Mga Batayang Estadistika

| Nilai Portofolio | $ 542,280,902 |

| Posisi Saat Ini | 56 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

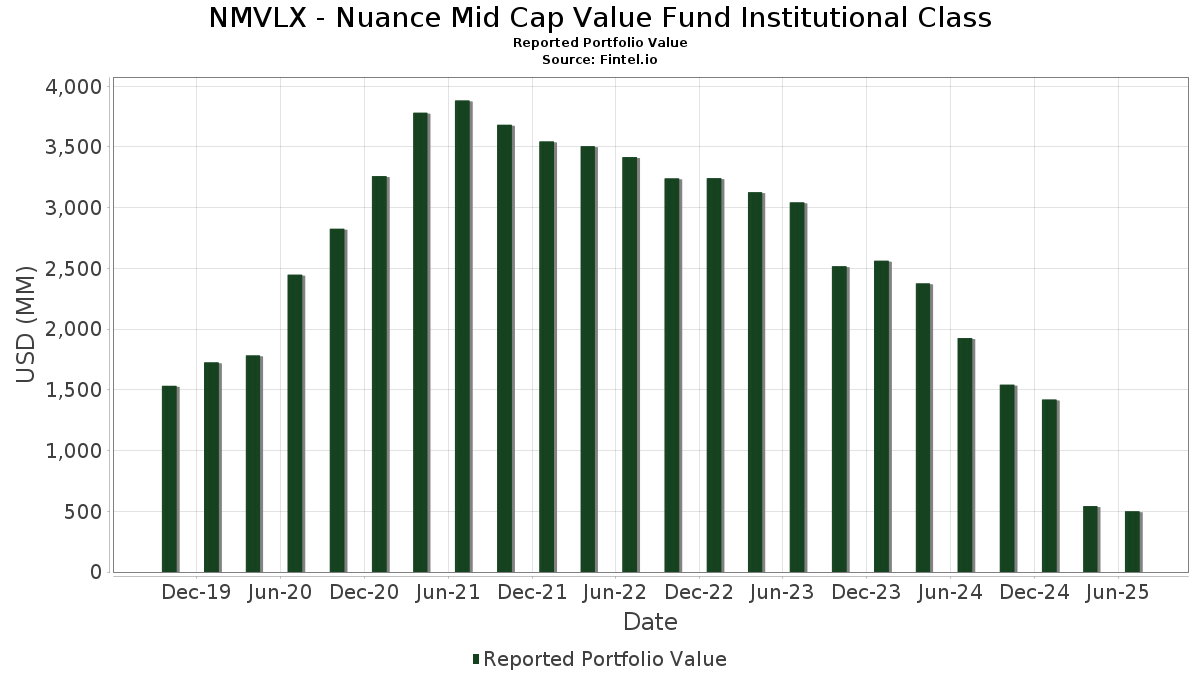

NMVLX - Nuance Mid Cap Value Fund Institutional Class telah mengungkapkan total kepemilikan 56 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 542,280,902 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama NMVLX - Nuance Mid Cap Value Fund Institutional Class adalah First American Funds Inc - First American Government Obligations Fund Class X (US:FGXXX) , The Estée Lauder Companies Inc. (US:EL) , Henkel AG & Co. KGaA - Depositary Receipt (Common Stock) (US:HENKY) , Qiagen N.V. (US:QGEN) , and California Water Service Group (US:CWT) . Posisi baru NMVLX - Nuance Mid Cap Value Fund Institutional Class meliputi: The Charles Schwab Corporation - Preferred Stock (US:SCHW.PRJ) , M&T Bank Corporation (US:MTB) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.72 | 30.60 | 5.6364 | 5.6364 | |

| 1.68 | 21.53 | 3.9656 | 2.2388 | |

| 0.37 | 21.63 | 3.9840 | 1.9615 | |

| 0.49 | 24.60 | 4.5314 | 1.9478 | |

| 0.29 | 19.00 | 3.5001 | 1.5168 | |

| 1.83 | 32.26 | 5.9416 | 1.2807 | |

| 0.11 | 15.45 | 2.8458 | 1.1577 | |

| 0.04 | 7.42 | 1.3675 | 1.0970 | |

| 0.20 | 19.14 | 3.5254 | 1.0115 | |

| 0.29 | 16.37 | 3.0152 | 0.9093 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.97 | 13.49 | 2.4844 | -4.8015 | |

| 0.02 | 2.58 | 0.4747 | -1.7580 | |

| 1.03 | 13.77 | 2.5356 | -1.2436 | |

| 0.00 | 0.00 | -1.2370 | ||

| 0.04 | 5.53 | 1.0188 | -0.9752 | |

| 0.25 | 16.20 | 2.9829 | -0.6864 | |

| 0.17 | 21.18 | 3.9019 | -0.6768 | |

| 0.51 | 15.17 | 2.7948 | -0.6331 | |

| 0.05 | 1.92 | 0.3528 | -0.6048 | |

| 0.01 | 0.29 | 0.0527 | -0.5602 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-06-17 untuk periode pelaporan 2025-04-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| FGXXX / First American Funds Inc - First American Government Obligations Fund Class X | 47.44 | -61.27 | 47.44 | -61.27 | 8.7376 | 0.1310 | |||

| EL / The Estée Lauder Companies Inc. | 0.64 | -46.08 | 38.43 | -61.25 | 7.0776 | 0.1102 | |||

| HENKY / Henkel AG & Co. KGaA - Depositary Receipt (Common Stock) | 1.83 | -46.78 | 32.26 | -51.37 | 5.9416 | 1.2807 | |||

| QGEN / Qiagen N.V. | 0.72 | 30.60 | 5.6364 | 5.6364 | |||||

| CWT / California Water Service Group | 0.49 | -40.17 | 24.60 | -33.09 | 4.5314 | 1.9478 | |||

| HOLX / Hologic, Inc. | 0.37 | -6.85 | 21.63 | -24.85 | 3.9840 | 1.9615 | |||

| MRTN / Marten Transport, Ltd. | 1.68 | 5.07 | 21.53 | -12.39 | 3.9656 | 2.2388 | |||

| GL / Globe Life Inc. | 0.17 | -67.82 | 21.18 | -67.49 | 3.9019 | -0.6768 | |||

| WERN / Werner Enterprises, Inc. | 0.79 | -49.35 | 19.44 | -65.40 | 3.5812 | -0.3677 | |||

| NTRS / Northern Trust Corporation | 0.20 | -36.08 | 19.14 | -46.50 | 3.5254 | 1.0115 | |||

| SOLV / Solventum Corporation | 0.29 | -24.59 | 19.00 | -32.67 | 3.5001 | 1.5168 | |||

| HTO / H2O America | 0.29 | -51.65 | 16.37 | -45.38 | 3.0152 | 0.9093 | |||

| HSIC / Henry Schein, Inc. | 0.25 | -61.81 | 16.20 | -68.99 | 2.9829 | -0.6864 | |||

| CLX / The Clorox Company | 0.11 | -28.28 | 15.45 | -35.69 | 2.8458 | 1.1577 | |||

| UUGRY / United Utilities Group PLC - Depositary Receipt (Common Stock) | 0.51 | -73.74 | 15.17 | -68.90 | 2.7948 | -0.6331 | |||

| PEGRY / Pennon Group Plc - Depositary Receipt (Common Stock) | 1.03 | -72.78 | 13.77 | -74.41 | 2.5356 | -1.2436 | |||

| XRAY / DENTSPLY SIRONA Inc. | 0.97 | -81.51 | 13.49 | -86.99 | 2.4844 | -4.8015 | |||

| SCHW.PRD / The Charles Schwab Corporation - Preferred Stock | 0.51 | -41.40 | 12.70 | -42.17 | 2.3400 | 0.7964 | |||

| CVGW / Calavo Growers, Inc. | 0.40 | -47.17 | 11.01 | -36.26 | 2.0287 | 0.8146 | |||

| ROG / Rogers Corporation | 0.16 | -52.91 | 10.11 | -68.72 | 1.8620 | -0.4090 | |||

| NOC / Northrop Grumman Corporation | 0.02 | -62.65 | 7.60 | -62.70 | 1.4000 | -0.0320 | |||

| BDX / Becton, Dickinson and Company | 0.04 | 130.62 | 7.42 | 92.88 | 1.3675 | 1.0970 | |||

| ATR / AptarGroup, Inc. | 0.05 | 14.32 | 7.42 | 9.09 | 1.3660 | 0.8883 | |||

| IEX / IDEX Corporation | 0.03 | -40.43 | 5.78 | -53.80 | 1.0639 | 0.1854 | |||

| TTC / The Toro Company | 0.08 | -63.05 | 5.58 | -69.70 | 1.0269 | -0.2661 | |||

| AVO / Mission Produce, Inc. | 0.53 | -45.90 | 5.55 | -52.34 | 1.0221 | 0.2040 | |||

| AWK / American Water Works Company, Inc. | 0.04 | -83.47 | 5.53 | -80.51 | 1.0188 | -0.9752 | |||

| SPXSY / Spirax Group plc - Depositary Receipt (Common Stock) | 0.14 | -37.37 | 5.35 | -51.16 | 0.9853 | 0.2157 | |||

| RGA / Reinsurance Group of America, Incorporated | 0.03 | -56.03 | 5.14 | -63.86 | 0.9466 | -0.0525 | |||

| WAT / Waters Corporation | 0.01 | -44.30 | 4.44 | -40.07 | 0.8175 | 0.3344 | |||

| NKE / NIKE, Inc. | 0.08 | 72.69 | 4.38 | 26.66 | 0.8067 | 0.5638 | |||

| KNX / Knight-Swift Transportation Holdings Inc. | 0.10 | -66.19 | 4.06 | -76.81 | 0.7479 | -0.4822 | |||

| A / Agilent Technologies, Inc. | 0.03 | 3.63 | 0.6691 | 0.6691 | |||||

| JDEPY / JDE Peet's N.V. - Depositary Receipt (Common Stock) | 0.28 | -68.90 | 3.43 | -56.04 | 0.6314 | 0.0835 | |||

| BDRFY / Beiersdorf Aktiengesellschaft - Depositary Receipt (Common Stock) | 0.11 | -16.61 | 3.21 | -12.39 | 0.5915 | 0.3339 | |||

| LNN / Lindsay Corporation | 0.02 | -55.96 | 2.97 | -57.65 | 0.5469 | 0.0543 | |||

| LMT / Lockheed Martin Corporation | 0.01 | -20.75 | 2.92 | -18.22 | 0.5383 | 0.2872 | |||

| TGT / Target Corporation | 0.03 | 51.75 | 2.89 | 6.40 | 0.5329 | 0.3419 | |||

| LGRDY / Legrand SA - Depositary Receipt (Common Stock) | 0.13 | -28.62 | 2.87 | -22.74 | 0.5295 | 0.2681 | |||

| GGG / Graco Inc. | 0.03 | -78.83 | 2.83 | -79.48 | 0.5221 | -0.4483 | |||

| AMAT / Applied Materials, Inc. | 0.02 | -17.43 | 2.78 | -31.01 | 0.5115 | 0.2287 | |||

| DKILY / Daikin Industries,Ltd. - Depositary Receipt (Common Stock) | 0.24 | -25.05 | 2.77 | -26.86 | 0.5103 | 0.2442 | |||

| KMB / Kimberly-Clark Corporation | 0.02 | -92.00 | 2.58 | -91.89 | 0.4747 | -1.7580 | |||

| SCHW.PRJ / The Charles Schwab Corporation - Preferred Stock | 0.13 | 2.43 | 0.4478 | 0.4478 | |||||

| NDSN / Nordson Corporation | 0.01 | -26.96 | 2.36 | -37.14 | 0.4355 | 0.1713 | |||

| EG / Everest Group, Ltd. | 0.01 | -45.64 | 1.99 | -43.86 | 0.3656 | 0.1171 | |||

| MTB / M&T Bank Corporation | 0.01 | 1.95 | 0.3598 | 0.3598 | |||||

| THRM / Gentherm Incorporated | 0.07 | -59.69 | 1.92 | -72.53 | 0.3540 | -0.1374 | |||

| CNH / CNH Industrial N.V. | 0.17 | -38.57 | 1.92 | -44.84 | 0.3536 | 0.1091 | |||

| POR / Portland General Electric Company | 0.05 | -86.27 | 1.92 | -85.95 | 0.3528 | -0.6048 | |||

| INDB / Independent Bank Corp. | 0.02 | -56.58 | 1.40 | -61.81 | 0.2574 | 0.0004 | |||

| STRNY / Severn Trent PLC - Depositary Receipt (Common Stock) | 0.04 | -67.97 | 1.39 | -61.70 | 0.2564 | 0.0011 | |||

| ARE / Alexandria Real Estate Equities, Inc. | 0.02 | -46.30 | 1.38 | -59.94 | 0.2534 | 0.0122 | |||

| IDA / IDACORP, Inc. | 0.01 | -82.25 | 1.37 | -80.94 | 0.2521 | -0.2523 | |||

| DOC / Healthpeak Properties, Inc. | 0.07 | -78.97 | 1.29 | -81.85 | 0.2385 | -0.2626 | |||

| NTRSO / Northern Trust Corporation - Preferred Stock | 0.01 | -96.69 | 0.29 | -97.40 | 0.0527 | -0.5602 | |||

| PII / Polaris Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.2435 | ||||

| PYCR / Paycor HCM, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.2370 |