Mga Batayang Estadistika

| Nilai Portofolio | $ 1,113,642,849 |

| Posisi Saat Ini | 72 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

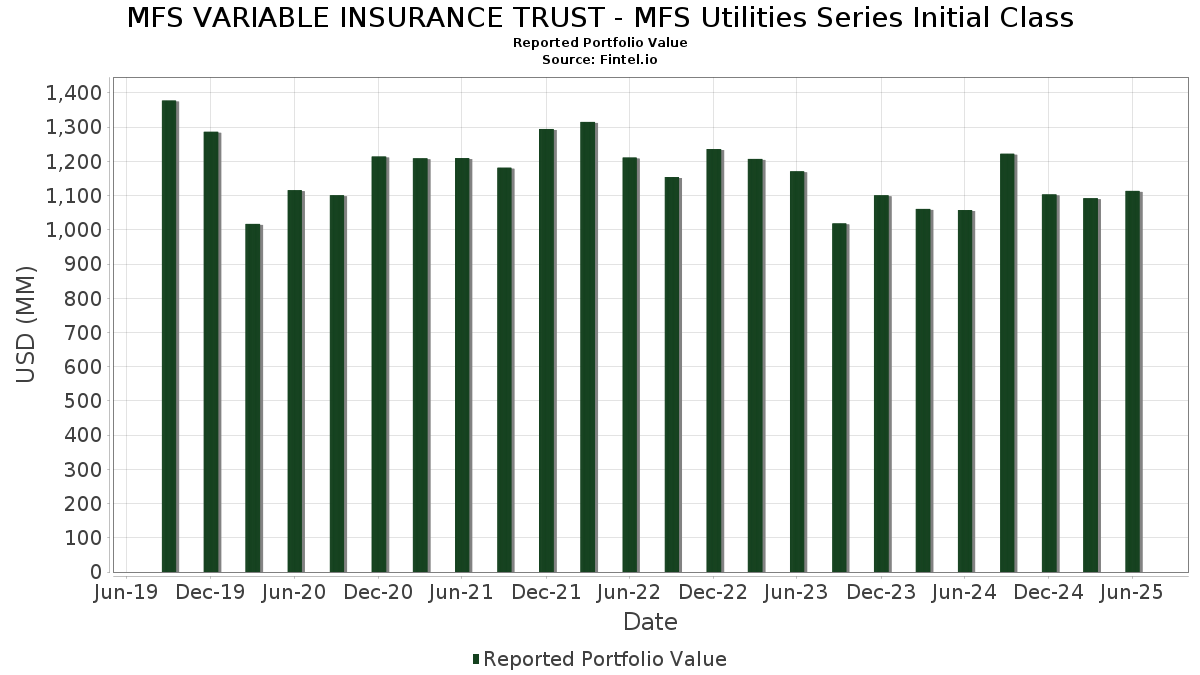

MFS VARIABLE INSURANCE TRUST - MFS Utilities Series Initial Class telah mengungkapkan total kepemilikan 72 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 1,113,642,849 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama MFS VARIABLE INSURANCE TRUST - MFS Utilities Series Initial Class adalah NextEra Energy, Inc. (US:NEE) , Constellation Energy Corporation (US:CEG) , PG&E Corporation (US:PCG) , Vistra Corp. (US:VST) , and Xcel Energy Inc. (US:XEL) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.28 | 90.89 | 8.0861 | 2.8612 | |

| 0.29 | 56.98 | 5.0692 | 1.8459 | |

| 0.33 | 27.71 | 2.4655 | 0.6845 | |

| 2.02 | 22.59 | 2.0095 | 0.3899 | |

| 0.99 | 41.44 | 3.6873 | 0.2875 | |

| 3.31 | 14.36 | 1.2772 | 0.2326 | |

| 1.09 | 27.37 | 2.4350 | 0.2253 | |

| 0.81 | 12.70 | 1.1302 | 0.1990 | |

| 0.65 | 49.31 | 4.3869 | 0.1969 | |

| 0.49 | 29.88 | 2.6586 | 0.1549 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 4.24 | 59.17 | 5.2642 | -1.2800 | |

| 0.99 | 14.46 | 1.2867 | -0.8089 | |

| 0.13 | 0.13 | 0.0113 | -0.6516 | |

| 0.10 | 24.55 | 2.1838 | -0.5965 | |

| 0.62 | 32.14 | 2.8592 | -0.5461 | |

| 0.74 | 41.98 | 3.7354 | -0.5239 | |

| 1.11 | 37.49 | 3.3359 | -0.4164 | |

| 0.39 | 51.23 | 4.5580 | -0.3979 | |

| 0.51 | 19.94 | 1.7739 | -0.3393 | |

| 0.43 | 41.11 | 3.6574 | -0.3381 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-25 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| NEE / NextEra Energy, Inc. | 1.71 | 1.69 | 119.05 | -0.42 | 10.5916 | -0.3185 | |||

| CEG / Constellation Energy Corporation | 0.28 | -0.83 | 90.89 | 58.74 | 8.0861 | 2.8612 | |||

| PCG / PG&E Corporation | 4.24 | 1.69 | 59.17 | -17.49 | 5.2642 | -1.2800 | |||

| VST / Vistra Corp. | 0.29 | -2.25 | 56.98 | 61.31 | 5.0692 | 1.8459 | |||

| XEL / Xcel Energy Inc. | 0.82 | 1.69 | 55.64 | -2.18 | 4.9505 | -0.2403 | |||

| DTE / DTE Energy Company | 0.39 | -1.53 | 51.23 | -5.66 | 4.5580 | -0.3979 | |||

| SRE / Sempra | 0.65 | 1.14 | 49.31 | 7.39 | 4.3869 | 0.1969 | |||

| SO / The Southern Company | 0.48 | -2.25 | 44.42 | -2.38 | 3.9518 | -0.2004 | |||

| D / Dominion Energy, Inc. | 0.74 | -10.76 | 41.98 | -10.05 | 3.7354 | -0.5239 | |||

| AEP / American Electric Power Company, Inc. | 0.40 | 7.22 | 41.84 | 1.82 | 3.7227 | -0.0276 | |||

| RWE / RWE Aktiengesellschaft | 0.99 | -4.83 | 41.44 | 11.25 | 3.6873 | 0.2875 | |||

| AEE / Ameren Corporation | 0.43 | -1.85 | 41.11 | -6.11 | 3.6574 | -0.3381 | |||

| PPL / PPL Corporation | 1.11 | -2.84 | 37.49 | -8.81 | 3.3359 | -0.4164 | |||

| EIX / Edison International | 0.62 | -1.66 | 32.14 | -13.88 | 2.8592 | -0.5461 | |||

| LNT / Alliant Energy Corporation | 0.49 | 15.90 | 29.88 | 8.92 | 2.6586 | 0.1549 | |||

| PEG / Public Service Enterprise Group Incorporated | 0.33 | 38.82 | 27.71 | 41.99 | 2.4655 | 0.6845 | |||

| SSEZY / SSE plc - Depositary Receipt (Common Stock) | 1.09 | -7.40 | 27.37 | 13.03 | 2.4350 | 0.2253 | |||

| ENEL / Enel SpA | 2.86 | -22.95 | 27.11 | -9.80 | 2.4121 | -0.3308 | |||

| SBAC / SBA Communications Corporation | 0.10 | -24.52 | 24.55 | -19.43 | 2.1838 | -0.5965 | |||

| ATO / Atmos Energy Corporation | 0.16 | -1.31 | 24.31 | -1.61 | 2.1627 | -0.0919 | |||

| EDPR / EDP Renováveis, S.A. | 2.02 | -4.94 | 22.59 | 27.27 | 2.0095 | 0.3899 | |||

| PNW / Pinnacle West Capital Corporation | 0.23 | -2.25 | 20.33 | -8.18 | 1.8088 | -0.2119 | |||

| CLNX / Cellnex Telecom, S.A. | 0.51 | -21.25 | 19.94 | -13.90 | 1.7739 | -0.3393 | |||

| POR / Portland General Electric Company | 0.38 | -2.25 | 15.26 | -10.96 | 1.3579 | -0.2062 | |||

| NG. / National Grid plc | 0.99 | -43.69 | 14.46 | -37.02 | 1.2867 | -0.8089 | |||

| EDP / EDP - Energias de Portugal, S.A. | 3.31 | -2.25 | 14.36 | 25.40 | 1.2772 | 0.2326 | |||

| UU. / United Utilities Group PLC | 0.81 | 3.62 | 12.70 | 24.49 | 1.1302 | 0.1990 | |||

| OGE / OGE Energy Corp. | 0.28 | 8.01 | 12.34 | 4.29 | 1.0981 | 0.0181 | |||

| DUK / Duke Energy Corporation | 0.10 | -1.66 | 11.65 | -4.86 | 1.0361 | -0.0809 | |||

| EOAN / E.ON SE | 0.51 | -12.80 | 9.42 | 6.33 | 0.8382 | 0.0296 | |||

| RCI / Rogers Communications Inc. | 0.29 | -2.25 | 8.55 | 8.57 | 0.7605 | 0.0420 | |||

| CNP / CenterPoint Energy, Inc. | 0.23 | -14.03 | 8.30 | -12.82 | 0.7384 | -0.1303 | |||

| HTO / Hellenic Telecommunications Organization S.A. | 0.35 | -9.57 | 6.72 | 5.84 | 0.5980 | 0.0184 | |||

| VIE / Veolia Environnement SA | 0.16 | -1.00 | 5.84 | 2.64 | 0.5196 | 0.0003 | |||

| EXC / Exelon Corporation | 0.13 | -1.66 | 5.60 | -7.34 | 0.4985 | -0.0533 | |||

| EQTL3 / Equatorial S.A. | 0.49 | -17.03 | 3.24 | -2.06 | 0.2881 | -0.0136 | |||

| SBSP3 / Companhia de Saneamento Básico do Estado de São Paulo - SABESP | 0.14 | -18.13 | 2.99 | 0.44 | 0.2661 | -0.0057 | |||

| MGMXX / JPMorgan Trust II - JPMorgan U.S. Government Money Market Fund IM | 0.92 | 6.56 | 0.92 | 6.52 | 0.0815 | 0.0031 | |||

| US55291X1090 / MFS Institutional Money Market Portfolio | 0.13 | -98.25 | 0.13 | -98.25 | 0.0113 | -0.6516 | |||

| PURCHASED GBP / SOLD USD / DFE (000000000) | 0.08 | 0.0067 | 0.0067 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0.06 | 0.0050 | 0.0050 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0.04 | 0.0039 | 0.0039 | ||||||

| PURCHASED GBP / SOLD USD / DFE (000000000) | 0.04 | 0.0038 | 0.0038 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0.03 | 0.0030 | 0.0030 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0.03 | 0.0027 | 0.0027 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0.02 | 0.0020 | 0.0020 | ||||||

| PURCHASED CAD / SOLD USD / DFE (000000000) | 0.02 | 0.0015 | 0.0015 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0.01 | 0.0013 | 0.0013 | ||||||

| PURCHASED GBP / SOLD USD / DFE (000000000) | 0.01 | 0.0012 | 0.0012 | ||||||

| BNP / BNP Paribas SA | 0.01 | 0.0011 | 0.0011 | ||||||

| BNP / BNP Paribas SA | 0.01 | 0.0011 | 0.0011 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0.01 | 0.0009 | 0.0009 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0.01 | 0.0008 | 0.0008 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | 0.01 | 0.0005 | 0.0005 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0.00 | 0.0003 | 0.0003 | ||||||

| PURCHASED GBP / SOLD USD / DFE (000000000) | 0.00 | 0.0003 | 0.0003 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0.00 | 0.0002 | 0.0002 | ||||||

| PURCHASED CAD / SOLD USD / DFE (000000000) | 0.00 | 0.0001 | 0.0001 | ||||||

| PURCHASED CAD / SOLD USD / DFE (000000000) | 0.00 | 0.0001 | 0.0001 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | 0.00 | 0.0000 | 0.0000 | ||||||

| PURCHASED USD / SOLD GBP / DFE (000000000) | -0.00 | -0.0001 | -0.0001 | ||||||

| PURCHASED USD / SOLD CAD / DFE (000000000) | -0.02 | -0.0022 | -0.0022 | ||||||

| BNP / BNP Paribas SA | -0.02 | -0.0022 | -0.0022 | ||||||

| PURCHASED USD / SOLD CAD / DFE (000000000) | -0.03 | -0.0030 | -0.0030 | ||||||

| PURCHASED USD / SOLD GBP / DFE (000000000) | -0.12 | -0.0104 | -0.0104 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -0.12 | -0.0110 | -0.0110 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -0.60 | -0.0531 | -0.0531 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0.77 | -0.0688 | -0.0688 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | -0.86 | -0.0764 | -0.0764 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -0.97 | -0.0864 | -0.0864 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -1.02 | -0.0910 | -0.0910 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -1.16 | -0.1033 | -0.1033 |