Mga Batayang Estadistika

| Nilai Portofolio | $ 314,276,056 |

| Posisi Saat Ini | 61 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

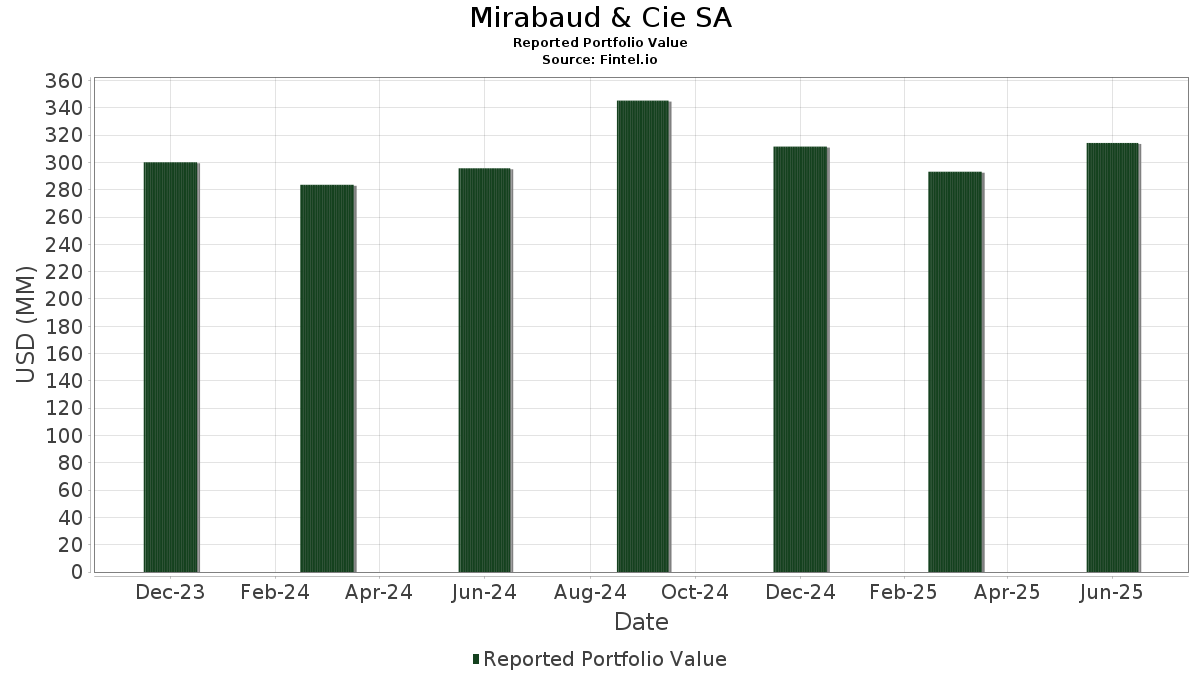

Mirabaud & Cie SA telah mengungkapkan total kepemilikan 61 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 314,276,056 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Mirabaud & Cie SA adalah Microsoft Corporation (US:MSFT) , Direxion Shares ETF Trust - Direxion Daily NVDA Bear 1X Shares (US:NVDD) , Apple Inc. (US:AAPL) , iShares Trust - iShares 7-10 Year Treasury Bond ETF (US:IEF) , and iShares Trust - iShares 3-7 Year Treasury Bond ETF (US:IEI) . Posisi baru Mirabaud & Cie SA meliputi: The Coca-Cola Company (US:KO) , Republic Services, Inc. (US:RSG) , IonQ, Inc. (US:IONQ) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.25 | 38.95 | 12.3931 | 2.8394 | |

| 0.09 | 42.55 | 13.5381 | 2.1583 | |

| 0.02 | 13.62 | 4.3347 | 1.8241 | |

| 0.01 | 9.62 | 3.0621 | 1.4601 | |

| 0.01 | 2.61 | 0.8302 | 0.7319 | |

| 0.03 | 2.01 | 0.6390 | 0.6390 | |

| 0.02 | 3.24 | 1.0295 | 0.6296 | |

| 0.01 | 1.72 | 0.5477 | 0.5477 | |

| 0.01 | 1.83 | 0.5809 | 0.4944 | |

| 0.09 | 4.52 | 1.4394 | 0.3168 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.07 | 14.52 | 4.6195 | -1.8810 | |

| 0.11 | 23.24 | 7.3962 | -1.7239 | |

| 0.00 | 0.53 | 0.1686 | -1.0737 | |

| 0.05 | 3.42 | 1.0885 | -1.0446 | |

| 0.03 | 3.85 | 1.2250 | -0.7334 | |

| 0.01 | 3.92 | 1.2459 | -0.6720 | |

| 0.05 | 9.51 | 3.0246 | -0.5688 | |

| 0.20 | 18.91 | 6.0162 | -0.4474 | |

| 0.03 | 10.66 | 3.3911 | -0.1611 | |

| 0.01 | 2.27 | 0.7220 | -0.1585 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-07-08 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MSFT / Microsoft Corporation | 0.09 | -3.77 | 42.55 | 27.51 | 13.5381 | 2.1583 | |||

| NVDD / Direxion Shares ETF Trust - Direxion Daily NVDA Bear 1X Shares | 0.25 | -4.62 | 38.95 | 39.05 | 12.3931 | 2.8394 | |||

| AAPL / Apple Inc. | 0.11 | -5.89 | 23.24 | -13.07 | 7.3962 | -1.7239 | |||

| IEF / iShares Trust - iShares 7-10 Year Treasury Bond ETF | 0.20 | -0.65 | 18.91 | -0.23 | 6.0162 | -0.4474 | |||

| IEI / iShares Trust - iShares 3-7 Year Treasury Bond ETF | 0.14 | 8.37 | 17.03 | 9.25 | 5.4177 | 0.1023 | |||

| GOOG / Alphabet Inc. | 0.09 | -2.84 | 15.15 | 10.31 | 4.8208 | 0.1367 | |||

| AMZN / Amazon.com, Inc. | 0.07 | -33.94 | 14.52 | -23.83 | 4.6195 | -1.8810 | |||

| META / Meta Platforms, Inc. | 0.02 | 44.51 | 13.62 | 85.06 | 4.3347 | 1.8241 | |||

| V / Visa Inc. | 0.03 | 1.00 | 10.66 | 2.32 | 3.3911 | -0.1611 | |||

| LLY / Eli Lilly and Company | 0.01 | 117.07 | 9.62 | 104.92 | 3.0621 | 1.4601 | |||

| GOOGL / Alphabet Inc. | 0.05 | -20.83 | 9.51 | -9.79 | 3.0246 | -0.5688 | |||

| JPM / JPMorgan Chase & Co. | 0.03 | -5.60 | 9.09 | 11.57 | 2.8915 | 0.1134 | |||

| GJR / Strats Trust For Procter & Gambel Security - Preferred Security | 0.05 | 8.70 | 8.65 | 1.62 | 2.7533 | -0.1507 | |||

| EEM / iShares, Inc. - iShares MSCI Emerging Markets ETF | 0.09 | 24.50 | 4.52 | 37.44 | 1.4394 | 0.3168 | |||

| SPY / SPDR S&P 500 ETF | 0.01 | -5.32 | 3.96 | 4.62 | 1.2606 | -0.0307 | |||

| AVGO / Broadcom Inc. | 0.01 | -57.71 | 3.92 | -30.38 | 1.2459 | -0.6720 | |||

| MS / Morgan Stanley | 0.03 | -44.47 | 3.85 | -32.97 | 1.2250 | -0.7334 | |||

| MA / Mastercard Incorporated | 0.01 | 15.31 | 3.60 | 18.22 | 1.1460 | 0.1069 | |||

| WMT / Walmart Inc. | 0.04 | 6.70 | 3.44 | 18.84 | 1.0960 | 0.1075 | |||

| CSCO / Cisco Systems, Inc. | 0.05 | -51.35 | 3.42 | -45.31 | 1.0885 | -1.0446 | |||

| NFLX / Netflix, Inc. | 0.00 | -29.02 | 3.29 | 1.98 | 1.0484 | -0.0533 | |||

| URI / United Rentals, Inc. | 0.00 | -1.13 | 3.28 | 18.86 | 1.0452 | 0.1026 | |||

| PANW / Palo Alto Networks, Inc. | 0.02 | 130.13 | 3.24 | 176.02 | 1.0295 | 0.6296 | |||

| SPGI / S&P Global Inc. | 0.01 | -1.09 | 3.11 | 2.64 | 0.9887 | -0.0437 | |||

| XOM / Exxon Mobil Corporation | 0.03 | 5.58 | 2.71 | -4.34 | 0.8638 | -0.1040 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.01 | 892.79 | 2.61 | 805.90 | 0.8302 | 0.7319 | |||

| GSCE / GS Connect S&P GSCI Enhanced Commodity Total Return ETN | 0.00 | -27.50 | 2.43 | -6.08 | 0.7724 | -0.1090 | |||

| DIS / The Walt Disney Company | 0.02 | -0.81 | 2.27 | 24.60 | 0.7221 | 0.1010 | |||

| SYK / Stryker Corporation | 0.01 | -17.30 | 2.27 | -12.13 | 0.7220 | -0.1585 | |||

| KO / The Coca-Cola Company | 0.03 | 2.01 | 0.6390 | 0.6390 | |||||

| AME / AMETEK, Inc. | 0.01 | 0.00 | 1.95 | 5.11 | 0.6219 | -0.0122 | |||

| SGOL / abrdn Gold ETF Trust - abrdn Physical Gold Shares ETF | 0.06 | 0.00 | 1.83 | 5.84 | 0.5820 | -0.0074 | |||

| CRM / Salesforce, Inc. | 0.01 | 608.47 | 1.83 | 621.34 | 0.5809 | 0.4944 | |||

| SOXX / iShares Trust - iShares Semiconductor ETF | 0.01 | 0.00 | 1.79 | 26.86 | 0.5696 | 0.0883 | |||

| RSG / Republic Services, Inc. | 0.01 | 1.72 | 0.5477 | 0.5477 | |||||

| MRNA / Moderna, Inc. | 0.06 | -2.45 | 1.66 | -5.05 | 0.5270 | -0.0680 | |||

| MU / Micron Technology, Inc. | 0.01 | 0.00 | 1.63 | 41.88 | 0.5177 | 0.1265 | |||

| QCOM / QUALCOMM Incorporated | 0.01 | -0.08 | 1.55 | 3.60 | 0.4942 | -0.0171 | |||

| AWK / American Water Works Company, Inc. | 0.01 | 10.76 | 1.45 | 4.46 | 0.4626 | -0.0121 | |||

| ECL / Ecolab Inc. | 0.01 | 2.26 | 1.40 | 8.68 | 0.4464 | 0.0061 | |||

| APD / Air Products and Chemicals, Inc. | 0.00 | 2.28 | 1.26 | -2.17 | 0.4021 | -0.0385 | |||

| HD / The Home Depot, Inc. | 0.00 | 7.03 | 1.12 | 7.07 | 0.3570 | -0.0004 | |||

| DHR / Danaher Corporation | 0.01 | 0.00 | 1.03 | -3.64 | 0.3289 | -0.0369 | |||

| NKE / NIKE, Inc. | 0.01 | 12.52 | 0.96 | 25.92 | 0.3047 | 0.0453 | |||

| ABBV / AbbVie Inc. | 0.01 | 0.00 | 0.95 | -11.42 | 0.3012 | -0.0632 | |||

| AMD / Advanced Micro Devices, Inc. | 0.01 | 16.62 | 0.90 | 61.15 | 0.2851 | 0.0954 | |||

| PYPL / PayPal Holdings, Inc. | 0.01 | 0.00 | 0.86 | 13.91 | 0.2740 | 0.0161 | |||

| BNTX / BioNTech SE - Depositary Receipt (Common Stock) | 0.01 | 0.00 | 0.64 | 16.85 | 0.2033 | 0.0169 | |||

| XOP / SPDR Series Trust - SPDR S&P Oil & Gas Exploration & Production ETF | 0.01 | 0.00 | 0.63 | -4.41 | 0.2002 | -0.0245 | |||

| ADBE / Adobe Inc. | 0.00 | -85.58 | 0.53 | -85.45 | 0.1686 | -1.0737 | |||

| NVO / Novo Nordisk A/S - Depositary Receipt (Common Stock) | 0.01 | -1.83 | 0.52 | -2.45 | 0.1647 | -0.0162 | |||

| WBD / Warner Bros. Discovery, Inc. | 0.03 | 0.00 | 0.34 | 6.85 | 0.1094 | -0.0004 | |||

| EMR / Emerson Electric Co. | 0.00 | 0.31 | 0.0988 | 0.0988 | |||||

| MCD / McDonald's Corporation | 0.00 | 50.36 | 0.31 | 40.55 | 0.0971 | 0.0231 | |||

| ALB / Albemarle Corporation | 0.00 | 0.00 | 0.28 | -13.04 | 0.0893 | -0.0207 | |||

| PFE / Pfizer Inc. | 0.01 | -11.34 | 0.27 | -15.17 | 0.0874 | -0.0231 | |||

| BMY / Bristol-Myers Squibb Company | 0.01 | 0.00 | 0.27 | -24.01 | 0.0857 | -0.0353 | |||

| XLE / The Select Sector SPDR Trust - The Energy Select Sector SPDR Fund | 0.00 | 0.00 | 0.27 | -9.22 | 0.0847 | -0.0153 | |||

| ADI / Analog Devices, Inc. | 0.00 | 0.24 | 0.0751 | 0.0751 | |||||

| IONQ / IonQ, Inc. | 0.01 | 0.23 | 0.0731 | 0.0731 | |||||

| FXI / iShares Trust - iShares China Large-Cap ETF | Call | 0.09 | -59.27 | 0.12 | -28.99 | 0.0382 | -0.0196 | ||

| KHC / The Kraft Heinz Company | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| UNH / UnitedHealth Group Incorporated | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| TJX / The TJX Companies, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| GLDD / Great Lakes Dredge & Dock Corporation | 0.00 | -100.00 | 0.00 | 0.0000 |