Mga Batayang Estadistika

| Nilai Portofolio | $ 1,111,462,786 |

| Posisi Saat Ini | 50 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

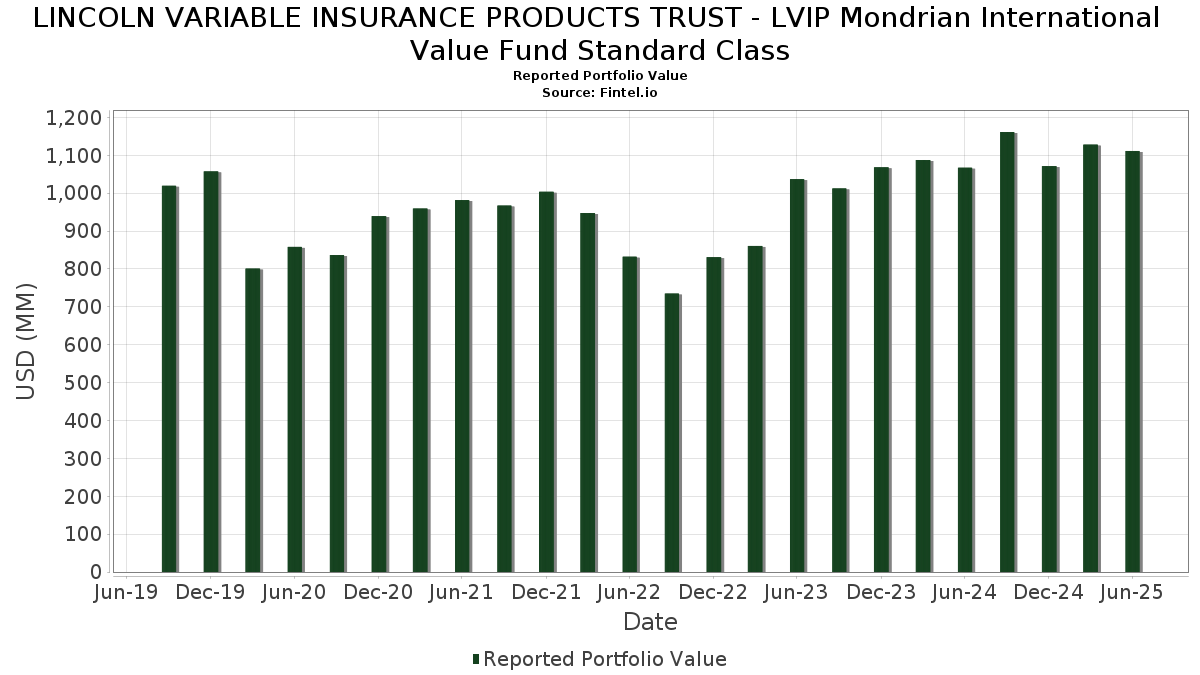

LINCOLN VARIABLE INSURANCE PRODUCTS TRUST - LVIP Mondrian International Value Fund Standard Class telah mengungkapkan total kepemilikan 50 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 1,111,462,786 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama LINCOLN VARIABLE INSURANCE PRODUCTS TRUST - LVIP Mondrian International Value Fund Standard Class adalah Enel SpA - Depositary Receipt (Common Stock) (US:ENLAY) , SSE plc - Depositary Receipt (Common Stock) (US:SSEZY) , Lloyds Banking Group plc - Depositary Receipt (Common Stock) (US:LYG) , Banco Santander, S.A. (CH:BSD2) , and Allianz SE (DE:ALV) . Posisi baru LINCOLN VARIABLE INSURANCE PRODUCTS TRUST - LVIP Mondrian International Value Fund Standard Class meliputi: Komatsu Ltd. (MX:6301 N) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.14 | 24.55 | 2.1950 | 1.5433 | |

| 0.20 | 25.46 | 2.2770 | 1.0291 | |

| 2.05 | 18.55 | 1.6584 | 0.6125 | |

| 0.15 | 5.00 | 0.4467 | 0.4467 | |

| 0.75 | 35.68 | 3.1904 | 0.4377 | |

| 0.98 | 27.68 | 2.4748 | 0.4110 | |

| 0.50 | 15.17 | 1.3568 | 0.4035 | |

| 0.21 | 24.04 | 2.1497 | 0.3516 | |

| 1.53 | 38.46 | 3.4387 | 0.3359 | |

| 0.27 | 26.43 | 2.3638 | 0.3191 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.33 | 32.48 | 2.9043 | -0.5969 | |

| 0.91 | 18.70 | 1.6723 | -0.5196 | |

| 2.08 | 8.32 | 0.7441 | -0.4504 | |

| 1.62 | 30.97 | 2.7690 | -0.2932 | |

| 0.57 | 19.79 | 1.7699 | -0.2776 | |

| 0.27 | 26.33 | 2.3548 | -0.2665 | |

| 35.74 | 37.58 | 3.3604 | -0.2613 | |

| 1.37 | 35.58 | 3.1820 | -0.2166 | |

| 0.79 | 19.08 | 1.7063 | -0.1805 | |

| 0.64 | 28.86 | 2.5807 | -0.1446 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-06 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| ENLAY / Enel SpA - Depositary Receipt (Common Stock) | 4.07 | -10.99 | 38.58 | 4.21 | 3.4501 | 0.1879 | |||

| SSEZY / SSE plc - Depositary Receipt (Common Stock) | 1.53 | -10.67 | 38.46 | 9.20 | 3.4387 | 0.3359 | |||

| LYG / Lloyds Banking Group plc - Depositary Receipt (Common Stock) | 35.74 | -18.45 | 37.58 | -8.58 | 3.3604 | -0.2613 | |||

| BSD2 / Banco Santander, S.A. | 4.45 | -22.71 | 36.82 | -5.00 | 3.2928 | -0.1225 | |||

| ALV / Allianz SE | 0.09 | -10.96 | 36.74 | -5.58 | 3.2857 | -0.1431 | |||

| BATS / British American Tobacco p.l.c. | 0.75 | -1.46 | 35.68 | 14.20 | 3.1904 | 0.4377 | |||

| SNEJF / Sony Group Corporation | 1.37 | -10.22 | 35.58 | -7.74 | 3.1820 | -0.2166 | |||

| UOVEY / United Overseas Bank Limited - Depositary Receipt (Common Stock) | 1.24 | -1.05 | 35.10 | -0.74 | 3.1383 | 0.0230 | |||

| SRG / Snam S.p.A. | 5.56 | -10.73 | 33.68 | 4.23 | 3.0115 | 0.1645 | |||

| FJTSY / Fujitsu Limited - Depositary Receipt (Common Stock) | 1.37 | -18.16 | 33.25 | -0.23 | 2.9737 | 0.0368 | |||

| NESN / Nestlé S.A. | 0.33 | -16.92 | 32.48 | -18.26 | 2.9043 | -0.5969 | |||

| VCISY / Vinci SA - Depositary Receipt (Common Stock) | 0.21 | -10.80 | 31.14 | 4.35 | 2.7847 | 0.1551 | |||

| GLAXF / GSK plc | 1.62 | -10.70 | 30.97 | -10.90 | 2.7690 | -0.2932 | |||

| EN / Bouygues SA | 0.64 | -18.67 | 28.86 | -6.70 | 2.5807 | -0.1446 | |||

| AFO1 / Associated British Foods plc | 0.98 | 3.67 | 27.68 | 18.15 | 2.4748 | 0.4110 | |||

| DPW / Deutsche Post AG | 0.59 | -10.40 | 27.41 | -3.33 | 2.4509 | -0.0472 | |||

| RI / Pernod Ricard SA | 0.27 | 12.82 | 26.43 | 13.92 | 2.3638 | 0.3191 | |||

| FJI / FUJIFILM Holdings Corporation | 1.22 | -5.21 | 26.42 | 7.15 | 2.3623 | 0.1899 | |||

| SAN / Santander UK plc - Preferred Stock | 0.27 | 1.23 | 26.33 | -11.48 | 2.3548 | -0.2665 | |||

| MRK / Marks Electrical Group PLC | 0.20 | 90.81 | 25.46 | 79.79 | 2.2770 | 1.0291 | |||

| CAP / Capgemini SE | 0.14 | 191.22 | 24.55 | 231.88 | 2.1950 | 1.5433 | |||

| TYIDY / Toyota Industries Corporation - Depositary Receipt (Common Stock) | 0.21 | -10.73 | 24.04 | 17.80 | 2.1497 | 0.3516 | |||

| CKHUF / CK Hutchison Holdings Limited | 3.61 | -10.84 | 22.21 | -2.60 | 1.9861 | -0.0232 | |||

| 6752 / Panasonic Holdings Corporation | 1.98 | 4.31 | 21.18 | -6.44 | 1.8944 | -0.1008 | |||

| KDDIY / KDDI Corporation - Depositary Receipt (Common Stock) | 1.22 | -9.96 | 20.87 | -2.12 | 1.8660 | -0.0126 | |||

| SHELLA / Shell plc | 0.57 | -11.14 | 19.79 | -14.83 | 1.7699 | -0.2776 | |||

| PHG / Koninklijke Philips N.V. - Depositary Receipt (Common Stock) | 0.79 | -5.53 | 19.08 | -10.89 | 1.7063 | -0.1805 | |||

| EVK / Evonik Industries AG | 0.91 | -21.11 | 18.70 | -24.82 | 1.6723 | -0.5196 | |||

| 0WP / WPP plc | 2.64 | 4.12 | 18.57 | -3.52 | 1.6607 | -0.0354 | |||

| AAGIY / AIA Group Limited - Depositary Receipt (Common Stock) | 2.05 | 30.56 | 18.55 | 56.23 | 1.6584 | 0.6125 | |||

| BP / BP p.l.c. - Depositary Receipt (Common Stock) | 3.64 | 4.26 | 18.14 | -7.43 | 1.6217 | -0.1044 | |||

| SOMLF / SECOM CO., LTD. | 0.48 | -9.88 | 17.41 | -4.94 | 1.5568 | -0.0569 | |||

| H4W / Jardine Matheson Holdings Limited | 0.36 | -12.54 | 17.12 | -0.47 | 1.5313 | 0.0153 | |||

| IMB / Imperial Brands PLC | 0.42 | -11.73 | 16.78 | -5.75 | 1.5001 | -0.0681 | |||

| ANDR / Andritz AG | 0.22 | -10.46 | 16.73 | 18.85 | 1.4956 | 0.2557 | |||

| NTT1 N / NTT, Inc. | 14.61 | -10.83 | 15.62 | -1.36 | 1.3965 | 0.0014 | |||

| MNBEF / MINEBEA MITSUMI Inc. | 1.05 | -10.27 | 15.37 | -10.23 | 1.3744 | -0.1341 | |||

| NHOLF / Sompo Holdings, Inc. | 0.50 | 41.71 | 15.17 | 40.23 | 1.3568 | 0.4035 | |||

| CA / Carrefour SA | 1.05 | 9.57 | 14.78 | 8.07 | 1.3218 | 0.1166 | |||

| MITS N / Mitsubishi Electric Corporation | 0.68 | -9.70 | 14.67 | 5.31 | 1.3119 | 0.0844 | |||

| HIA1 / Hitachi, Ltd. | 0.50 | -10.64 | 14.58 | 10.62 | 1.3034 | 0.1424 | |||

| HNDAF / Honda Motor Co., Ltd. | 1.46 | -9.45 | 14.10 | -3.51 | 1.2612 | -0.0267 | |||

| QRL / Aurizon Holdings Limited | 6.69 | -10.48 | 13.34 | -8.16 | 1.1929 | -0.0868 | |||

| RHHBY / Roche Holding AG - Depositary Receipt (Common Stock) | 0.04 | -9.91 | 12.43 | -10.65 | 1.1113 | -0.1143 | |||

| KER / Kering SA | 0.06 | -9.34 | 12.26 | -5.06 | 1.0967 | -0.0415 | |||

| E / Eni S.p.A. - Depositary Receipt (Common Stock) | 0.53 | -10.38 | 8.55 | -6.40 | 0.7644 | -0.0402 | |||

| KFI1 / Kingfisher plc | 2.08 | -49.37 | 8.32 | -38.62 | 0.7441 | -0.4504 | |||

| KYR / Kyocera Corporation | 0.45 | -11.42 | 5.36 | -5.80 | 0.4792 | -0.0221 | |||

| 6301 N / Komatsu Ltd. | 0.15 | 5.00 | 0.4467 | 0.4467 | |||||

| GVMXX / State Street Institutional Investment Trust - State Street Institutional US Govt Money Market Fnd Premier Cls | 3.55 | 173.08 | 3.55 | 173.11 | 0.3170 | 0.2026 |