Mga Batayang Estadistika

| Nilai Portofolio | $ 793,715,356 |

| Posisi Saat Ini | 125 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

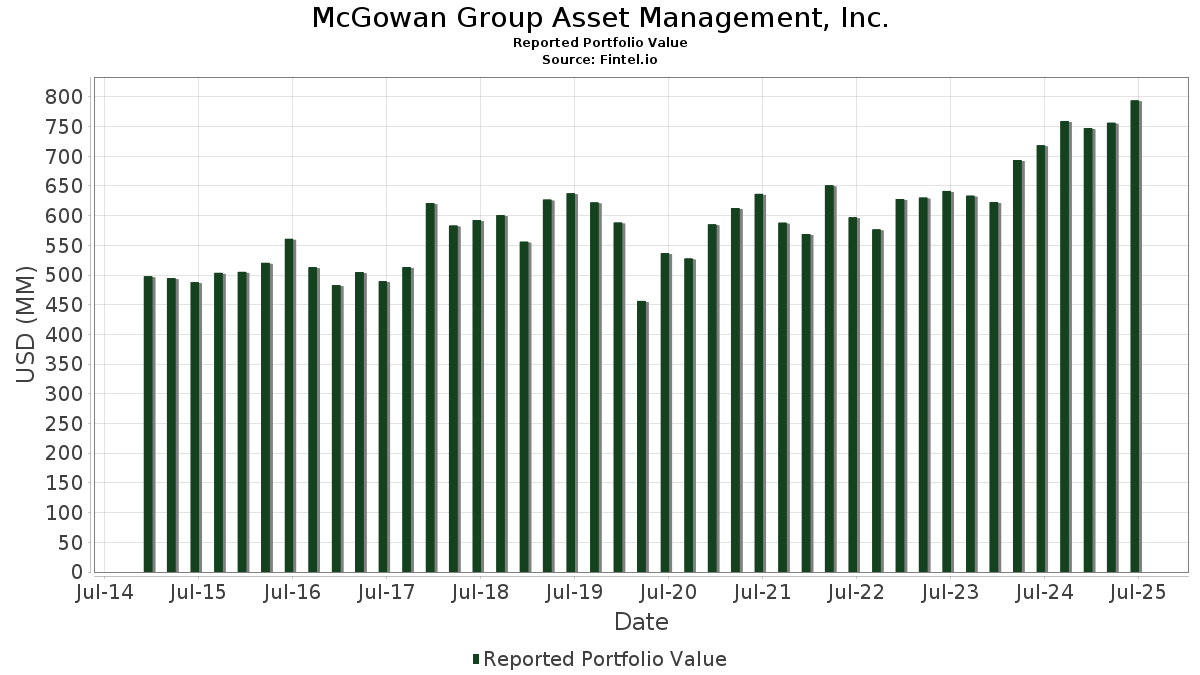

McGowan Group Asset Management, Inc. telah mengungkapkan total kepemilikan 125 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 793,715,356 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama McGowan Group Asset Management, Inc. adalah Nuveen Global High Income Fund (US:JGH) , AllianceBernstein Global High Income Fund (US:AWF) , DoubleLine Income Solutions Fund (US:DSL) , BlackRock Corporate High Yield Fund, Inc. (US:HYT) , and Cohen & Steers Infrastructure Fund, Inc (US:UTF) . Posisi baru McGowan Group Asset Management, Inc. meliputi: United Parcel Service, Inc. (US:UPS) , T-Mobile US, Inc. (US:TMUS) , Prairieland Detention Center Proj - Pub Fac Corp Texas Proj Rev Taxable Bond (US:73972CAN4) , Pima Cnty Arizona Indl Dev Auth Edu Revenue Griffin Fndtn Proj Ser A Bond (US:72177MJQ1) , and Copa Holdings, S.A. (US:CPA) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.22 | 21.97 | 2.7686 | 2.7686 | |

| 0.94 | 12.85 | 1.6192 | 1.5576 | |

| 0.03 | 6.98 | 0.8792 | 0.7946 | |

| 0.13 | 18.64 | 2.3486 | 0.6873 | |

| 0.02 | 4.78 | 0.6023 | 0.6023 | |

| 0.13 | 16.31 | 2.0551 | 0.4878 | |

| 3.77 | 36.79 | 4.6356 | 0.4128 | |

| 0.56 | 26.46 | 3.3337 | 0.3442 | |

| 0.02 | 9.17 | 1.1554 | 0.2736 | |

| 0.02 | 1.92 | 0.2413 | 0.2413 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.26 | 27.57 | 3.4735 | -0.5637 | |

| 0.24 | 13.45 | 1.6949 | -0.3880 | |

| 3.23 | 39.49 | 4.9748 | -0.3448 | |

| 3.75 | 48.52 | 6.1128 | -0.2987 | |

| 0.02 | 16.84 | 2.1221 | -0.2598 | |

| 0.37 | 11.48 | 1.4464 | -0.2161 | |

| 0.05 | 5.01 | 0.6314 | -0.1590 | |

| 0.04 | 5.97 | 0.7515 | -0.1505 | |

| 0.86 | 15.58 | 1.9628 | -0.1342 | |

| 1.17 | 25.61 | 3.2264 | -0.1269 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-13 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| GENERAL MNY MKT FUND / MONEY MARKET (370990228) | 64.87 | 64.87 | 0.0000 | ||||||

| JGH / Nuveen Global High Income Fund | 3.75 | 1.23 | 48.52 | 0.07 | 6.1128 | -0.2987 | |||

| AWF / AllianceBernstein Global High Income Fund | 3.80 | 0.19 | 41.94 | 2.99 | 5.2836 | -0.1010 | |||

| DSL / DoubleLine Income Solutions Fund | 3.23 | 1.12 | 39.49 | -1.84 | 4.9748 | -0.3448 | |||

| HYT / BlackRock Corporate High Yield Fund, Inc. | 3.77 | 13.21 | 36.79 | 15.22 | 4.6356 | 0.4128 | |||

| UTF / Cohen & Steers Infrastructure Fund, Inc | 1.36 | 2.53 | 36.68 | 8.15 | 4.6207 | 0.1363 | |||

| XOM / Exxon Mobil Corporation | 0.26 | -0.37 | 27.57 | -9.70 | 3.4735 | -0.5637 | |||

| BTI / British American Tobacco p.l.c. - Depositary Receipt (Common Stock) | 0.56 | 2.31 | 26.46 | 17.04 | 3.3337 | 0.3442 | |||

| PAGP / Plains GP Holdings, L.P. - Limited Partnership | 1.33 | 13.14 | 25.89 | 2.92 | 3.2613 | -0.0647 | |||

| ARCC / Ares Capital Corporation | 1.17 | 1.91 | 25.61 | 0.99 | 3.2264 | -0.1269 | |||

| UPS / United Parcel Service, Inc. | 0.22 | 21.97 | 2.7686 | 2.7686 | |||||

| EVT / Eaton Vance Tax-Advantaged Dividend Income Fund | 0.83 | 0.51 | 20.09 | 4.09 | 2.5306 | -0.0210 | |||

| MMM / 3M Company | 0.13 | 1.11 | 19.59 | 4.82 | 2.4678 | -0.0034 | |||

| BWXT / BWX Technologies, Inc. | 0.13 | 1.61 | 18.64 | 48.39 | 2.3486 | 0.6873 | |||

| LLY / Eli Lilly and Company | 0.02 | -0.92 | 16.84 | -6.48 | 2.1221 | -0.2598 | |||

| GSST / Goldman Sachs ETF Trust - Goldman Sachs Ultra Short Bond ETF | 0.32 | 8.46 | 16.40 | 8.51 | 2.0660 | 0.0676 | |||

| DELL / Dell Technologies Inc. | 0.13 | 2.32 | 16.31 | 37.62 | 2.0551 | 0.4878 | |||

| ET / Energy Transfer LP - Limited Partnership | 0.86 | 0.73 | 15.58 | -1.76 | 1.9628 | -0.1342 | |||

| UNM / Unum Group | 0.19 | -0.04 | 15.43 | -0.90 | 1.9443 | -0.1150 | |||

| CSQ / Calamos Strategic Total Return Fund | 0.78 | 3.89 | 14.28 | 17.12 | 1.7989 | 0.1867 | |||

| NEA / Nuveen AMT-Free Quality Municipal Income Fund | 1.29 | 10.59 | 14.06 | 7.82 | 1.7709 | 0.0470 | |||

| NAD / Nuveen Quality Municipal Income Fund | 1.24 | 10.49 | 14.04 | 8.29 | 1.7686 | 0.0544 | |||

| CQP / Cheniere Energy Partners, L.P. - Limited Partnership | 0.24 | 0.63 | 13.45 | -14.59 | 1.6949 | -0.3880 | |||

| ETG / Eaton Vance Tax-Advantaged Global Dividend Income Fund | 0.62 | 0.18 | 13.01 | 15.14 | 1.6395 | 0.1449 | |||

| PR / Permian Resources Corporation | 0.94 | 2,706.34 | 12.85 | 2,663.66 | 1.6192 | 1.5576 | |||

| EBAY / eBay Inc. | 0.16 | 0.02 | 11.62 | 9.96 | 1.4639 | 0.0665 | |||

| EPD / Enterprise Products Partners L.P. - Limited Partnership | 0.37 | 0.53 | 11.48 | -8.69 | 1.4464 | -0.2161 | |||

| MSFT / Microsoft Corporation | 0.02 | 3.79 | 9.17 | 37.54 | 1.1554 | 0.2736 | |||

| V / Visa Inc. | 0.03 | 0.76 | 8.92 | 2.08 | 1.1233 | -0.0317 | |||

| TOST / Toast, Inc. | 0.18 | -2.20 | 8.06 | 30.61 | 1.0150 | 0.1992 | |||

| ALL / The Allstate Corporation | 0.03 | 1,020.79 | 6.98 | 990.31 | 0.8792 | 0.7946 | |||

| CVX / Chevron Corporation | 0.04 | 2.16 | 5.97 | -12.55 | 0.7515 | -0.1505 | |||

| GOOGL / Alphabet Inc. | 0.03 | -1.89 | 5.59 | 11.81 | 0.7040 | 0.0431 | |||

| TXN / Texas Instruments Incorporated | 0.03 | 0.00 | 5.55 | 15.54 | 0.6997 | 0.0641 | |||

| JAZZ / Jazz Pharmaceuticals plc | 0.05 | -1.91 | 5.01 | -16.16 | 0.6314 | -0.1590 | |||

| NVG / Nuveen AMT-Free Municipal Credit Income Fund | 0.41 | 4.18 | 4.86 | 0.37 | 0.6123 | -0.0279 | |||

| TMUS / T-Mobile US, Inc. | 0.02 | 4.78 | 0.6023 | 0.6023 | |||||

| AMZN / Amazon.com, Inc. | 0.02 | -1.28 | 4.67 | 13.82 | 0.5885 | 0.0459 | |||

| NZF / Nuveen Municipal Credit Income Fund | 0.38 | 4.53 | 4.54 | 1.88 | 0.5723 | -0.0173 | |||

| AAPL / Apple Inc. | 0.02 | -1.18 | 4.06 | -8.74 | 0.5120 | -0.0768 | |||

| FANG / Diamondback Energy, Inc. | 0.03 | 2.31 | 3.92 | -12.09 | 0.4941 | -0.0957 | |||

| KYN / Kayne Anderson Energy Infrastructure Fund, Inc. | 0.31 | 0.55 | 3.90 | -0.31 | 0.4913 | -0.0260 | |||

| STKS / The ONE Group Hospitality, Inc. | 0.84 | 0.00 | 3.40 | 35.47 | 0.4278 | 0.0963 | |||

| 73972CAN4 / Prairieland Detention Center Proj - Pub Fac Corp Texas Proj Rev Taxable Bond | 3.31 | 0.82 | 0.4165 | -0.0171 | |||||

| DDOG / Datadog, Inc. | 0.02 | -2.04 | 3.26 | 32.64 | 0.4102 | 0.0856 | |||

| ENVX / Enovix Corporation | 0.30 | 0.70 | 3.09 | 41.87 | 0.3889 | 0.1012 | |||

| PANW / Palo Alto Networks, Inc. | 0.01 | -0.97 | 2.91 | 18.79 | 0.3671 | 0.0427 | |||

| 72177MJQ1 / Pima Cnty Arizona Indl Dev Auth Edu Revenue Griffin Fndtn Proj Ser A Bond | 2.78 | -2.56 | 0.3498 | -0.0269 | |||||

| EXE / Expand Energy Corporation | 0.02 | 0.43 | 2.77 | 5.49 | 0.3484 | 0.0018 | |||

| PG / The Procter & Gamble Company | 0.02 | 0.15 | 2.73 | -6.36 | 0.3434 | -0.0416 | |||

| PLTR / Palantir Technologies Inc. | 0.02 | 22.27 | 2.55 | 97.52 | 0.3208 | 0.1503 | |||

| CPA / Copa Holdings, S.A. | 0.02 | 1.92 | 0.2413 | 0.2413 | |||||

| LNG / Cheniere Energy, Inc. | 0.01 | -0.31 | 1.66 | 4.93 | 0.2092 | -0.0001 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | 0.69 | 1.56 | -8.20 | 0.1963 | -0.0280 | |||

| 307149AM6 / Fannin County Texas Public Fac Corp Revenue Txble Bond | 1.45 | 1.12 | 0.1828 | -0.0069 | |||||

| MA / Mastercard Incorporated | 0.00 | 0.83 | 1.43 | 3.41 | 0.1797 | -0.0028 | |||

| PM / Philip Morris International Inc. | 0.01 | 0.03 | 1.16 | 14.79 | 0.1467 | 0.0125 | |||

| DE / Deere & Company | 0.00 | -0.10 | 1.02 | 8.26 | 0.1289 | 0.0039 | |||

| NVDA / NVIDIA Corporation | 0.01 | -12.65 | 0.98 | 27.30 | 0.1241 | 0.0218 | |||

| APH / Amphenol Corporation | 0.01 | -0.81 | 0.98 | 49.39 | 0.1231 | 0.0366 | |||

| WMT / Walmart Inc. | 0.01 | -6.56 | 0.96 | 4.10 | 0.1215 | -0.0010 | |||

| MO / Altria Group, Inc. | 0.02 | 0.28 | 0.92 | -2.03 | 0.1157 | -0.0083 | |||

| F / Ford Motor Company | 0.08 | 16.83 | 0.87 | 26.53 | 0.1094 | 0.0185 | |||

| ORCL / Oracle Corporation | 0.00 | 0.03 | 0.85 | 56.41 | 0.1077 | 0.0354 | |||

| KLAC / KLA Corporation | 0.00 | 0.00 | 0.84 | 31.61 | 0.1061 | 0.0216 | |||

| META / Meta Platforms, Inc. | 0.00 | 4.84 | 0.80 | 34.29 | 0.1007 | 0.0220 | |||

| THQ / Abrdn Healthcare Opportunities Fund | 0.04 | -1.25 | 0.79 | -11.94 | 0.0994 | -0.0192 | |||

| IBM / International Business Machines Corporation | 0.00 | 4.70 | 0.75 | 24.05 | 0.0943 | 0.0146 | |||

| AMLP / ALPS ETF Trust - Alerian MLP ETF | 0.02 | 0.03 | 0.74 | -5.94 | 0.0938 | -0.0108 | |||

| RLGT / Radiant Logistics, Inc. | 0.12 | -0.24 | 0.72 | -1.37 | 0.0910 | -0.0058 | |||

| JNJ / Johnson & Johnson | 0.00 | 0.67 | 0.71 | -7.30 | 0.0897 | -0.0118 | |||

| COP / ConocoPhillips | 0.01 | 0.00 | 0.68 | -14.55 | 0.0859 | -0.0196 | |||

| ACN / Accenture plc | 0.00 | 0.00 | 0.64 | -4.20 | 0.0805 | -0.0077 | |||

| TSLA / Tesla, Inc. | 0.00 | 55.94 | 0.63 | 91.13 | 0.0788 | 0.0355 | |||

| CW / Curtiss-Wright Corporation | 0.00 | 0.00 | 0.62 | 53.96 | 0.0785 | 0.0250 | |||

| CAT / Caterpillar Inc. | 0.00 | 0.13 | 0.62 | 17.97 | 0.0778 | 0.0085 | |||

| US899062BQ58 / Tulane Univ La Rfdg-tulane Univ-c Bond | 0.61 | 0.33 | 0.0771 | -0.0036 | |||||

| CG / The Carlyle Group Inc. | 0.01 | 2.63 | 0.59 | 20.99 | 0.0742 | 0.0098 | |||

| VZ / Verizon Communications Inc. | 0.01 | -10.87 | 0.56 | -15.06 | 0.0711 | -0.0167 | |||

| CINF / Cincinnati Financial Corporation | 0.00 | 0.00 | 0.56 | 0.72 | 0.0711 | -0.0029 | |||

| US66285WXM36 / N TX TOLLWAY AUTH REVENUE | 0.55 | -0.90 | 0.0695 | -0.0040 | |||||

| AMAT / Applied Materials, Inc. | 0.00 | 0.03 | 0.53 | 26.20 | 0.0662 | 0.0111 | |||

| CI / The Cigna Group | 0.00 | -0.88 | 0.52 | -0.38 | 0.0655 | -0.0035 | |||

| RTX / RTX Corporation | 0.00 | 0.12 | 0.51 | 10.46 | 0.0639 | 0.0031 | |||

| WMB / The Williams Companies, Inc. | 0.01 | 0.63 | 0.50 | 5.96 | 0.0628 | 0.0005 | |||

| US9128284Z04 / United States Treasury Note/Bond | 0.48 | 0.21 | 0.0609 | -0.0028 | |||||

| JPM / JPMorgan Chase & Co. | 0.00 | 0.12 | 0.48 | 18.36 | 0.0602 | 0.0068 | |||

| 72177MJR9 / Pima Cnty Arizona Indl Dev Auth Edu Revenue Griffin Fndtn Proj Ser B Bond | 0.45 | -2.39 | 0.0568 | -0.0043 | |||||

| SO / The Southern Company | 0.00 | 0.04 | 0.44 | -0.23 | 0.0550 | -0.0028 | |||

| FCX / Freeport-McMoRan Inc. | 0.01 | 0.13 | 0.43 | 14.59 | 0.0546 | 0.0046 | |||

| 307149AN4 / Fannin County Texas Public Fac Corp Revenue Txble-ref Bond | 0.41 | 0.24 | 0.0517 | -0.0025 | |||||

| SOUN / SoundHound AI, Inc. | 0.04 | 0.00 | 0.40 | 32.13 | 0.0508 | 0.0105 | |||

| QCOM / QUALCOMM Incorporated | 0.00 | 0.04 | 0.39 | 3.74 | 0.0490 | -0.0006 | |||

| DLR / Digital Realty Trust, Inc. | 0.00 | 0.00 | 0.39 | 21.63 | 0.0490 | 0.0067 | |||

| CRK / Comstock Resources, Inc. | 0.01 | 0.00 | 0.38 | 36.30 | 0.0483 | 0.0110 | |||

| DUK / Duke Energy Corporation | 0.00 | 0.06 | 0.37 | -3.12 | 0.0470 | -0.0040 | |||

| MELI / MercadoLibre, Inc. | 0.00 | 5.26 | 0.37 | 40.93 | 0.0461 | 0.0118 | |||

| IUSV / iShares Trust - iShares Core S&P U.S. Value ETF | 0.00 | 0.47 | 0.36 | 2.82 | 0.0460 | -0.0009 | |||

| NOC / Northrop Grumman Corporation | 0.00 | 0.00 | 0.36 | -2.43 | 0.0457 | -0.0034 | |||

| US91282CFP14 / United States Treasury Note/Bond | 0.33 | -0.30 | 0.0416 | -0.0021 | |||||

| CSCO / Cisco Systems, Inc. | 0.00 | 0.13 | 0.32 | 12.68 | 0.0404 | 0.0027 | |||

| US82706TAD37 / Silicon Vly Ca Tobacco Securitization Auth Tabacco Settlem Cap Apprec Bond | 0.31 | -6.15 | 0.0384 | -0.0046 | |||||

| VOC / VOC Energy Trust | 0.11 | 1.32 | 0.31 | -7.85 | 0.0384 | -0.0054 | |||

| HMC / Honda Motor Co., Ltd. - Depositary Receipt (Common Stock) | 0.01 | 0.64 | 0.30 | 6.86 | 0.0374 | 0.0007 | |||

| ITW / Illinois Tool Works Inc. | 0.00 | 0.00 | 0.29 | -0.35 | 0.0363 | -0.0019 | |||

| GT / The Goodyear Tire & Rubber Company | 0.03 | -3.04 | 0.28 | 9.13 | 0.0347 | 0.0012 | |||

| GDX / VanEck ETF Trust - VanEck Gold Miners ETF | 0.01 | 0.00 | 0.27 | 13.62 | 0.0337 | 0.0025 | |||

| VTI / Vanguard Index Funds - Vanguard Total Stock Market ETF | 0.00 | -36.63 | 0.26 | -30.13 | 0.0331 | -0.0165 | |||

| PEP / PepsiCo, Inc. | 0.00 | 0.15 | 0.26 | -11.49 | 0.0330 | -0.0063 | |||

| AZO / AutoZone, Inc. | 0.00 | -2.78 | 0.26 | -5.47 | 0.0327 | -0.0036 | |||

| ORLY / O'Reilly Automotive, Inc. | 0.00 | 1,400.00 | 0.25 | -5.58 | 0.0320 | -0.0036 | |||

| LOW / Lowe's Companies, Inc. | 0.00 | 0.09 | 0.25 | -4.92 | 0.0317 | -0.0033 | |||

| TPZ / Tortoise Essential Energy Fund | 0.01 | 0.70 | 0.25 | 0.00 | 0.0310 | -0.0015 | |||

| PVL / Permianville Royalty Trust | 0.13 | 0.00 | 0.24 | 18.32 | 0.0302 | 0.0034 | |||

| MCD / McDonald's Corporation | 0.00 | 0.37 | 0.24 | -6.35 | 0.0298 | -0.0035 | |||

| COST / Costco Wholesale Corporation | 0.00 | -2.07 | 0.23 | 2.64 | 0.0295 | -0.0007 | |||

| GE / General Electric Company | 0.00 | 0.23 | 0.0285 | 0.0285 | |||||

| PSX / Phillips 66 | 0.00 | 0.00 | 0.23 | -3.43 | 0.0285 | -0.0025 | |||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 0.00 | 0.22 | 0.0283 | 0.0283 | |||||

| MDLZ / Mondelez International, Inc. | 0.00 | -7.09 | 0.22 | -7.66 | 0.0274 | -0.0037 | |||

| NKE / NIKE, Inc. | 0.00 | 0.21 | 0.0267 | 0.0267 | |||||

| US88880NAW92 / Tobacco Settlement Financing Corp/VA | 0.21 | -6.70 | 0.0264 | -0.0033 | |||||

| IVV / iShares Trust - iShares Core S&P 500 ETF | 0.00 | 0.20 | 0.0257 | 0.0257 | |||||

| UNH / UnitedHealth Group Incorporated | 0.00 | -14.92 | 0.20 | -49.50 | 0.0255 | -0.0274 | |||

| OGE / OGE Energy Corp. | 0.00 | 0.47 | 0.20 | -2.96 | 0.0249 | -0.0020 | |||

| PDI / PIMCO Dynamic Income Fund | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| SQQQ / ProShares Trust - ProShares UltraPro Short QQQ | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| TJX / The TJX Companies, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| CB / Chubb Limited | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| OKE / ONEOK, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 |