Mga Batayang Estadistika

| Nilai Portofolio | $ 818,142,130 |

| Posisi Saat Ini | 386 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

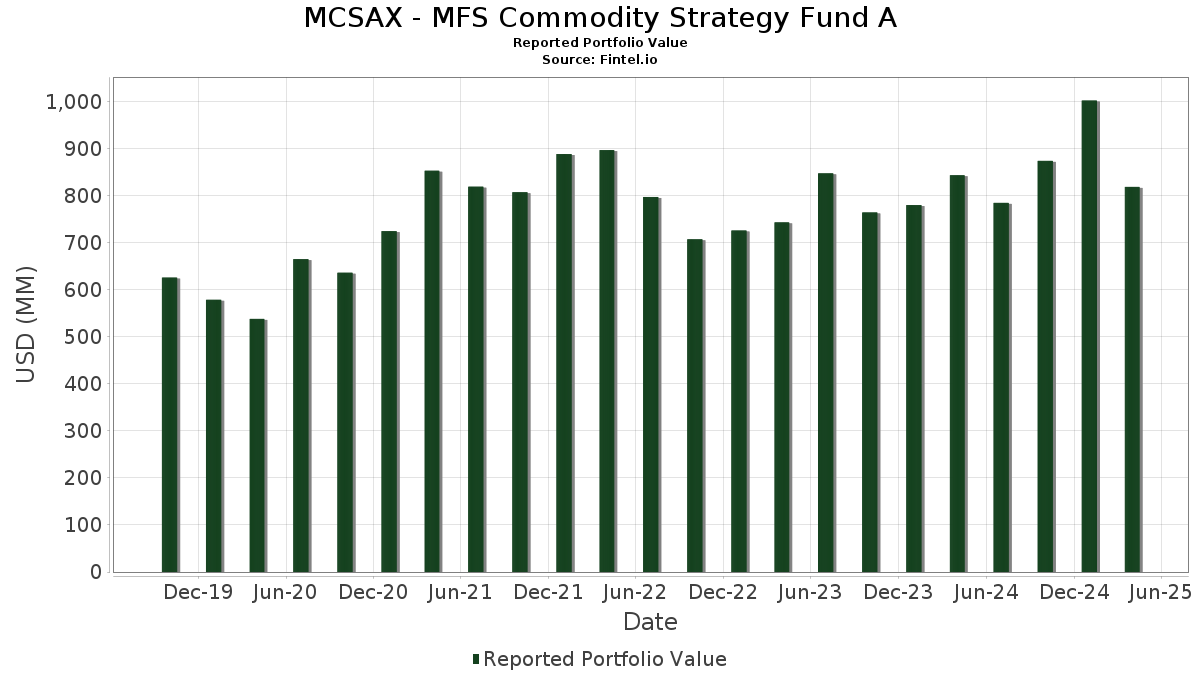

MCSAX - MFS Commodity Strategy Fund A telah mengungkapkan total kepemilikan 386 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 818,142,130 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama MCSAX - MFS Commodity Strategy Fund A adalah U.S. Treasury Notes (US:US91282CHM64) , UST NOTES 4.875% 11/30/2025 (US:US91282CJL63) , MFS Institutional Money Market Portfolio (US:US55291X1090) , United States Treasury Note/Bond (US:US912828M565) , and US TREASURY N/B 4.625% 11-15-26 (US:US91282CJK80) . Posisi baru MCSAX - MFS Commodity Strategy Fund A meliputi: U.S. Treasury Notes (US:US91282CHM64) , UST NOTES 4.875% 11/30/2025 (US:US91282CJL63) , United States Treasury Note/Bond (US:US912828M565) , US TREASURY N/B 4.625% 11-15-26 (US:US91282CJK80) , and United States Treasury Note/Bond (US:US91282CHH79) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 55.81 | 6.6931 | 6.6931 | ||

| 30.02 | 3.6004 | 3.6004 | ||

| 23.96 | 2.8735 | 2.8735 | ||

| 58.15 | 6.9736 | 0.4959 | ||

| 51.50 | 6.1762 | 0.4140 | ||

| 3.23 | 0.3871 | 0.3871 | ||

| 3.13 | 0.3750 | 0.3750 | ||

| 3.12 | 0.3736 | 0.3736 | ||

| 3.05 | 0.3656 | 0.3656 | ||

| 2.96 | 0.3548 | 0.3548 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 46.20 | 46.20 | 5.5408 | -3.9273 | |

| 32.74 | 3.9268 | -1.0639 | ||

| -6.30 | -0.7558 | -0.7558 | ||

| -5.86 | -0.7027 | -0.7027 | ||

| -5.10 | -0.6119 | -0.6119 | ||

| -2.35 | -0.2823 | -0.2823 | ||

| -2.24 | -0.2689 | -0.2689 | ||

| -2.24 | -0.2689 | -0.2689 | ||

| -2.17 | -0.2597 | -0.2597 | ||

| -1.92 | -0.2301 | -0.2301 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-06-24 untuk periode pelaporan 2025-04-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US91282CHM64 / U.S. Treasury Notes | 58.15 | 0.40 | 6.9736 | 0.4959 | |||||

| US3130AK6H44 / Federal Home Loan Banks | 55.81 | 6.6931 | 6.6931 | ||||||

| US91282CJL63 / UST NOTES 4.875% 11/30/2025 | 51.50 | -0.04 | 6.1762 | 0.4140 | |||||

| US55291X1090 / MFS Institutional Money Market Portfolio | 46.20 | -45.41 | 46.20 | -45.43 | 5.5408 | -3.9273 | |||

| US912828M565 / United States Treasury Note/Bond | 33.16 | 0.55 | 3.9769 | 0.2885 | |||||

| US91282CJK80 / US TREASURY N/B 4.625% 11-15-26 | 32.74 | -26.62 | 3.9268 | -1.0639 | |||||

| US91282CHH79 / United States Treasury Note/Bond | 30.85 | 0.42 | 3.6994 | 0.2639 | |||||

| US9128286L99 / United States Treasury Note/Bond | 30.02 | 3.6004 | 3.6004 | ||||||

| US91282CFE66 / United States Treasury Note/Bond | 29.09 | 0.26 | 3.4885 | 0.2437 | |||||

| U.S. Treasury Notes / DBT (US91282CKB62) | 23.96 | 2.8735 | 2.8735 | ||||||

| US097023DG73 / Boeing Co/The | 4.30 | 0.58 | 0.5161 | 0.0375 | |||||

| TCW CLO 2020-1 Ltd / ABS-CBDO (US87190CBL37) | 4.10 | -1.66 | 0.4912 | 0.0254 | |||||

| US693475BK03 / PNC FINANCIAL SERVICES GROUP INC ( | 4.05 | 0.80 | 0.4852 | 0.0362 | |||||

| US11271LAC63 / Brookfield Finance Inc | 3.99 | 0.76 | 0.4782 | 0.0356 | |||||

| US775109CG49 / Rogers Communications, Inc. | 3.94 | 1.05 | 0.4723 | 0.0365 | |||||

| US95000U2V48 / WELLS FARGO & COMPANY REGD V/R MTN 3.52600000 | 3.80 | 1.12 | 0.4561 | 0.0355 | |||||

| US46590XAN66 / CORP. NOTE | 3.74 | 2.07 | 0.4487 | 0.0387 | |||||

| US89115A2S07 / Toronto-Dominion Bank (The) | 3.71 | 0.11 | 0.4454 | 0.0305 | |||||

| US224044CR68 / COX COMMUNICATIONS INC REGD 144A P/P 5.45000000 | 3.52 | 1.67 | 0.4224 | 0.0349 | |||||

| B1BT34 / Truist Financial Corporation - Depositary Receipt (Common Stock) | 3.42 | 49.89 | 0.4105 | 0.1551 | |||||

| US09659W2T04 / BNP Paribas SA | 3.38 | 1.14 | 0.4048 | 0.0315 | |||||

| Sammons Financial Group Global Funding / DBT (US79587J2A00) | 3.37 | 2.40 | 0.4045 | 0.0361 | |||||

| US459506AN18 / CORP. NOTE | 3.33 | 0.67 | 0.3990 | 0.0293 | |||||

| PCG.PRD / Pacific Gas and Electric Company - Preferred Stock | 3.29 | -0.18 | 0.3949 | 0.0259 | |||||

| EFN / Element Fleet Management Corp. | 3.27 | 0.21 | 0.3923 | 0.0272 | |||||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 3.26 | -1.51 | 0.3910 | 0.0209 | |||||

| Dryden 95 CLO Ltd / ABS-CBDO (US262487AL52) | 3.23 | 0.3871 | 0.3871 | ||||||

| US22003BAL09 / Corporate Office Properties LP | 3.20 | 0.50 | 0.3832 | 0.0276 | |||||

| Mars Inc / DBT (US571676AY11) | 3.13 | 0.3750 | 0.3750 | ||||||

| Balboa Bay Loan Funding 2022-1 Ltd / ABS-CBDO (US05766EAN22) | 3.12 | 0.3736 | 0.3736 | ||||||

| CBOM / Credit Bank of Moscow (public joint-stock company) | 3.05 | 0.3656 | 0.3656 | ||||||

| US501889AD16 / LKQ Corp | 3.04 | 0.26 | 0.3644 | 0.0255 | |||||

| US63861VAF40 / Nationwide Building Society | 3.04 | 1.40 | 0.3640 | 0.0292 | |||||

| US55283TAE82 / MF1 Multifamily Housing Mortgage Loan Trust | 3.03 | -0.43 | 0.3635 | 0.0230 | |||||

| US723787AQ06 / Pioneer Natural Resources Co | 3.03 | 2.64 | 0.3635 | 0.0332 | |||||

| US78392BAD91 / SK Hynix Inc | 3.01 | -0.27 | 0.3605 | 0.0235 | |||||

| US55285AAE73 / MF1 2022-FL9 LLC | 2.99 | 0.07 | 0.3586 | 0.0243 | |||||

| Palmer Square Loan Funding 2025-1 Ltd / ABS-CBDO (US69704CAC10) | 2.96 | 0.3548 | 0.3548 | ||||||

| Provident Funding Mortgage Trust 2025-1 / ABS-MBS (US74388NAC02) | 2.93 | 0.3519 | 0.3519 | ||||||

| Rentokil Terminix Funding LLC / DBT (US760130AA26) | 2.93 | 0.3513 | 0.3513 | ||||||

| US034863AR12 / Anglo American Capital PLC | 2.93 | -26.98 | 0.3509 | -0.0972 | |||||

| Angel Oak Mortgage Trust 2024-13 / ABS-MBS (US03466PAA30) | 2.91 | -6.98 | 0.3485 | -0.0008 | |||||

| US23311VAJ61 / DCP Midstream Operating LP | 2.90 | 0.17 | 0.3483 | 0.0241 | |||||

| R2RX34 / Regal Rexnord Corporation - Depositary Receipt (Common Stock) | 2.86 | -0.28 | 0.3434 | 0.0223 | |||||

| US05635JAA88 / Bacardi Ltd / Bacardi-Martini BV | 2.81 | 25.32 | 0.3366 | 0.0862 | |||||

| US06738EBU82 / Barclays PLC | 2.75 | 0.92 | 0.3300 | 0.0250 | |||||

| US78448TAB89 / SMBC Aviation Capital Finance DAC | 2.75 | 74.90 | 0.3293 | 0.1537 | |||||

| US87276WAE30 / TRTX 2021-FL4 Issuer Ltd | 2.74 | 0.44 | 0.3282 | 0.0235 | |||||

| AXP / American Express Company - Depositary Receipt (Common Stock) | 2.72 | 0.3264 | 0.3264 | ||||||

| US08576PAF80 / Berry Global Inc | 2.70 | 0.93 | 0.3239 | 0.0246 | |||||

| US808513CG89 / Charles Schwab Corp/The | 2.69 | 0.11 | 0.3231 | 0.0221 | |||||

| US03880XAG16 / Arbor Realty Collateralized Loan Obligation Ltd | 2.68 | -0.11 | 0.3214 | 0.0213 | |||||

| US00135TAC80 / AIB Group PLC | 2.66 | -0.63 | 0.3194 | 0.0196 | |||||

| LoanCore 2025 2025-CRE8 Issuer LLC / ABS-CBDO (US53947FAC59) | 2.65 | -1.45 | 0.3184 | 0.0171 | |||||

| US378272AX69 / Glencore Funding LLC | 2.65 | 0.76 | 0.3175 | 0.0236 | |||||

| US822866AG44 / Shelter Growth CRE Issuer Ltd | 2.65 | 0.15 | 0.3175 | 0.0219 | |||||

| US571903BL69 / Marriott International Inc/MD | 2.64 | 102.30 | 0.3169 | 0.1708 | |||||

| PCG.PRD / Pacific Gas and Electric Company - Preferred Stock | 2.60 | 1.96 | 0.3121 | 0.0266 | |||||

| US19828AAB35 / Columbia Pipelines Holding Co LLC | 2.60 | 0.35 | 0.3115 | 0.0220 | |||||

| US80007RAK14 / Sands China Ltd | 2.58 | 0.16 | 0.3100 | 0.0214 | |||||

| PNCS34 / The PNC Financial Services Group, Inc. - Depositary Receipt (Common Stock) | 2.58 | 0.00 | 0.3094 | 0.0209 | |||||

| US00217VAE02 / AREIT LLC, Series 2022-CRE7, Class B | 2.57 | -0.12 | 0.3077 | 0.0204 | |||||

| US92660FAK03 / Videotron Ltd | 2.56 | 0.23 | 0.3074 | 0.0214 | |||||

| US05609GAC24 / BXMT 2021-FL4 Ltd | 2.53 | 1.89 | 0.3037 | 0.0257 | |||||

| CABK / CaixaBank, S.A. | 2.52 | 26.48 | 0.3019 | 0.0792 | |||||

| US904678AU32 / UniCredit SpA | 2.50 | 0.73 | 0.2996 | 0.0222 | |||||

| Angel Oak Mortgage Trust 2024-7 / ABS-MBS (US03466CAA27) | 2.49 | -4.92 | 0.2989 | 0.0057 | |||||

| EFN / Element Fleet Management Corp. | 2.49 | 0.2986 | 0.2986 | ||||||

| Glencore Funding LLC / DBT (US378272BZ09) | 2.46 | 0.2956 | 0.2956 | ||||||

| US58003UAE82 / MF1 Multifamily Housing Mortgage Loan Trust, Series 2020-FL4, Class B | 2.44 | 0.16 | 0.2924 | 0.0201 | |||||

| US68269HAC97 / OMFIT_23-2A | 2.36 | 0.72 | 0.2834 | 0.0210 | |||||

| US26884LAQ23 / EQT Corp. | 2.35 | 0.86 | 0.2820 | 0.0212 | |||||

| A2RW34 / Arrow Electronics, Inc. - Depositary Receipt (Common Stock) | 2.34 | 1.04 | 0.2808 | 0.0215 | |||||

| Bain Capital Credit CLO 2021-4 Ltd / ABS-CBDO (US05685AAU25) | 2.31 | -1.71 | 0.2766 | 0.0142 | |||||

| US08576PAH47 / Berry Global Inc | 2.30 | 0.66 | 0.2761 | 0.0202 | |||||

| US78486BAE48 / STWD 2021-FL2 Ltd | 2.28 | -0.09 | 0.2736 | 0.0182 | |||||

| C1FG34 / Citizens Financial Group, Inc. - Depositary Receipt (Common Stock) | 2.25 | 0.63 | 0.2702 | 0.0198 | |||||

| OCP CLO 2015-10 Ltd / ABS-CBDO (US67092DBF50) | 2.24 | -1.06 | 0.2689 | 0.0154 | |||||

| US92928QAE89 / WEA Finance LLC | 2.22 | 2.16 | 0.2663 | 0.0232 | |||||

| US86562MCM01 / Sumitomo Mitsui Financial Group Inc | 2.21 | 1.19 | 0.2656 | 0.0208 | |||||

| US37940XAE22 / Global Payments Inc | 2.21 | 0.73 | 0.2650 | 0.0196 | |||||

| US05530QAQ38 / BAT International Finance plc | 2.18 | 69.30 | 0.2620 | 0.1176 | |||||

| US62878U2F87 / NBN Co Ltd | 2.15 | 1.36 | 0.2584 | 0.0207 | |||||

| US808513CD58 / Charles Schwab Corp. (The) | 2.15 | 1.23 | 0.2577 | 0.0203 | |||||

| CBRE Services Inc / DBT (US12505BAH33) | 2.05 | 0.2461 | 0.2461 | ||||||

| US25160PAN78 / Deutsche Bank AG | 2.04 | -0.44 | 0.2447 | 0.0155 | |||||

| COLT 2024-5 Mortgage Loan Trust / ABS-MBS (US19685AAA79) | 2.04 | -5.77 | 0.2447 | 0.0024 | |||||

| US46647PBW59 / JPMorgan Chase & Co | 2.04 | 1.04 | 0.2442 | 0.0188 | |||||

| AU3FN0029609 / AAI Ltd | 2.02 | 1.87 | 0.2421 | 0.0204 | |||||

| US928668BE16 / VOLKSWAGEN GROUP AMER FIN LLC 3.35% 05/13/2025 144A | 2.01 | 0.40 | 0.2414 | 0.0171 | |||||

| Provident Funding Mortgage Trust 2024-1 / ABS-MBS (US74389BAC54) | 2.01 | -4.15 | 0.2412 | 0.0065 | |||||

| ENB.PRN / Enbridge Inc. - Preferred Security | 2.01 | 0.40 | 0.2405 | 0.0171 | |||||

| Suntory Holdings Ltd / DBT (US86803UAE10) | 2.00 | 1.47 | 0.2401 | 0.0195 | |||||

| Sun Communities Operating LP / DBT (US866677AK36) | 1.98 | 1.80 | 0.2379 | 0.0199 | |||||

| Consolidated Edison Co of New York Inc / DBT (US209111GL10) | 1.98 | -0.75 | 0.2374 | 0.0142 | |||||

| G1PC34 / Genuine Parts Company - Depositary Receipt (Common Stock) | 1.95 | 1.14 | 0.2344 | 0.0182 | |||||

| US26244QAQ64 / Dryden 49 Senior Loan Fund | 1.95 | -0.15 | 0.2335 | 0.0154 | |||||

| US92660FAN42 / Videotron Ltd | 1.93 | 1.64 | 0.2309 | 0.0191 | |||||

| US06675FBA49 / Banque Federative du Credit Mutuel SA | 1.92 | 0.10 | 0.2300 | 0.0157 | |||||

| US3137B2BP40 / Freddie Mac REMICS | 1.90 | -2.26 | 0.2281 | 0.0105 | |||||

| BA / The Boeing Company - Depositary Receipt (Common Stock) | 1.90 | 41.61 | 0.2278 | 0.0777 | |||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 1.87 | 0.2242 | 0.2242 | ||||||

| US55608JAR95 / Macquarie Group Ltd | 1.86 | 0.98 | 0.2231 | 0.0171 | |||||

| US902613AU26 / UBS Group AG | 1.85 | -0.16 | 0.2214 | 0.0147 | |||||

| Penske Truck Leasing Co Lp / PTL Finance Corp / DBT (US709599BZ68) | 1.84 | 0.99 | 0.2202 | 0.0168 | |||||

| Angel Oak Mortgage Trust 2024-9 / ABS-MBS (US03466JAA79) | 1.82 | -4.30 | 0.2187 | 0.0056 | |||||

| US21871XAD12 / CORP. NOTE | 1.81 | 1.06 | 0.2171 | 0.0168 | |||||

| US00500RAC97 / ACREC 2021-FL1 Ltd | 1.80 | -0.61 | 0.2158 | 0.0132 | |||||

| OBX 2024-NQM11 Trust / ABS-MBS (US67119EAA47) | 1.78 | -6.46 | 0.2138 | 0.0007 | |||||

| 2914 / Japan Tobacco Inc. | 1.78 | 0.2129 | 0.2129 | ||||||

| Molex Electronic Technologies LLC / DBT (US60856BAE48) | 1.77 | 0.2127 | 0.2127 | ||||||

| R2RX34 / Regal Rexnord Corporation - Depositary Receipt (Common Stock) | 1.77 | 0.57 | 0.2126 | 0.0155 | |||||

| LoanCore 2025 2025-CRE8 Issuer LLC / ABS-CBDO (US53947FAA93) | 1.77 | -0.90 | 0.2125 | 0.0126 | |||||

| US682696AA77 / OneMain Financial Issuance Trust 2020-2 | 1.76 | 0.74 | 0.2116 | 0.0157 | |||||

| US49130NGL73 / Kentucky Higher Education Student Loan Corp | 1.76 | 1.91 | 0.2116 | 0.0179 | |||||

| US031162DN74 / Amgen Inc | 1.76 | 0.00 | 0.2109 | 0.0142 | |||||

| US34706CAC38 / FORT CRE 2022-FL3 Issuer LLC | 1.75 | 0.75 | 0.2100 | 0.0156 | |||||

| US53947XAE22 / LoanCore 2021-CRE5 Issuer Ltd | 1.74 | -0.46 | 0.2092 | 0.0132 | |||||

| US65249BAA70 / News Corp | 1.71 | 0.2049 | 0.2049 | ||||||

| US778296AF07 / Ross Stores, Inc. | 1.69 | 1.02 | 0.2025 | 0.0155 | |||||

| US65339KBS87 / NextEra Energy Capital Holdings Inc | 1.69 | -0.18 | 0.2022 | 0.0132 | |||||

| GMF Floorplan Owner Revolving Trust / ABS-O (US361886DR27) | 1.69 | -0.65 | 0.2021 | 0.0123 | |||||

| US03880RAC34 / Arbor Realty Commercial Real Estate Notes 2021-FL4 Ltd | 1.68 | -0.24 | 0.2019 | 0.0132 | |||||

| US281020AU14 / Edison International | 1.68 | 0.18 | 0.2018 | 0.0139 | |||||

| New Residential Mortgage Loan Trust 2024-NQM1 / ABS-MBS (US64828DAA54) | 1.68 | -7.85 | 0.2013 | -0.0023 | |||||

| US03880RAE99 / Arbor Realty Commercial Real Estate Notes 2021-FL4 Ltd | 1.68 | 0.12 | 0.2011 | 0.0137 | |||||

| US86562MCA62 / Sumitomo Mitsui Financial Group Inc | 1.67 | 0.79 | 0.1997 | 0.0149 | |||||

| AVGO / Broadcom Inc. - Depositary Receipt (Common Stock) | 1.66 | 30.04 | 0.1989 | 0.0562 | |||||

| US50212YAD67 / LPL Holdings Inc | 1.65 | 1.48 | 0.1975 | 0.0160 | |||||

| US378272BD96 / Glencore Funding LLC | 1.63 | 0.81 | 0.1949 | 0.0145 | |||||

| Penske Truck Leasing Co Lp / PTL Finance Corp / DBT (US709599BY93) | 1.62 | 0.31 | 0.1938 | 0.0135 | |||||

| US05401AAR23 / Avolon Holdings Funding Ltd | 1.61 | 0.88 | 0.1931 | 0.0145 | |||||

| LPL Holdings Inc / DBT (US50212YAJ38) | 1.61 | 0.50 | 0.1925 | 0.0138 | |||||

| US694308KL02 / Pacific Gas and Electric Co | 1.60 | 1.84 | 0.1924 | 0.0163 | |||||

| 3690 / Meituan | 1.57 | 1.36 | 0.1882 | 0.0150 | |||||

| US29278GAZ19 / Enel Finance International NV | 1.55 | -0.71 | 0.1856 | 0.0112 | |||||

| COLT 2024-3 Mortgage Loan Trust / ABS-MBS (US19688VAA89) | 1.54 | -5.63 | 0.1849 | 0.0022 | |||||

| US846031AS15 / Southwick Park CLO LLC | 1.53 | -0.26 | 0.1831 | 0.0119 | |||||

| US88032WAT36 / Tencent Holdings Ltd | 1.52 | 1.00 | 0.1826 | 0.0140 | |||||

| Mars Inc / DBT (US571676AX38) | 1.49 | 0.1786 | 0.1786 | ||||||

| AerCap Ireland Capital DAC / AerCap Global Aviation Trust / DBT (US00774MBG96) | 1.48 | 0.00 | 0.1778 | 0.0120 | |||||

| US29449WAA53 / Equitable Financial Life Global Funding | 1.48 | 0.68 | 0.1770 | 0.0131 | |||||

| US12434LAE48 / BXMT 2020-FL2 LTD | 1.46 | -0.95 | 0.1755 | 0.0102 | |||||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 1.43 | 0.1712 | 0.1712 | ||||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 1.43 | 0.1709 | 0.1709 | ||||||

| Rio Tinto Finance USA PLC / DBT (US76720AAS50) | 1.42 | 0.1702 | 0.1702 | ||||||

| US055983AA86 / BSPRT 2022-FL8 Issuer Ltd | 1.41 | -10.68 | 0.1695 | -0.0074 | |||||

| US00500RAE53 / ACREC 2021-FL1 Ltd | 1.40 | 1.16 | 0.1681 | 0.0131 | |||||

| US29449WAP23 / EQUITABLE FINANCIAL LIFE GLOBAL FU | 1.38 | -0.22 | 0.1660 | 0.0109 | |||||

| US161175CM43 / Charter Communications Operating LLC / Charter Communications Operating Capital | 1.38 | 0.00 | 0.1658 | 0.0112 | |||||

| US14040HDB87 / Capital One Financial Corp | 1.35 | -0.22 | 0.1619 | 0.0106 | |||||

| AGCO / AGCO Corporation | 1.35 | -0.22 | 0.1617 | 0.0106 | |||||

| A1JG34 / Arthur J. Gallagher & Co. - Depositary Receipt (Common Stock) | 1.34 | 1.98 | 0.1604 | 0.0137 | |||||

| US928668BL58 / VOLKSWAGEN GROUP AMER FIN LLC 1.25% 11/24/2025 144A | 1.33 | 0.91 | 0.1598 | 0.0121 | |||||

| US224936AC84 / Credit Acceptance Auto Loan Trust, Series 2023-3A, Class B | 1.33 | 0.23 | 0.1597 | 0.0111 | |||||

| A1JG34 / Arthur J. Gallagher & Co. - Depositary Receipt (Common Stock) | 1.33 | 1.14 | 0.1597 | 0.0124 | |||||

| Schlumberger Holdings Corp / DBT (US806851AL54) | 1.33 | 0.61 | 0.1596 | 0.0116 | |||||

| M1TB34 / M&T Bank Corporation - Depositary Receipt (Common Stock) | 1.32 | 0.68 | 0.1588 | 0.0117 | |||||

| MMC / Marsh & McLennan Companies, Inc. - Depositary Receipt (Common Stock) | 1.31 | 1.16 | 0.1575 | 0.0123 | |||||

| OXYD / Occidental Petroleum Corporation - Depositary Receipt (Common Stock) | 1.31 | -0.91 | 0.1575 | 0.0092 | |||||

| MMC / Marsh & McLennan Companies, Inc. - Depositary Receipt (Common Stock) | 1.31 | 2.10 | 0.1572 | 0.0137 | |||||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 1.31 | -1.81 | 0.1566 | 0.0080 | |||||

| ANTX / AN2 Therapeutics, Inc. | 1.30 | 0.46 | 0.1561 | 0.0112 | |||||

| US87276WAC73 / TRTX 2021-FL4 Issuer Ltd | 1.30 | 0.39 | 0.1559 | 0.0110 | |||||

| Penske Truck Leasing Co Lp / PTL Finance Corp / DBT (US709599CA09) | 1.30 | 1.25 | 0.1558 | 0.0123 | |||||

| Long: TR11791 TRS USD R V 03MTBILL TR11791R/USB3MTA-5.00BPS / Short: TR11791 TRS USD P E TR11791P / DCO (000000000) | 1.29 | 0.1547 | 0.1547 | ||||||

| US718172CZ06 / PHILIP MORRIS INTERNATIONAL INC | 1.28 | 1.26 | 0.1541 | 0.0122 | |||||

| US446413AS53 / HUNTINGTON INGALLS INDUS COMPANY GUAR 05/25 3.844 | 1.27 | 0.32 | 0.1527 | 0.0107 | |||||

| GXO / GXO Logistics, Inc. | 1.25 | -1.03 | 0.1500 | 0.0086 | |||||

| US38141GXM13 / Goldman Sachs Group Inc/The | 1.24 | 1.06 | 0.1488 | 0.0114 | |||||

| US902613AS79 / UBS Group AG | 1.24 | 0.16 | 0.1483 | 0.0102 | |||||

| RIO TINTO FIN USA PLC / DBT (US76720AAR77) | 1.23 | 0.1479 | 0.1479 | ||||||

| US05401AAP66 / Avolon Holdings Funding Ltd | 1.23 | 0.57 | 0.1476 | 0.0107 | |||||

| GMF Floorplan Owner Revolving Trust / ABS-O (US361886DL56) | 1.22 | -0.65 | 0.1462 | 0.0090 | |||||

| US85855CAA80 / Stellantis Finance US Inc | 1.21 | 0.84 | 0.1446 | 0.0109 | |||||

| US045054AL70 / Ashtead Capital Inc | 1.18 | 0.1421 | 0.1421 | ||||||

| AVGO / Broadcom Inc. - Depositary Receipt (Common Stock) | 1.18 | 28.70 | 0.1421 | 0.0391 | |||||

| M1PC34 / Marathon Petroleum Corporation - Depositary Receipt (Common Stock) | 1.18 | 0.1413 | 0.1413 | ||||||

| Dell Equipment Finance Trust 2024-2 / ABS-O (US24704EAC21) | 1.17 | -0.09 | 0.1408 | 0.0094 | |||||

| AVGO / Broadcom Inc. - Depositary Receipt (Common Stock) | 1.17 | 29.86 | 0.1404 | 0.0395 | |||||

| OBX 2024-NQM8 Trust / ABS-MBS (US67119CAA80) | 1.17 | -5.89 | 0.1399 | 0.0012 | |||||

| US68267HAA59 / OneMain Financial Issuance Trust, Series 2022-S1, Class A | 1.16 | 0.09 | 0.1397 | 0.0095 | |||||

| Corebridge Global Funding / DBT (US00138CAX65) | 1.14 | 1.33 | 0.1367 | 0.0109 | |||||

| JP Morgan Mortgage Trust Series 2024-NQM1 / ABS-MBS (US465983AA20) | 1.13 | -6.44 | 0.1360 | 0.0005 | |||||

| US00500RAG02 / ACREC 2021-FL1 Ltd | 1.12 | -0.18 | 0.1347 | 0.0089 | |||||

| ANTX / AN2 Therapeutics, Inc. | 1.11 | 1.64 | 0.1335 | 0.0110 | |||||

| US928563AJ42 / VMware Inc | 1.10 | 1.01 | 0.1316 | 0.0100 | |||||

| US448579AQ51 / Hyatt Hotels Corp | 1.09 | 0.09 | 0.1301 | 0.0089 | |||||

| US50212YAC84 / LPL Holdings, Inc. | 1.08 | 1.31 | 0.1295 | 0.0103 | |||||

| Long: TR11606 TRS USD R V 03MTBILL TR11606R/USB3MTA-3.00BPS / Short: TR11606 TRS USD P E TR11606P / DCO (000000000) | 1.07 | 0.1281 | 0.1281 | ||||||

| COLT 2024-2 Mortgage Loan Trust / ABS-MBS (US12665LAA26) | 1.06 | -7.60 | 0.1270 | -0.0011 | |||||

| US459506AP65 / INTERNATIONAL FLAVORS and FRAGRANCES INC 1.832% 10/15/2027 144A | 1.05 | 1.44 | 0.1265 | 0.0103 | |||||

| US674599ED34 / Occidental Petroleum Corp | 1.03 | 0.1240 | 0.1240 | ||||||

| US55903VBA08 / Warnermedia Holdings Inc | 1.03 | 0.49 | 0.1239 | 0.0089 | |||||

| US846031AR32 / Southwick Park CLO LLC | 1.03 | 0.88 | 0.1239 | 0.0095 | |||||

| US29278NAP87 / ENERGY TRANSFER OPERATNG COMPANY GUAR 05/25 2.9 | 1.03 | 0.49 | 0.1231 | 0.0089 | |||||

| US03880RAG48 / Arbor Realty Commercial Real Estate Notes 2021-FL4 Ltd | 1.01 | -0.10 | 0.1206 | 0.0081 | |||||

| H1II34 / Huntington Ingalls Industries, Inc. - Depositary Receipt (Common Stock) | 1.00 | 0.1205 | 0.1205 | ||||||

| US68269HAB15 / ONEMAIN FINANCIAL ISSUANCE TRUST 2023-2 6.17% 09/15/2036 144A | 1.00 | 0.70 | 0.1200 | 0.0089 | |||||

| DANSKE / Danske Bank A/S | 0.99 | 1.23 | 0.1189 | 0.0093 | |||||

| US47216QAB95 / JDE Peet's NV | 0.99 | 0.71 | 0.1184 | 0.0087 | |||||

| Business Jet Securities 2024-2 LLC / ABS-O (US12326TAA60) | 0.97 | -1.81 | 0.1169 | 0.0059 | |||||

| US04273WAC55 / Arrow Electronics Inc | 0.97 | 0.1165 | 0.1165 | ||||||

| US718172CV91 / Philip Morris International Inc | 0.97 | 0.84 | 0.1159 | 0.0086 | |||||

| US29444UBF21 / Equinix Inc | 0.96 | 0.73 | 0.1157 | 0.0087 | |||||

| US251526CP29 / Deutsche Bank AG/New York NY | 0.96 | 0.95 | 0.1154 | 0.0088 | |||||

| US65345GAA94 / NextGear Floorplan Master Owner Trust | 0.96 | -0.42 | 0.1148 | 0.0073 | |||||

| H1BA34 / Huntington Bancshares Incorporated - Depositary Receipt (Common Stock) | 0.95 | 0.63 | 0.1143 | 0.0083 | |||||

| F1AN34 / Diamondback Energy, Inc. - Depositary Receipt (Common Stock) | 0.95 | 1.07 | 0.1137 | 0.0088 | |||||

| F1AN34 / Diamondback Energy, Inc. - Depositary Receipt (Common Stock) | 0.95 | 0.42 | 0.1136 | 0.0081 | |||||

| Exeter Automobile Receivables Trust 2024-4 / ABS-O (US30166UAC45) | 0.95 | -0.32 | 0.1135 | 0.0074 | |||||

| FCNCO / First Citizens BancShares, Inc. - Preferred Stock | 0.94 | 0.1129 | 0.1129 | ||||||

| US29273VAP58 / Energy Transfer LP | 0.94 | 0.75 | 0.1126 | 0.0084 | |||||

| Long: TR11795 TRS USD R E TR11795R / Short: TR11795 TRS USD P V 03MTBILL TR11795P/USB3MTA+10.00BPS / DCO (000000000) | 0.94 | 0.1122 | 0.1122 | ||||||

| Schlumberger Holdings Corp / DBT (US806851AM38) | 0.93 | 1.19 | 0.1119 | 0.0087 | |||||

| US55284JAG40 / MF1 2022-FL8 Ltd | 0.93 | -0.11 | 0.1111 | 0.0073 | |||||

| Sammons Financial Group Global Funding / DBT (US79587J2B82) | 0.92 | 1.66 | 0.1102 | 0.0091 | |||||

| PM / Philip Morris International Inc. - Depositary Receipt (Common Stock) | 0.90 | 0.1082 | 0.1082 | ||||||

| Verus Securitization Trust 2024-3 / ABS-MBS (US92540MAB19) | 0.90 | -10.91 | 0.1077 | -0.0051 | |||||

| OXYD / Occidental Petroleum Corporation - Depositary Receipt (Common Stock) | 0.89 | -0.11 | 0.1073 | 0.0071 | |||||

| US05401AAK79 / Avolon Holdings Funding Ltd | 0.89 | -0.33 | 0.1071 | 0.0069 | |||||

| Long: TR11660 TRS USD R V 03MTBILL TR11660R/USB3MTA-5.00BPS / Short: TR11660 TRS USD P E TR11660P / DCO (000000000) | 0.89 | 0.1071 | 0.1071 | ||||||

| US04002VAG68 / AREIT 2022-CRE6 Trust | 0.89 | 0.00 | 0.1062 | 0.0072 | |||||

| US337932AN77 / FirstEnergy Corp | 0.88 | 0.46 | 0.1053 | 0.0076 | |||||

| US50212YAH71 / LPL Holdings, Inc. | 0.87 | 0.81 | 0.1048 | 0.0078 | |||||

| Verus Securitization Trust 2024-6 / ABS-MBS (US92540JAA07) | 0.86 | -6.66 | 0.1026 | 0.0000 | |||||

| Business Jet Securities 2024-1 LLC / ABS-O (US12327CAA27) | 0.85 | -4.60 | 0.1020 | 0.0023 | |||||

| T-Mobile USA Inc / DBT (US87264ADL61) | 0.84 | 1.93 | 0.1013 | 0.0086 | |||||

| 3690 / Meituan | 0.84 | 2.07 | 0.1008 | 0.0087 | |||||

| LVS / Las Vegas Sands Corp. - Depositary Receipt (Common Stock) | 0.84 | -0.12 | 0.1006 | 0.0067 | |||||

| Trans-Allegheny Interstate Line Co / DBT (US893045AF16) | 0.83 | 0.1000 | 0.1000 | ||||||

| MF1 2024-FL14 LLC / ABS-CBDO (US55416AAG40) | 0.82 | 0.00 | 0.0986 | 0.0066 | |||||

| Long: TR11748 TRS USD R E TR11748R / Short: TR11748 TRS USD P V 03MTBILL TR11748P/USB3MTA+15.00 BP / DCO (000000000) | 0.82 | 0.0980 | 0.0980 | ||||||

| IQVIA Inc / DBT (US46266TAC27) | 0.80 | 0.13 | 0.0962 | 0.0067 | |||||

| Enterprise Fleet Financing 2024-3 LLC / ABS-O (US29375QAB41) | 0.80 | -6.32 | 0.0962 | 0.0005 | |||||

| US04002VAJ08 / AREIT 2022-CRE6 Trust | 0.79 | 1.02 | 0.0950 | 0.0073 | |||||

| US07335YAE68 / BDS 2021-FL10 Ltd | 0.79 | -1.01 | 0.0943 | 0.0055 | |||||

| AmeriCredit Automobile Receivables Trust 2024-1 / ABS-O (US023947AB05) | 0.79 | -32.03 | 0.0942 | -0.0351 | |||||

| US88581EAF88 / 3650R 2021-PF1 Commercial Mortgage Trust | 0.78 | -3.09 | 0.0941 | 0.0036 | |||||

| US05493EAZ51 / BBCMS Mortgage Trust 2021-C9 | 0.77 | -3.37 | 0.0928 | 0.0033 | |||||

| US08163HAG39 / Benchmark Mortgage Trust, Series 2021-B27, Class XA | 0.77 | -2.66 | 0.0921 | 0.0039 | |||||

| US05401AAL52 / Avolon Holdings Funding Ltd | 0.76 | 0.13 | 0.0914 | 0.0063 | |||||

| US55261FAS39 / M&T Bank Corp | 0.76 | 0.0911 | 0.0911 | ||||||

| US06738EBL83 / Barclays PLC | 0.76 | 0.53 | 0.0910 | 0.0066 | |||||

| Dell Equipment Finance Trust 2024-2 / ABS-O (US24704EAE86) | 0.76 | 0.40 | 0.0908 | 0.0064 | |||||

| MUFG / Mitsubishi UFJ Financial Group, Inc. - Depositary Receipt (Common Stock) | 0.75 | 0.0894 | 0.0894 | ||||||

| BDS 2024-FL13 LLC / ABS-CBDO (US05555MAA71) | 0.74 | -1.06 | 0.0893 | 0.0051 | |||||

| US53947XAG79 / LoanCore 2021-CRE5 Issuer Ltd | 0.74 | -0.27 | 0.0885 | 0.0058 | |||||

| US0158578734 / Algonquin Power & Utilities Corp | 0.73 | 0.14 | 0.0872 | 0.0060 | |||||

| US404280CG21 / HSBC Holdings PLC | 0.73 | 0.69 | 0.0871 | 0.0064 | |||||

| US81882HAE53 / Shackleton 2013-IV-R CLO Ltd | 0.72 | -0.28 | 0.0864 | 0.0055 | |||||

| US055983AG56 / BSPRT 2022-FL8 Issuer Ltd | 0.72 | 0.85 | 0.0860 | 0.0066 | |||||

| Long: SM11481 IRS USD R F 4.96700 SM11481_FIX CCPOIS / Short: SM11481 IRS USD P V 12MSOFR SM11481_FLO CCPOIS / DIR (000000000) | 0.71 | 0.0851 | 0.0851 | ||||||

| US29375NAC92 / ENTERPRISE FLEET FINANCING 2023-2 LLC SER 2023-2 CL A3 REGD 144A P/P 5.50000000 | 0.70 | 0.14 | 0.0841 | 0.0058 | |||||

| Long: SM11727 IRS USD R F 4.10600 SM11727_FIX CCPOIS / Short: SM11727 IRS USD P V 12MSOFR SM11727_FLO CCPOIS / DIR (000000000) | 0.69 | 0.0833 | 0.0833 | ||||||

| LAD Auto Receivables Trust 2024-3 / ABS-O (US505709AB17) | 0.69 | -10.08 | 0.0824 | -0.0030 | |||||

| P1AY34 / Paychex, Inc. - Depositary Receipt (Common Stock) | 0.69 | 0.0822 | 0.0822 | ||||||

| US26884TAP75 / ERAC USA Finance LLC | 0.68 | 0.15 | 0.0817 | 0.0056 | |||||

| US165183CZ56 / Chesapeake Funding II LLC, Series 2023-2A, Class A1 | 0.67 | -14.03 | 0.0809 | -0.0068 | |||||

| AVGO / Broadcom Inc. - Depositary Receipt (Common Stock) | 0.67 | 29.65 | 0.0803 | 0.0226 | |||||

| US718172CU19 / Philip Morris International Inc | 0.67 | -0.15 | 0.0802 | 0.0054 | |||||

| US3137FNAS95 / Freddie Mac Multifamily Structured Pass Through Ctfs. | 0.66 | -0.60 | 0.0790 | 0.0049 | |||||

| US404280DQ93 / HSBC Holdings PLC | 0.65 | -0.46 | 0.0785 | 0.0049 | |||||

| US08162RAF47 / Benchmark 2021-B23 Mortgage Trust | 0.64 | 0.31 | 0.0773 | 0.0055 | |||||

| US846031AQ58 / Southwick Park CLO LLC, Series 2019-4A, Class B1R | 0.64 | -0.16 | 0.0772 | 0.0051 | |||||

| CAON34 / Capital One Financial Corporation - Depositary Receipt (Common Stock) | 0.64 | 0.79 | 0.0763 | 0.0057 | |||||

| Empire District Bondco LLC / DBT (US291918AA87) | 0.63 | 1.45 | 0.0755 | 0.0061 | |||||

| IQVIA Inc / DBT (US46266TAF57) | 0.62 | 0.49 | 0.0745 | 0.0053 | |||||

| US06541ABM18 / BANK 2021-BNK31 | 0.62 | -2.83 | 0.0741 | 0.0030 | |||||

| US29375NAB10 / EFF_23-2 | 0.60 | -16.85 | 0.0722 | -0.0088 | |||||

| US165183CU69 / Chesapeake Funding II LLC | 0.60 | -16.30 | 0.0721 | -0.0082 | |||||

| US07274EAJ29 / BAYER US FINANCE LLC 144A LIFE SR UNSEC 6.25% 01-21-29 | 0.59 | 1.72 | 0.0708 | 0.0058 | |||||

| US08163JAG94 / Benchmark 2021-B29 Mortgage Trust | 0.59 | -6.37 | 0.0706 | 0.0003 | |||||

| US067316AF68 / Bacardi Ltd | 0.58 | 0.0700 | 0.0700 | ||||||

| Santander Drive Auto Receivables Trust 2024-4 / ABS-O (US802919AB63) | 0.58 | -40.55 | 0.0698 | -0.0397 | |||||

| US07335YAG17 / BDS 2021-FL10 Ltd | 0.57 | -0.87 | 0.0687 | 0.0041 | |||||

| US03880KAE47 / Arbor Realty Commercial Real Estate Notes 2021-FL3 Ltd | 0.57 | -0.53 | 0.0678 | 0.0042 | |||||

| Business Jet Securities 2024-2 LLC / ABS-O (US12326TAB44) | 0.56 | -2.60 | 0.0674 | 0.0029 | |||||

| CBRE Services Inc / DBT (US12505BAJ98) | 0.56 | 0.0673 | 0.0673 | ||||||

| US08163GAZ37 / Benchmark 2021-B28 Mortgage Trust | 0.56 | -2.78 | 0.0671 | 0.0028 | |||||

| OBX 2024-NQM1 Trust / ABS-MBS (US67448LAA08) | 0.56 | -6.24 | 0.0667 | 0.0004 | |||||

| TPRY34 / Tapestry, Inc. - Depositary Receipt (Common Stock) | 0.55 | 1.09 | 0.0665 | 0.0051 | |||||

| OBX 2024-NQM5 Trust / ABS-MBS (US67448NAA63) | 0.51 | -10.14 | 0.0618 | -0.0023 | |||||

| COLT 2024-3 Mortgage Loan Trust / ABS-MBS (US19688VAB62) | 0.51 | -5.88 | 0.0615 | 0.0006 | |||||

| US92928QAF54 / WEA FINANCE LLC 144A LIFE SR UNSEC 3.5% 06-15-29 | 0.51 | 2.22 | 0.0608 | 0.0054 | |||||

| US29375CAB54 / Enterprise Fleet Financing 2023-1 LLC | 0.50 | -22.70 | 0.0605 | -0.0125 | |||||

| Long: TR11749 TRS USD R V 03MTBILL TR11749R/USB3MTA+7.0BPS / Short: TR11749 TRS USD P E TR11749P / DCO (000000000) | 0.49 | 0.0587 | 0.0587 | ||||||

| US22822VAS07 / CROWN CASTLE INTL CORP 1.35% 07/15/2025 | 0.49 | 0.83 | 0.0586 | 0.0044 | |||||

| US61691YAP60 / Morgan Stanley Capital I Trust 2021-L5 | 0.48 | -3.98 | 0.0578 | 0.0016 | |||||

| US06541JAR23 / BANK 2021-BNK34 | 0.48 | -2.83 | 0.0577 | 0.0023 | |||||

| US05601HAG92 / BSPRT 2021-FL6 Issuer Ltd | 0.48 | 1.06 | 0.0574 | 0.0045 | |||||

| US22003BAN64 / Corporate Office Properties LP | 0.47 | 0.65 | 0.0562 | 0.0042 | |||||

| US446150BC73 / Huntington Bancshares Inc/OH | 0.47 | 0.22 | 0.0560 | 0.0040 | |||||

| US902613BF40 / UBS Group AG | 0.46 | -0.86 | 0.0555 | 0.0033 | |||||

| US571903AP82 / Marriott International Inc./MD | 0.46 | 0.00 | 0.0548 | 0.0037 | |||||

| Virginia Power Fuel Securitization LLC / DBT (US92808VAA08) | 0.45 | 0.45 | 0.0541 | 0.0039 | |||||

| US055983AE09 / BSPRT 2022-FL8 Issuer Ltd | 0.44 | 0.45 | 0.0532 | 0.0038 | |||||

| COOPR Residential Mortgage Trust 2025-CES1 / ABS-MBS (US12596SAA15) | 0.44 | 0.0528 | 0.0528 | ||||||

| US12592BAL80 / CNH Industrial Capital LLC | 0.44 | 0.46 | 0.0526 | 0.0038 | |||||

| US22822VAZ40 / Crown Castle International Corp | 0.43 | 0.70 | 0.0521 | 0.0039 | |||||

| US00135TAD63 / AIB Group PLC | 0.43 | 0.93 | 0.0519 | 0.0039 | |||||

| US05493MAG96 / BBCMS Mortgage Trust 2021-C11 | 0.43 | -2.94 | 0.0515 | 0.0021 | |||||

| LVS / Las Vegas Sands Corp. - Depositary Receipt (Common Stock) | 0.43 | 0.0514 | 0.0514 | ||||||

| US05602CAG96 / BSPRT 2021-FL7 Issuer Ltd | 0.40 | 0.25 | 0.0485 | 0.0034 | |||||

| US361841AH26 / GLP Capital LP / GLP Financing II Inc | 0.40 | -0.49 | 0.0484 | 0.0031 | |||||

| DLLST 2024-1 LLC / ABS-O (US23346HAC16) | 0.40 | -0.25 | 0.0480 | 0.0032 | |||||

| US05491UBE73 / BBCMS_18-C2 | 0.40 | -6.34 | 0.0479 | 0.0002 | |||||

| US3137FTG271 / Freddie Mac Multifamily Structured Pass Through Certificates | 0.40 | -3.88 | 0.0476 | 0.0014 | |||||

| Affirm Asset Securitization Trust 2024-X2 / ABS-O (US00833QAA31) | 0.39 | -30.86 | 0.0471 | -0.0164 | |||||

| US36258RBC60 / GS Mortgage Securities Trust, Series 2020-GC47, Class XA | 0.39 | -3.69 | 0.0470 | 0.0016 | |||||

| US862121AA88 / STORE Capital Corp | 0.39 | 1.31 | 0.0466 | 0.0036 | |||||

| US12434LAA26 / BXMT 2020-FL2 A | 0.38 | -9.26 | 0.0458 | -0.0013 | |||||

| US92928QAH11 / WEA Finance LLC | 0.38 | 1.88 | 0.0455 | 0.0038 | |||||

| US61692CBK36 / Morgan Stanley Capital I Inc | 0.38 | -3.56 | 0.0455 | 0.0015 | |||||

| US05551VBK89 / BBCMS Trust | 0.37 | -4.15 | 0.0445 | 0.0012 | |||||

| US12530MAA36 / CF Hippolyta LLC, Series 2020-1, Class A1 | 0.35 | 0.57 | 0.0424 | 0.0031 | |||||

| Fannie Mae Connecticut Avenue Securities / ABS-MBS (US20754TAB89) | 0.35 | 0.0424 | 0.0424 | ||||||

| US09951LAB99 / Booz Allen Hamilton Inc | 0.35 | 0.0421 | 0.0421 | ||||||

| US61691RAF38 / Morgan Stanley Capital I Trust 2018-H4 | 0.35 | -7.16 | 0.0421 | -0.0002 | |||||

| US95003QBC24 / Wells Fargo Commercial Mortgage Trust 2021-C61 | 0.34 | -2.56 | 0.0410 | 0.0017 | |||||

| US06542BBN64 / BANK 2021-BNK32 | 0.34 | -4.78 | 0.0408 | 0.0009 | |||||

| US05602CAE49 / BSPRT 2021-FL7 Issuer Ltd | 0.34 | 0.00 | 0.0404 | 0.0028 | |||||

| STZB34 / Constellation Brands, Inc. - Depositary Receipt (Common Stock) | 0.34 | 0.0402 | 0.0402 | ||||||

| US03880KAG94 / Arbor Realty Commercial Real Estate Notes 2021-FL3 Ltd | 0.33 | -0.61 | 0.0393 | 0.0025 | |||||

| US3137BNPS76 / Freddie Mac REMICS | 0.32 | -1.52 | 0.0390 | 0.0022 | |||||

| US04033GAB32 / ARI Fleet Lease Trust 2023-B | 0.32 | -16.93 | 0.0383 | -0.0047 | |||||

| US57563RQZ54 / Massachusetts Educational Financing Authority | 0.31 | 0.65 | 0.0370 | 0.0027 | |||||

| LAD Auto Receivables Trust 2024-2 / ABS-O (US505920AB44) | 0.31 | -45.44 | 0.0366 | -0.0259 | |||||

| US3137AV5K91 / Freddie Mac REMICS | 0.29 | -1.71 | 0.0345 | 0.0017 | |||||

| US06540CBL00 / BANK 2021-BNK35 | 0.28 | -2.80 | 0.0334 | 0.0014 | |||||

| US446150BB90 / Huntington Bancshares Inc/OH | 0.25 | 0.40 | 0.0303 | 0.0022 | |||||

| US57563RQY89 / Massachusetts Educational Financing Authority | 0.25 | 0.81 | 0.0299 | 0.0022 | |||||

| US06540VBC81 / BANK 2019-BNK24 | 0.23 | -3.73 | 0.0279 | 0.0009 | |||||

| US030288AC89 / American Transmission Systems Inc | 0.22 | 0.0263 | 0.0263 | ||||||

| Long: TR11626 TRS USD R E TR11626R / Short: TR11626 TRS USD P V 03MTBILL TR11626P/USB3MTA+12.00BPS / DCO (000000000) | 0.22 | 0.0259 | 0.0259 | ||||||

| Long: SM11592 IRS USD R F 4.66400 SM11592_FIX CCPOIS / Short: SM11592 IRS USD P V 12MSOFR SM11592_FLO CCPOIS / DIR (000000000) | 0.21 | 0.0256 | 0.0256 | ||||||

| US36254CAX83 / GS MORTGAGE SECURITIES TRUST 2017-GS7 SER 2017-GS7 CL XA V/R REGD 1.27778700 | 0.19 | -11.68 | 0.0227 | -0.0012 | |||||

| US251526CS67 / Deutsche Bank AG/New York NY | 0.18 | 0.57 | 0.0213 | 0.0016 | |||||

| US34706CAA71 / FORT CRE 2022-FL3 ISSUER LLC SER 2022-FL3 CL A V/R REGD 144A P/P 1.90000000 | 0.17 | -49.40 | 0.0203 | -0.0171 | |||||

| OBX 2024-NQM1 Trust / ABS-MBS (US67448LAB80) | 0.17 | -6.15 | 0.0202 | 0.0001 | |||||

| US12515DAS36 / CD 2017-CD4 Mortgage Trust | 0.17 | -13.16 | 0.0198 | -0.0015 | |||||

| US39154TCB26 / GreatAmerica Leasing Receivables | 0.16 | -44.52 | 0.0195 | -0.0133 | |||||

| US465968AG07 / JPMCC COMMERCIAL MORTGAGE SECURITIES TRUST 2017-JP JPMCC 2017-JP7 XA | 0.16 | -11.24 | 0.0189 | -0.0010 | |||||

| US90278KBB61 / UBS Commercial Mortgage Trust, Series 2018-C14, Class XA | 0.16 | -6.06 | 0.0186 | 0.0001 | |||||

| US36253PAE25 / GS MORTGAGE SECURITIES TRUST 2017-GS6 SER 2017-GS6 CL XA V/R REGD 1.18867500 | 0.15 | -13.56 | 0.0184 | -0.0014 | |||||

| US442851AG63 / Howard University | 0.15 | 0.00 | 0.0180 | 0.0013 | |||||

| US61767CAW82 / Morgan Stanley Bank of America Merrill Lynch Trust, Series 2017-C33, Class XA | 0.14 | -13.75 | 0.0166 | -0.0013 | |||||

| US12530MAC91 / CF Hippolyta LLC, Series 2020-1, Class B1 | 0.11 | 0.91 | 0.0134 | 0.0010 | |||||

| US12508GAV86 / CCUBS Commercial Mortgage Trust 2017-C1 | 0.11 | -11.48 | 0.0130 | -0.0007 | |||||

| US3138ERQS28 / Fannie Mae Pool | 0.11 | -4.42 | 0.0130 | 0.0003 | |||||

| US501687AA54 / LAD Auto Receivables Trust 2022-1 | 0.10 | -39.64 | 0.0124 | -0.0066 | |||||

| Business Jet Securities 2024-1 LLC / ABS-O (US12327CAB00) | 0.10 | -4.72 | 0.0122 | 0.0003 | |||||

| US 2YR NOTE (CBT) JUN25 / DIR (000000000) | 0.08 | 0.0102 | 0.0102 | ||||||

| US61691JAW45 / MORGAN STANLEY CAPITAL I TRUST 2017-H1 SER 2017-H1 CL XA V/R REGD 1.59467800 | 0.07 | -8.45 | 0.0078 | -0.0001 | |||||

| US3138ERQU73 / Fannie Mae Pool | 0.05 | -1.85 | 0.0064 | 0.0003 | |||||

| US59447TH891 / Michigan Finance Authority | 0.04 | 0.00 | 0.0054 | 0.0004 | |||||

| American Credit Acceptance Receivables Trust 2024-1 / ABS-O (US02531AAA97) | 0.01 | -93.10 | 0.0014 | -0.0181 | |||||

| US3128PRZ513 / FHLMC | 0.00 | -100.00 | 0.0001 | -0.0001 | |||||

| US3128PRZ695 / FHLMC | 0.00 | 0.0001 | -0.0000 | ||||||

| US3128PR3E70 / FHLMC | 0.00 | -100.00 | 0.0001 | -0.0001 | |||||

| US3128PR3G29 / FHLMC | 0.00 | 0.0000 | -0.0001 | ||||||

| US31418TKF39 / UMBS | 0.00 | -100.00 | 0.0000 | -0.0001 | |||||

| Long: TR11721 TRS USD R E TR11721R / Short: TR11721 TRS USD P V 03MTBILL TR11721P/USB3MTA+14.00BPS / DCO (000000000) | -0.10 | -0.0118 | -0.0118 | ||||||

| Long: TR11691 TRS USD R V 03MTBILL TR11691R/USB3MTA-5.00BPS / Short: TR11691 TRS USD P E TR11691P / DCO (000000000) | -0.48 | -0.0570 | -0.0570 | ||||||

| Long: TR11750 TRS USD R E TR11750R / Short: TR11750 TRS USD P V 03MTBILL TR11750P/USB3MTA + 7.00 BP / DCO (000000000) | -0.49 | -0.0593 | -0.0593 | ||||||

| DE000C4SA6R6 / EURO STOXX 50 Index | -0.55 | -0.0663 | -0.0663 | ||||||

| Long: TR11737 TRS USD R E TR11737R / Short: TR11737 TRS USD P V 03MTBILL TR11737P/USB3MTA+11.00BPS / DCO (000000000) | -0.57 | -0.0688 | -0.0688 | ||||||

| DE000C4SA6R6 / EURO STOXX 50 Index | -0.74 | -0.0891 | -0.0891 | ||||||

| Long: TR11753 TRS USD R E TR11753R / Short: TR11753 TRS USD P V 03MTBILL TR11753P/USB3MTA+11.00BPS / DCO (000000000) | -0.92 | -0.1105 | -0.1105 | ||||||

| Long: TR11585 TRS USD R E TR11585R / Short: TR11585 TRS USD P V 03MTBILL TR11585P/USB3MTA+7BPS / DCO (000000000) | -1.37 | -0.1643 | -0.1643 | ||||||

| Long: TR11703 TRS USD R V 03MTBILL TR11703P/USB3MTA-4.00BPS / Short: TR11703 TRS USD P E TR11703R / DCO (000000000) | -1.38 | -0.1652 | -0.1652 | ||||||

| Long: TR11624 TRS USD R E TR11624R / Short: TR11624 TRS USD P V 03MTBILL TR11624P/USB3MTA+6.50BPS / DCO (000000000) | -1.40 | -0.1674 | -0.1674 | ||||||

| Long: TR11735 TRS USD R E TR11735R / Short: TR11735 TRS USD P V 03MTBILL TR11735P/USB3MTA+6.50BPS / DCO (000000000) | -1.51 | -0.1808 | -0.1808 | ||||||

| Long: TR11652 TRS USD R E TR11652R / Short: TR11652 TRS USD P V 03MTBILL TR11652P/USB3MTA+6.50BPS / DCO (000000000) | -1.58 | -0.1895 | -0.1895 | ||||||

| Long: TR11690 TRS USD R E TR11690R / Short: TR11690 TRS USD P V 03MTBILL TR11690P/USB3MTA+6.50BPS / DCO (000000000) | -1.63 | -0.1950 | -0.1950 | ||||||

| Long: TR11738 TRS USD R E TR11738R / Short: TR11738 TRS USD P V 03MTBILL TR11738P/USB3MTA+10.00BPS / DCO (000000000) | -1.72 | -0.2065 | -0.2065 | ||||||

| Long: TR11739 TRS USD R E TR11739R / Short: TR11739 TRS USD P V 03MTBILL TR11739P/USB3MTA+11.00BPS / DCO (000000000) | -1.72 | -0.2065 | -0.2065 | ||||||

| Long: TR11692 TRS USD R E TR11692R / Short: TR11692 TRS USD P V 03MTBILL TR11692P/USB3MTA+4.00BPS / DCO (000000000) | -1.73 | -0.2076 | -0.2076 | ||||||

| Long: TR11659 TRS USD R E TR11659R / Short: TR11659 TRS USD P V 03MTBILL TR11659P/USB3MTA+7.00BPS / DCO (000000000) | -1.92 | -0.2301 | -0.2301 | ||||||

| DE000C4SA6R6 / EURO STOXX 50 Index | -2.17 | -0.2597 | -0.2597 | ||||||

| Long: TR11653 TRS USD R E TR11653R / Short: TR11653 TRS USD P V 03MTBILL TR11653P/USB3MTA+9.00BPS / DCO (000000000) | -2.24 | -0.2689 | -0.2689 | ||||||

| DE000C4SA6R6 / EURO STOXX 50 Index | -2.24 | -0.2689 | -0.2689 | ||||||

| Long: TR11655 TRS USD R E TR11655R / Short: TR11655 TRS USD P V 03MTBILL TR11655P/USB3MTA+8.90BPS / DCO (000000000) | -2.35 | -0.2823 | -0.2823 | ||||||

| Long: TR11630 TRS USD R E TR11630R / Short: TR11630 TRS USD P V 03MTBILL TR11630P/USB3MTA+9.00BPS / DCO (000000000) | -5.10 | -0.6119 | -0.6119 | ||||||

| Long: TR11674 TRS USD R E TR11674R / Short: TR11674 TRS USD P V 03MTBILL TR11674P/USB3MTA+11.00BPS / DCO (000000000) | -5.86 | -0.7027 | -0.7027 | ||||||

| Long: TR11704 TRS USD R E TR11704P / Short: TR11704 TRS USD P V 03MTBILL TR11704R/USB3MTA+13.00BPS / DCO (000000000) | -6.30 | -0.7558 | -0.7558 |