Mga Batayang Estadistika

| Nilai Portofolio | $ 50,334,000 |

| Posisi Saat Ini | 29 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

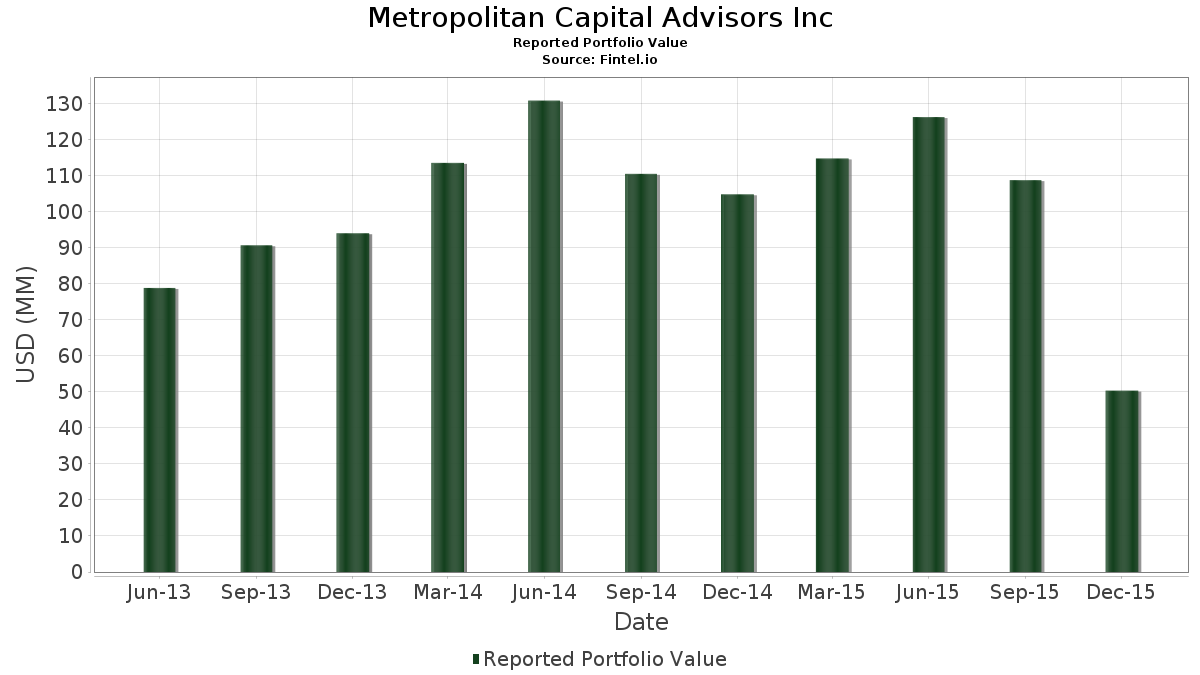

Metropolitan Capital Advisors Inc telah mengungkapkan total kepemilikan 29 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 50,334,000 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Metropolitan Capital Advisors Inc adalah JPMorgan Chase & Co. (US:JPM) , Anthem Inc (US:ANTM) , Michael Kors Holdings Ltd. (US:KORS) , Foot Locker, Inc. (US:FL) , and Live Nation Entertainment, Inc. (US:LYV) . Posisi baru Metropolitan Capital Advisors Inc meliputi: Golar LNG Partners LP (US:MHY2745C1021) , Calpine Corp. (US:CPN) , Hamilton Bancorp, Inc. (US:HABK) , VanEck ETF Trust - VanEck Oil Services ETF (US:OIH) , and .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.11 | 4.57 | 9.0833 | 6.8460 | |

| 0.07 | 4.50 | 8.9482 | 6.7707 | |

| 0.10 | 6.44 | 12.8005 | 6.4445 | |

| 0.03 | 4.68 | 9.2979 | 3.3842 | |

| 0.12 | 1.67 | 3.3198 | 3.3198 | |

| 0.03 | 2.69 | 5.3463 | 2.4589 | |

| 0.07 | 3.41 | 6.7807 | 2.3098 | |

| 0.14 | 3.46 | 6.8721 | 2.1970 | |

| 0.19 | 3.15 | 6.2522 | 2.1032 | |

| 0.02 | 2.16 | 4.2933 | 1.3829 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.02 | 0.68 | 1.3549 | -7.8665 | |

| 0.00 | 0.00 | -4.8323 | ||

| 0.00 | 0.00 | -3.6148 | ||

| 0.11 | 1.27 | 2.5311 | -2.8171 | |

| 0.00 | 0.00 | -2.2713 | ||

| 0.00 | 0.00 | -2.1619 | ||

| 0.00 | 0.00 | -2.0175 | ||

| 0.00 | 0.00 | -1.9486 | ||

| 0.00 | 0.00 | -1.9173 | ||

| 0.00 | 0.00 | -1.3996 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2016-02-16 untuk periode pelaporan 2015-12-31. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| JPM / JPMorgan Chase & Co. | 0.10 | -13.94 | 6.44 | -6.79 | 12.8005 | 6.4445 | |||

| ANTM / Anthem Inc | 0.03 | -26.94 | 4.68 | -27.23 | 9.2979 | 3.3842 | |||

| KORS / Michael Kors Holdings Ltd. | 0.11 | 98.14 | 4.57 | 87.92 | 9.0833 | 6.8460 | |||

| FL / Foot Locker, Inc. | 0.07 | 110.31 | 4.50 | 90.20 | 8.9482 | 6.7707 | |||

| LYV / Live Nation Entertainment, Inc. | 0.14 | -33.43 | 3.46 | -31.96 | 6.8721 | 2.1970 | |||

| C / Citigroup Inc. | 0.07 | -32.70 | 3.41 | -29.80 | 6.7807 | 2.3098 | |||

| BAC / Bank of America Corporation | 0.19 | -35.44 | 3.15 | -30.25 | 6.2522 | 2.1032 | |||

| VRSN / VeriSign, Inc. | 0.03 | -30.79 | 2.69 | -14.30 | 5.3463 | 2.4589 | |||

| CVS / CVS Health Corporation | 0.02 | -32.62 | 2.16 | -31.72 | 4.2933 | 1.3829 | |||

| URI / United Rentals, Inc. | 0.03 | -48.14 | 2.10 | -37.35 | 4.1761 | 1.0910 | |||

| MHY2745C1021 / Golar LNG Partners LP | 0.12 | 1.67 | 3.3198 | 3.3198 | |||||

| IAC / IAC Inc. | 0.03 | -17.74 | 1.61 | -24.32 | 3.2086 | 1.2462 | |||

| MOH / Molina Healthcare, Inc. | 0.02 | -62.29 | 1.36 | -67.07 | 2.7119 | -1.0997 | |||

| AAPL / Apple Inc. | 0.01 | -12.04 | 1.31 | -16.05 | 2.5986 | 1.1660 | |||

| LPG / Dorian LPG Ltd. | 0.11 | -80.82 | 1.27 | -78.09 | 2.5311 | -2.8171 | |||

| GLNG / Golar LNG Limited | 0.05 | 101.93 | 0.83 | 14.38 | 1.6430 | 0.9782 | |||

| XBI / SPDR Series Trust - SPDR S&P Biotech ETF | 0.01 | -11.40 | 0.71 | -0.14 | 1.4086 | 0.7557 | |||

| M / Macy's, Inc. | 0.02 | -90.02 | 0.68 | -93.20 | 1.3549 | -7.8665 | |||

| EEM / iShares, Inc. - iShares MSCI Emerging Markets ETF | 0.02 | 44.79 | 0.56 | 11.35 | 1.1106 | 0.5766 | |||

| MU / Micron Technology, Inc. | 0.04 | -35.27 | 0.53 | -38.86 | 1.0470 | 0.2543 | |||

| MS / Morgan Stanley | 0.01 | 0.42 | 0.8364 | 0.8364 | |||||

| NNA / Navios Maritime Acquisition Corp | 0.11 | 87.16 | 0.34 | 60.29 | 0.6656 | 0.4734 | |||

| GPS / The Gap, Inc. | 0.01 | -51.85 | 0.32 | -58.31 | 0.6377 | -0.0703 | |||

| CPN / Calpine Corp. | 0.02 | 0.32 | 0.6318 | 0.6318 | |||||

| DYN / Dyne Therapeutics, Inc. | 0.02 | 66.38 | 0.28 | 3.31 | 0.5583 | 0.2689 | |||

| FINL / Finish Line, Inc. (THE) | 0.02 | -76.78 | 0.28 | -78.28 | 0.5523 | -0.6247 | |||

| TEX / Terex Corporation | 0.01 | 0.00 | 0.26 | 2.73 | 0.5225 | 0.2871 | |||

| US74733V1008 / QEP Resources, Inc. | 0.02 | 23.69 | 0.21 | -46.21 | 0.4093 | 0.4093 | |||

| HABK / Hamilton Bancorp, Inc. | 0.01 | 0.20 | 0.4013 | 0.4013 | |||||

| NADL / North Atlantic Drilling Ltd. | 0.00 | -100.00 | 0.00 | -100.00 | -0.9334 | ||||

| MDAS / MedAssets, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -3.6148 | ||||

| HSII / Heidrick & Struggles International, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.0805 | ||||

| SUNE / SUNation Energy Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.3996 | ||||

| NAP / Navios Maritime Midstream Partners LP | 0.00 | -100.00 | 0.00 | -100.00 | -0.2621 | ||||

| PLCE / The Children's Place, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -2.2713 | ||||

| SUNE / SUNation Energy Inc. | Call | 0.00 | -100.00 | 0.00 | -100.00 | -0.6602 | |||

| OAK / Oaktree Capital Group, LLC | 0.00 | -100.00 | 0.00 | -100.00 | -2.1619 | ||||

| OIH / VanEck ETF Trust - VanEck Oil Services ETF | 0.00 | 0.00 | 0.0000 | 0.0000 | |||||

| WFM / Whole Foods Market, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.7476 | ||||

| PSG / Performance Sports Group Ltd. | 0.00 | -100.00 | 0.00 | -100.00 | -1.0235 | ||||

| VIAB / Viacom, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.9486 | ||||

| DIS / The Walt Disney Company | 0.00 | -100.00 | 0.00 | -100.00 | -1.9173 | ||||

| PFE / Pfizer Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.9269 | ||||

| M / Macy's, Inc. | Call | 0.00 | -100.00 | 0.00 | -100.00 | -4.8323 | |||

| UAN / CVR Partners, LP - Limited Partnership | 0.00 | -100.00 | 0.00 | -100.00 | -2.0175 |