Mga Batayang Estadistika

| Nilai Portofolio | $ 155,154,027 |

| Posisi Saat Ini | 62 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

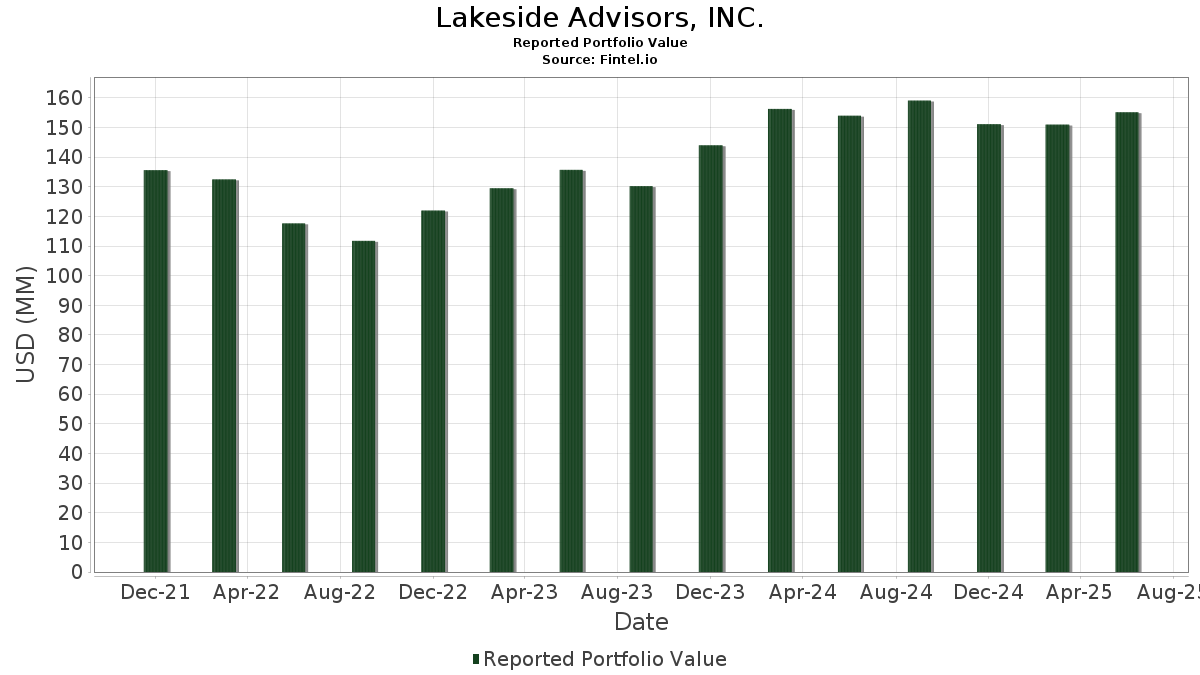

Lakeside Advisors, INC. telah mengungkapkan total kepemilikan 62 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 155,154,027 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Lakeside Advisors, INC. adalah Microsoft Corporation (US:MSFT) , Berkshire Hathaway Inc. (US:BRK.B) , Costco Wholesale Corporation (US:COST) , Nucor Corporation (US:NUE) , and Strats Trust For Procter & Gambel Security - Preferred Security (US:GJR) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.09 | 42.99 | 27.7055 | 3.7465 | |

| 0.01 | 2.91 | 1.8771 | 0.3771 | |

| 0.00 | 1.22 | 0.7844 | 0.3194 | |

| 0.01 | 2.37 | 1.5274 | 0.2856 | |

| 0.02 | 5.31 | 3.4228 | 0.2421 | |

| 0.00 | 1.06 | 0.6807 | 0.1883 | |

| 0.05 | 6.22 | 4.0119 | 0.0875 | |

| 0.10 | 4.50 | 2.8979 | 0.0839 | |

| 0.00 | 0.70 | 0.4511 | 0.0738 | |

| 0.04 | 0.80 | 0.5186 | 0.0656 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.03 | 14.56 | 9.3823 | -1.4646 | |

| 0.04 | 5.88 | 3.7898 | -0.5166 | |

| 0.02 | 2.98 | 1.9233 | -0.4048 | |

| 0.07 | 2.14 | 1.3767 | -0.3846 | |

| 0.01 | 1.74 | 1.1207 | -0.3795 | |

| 0.01 | 13.39 | 8.6288 | -0.3659 | |

| 0.02 | 3.51 | 2.2611 | -0.2706 | |

| 0.02 | 4.31 | 2.7804 | -0.2223 | |

| 0.01 | 1.46 | 0.9434 | -0.2046 | |

| 0.03 | 3.66 | 2.3611 | -0.1997 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-07-23 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MSFT / Microsoft Corporation | 0.09 | -10.32 | 42.99 | 18.83 | 27.7055 | 3.7465 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.03 | -2.55 | 14.56 | -11.11 | 9.3823 | -1.4646 | |||

| COST / Costco Wholesale Corporation | 0.01 | -5.82 | 13.39 | -1.42 | 8.6288 | -0.3659 | |||

| NUE / Nucor Corporation | 0.05 | -2.41 | 6.22 | 5.05 | 4.0119 | 0.0875 | |||

| GJR / Strats Trust For Procter & Gambel Security - Preferred Security | 0.04 | -3.26 | 5.88 | -9.55 | 3.7898 | -0.5166 | |||

| VTI / Vanguard Index Funds - Vanguard Total Stock Market ETF | 0.02 | 0.00 | 5.31 | 10.58 | 3.4228 | 0.2421 | |||

| USB / U.S. Bancorp | 0.10 | -1.26 | 4.50 | 5.84 | 2.8979 | 0.0839 | |||

| MMM / 3M Company | 0.03 | -0.93 | 4.35 | 2.69 | 2.8020 | -0.0017 | |||

| WM / Waste Management, Inc. | 0.02 | -3.72 | 4.31 | -4.85 | 2.7804 | -0.2223 | |||

| EXPD / Expeditors International of Washington, Inc. | 0.03 | -0.27 | 3.66 | -5.25 | 2.3611 | -0.1997 | |||

| JNJ / Johnson & Johnson | 0.02 | -0.36 | 3.51 | -8.22 | 2.2611 | -0.2706 | |||

| PCAR / PACCAR Inc | 0.03 | 0.15 | 3.21 | -2.22 | 2.0704 | -0.1056 | |||

| ABBV / AbbVie Inc. | 0.02 | -4.17 | 2.98 | -15.08 | 1.9233 | -0.4048 | |||

| GE / General Electric Company | 0.01 | 0.00 | 2.91 | 28.62 | 1.8771 | 0.3771 | |||

| NVDA / NVIDIA Corporation | 0.01 | -13.29 | 2.37 | 26.41 | 1.5274 | 0.2856 | |||

| SBUX / Starbucks Corporation | 0.02 | 0.05 | 2.20 | -6.51 | 1.4154 | -0.1409 | |||

| T / AT&T Inc. | 0.07 | -21.51 | 2.14 | -19.67 | 1.3767 | -0.3846 | |||

| KR / The Kroger Co. | 0.03 | -4.17 | 2.06 | 1.53 | 1.3271 | -0.0158 | |||

| AAPL / Apple Inc. | 0.01 | -16.89 | 1.74 | -23.23 | 1.1207 | -0.3795 | |||

| HD / The Home Depot, Inc. | 0.00 | 0.00 | 1.71 | 0.06 | 1.1047 | -0.0301 | |||

| XOM / Exxon Mobil Corporation | 0.01 | -6.84 | 1.46 | -15.58 | 0.9434 | -0.2046 | |||

| DINT / Davis Fundamental ETF Trust - Davis Select International ETF | 0.06 | -4.27 | 1.45 | 7.18 | 0.9334 | 0.0379 | |||

| NVO / Novo Nordisk A/S - Depositary Receipt (Common Stock) | 0.02 | -1.05 | 1.30 | -1.59 | 0.8385 | -0.0376 | |||

| GEV / GE Vernova Inc. | 0.00 | 0.00 | 1.22 | 73.36 | 0.7844 | 0.3194 | |||

| MCD / McDonald's Corporation | 0.00 | 0.00 | 1.20 | -6.45 | 0.7755 | -0.0765 | |||

| MDT / Medtronic plc | 0.01 | 0.06 | 1.17 | -2.91 | 0.7522 | -0.0442 | |||

| CB / Chubb Limited | 0.00 | -7.00 | 1.16 | -10.74 | 0.7447 | -0.1130 | |||

| CEG / Constellation Energy Corporation | 0.00 | -11.26 | 1.06 | 42.13 | 0.6807 | 0.1883 | |||

| GILD / Gilead Sciences, Inc. | 0.01 | -7.83 | 1.04 | -8.76 | 0.6716 | -0.0852 | |||

| MUST / Columbia ETF Trust I - Columbia Multi-Sector Municipal Income ETF | 0.04 | 17.74 | 0.80 | 17.72 | 0.5186 | 0.0656 | |||

| FDX / FedEx Corporation | 0.00 | -1.51 | 0.74 | -8.17 | 0.4784 | -0.0569 | |||

| LOW / Lowe's Companies, Inc. | 0.00 | 0.00 | 0.71 | -4.94 | 0.4593 | -0.0369 | |||

| CSX / CSX Corporation | 0.02 | 0.00 | 0.70 | 10.87 | 0.4543 | 0.0332 | |||

| BA / The Boeing Company | 0.00 | 0.00 | 0.70 | 22.85 | 0.4511 | 0.0738 | |||

| CAT / Caterpillar Inc. | 0.00 | 0.00 | 0.69 | 17.86 | 0.4470 | 0.0569 | |||

| EXC / Exelon Corporation | 0.02 | -1.30 | 0.66 | -6.93 | 0.4242 | -0.0445 | |||

| CSCO / Cisco Systems, Inc. | 0.01 | 0.07 | 0.59 | 12.57 | 0.3809 | 0.0330 | |||

| WFC / Wells Fargo & Company | 0.01 | 0.00 | 0.58 | 11.49 | 0.3757 | 0.0298 | |||

| QCOM / QUALCOMM Incorporated | 0.00 | 0.06 | 0.53 | 3.75 | 0.3388 | 0.0032 | |||

| SOLV / Solventum Corporation | 0.01 | -1.78 | 0.49 | -1.99 | 0.3175 | -0.0156 | |||

| DIVS / Guinness Atkinson Funds - SmartETFs Dividend Builder ETF | 0.01 | -11.93 | 0.45 | -7.10 | 0.2871 | -0.0307 | |||

| VOO / Vanguard Index Funds - Vanguard S&P 500 ETF | 0.00 | 0.00 | 0.43 | 10.65 | 0.2746 | 0.0193 | |||

| AMZN / Amazon.com, Inc. | 0.00 | -20.66 | 0.42 | -8.48 | 0.2715 | -0.0335 | |||

| MA / Mastercard Incorporated | 0.00 | 0.00 | 0.41 | 2.52 | 0.2626 | -0.0006 | |||

| JPM / JPMorgan Chase & Co. | 0.00 | -3.47 | 0.40 | 14.16 | 0.2550 | 0.0253 | |||

| LLY / Eli Lilly and Company | 0.00 | 0.00 | 0.37 | -5.60 | 0.2397 | -0.0213 | |||

| AMGN / Amgen Inc. | 0.00 | 0.23 | 0.36 | -10.12 | 0.2347 | -0.0338 | |||

| MDLZ / Mondelez International, Inc. | 0.01 | -3.66 | 0.35 | -4.32 | 0.2287 | -0.0167 | |||

| GOOG / Alphabet Inc. | 0.00 | 6.82 | 0.35 | 21.33 | 0.2240 | 0.0342 | |||

| GEHC / GE HealthCare Technologies Inc. | 0.00 | 0.00 | 0.33 | -8.12 | 0.2116 | -0.0253 | |||

| FPAG / Investment Managers Series Trust III - FPA Global Equity ETF | 0.01 | 0.00 | 0.33 | 13.19 | 0.2103 | 0.0194 | |||

| VIG / Vanguard Specialized Funds - Vanguard Dividend Appreciation ETF | 0.00 | -3.08 | 0.32 | 2.23 | 0.2075 | -0.0010 | |||

| CVX / Chevron Corporation | 0.00 | -8.97 | 0.29 | -22.07 | 0.1846 | -0.0588 | |||

| SOLR / Guinness Atkinson Funds - SmartETFs Sustainable Energy II ETF | 0.01 | 0.00 | 0.28 | 18.22 | 0.1798 | 0.0231 | |||

| PFE / Pfizer Inc. | 0.01 | 0.03 | 0.28 | -4.14 | 0.1793 | -0.0133 | |||

| WAFD / WaFd, Inc | 0.01 | 0.13 | 0.26 | 2.80 | 0.1657 | -0.0003 | |||

| CGSM / Capital Group Fixed Income ETF Trust - Capital Group Short Duration Municipal Income ETF | 0.01 | 0.00 | 0.25 | 0.00 | 0.1597 | -0.0040 | |||

| NKE / NIKE, Inc. | 0.00 | 0.00 | 0.25 | 11.87 | 0.1580 | 0.0129 | |||

| ADIV / Guinness Atkinson Funds - SmartETFs Asia Pacific Dividend Builder ETF | 0.01 | 0.00 | 0.25 | 15.02 | 0.1579 | 0.0163 | |||

| VZ / Verizon Communications Inc. | 0.01 | -8.78 | 0.22 | -12.84 | 0.1446 | -0.0262 | |||

| BMY / Bristol-Myers Squibb Company | 0.00 | 0.07 | 0.20 | -24.25 | 0.1312 | -0.0464 | |||

| MVIS / MicroVision, Inc. | 0.10 | 66.52 | 0.12 | 53.95 | 0.0754 | 0.0248 | |||

| IBM / International Business Machines Corporation | 0.00 | -100.00 | 0.00 | 0.0000 |