Mga Batayang Estadistika

| Nilai Portofolio | $ 178,926,588 |

| Posisi Saat Ini | 82 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

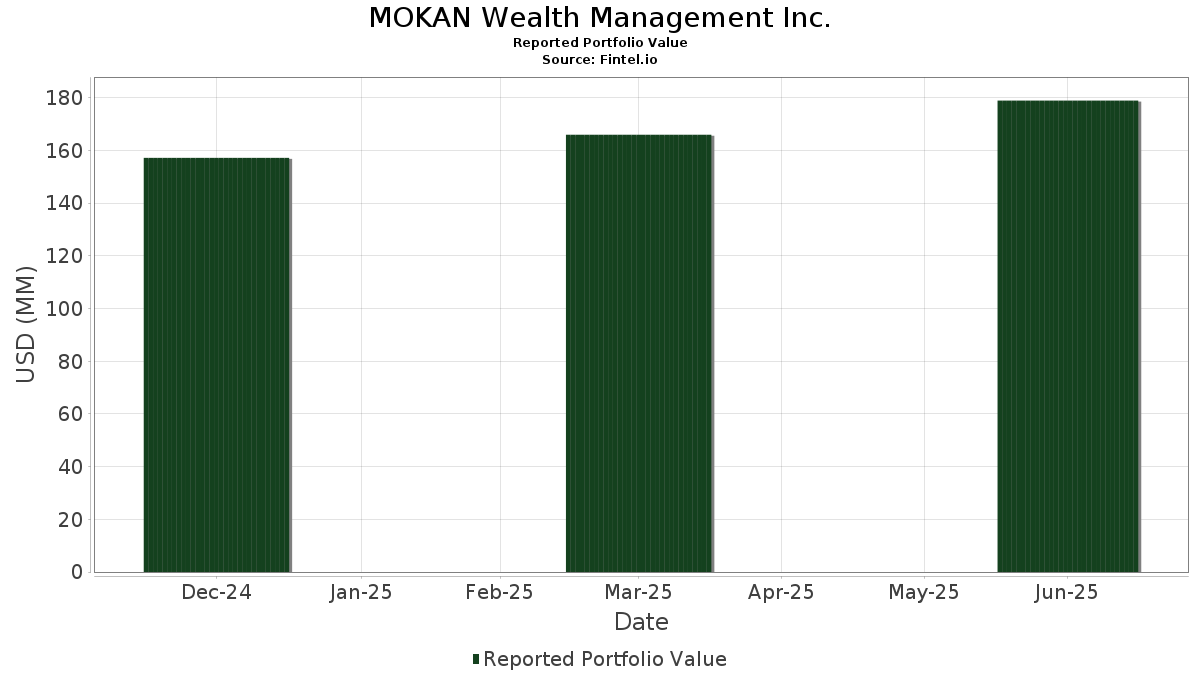

MOKAN Wealth Management Inc. telah mengungkapkan total kepemilikan 82 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 178,926,588 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama MOKAN Wealth Management Inc. adalah Vanguard Scottsdale Funds - Vanguard Short-Term Treasury ETF (US:VGSH) , SPDR Series Trust - SPDR Bloomberg 1-3 Month T-Bill ETF (US:BIL) , SPDR Series Trust - SPDR Bloomberg 3-12 Month T-Bill ETF (US:BILS) , Broadcom Inc. (US:AVGO) , and Vanguard World Fund - Vanguard Information Technology ETF (US:VGT) . Posisi baru MOKAN Wealth Management Inc. meliputi: Allegion plc (US:ALLE) , PulteGroup, Inc. (MX:PHM) , PPG Industries, Inc. (US:PPG) , Avery Dennison Corporation (US:AVY) , and Conagra Brands, Inc. (US:CAG) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.03 | 7.71 | 4.3065 | 1.1278 | |

| 0.01 | 1.38 | 0.7731 | 0.7731 | |

| 0.01 | 1.37 | 0.7669 | 0.7669 | |

| 0.01 | 1.37 | 0.7634 | 0.7634 | |

| 0.01 | 1.31 | 0.7334 | 0.7334 | |

| 0.00 | 1.26 | 0.7058 | 0.7058 | |

| 0.02 | 3.29 | 1.8393 | 0.4717 | |

| 0.03 | 0.60 | 0.3350 | 0.3350 | |

| 0.06 | 4.70 | 2.6277 | 0.2035 | |

| 0.04 | 4.23 | 2.3668 | 0.1632 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.05 | 4.09 | 2.2880 | -1.0374 | |

| 0.00 | 0.72 | 0.4009 | -0.7618 | |

| 0.01 | 4.03 | 2.2512 | -0.6667 | |

| 0.01 | 6.59 | 3.6824 | -0.6560 | |

| 0.01 | 0.75 | 0.4202 | -0.6074 | |

| 0.03 | 5.79 | 3.2352 | -0.4479 | |

| 0.01 | 6.81 | 3.8043 | -0.3585 | |

| 0.00 | 0.26 | 0.1427 | -0.2814 | |

| 0.02 | 3.16 | 1.7684 | -0.2301 | |

| 0.02 | 4.68 | 2.6129 | -0.2098 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-07-25 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| VGSH / Vanguard Scottsdale Funds - Vanguard Short-Term Treasury ETF | 0.21 | 8.25 | 12.37 | 8.42 | 6.9146 | 0.0387 | |||

| BIL / SPDR Series Trust - SPDR Bloomberg 1-3 Month T-Bill ETF | 0.13 | 8.64 | 12.24 | 8.65 | 6.8420 | 0.0525 | |||

| BILS / SPDR Series Trust - SPDR Bloomberg 3-12 Month T-Bill ETF | 0.11 | 7.51 | 11.04 | 7.45 | 6.1724 | -0.0209 | |||

| AVGO / Broadcom Inc. | 0.03 | -11.32 | 7.71 | 46.07 | 4.3065 | 1.1278 | |||

| VGT / Vanguard World Fund - Vanguard Information Technology ETF | 0.01 | -19.44 | 6.81 | -1.48 | 3.8043 | -0.3585 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.01 | 0.29 | 6.59 | -8.49 | 3.6824 | -0.6560 | |||

| MSFT / Microsoft Corporation | 0.01 | -19.47 | 6.01 | 6.64 | 3.3572 | -0.0367 | |||

| AAPL / Apple Inc. | 0.03 | 2.54 | 5.79 | -5.30 | 3.2352 | -0.4479 | |||

| MRK / Merck & Co., Inc. | 0.06 | 32.50 | 4.70 | 16.85 | 2.6277 | 0.2035 | |||

| AMZN / Amazon.com, Inc. | 0.02 | -13.40 | 4.68 | -0.19 | 2.6129 | -0.2098 | |||

| WMT / Walmart Inc. | 0.04 | 3.97 | 4.23 | 15.78 | 2.3668 | 0.1632 | |||

| COP / ConocoPhillips | 0.05 | -13.19 | 4.09 | -25.82 | 2.2880 | -1.0374 | |||

| VUG / Vanguard Index Funds - Vanguard Growth ETF | 0.01 | -29.64 | 4.03 | -16.83 | 2.2512 | -0.6667 | |||

| SCHD / Schwab Strategic Trust - Schwab U.S. Dividend Equity ETF | 0.15 | 4.86 | 4.00 | -0.62 | 2.2330 | -0.1893 | |||

| MCD / McDonald's Corporation | 0.01 | 8.70 | 3.47 | 1.64 | 1.9408 | -0.1177 | |||

| ABBV / AbbVie Inc. | 0.02 | 21.49 | 3.40 | 7.64 | 1.8981 | -0.0031 | |||

| NVDA / NVIDIA Corporation | 0.02 | -0.54 | 3.29 | 45.04 | 1.8393 | 0.4717 | |||

| GOOG / Alphabet Inc. | 0.02 | -15.94 | 3.16 | -4.58 | 1.7684 | -0.2301 | |||

| ABT / Abbott Laboratories | 0.02 | 11.94 | 2.99 | 14.77 | 1.6726 | 0.1012 | |||

| COST / Costco Wholesale Corporation | 0.00 | 9.10 | 2.85 | 13.89 | 1.5902 | 0.0847 | |||

| UNH / UnitedHealth Group Incorporated | 0.01 | 63.87 | 2.74 | -2.32 | 1.5319 | -0.1593 | |||

| GJR / Strats Trust For Procter & Gambel Security - Preferred Security | 0.02 | 13.70 | 2.44 | 6.36 | 1.3648 | -0.0191 | |||

| HD / The Home Depot, Inc. | 0.01 | 13.22 | 2.35 | 13.11 | 1.3121 | 0.0615 | |||

| JNJ / Johnson & Johnson | 0.01 | 18.96 | 2.16 | 9.61 | 1.2051 | 0.0197 | |||

| EOG / EOG Resources, Inc. | 0.02 | 20.45 | 2.15 | 12.31 | 1.2034 | 0.0483 | |||

| GILD / Gilead Sciences, Inc. | 0.02 | 18.87 | 2.15 | 17.60 | 1.1993 | 0.1002 | |||

| CBOE / Cboe Global Markets, Inc. | 0.01 | 4.74 | 2.13 | 7.84 | 1.1917 | -0.0000 | |||

| HSY / The Hershey Company | 0.01 | 20.05 | 2.11 | 16.48 | 1.1809 | 0.0876 | |||

| PEP / PepsiCo, Inc. | 0.02 | 30.36 | 2.09 | 14.84 | 1.1677 | 0.0714 | |||

| VTV / Vanguard Index Funds - Vanguard Value ETF | 0.01 | 10.84 | 2.04 | 13.37 | 1.1422 | 0.0560 | |||

| SNA / Snap-on Incorporated | 0.01 | 15.00 | 2.01 | 6.34 | 1.1257 | -0.0160 | |||

| VIG / Vanguard Specialized Funds - Vanguard Dividend Appreciation ETF | 0.01 | 9.47 | 1.72 | 15.49 | 0.9627 | 0.0639 | |||

| QCOM / QUALCOMM Incorporated | 0.01 | 14.93 | 1.51 | 19.16 | 0.8449 | 0.0803 | |||

| YUM / Yum! Brands, Inc. | 0.01 | 21.57 | 1.45 | 14.55 | 0.8101 | 0.0478 | |||

| V / Visa Inc. | 0.00 | 7.02 | 1.45 | 8.56 | 0.8078 | 0.0053 | |||

| EXPD / Expeditors International of Washington, Inc. | 0.01 | 17.45 | 1.44 | 11.66 | 0.8027 | 0.0277 | |||

| MA / Mastercard Incorporated | 0.00 | 6.27 | 1.42 | 8.92 | 0.7918 | 0.0084 | |||

| ITW / Illinois Tool Works Inc. | 0.01 | 15.66 | 1.41 | 15.25 | 0.7901 | 0.0513 | |||

| ALLE / Allegion plc | 0.01 | 1.38 | 0.7731 | 0.7731 | |||||

| PHM / PulteGroup, Inc. | 0.01 | 1.37 | 0.7669 | 0.7669 | |||||

| PPG / PPG Industries, Inc. | 0.01 | 1.37 | 0.7634 | 0.7634 | |||||

| AON / Aon plc | 0.00 | 20.35 | 1.32 | 7.47 | 0.7402 | -0.0027 | |||

| AVY / Avery Dennison Corporation | 0.01 | 1.31 | 0.7334 | 0.7334 | |||||

| PAYX / Paychex, Inc. | 0.01 | 7.26 | 1.30 | 1.17 | 0.7264 | -0.0474 | |||

| ACN / Accenture plc | 0.00 | 1.26 | 0.7058 | 0.7058 | |||||

| ZTS / Zoetis Inc. | 0.01 | 10.23 | 1.24 | 4.39 | 0.6908 | -0.0227 | |||

| VOO / Vanguard Index Funds - Vanguard S&P 500 ETF | 0.00 | 17.24 | 1.22 | 29.48 | 0.6825 | 0.1137 | |||

| GOOGL / Alphabet Inc. | 0.01 | 2.68 | 1.14 | 16.92 | 0.6374 | 0.0496 | |||

| VYM / Vanguard Whitehall Funds - Vanguard High Dividend Yield ETF | 0.01 | 4.38 | 0.96 | 7.97 | 0.5378 | 0.0004 | |||

| RTX / RTX Corporation | 0.01 | -0.40 | 0.87 | 9.75 | 0.4850 | 0.0088 | |||

| CSCO / Cisco Systems, Inc. | 0.01 | 9.15 | 0.78 | 22.71 | 0.4350 | 0.0529 | |||

| LMT / Lockheed Martin Corporation | 0.00 | 5.28 | 0.77 | 8.97 | 0.4278 | 0.0045 | |||

| TROW / T. Rowe Price Group, Inc. | 0.01 | -58.07 | 0.75 | -55.95 | 0.4202 | -0.6074 | |||

| CME / CME Group Inc. | 0.00 | -64.21 | 0.72 | -62.83 | 0.4009 | -0.7618 | |||

| VZ / Verizon Communications Inc. | 0.02 | 9.35 | 0.71 | 4.41 | 0.3975 | -0.0132 | |||

| DGX / Quest Diagnostics Incorporated | 0.00 | 13.50 | 0.69 | 20.60 | 0.3834 | 0.0408 | |||

| VICI / VICI Properties Inc. | 0.02 | 14.93 | 0.68 | 14.86 | 0.3806 | 0.0233 | |||

| USB / U.S. Bancorp | 0.01 | 13.22 | 0.68 | 21.33 | 0.3789 | 0.0423 | |||

| FOXA / Fox Corporation | 0.01 | 14.74 | 0.67 | 13.68 | 0.3764 | 0.0191 | |||

| CL / Colgate-Palmolive Company | 0.01 | 14.69 | 0.67 | 11.33 | 0.3734 | 0.0115 | |||

| KMB / Kimberly-Clark Corporation | 0.01 | 13.74 | 0.66 | 2.96 | 0.3692 | -0.0172 | |||

| CF / CF Industries Holdings, Inc. | 0.01 | -7.35 | 0.66 | 9.27 | 0.3689 | 0.0047 | |||

| MO / Altria Group, Inc. | 0.01 | 6.92 | 0.66 | 4.44 | 0.3680 | -0.0119 | |||

| GIS / General Mills, Inc. | 0.01 | 26.25 | 0.65 | 9.40 | 0.3647 | 0.0052 | |||

| XOM / Exxon Mobil Corporation | 0.01 | 5.34 | 0.62 | -4.60 | 0.3481 | -0.0449 | |||

| CAG / Conagra Brands, Inc. | 0.03 | 0.60 | 0.3350 | 0.3350 | |||||

| KO / The Coca-Cola Company | 0.01 | 0.26 | 0.59 | -1.01 | 0.3308 | -0.0292 | |||

| TSLA / Tesla, Inc. | 0.00 | 4.71 | 0.54 | 28.37 | 0.3039 | 0.0485 | |||

| TMUS / T-Mobile US, Inc. | 0.00 | 0.40 | 0.48 | -10.45 | 0.2688 | -0.0544 | |||

| HRB / H&R Block, Inc. | 0.01 | 0.67 | 0.34 | 0.59 | 0.1902 | -0.0136 | |||

| NEE / NextEra Energy, Inc. | 0.00 | -0.38 | 0.33 | -2.40 | 0.1827 | -0.0191 | |||

| VXUS / Vanguard STAR Funds - Vanguard Total International Stock ETF | 0.00 | 0.71 | 0.28 | 12.30 | 0.1583 | 0.0060 | |||

| META / Meta Platforms, Inc. | 0.00 | 2.43 | 0.28 | 31.46 | 0.1570 | 0.0281 | |||

| CVX / Chevron Corporation | 0.00 | 3.77 | 0.27 | -11.11 | 0.1521 | -0.0325 | |||

| PANW / Palo Alto Networks, Inc. | 0.00 | 8.23 | 0.27 | 30.14 | 0.1521 | 0.0257 | |||

| CRH / CRH plc | 0.00 | -65.24 | 0.26 | -63.73 | 0.1427 | -0.2814 | |||

| LOW / Lowe's Companies, Inc. | 0.00 | 19.04 | 0.24 | 13.08 | 0.1357 | 0.0066 | |||

| BA / The Boeing Company | 0.00 | 0.24 | 0.1355 | 0.1355 | |||||

| PM / Philip Morris International Inc. | 0.00 | 0.23 | 0.1259 | 0.1259 | |||||

| JBL / Jabil Inc. | 0.00 | 0.22 | 0.1227 | 0.1227 | |||||

| DY / Dycom Industries, Inc. | 0.00 | 0.21 | 0.1198 | 0.1198 | |||||

| FLEX / Flex Ltd. | 0.00 | 0.20 | 0.1124 | 0.1124 | |||||

| MDLZ / Mondelez International, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| BLK / BlackRock, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| DVN / Devon Energy Corporation | 0.00 | -100.00 | 0.00 | 0.0000 |