Mga Batayang Estadistika

| Nilai Portofolio | $ 483,260,599 |

| Posisi Saat Ini | 336 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

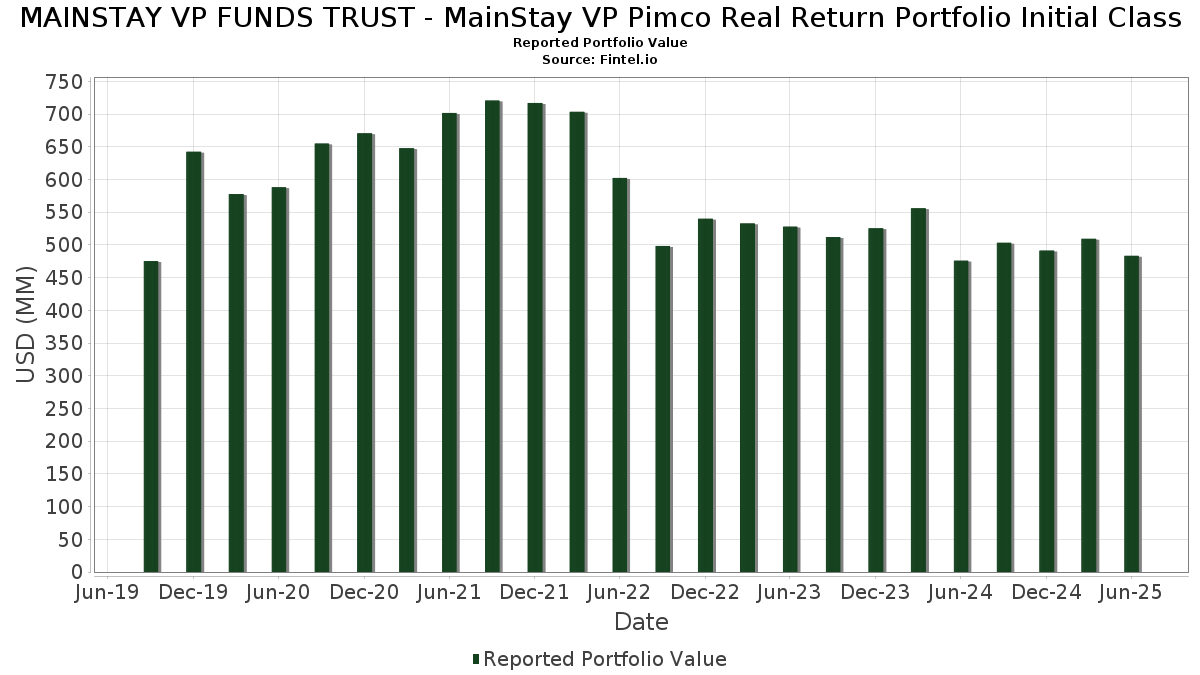

MAINSTAY VP FUNDS TRUST - MainStay VP Pimco Real Return Portfolio Initial Class telah mengungkapkan total kepemilikan 336 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 483,260,599 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama MAINSTAY VP FUNDS TRUST - MainStay VP Pimco Real Return Portfolio Initial Class adalah U.S. Treasury Inflation Linked Notes (US:US91282CEZ05) , UNITED STATES TREASURY INFLATION INDEXED BONDS 0.12500000 (US:US91282CDC29) , United States Treasury Inflation Indexed Bonds (US:US91282CHP95) , Edwards Lifesciences Corporation (US:EW) , and United States Treasury Inflation Indexed Bonds (US:US912810PV44) . Posisi baru MAINSTAY VP FUNDS TRUST - MainStay VP Pimco Real Return Portfolio Initial Class meliputi: U.S. Treasury Inflation Linked Notes (US:US91282CEZ05) , UNITED STATES TREASURY INFLATION INDEXED BONDS 0.12500000 (US:US91282CDC29) , United States Treasury Inflation Indexed Bonds (US:US91282CHP95) , Edwards Lifesciences Corporation (US:EW) , and United States Treasury Inflation Indexed Bonds (US:US912810PV44) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 18.84 | 4.6835 | 3.3431 | ||

| 8.14 | 2.0231 | 2.0231 | ||

| 15.55 | 3.8645 | 1.2813 | ||

| 9.49 | 2.3601 | 1.2042 | ||

| 3.25 | 0.8074 | 0.8074 | ||

| 2.00 | 0.4971 | 0.4971 | ||

| 1.99 | 0.4958 | 0.4958 | ||

| 37.90 | 9.4202 | 0.3988 | ||

| 29.01 | 7.2117 | 0.2864 | ||

| 0.94 | 0.2346 | 0.2346 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 1.27 | 0.3157 | -0.9123 | ||

| 5.39 | 1.3404 | -0.7342 | ||

| 11.89 | 2.9567 | -0.5200 | ||

| 0.85 | 0.85 | 0.2110 | -0.3205 | |

| -1.08 | -0.2685 | -0.2685 | ||

| 3.20 | 0.7946 | -0.2349 | ||

| 5.32 | 1.3230 | -0.1981 | ||

| -0.66 | -0.1638 | -0.1638 | ||

| -0.64 | -0.1591 | -0.1591 | ||

| -0.34 | -0.0834 | -0.0834 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-25 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US91282CEZ05 / U.S. Treasury Inflation Linked Notes | 37.90 | 0.91 | 9.4202 | 0.3988 | |||||

| US91282CDC29 / UNITED STATES TREASURY INFLATION INDEXED BONDS 0.12500000 | 29.01 | 0.63 | 7.2117 | 0.2864 | |||||

| US91282CHP95 / United States Treasury Inflation Indexed Bonds | 19.59 | 0.54 | 4.8698 | 0.1891 | |||||

| EW / Edwards Lifesciences Corporation | 18.84 | 249.43 | 4.6835 | 3.3431 | |||||

| U.S. Treasury Inflation Linked Notes / DBT (US91282CLE92) | 18.42 | 0.13 | 4.5778 | 0.1598 | |||||

| US912810PV44 / United States Treasury Inflation Indexed Bonds | 15.86 | 0.62 | 3.9412 | 0.1561 | |||||

| US01F0606750 / Uniform Mortgage-Backed Security, TBA | 15.55 | 43.56 | 3.8645 | 1.2813 | |||||

| US91282CJH51 / US TREASURY I/L 2.375% 10-15-28 | 14.88 | 0.55 | 3.6996 | 0.1440 | |||||

| US912828Y388 / United States Treasury Inflation Indexed Bonds | 13.65 | 0.94 | 3.3921 | 0.1447 | |||||

| US91282CEJ62 / United States Treasury Inflation Indexed Bonds | 12.90 | 0.72 | 3.2075 | 0.1300 | |||||

| US91282CDX65 / United States Treasury Inflation Indexed Bonds | 12.38 | 1.14 | 3.0764 | 0.1368 | |||||

| US91282CGK18 / U.S. Treasury Inflation Linked Notes | 12.14 | 0.73 | 3.0184 | 0.1227 | |||||

| US91282CCM10 / United States Treasury Inflation Indexed Bonds | 11.89 | -17.82 | 2.9567 | -0.5200 | |||||

| US9128287D64 / United States Treasury Inflation Indexed Bonds | 11.49 | 1.24 | 2.8558 | 0.1300 | |||||

| US912828S505 / United States Treasury Inflation Indexed Bonds | 11.42 | 0.58 | 2.8395 | 0.1114 | |||||

| US91282CFR79 / United States Treasury Inflation Indexed Bonds | 11.07 | 0.59 | 2.7526 | 0.1083 | |||||

| US912828ZZ63 / United States Treasury Inflation Indexed Bonds | 10.01 | 1.27 | 2.4891 | 0.1141 | |||||

| U.S. Treasury Inflation Linked Notes / DBT (US91282CLV18) | 9.49 | 97.34 | 2.3601 | 1.2042 | |||||

| US91282CBF77 / United States Treasury Inflation Indexed Bonds | 8.15 | 1.30 | 2.0264 | 0.0935 | |||||

| GNMA II, Single Family, 30 Year / ABS-MBS (US3618N5KS70) | 8.14 | 2.0231 | 2.0231 | ||||||

| US912810QF84 / United States Treasury Inflation Indexed Bonds | 7.12 | -1.36 | 1.7696 | 0.0360 | |||||

| US912810RW09 / United States Treasury Inflation Indexed Bonds | 6.97 | -3.31 | 1.7328 | 0.0008 | |||||

| US912810RF75 / United States Treasury Inflation Indexed Bonds | 6.92 | -2.60 | 1.7202 | 0.0134 | |||||

| US912810PZ57 / United States Treasury Inflation Indexed Bonds | 6.42 | 0.55 | 1.5959 | 0.0620 | |||||

| US912810RL44 / United States Treasury Inflation Indexed Bonds | 6.40 | -2.84 | 1.5914 | 0.0085 | |||||

| U.S. Treasury Inflation Linked Notes / DBT (US91282CKL45) | 6.39 | 0.73 | 1.5884 | 0.0644 | |||||

| EW / Edwards Lifesciences Corporation | 5.39 | -38.00 | 1.3404 | -0.7342 | |||||

| US912810QV35 / United States Treasury Inflation Indexed Bonds | 5.32 | 11.45 | 1.3232 | 0.1759 | |||||

| US912810RR14 / United States Treasury Inflation Indexed Bonds | 5.32 | -15.95 | 1.3230 | -0.1981 | |||||

| U.S. Treasury Inflation Linked Notes / DBT (US91282CJY84) | 5.07 | 0.26 | 1.2600 | 0.0457 | |||||

| JP1120241K56 / Japanese Government CPI Linked Bond | 4.95 | 5.59 | 1.2302 | 0.1043 | |||||

| US38383KCV26 / GNMA, Series 2023-H20, Class FA | 4.86 | -1.90 | 1.2090 | 0.0181 | |||||

| U.S. Treasury Inflation Linked Notes / DBT (US91282CML27) | 4.86 | -0.02 | 1.2069 | 0.0405 | |||||

| US9128285W63 / United States Treasury Inflation Indexed Bonds | 4.75 | 1.00 | 1.1798 | 0.0509 | |||||

| FR0013519253 / French Republic Government Bond OAT | 4.42 | 9.72 | 1.0996 | 0.1314 | |||||

| US912810TP30 / US TREASURY I/L 1.5% 02-15-53 | 4.27 | -3.89 | 1.0617 | -0.0059 | |||||

| U.S. Treasury Inflation Linked Bonds / DBT (US912810TY47) | 4.21 | -3.75 | 1.0455 | -0.0041 | |||||

| US912810SB52 / United States Treasury Inflation Indexed Bonds | 3.64 | -3.34 | 0.9052 | 0.0001 | |||||

| GNMA II, Single Family, 30 Year / ABS-MBS (US3618N5ER61) | 3.53 | -1.17 | 0.8782 | 0.0193 | |||||

| JGBI / JAPAN GOVT CPI LINKED BONDS 03/28 0.1 | 3.48 | 4.73 | 0.8645 | 0.0667 | |||||

| U.S. Treasury Inflation Linked Notes / DBT (US91282CNB36) | 3.25 | 0.8074 | 0.8074 | ||||||

| US912810QP66 / United States Treasury Inflation Indexed Bonds | 3.20 | -25.41 | 0.7946 | -0.2349 | |||||

| U.S. Treasury Inflation Linked Bonds / DBT (US912810UH94) | 2.85 | -3.56 | 0.7081 | -0.0014 | |||||

| US912810SV17 / United States Treasury Inflation Indexed Bonds | 2.42 | -4.39 | 0.6018 | -0.0062 | |||||

| Barings Euro CLO DAC, Series 2021-2A, Class A / ABS-CBDO (XS2369918813) | 2.34 | 9.24 | 0.5823 | 0.0671 | |||||

| US912810SM18 / US TII .25 02/15/2050 (TIPS) | 2.16 | -3.92 | 0.5365 | -0.0032 | |||||

| CarVal CLO III Ltd., Series 2019-2A, Class AR2 / ABS-CBDO (US14686WAW10) | 2.07 | -0.96 | 0.5151 | 0.0125 | |||||

| US91282CGW55 / United States Treasury Inflation Indexed Bonds | 2.03 | 0.80 | 0.5042 | 0.0207 | |||||

| Bain Capital Credit CLO Ltd., Series 2022-2A, Class A1R / ABS-CBDO (US05682GAQ10) | 2.00 | 0.4971 | 0.4971 | ||||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 1.99 | 0.4958 | 0.4958 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 1.98 | -5.14 | 0.4914 | -0.0092 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 1.91 | -4.03 | 0.4738 | -0.0031 | |||||

| US912810RA88 / United States Treasury Inflation Indexed Bonds | 1.85 | -2.38 | 0.4587 | 0.0045 | |||||

| IT0005387052 / Italy Buoni Poliennali Del Tesoro | 1.85 | 11.41 | 0.4586 | 0.0607 | |||||

| XS2274529275 / CIFC European Funding CLO III DAC | 1.41 | 9.20 | 0.3514 | 0.0403 | |||||

| XS2073824851 / BLUEMOUNTAIN EUR CLO BLUME 5A A 144A | 1.29 | 8.77 | 0.3209 | 0.0357 | |||||

| US91282CCA71 / United States Treasury Inflation Indexed Bonds | 1.27 | -75.16 | 0.3157 | -0.9123 | |||||

| Greywolf CLO III Ltd., Series 2020-3RA, Class A1R2 / ABS-CBDO (US39809CAY03) | 1.20 | 0.25 | 0.2988 | 0.0107 | |||||

| CVC Cordatus Loan Fund XXI DAC, Series 21A, Class A1E / ABS-CBDO (XS2370710936) | 1.18 | 9.30 | 0.2921 | 0.0337 | |||||

| US912810TE82 / United States Treasury Inflation Indexed Bonds | 1.11 | -4.82 | 0.2751 | -0.0042 | |||||

| US68389FKR46 / OPTION ONE MORTGAGE LOAN TRUST OOMLT 2006 1 M1 | 1.07 | -4.37 | 0.2668 | -0.0028 | |||||

| US73316PJX96 / POPULAR ABS MORTGAGE PASS THRO POPLR 2006 A M2 | 1.04 | -5.29 | 0.2584 | -0.0054 | |||||

| US74923EAA64 / Rad CLO 5 Ltd | 1.04 | -15.82 | 0.2580 | -0.0383 | |||||

| LCM 35 Ltd., Series 35A, Class A1R / ABS-CBDO (US50202QAL77) | 1.00 | 0.50 | 0.2486 | 0.0096 | |||||

| FR0014001N38 / French Republic | 0.96 | 10.71 | 0.2389 | 0.0302 | |||||

| US12669WAA45 / Countrywide Asset-Backed Certificates | 0.95 | -2.37 | 0.2359 | 0.0024 | |||||

| US3137FKAX42 / FREDDIE MAC FHR 4851 PF | 0.94 | 0.2346 | 0.2346 | ||||||

| Anchorage Capital CLO 20 Ltd., Series 2021-20A, Class A1R / ABS-CBDO (US03330YAJ91) | 0.90 | 0.45 | 0.2236 | 0.0085 | |||||

| CA135087VS05 / Canadian Government Real Return Bond | 0.86 | 5.13 | 0.2143 | 0.0174 | |||||

| 56064L488 / MainStay US Government Liquidity Fund | 0.85 | -61.64 | 0.85 | -61.66 | 0.2110 | -0.3205 | |||

| IRS / DIR (N/A) | 0.83 | 0.2052 | 0.2052 | ||||||

| US03880XAA46 / Arbor Realty Collateralized Loan Obligation Ltd., Series 2022-FL1, Class A | 0.80 | -11.09 | 0.1995 | -0.0172 | |||||

| Adagio CLO VIII DAC, Series VIII-A, Class AN / ABS-CBDO (XS2054620070) | 0.77 | -14.78 | 0.1907 | -0.0256 | |||||

| Italy Buoni Poliennali del Tesoro / DBT (IT0005588881) | 0.73 | 13.18 | 0.1817 | 0.0266 | |||||

| US50200YAQ17 / LCM LTD PARTNERSHIP LCM 30A AR 144A | 0.73 | -20.83 | 0.1805 | -0.0398 | |||||

| OIS / DIR (N/A) | 0.71 | 0.1762 | 0.1762 | ||||||

| US3137BYWC07 / FHLMC, Series 4694, Class FA | 0.69 | -4.28 | 0.1727 | -0.0015 | |||||

| US912810FQ68 / United States Treas Bds Treas Bond | 0.66 | 0.61 | 0.1635 | 0.0064 | |||||

| USCPI / DIR (N/A) | 0.65 | 0.1616 | 0.1616 | ||||||

| XS2347648961 / ARES EUROPEAN CLO ARESE 10A AR 144A | 0.64 | -3.47 | 0.1591 | -0.0004 | |||||

| US912810SG40 / United States Treasury Inflation Indexed Bonds | 0.60 | -3.85 | 0.1494 | -0.0005 | |||||

| XS2339017928 / CARLYLE GLOBAL MARKET STRATEGI CGMSE 2014 2A AR1 144A | 0.59 | -11.13 | 0.1471 | -0.0127 | |||||

| XS2346593242 / Madison Park Euro Funding IX DAC | 0.59 | 9.33 | 0.1457 | 0.0167 | |||||

| XS2402448703 / St Pauls CLO II DAC | 0.59 | 9.14 | 0.1455 | 0.0167 | |||||

| U.S. Treasury 10 Year Ultra Bonds / DIR (N/A) | 0.58 | 0.1448 | 0.1448 | ||||||

| US75115GAA67 / RALI 2006-QH1 A1 | 0.50 | -6.52 | 0.1248 | -0.0043 | |||||

| US38382Y5C34 / GOVERNMENT NATIONAL MORTGAGE ASSOCIATION SER 2023-H11 CL FC V/R 6.10000000 | 0.49 | -1.80 | 0.1225 | 0.0020 | |||||

| US53946PAA84 / LoanCore 2022-CRE7 Issuer Ltd | 0.49 | -5.95 | 0.1220 | -0.0032 | |||||

| US76110WQ667 / RESIDENTIAL ASSET SECURITIES C RASC 2005 EMX1 M2 | 0.48 | -6.82 | 0.1190 | -0.0044 | |||||

| US31418EE639 / FN MA4656 | 0.48 | -2.66 | 0.1183 | 0.0010 | |||||

| US50189XAA37 / LCM LOAN INCOME FUND I LTD SER 1A CL A V/R REGD 144A P/P 6.61775000 | 0.47 | -34.50 | 0.1161 | -0.0554 | |||||

| Palmer Square European Loan Funding DAC, Series 2023-3A, Class AR / ABS-CBDO (XS2934650610) | 0.46 | -2.35 | 0.1141 | 0.0013 | |||||

| US1248RHAC14 / CREDIT-BASED ASSET SERVICING & SECURITIZATIO SER 2007-CB6 CL A3 V/R REGD 144A P/P 2.04275000 | 0.45 | -1.97 | 0.1113 | 0.0016 | |||||

| US36179W7L60 / Ginnie Mae II Pool | 0.44 | 0.1093 | 0.1093 | ||||||

| XS2301385832 / Invesco Euro CLO I DAC | 0.43 | -0.69 | 0.1077 | 0.0030 | |||||

| US45660LRU51 / IndyMac INDX Mortgage Loan Trust, Series 2005-AR14, Class 1A1A | 0.43 | -1.38 | 0.1065 | 0.0020 | |||||

| GNMA II, Single Family, 30 Year / ABS-MBS (US36180AB691) | 0.42 | 0.1054 | 0.1054 | ||||||

| XS2353412633 / DRYDEN EURO CLO DRYD 2017 52A AR 144A | 0.42 | 4.20 | 0.1051 | 0.0077 | |||||

| US83609GBN43 / Sound Point CLO IX Ltd | 0.42 | -11.92 | 0.1047 | -0.0102 | |||||

| US31418EQL73 / FNMA 30YR 4.5% 03/01/2053#MA4958 | 0.42 | -2.34 | 0.1041 | 0.0013 | |||||

| US92332LAU35 / VENTURE CDO LTD VENTR 2019 36A A1AR 144A | 0.41 | -18.06 | 0.1027 | -0.0184 | |||||

| XS2259201098 / BAIN CAPITAL EURO CLO 2020-1 DAC | 0.39 | -11.91 | 0.0975 | -0.0094 | |||||

| U.S. Treasury 5 Year Notes / DIR (N/A) | 0.38 | 0.0957 | 0.0957 | ||||||

| US31418EGJ38 / FN MA4700 | 0.37 | -2.35 | 0.0930 | 0.0009 | |||||

| US03880RAA77 / Arbor Realty Collateralized Loan Obligation Ltd | 0.37 | -16.03 | 0.0927 | -0.0138 | |||||

| US3133B2P527 / Freddie Mac Pool | 0.32 | -0.61 | 0.0806 | 0.0021 | |||||

| IRS / DIR (N/A) | 0.31 | 0.0778 | 0.0778 | ||||||

| US12551YAA10 / CIFC 2018-3A A | 0.31 | -17.51 | 0.0775 | -0.0132 | |||||

| USCPI / DIR (N/A) | 0.31 | 0.0774 | 0.0774 | ||||||

| IRS / DIR (N/A) | 0.31 | 0.0774 | 0.0774 | ||||||

| US32028KAB26 / First Franklin Mortgage Loan Trust 2006-FF17 | 0.31 | -0.65 | 0.0766 | 0.0023 | |||||

| US75406DAD57 / RASC Series 2006-EMX1 Trust | 0.31 | -2.55 | 0.0762 | 0.0006 | |||||

| US22540A7A01 / CREDIT SUISSE FIRST BOSTON MOR CSFB 2001 HE17 A1 | 0.30 | -2.88 | 0.0754 | 0.0003 | |||||

| US36361UAL44 / Gallatin CLO VIII 2017-1 Ltd | 0.30 | -1.31 | 0.0749 | 0.0015 | |||||

| PEP01000C5F6 / Peru Government Bond | 0.30 | 3.87 | 0.0735 | 0.0053 | |||||

| US362257AC18 / GSAA Home Equity Trust 2006-17 | 0.29 | -0.34 | 0.0726 | 0.0022 | |||||

| US38380LJY02 / Government National Mortgage Association | 0.29 | -1.03 | 0.0719 | 0.0016 | |||||

| DTRS / DIR (N/A) | 0.27 | 0.0664 | 0.0664 | ||||||

| SB12AGO32 / Peru - Sovereign or Government Agency Debt | 0.26 | 6.94 | 0.0652 | 0.0061 | |||||

| OIS / DIR (N/A) | 0.25 | 0.0633 | 0.0633 | ||||||

| DK0009403727 / JYSKE REALKREDIT A/S COVERED 10/53 1.5 | 0.24 | 9.42 | 0.0607 | 0.0070 | |||||

| US92558NAJ19 / Vibrant CLO XI Ltd | 0.23 | -22.52 | 0.0584 | -0.0142 | |||||

| US93936AAB70 / Washington Mutual Mortgage Pass-Through Certificates WMALT Series 2007-HY1 Trust | 0.23 | -4.18 | 0.0571 | -0.0005 | |||||

| USCPI / DIR (N/A) | 0.21 | 0.0522 | 0.0522 | ||||||

| OIS / DIR (N/A) | 0.21 | 0.0519 | 0.0519 | ||||||

| US78442GLL85 / SLM Student Loan Trust 2004-3 | 0.21 | -2.36 | 0.0516 | 0.0006 | |||||

| US885220FE80 / TMST 2004-2 A1 | 0.20 | -1.96 | 0.0499 | 0.0007 | |||||

| US060505FL38 / Bank of America Corp | 0.19 | 1.05 | 0.0480 | 0.0020 | |||||

| 3 Month Euro Euribor / DIR (GB00J8R2ZN46) | 0.19 | 1,011.76 | 0.0471 | 0.0430 | |||||

| DK0009397069 / JYSKE REALKREDIT A/S COVERED REGS 10/50 1 | 0.18 | 9.52 | 0.0458 | 0.0053 | |||||

| US23246KAA97 / Alternative Loan Trust 2007-1T1 | 0.18 | -3.26 | 0.0443 | 0.0000 | |||||

| US81376YAD31 / SECURITIZED ASSET BACKED RECEI SABR 2006 HE1 A2C | 0.17 | 0.00 | 0.0410 | 0.0014 | |||||

| IRS / DIR (N/A) | 0.16 | 0.0405 | 0.0405 | ||||||

| US83612TAA07 / Soundview Home Loan Trust 2007-OPT1 | 0.15 | -0.65 | 0.0383 | 0.0009 | |||||

| DTRS / DIR (N/A) | 0.14 | 0.0350 | 0.0350 | ||||||

| CH1214797172 / Credit Suisse Group AG | 0.13 | 9.09 | 0.0330 | 0.0037 | |||||

| US3132DWDC47 / Freddie Mac Pool | 0.13 | -2.24 | 0.0328 | 0.0005 | |||||

| US437084QA78 / Home Equity Asset Trust | 0.13 | -8.03 | 0.0316 | -0.0015 | |||||

| US12551JAL08 / CIFC FUNDING LTD CIFC 2017 4A A1R 144A | 0.12 | -23.12 | 0.0306 | -0.0080 | |||||

| Euro-OAT / DIR (DE000F1NGGA8) | 0.12 | 0.0305 | 0.0305 | ||||||

| US17311WAA53 / CITIGROUP MORTGAGE LOAN TRUST CMLTI 2007 AR4 1A1A | 0.12 | 0.00 | 0.0301 | 0.0008 | |||||

| USCPI / DIR (N/A) | 0.12 | 0.0301 | 0.0301 | ||||||

| US38375UZZ64 / Government National Mortgage Association | 0.12 | -6.98 | 0.0300 | -0.0010 | |||||

| US81377AAD46 / Securitized Asset Backed Receivables LLC Trust 2006-HE2 | 0.12 | -0.83 | 0.0297 | 0.0008 | |||||

| OIS / DIR (N/A) | 0.12 | 0.0297 | 0.0297 | ||||||

| US64830NAA90 / New Residential Mortgage Loan Trust 2019-RPL3 | 0.12 | -4.80 | 0.0296 | -0.0006 | |||||

| US67113DAW48 / OZLM XXIV Ltd | 0.12 | -23.87 | 0.0295 | -0.0078 | |||||

| US3132HTBH86 / Freddie Mac Strips | 0.12 | -2.52 | 0.0289 | 0.0002 | |||||

| US83613DAD84 / SOUNDVIEW HOME LOAN TRUST 2007-OPT2 SER 2007-OPT2 CL 2A3 V/R REGD 1.88800000 | 0.11 | -1.75 | 0.0281 | 0.0006 | |||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.11 | 0.0279 | 0.0279 | ||||||

| US68383NBC65 / Opteum Mortgage Acceptance Corp Asset Backed Pass-Through Certificates 2005-2 | 0.10 | 0.00 | 0.0246 | 0.0009 | |||||

| U.S. Treasury Ultra Bonds / DIR (N/A) | 0.10 | 0.0244 | 0.0244 | ||||||

| DK0004619467 / Realkredit Danmark A/S | 0.10 | 8.99 | 0.0242 | 0.0027 | |||||

| US80317LAJ26 / Saranac Clo VI Ltd | 0.10 | -14.29 | 0.0241 | -0.0030 | |||||

| USCPI / DIR (N/A) | 0.09 | 0.0232 | 0.0232 | ||||||

| US17307GGX07 / CITIGROUP MORTGAGE LOAN TRUST INC SER 2004-NCM2 CL 1CB1 REGD 5.50000000 | 0.09 | -1.09 | 0.0228 | 0.0006 | |||||

| XS1713075973 / BLACK DIAMOND CLO BLACK 2017 2A A1 144A | 0.09 | -39.46 | 0.0224 | -0.0131 | |||||

| US31407UMR58 / Fannie Mae Pool | 0.09 | -3.26 | 0.0222 | 0.0001 | |||||

| US77587UAL61 / ROMARK CLO LTD RMRK 2017 1A A1R 144A | 0.09 | -36.96 | 0.0216 | -0.0115 | |||||

| US3137F4BX98 / Freddie Mac REMICS | 0.08 | -9.68 | 0.0210 | -0.0015 | |||||

| US54251TAC36 / Long Beach Mortgage Loan Trust 2006-7 | 0.08 | 0.00 | 0.0206 | 0.0008 | |||||

| US04942PAJ66 / Atlas Static Senior Loan Fund I Ltd | 0.08 | -43.45 | 0.0205 | -0.0144 | |||||

| OIS / DIR (N/A) | 0.08 | 0.0198 | 0.0198 | ||||||

| US64830KAA51 / New Residential Mortgage Loan Trust 2018-3 | 0.08 | -3.75 | 0.0191 | -0.0001 | |||||

| HICPXT / DIR (N/A) | 0.07 | 0.0176 | 0.0176 | ||||||

| US31402LPB26 / FANNIE MAE 2.757% 06/01/2043 FAR FNARM | 0.07 | -4.11 | 0.0176 | -0.0001 | |||||

| US61744CLW46 / Morgan Stanley ABS Capital I Inc Trust 2005-WMC1 | 0.07 | -4.23 | 0.0169 | -0.0002 | |||||

| US45660LMG13 / IndyMac INDX Mortgage Loan Trust 2005-AR12 | 0.07 | -1.49 | 0.0166 | 0.0004 | |||||

| OIS / DIR (N/A) | 0.07 | 0.0166 | 0.0166 | ||||||

| US76113LAE74 / RESIDENTIAL ASSET SECURITIZATION TRUST 2006-A10 SER 2006-A10 CL A5 REGD 6.50000000 | 0.07 | -1.49 | 0.0166 | 0.0003 | |||||

| OIS / DIR (N/A) | 0.07 | 0.0164 | 0.0164 | ||||||

| DK0002050442 / Nordea Kredit Realkreditaktieselskab | 0.07 | 8.33 | 0.0163 | 0.0019 | |||||

| US040104TG69 / Argent Securities Trust 2006-W4 | 0.06 | -1.54 | 0.0160 | 0.0004 | |||||

| US05401AAR23 / Avolon Holdings Funding Ltd | 0.06 | 1.64 | 0.0156 | 0.0008 | |||||

| US80557BAA26 / Saxon Asset Securities Trust 2007-3 | 0.06 | -3.28 | 0.0147 | -0.0001 | |||||

| HICPXT / DIR (N/A) | 0.06 | 0.0146 | 0.0146 | ||||||

| IRS / DIR (N/A) | 0.06 | 0.0143 | 0.0143 | ||||||

| DTRS / DIR (N/A) | 0.06 | 0.0141 | 0.0141 | ||||||

| DK0002050012 / NORDEA KREDIT REALKREDIT /DKK/ REGD 1.50000000 | 0.05 | 8.00 | 0.0136 | 0.0016 | |||||

| US59020UXH30 / MERRILL LYNCH MORTGAGE INVESTORS TRUST MLMI SERIES MLMI 2005-A4 1A | 0.05 | -1.85 | 0.0134 | 0.0003 | |||||

| OIS / DIR (N/A) | 0.05 | 0.0131 | 0.0131 | ||||||

| DK0002051093 / Nordea Kredit Realkreditaktieselskab | 0.05 | 10.64 | 0.0130 | 0.0016 | |||||

| HICPXT / DIR (N/A) | 0.05 | 0.0130 | 0.0130 | ||||||

| Euro-BTP / DIR (DE000F1NGF38) | 0.05 | 0.0124 | 0.0124 | ||||||

| XS0308666493 / EUROSAIL PLC ESAIL 2007 3X A3A REGS | 0.05 | -7.55 | 0.0123 | -0.0004 | |||||

| Australia 10 Year Bonds / DIR (N/A) | 0.05 | 0.0122 | 0.0122 | ||||||

| USCPI / DIR (N/A) | 0.05 | 0.0120 | 0.0120 | ||||||

| HICPXT / DIR (N/A) | 0.05 | 0.0117 | 0.0117 | ||||||

| US39539FAK03 / GreenPoint Mortgage Funding Trust Series 2006-AR4 | 0.05 | -2.13 | 0.0115 | 0.0001 | |||||

| FCT / Fincantieri S.p.A. | 0.05 | 9.76 | 0.0114 | 0.0014 | |||||

| HICPXT / DIR (N/A) | 0.04 | 0.0111 | 0.0111 | ||||||

| Euro-Buxl / DIR (DE000F1NGF87) | 0.04 | 0.0111 | 0.0111 | ||||||

| DK0004619624 / Realkredit Danmark A/S | 0.04 | 10.26 | 0.0108 | 0.0013 | |||||

| US64352VJJ17 / New Century Home Equity Loan Trust, Series 2004-4, Class M1 | 0.04 | -4.76 | 0.0100 | -0.0001 | |||||

| DK0009528424 / NYKREDIT REALKREDIT AS COVERED REGS 10/53 1.5 | 0.04 | 8.33 | 0.0098 | 0.0011 | |||||

| US92915UAG94 / VOYA CLO LTD VOYA 2017 2A A1R 144A | 0.04 | 0.00 | 0.0094 | 0.0003 | |||||

| US36179WZB70 / Ginnie Mae II Pool | 0.04 | 0.0089 | 0.0089 | ||||||

| USCPI / DIR (N/A) | 0.04 | 0.0088 | 0.0088 | ||||||

| IRS / DIR (N/A) | 0.04 | 0.0087 | 0.0087 | ||||||

| US57645MAE21 / Mastr Asset-Backed Securities Trust, Series 2006-WMC4, Class A5 | 0.03 | 0.00 | 0.0085 | 0.0003 | |||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.03 | 0.0084 | 0.0084 | ||||||

| HICPXT / DIR (N/A) | 0.03 | 0.0084 | 0.0084 | ||||||

| OIS / DIR (N/A) | 0.03 | 0.0081 | 0.0081 | ||||||

| US912810PS15 / United States Treasury Inflation Indexed Bonds | 0.03 | 0.00 | 0.0080 | 0.0003 | |||||

| US69702HAA68 / Palmer Square Loan Funding Ltd | 0.03 | -58.67 | 0.0078 | -0.0103 | |||||

| IRS / DIR (N/A) | 0.03 | 0.0074 | 0.0074 | ||||||

| IRS / DIR (N/A) | 0.03 | 0.0070 | 0.0070 | ||||||

| IRS / DIR (N/A) | 0.03 | 0.0067 | 0.0067 | ||||||

| OIS / DIR (N/A) | 0.03 | 0.0065 | 0.0065 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.03 | 0.0064 | 0.0064 | ||||||

| HICPXT / DIR (N/A) | 0.02 | 0.0060 | 0.0060 | ||||||

| USCPI / DIR (N/A) | 0.02 | 0.0059 | 0.0059 | ||||||

| RPI / DIR (N/A) | 0.02 | 0.0058 | 0.0058 | ||||||

| Euro-Bund / DIR (DE000F1NGF53) | 0.02 | 0.0056 | 0.0056 | ||||||

| US31385HJE36 / FANNIE MAE POOL P#544861 4.18600000 | 0.02 | -8.70 | 0.0054 | -0.0002 | |||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.02 | 0.0052 | 0.0052 | ||||||

| US93934NAQ88 / Washington Mutual Mortgage Pass-Through Certificates WMALT Series 2006-5 Trust | 0.02 | 0.00 | 0.0051 | 0.0001 | |||||

| US36179W5D62 / Ginnie Mae II Pool | 0.02 | 0.0050 | 0.0050 | ||||||

| US52525AAA25 / LEHMAN XS TRUST SERIES 2007-20N SER 2007-20N CL A1 V/R REGD 2.85800000 | 0.02 | -5.00 | 0.0048 | -0.0003 | |||||

| OIS / DIR (N/A) | 0.02 | 0.0042 | 0.0042 | ||||||

| HICPXT / DIR (N/A) | 0.02 | 0.0042 | 0.0042 | ||||||

| RPI / DIR (N/A) | 0.02 | 0.0042 | 0.0042 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.02 | 0.0038 | 0.0038 | ||||||

| DTRS / DIR (N/A) | 0.01 | 0.0037 | 0.0037 | ||||||

| RPI / DIR (N/A) | 0.01 | 0.0037 | 0.0037 | ||||||

| US67112FAD24 / OBX 2018-1 TRUST OBX 2018-1 A2 | 0.01 | -6.67 | 0.0036 | -0.0001 | |||||

| HICPXT / DIR (N/A) | 0.01 | 0.0036 | 0.0036 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.01 | 0.0035 | 0.0035 | ||||||

| IRS / DIR (N/A) | 0.01 | 0.0034 | 0.0034 | ||||||

| US29880YAJ82 / EUROSAIL PLC ESAIL 2007 3A A3C 144A | 0.01 | -7.14 | 0.0033 | -0.0001 | |||||

| XS0308710143 / EUROSAIL PLC ESAIL 2007 3X A3C REGS | 0.01 | -7.14 | 0.0033 | -0.0001 | |||||

| RPI / DIR (N/A) | 0.01 | 0.0031 | 0.0031 | ||||||

| OIS / DIR (N/A) | 0.01 | 0.0031 | 0.0031 | ||||||

| US12667GUG62 / Countrywide Alternative Loan Trust, Series 2005-29CB, Class A4 | 0.01 | -8.33 | 0.0030 | -0.0001 | |||||

| OIS / DIR (N/A) | 0.01 | 0.0029 | 0.0029 | ||||||

| OIS / DIR (N/A) | 0.01 | 0.0029 | 0.0029 | ||||||

| DK0009532020 / Nykredit Realkredit AS | 0.01 | 11.11 | 0.0027 | 0.0003 | |||||

| US170255AA19 / CHL MORTGAGE PASS-THROUGH TRUST 2007-1 SER 2007-1 CL A1 REGD 6.00000000 | 0.01 | -9.09 | 0.0027 | 0.0000 | |||||

| DK0002047224 / Nordea Kredit Realkreditaktieselskab | 0.01 | 11.11 | 0.0026 | 0.0003 | |||||

| OIS / DIR (N/A) | 0.01 | 0.0026 | 0.0026 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.01 | 0.0018 | 0.0018 | ||||||

| USCPI / DIR (N/A) | 0.01 | 0.0017 | 0.0017 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.01 | 0.0017 | 0.0017 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.01 | 0.0016 | 0.0016 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.01 | 0.0015 | 0.0015 | ||||||

| USCPI / DIR (N/A) | 0.01 | 0.0014 | 0.0014 | ||||||

| US22616CAJ27 / Crestline Denali CLO XV Ltd | 0.01 | -82.76 | 0.0012 | -0.0057 | |||||

| IRS / DIR (N/A) | 0.00 | 0.0011 | 0.0011 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0011 | 0.0011 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0010 | 0.0010 | ||||||

| DK0009522815 / NYKREDIT REALKREDIT AS COVERED REGS 10/50 1 | 0.00 | 33.33 | 0.0010 | 0.0001 | |||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0009 | 0.0009 | ||||||

| OIS / DIR (N/A) | 0.00 | 0.0008 | 0.0008 | ||||||

| HICPXT / DIR (N/A) | 0.00 | 0.0008 | 0.0008 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0008 | 0.0008 | ||||||

| HICPXT / DIR (N/A) | 0.00 | 0.0008 | 0.0008 | ||||||

| HICPXT / DIR (N/A) | 0.00 | 0.0008 | 0.0008 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0007 | 0.0007 | ||||||

| OIS / DIR (N/A) | 0.00 | 0.0006 | 0.0006 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0006 | 0.0006 | ||||||

| DK0009399784 / JYSKE REALKREDIT A/S COVERED 10/43 0.5 | 0.00 | 0.00 | 0.0006 | 0.0001 | |||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0005 | 0.0005 | ||||||

| OIS / DIR (N/A) | 0.00 | 0.0005 | 0.0005 | ||||||

| DK0002050368 / Nordea Kredit Realkreditaktieselskab | 0.00 | 0.00 | 0.0004 | 0.0000 | |||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0004 | 0.0004 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0004 | 0.0004 | ||||||

| Euro-Bobl / DIR (DE000F1NGF61) | 0.00 | 0.0003 | 0.0003 | ||||||

| DK0009292559 / REALKREDIT DANMARK COVERED 07/47 2.5 | 0.00 | 0.00 | 0.0003 | 0.0000 | |||||

| HICPXT / DIR (N/A) | 0.00 | 0.0003 | 0.0003 | ||||||

| DK0004616018 / Realkredit Danmark A/S | 0.00 | 0.0002 | 0.0000 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0002 | 0.0002 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0001 | 0.0001 | ||||||

| DK0009382707 / JYSKE REALKREDIT A/S COVERED 10/47 2.5 | 0.00 | 0.0001 | 0.0000 | ||||||

| OIS / DIR (N/A) | 0.00 | 0.0001 | 0.0001 | ||||||

| NDASS / NORDEA KREDIT REALKREDIT COVERED 10/47 2.5 | 0.00 | 0.0001 | 0.0000 | ||||||

| DK0009798803 / NYKREDIT REALKREDIT AS COVERED REGS 10/47 2.5 | 0.00 | 0.0001 | 0.0000 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0000 | 0.0000 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0000 | 0.0000 | ||||||

| DK0009527293 / NYKREDIT REALKREDIT AS COVERED REGS 10/53 1 | 0.00 | 0.0000 | 0.0000 | ||||||

| DK0009532889 / NYKREDIT REALKREDIT AS /DKK/ REGD REG S SER 01E* 2.00000000 | 0.00 | 0.0000 | 0.0000 | ||||||

| DK0009528697 / Nykredit Realkredit A/S, Series 01E | 0.00 | 0.0000 | 0.0000 | ||||||

| DK0004619384 / REALKREDIT DANMARK COVERED REGS 10/53 1.5 | 0.00 | 0.0000 | 0.0000 | ||||||

| DK0009527616 / NYKREDIT REALKREDIT AS COVERED REGS 10/53 1.5 | 0.00 | 0.0000 | 0.0000 | ||||||

| DK0009527376 / Nykredit Realkredit A/S, Series 01E | 0.00 | 0.0000 | 0.0000 | ||||||

| DK0002047141 / Nordea Kredit Realkreditaktieselskab | 0.00 | 0.0000 | 0.0000 | ||||||

| DK0009527103 / NYKREDIT REALKREDIT AS COVERED REGS 10/43 0.5 | 0.00 | 0.0000 | 0.0000 | ||||||

| DK0004616281 / REALKREDIT DKK SR SEC SF COVERED 1.0% 10-01-53 | 0.00 | 0.0000 | 0.0000 | ||||||

| DK0009403131 / JYSKE REALKREDIT A/S COVERED 10/53 1 | 0.00 | 0.0000 | 0.0000 | ||||||

| DK0002044551 / NORDEA KREDIT REALKREDIT COVERED REGS 10/50 1 | 0.00 | 0.0000 | 0.0000 | ||||||

| DK0009403644 / JYSKE REALKREDIT A/S COVERED 10/53 1.5 | 0.00 | 0.0000 | 0.0000 | ||||||

| DK0004612454 / REALKREDIT DANMARK A/S COVERED 10/50 1 | 0.00 | 0.0000 | 0.0000 | ||||||

| HICPXT / DIR (N/A) | -0.00 | -0.0000 | -0.0000 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.00 | -0.0001 | -0.0001 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.00 | -0.0001 | -0.0001 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.00 | -0.0002 | -0.0002 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.00 | -0.0002 | -0.0002 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.00 | -0.0002 | -0.0002 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.00 | -0.0003 | -0.0003 | ||||||

| USCPI / DIR (N/A) | -0.00 | -0.0005 | -0.0005 | ||||||

| Euro-Schatz / DIR (DE000F1NGF79) | -0.00 | -0.0005 | -0.0005 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.00 | -0.0008 | -0.0008 | ||||||

| DTRS / DIR (N/A) | -0.00 | -0.0008 | -0.0008 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.00 | -0.0009 | -0.0009 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.00 | -0.0012 | -0.0012 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.01 | -0.0013 | -0.0013 | ||||||

| HICPXT / DIR (N/A) | -0.01 | -0.0015 | -0.0015 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.01 | -0.0015 | -0.0015 | ||||||

| USCPI / DIR (N/A) | -0.01 | -0.0015 | -0.0015 | ||||||

| USCPI / DIR (N/A) | -0.01 | -0.0016 | -0.0016 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.01 | -0.0016 | -0.0016 | ||||||

| OIS / DIR (N/A) | -0.01 | -0.0017 | -0.0017 | ||||||

| OIS / DIR (N/A) | -0.01 | -0.0018 | -0.0018 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.01 | -0.0018 | -0.0018 | ||||||

| OIS / DIR (N/A) | -0.01 | -0.0019 | -0.0019 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.01 | -0.0021 | -0.0021 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.01 | -0.0022 | -0.0022 | ||||||

| HICPXT / DIR (N/A) | -0.01 | -0.0022 | -0.0022 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.01 | -0.0026 | -0.0026 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.01 | -0.0026 | -0.0026 | ||||||

| HICPXT / DIR (N/A) | -0.01 | -0.0028 | -0.0028 | ||||||

| USCPI / DIR (N/A) | -0.01 | -0.0036 | -0.0036 | ||||||

| USCPI / DIR (N/A) | -0.02 | -0.0037 | -0.0037 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.02 | -0.0045 | -0.0045 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.02 | -0.0050 | -0.0050 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.02 | -0.0055 | -0.0055 | ||||||

| OIS / DIR (N/A) | -0.03 | -0.0065 | -0.0065 | ||||||

| USCPI / DIR (N/A) | -0.03 | -0.0066 | -0.0066 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.03 | -0.0067 | -0.0067 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.03 | -0.0079 | -0.0079 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.03 | -0.0084 | -0.0084 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.03 | -0.0084 | -0.0084 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.03 | -0.0086 | -0.0086 | ||||||

| OIS / DIR (N/A) | -0.04 | -0.0099 | -0.0099 | ||||||

| OIS / DIR (N/A) | -0.05 | -0.0122 | -0.0122 | ||||||

| USCPI / DIR (N/A) | -0.05 | -0.0130 | -0.0130 | ||||||

| OIS / DIR (N/A) | -0.07 | -0.0169 | -0.0169 | ||||||

| USCPI / DIR (N/A) | -0.08 | -0.0196 | -0.0196 | ||||||

| OIS / DIR (N/A) | -0.08 | -0.0207 | -0.0207 | ||||||

| OIS / DIR (N/A) | -0.10 | -0.0248 | -0.0248 | ||||||

| SOP / DIR (N/A) | -0.12 | -0.0305 | -0.0305 | ||||||

| GB00HB9WVH19 / 3 Month Euro Euribor | -0.15 | 370.97 | -0.0365 | -0.0290 | |||||

| U.S. Treasury 2 Year Notes / DIR (N/A) | -0.15 | -0.0383 | -0.0383 | ||||||

| SOP / DIR (N/A) | -0.20 | -0.0488 | -0.0488 | ||||||

| U.S. Treasury Long Bonds / DIR (N/A) | -0.31 | -0.0768 | -0.0768 | ||||||

| USCPI / DIR (N/A) | -0.32 | -0.0790 | -0.0790 | ||||||

| USCPI / DIR (N/A) | -0.34 | -0.0834 | -0.0834 | ||||||

| HICPXT / DIR (N/A) | -0.64 | -0.1591 | -0.1591 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.66 | -0.1638 | -0.1638 | ||||||

| U.S. Treasury 10 Year Notes / DIR (N/A) | -1.08 | -0.2685 | -0.2685 |