Mga Batayang Estadistika

| Nilai Portofolio | $ 1,651,427,584 |

| Posisi Saat Ini | 203 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

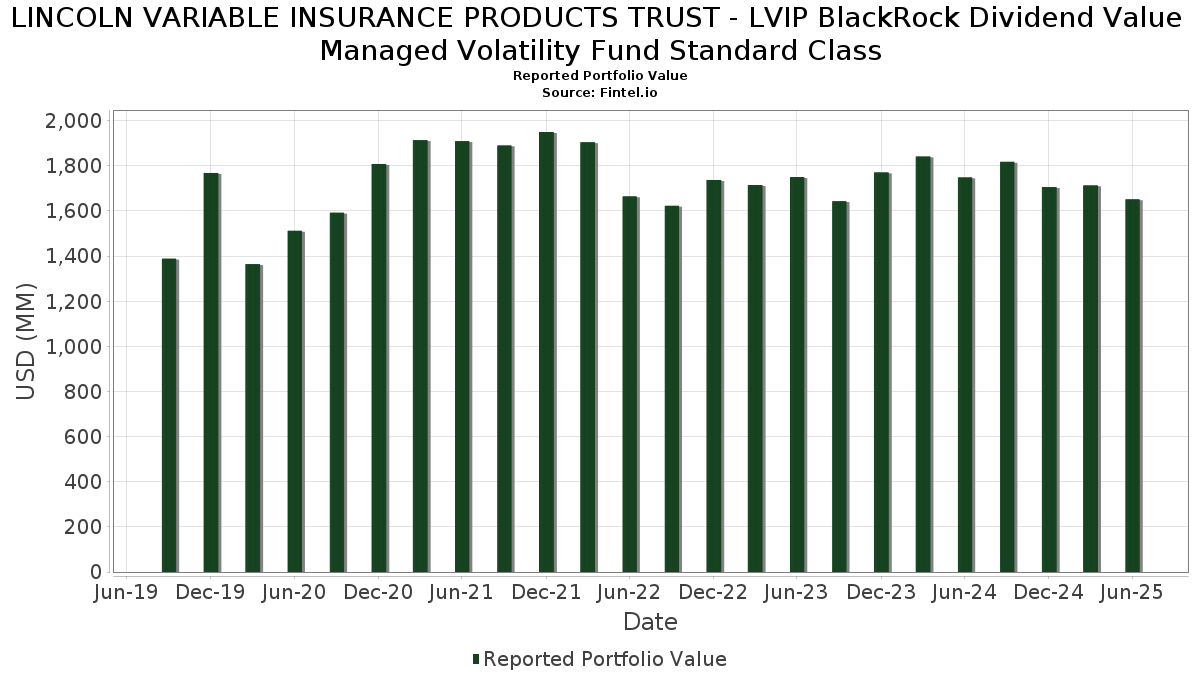

LINCOLN VARIABLE INSURANCE PRODUCTS TRUST - LVIP BlackRock Dividend Value Managed Volatility Fund Standard Class telah mengungkapkan total kepemilikan 203 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 1,651,427,584 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama LINCOLN VARIABLE INSURANCE PRODUCTS TRUST - LVIP BlackRock Dividend Value Managed Volatility Fund Standard Class adalah State Street Institutional Investment Trust - State Street Institutional US Govt Money Market Fnd Premier Cls (US:GVMXX) , Citigroup Inc. (US:C) , Wells Fargo & Company (US:WFC) , First Citizens BancShares, Inc. (US:FCNCA) , and SS&C Technologies Holdings, Inc. (US:SSNC) . Posisi baru LINCOLN VARIABLE INSURANCE PRODUCTS TRUST - LVIP BlackRock Dividend Value Managed Volatility Fund Standard Class meliputi: AvalonBay Communities, Inc. (US:AVB) , CSX Corporation (US:CSX) , Meta Platforms, Inc. (US:META) , Salesforce, Inc. (US:CRM) , and Evergy, Inc. (US:EVRG) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.10 | 18.54 | 1.1185 | 1.1185 | |

| 0.14 | 30.64 | 1.8480 | 1.1043 | |

| 0.10 | 17.72 | 1.0689 | 0.8802 | |

| 0.04 | 7.87 | 0.4748 | 0.4748 | |

| 0.12 | 7.61 | 0.4592 | 0.4592 | |

| 0.20 | 6.57 | 0.3961 | 0.3961 | |

| 0.02 | 34.88 | 2.1041 | 0.3848 | |

| 0.01 | 6.35 | 0.3833 | 0.3833 | |

| 0.50 | 42.83 | 2.5832 | 0.3778 | |

| 0.02 | 6.21 | 0.3747 | 0.3747 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.25 | 6.45 | 0.3888 | -0.7261 | |

| 0.15 | 25.17 | 1.5182 | -0.5362 | |

| 0.13 | 11.34 | 0.6841 | -0.3765 | |

| 0.04 | 10.71 | 0.6459 | -0.3418 | |

| 0.00 | 0.00 | -0.3277 | ||

| 0.14 | 10.72 | 0.6465 | -0.2910 | |

| 0.58 | 8.12 | 0.4900 | -0.2907 | |

| 0.45 | 31.39 | 1.8932 | -0.2748 | |

| 0.45 | 5.83 | 0.3518 | -0.2723 | |

| 0.02 | 6.27 | 0.3781 | -0.2722 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-06 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| GVMXX / State Street Institutional Investment Trust - State Street Institutional US Govt Money Market Fnd Premier Cls | 106.31 | 1.10 | 106.31 | 1.10 | 6.4125 | 0.2985 | |||

| C / Citigroup Inc. | 0.50 | -5.84 | 42.83 | 12.91 | 2.5832 | 0.3778 | |||

| WFC / Wells Fargo & Company | 0.51 | -14.10 | 41.26 | -4.13 | 2.4888 | -0.0136 | |||

| FCNCA / First Citizens BancShares, Inc. | 0.02 | 11.80 | 34.88 | 17.97 | 2.1041 | 0.3848 | |||

| SSNC / SS&C Technologies Holdings, Inc. | 0.40 | -1.00 | 33.26 | -1.86 | 2.0062 | 0.0356 | |||

| CSCO / Cisco Systems, Inc. | 0.45 | -25.13 | 31.39 | -15.82 | 1.8932 | -0.2748 | |||

| AMZN / Amazon.com, Inc. | 0.14 | 107.72 | 30.64 | 139.52 | 1.8480 | 1.1043 | |||

| CVS / CVS Health Corporation | 0.43 | -17.38 | 29.99 | -15.88 | 1.8089 | -0.2641 | |||

| MSFT / Microsoft Corporation | 0.05 | -28.51 | 26.59 | -5.28 | 1.6040 | -0.0283 | |||

| VZ / Verizon Communications Inc. | 0.61 | -9.72 | 26.34 | -13.88 | 1.5886 | -0.1895 | |||

| CAH / Cardinal Health, Inc. | 0.15 | -41.58 | 25.17 | -28.77 | 1.5182 | -0.5362 | |||

| BAX / Baxter International Inc. | 0.79 | 0.18 | 23.80 | -11.38 | 1.4354 | -0.1260 | |||

| MDT / Medtronic plc | 0.27 | -12.39 | 23.73 | -15.01 | 1.4312 | -0.1922 | |||

| WTY / Willis Towers Watson Public Limited Company | 0.08 | -5.84 | 23.19 | -14.60 | 1.3985 | -0.1800 | |||

| BP / BP p.l.c. - Depositary Receipt (Common Stock) | 4.56 | 2.26 | 22.72 | -9.21 | 1.3702 | -0.0846 | |||

| LHX / L3Harris Technologies, Inc. | 0.09 | -24.33 | 21.89 | -9.31 | 1.3204 | -0.0831 | |||

| ICE / Intercontinental Exchange, Inc. | 0.12 | -7.35 | 21.43 | -1.46 | 1.2929 | 0.0281 | |||

| DG / Dollar General Corporation | 0.19 | 1.10 | 21.19 | 31.52 | 1.2784 | 0.3414 | |||

| FIS / Fidelity National Information Services, Inc. | 0.25 | 0.91 | 20.33 | 10.00 | 1.2261 | 0.1517 | |||

| CMCSA / Comcast Corporation | 0.57 | -5.84 | 20.21 | -8.92 | 1.2193 | -0.0712 | |||

| BC94 / Samsung Electronics Co., Ltd. - Depositary Receipt (Common Stock) | 0.02 | -6.29 | 19.90 | 5.10 | 1.2001 | 0.0994 | |||

| LMT / Lockheed Martin Corporation | 0.04 | 25.05 | 19.84 | 29.65 | 1.1967 | 0.3069 | |||

| SHELLA / Shell plc | 0.56 | -5.84 | 19.68 | -9.75 | 1.1870 | -0.0807 | |||

| GOOG / Alphabet Inc. | 0.10 | 18.54 | 1.1185 | 1.1185 | |||||

| MRK / Merck & Co., Inc. | 0.23 | 27.47 | 17.83 | 12.42 | 1.0753 | 0.1532 | |||

| BDX / Becton, Dickinson and Company | 0.10 | 626.05 | 17.72 | 446.10 | 1.0689 | 0.8802 | |||

| BMY / Bristol-Myers Squibb Company | 0.37 | 33.97 | 17.11 | 1.68 | 1.0322 | 0.0537 | |||

| TXN / Texas Instruments Incorporated | 0.08 | -8.76 | 15.99 | 5.42 | 0.9648 | 0.0826 | |||

| KHC / The Kraft Heinz Company | 0.61 | 1.36 | 15.84 | -14.00 | 0.9552 | -0.1154 | |||

| EA / Electronic Arts Inc. | 0.10 | -12.32 | 15.70 | -3.11 | 0.9470 | 0.0049 | |||

| JPM / JPMorgan Chase & Co. | 0.05 | -31.69 | 15.50 | -19.27 | 0.9350 | -0.1814 | |||

| COP / ConocoPhillips | 0.17 | -7.49 | 15.34 | -20.96 | 0.9252 | -0.2031 | |||

| CVX / Chevron Corporation | 0.11 | -1.84 | 15.30 | -15.99 | 0.9229 | -0.1360 | |||

| PEP / PepsiCo, Inc. | 0.11 | 4.61 | 14.72 | -7.88 | 0.8880 | -0.0412 | |||

| FNF / Fidelity National Financial, Inc. | 0.26 | -5.36 | 14.70 | -18.47 | 0.8864 | -0.1617 | |||

| ABBV / AbbVie Inc. | 0.08 | 0.57 | 14.55 | -10.90 | 0.8777 | -0.0719 | |||

| KO / The Coca-Cola Company | 0.21 | -12.23 | 14.55 | -13.29 | 0.8777 | -0.0981 | |||

| MO / Altria Group, Inc. | 0.25 | -10.25 | 14.51 | -12.33 | 0.8753 | -0.0871 | |||

| HD / The Home Depot, Inc. | 0.04 | -7.22 | 14.46 | -7.18 | 0.8725 | -0.0336 | |||

| HPQ / HP Inc. | 0.59 | 17.98 | 14.44 | 4.22 | 0.8710 | 0.0654 | |||

| AMGN / Amgen Inc. | 0.05 | -1.97 | 14.29 | -12.15 | 0.8618 | -0.0838 | |||

| BAC / Bank of America Corporation | 0.29 | 17.83 | 13.78 | 33.62 | 0.8309 | 0.2315 | |||

| CCI / Crown Castle Inc. | 0.13 | -5.84 | 13.55 | -7.19 | 0.8175 | -0.0316 | |||

| HAS / Hasbro, Inc. | 0.18 | -11.19 | 13.08 | 6.62 | 0.7892 | 0.0757 | |||

| CG / The Carlyle Group Inc. | 0.25 | 7.24 | 12.82 | 26.46 | 0.7736 | 0.1839 | |||

| BTI / British American Tobacco p.l.c. - Depositary Receipt (Common Stock) | 0.26 | -17.43 | 12.46 | -5.54 | 0.7513 | -0.0154 | |||

| PPG / PPG Industries, Inc. | 0.11 | -5.84 | 12.35 | -2.05 | 0.7450 | 0.0118 | |||

| EXC / Exelon Corporation | 0.27 | -10.25 | 11.88 | -15.42 | 0.7168 | -0.1002 | |||

| ELV / Elevance Health, Inc. | 0.03 | -3.70 | 11.52 | -13.89 | 0.6951 | -0.0830 | |||

| SRE / Sempra | 0.15 | -14.97 | 11.48 | -9.72 | 0.6923 | -0.0469 | |||

| UPS / United Parcel Service, Inc. | 0.11 | -6.03 | 11.36 | -13.77 | 0.6854 | -0.0808 | |||

| AIG / American International Group, Inc. | 0.13 | -36.84 | 11.34 | -37.82 | 0.6841 | -0.3765 | |||

| SEE / Sealed Air Corporation | 0.36 | -12.84 | 11.07 | -6.42 | 0.6675 | -0.0200 | |||

| CTSH / Cognizant Technology Solutions Corporation | 0.14 | -34.83 | 10.72 | -33.53 | 0.6465 | -0.2910 | |||

| LH / Labcorp Holdings Inc. | 0.04 | -44.11 | 10.71 | -36.97 | 0.6459 | -0.3418 | |||

| LDOS / Leidos Holdings, Inc. | 0.07 | -19.49 | 10.45 | -5.88 | 0.6302 | -0.0152 | |||

| HPE / Hewlett Packard Enterprise Company | 0.51 | 58.77 | 10.36 | 110.42 | 0.6246 | 0.3385 | |||

| HES / Hess Corporation | 0.07 | -11.03 | 10.15 | -22.84 | 0.6126 | -0.1526 | |||

| SAN / Santander UK plc - Preferred Stock | 0.10 | -5.32 | 10.04 | -17.22 | 0.6054 | -0.0996 | |||

| EOG / EOG Resources, Inc. | 0.08 | -8.38 | 10.01 | -14.54 | 0.6038 | -0.0773 | |||

| HEN3 / Henkel AG & Co. KGaA - Preferred Stock | 0.13 | 7.32 | 9.94 | 6.00 | 0.5997 | 0.0543 | |||

| RTO / Rentokil Initial plc - Depositary Receipt (Common Stock) | 2.05 | 11.15 | 9.89 | 18.17 | 0.5967 | 0.1100 | |||

| D / Dominion Energy, Inc. | 0.17 | 79.71 | 9.84 | 81.16 | 0.5935 | 0.2777 | |||

| APD / Air Products and Chemicals, Inc. | 0.03 | -5.83 | 9.67 | -9.94 | 0.5835 | -0.0411 | |||

| EPD / Enterprise Products Partners L.P. - Limited Partnership | 0.31 | -16.82 | 9.60 | -24.45 | 0.5793 | -0.1598 | |||

| HON / Honeywell International Inc. | 0.04 | 18.05 | 9.12 | 29.83 | 0.5500 | 0.1416 | |||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 0.04 | -4.30 | 8.91 | 30.58 | 0.5375 | 0.1407 | |||

| GM / General Motors Company | 0.18 | -5.32 | 8.82 | -0.94 | 0.5321 | 0.0143 | |||

| 0WP / WPP plc | 1.20 | -5.84 | 8.43 | -12.76 | 0.5086 | -0.0533 | |||

| SCHW / The Charles Schwab Corporation | 0.09 | 33.88 | 8.35 | 56.04 | 0.5036 | 0.1925 | |||

| STMPA / STMicroelectronics N.V. | 0.27 | 33.61 | 8.24 | 86.82 | 0.4969 | 0.2405 | |||

| PCG / PG&E Corporation | 0.58 | -25.43 | 8.12 | -39.50 | 0.4900 | -0.2907 | |||

| AVB / AvalonBay Communities, Inc. | 0.04 | 7.87 | 0.4748 | 0.4748 | |||||

| OKE / ONEOK, Inc. | 0.10 | -6.04 | 7.83 | -22.70 | 0.4725 | -0.1167 | |||

| AZN / Astrazeneca plc | 0.06 | 11.28 | 7.66 | 5.46 | 0.4623 | 0.0397 | |||

| DIS / The Walt Disney Company | 0.06 | -33.34 | 7.63 | -16.24 | 0.4602 | -0.0694 | |||

| WDC / Western Digital Corporation | 0.12 | 7.61 | 0.4592 | 0.4592 | |||||

| LW / Lamb Weston Holdings, Inc. | 0.15 | -16.96 | 7.53 | -19.22 | 0.4541 | -0.0878 | |||

| FAST / Fastenal Company | 0.18 | 86.15 | 7.39 | 0.82 | 0.4459 | 0.0196 | |||

| WAB / Westinghouse Air Brake Technologies Corporation | 0.03 | -20.22 | 7.21 | -7.91 | 0.4349 | -0.0203 | |||

| IFF / International Flavors & Fragrances Inc. | 0.10 | -19.06 | 7.18 | -23.30 | 0.4330 | -0.1112 | |||

| PAYX / Paychex, Inc. | 0.05 | -7.68 | 7.17 | -12.95 | 0.4325 | -0.0465 | |||

| TECK / Teck Resources Limited | 0.18 | 14.06 | 7.14 | 26.43 | 0.4306 | 0.1023 | |||

| SLB / Schlumberger Limited | 0.21 | -9.79 | 7.05 | -27.06 | 0.4254 | -0.1368 | |||

| KDP / Keurig Dr Pepper Inc. | 0.21 | -4.51 | 6.90 | -7.75 | 0.4165 | -0.0187 | |||

| V / Visa Inc. | 0.02 | -37.65 | 6.90 | -36.83 | 0.4160 | -0.2188 | |||

| TGT / Target Corporation | 0.07 | -7.70 | 6.88 | -12.75 | 0.4149 | -0.0435 | |||

| AIR / Airbus SE | 0.03 | -5.83 | 6.82 | 11.87 | 0.4115 | 0.0569 | |||

| CSX / CSX Corporation | 0.20 | 6.57 | 0.3961 | 0.3961 | |||||

| KMB / Kimberly-Clark Corporation | 0.05 | -5.27 | 6.56 | -14.13 | 0.3956 | -0.0485 | |||

| JCI / Johnson Controls International plc | 0.06 | -46.49 | 6.51 | -29.46 | 0.3926 | -0.1438 | |||

| F / Ford Motor Company | 0.60 | -6.29 | 6.50 | 1.37 | 0.3921 | 0.0193 | |||

| BA / The Boeing Company | 0.03 | -39.89 | 6.49 | -26.16 | 0.3915 | -0.1195 | |||

| VLO / Valero Energy Corporation | 0.05 | -6.43 | 6.46 | -4.76 | 0.3895 | -0.0047 | |||

| SNEJF / Sony Group Corporation | 0.25 | -67.29 | 6.45 | -66.39 | 0.3888 | -0.7261 | |||

| META / Meta Platforms, Inc. | 0.01 | 6.35 | 0.3833 | 0.3833 | |||||

| CI / The Cigna Group | 0.02 | -44.22 | 6.27 | -43.96 | 0.3781 | -0.2722 | |||

| CRM / Salesforce, Inc. | 0.02 | 6.21 | 0.3747 | 0.3747 | |||||

| EVRG / Evergy, Inc. | 0.09 | 6.09 | 0.3675 | 0.3675 | |||||

| AEP / American Electric Power Company, Inc. | 0.06 | -5.83 | 5.98 | -10.59 | 0.3610 | -0.0282 | |||

| CNH / CNH Industrial N.V. | 0.45 | -48.51 | 5.83 | -45.67 | 0.3518 | -0.2723 | |||

| CCK / Crown Holdings, Inc. | 0.06 | 19.49 | 5.75 | 37.86 | 0.3466 | 0.1042 | |||

| FTV / Fortive Corporation | 0.11 | 37.76 | 5.73 | -1.87 | 0.3454 | 0.0061 | |||

| LLY / Eli Lilly and Company | 0.01 | 22.69 | 5.70 | 15.80 | 0.3440 | 0.0576 | |||

| RTX / RTX Corporation | 0.04 | -46.74 | 5.42 | -41.29 | 0.3267 | -0.2097 | |||

| NVDA / NVIDIA Corporation | 0.03 | 7.56 | 5.36 | 56.81 | 0.3230 | 0.1244 | |||

| COF / Capital One Financial Corporation | 0.02 | -24.17 | 5.08 | 73.57 | 0.3066 | 0.1383 | |||

| STAG / STAG Industrial, Inc. | 0.14 | 51.90 | 4.92 | 52.61 | 0.2966 | 0.1092 | |||

| LEA / Lear Corporation | 0.05 | -5.84 | 4.91 | 1.38 | 0.2961 | 0.0146 | |||

| GIS / General Mills, Inc. | 0.08 | -5.44 | 4.35 | -18.06 | 0.2625 | -0.0463 | |||

| FITB / Fifth Third Bancorp | 0.10 | -9.48 | 4.22 | -5.02 | 0.2545 | -0.0038 | |||

| DRI / Darden Restaurants, Inc. | 0.02 | -7.06 | 3.92 | -2.49 | 0.2363 | 0.0027 | |||

| HR / Healthcare Realty Trust Incorporated | 0.25 | 983.39 | 3.90 | 918.28 | 0.2353 | 0.2130 | |||

| ADM / Archer-Daniels-Midland Company | 0.07 | -5.15 | 3.89 | 4.28 | 0.2349 | 0.0178 | |||

| INTC / Intel Corporation | 0.17 | -43.31 | 3.77 | -44.09 | 0.2275 | -0.1647 | |||

| HSY / The Hershey Company | 0.02 | -5.42 | 3.77 | -8.23 | 0.2274 | -0.0115 | |||

| CINF / Cincinnati Financial Corporation | 0.02 | -8.99 | 3.58 | -8.27 | 0.2162 | -0.0109 | |||

| TROW / T. Rowe Price Group, Inc. | 0.03 | -8.45 | 3.29 | -3.86 | 0.1983 | -0.0005 | |||

| ALLE / Allegion plc | 0.02 | 9.79 | 3.28 | 21.30 | 0.1979 | 0.0406 | |||

| RF / Regions Financial Corporation | 0.14 | -10.83 | 3.25 | -3.48 | 0.1959 | 0.0002 | |||

| AMCR / Amcor plc | 0.35 | 45.73 | 3.22 | 38.09 | 0.1944 | 0.0587 | |||

| EIX / Edison International | 0.06 | -18.66 | 3.08 | -47.43 | 0.1861 | -0.1558 | |||

| PFE / Pfizer Inc. | 0.12 | -47.75 | 3.02 | -52.27 | 0.1821 | -0.1864 | |||

| CTRA / Coterra Energy Inc. | 0.12 | -3.43 | 2.97 | -15.18 | 0.1790 | -0.0245 | |||

| AMKR / Amkor Technology, Inc. | 0.13 | 2.77 | 0.1670 | 0.1670 | |||||

| HAL / Halliburton Company | 0.13 | -8.42 | 2.68 | -26.43 | 0.1619 | -0.0503 | |||

| PKG / Packaging Corporation of America | 0.01 | -9.36 | 2.59 | -13.73 | 0.1565 | -0.0184 | |||

| WCC / WESCO International, Inc. | 0.01 | 93.63 | 2.58 | 130.92 | 0.1559 | 0.0908 | |||

| SNA / Snap-on Incorporated | 0.01 | -8.69 | 2.50 | -15.68 | 0.1508 | -0.0216 | |||

| WSO / Watsco, Inc. | 0.01 | -8.33 | 2.38 | -20.38 | 0.1433 | -0.0301 | |||

| REXR / Rexford Industrial Realty, Inc. | 0.06 | 2.30 | 0.1386 | 0.1386 | |||||

| CF / CF Industries Holdings, Inc. | 0.02 | -13.19 | 2.29 | 2.24 | 0.1378 | 0.0078 | |||

| LYB / LyondellBasell Industries N.V. | 0.04 | -3.65 | 2.28 | -20.81 | 0.1375 | -0.0299 | |||

| EWBC / East West Bancorp, Inc. | 0.02 | -12.06 | 2.15 | -1.06 | 0.1297 | 0.0033 | |||

| UNM / Unum Group | 0.02 | -15.11 | 2.00 | -15.85 | 0.1204 | -0.0175 | |||

| BBY / Best Buy Co., Inc. | 0.03 | -8.16 | 1.98 | -16.25 | 0.1197 | -0.0181 | |||

| RAL / Ralliant Corporation | 0.04 | 1.78 | 0.1071 | 0.1071 | |||||

| SWKS / Skyworks Solutions, Inc. | 0.02 | -11.99 | 1.72 | 1.48 | 0.1037 | 0.0052 | |||

| OVV / Ovintiv Inc. | 0.04 | -8.71 | 1.51 | -18.86 | 0.0914 | -0.0172 | |||

| IPG / The Interpublic Group of Companies, Inc. | 0.06 | -12.70 | 1.40 | -21.32 | 0.0842 | -0.0189 | |||

| AFG / American Financial Group, Inc. | 0.01 | -7.02 | 1.39 | -10.63 | 0.0837 | -0.0066 | |||

| ALV / Autoliv, Inc. | 0.01 | -11.32 | 1.22 | 12.12 | 0.0737 | 0.0104 | |||

| S+P500 EMINI FUT SEP25 / DE (000000000) | 1.22 | 0.0735 | 0.0735 | ||||||

| CMA / Comerica Incorporated | 0.02 | -14.91 | 1.21 | -14.07 | 0.0730 | -0.0089 | |||

| US4039491000 / HF Sinclair Corp. | 0.02 | -15.74 | 1.02 | 5.26 | 0.0616 | 0.0052 | |||

| APA / APA Corporation | 0.06 | -10.08 | 1.01 | -21.76 | 0.0612 | -0.0142 | |||

| MTN / Vail Resorts, Inc. | 0.01 | -9.34 | 0.90 | -10.92 | 0.0541 | -0.0045 | |||

| WHR / Whirlpool Corporation | 0.01 | -4.93 | 0.87 | 7.05 | 0.0522 | 0.0052 | |||

| FMC / FMC Corporation | 0.02 | -4.88 | 0.80 | -5.89 | 0.0483 | -0.0012 | |||

| JHG / Janus Henderson Group plc | 0.02 | -18.28 | 0.78 | -12.22 | 0.0469 | -0.0046 | |||

| COLB / Columbia Banking System, Inc. | 0.03 | -17.29 | 0.77 | -22.40 | 0.0464 | -0.0113 | |||

| OZK / Bank OZK | 0.02 | -15.65 | 0.77 | -8.57 | 0.0463 | -0.0026 | |||

| NXST / Nexstar Media Group, Inc. | 0.00 | -11.66 | 0.75 | -14.77 | 0.0453 | -0.0059 | |||

| RDN / Radian Group Inc. | 0.02 | -28.23 | 0.74 | -21.92 | 0.0447 | -0.0104 | |||

| RHI / Robert Half Inc. | 0.02 | -10.51 | 0.64 | -32.71 | 0.0389 | -0.0168 | |||

| MSM / MSC Industrial Direct Co., Inc. | 0.01 | -22.58 | 0.59 | -15.23 | 0.0356 | -0.0049 | |||

| IBOC / International Bancshares Corporation | 0.01 | -24.38 | 0.55 | -20.29 | 0.0332 | -0.0069 | |||

| FHI / Federated Hermes, Inc. | 0.01 | -26.48 | 0.53 | -20.12 | 0.0319 | -0.0066 | |||

| SIG / Signet Jewelers Limited | 0.01 | -12.38 | 0.52 | 19.95 | 0.0316 | 0.0062 | |||

| APAM / Artisan Partners Asset Management Inc. | 0.01 | 0.51 | 0.0306 | 0.0306 | |||||

| CATY / Cathay General Bancorp | 0.01 | 0.48 | 0.0289 | 0.0289 | |||||

| FLO / Flowers Foods, Inc. | 0.03 | -22.08 | 0.47 | -34.44 | 0.0285 | -0.0134 | |||

| MUR / Murphy Oil Corporation | 0.02 | -21.82 | 0.46 | -38.02 | 0.0279 | -0.0155 | |||

| MC / Moelis & Company | 0.01 | 0.45 | 0.0272 | 0.0272 | |||||

| WU / The Western Union Company | 0.05 | -16.13 | 0.42 | -33.33 | 0.0255 | -0.0113 | |||

| CVBF / CVB Financial Corp. | 0.02 | -5.94 | 0.40 | 0.76 | 0.0241 | 0.0011 | |||

| IPAR / Interparfums, Inc. | 0.00 | -23.87 | 0.36 | -12.17 | 0.0218 | -0.0021 | |||

| BANR / Banner Corporation | 0.01 | 0.35 | 0.0210 | 0.0210 | |||||

| CNS / Cohen & Steers, Inc. | 0.00 | -27.38 | 0.33 | -31.84 | 0.0202 | -0.0083 | |||

| NSP / Insperity, Inc. | 0.01 | -16.29 | 0.33 | -43.55 | 0.0198 | -0.0140 | |||

| OFG / OFG Bancorp | 0.01 | 0.32 | 0.0192 | 0.0192 | |||||

| CHCO / City Holding Company | 0.00 | 0.29 | 0.0178 | 0.0178 | |||||

| WEN / The Wendy's Company | 0.02 | -15.42 | 0.28 | -33.96 | 0.0170 | -0.0078 | |||

| FCF / First Commonwealth Financial Corporation | 0.02 | 0.27 | 0.0162 | 0.0162 | |||||

| NWBI / Northwest Bancshares, Inc. | 0.02 | 0.27 | 0.0161 | 0.0161 | |||||

| HUN / Huntsman Corporation | 0.03 | -22.05 | 0.26 | -48.73 | 0.0159 | -0.0139 | |||

| LKFN / Lakeland Financial Corporation | 0.00 | 0.26 | 0.0155 | 0.0155 | |||||

| GABC / German American Bancorp, Inc. | 0.01 | -26.98 | 0.24 | -24.92 | 0.0147 | -0.0042 | |||

| STBA / S&T Bancorp, Inc. | 0.01 | 0.24 | 0.0143 | 0.0143 | |||||

| BKE / The Buckle, Inc. | 0.00 | -43.11 | 0.21 | -32.59 | 0.0127 | -0.0055 | |||

| VRTS / Virtus Investment Partners, Inc. | 0.00 | -40.54 | 0.20 | -37.30 | 0.0121 | -0.0065 | |||

| CRI / Carter's, Inc. | 0.01 | -11.25 | 0.17 | -34.47 | 0.0105 | -0.0050 | |||

| SRCE / 1st Source Corporation | 0.00 | -47.92 | 0.17 | -46.10 | 0.0101 | -0.0079 | |||

| CWENA / Clearway Energy Inc - Class A | 0.01 | 0.00 | 0.16 | 5.92 | 0.0098 | 0.0009 | |||

| S+P MID 400 EMINI SEP25 / DE (000000000) | 0.14 | 0.0087 | 0.0087 | ||||||

| CNA / CNA Financial Corporation | 0.00 | -19.23 | 0.14 | -25.82 | 0.0082 | -0.0025 | |||

| AMSF / AMERISAFE, Inc. | 0.00 | -49.07 | 0.13 | -57.76 | 0.0078 | -0.0099 | |||

| CPF / Central Pacific Financial Corp. | 0.00 | 0.12 | 0.0072 | 0.0072 | |||||

| NIKKEI 225 (OSE) SEP25 / DE (000000000) | 0.12 | 0.0070 | 0.0070 | ||||||

| KFRC / Kforce Inc. | 0.00 | -54.97 | 0.11 | -62.28 | 0.0064 | -0.0099 | |||

| THFF / First Financial Corporation | 0.00 | -61.75 | 0.09 | -57.99 | 0.0056 | -0.0072 | |||

| OXM / Oxford Industries, Inc. | 0.00 | -30.21 | 0.09 | -52.08 | 0.0056 | -0.0056 | |||

| ETD / Ethan Allen Interiors Inc. | 0.00 | -44.18 | 0.09 | -44.03 | 0.0054 | -0.0039 | |||

| EURO FX CURR FUT SEP25 / DFE (000000000) | 0.08 | 0.0046 | 0.0046 | ||||||

| EBF / Ennis, Inc. | 0.00 | -66.45 | 0.07 | -69.91 | 0.0041 | -0.0090 | |||

| E-MINI RUSS 1000 VSEP25 / DE (000000000) | 0.03 | 0.0017 | 0.0017 | ||||||

| BP CURRENCY FUT SEP25 / DFE (000000000) | 0.03 | 0.0015 | 0.0015 | ||||||

| E-MINI RUSS 2000 SEP25 / DE (000000000) | 0.01 | 0.0007 | 0.0007 | ||||||

| JPN YEN CURR FUT SEP25 / DFE (000000000) | 0.01 | 0.0003 | 0.0003 | ||||||

| MSCI EMGMKT SEP25 / DE (000000000) | 0.00 | 0.0002 | 0.0002 | ||||||

| XAP CONS STAPLES SEP25 / DE (000000000) | 0.00 | 0.0000 | 0.0000 | ||||||

| FTRE / Fortrea Holdings Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0805 | ||||

| MCHP / Microchip Technology Incorporated | 0.00 | -100.00 | 0.00 | -100.00 | -0.3277 | ||||

| FBMS / The First Bancshares, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0169 | ||||

| EURO STOXX 50 SEP25 / DE (000000000) | -0.01 | -0.0008 | -0.0008 | ||||||

| FTSE 100 IDX FUT SEP25 / DE (000000000) | -0.02 | -0.0009 | -0.0009 |