Mga Batayang Estadistika

| Nilai Portofolio | $ 475,079,803 |

| Posisi Saat Ini | 54 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

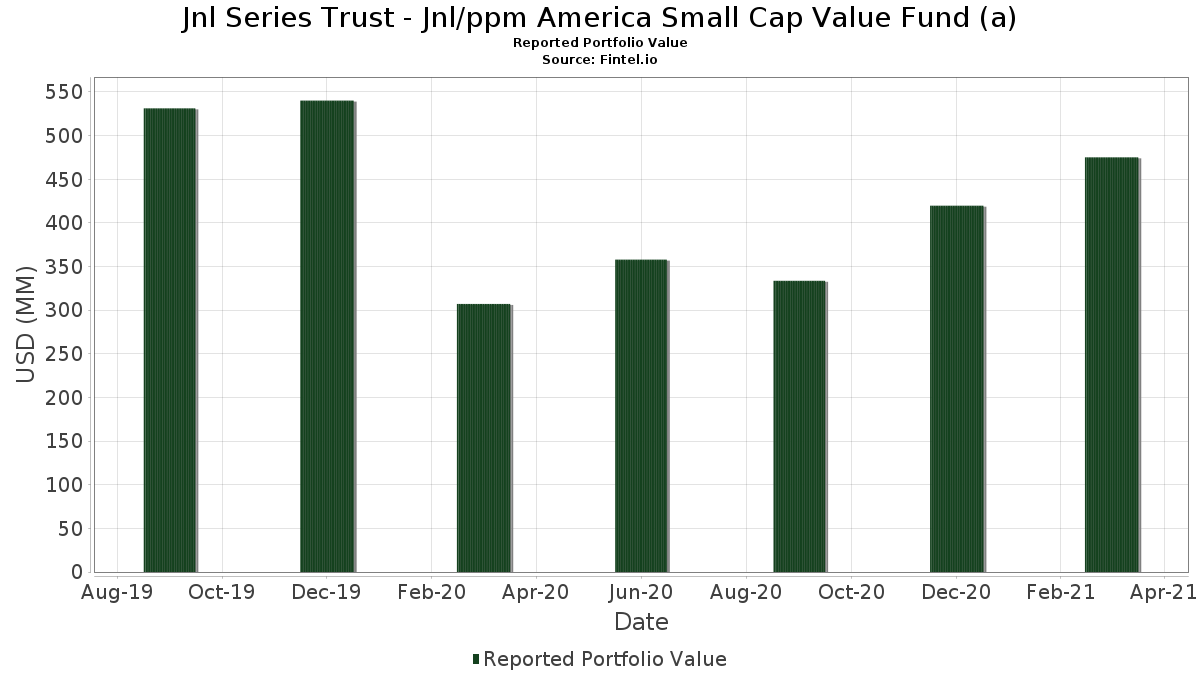

Jnl Series Trust - Jnl/ppm America Small Cap Value Fund (a) telah mengungkapkan total kepemilikan 54 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 475,079,803 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Jnl Series Trust - Jnl/ppm America Small Cap Value Fund (a) adalah MasTec, Inc. (US:MTZ) , Axos Financial, Inc. (US:AX) , Cimarex Energy Co. (US:XEC) , Western Alliance Bancorporation (US:WAL) , and Terex Corporation (US:TEX) . Posisi baru Jnl Series Trust - Jnl/ppm America Small Cap Value Fund (a) meliputi: Supernus Pharmaceuticals, Inc. (US:SUPN) , Computer Programs and Systems, Inc. (US:CPSI) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.23 | 6.01 | 1.2674 | 1.2674 | |

| 0.15 | 4.65 | 0.9808 | 0.9808 | |

| 0.32 | 12.23 | 2.5782 | 0.8283 | |

| 0.26 | 12.01 | 2.5317 | 0.7424 | |

| 0.14 | 13.35 | 2.8140 | 0.5989 | |

| 0.61 | 10.35 | 2.1815 | 0.5900 | |

| 0.07 | 10.29 | 2.1694 | 0.5742 | |

| 0.16 | 8.98 | 1.8924 | 0.5688 | |

| 0.23 | 13.64 | 2.8735 | 0.5440 | |

| 0.04 | 6.71 | 1.4150 | 0.4683 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.17 | 5.77 | 1.2157 | -0.6366 | |

| 0.04 | 7.71 | 1.6247 | -0.4932 | |

| 0.24 | 7.42 | 1.5642 | -0.4508 | |

| 0.10 | 9.60 | 2.0228 | -0.4460 | |

| 0.13 | 6.10 | 1.2845 | -0.4334 | |

| 0.13 | 8.44 | 1.7779 | -0.4210 | |

| 0.10 | 8.29 | 1.7462 | -0.3638 | |

| 0.09 | 6.03 | 1.2715 | -0.3528 | |

| 0.09 | 3.89 | 0.8201 | -0.2789 | |

| 0.25 | 9.98 | 2.1023 | -0.2519 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2021-05-27 untuk periode pelaporan 2021-03-31. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MTZ / MasTec, Inc. | 0.15 | -8.71 | 14.00 | 25.46 | 2.9499 | 0.2910 | |||

| AX / Axos Financial, Inc. | 0.29 | -9.19 | 13.72 | 13.74 | 2.8917 | 0.0168 | |||

| XEC / Cimarex Energy Co. | 0.23 | -11.90 | 13.64 | 39.49 | 2.8735 | 0.5440 | |||

| WAL / Western Alliance Bancorporation | 0.14 | -8.80 | 13.35 | 43.66 | 2.8140 | 0.5989 | |||

| TEX / Terex Corporation | 0.29 | -8.59 | 13.29 | 20.71 | 2.8008 | 0.1768 | |||

| HOMB / Home Bancshares, Inc. (Conway, AR) | 0.49 | -8.89 | 13.20 | 26.51 | 2.7823 | 0.2952 | |||

| PACW / Pacwest Bancorp | 0.32 | 10.93 | 12.23 | 66.61 | 2.5782 | 0.8283 | |||

| SKYW / SkyWest, Inc. | 0.22 | -8.77 | 12.13 | 23.30 | 2.5555 | 0.2117 | |||

| MDP / Meredith Holdings Corp | 0.40 | -13.44 | 12.05 | 34.26 | 2.5397 | 0.4004 | |||

| KBH / KB Home | 0.26 | 15.27 | 12.01 | 60.02 | 2.5317 | 0.7424 | |||

| PAG / Penske Automotive Group, Inc. | 0.15 | -8.42 | 11.96 | 23.74 | 2.5203 | 0.2169 | |||

| KRG / Kite Realty Group Trust | 0.61 | -3.61 | 11.83 | 24.29 | 2.4922 | 0.2247 | |||

| STL / Sterling Bancorp. | 0.51 | -8.36 | 11.81 | 17.33 | 2.4895 | 0.0901 | |||

| APOG / Apogee Enterprises, Inc. | 0.28 | -8.39 | 11.48 | 18.22 | 2.4185 | 0.1050 | |||

| SKX / Skechers U.S.A., Inc. | 0.27 | 3.54 | 11.23 | 20.16 | 2.3661 | 0.1393 | |||

| HUN / Huntsman Corporation | 0.39 | 11.20 | 11.22 | 27.52 | 2.3639 | 0.2677 | |||

| DRH / DiamondRock Hospitality Company | 1.09 | -8.22 | 11.22 | 14.59 | 2.3639 | 0.0310 | |||

| ABCB / Ameris Bancorp | 0.20 | 3.57 | 10.66 | 42.86 | 2.2468 | 0.4682 | |||

| AXL / American Axle & Manufacturing Holdings, Inc. | 1.09 | -4.08 | 10.48 | 11.11 | 2.2088 | -0.0393 | |||

| FHN / First Horizon Corporation | 0.61 | 16.97 | 10.35 | 55.02 | 2.1815 | 0.5900 | |||

| RS / Reliance, Inc. | 0.07 | 20.93 | 10.29 | 53.78 | 2.1694 | 0.5742 | |||

| EVR / Evercore Inc. | 0.08 | -8.23 | 10.13 | 10.26 | 2.1348 | -0.0546 | |||

| KMT / Kennametal Inc. | 0.25 | -8.44 | 9.98 | 0.98 | 2.1023 | -0.2519 | |||

| RNST / Renasant Corporation | 0.24 | -8.15 | 9.89 | 12.84 | 2.0832 | -0.0044 | |||

| ITGR / Integer Holdings Corporation | 0.10 | -18.32 | 9.60 | -7.34 | 2.0228 | -0.4460 | |||

| FL / Foot Locker, Inc. | 0.16 | 16.24 | 8.98 | 61.69 | 1.8924 | 0.5688 | |||

| LNTH / Lantheus Holdings, Inc. | 0.42 | -7.59 | 8.88 | 46.40 | 1.8704 | 0.4256 | |||

| GATX / GATX Corporation | 0.09 | -8.36 | 8.75 | 2.17 | 1.8429 | -0.1968 | |||

| HLI / Houlihan Lokey, Inc. | 0.13 | -7.58 | 8.44 | -8.57 | 1.7779 | -0.4210 | |||

| BANC / Banc of California, Inc. | 0.47 | 4.53 | 8.44 | 28.48 | 1.7777 | 0.2129 | |||

| INDB / Independent Bank Corp. | 0.10 | -18.81 | 8.29 | -6.42 | 1.7462 | -0.3638 | |||

| DOC / Healthpeak Properties, Inc. | 0.45 | 10.53 | 7.90 | 9.72 | 1.6655 | -0.0511 | |||

| HELE / Helen of Troy Limited | 0.04 | -8.50 | 7.71 | -13.24 | 1.6247 | -0.4932 | |||

| IDA / IDACORP, Inc. | 0.08 | 15.64 | 7.69 | 20.39 | 1.6200 | 0.0982 | |||

| JHG / Janus Henderson Group plc | 0.24 | -8.38 | 7.42 | -12.21 | 1.5642 | -0.4508 | |||

| BDN / Brandywine Realty Trust | 0.56 | -7.17 | 7.22 | 0.61 | 1.5210 | -0.1884 | |||

| CNXC / Concentrix Corporation | 0.04 | 11.43 | 6.71 | 69.03 | 1.4150 | 0.4683 | |||

| SPR / Spirit AeroSystems Holdings, Inc. | 0.13 | -6.79 | 6.28 | 15.99 | 1.3225 | 0.0333 | |||

| 719405AF9 / Photronics, Inc. Bond | 0.48 | 5.84 | 6.16 | 21.97 | 1.2975 | 0.0944 | |||

| AJRD / Aerojet Rocketdyne Holdings Inc | 0.13 | -4.84 | 6.10 | -15.44 | 1.2845 | -0.4334 | |||

| SMTC / Semtech Corporation | 0.09 | -7.51 | 6.03 | -11.47 | 1.2715 | -0.3528 | |||

| SUPN / Supernus Pharmaceuticals, Inc. | 0.23 | 6.01 | 1.2674 | 1.2674 | |||||

| PINC / Premier, Inc. | 0.17 | -23.04 | 5.77 | -25.78 | 1.2157 | -0.6366 | |||

| PBF / PBF Energy Inc. | 0.40 | -36.64 | 5.71 | 26.28 | 1.2041 | 0.1258 | |||

| AVYA / Avaya Holdings Corp. | 0.20 | -6.79 | 5.54 | 36.45 | 1.1669 | 0.1996 | |||

| KBR / KBR, Inc. | 0.14 | -6.73 | 5.38 | 15.76 | 1.1330 | 0.0263 | |||

| PRMW / Primo Water Corporation | 0.32 | -6.87 | 5.25 | -3.42 | 1.1061 | -0.1891 | |||

| BHE / Benchmark Electronics, Inc. | 0.15 | -13.16 | 4.78 | -0.58 | 1.0064 | -0.1384 | |||

| CPSI / Computer Programs and Systems, Inc. | 0.15 | 4.65 | 0.9808 | 0.9808 | |||||

| SAFM / Sanderson Farms, Inc. | 0.03 | 16.21 | 4.58 | 36.93 | 0.9651 | 0.1681 | |||

| BDC / Belden Inc. | 0.10 | -6.81 | 4.31 | -1.33 | 0.9088 | -0.1326 | |||

| VRNT / Verint Systems Inc. | 0.09 | 24.62 | 3.89 | -15.61 | 0.8201 | -0.2789 | |||

| CACI / CACI International Inc | 0.01 | -6.71 | 3.43 | -7.73 | 0.7225 | -0.1628 | |||

| CSGS / CSG Systems International, Inc. | 0.07 | -7.01 | 3.04 | -7.38 | 0.6404 | -0.1415 | |||

| 46628D437 / JNL Government Money Market Fund | 0.00 | -100.00 | 0.00 | -100.00 | -0.0908 |