Mga Batayang Estadistika

| Nilai Portofolio | $ 12,623,401 |

| Posisi Saat Ini | 43 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

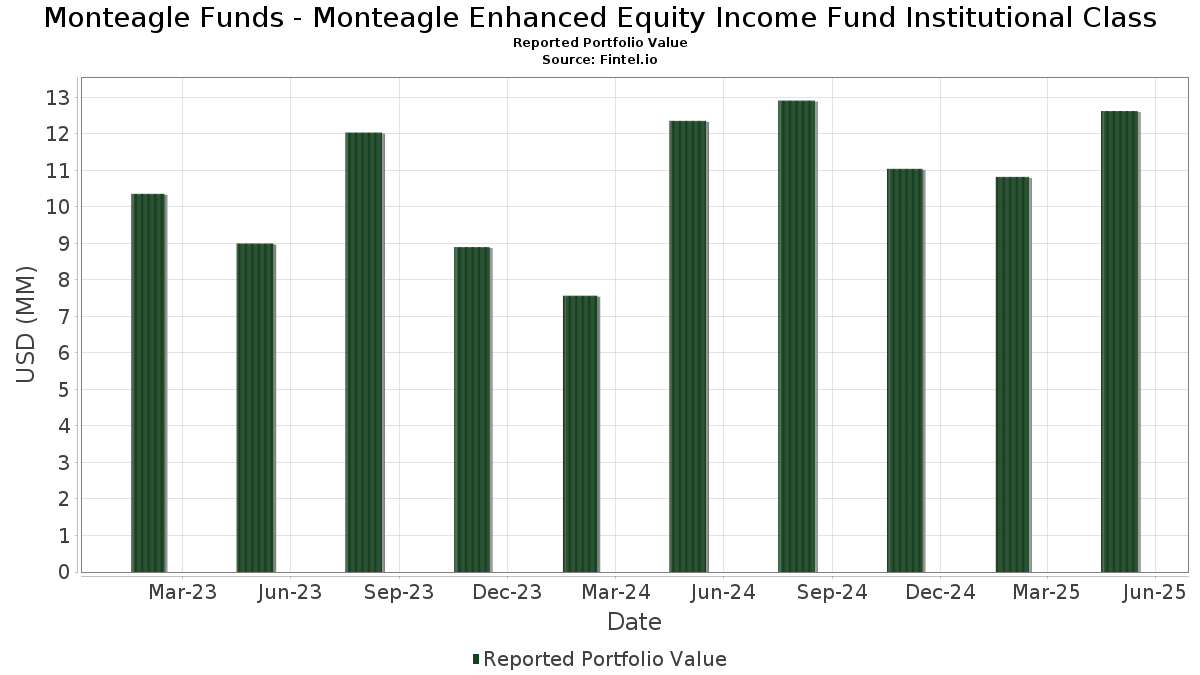

Monteagle Funds - Monteagle Enhanced Equity Income Fund Institutional Class telah mengungkapkan total kepemilikan 43 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 12,623,401 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Monteagle Funds - Monteagle Enhanced Equity Income Fund Institutional Class adalah SPDR S&P 500 ETF (US:SPY) , Federated Hermes Money Market Obligations Trust - Federated Hermes Gov Oblig Fd Inst Shs USD (US:GOIXX) , Microsoft Corporation (US:MSFT) , T-Mobile US, Inc. (US:TMUS) , and Palo Alto Networks, Inc. (US:PANW) . Posisi baru Monteagle Funds - Monteagle Enhanced Equity Income Fund Institutional Class meliputi: Direxion Shares ETF Trust - Direxion Daily NVDA Bear 1X Shares (US:NVDD) , United Parcel Service, Inc. (US:UPS) , Enterprise Products Partners L.P. - Limited Partnership (US:EPD) , Fifth Third Bancorp (US:FITB) , and Schlumberger Limited (US:SLB) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.00 | 0.88 | 6.8400 | 3.6900 | |

| 0.70 | 0.70 | 5.4500 | 3.6700 | |

| 0.00 | 0.42 | 3.2400 | 3.2400 | |

| 0.00 | 0.41 | 3.1800 | 2.5300 | |

| 0.00 | 0.38 | 2.9400 | 2.2200 | |

| 0.00 | 0.38 | 2.9500 | 2.1300 | |

| 0.01 | 0.42 | 3.2200 | 2.0800 | |

| 0.00 | 0.27 | 2.0800 | 2.0800 | |

| 0.01 | 0.26 | 2.0300 | 2.0300 | |

| 0.01 | 0.24 | 1.8400 | 1.8400 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.00 | 0.27 | 2.1000 | -1.1400 | |

| 0.00 | 0.33 | 2.5200 | -1.0500 | |

| 0.00 | 0.30 | 2.3400 | -0.9700 | |

| 0.00 | 0.31 | 2.4200 | -0.7600 | |

| 0.00 | 0.28 | 2.1800 | -0.6300 | |

| 0.00 | 0.21 | 1.6100 | -0.3800 | |

| 0.00 | 0.44 | 3.3800 | -0.3000 | |

| 0.00 | 0.34 | 2.6100 | -0.1700 | |

| -0.02 | -0.1600 | -0.1600 | ||

| -0.02 | -0.1600 | -0.1600 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-07-30 untuk periode pelaporan 2025-05-31. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| SPY / SPDR S&P 500 ETF | 0.00 | 114.29 | 0.88 | 113.01 | 6.8400 | 3.6900 | |||

| GOIXX / Federated Hermes Money Market Obligations Trust - Federated Hermes Gov Oblig Fd Inst Shs USD | 0.70 | 199.65 | 0.70 | 200.43 | 5.4500 | 3.6700 | |||

| MSFT / Microsoft Corporation | 0.00 | 0.00 | 0.60 | 15.89 | 4.6300 | 0.7200 | |||

| TMUS / T-Mobile US, Inc. | 0.00 | 0.00 | 0.44 | -10.31 | 3.3800 | -0.3000 | |||

| PANW / Palo Alto Networks, Inc. | 0.00 | 0.00 | 0.42 | 1.20 | 3.2800 | 0.1100 | |||

| LIN / Linde plc | 0.00 | 0.00 | 0.42 | 0.00 | 3.2600 | 0.0700 | |||

| NVDD / Direxion Shares ETF Trust - Direxion Daily NVDA Bear 1X Shares | 0.00 | 0.42 | 3.2400 | 3.2400 | |||||

| ETN / Eaton Corporation plc | 0.00 | 0.00 | 0.42 | 9.19 | 3.2200 | 0.3300 | |||

| BAC / Bank of America Corporation | 0.01 | 189.54 | 0.42 | 178.52 | 3.2200 | 2.0800 | |||

| GOOGL / Alphabet Inc. | 0.00 | 378.60 | 0.41 | 382.35 | 3.1800 | 2.5300 | |||

| NEE / NextEra Energy, Inc. | 0.01 | 0.00 | 0.40 | 0.75 | 3.1200 | 0.0900 | |||

| CRM / Salesforce, Inc. | 0.00 | 7.14 | 0.40 | -4.33 | 3.0800 | -0.0800 | |||

| ISRG / Intuitive Surgical, Inc. | 0.00 | 0.00 | 0.39 | -3.74 | 2.9900 | -0.0500 | |||

| AAPL / Apple Inc. | 0.00 | 322.22 | 0.38 | 252.78 | 2.9500 | 2.1300 | |||

| AMZN / Amazon.com, Inc. | 0.00 | 311.11 | 0.38 | 298.95 | 2.9400 | 2.2200 | |||

| GD / General Dynamics Corporation | 0.00 | 0.00 | 0.36 | 10.37 | 2.8000 | 0.3100 | |||

| XOM / Exxon Mobil Corporation | 0.00 | 0.00 | 0.34 | -8.17 | 2.6100 | -0.1700 | |||

| FI / Fiserv, Inc. | 0.00 | 0.00 | 0.33 | -31.00 | 2.5200 | -1.0500 | |||

| COST / Costco Wholesale Corporation | 0.00 | -25.00 | 0.31 | -25.54 | 2.4200 | -0.7600 | |||

| DELL / Dell Technologies Inc. | 0.00 | 0.00 | 0.31 | 8.36 | 2.4100 | 0.2300 | |||

| BWA / BorgWarner Inc. | 0.01 | 0.00 | 0.30 | 11.36 | 2.3600 | 0.2800 | |||

| HD / The Home Depot, Inc. | 0.00 | -25.45 | 0.30 | -30.96 | 2.3400 | -0.9700 | |||

| SBAC / SBA Communications Corporation | 0.00 | 0.00 | 0.30 | 6.36 | 2.3300 | 0.1800 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.00 | 0.00 | 0.28 | -24.05 | 2.1800 | -0.6300 | |||

| UNH / UnitedHealth Group Incorporated | 0.00 | 0.00 | 0.27 | -36.53 | 2.1000 | -1.1400 | |||

| UPS / United Parcel Service, Inc. | 0.00 | 0.27 | 2.0800 | 2.0800 | |||||

| JPM / JPMorgan Chase & Co. | 0.00 | 25.00 | 0.26 | 25.12 | 2.0400 | 0.4400 | |||

| EPD / Enterprise Products Partners L.P. - Limited Partnership | 0.01 | 0.26 | 2.0300 | 2.0300 | |||||

| KO / The Coca-Cola Company | 0.00 | 43.44 | 0.26 | 44.94 | 2.0000 | 0.6500 | |||

| FITB / Fifth Third Bancorp | 0.01 | 0.24 | 1.8400 | 1.8400 | |||||

| SLB / Schlumberger Limited | 0.01 | 0.23 | 1.7900 | 1.7900 | |||||

| UBS N / UBS Group AG | 0.01 | 0.23 | 1.7800 | 1.7800 | |||||

| TGT / Target Corporation | 0.00 | 0.23 | 1.7700 | 1.7700 | |||||

| PFE / Pfizer Inc. | 0.01 | 0.21 | 1.6400 | 1.6400 | |||||

| NVO / Novo Nordisk A/S - Depositary Receipt (Common Stock) | 0.00 | 0.00 | 0.21 | -20.99 | 1.6100 | -0.3800 | |||

| APO / Apollo Global Management, Inc. | 0.00 | 0.00 | 0.09 | -12.50 | 0.7100 | -0.0800 | |||

| UnitedHealth Group, Inc., June 20, 2025, Call @ $570.00 / DE (N/A) | -0.00 | 0.0000 | 0.0000 | ||||||

| T-Mobile US, Inc., June 20, 2025, Call @ $280.00 / DE (N/A) | -0.00 | 0.0000 | 0.0000 | ||||||

| SBA Communications Corp., June 20, 20205, Call @ $240.00 / DE (N/A) | -0.00 | -0.0200 | -0.0200 | ||||||

| SPDR S&P 500 ETF, July 31, 2025, Call @ $615.00 / DE (N/A) | -0.00 | -0.0300 | -0.0300 | ||||||

| SPDR S&P 500 ETF, June 20, 2025, Call @ $590.00 / DE (N/A) | -0.01 | -0.0500 | -0.0500 | ||||||

| Eaton Corp. plc, June 20, 2025, Call @ $310.00 / DE (N/A) | -0.02 | -0.1600 | -0.1600 | ||||||

| Intuitive Surgical, Inc., June 20, 2025, Call @ $530.00 / DE (N/A) | -0.02 | -0.1600 | -0.1600 |