Mga Batayang Estadistika

| Nilai Portofolio | $ 678,392,985 |

| Posisi Saat Ini | 57 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

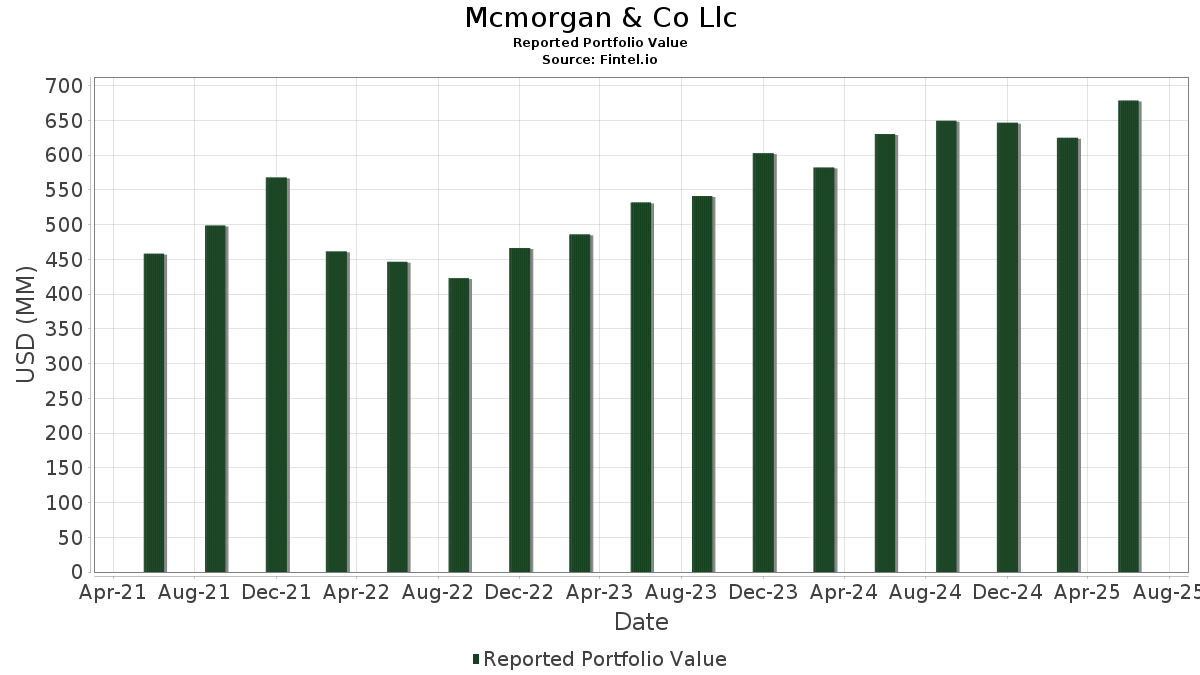

Mcmorgan & Co Llc telah mengungkapkan total kepemilikan 57 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 678,392,985 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Mcmorgan & Co Llc adalah Vanguard Bond Index Funds - Vanguard Total Bond Market ETF (US:BND) , iShares Trust - iShares Core Total USD Bond Market ETF (US:IUSB) , iShares Trust - iShares Currency Hedged MSCI EAFE ETF (US:HEFA) , Vanguard Tax-Managed Funds - Vanguard FTSE Developed Markets ETF (US:VEA) , and BlackRock ETF Trust - iShares U.S. Equity Factor Rotation Active ETF (US:DYNF) . Posisi baru Mcmorgan & Co Llc meliputi: Thryv Holdings, Inc. (US:THRY) , Jamf Holding Corp. (US:JAMF) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.71 | 36.00 | 5.3060 | 2.0354 | |

| 0.47 | 24.00 | 3.5378 | 1.3584 | |

| 0.18 | 2.15 | 0.3175 | 0.3175 | |

| 0.19 | 1.78 | 0.2622 | 0.2622 | |

| 0.23 | 25.78 | 3.8000 | 0.2513 | |

| 0.19 | 4.66 | 0.6873 | 0.2506 | |

| 0.05 | 13.77 | 2.0295 | 0.2485 | |

| 0.13 | 3.89 | 0.5736 | 0.2312 | |

| 0.04 | 4.12 | 0.6076 | 0.1783 | |

| 0.06 | 3.54 | 0.5219 | 0.1663 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 1.87 | 137.35 | 20.2469 | -1.5626 | |

| 1.67 | 77.13 | 11.3696 | -0.9098 | |

| 1.03 | 27.33 | 4.0289 | -0.4166 | |

| 1.17 | 44.28 | 6.5274 | -0.3373 | |

| 0.29 | 18.78 | 2.7686 | -0.2483 | |

| 0.08 | 16.45 | 2.4244 | -0.1792 | |

| 0.27 | 14.35 | 2.1156 | -0.1632 | |

| 0.10 | 4.21 | 0.6210 | -0.1173 | |

| 0.09 | 9.58 | 1.4127 | -0.1121 | |

| 0.11 | 2.40 | 0.3544 | -0.1001 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-13 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| BND / Vanguard Bond Index Funds - Vanguard Total Bond Market ETF | 1.87 | 0.54 | 137.35 | 0.79 | 20.2469 | -1.5626 | |||

| IUSB / iShares Trust - iShares Core Total USD Bond Market ETF | 1.67 | 0.20 | 77.13 | 0.52 | 11.3696 | -0.9098 | |||

| HEFA / iShares Trust - iShares Currency Hedged MSCI EAFE ETF | 1.17 | -1.31 | 44.28 | 3.23 | 6.5274 | -0.3373 | |||

| VEA / Vanguard Tax-Managed Funds - Vanguard FTSE Developed Markets ETF | 0.73 | -3.14 | 41.45 | 8.63 | 6.1098 | 0.0036 | |||

| DYNF / BlackRock ETF Trust - iShares U.S. Equity Factor Rotation Active ETF | 0.70 | -1.45 | 37.98 | 10.07 | 5.5986 | 0.0763 | |||

| JPST / J.P. Morgan Exchange-Traded Fund Trust - JPMorgan Ultra-Short Income ETF | 0.71 | 75.96 | 36.00 | 76.14 | 5.3060 | 2.0354 | |||

| SPTL / SPDR Series Trust - SPDR Portfolio Long Term Treasury ETF | 1.03 | 0.91 | 27.33 | -1.61 | 4.0289 | -0.4166 | |||

| IVW / iShares Trust - iShares S&P 500 Growth ETF | 0.23 | -1.98 | 25.78 | 16.25 | 3.8000 | 0.2513 | |||

| FLOT / iShares Trust - iShares Floating Rate Bond ETF | 0.47 | 76.34 | 24.00 | 76.25 | 3.5378 | 1.3584 | |||

| QUAL / iShares Trust - iShares MSCI USA Quality Factor ETF | 0.13 | -0.39 | 23.62 | 6.56 | 3.4822 | -0.0655 | |||

| THRO / BlackRock ETF Trust - iShares U.S. Thematic Rotation Active ETF | 0.58 | -1.24 | 20.75 | 10.89 | 3.0584 | 0.0640 | |||

| GLDM / World Gold Trust - SPDR Gold MiniShares Trust | 0.29 | -5.89 | 18.78 | -0.37 | 2.7686 | -0.2483 | |||

| IVE / iShares Trust - iShares S&P 500 Value ETF | 0.08 | -1.41 | 16.45 | 1.09 | 2.4244 | -0.1792 | |||

| BINC / BlackRock ETF Trust II - iShares Flexible Income Active ETF | 0.27 | -0.08 | 14.35 | 0.79 | 2.1156 | -0.1632 | |||

| XLK / The Select Sector SPDR Trust - The Technology Select Sector SPDR Fund | 0.05 | 0.88 | 13.77 | 23.71 | 2.0295 | 0.2485 | |||

| OEF / iShares Trust - iShares S&P 100 ETF | 0.04 | -0.95 | 12.48 | 11.30 | 1.8393 | 0.0453 | |||

| VOO / Vanguard Index Funds - Vanguard S&P 500 ETF | 0.02 | -4.86 | 10.05 | 5.16 | 1.4817 | -0.0479 | |||

| STIP / iShares Trust - iShares 0-5 Year TIPS Bond ETF | 0.09 | 1.13 | 9.58 | 0.58 | 1.4127 | -0.1121 | |||

| INFA / Informatica Inc. | 0.19 | 22.45 | 4.66 | 70.89 | 0.6873 | 0.2506 | |||

| EXLS / ExlService Holdings, Inc. | 0.10 | -1.55 | 4.21 | -8.69 | 0.6210 | -0.1173 | |||

| SN / SharkNinja, Inc. | 0.04 | 29.47 | 4.12 | 53.65 | 0.6076 | 0.1783 | |||

| NSSC / Napco Security Technologies, Inc. | 0.13 | 41.00 | 3.89 | 81.91 | 0.5736 | 0.2312 | |||

| CCCS / CCC Intelligent Solutions Holdings Inc. | 0.40 | 3.18 | 3.78 | 7.52 | 0.5565 | -0.0054 | |||

| IIIV / i3 Verticals, Inc. | 0.13 | -0.47 | 3.65 | 10.88 | 0.5379 | 0.0112 | |||

| USMV / iShares Trust - iShares MSCI USA Min Vol Factor ETF | 0.04 | -3.51 | 3.63 | -3.30 | 0.5355 | -0.0657 | |||

| BL / BlackLine, Inc. | 0.06 | 36.28 | 3.54 | 59.39 | 0.5219 | 0.1663 | |||

| YOU / Clear Secure, Inc. | 0.13 | 27.75 | 3.52 | 36.86 | 0.5189 | 0.1073 | |||

| BLKB / Blackbaud, Inc. | 0.05 | 4.87 | 3.49 | 8.51 | 0.5148 | -0.0002 | |||

| CROX / Crocs, Inc. | 0.03 | 4.89 | 3.02 | 0.03 | 0.4448 | -0.0380 | |||

| MEDP / Medpace Holdings, Inc. | 0.01 | 2.34 | 2.95 | 5.40 | 0.4347 | -0.0130 | |||

| WSC / WillScot Holdings Corporation | 0.11 | 11.81 | 2.92 | 10.19 | 0.4305 | 0.0064 | |||

| OSW / OneSpaWorld Holdings Limited | 0.13 | -0.46 | 2.63 | 20.87 | 0.3877 | 0.0395 | |||

| BV / BrightView Holdings, Inc. | 0.15 | 2.28 | 2.44 | 32.64 | 0.3595 | 0.0652 | |||

| PBH / Prestige Consumer Healthcare Inc. | 0.03 | -0.41 | 2.41 | -7.49 | 0.3553 | -0.0617 | |||

| FC / Franklin Covey Co. | 0.11 | 2.47 | 2.40 | -15.36 | 0.3544 | -0.1001 | |||

| WH / Wyndham Hotels & Resorts, Inc. | 0.03 | -0.46 | 2.35 | -10.72 | 0.3464 | -0.0747 | |||

| THRY / Thryv Holdings, Inc. | 0.18 | 2.15 | 0.3175 | 0.3175 | |||||

| VRNT / Verint Systems Inc. | 0.11 | 1.59 | 2.13 | 11.93 | 0.3139 | 0.0095 | |||

| PLOW / Douglas Dynamics, Inc. | 0.07 | 0.51 | 2.03 | 27.52 | 0.2999 | 0.0445 | |||

| IMXI / International Money Express, Inc. | 0.20 | 4.03 | 2.03 | -16.82 | 0.2989 | -0.0912 | |||

| CSCO / Cisco Systems, Inc. | 0.03 | 11.82 | 1.94 | 25.70 | 0.2857 | 0.0390 | |||

| SPSC / SPS Commerce, Inc. | 0.01 | 37.29 | 1.93 | 40.82 | 0.2849 | 0.0652 | |||

| GNTX / Gentex Corporation | 0.08 | 3.11 | 1.83 | -2.72 | 0.2694 | -0.0311 | |||

| JAMF / Jamf Holding Corp. | 0.19 | 1.78 | 0.2622 | 0.2622 | |||||

| EWCZ / European Wax Center, Inc. | 0.29 | 2.48 | 1.64 | 46.04 | 0.2418 | 0.0621 | |||

| HI / Hillenbrand, Inc. | 0.07 | 2.69 | 1.40 | -14.63 | 0.2064 | -0.0561 | |||

| GOOG / Alphabet Inc. | 0.01 | 9.53 | 1.20 | 24.30 | 0.1773 | 0.0225 | |||

| MSFT / Microsoft Corporation | 0.00 | 19.06 | 1.15 | 57.83 | 0.1694 | 0.0528 | |||

| V / Visa Inc. | 0.00 | 12.67 | 1.09 | 14.15 | 0.1606 | 0.0078 | |||

| SSTK / Shutterstock, Inc. | 0.05 | 2.84 | 1.00 | 4.63 | 0.1467 | -0.0055 | |||

| PM / Philip Morris International Inc. | 0.00 | 22.60 | 0.85 | 40.69 | 0.1260 | 0.0288 | |||

| JNJ / Johnson & Johnson | 0.01 | 9.63 | 0.84 | 0.96 | 0.1241 | -0.0093 | |||

| ORCL / Oracle Corporation | 0.00 | 5.97 | 0.81 | 65.64 | 0.1195 | 0.0412 | |||

| DPZ / Domino's Pizza, Inc. | 0.00 | 2.59 | 0.62 | 0.65 | 0.0919 | -0.0073 | |||

| PEP / PepsiCo, Inc. | 0.00 | 4.40 | 0.53 | -7.94 | 0.0786 | -0.0142 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.00 | 3.65 | 0.35 | -15.65 | 0.0510 | -0.0146 | |||

| ZBH / Zimmer Biomet Holdings, Inc. | 0.00 | 4.96 | 0.33 | -15.25 | 0.0484 | -0.0137 | |||

| SWI / SolarWinds Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| PYCR / Paycor HCM, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 |