Mga Batayang Estadistika

| Nilai Portofolio | $ 1,459,888,752 |

| Posisi Saat Ini | 88 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

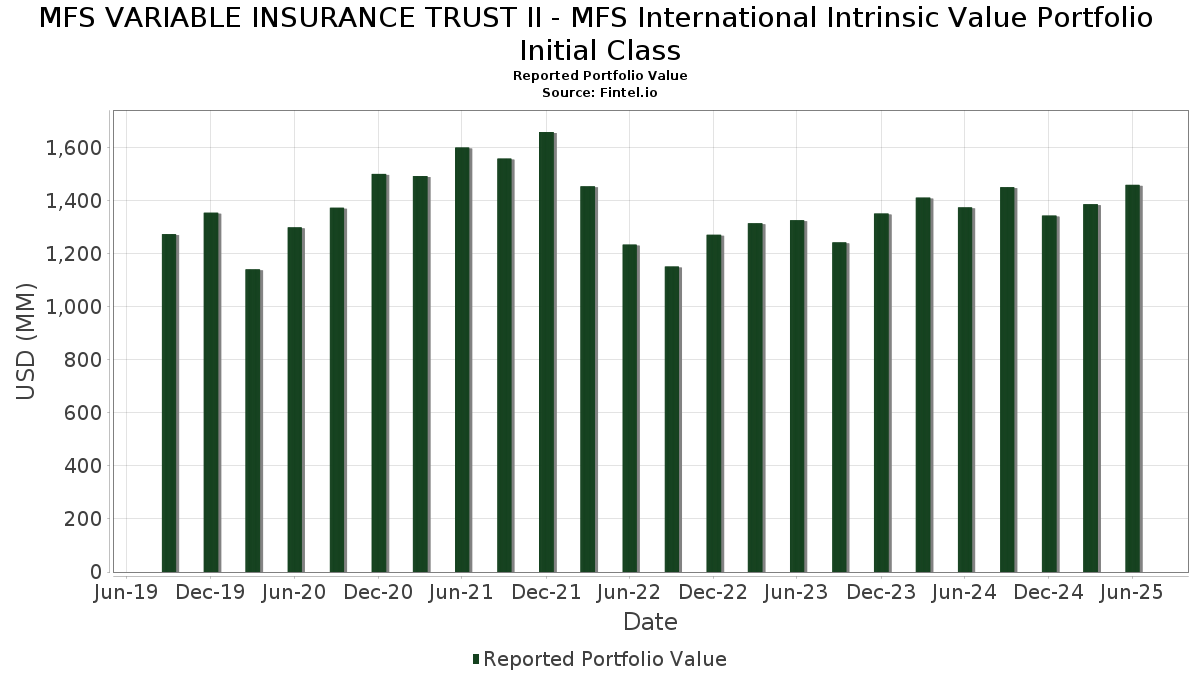

MFS VARIABLE INSURANCE TRUST II - MFS International Intrinsic Value Portfolio Initial Class telah mengungkapkan total kepemilikan 88 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 1,459,888,752 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama MFS VARIABLE INSURANCE TRUST II - MFS International Intrinsic Value Portfolio Initial Class adalah Franco-Nevada Corporation (US:FNV) , Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) (US:TSM) , NatWest Group plc (DE:RYSD) , Legrand SA (FR:LR) , and Schneider Electric S.E. - Depositary Receipt (Common Stock) (US:SBGSY) . Posisi baru MFS VARIABLE INSURANCE TRUST II - MFS International Intrinsic Value Portfolio Initial Class meliputi: ASSA ABLOY AB (publ) (DE:ALZC) , Alcon Inc. (CH:ALC) , BPER Banca SpA (IT:BPE) , Northern Star Resources Limited (AU:NST) , and JPMorgan Trust II - JPMorgan U.S. Government Money Market Fund IM (US:MGMXX) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.54 | 16.99 | 1.1583 | 1.1583 | |

| 0.12 | 10.20 | 0.6952 | 0.6952 | |

| 0.22 | 49.33 | 3.3630 | 0.6503 | |

| 0.83 | 7.58 | 0.5167 | 0.5167 | |

| 0.33 | 43.46 | 2.9624 | 0.3793 | |

| 26.25 | 26.25 | 1.7896 | 0.3576 | |

| 0.36 | 4.41 | 0.3004 | 0.3004 | |

| 0.32 | 17.66 | 1.2042 | 0.2964 | |

| 0.29 | 16.90 | 1.1523 | 0.2376 | |

| 0.16 | 42.03 | 2.8655 | 0.1711 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.09 | 5.71 | 0.3890 | -0.3962 | |

| 0.61 | 37.47 | 2.5545 | -0.3521 | |

| 0.08 | 5.41 | 0.3686 | -0.3181 | |

| 0.30 | 49.56 | 3.3783 | -0.3073 | |

| 0.72 | 11.13 | 0.7590 | -0.3058 | |

| 0.09 | 15.03 | 1.0248 | -0.2786 | |

| 0.08 | 21.23 | 1.4471 | -0.2431 | |

| 0.03 | 9.16 | 0.6247 | -0.1949 | |

| 0.12 | 37.74 | 2.5726 | -0.1821 | |

| 0.08 | 25.61 | 1.7460 | -0.1586 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-25 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| FNV / Franco-Nevada Corporation | 0.30 | -7.69 | 49.56 | -3.64 | 3.3783 | -0.3073 | |||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 0.22 | -4.48 | 49.33 | 30.33 | 3.3630 | 0.6503 | |||

| RYSD / NatWest Group plc | 6.45 | -8.79 | 45.31 | 9.28 | 3.0889 | 0.1174 | |||

| LR / Legrand SA | 0.33 | -4.52 | 43.46 | 20.56 | 2.9624 | 0.3793 | |||

| SBGSY / Schneider Electric S.E. - Depositary Receipt (Common Stock) | 0.16 | -2.70 | 42.03 | 11.80 | 2.8655 | 0.1711 | |||

| CABK / CaixaBank, S.A. | 4.53 | -9.49 | 39.21 | 0.74 | 2.6732 | -0.1163 | |||

| A5G / AIB Group plc | 4.62 | -11.62 | 38.03 | 12.02 | 2.5928 | 0.1596 | |||

| DB1 / Deutsche Börse AG | 0.12 | -11.29 | 37.74 | -1.82 | 2.5726 | -0.1821 | |||

| FP / TotalEnergies SE | 0.61 | -2.70 | 37.47 | -7.61 | 2.5545 | -0.3521 | |||

| 8308 / Resona Holdings, Inc. | 3.78 | -2.70 | 34.99 | 3.98 | 2.3851 | -0.0262 | |||

| SAP / SAP SE | 0.11 | -2.70 | 33.79 | 11.44 | 2.3034 | 0.1306 | |||

| HLN / Haleon plc - Depositary Receipt (Common Stock) | 5.76 | 1.95 | 29.61 | 3.51 | 2.0182 | -0.0314 | |||

| 6503 / Mitsubishi Electric Corporation | 1.37 | -5.27 | 29.54 | 12.08 | 2.0140 | 0.1250 | |||

| US55291X1090 / MFS Institutional Money Market Portfolio | 26.25 | 31.38 | 26.25 | 31.37 | 1.7896 | 0.3576 | |||

| GOB / Compagnie de Saint-Gobain S.A. | 0.22 | -12.96 | 25.84 | 2.78 | 1.7613 | -0.0402 | |||

| ROG / Roche Holding AG | 0.08 | -2.70 | 25.61 | -3.63 | 1.7460 | -0.1586 | |||

| BIRG / Bank of Ireland Group plc | 1.74 | -8.37 | 24.76 | 10.22 | 1.6878 | 0.0781 | |||

| ENX / Euronext N.V. | 0.14 | -8.25 | 24.65 | 8.28 | 1.6802 | 0.0489 | |||

| 005930 / Samsung Electronics Co., Ltd. | 0.54 | -2.70 | 23.95 | 8.87 | 1.6328 | 0.0561 | |||

| UBSG / UBS Group AG | 0.70 | 4.77 | 23.76 | 15.70 | 1.6199 | 0.1481 | |||

| WPM / Wheaton Precious Metals Corp. | 0.26 | -2.70 | 23.70 | 12.76 | 1.6158 | 0.1094 | |||

| IMI / IMI plc - Depositary Receipt (Common Stock) | 0.81 | -5.79 | 23.23 | 10.11 | 1.5836 | 0.0716 | |||

| AMS / Amadeus IT Group, S.A. | 0.27 | 3.32 | 22.70 | 13.52 | 1.5477 | 0.1145 | |||

| EXPN / Experian plc | 0.44 | -2.70 | 22.45 | 8.12 | 1.5305 | 0.0424 | |||

| LSEG / London Stock Exchange Group plc | 0.15 | -2.70 | 22.23 | -4.21 | 1.5157 | -0.1478 | |||

| EL / EssilorLuxottica Société anonyme | 0.08 | -5.62 | 21.23 | -10.00 | 1.4471 | -0.2431 | |||

| AEM / Agnico Eagle Mines Limited | 0.17 | -2.70 | 20.10 | 7.00 | 1.3703 | 0.0240 | |||

| 2875 / Toyo Suisan Kaisha, Ltd. | 0.29 | -2.68 | 19.30 | 10.03 | 1.3159 | 0.0586 | |||

| CRH / CRH plc | 0.20 | -2.70 | 18.80 | 1.53 | 1.2813 | -0.0453 | |||

| SDZ / Sandoz Group AG | 0.32 | 7.19 | 17.66 | 39.46 | 1.2042 | 0.2964 | |||

| A / Agilent Technologies, Inc. | 0.15 | -2.70 | 17.11 | -1.84 | 1.1667 | -0.0829 | |||

| DSY / Dassault Systèmes SE - Depositary Receipt (Common Stock) | 0.47 | 20.48 | 17.10 | 14.45 | 1.1657 | 0.0949 | |||

| ALZC / ASSA ABLOY AB (publ) | 0.54 | 16.99 | 1.1583 | 1.1583 | |||||

| RYAAY / Ryanair Holdings plc - Depositary Receipt (Common Stock) | 0.29 | -2.70 | 16.90 | 32.43 | 1.1523 | 0.2376 | |||

| WTY / Willis Towers Watson Public Limited Company | 0.06 | 6.15 | 16.90 | -3.73 | 1.1522 | -0.1060 | |||

| KVUE / Kenvue Inc. | 0.80 | 15.46 | 16.83 | 0.77 | 1.1473 | -0.0495 | |||

| DGE / Diageo plc | 0.67 | -2.70 | 16.70 | -6.41 | 1.1382 | -0.1403 | |||

| CAP / Capgemini SE | 0.09 | -2.70 | 15.86 | 11.18 | 1.0814 | 0.0588 | |||

| 7701 / Shimadzu Corporation | 0.64 | -2.70 | 15.75 | -3.50 | 1.0739 | -0.0960 | |||

| LLOY / Lloyds Banking Group plc | 14.91 | -2.70 | 15.70 | 9.49 | 1.0700 | 0.0427 | |||

| WTKWY / Wolters Kluwer N.V. - Depositary Receipt (Common Stock) | 0.09 | -23.27 | 15.03 | -17.35 | 1.0248 | -0.2786 | |||

| SN. / Smith & Nephew plc | 0.96 | -2.70 | 14.65 | 5.69 | 0.9990 | 0.0053 | |||

| GLEN / Glencore plc | 3.67 | -2.70 | 14.29 | 2.96 | 0.9739 | -0.0204 | |||

| RI / Pernod Ricard SA | 0.14 | -2.70 | 14.14 | -2.38 | 0.9642 | -0.0742 | |||

| ARC / Aker BP ASA | 0.51 | -2.70 | 13.06 | 4.94 | 0.8900 | -0.0016 | |||

| TKK1 / Taisei Corporation | 0.22 | -2.72 | 12.93 | 28.22 | 0.8816 | 0.1588 | |||

| 8331 / The Chiba Bank, Ltd. | 1.33 | -2.70 | 12.34 | -3.97 | 0.8411 | -0.0797 | |||

| WDS / Woodside Energy Group Ltd | 0.72 | -30.29 | 11.13 | -25.07 | 0.7590 | -0.3058 | |||

| ETE / Ekotechnika AG | 0.87 | 4.10 | 11.07 | 29.98 | 0.7549 | 0.1443 | |||

| BEI / Beiersdorf Aktiengesellschaft | 0.09 | 12.58 | 10.84 | 9.20 | 0.7388 | 0.0276 | |||

| KBX / Knorr-Bremse AG | 0.11 | -2.70 | 10.61 | 3.80 | 0.7232 | -0.0092 | |||

| 4YC / M3, Inc. | 0.76 | -2.70 | 10.45 | 17.16 | 0.7122 | 0.0732 | |||

| ALC / Alcon Inc. | 0.12 | 10.20 | 0.6952 | 0.6952 | |||||

| ASML / ASML Holding N.V. | 0.01 | -2.71 | 10.10 | 17.37 | 0.6888 | 0.0718 | |||

| 4307 / Nomura Research Institute, Ltd. | 0.25 | -15.79 | 9.92 | 4.21 | 0.6759 | -0.0060 | |||

| SY1 / Symrise AG | 0.09 | -2.70 | 9.91 | -1.27 | 0.6758 | -0.0438 | |||

| BAER / Julius Bär Gruppe AG | 0.14 | -2.70 | 9.48 | -4.77 | 0.6461 | -0.0672 | |||

| 4527 / Rohto Pharmaceutical Co.,Ltd. | 0.66 | -2.69 | 9.40 | -7.33 | 0.6409 | -0.0861 | |||

| WAT / Waters Corporation | 0.03 | -2.70 | 9.35 | -7.86 | 0.6377 | -0.0899 | |||

| SCHP / Schindler Holding AG - Preferred Stock | 0.03 | -21.00 | 9.32 | -5.99 | 0.6356 | -0.0751 | |||

| 000810 / Samsung Fire & Marine Insurance Co., Ltd. | 0.03 | -2.70 | 9.31 | 27.93 | 0.6345 | 0.1131 | |||

| CDNS / Cadence Design Systems, Inc. | 0.03 | -33.87 | 9.16 | -19.88 | 0.6247 | -0.1949 | |||

| ND5 / Nitto Denko Corporation | 0.47 | -2.71 | 9.12 | 2.32 | 0.6216 | -0.0170 | |||

| RKT / Reckitt Benckiser Group plc | 0.13 | 14.69 | 8.70 | 15.46 | 0.5931 | 0.0531 | |||

| HRO / Hirose Electric Co.,Ltd. | 0.07 | -2.74 | 8.61 | 1.61 | 0.5869 | -0.0204 | |||

| H2X3 / Hiscox Ltd | 0.49 | -2.70 | 8.48 | 10.33 | 0.5784 | 0.0273 | |||

| TEN / Tenaris S.A. | 0.43 | 31.93 | 8.00 | 27.13 | 0.5457 | 0.0944 | |||

| SIKA / Sika AG | 0.03 | -2.70 | 7.69 | 9.04 | 0.5240 | 0.0188 | |||

| BPE / BPER Banca SpA | 0.83 | 7.58 | 0.5167 | 0.5167 | |||||

| GALP / Galp Energia, SGPS, S.A. | 0.40 | -2.70 | 7.27 | 1.48 | 0.4954 | -0.0178 | |||

| NICE / NICE Ltd. - Depositary Receipt (Common Stock) | 0.04 | -12.03 | 6.96 | -3.63 | 0.4743 | -0.0431 | |||

| CFR / Compagnie Financière Richemont SA | 0.04 | -2.70 | 6.91 | 4.94 | 0.4709 | -0.0008 | |||

| 3AD1 / Epiroc AB (publ) | 0.31 | -26.69 | 6.70 | -21.20 | 0.4569 | -0.1526 | |||

| SCA / Svenska Cellulosa Aktiebolaget SCA (publ) | 0.49 | -2.70 | 6.41 | -4.04 | 0.4372 | -0.0417 | |||

| PBR.A / Petróleo Brasileiro S.A. - Petrobras - Depositary Receipt (Common Stock) | 0.51 | -2.70 | 5.92 | -13.89 | 0.4035 | -0.0891 | |||

| OLY1 / Olympus Corporation | 0.49 | -2.69 | 5.90 | -11.76 | 0.4019 | -0.0770 | |||

| LISP / Chocoladefabriken Lindt & Sprüngli AG - Preferred Stock | 0.00 | -2.52 | 5.86 | 21.52 | 0.3992 | 0.0539 | |||

| ITRK / Intertek Group plc | 0.09 | -48.17 | 5.71 | -47.93 | 0.3890 | -0.3962 | |||

| G1A / GEA Group Aktiengesellschaft | 0.08 | -51.21 | 5.41 | -43.58 | 0.3686 | -0.3181 | |||

| 5EJ / Ezaki Glico Co., Ltd. | 0.17 | -13.75 | 5.34 | -10.34 | 0.3640 | -0.0628 | |||

| 1LNB / Spirax Group plc | 0.07 | -2.70 | 5.31 | -1.25 | 0.3623 | -0.0234 | |||

| NST / Northern Star Resources Limited | 0.36 | 4.41 | 0.3004 | 0.3004 | |||||

| MC / LVMH Moët Hennessy - Louis Vuitton, Société Européenne | 0.01 | -2.71 | 3.97 | -18.40 | 0.2707 | -0.0780 | |||

| 6CMB / Croda International Plc | 0.09 | -2.70 | 3.48 | 3.02 | 0.2371 | -0.0048 | |||

| NZM2 / Novozymes A/S | 0.04 | -2.70 | 3.22 | 19.68 | 0.2198 | 0.0268 | |||

| MGMXX / JPMorgan Trust II - JPMorgan U.S. Government Money Market Fund IM | 1.68 | 1.68 | 0.1142 | 0.1142 | |||||

| 4912 / Lion Corporation | 0.12 | -22.93 | 1.26 | -32.85 | 0.0858 | -0.0486 | |||

| 4922 / KOSÉ Corporation | 0.03 | -2.92 | 1.18 | -7.99 | 0.0802 | -0.0114 |