Mga Batayang Estadistika

| Nilai Portofolio | $ 258,390,795 |

| Posisi Saat Ini | 95 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

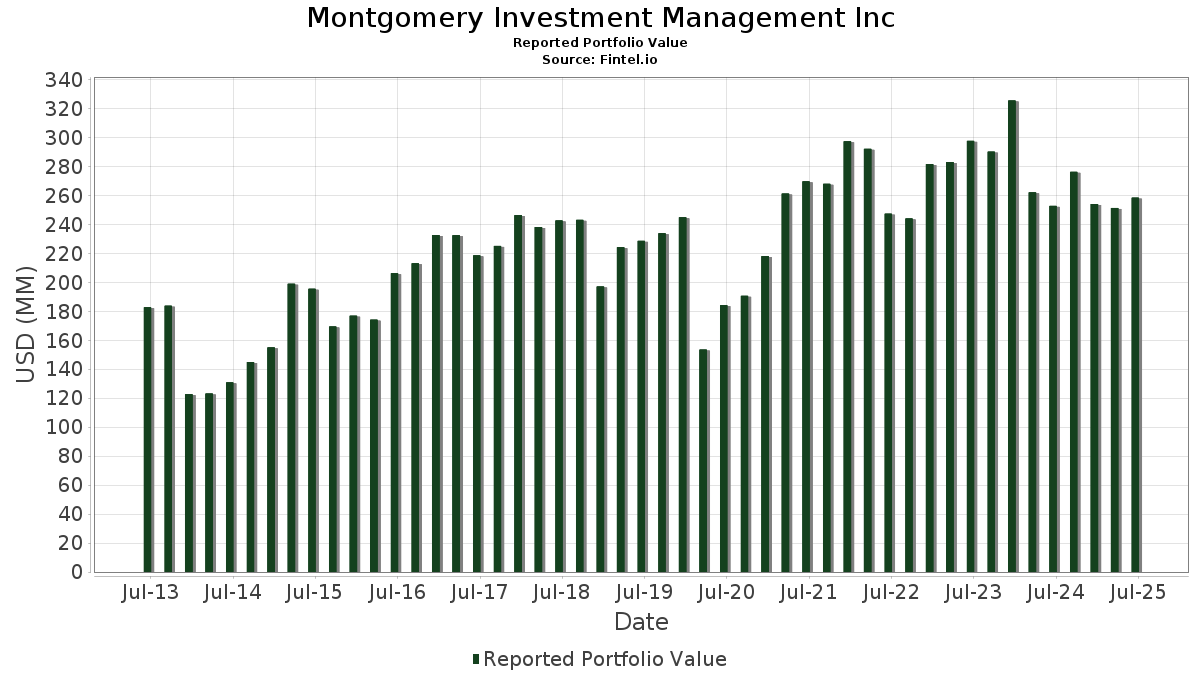

Montgomery Investment Management Inc telah mengungkapkan total kepemilikan 95 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 258,390,795 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Montgomery Investment Management Inc adalah United Rentals, Inc. (US:URI) , VSE Corporation (US:VSEC) , Truist Financial Corporation (US:TFC) , Deere & Company (US:DE) , and International Business Machines Corporation (US:IBM) . Posisi baru Montgomery Investment Management Inc meliputi: PulteGroup, Inc. (US:PHM) , GE Vernova Inc. (US:GEV) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.09 | 8.81 | 3.4097 | 1.5662 | |

| 0.03 | 25.61 | 9.9112 | 1.1847 | |

| 0.04 | 11.05 | 4.2772 | 0.5279 | |

| 0.01 | 5.16 | 1.9977 | 0.3801 | |

| 0.15 | 19.42 | 7.5174 | 0.3474 | |

| 0.01 | 5.95 | 2.3014 | 0.3214 | |

| 0.01 | 5.58 | 2.1593 | 0.2732 | |

| 0.02 | 1.60 | 0.6184 | 0.2658 | |

| 0.01 | 0.63 | 0.2449 | 0.2449 | |

| 0.05 | 4.63 | 1.7924 | 0.2238 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.09 | 8.38 | 3.2415 | -0.7424 | |

| 0.04 | 6.18 | 2.3932 | -0.6812 | |

| 0.05 | 10.25 | 3.9680 | -0.6228 | |

| 0.04 | 6.07 | 2.3500 | -0.6206 | |

| 0.03 | 1.76 | 0.6821 | -0.5230 | |

| 0.11 | 5.70 | 2.2065 | -0.4212 | |

| 0.06 | 6.01 | 2.3245 | -0.3519 | |

| 0.04 | 3.51 | 1.3579 | -0.2788 | |

| 0.00 | 10.78 | 4.1703 | -0.2662 | |

| 0.07 | 7.48 | 2.8943 | -0.2326 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-07-18 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| URI / United Rentals, Inc. | 0.03 | -2.86 | 25.61 | 16.78 | 9.9112 | 1.1847 | |||

| VSEC / VSE Corporation | 0.15 | -1.24 | 19.42 | 7.80 | 7.5174 | 0.3474 | |||

| TFC / Truist Financial Corporation | 0.32 | -3.72 | 13.75 | 0.59 | 5.3197 | -0.1181 | |||

| DE / Deere & Company | 0.03 | -5.25 | 13.03 | 2.65 | 5.0438 | -0.0083 | |||

| IBM / International Business Machines Corporation | 0.04 | -1.06 | 11.05 | 17.29 | 4.2772 | 0.5279 | |||

| NVR / NVR, Inc. | 0.00 | -5.20 | 10.78 | -3.35 | 4.1703 | -0.2662 | |||

| AAPL / Apple Inc. | 0.05 | -3.78 | 10.25 | -11.13 | 3.9680 | -0.6228 | |||

| SGOV / iShares Trust - iShares 0-3 Month Treasury Bond ETF | 0.09 | 90.13 | 8.81 | 90.20 | 3.4097 | 1.5662 | |||

| COP / ConocoPhillips | 0.09 | -2.10 | 8.38 | -16.34 | 3.2415 | -0.7424 | |||

| LEN / Lennar Corporation | 0.07 | -1.24 | 7.48 | -4.84 | 2.8943 | -0.2326 | |||

| CVX / Chevron Corporation | 0.04 | -6.49 | 6.18 | -19.96 | 2.3932 | -0.6812 | |||

| FANG / Diamondback Energy, Inc. | 0.04 | -5.35 | 6.07 | -18.66 | 2.3500 | -0.6206 | |||

| LENB / Lennar Corp. - Class B | 0.06 | -7.46 | 6.01 | -10.70 | 2.3245 | -0.3519 | |||

| MSFT / Microsoft Corporation | 0.01 | -9.81 | 5.95 | 19.52 | 2.3014 | 0.3214 | |||

| BAC / Bank of America Corporation | 0.12 | -7.21 | 5.79 | 5.22 | 2.2392 | 0.0511 | |||

| GIS / General Mills, Inc. | 0.11 | -0.36 | 5.70 | -13.66 | 2.2065 | -0.4212 | |||

| CAT / Caterpillar Inc. | 0.01 | 0.00 | 5.58 | 17.70 | 2.1593 | 0.2732 | |||

| NOW / ServiceNow, Inc. | 0.01 | -1.66 | 5.16 | 26.96 | 1.9977 | 0.3801 | |||

| FCX / Freeport-McMoRan Inc. | 0.11 | -5.85 | 4.89 | 7.81 | 1.8913 | 0.0875 | |||

| PSX / Phillips 66 | 0.04 | -3.70 | 4.65 | -6.96 | 1.8005 | -0.1893 | |||

| CF / CF Industries Holdings, Inc. | 0.05 | -0.20 | 4.63 | 17.51 | 1.7924 | 0.2238 | |||

| VLO / Valero Energy Corporation | 0.03 | -1.00 | 3.98 | 0.76 | 1.5393 | -0.0315 | |||

| MRK / Merck & Co., Inc. | 0.04 | -3.27 | 3.51 | -14.71 | 1.3579 | -0.2788 | |||

| IVV / iShares Trust - iShares Core S&P 500 ETF | 0.01 | 11.08 | 3.18 | 22.73 | 1.2308 | 0.1997 | |||

| JNJ / Johnson & Johnson | 0.02 | -2.66 | 2.78 | -10.37 | 1.0777 | -0.1582 | |||

| PNC / The PNC Financial Services Group, Inc. | 0.01 | 0.00 | 2.68 | 6.10 | 1.0368 | 0.0317 | |||

| SNV / Synovus Financial Corp. | 0.05 | -9.62 | 2.43 | 0.04 | 0.9412 | -0.0258 | |||

| ABBV / AbbVie Inc. | 0.01 | 0.00 | 2.42 | -11.42 | 0.9371 | -0.1505 | |||

| BRK.A / Berkshire Hathaway Inc. | 0.00 | 0.00 | 2.19 | -8.73 | 0.8462 | -0.1070 | |||

| SU / Suncor Energy Inc. | 0.06 | -1.40 | 2.11 | -4.62 | 0.8160 | -0.0638 | |||

| ABT / Abbott Laboratories | 0.01 | -9.22 | 2.01 | -6.90 | 0.7777 | -0.0814 | |||

| NEE / NextEra Energy, Inc. | 0.03 | -5.74 | 1.82 | -7.70 | 0.7055 | -0.0804 | |||

| MCD / McDonald's Corporation | 0.01 | 0.00 | 1.80 | -6.45 | 0.6963 | -0.0691 | |||

| RTX / RTX Corporation | 0.01 | 0.00 | 1.80 | 10.25 | 0.6951 | 0.0468 | |||

| LGIH / LGI Homes, Inc. | 0.03 | -24.91 | 1.76 | -41.81 | 0.6821 | -0.5230 | |||

| CCJ / Cameco Corporation | 0.02 | 0.00 | 1.60 | 80.45 | 0.6184 | 0.2658 | |||

| HPQ / HP Inc. | 0.06 | 0.00 | 1.51 | -11.63 | 0.5852 | -0.0960 | |||

| MRP / Millrose Properties, Inc. | 0.05 | -20.22 | 1.35 | -14.20 | 0.5241 | -0.1040 | |||

| COST / Costco Wholesale Corporation | 0.00 | 0.00 | 1.28 | 4.67 | 0.4942 | 0.0087 | |||

| LH / Labcorp Holdings Inc. | 0.00 | -12.70 | 1.26 | -1.56 | 0.4887 | -0.0216 | |||

| WMT / Walmart Inc. | 0.01 | 0.00 | 1.12 | 11.39 | 0.4319 | 0.0332 | |||

| KNF / Knife River Corporation | 0.01 | -5.70 | 1.01 | -14.67 | 0.3919 | -0.0803 | |||

| LOW / Lowe's Companies, Inc. | 0.00 | 0.00 | 0.94 | -4.86 | 0.3641 | -0.0294 | |||

| NVDA / NVIDIA Corporation | 0.01 | 15.62 | 0.94 | 68.77 | 0.3620 | 0.1412 | |||

| BHP / BHP Group Limited - Depositary Receipt (Common Stock) | 0.02 | 0.00 | 0.86 | -0.92 | 0.3341 | -0.0126 | |||

| IWM / iShares Trust - iShares Russell 2000 ETF | 0.00 | 0.00 | 0.86 | 8.28 | 0.3341 | 0.0165 | |||

| ODFL / Old Dominion Freight Line, Inc. | 0.00 | 0.00 | 0.81 | -1.82 | 0.3128 | -0.0151 | |||

| CVE / Cenovus Energy Inc. | 0.06 | 0.00 | 0.77 | -2.29 | 0.2976 | -0.0154 | |||

| DGX / Quest Diagnostics Incorporated | 0.00 | 0.00 | 0.76 | 6.15 | 0.2941 | 0.0093 | |||

| GL / Globe Life Inc. | 0.01 | 0.00 | 0.75 | -5.65 | 0.2910 | -0.0261 | |||

| MDU / MDU Resources Group, Inc. | 0.04 | 0.00 | 0.73 | -1.36 | 0.2811 | -0.0121 | |||

| WY / Weyerhaeuser Company | 0.03 | -0.16 | 0.72 | -12.38 | 0.2769 | -0.0481 | |||

| DAL / Delta Air Lines, Inc. | 0.01 | -0.69 | 0.71 | 12.03 | 0.2744 | 0.0225 | |||

| EQT / EQT Corporation | 0.01 | 0.00 | 0.70 | 9.05 | 0.2708 | 0.0157 | |||

| HON / Honeywell International Inc. | 0.00 | 0.00 | 0.68 | 9.93 | 0.2614 | 0.0170 | |||

| ECG / Everus Construction Group, Inc. | 0.01 | 0.00 | 0.67 | 71.28 | 0.2586 | 0.1034 | |||

| DRI / Darden Restaurants, Inc. | 0.00 | 0.00 | 0.65 | 4.82 | 0.2531 | 0.0051 | |||

| PHM / PulteGroup, Inc. | 0.01 | 0.63 | 0.2449 | 0.2449 | |||||

| ANET / Arista Networks Inc | 0.01 | 0.00 | 0.57 | 32.10 | 0.2217 | 0.0491 | |||

| AMZN / Amazon.com, Inc. | 0.00 | 0.00 | 0.57 | 15.38 | 0.2208 | 0.0239 | |||

| GE / General Electric Company | 0.00 | 0.00 | 0.57 | 28.73 | 0.2203 | 0.0442 | |||

| BKR / Baker Hughes Company | 0.01 | 0.00 | 0.54 | -12.76 | 0.2092 | -0.0374 | |||

| MELI / MercadoLibre, Inc. | 0.00 | 0.00 | 0.52 | 33.85 | 0.2023 | 0.0470 | |||

| LLY / Eli Lilly and Company | 0.00 | 0.00 | 0.51 | -5.60 | 0.1961 | -0.0175 | |||

| HPE / Hewlett Packard Enterprise Company | 0.02 | 0.00 | 0.50 | 32.35 | 0.1919 | 0.0430 | |||

| A / Agilent Technologies, Inc. | 0.00 | 0.00 | 0.49 | 0.82 | 0.1895 | -0.0036 | |||

| SYY / Sysco Corporation | 0.01 | 0.00 | 0.47 | 0.85 | 0.1832 | -0.0034 | |||

| RYN / Rayonier Inc. | 0.02 | 0.08 | 0.46 | -20.45 | 0.1763 | -0.0514 | |||

| PFE / Pfizer Inc. | 0.02 | -4.32 | 0.43 | -8.33 | 0.1661 | -0.0205 | |||

| FDX / FedEx Corporation | 0.00 | 0.00 | 0.40 | -6.79 | 0.1544 | -0.0159 | |||

| ENB / Enbridge Inc. | 0.01 | 0.00 | 0.39 | 2.34 | 0.1527 | -0.0008 | |||

| WCC / WESCO International, Inc. | 0.00 | -4.53 | 0.39 | 14.04 | 0.1510 | 0.0146 | |||

| AVGO / Broadcom Inc. | 0.00 | 0.22 | 0.38 | 64.94 | 0.1475 | 0.0556 | |||

| AXP / American Express Company | 0.00 | 0.00 | 0.37 | 18.35 | 0.1451 | 0.0193 | |||

| PR / Permian Resources Corporation | 0.03 | 0.00 | 0.37 | -1.61 | 0.1423 | -0.0065 | |||

| CRWD / CrowdStrike Holdings, Inc. | 0.00 | -35.91 | 0.37 | -7.32 | 0.1421 | -0.0157 | |||

| SHOP / Shopify Inc. | 0.00 | 0.00 | 0.35 | 20.98 | 0.1339 | 0.0199 | |||

| SLB / Schlumberger Limited | 0.01 | 0.00 | 0.34 | -19.28 | 0.1300 | -0.0353 | |||

| EXE / Expand Energy Corporation | 0.00 | 0.00 | 0.32 | 4.92 | 0.1240 | 0.0026 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | 0.00 | 0.31 | -8.90 | 0.1192 | -0.0152 | |||

| VWO / Vanguard International Equity Index Funds - Vanguard FTSE Emerging Markets ETF | 0.01 | 0.00 | 0.31 | 9.29 | 0.1187 | 0.0070 | |||

| PM / Philip Morris International Inc. | 0.00 | 0.00 | 0.31 | 14.66 | 0.1184 | 0.0123 | |||

| KEYS / Keysight Technologies, Inc. | 0.00 | 0.00 | 0.30 | 9.39 | 0.1173 | 0.0071 | |||

| GEV / GE Vernova Inc. | 0.00 | 0.29 | 0.1124 | 0.1124 | |||||

| DELL / Dell Technologies Inc. | 0.00 | 0.00 | 0.29 | 34.88 | 0.1124 | 0.0265 | |||

| TTD / The Trade Desk, Inc. | 0.00 | 0.00 | 0.29 | 31.65 | 0.1114 | 0.0243 | |||

| OVV / Ovintiv Inc. | 0.01 | 0.00 | 0.27 | -10.93 | 0.1042 | -0.0163 | |||

| BTE / Baytex Energy Corp. | 0.15 | 0.00 | 0.27 | -19.82 | 0.1036 | -0.0291 | |||

| AR / Antero Resources Corporation | 0.01 | 0.00 | 0.24 | -0.42 | 0.0920 | -0.0030 | |||

| HAL / Halliburton Company | 0.01 | 0.00 | 0.23 | -19.72 | 0.0883 | -0.0247 | |||

| CRGY / Crescent Energy Company | 0.02 | 0.00 | 0.21 | -23.66 | 0.0827 | -0.0284 | |||

| GOOG / Alphabet Inc. | 0.00 | 0.21 | 0.0825 | 0.0825 | |||||

| CMCSA / Comcast Corporation | 0.01 | 0.00 | 0.21 | -3.23 | 0.0815 | -0.0051 | |||

| RF / Regions Financial Corporation | 0.01 | 0.21 | 0.0808 | 0.0808 | |||||

| UNP / Union Pacific Corporation | 0.00 | -35.71 | 0.21 | -37.27 | 0.0801 | -0.0515 | |||

| MVF / BlackRock MuniVest Fund, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| FRT / Federal Realty Investment Trust | 0.00 | -100.00 | 0.00 | 0.0000 |