings Ltd. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0242 | ||||

| LH / Labcorp Holdings Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0406 | ||||

| BIIB / Biogen Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0408 | ||||

| HRL / Hormel Foods Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.0169 | ||||

| SOLV / Solventum Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.0199 | ||||

| NEM / Newmont Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.0945 | ||||

| WDAY / Workday, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.1087 | ||||

| TSLA / Tesla, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -2.1960 | ||||

| MNST / Monster Beverage Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.0663 | ||||

| APO / Apollo Global Management, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.1487 | ||||

| AMT / American Tower Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.1681 | ||||

| BX / Blackstone Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.2486 | ||||

| LII / Lennox International Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0373 | ||||

| MCO / Moody's Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.1514 | ||||

| MSFT / Microsoft Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -5.9968 | ||||

| AMAT / Applied Materials, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.2890 | ||||

| DECK / Deckers Outdoor Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.0524 | ||||

| HSY / The Hershey Company | 0.00 | -100.00 | 0.00 | -100.00 | -0.0428 |